Market Overview

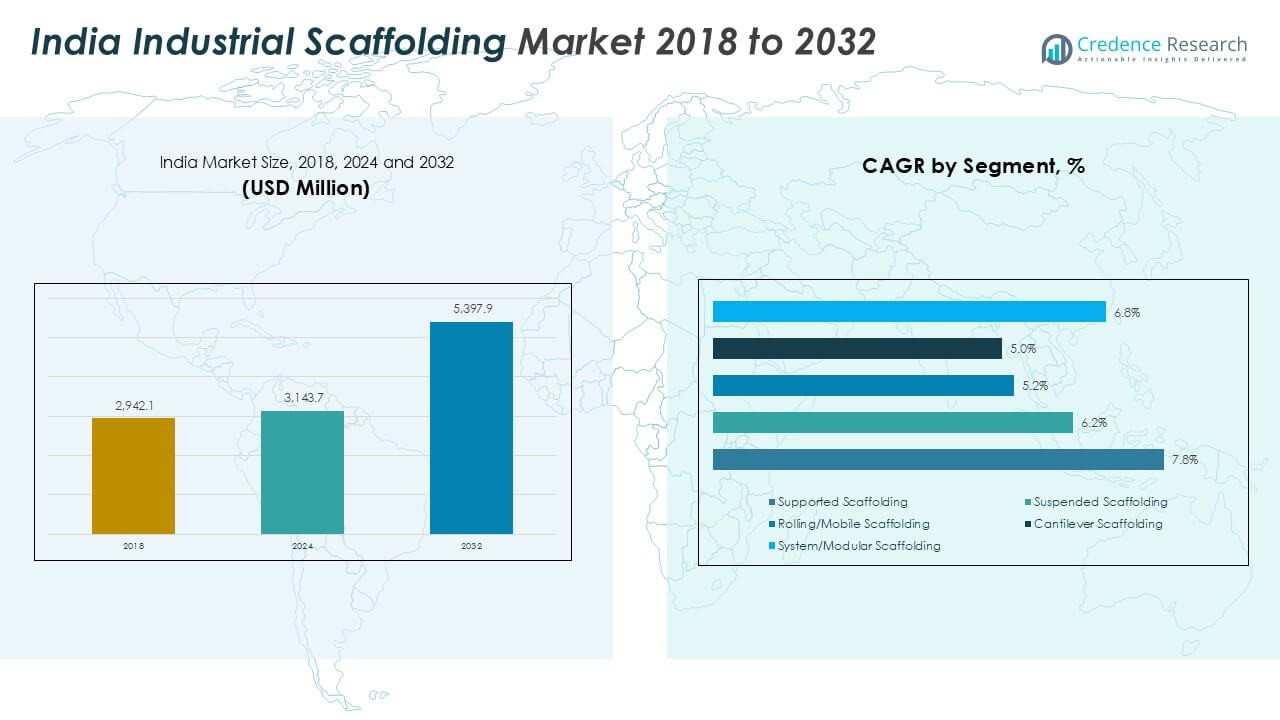

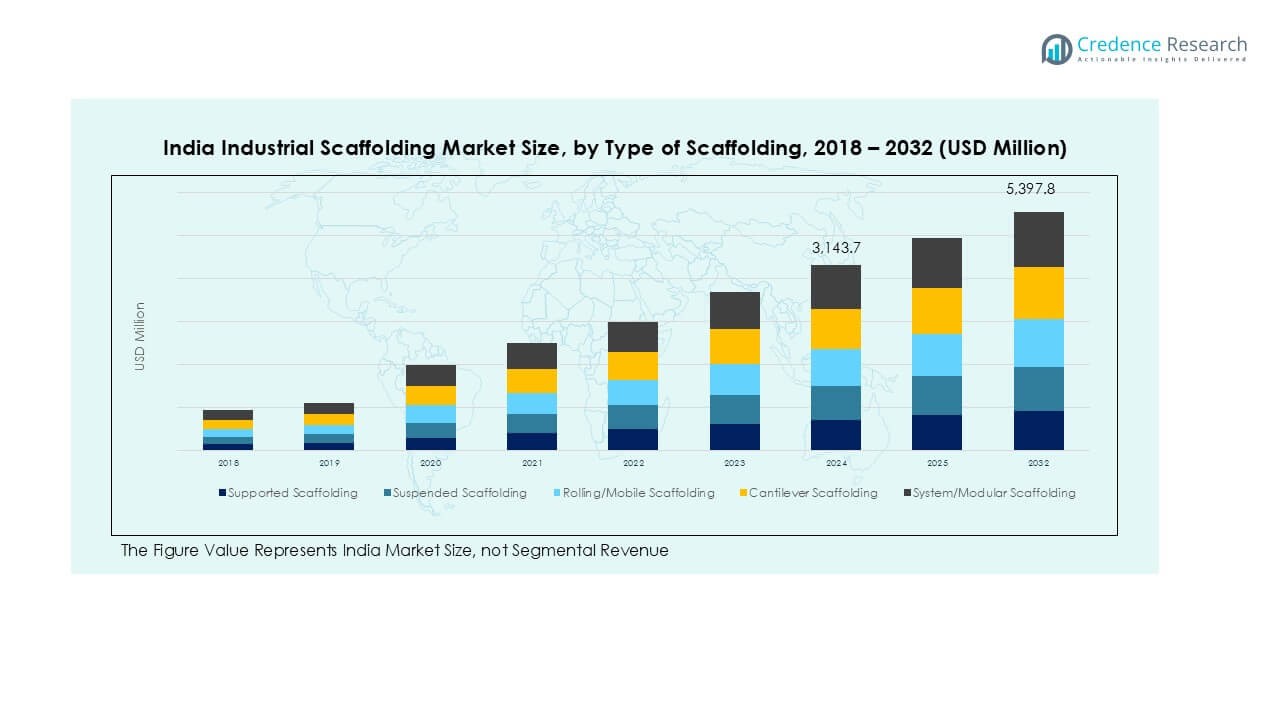

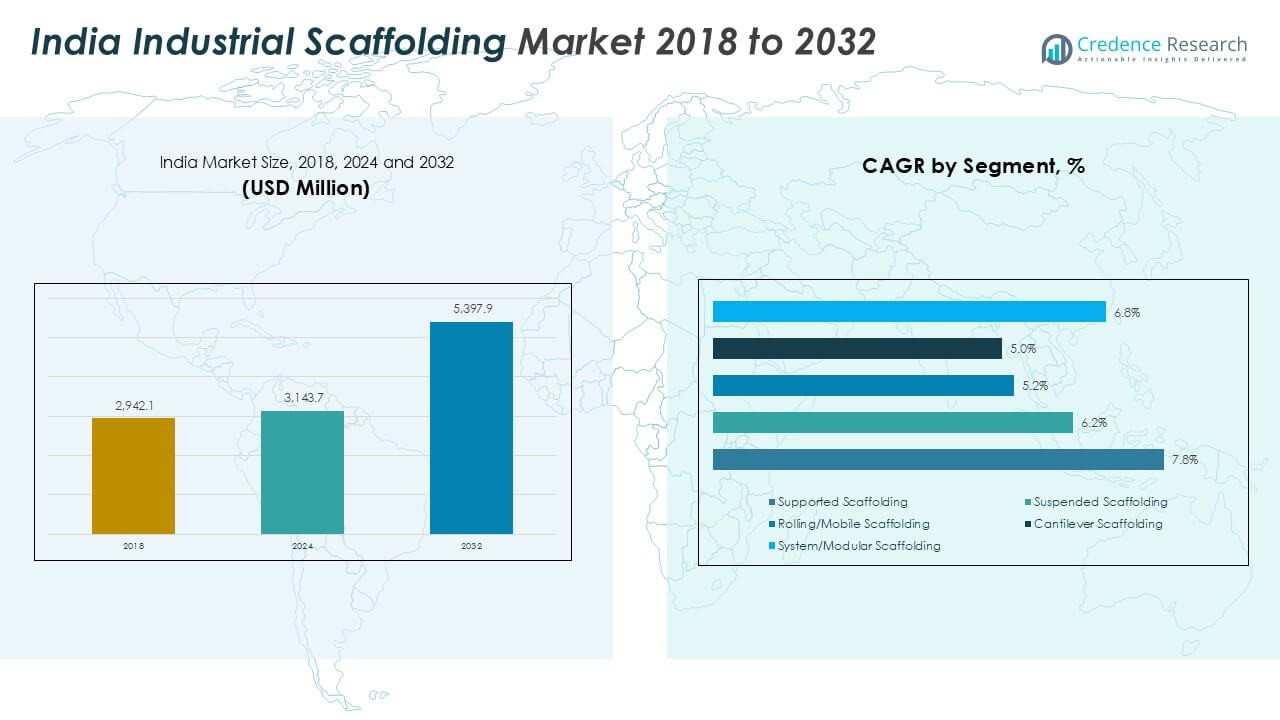

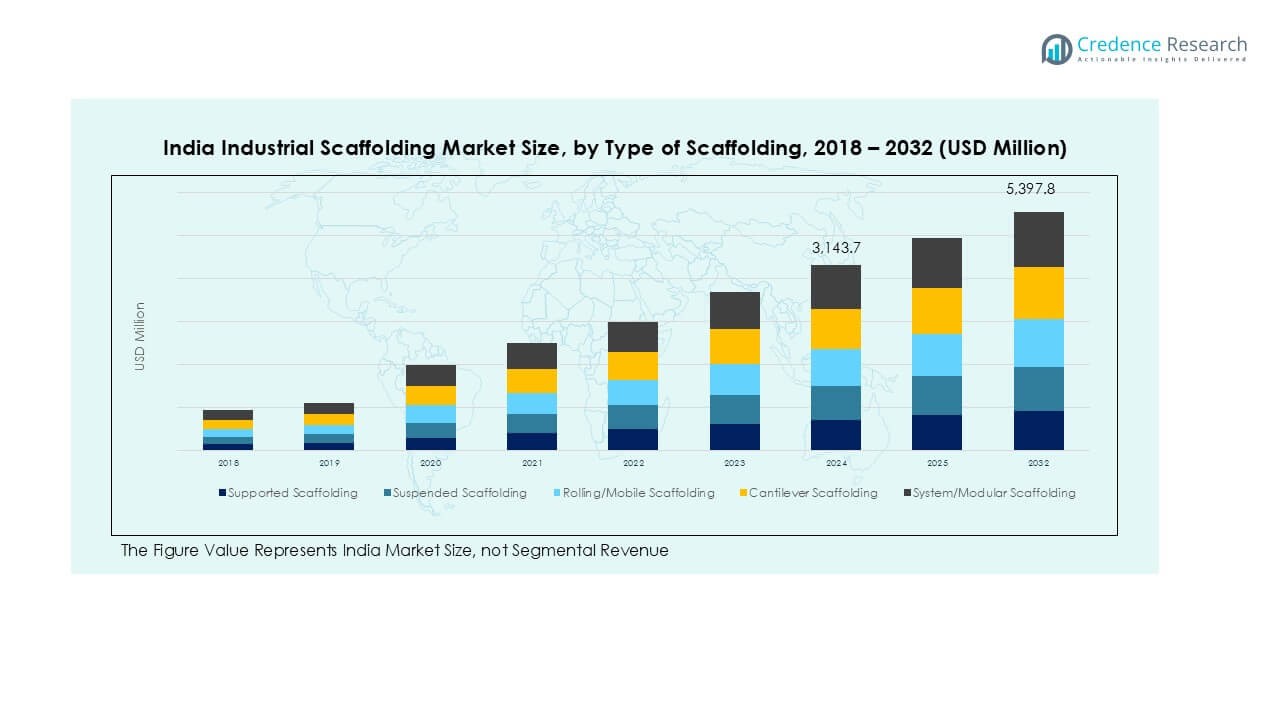

India Industrial Scaffolding market size was valued at USD 2942.1 million in 2018 to USD 3143.7 million in 2024 and is anticipated to reach USD 5397.9 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Industrial Scaffolding Market Size 2024 |

USD 3143.7 Million |

| India Industrial Scaffolding Market, CAGR |

6.6% |

| India Industrial Scaffolding Market Size 2032 |

USD 5397.9 Million |

The India industrial scaffolding market is shaped by key players such as Aarvi Scaffolding, Shiv Shakti Scaffolding, BSL Scaffolding Ltd, Utkarsh Scaffolding, Layher India, PERI India, ULMA Construction, and Shreeji Scaffolding. These companies compete through product innovation, strong rental networks, and adherence to global safety standards. Layher India and PERI India lead in modular and system scaffolding solutions, catering to large-scale industrial and infrastructure projects. Regionally, North India dominates the market with a 35% share, driven by metro rail, refinery, and power plant projects, followed by West India at 28% and South India at 22%, reflecting strong industrial growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- India Industrial Scaffolding market was valued at USD 3143.7 million in 2024 and is projected to reach USD 5397.9 million by 2032, growing at a CAGR of 6.6%.

- Market growth is driven by rising infrastructure projects, industrial expansion, and stricter workplace safety regulations increasing demand for reliable scaffolding systems.

- Trends include adoption of modular and lightweight scaffolding solutions, faster assembly systems, and use of digital monitoring for safety and efficiency during plant maintenance.

- The market is moderately fragmented with key players like Aarvi Scaffolding, Layher India, PERI India, and ULMA Construction focusing on rental services, safety compliance, and turnkey project solutions.

- North India holds 35% share, followed by West India at 28%, South India at 22%, and East India at 15%; supported scaffolding dominates with over 40% share, driven by stability and heavy-load applications across oil & gas, power generation, and large-scale infrastructure projects.

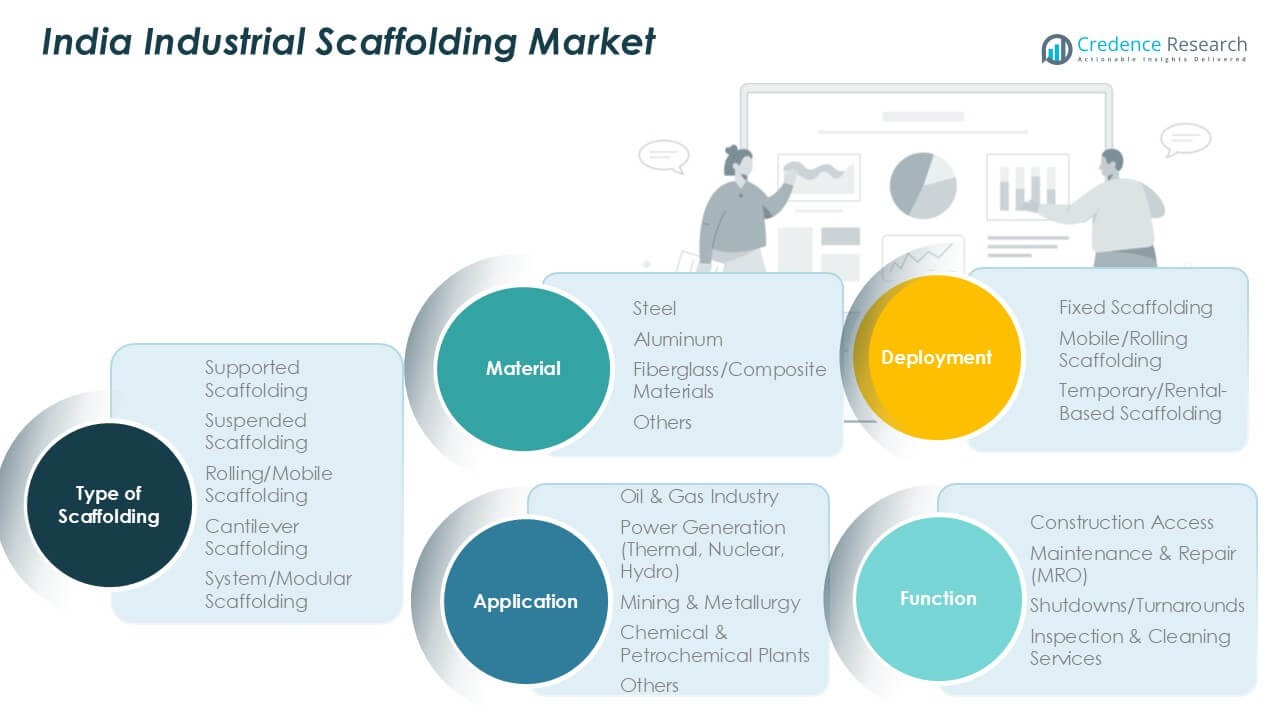

Market Segmentation Analysis:

By Type of Scaffolding

Supported scaffolding holds the dominant share in the India industrial scaffolding market, accounting for over 40% of total demand in 2024. Its popularity stems from its high load-bearing capacity, stability, and suitability for heavy-duty industrial projects. This type is extensively used in large-scale infrastructure and plant maintenance activities. System/modular scaffolding is gaining traction due to faster assembly and enhanced safety features, especially in time-critical shutdown projects. Growing investments in infrastructure upgrades and strict safety regulations drive adoption of reliable and easy-to-install scaffolding solutions across industrial facilities.

- For instance, Layher India supplies its Allround modular system, which is generally known to be faster to erect than conventional tube-and-coupler systems. While Layher has completed projects in industrial settings in India and its systems are used in refineries.

By Application

The oil & gas industry leads the application segment, capturing nearly 35% market share in 2024. Frequent maintenance, inspection, and shutdown activities in refineries and offshore facilities drive strong demand for scaffolding solutions. Power generation, including thermal and hydro plants, represents the second-largest share, supported by ongoing plant expansions and modernization projects. Mining and metallurgy operations also contribute significantly due to the need for access solutions in material handling and smelting units. The demand is driven by India’s industrial growth, increasing capital expenditure, and focus on worker safety standards.

- For instance, Cuplok Scaffolding India supported Vedanta’s Lanjigarh alumina refinery expansion with over 60,000 scaffold fittings, facilitating work on high-elevation material conveyors.

By Material

Steel dominates the material segment with over 60% share in 2024, owing to its strength, durability, and ability to handle heavy industrial loads. Steel scaffolding remains the preferred choice for complex, high-rise, and long-term projects across oil & gas, power, and chemical sectors. Aluminum is witnessing rising adoption due to its lightweight properties, making it ideal for quick assembly and disassembly during short maintenance cycles. Fiberglass/composite scaffolding is used in chemical plants where corrosion resistance is critical. Increasing emphasis on safety, reusability, and cost efficiency supports strong growth for steel-based systems.

Key Growth Drivers

Expanding Infrastructure and Industrial Projects

India’s rapid infrastructure development is a major growth driver for the industrial scaffolding market. Expansion of oil refineries, metro projects, power plants, and manufacturing facilities creates strong demand for access solutions. Scaffolding is essential for construction, maintenance, and periodic shutdowns across these sectors. Government initiatives like “Make in India” and large-scale infrastructure spending further boost project pipelines. Industrial growth and modernization programs in sectors such as steel, cement, and petrochemicals increase the frequency of scaffolding use, driving consistent demand throughout the forecast period.

- For instance, a scaffolding provider, potentially including a past entity known as Harsco Infrastructure, would have supplied a large quantity of scaffolding, potentially over 100,000 m², for a refinery shutdown at the Bharat Petroleum Kochi refinery.

Rising Focus on Worker Safety and Compliance

Stringent workplace safety regulations are pushing industries to adopt reliable scaffolding systems. Compliance with occupational safety standards requires certified, stable, and high-quality access equipment. Companies are increasingly replacing makeshift and unsafe scaffolds with modular, engineered systems that meet global safety norms. Regular audits and penalties for non-compliance encourage investment in durable solutions. This focus improves operational efficiency and reduces accident risks, leading to higher adoption of advanced scaffolding products across oil & gas, power, and chemical industries in India.

- For instance, Aluma Systems India introduced lightweight aluminum scaffold systems at Indian Oil’s Panipat refinery, reportedly reducing manual handling strain by 30% for over 500 workers.

Growth in Maintenance and Shutdown Activities

Periodic maintenance and plant shutdowns represent a key demand source for scaffolding solutions. Industries such as oil & gas, power generation, and mining rely on scaffolding for inspection, repair, and retrofitting activities. The rising number of brownfield projects and plant overhauls boosts demand for temporary access structures. Quick-assembly system scaffolding is increasingly preferred due to its ability to reduce downtime and labor costs. The growing emphasis on maintaining operational efficiency in aging industrial facilities continues to sustain the market for industrial scaffolding services.

Key Trend

Adoption of Modular and Lightweight Scaffolding

The market is witnessing a shift toward modular and lightweight scaffolding systems. These solutions offer faster installation, enhanced safety, and reduced labor requirements. Aluminum and composite scaffolding are gaining popularity for projects with frequent assembly-disassembly needs. Modular systems also enable flexible configurations to suit complex plant layouts, improving efficiency during shutdown projects. This trend aligns with industry demands for time savings, cost optimization, and compliance with safety standards, driving adoption across diverse sectors including power, petrochemicals, and infrastructure development.

- For instance, Layher introduced its Allround Lightweight system, whose components weigh significantly less and allow for faster assembly compared to older systems. The company reports an overall assembly speed increase of up to 10%.

Digitalization and Smart Monitoring Solutions

Digital transformation is creating opportunities in the industrial scaffolding market through smart monitoring systems. Integration of IoT-enabled sensors and software platforms allows real-time tracking of scaffold usage, load conditions, and worker movement. This improves safety compliance and reduces risks of collapse or misuse. Digital project management tools also streamline planning, inventory control, and workforce coordination, cutting operational costs. Companies investing in technology-driven scaffolding solutions can differentiate themselves and cater to large-scale industrial clients seeking efficiency and predictive maintenance capabilities.

- For instance, Datadog supports companies monitoring their IoT fleets with dashboards covering tens of thousands of devices, aggregating metrics across device hardware, logs, and network performance.

Key Challenge

High Initial Investment and Rental Costs

The high upfront cost of advanced scaffolding systems is a major barrier for small and medium contractors. Modular and system scaffolding require significant capital investment compared to conventional methods. Rental prices can also be high, particularly for long-term projects or specialized configurations. Budget constraints in smaller projects may limit adoption, leading contractors to use unsafe or improvised solutions. Price sensitivity in the Indian market continues to challenge suppliers, necessitating flexible pricing models and rental options to support wider adoption.

Skilled Labor Shortages and Training Needs

Shortage of skilled scaffolders and inadequate training programs hinder efficient deployment of advanced scaffolding systems. Proper erection, inspection, and dismantling require trained personnel to ensure safety and compliance with regulations. Lack of skilled labor increases the risk of workplace accidents and project delays. Training costs and time requirements add to operational challenges for contractors and plant operators. The industry needs structured certification programs and partnerships to build a competent workforce capable of handling complex scaffolding solutions effectively.

Regional Analysis

North India

North India holds the largest share of the India industrial scaffolding market, accounting for around 35% in 2024. The dominance is driven by extensive infrastructure projects, including metro rail expansions, highways, and industrial corridors such as the Delhi-Mumbai Industrial Corridor (DMIC). The region hosts several large-scale power plants, oil refineries, and manufacturing hubs, which generate consistent demand for scaffolding during construction and maintenance. The presence of major public sector enterprises and government-led development programs further supports market growth. Frequent plant shutdowns and maintenance activities in Uttar Pradesh, Haryana, and Rajasthan also contribute significantly to scaffolding demand.

West India

West India captures approximately 28% of the market share, driven by its concentration of petrochemical complexes, ports, and power plants. States like Maharashtra and Gujarat are major industrial hubs with significant refinery, chemical, and manufacturing operations requiring extensive scaffolding services. Ongoing investments in renewable energy projects and smart city developments are fueling growth in the region. High industrial activity in areas like Jamnagar and Hazira, coupled with frequent turnaround maintenance schedules, creates robust demand. The region benefits from the presence of leading scaffolding suppliers and a strong rental network that supports timely project execution and shutdown activities.

South India

South India accounts for nearly 22% of the industrial scaffolding market share in 2024. The region’s demand is fueled by strong growth in the construction, power, and manufacturing sectors across Tamil Nadu, Karnataka, and Andhra Pradesh. Large-scale thermal and hydroelectric power plants, along with port development projects, create continuous scaffolding requirements. The presence of automotive and electronics manufacturing clusters increases usage for plant expansions and maintenance. Government-backed infrastructure initiatives, such as Chennai Metro Phase 2 and Vizag Industrial Corridor, contribute to demand. Growing investments in renewable energy and industrial automation are expected to further strengthen market growth.

East India

East India represents around 15% of the market share, with demand largely concentrated in steel, mining, and heavy engineering sectors. States like Odisha, Jharkhand, and West Bengal host major steel plants and mining operations, which rely heavily on scaffolding for construction and equipment maintenance. The region is witnessing infrastructure development, including new road and railway projects, boosting demand for temporary access solutions. However, compared to other regions, adoption of modular scaffolding remains limited, leaving room for modernization. Increased government focus on industrial corridor development and port connectivity projects is expected to gradually drive market penetration in coming years.

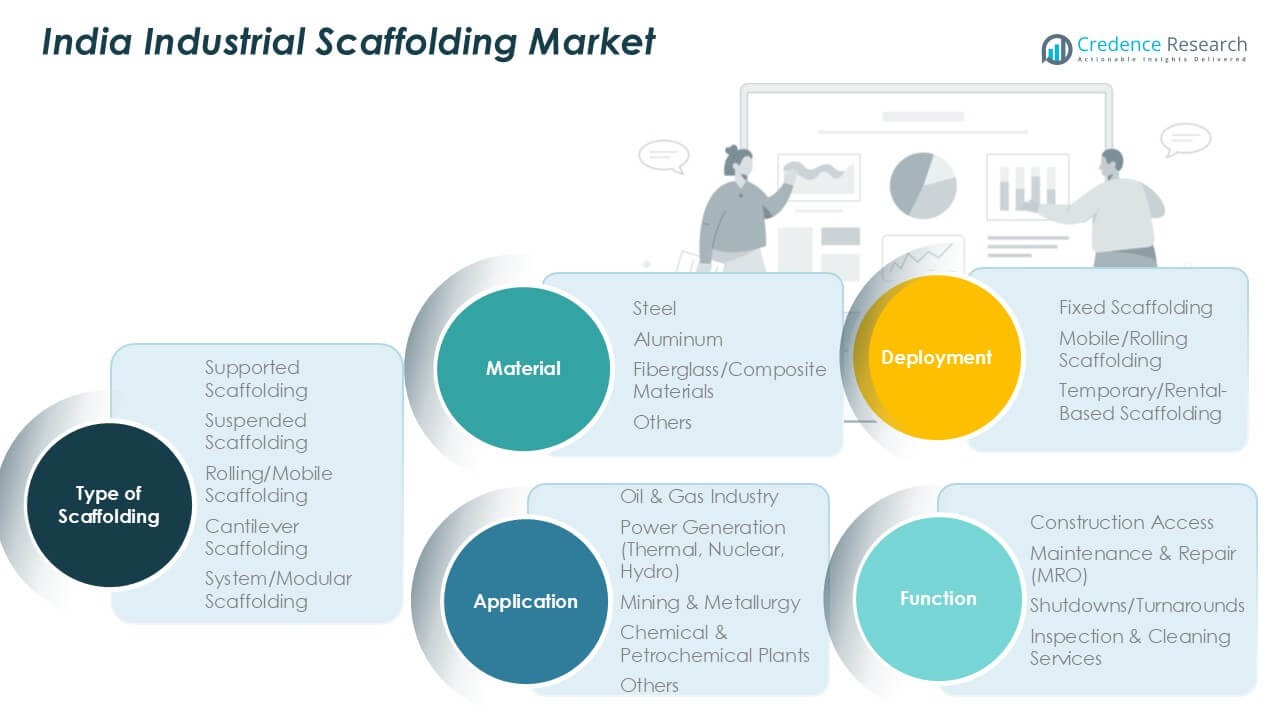

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- North India

- West India

- South India

- East India

Competitive Landscape

The India industrial scaffolding market is moderately fragmented, with a mix of domestic manufacturers, rental service providers, and global players competing for market share. Key companies include Aarvi Scaffolding, Shiv Shakti Scaffolding, BSL Scaffolding Ltd, Utkarsh Scaffolding, Layher India, PERI India, and ULMA Construction. Domestic players focus on cost-effective solutions and wide rental networks to cater to local demand, while international companies emphasize modular and engineered systems with advanced safety features. Competition is driven by pricing, product durability, compliance with safety standards, and timely project delivery. Partnerships with EPC contractors and plant operators are common strategies to secure long-term contracts. Growing demand for system scaffolding and turnkey solutions encourages players to invest in product innovation and workforce training. The market is expected to see increased consolidation, with mergers and collaborations likely as companies seek to expand their geographic reach and service capabilities across India’s industrial hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice.

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with expansion of oil & gas, power, and infrastructure projects.

- Adoption of modular and system scaffolding will rise for faster installation and safety.

- Rental services will see strong growth due to cost efficiency and flexibility.

- Digital monitoring and IoT-enabled scaffolding management will gain traction.

- Worker safety regulations will drive investment in certified, engineered scaffolding systems.

- Steel scaffolding will maintain dominance, but aluminum and composite use will increase.

- Maintenance and plant shutdown projects will remain key revenue sources.

- Market consolidation is expected as players form partnerships and acquisitions.

- Skilled workforce training programs will become a priority for safe operations.

- Regional demand will remain highest in North and West India, supporting long-term growth.