Market Overview:

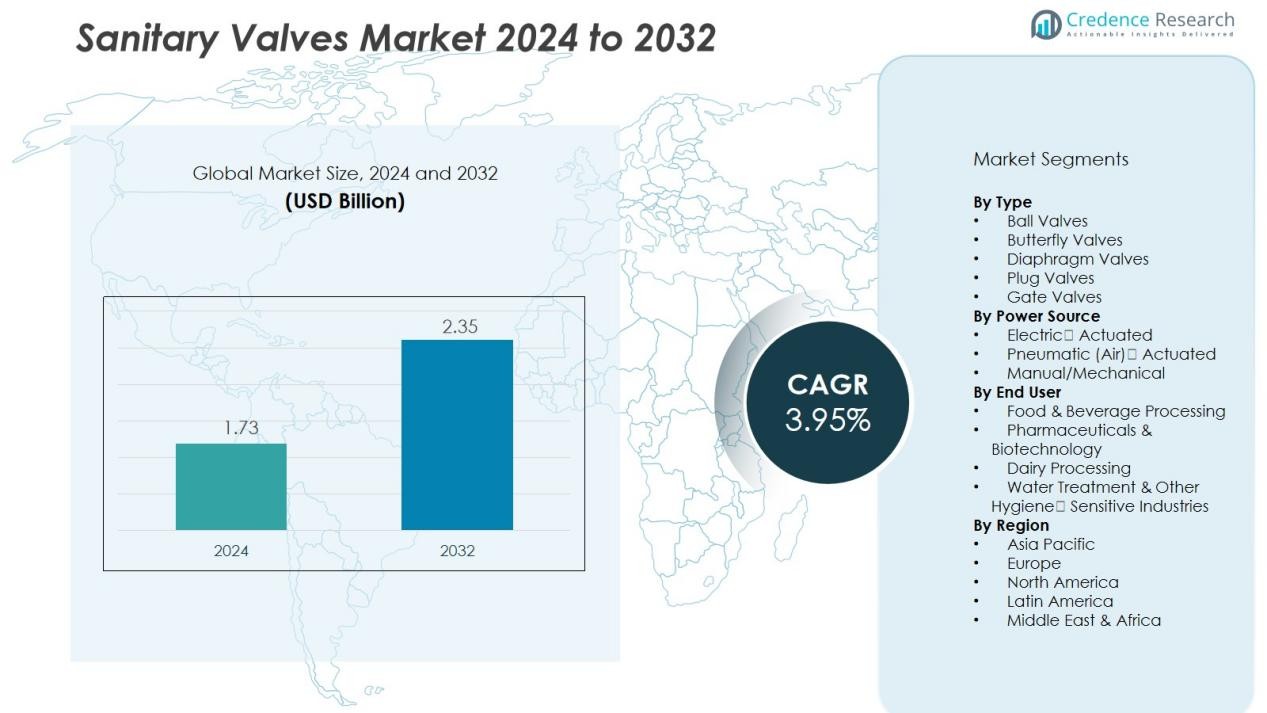

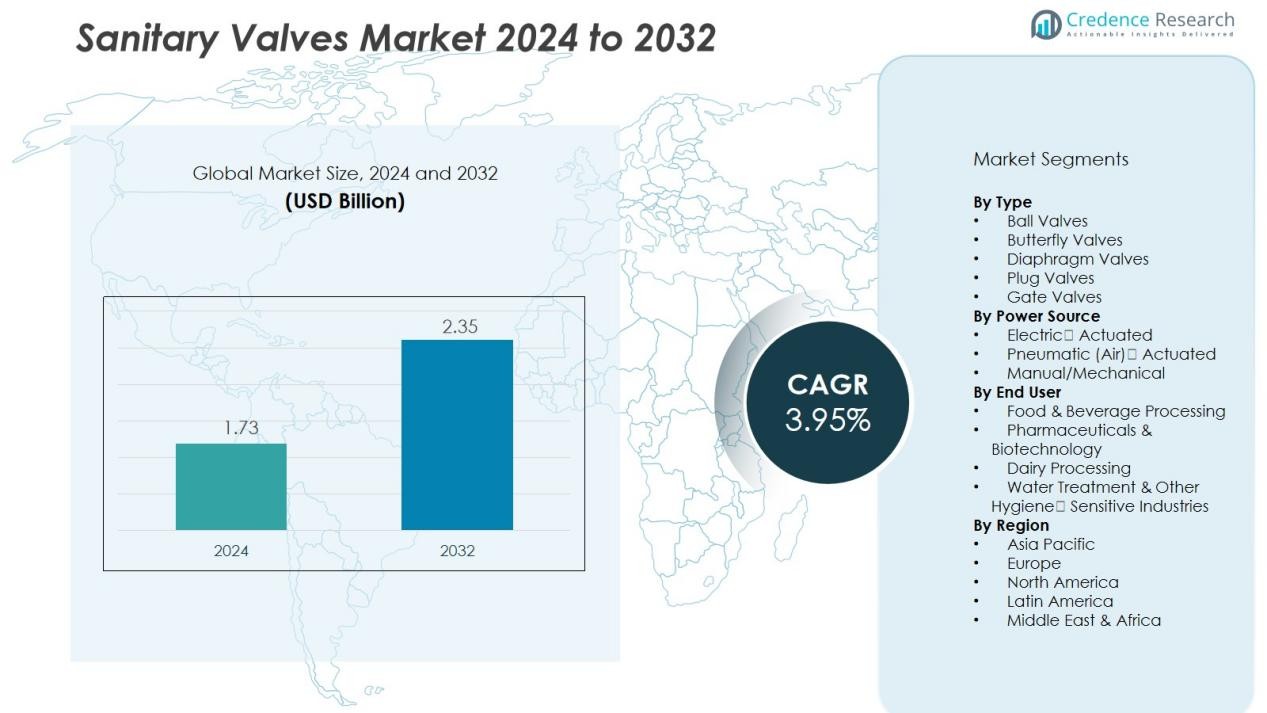

The Sanitary Valves Market size was valued at USD 1.73 billion in 2024 and is anticipated to reach USD 2.35 billion by 2032, at a CAGR of 3.95 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sanitary Valves Market Size 2024 |

USD 1.73 Billion |

| Sanitary Valves Market, CAGR |

3.95% |

| Sanitary Valves Market Size 2032 |

USD 2.35 Billion |

Key drivers of this market expansion include the rising focus on maintaining hygienic conditions in manufacturing and processing plants. Stringent hygiene and safety regulations are pushing companies to adopt sanitary valves that meet compliance standards. Additionally, advancements in valve technology, such as smart monitoring features, corrosion-resistant materials, and improved clean-in-place capabilities, are fueling market demand. These innovations are allowing for greater efficiency, performance, and reliability in sanitation-critical applications.

Regionally, North America holds a significant share of the sanitary valves market, driven by robust regulatory frameworks and a well-established food processing and pharmaceutical industry. Europe follows closely, benefiting from its stringent environmental and hygiene standards. Meanwhile, the Asia-Pacific region is expected to witness the highest growth due to rapid industrialization, increasing manufacturing capacity, and rising awareness of hygiene practices in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Sanitary Valves Market was valued at USD 1.73 billion in 2024 and is projected to reach USD 2.35 billion by 2032, growing at a CAGR of 3.95% during the forecast period.

- North America leads the market with a 40% share, driven by its mature food and beverage and pharmaceutical industries, coupled with strict regulatory frameworks. Europe follows closely with a 30% share, supported by stringent environmental and hygiene standards across its processing sectors. The Asia-Pacific region holds 25% of the market, experiencing rapid industrialization and rising manufacturing capacities in food, beverage, and pharmaceutical sectors.

- The Asia-Pacific region is the fastest-growing market, expected to expand significantly due to increasing industrial expansion, higher manufacturing capacity, and growing awareness of hygiene practices in emerging economies.

- In terms of segment distribution, ball valves dominate the Sanitary Valves Market with a significant share, followed by diaphragm valves which are crucial for industries requiring high cleanliness standards. Pneumatic actuated valves hold a prominent share due to their widespread use in industries with established compressed air infrastructure.

- The food & beverage processing segment holds the largest share in the market, driven by rising hygiene demands, with pharmaceutical and biotechnology sectors closely following due to the need for stringent sanitary controls.

Market Drivers:

Market Drivers:

Rising Demand for Hygienic Standards in Food & Beverage Processing

The growing demand for hygienic standards in food and beverage processing is a significant driver for the sanitary valves market. Regulatory frameworks governing food safety and cleanliness are becoming more stringent, prompting manufacturers to prioritize contamination-free environments. Sanitary valves, designed to ensure easy cleaning and minimal contamination, are increasingly used to meet these standards. The food industry’s emphasis on maintaining product quality and safety during production, handling, and packaging has spurred the adoption of sanitary valves across various processes.

- For instance, GEA hygienic valve technology meets stringent requirements in terms of food safety and optimum quality, offering manufacturers maximum product safety and process reliability.

Technological Advancements in Valve Design

Innovations in valve technology have been instrumental in driving the growth of the sanitary valves market. Modern sanitary valves now incorporate features such as smart monitoring systems, automated controls, and enhanced corrosion resistance. These improvements contribute to the valves’ ability to operate more efficiently, reduce maintenance costs, and extend service life. The development of advanced materials for valve construction also supports the growing need for durability and reliability in critical applications, making sanitary valves an essential component in a variety of industries.

- For Instance, Parker Hannifin offers stainless-steel valves for high-hygiene applications, including some with features like FDA-compliant seal materials and designs that facilitate thorough cleaning, to help meet stringent industry standards

Stringent Regulatory and Safety Standards

Sanitary valves are increasingly in demand due to the implementation of stringent regulatory and safety standards across industries such as pharmaceuticals and biotechnology. Compliance with these regulations requires highly reliable and easy-to-clean components in manufacturing systems. Sanitary valves are designed to meet the highest hygiene standards, ensuring that processes remain contamination-free. The need to adhere to these standards is accelerating the market’s expansion, particularly in highly regulated sectors that cannot afford even minimal contamination risks.

Growth in the Pharmaceutical and Biotech Industries

The pharmaceutical and biotechnology industries represent a growing market for sanitary valves. These sectors demand high levels of sanitation to prevent contamination during drug manufacturing and processing. Sanitary valves are critical in controlling the flow of fluids and gases in sterile environments. The rapid growth in biotech and pharmaceutical research and production continues to drive the demand for valves that provide tight control and ease of maintenance while ensuring compliance with health and safety standards.

Market Trends:

Technological Integration and Smart Monitoring Leading the Way

The Sanitary Valves Market has shifted toward greater integration of automation and digital monitoring in its systems. It now features valves equipped with sensors that track position, pressure, temperature, and wear metrics, enabling remote diagnostics and predictive maintenance. Manufacturers deploy these smart valves to reduce downtime, minimise manual inspection, and optimise operational efficiency in hygiene‑critical sectors. Material choices are evolving to include high‑performance alloys and composites that offer enhanced corrosion resistance and longer service intervals. Customers show increasing willingness to invest in these advanced systems even when upfront cost remains higher, because lifetime cost savings and performance benefits justify the expenditure.

- For Instance, Duplex stainless steel is used in sanitary valves to provide superior strength and enhanced corrosion resistance, particularly in challenging environments like those with high chloride concentrations, compared to traditional austenitic stainless steel grades.

Sustainability and Customised Hygienic Solutions Gaining Traction

The market shows a strong trend toward eco‑friendly materials and designs that support responsible manufacturing practices in regulated industries. It satisfies this demand by offering valves constructed from recyclable stainless steel, low‑waste assembly methods, and designs that simplify cleaning and reduce water and chemical usage. End‑users in food, beverage and biotechnology sectors expect tailored valve configurations that fit specific fluid types, process pressures and hygiene criteria—thus driving suppliers to offer more modular, custom solutions. The demand for compact footprint valves and systems compatible with clean‑in‑place (CIP) operations continues to rise, reflecting the need for flexible production lines and sanitation‑ready hardware. This trend underscores that performance metrics now include environmental and operational sustainability in addition to technical capability.

- For instance, Winmate’s Stainless Series Panel PCs are engineered for industrial food and pharmaceutical use, supporting clean-in-place operations and compact system integration, with compatibility validated for 24/7 operation in environments exceeding stringent hygiene metrics.

Market Challenges Analysis:

High Volatility in Raw Material Costs and Supply‑Chain Pressure

The Sanitary Valves Market faces considerable challenges due to fluctuations in raw material prices and disruptions within global supply chains. Manufacturers must absorb rising costs for stainless steel and specialty alloys without being able to fully pass them on to end‑users, which squeezes margins. Frequent supply delays force firms to hold higher inventory levels, raising operational expense and tying up working capital. Smaller producers feel the pressure more acutely because they lack the purchasing power and scale of larger competitors. It becomes harder to maintain consistent product delivery times and pricing stability in such an environment.

Complex Regulatory Requirements and Competitive Pressure from Low‑Cost Entrants

The market operates under strict hygiene, safety and material‑traceability regulations across food processing, pharmaceuticals and biotechnology sectors. Firms must invest heavily in certification, documentation and process control to comply with evolving standards, which elevates entry‑cost and ongoing overhead. At the same time, low‑cost manufacturers from emerging regions enter the sanitary‑valves field and offer less expensive alternatives, which forces established suppliers to choose between eroding margin or losing business. It becomes difficult for firms to differentiate purely on cost, since regulatory compliance levels the playing field. Competitive intensity therefore remains high and growth can stall when firms prioritise cost‑cuts over innovation or quality.

Market Opportunities:

Expansion of Smart Technology Integration and Value‑Added Services

The sanitary valves market presents significant opportunity in the integration of smart technologies and associated services. Many end‑users now expect valves to perform not only mechanical functions but also to provide real‑time diagnostics, remote monitoring, and predictive maintenance capabilities. Manufacturers can capture value by offering connected valve systems that feed into digital production control platforms. It opens channels for service contracts, lifecycle support and retrofit solutions in existing plants. Firms that invest in sensor‑embedded valves, data analytics and remote diagnostics can differentiate themselves and command premium pricing. These advanced offerings support customers’ drive to improve uptime, reduce maintenance costs and ensure process integrity.

Untapped Growth in Emerging Regions and Application Sectors

Growth of the sanitary valves market will also stem from penetration in emerging geographies and under‑served application areas. Regions such as South‑East Asia, Africa and Latin America are upgrading their food‑&‑beverage and pharmaceutical manufacturing infrastructure, creating new valve demand. Opportunities exist in niche sectors such as biotechnology, dairy processing, and water treatment where hygiene standards are tightening. Providers that tailor products to local needs—low‑cost variants, simplified service models or modular designs—can gain market share. Strategic partnerships with local distributors and adaptation of product portfolios to regional manufacturing norms enhance access. The combination of rising industrial investment and broadening of use‑cases fuels long‑term potential for valve suppliers.

Market Segmentation Analysis:

By Type

The Sanitary Valves Market segments by valve type including ball valves, butterfly valves, diaphragm valves and other specialised variants. It sees ball valves deployed widely due to their reliable sealing, low maintenance and suitability for high‑hygiene applications. Butterfly valves gain traction where space, cost and quick actuation matter, particularly in large‑diameter lines. Diaphragm valves find favour within sectors requiring extreme cleanliness and minimal dead‑space, such as pharmaceutical and biotech. Suppliers tailor design and material (for example stainless steel, alloy or PFA coating) to match fluid characteristics and sanitation demands.

- For instance, Saunders (a Crane brand) manufactures sanitary diaphragm valves (and newly introduced hygienic ball valves) with internal surface polishing achieving an Ra value (surface roughness) of ≤ 0.4μm, meeting zero-leakage requirements for pharmaceutical and food processing applications.

By Power Source

Within this market, power source segmentation refers to how the valves operate or control actuation rather than purely mechanical flow parts: options include electric‑actuated and pneumatic (air)‑actuated valves. Electric actuation appeals because it delivers precise control, enables digital monitoring and fits well into automated production lines. Air (pneumatic) actuation remains popular in facilities where compressed air infrastructure is established and explosion‑proof or intrinsically safe environments exist. Selection of power source depends on reliability, environmental conditions, certification needs and maintenance regime. It gives suppliers a chance to differentiate via control interface, connectivity and service support.

- For instance, Rotork’s CVA precision modulating actuators achieve position control accuracy of up to 0.1% using a 4 to 20 mA signal, enabling manufacturing facilities to maintain exact valve positioning critical for fuel injection and combustion processes.

By End User

End‑user segmentation for the Sanitary Valves Market covers food processing, beverages (non‑alcoholic and alcoholic), dairy, pharmaceuticals, biotechnology and other hygiene‑sensitive industries. The pharmaceutical sector demands the highest certification, purgeability and aseptic performance so it commands a major share of valve‑specification spend. Food and beverage processing requires valves that support rapid cleaning, recipe changeovers and contamination prevention. Dairy operations emphasise ease of cleaning, resistance to CIP/SIP cycles and gentle handling of sensitive products. Other sectors such as personal care, cosmetics and water‑treatment also adopt sanitary‑grade valves to meet regulatory hygiene standards. Each end‑user category sets unique requirements for materials, certification, design and service support, which drives segmentation and supplier strategy.

Segmentations:

By Type

- Ball Valves

- Butterfly Valves

- Diaphragm Valves

- Plug Valves

- Gate Valves

By Power Source

- Electric‑Actuated

- Pneumatic (Air)‑Actuated

- Manual/Mechanical

By End User

- Food & Beverage Processing

- Pharmaceuticals & Biotechnology

- Dairy Processing

- Water Treatment & Other Hygiene‑Sensitive Industries

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Market Region

The North America region leads the Sanitary Valves Market with a market share of approximately 40%. It benefits from mature food & beverage and pharmaceutical industries that demand high‑specification sanitary valves. It sees strong investment in automation and advanced valve technologies, which drives replacement and upgrade cycles. Manufacturers in this region face high regulatory and certification standards, which raise both entry‑costs and product‑value. It also leverages a strong supplier ecosystem and established distribution networks, which supports rapid deployment of new valve solutions. The combination of high demand and rigorous quality requirements makes North America a benchmark region for sanitary‑valve performance.

Europe Market Region

Europe holds an estimated market share of around 30% of the Sanitary Valves Market. It draws strength from regulatory frameworks that emphasise hygiene, safety and environmental compliance in processing industries. It maintains a strong manufacturing base in food processing, beverages and pharmaceuticals, which consistently drives demand for sanitary valves. It also pursues sustainability‑driven design, including materials reuse and energy‑efficient actuation technologies. European firms face competitive pressure to innovate and reduce cost while meeting stringent standards, which fosters high‑end product development. It remains an appealing region for both established manufacturers and new entrants focusing on premium sanitary valve solutions.

Asia‑Pacific & Rest of World Region

The Asia‑Pacific region commands an approximate market share of 25% in the Sanitary Valves Market and shows the fastest growth rate among all regions. It gains traction from rapid industrial expansion, increased food and beverage manufacturing capacity and rising pharmaceutical and biotech operations in countries such as China and India. It faces lower baseline infrastructure quality compared to mature markets, which creates both challenge and opportunity for valve suppliers. It often has cost‑sensitive buyers who still require hygiene‑compliant equipment, pushing suppliers to balance performance and affordability. Growth in emerging markets in Latin America, Middle East & Africa complements momentum by offering new green‑field opportunities for sanitary valve adoption.

Key Player Analysis:

- Alfa Laval AB

- Ampco Pumps Company

- Dixon Valve & Coupling Company LLC

- Dover Corporation

- GEA Group Aktiengesellschaft

- Holland Applied Technologies, Inc.

- IDEX Corporation

- KSB SE & Co. KGaA

- SPX Corporation

- Tapflo Group

Competitive Analysis:

The competitive landscape of the Sanitary Valves Market features a combination of global leaders and specialized niche players that drive innovation and set industry standards. Key companies include Alfa Laval AB, Ampco Pumps Company, Dixon Valve & Coupling Company LLC and Dover Corporation.

Alfa Laval AB holds a prominent position through its extensive hygienic valve portfolio tailored for food, beverage and pharmaceutical applications, and it frequently expands its offerings to meet stricter hygiene standards. Ampco Pumps Company focuses more on pumps, but its involvement in sanitary fluid handling systems positions it as a complementary player within hygienic process systems and indirectly impacts valve demand. Dixon Valve & Coupling Company LLC supplies hygienic valves and fittings, firmly aligning with plant‑upgrade demands in regulated sectors, which gives it targeted influence. Dover Corporation, though diversified, contains business units that address hygienic fluid‑handling and sanitary valve applications, operating at scale and leveraging global supply chains and aftermarket services.

Competitive dynamics require firms to innovate in materials, actuation technology and monitoring capability while maintaining compliance with rigorous hygiene regulations. Pricing pressure from low‑cost suppliers in emerging markets forces established companies to emphasise product differentiation, lifecycle support and turnkey solutions. Partnerships, acquisitions and geographic expansion serve as strategic levers to secure access to fast‑growing regional markets and bolster service networks.

Recent Developments:

- In July 2025, Alfa Laval AB completed the acquisition of the cryogenics business unit of Fives, known as Fives Energy Cryogenics, expanding its portfolio in LNG, hydrogen, and industrial gas technologies.

- In May 2025, Dover Corporation announced an agreement to acquire SIKORA AG, a German technology firm, for €550 million to strengthen its Pumps & Process Solutions segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Power Source, End User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The sanitary valves market will see rising demand for smart valve solutions that provide condition monitoring and predictive maintenance.

- It will benefit from expanding automation adoption in the food & beverage, pharmaceutical and biotech industries.

- The industry will move toward advanced materials that offer enhanced corrosion resistance, longer life‑cycle and easier cleaning.

- Suppliers will increase focus on modular and configurable valve systems to support flexible production lines and clean‑in‑place operations.

- Expansion into emerging markets in Asia‑Pacific, Latin America and Middle East & Africa will create substantial growth avenues for valve manufacturers.

- It will face opportunity in new applications such as water treatment, personal care manufacturing and dairy processing where hygiene standards are rising.

- Growth will arise from service‑based offerings and aftermarket support including retrofits, digital upgrades and lifecycle management.

- It will require manufacturers to meet stricter regulatory compliance and traceability demands in hygiene‑critical sectors, thus raising entry‑barriers and product value.

- Sustainability considerations will influence product design, with demand for energy‑efficient actuation, recyclable materials and reduced‑waste manufacturing.

- It will encourage strategic partnerships and regional distribution networks to deliver localized support, shorten lead times and adapt to regional requirements.

Market Drivers:

Market Drivers: