Market Overview:

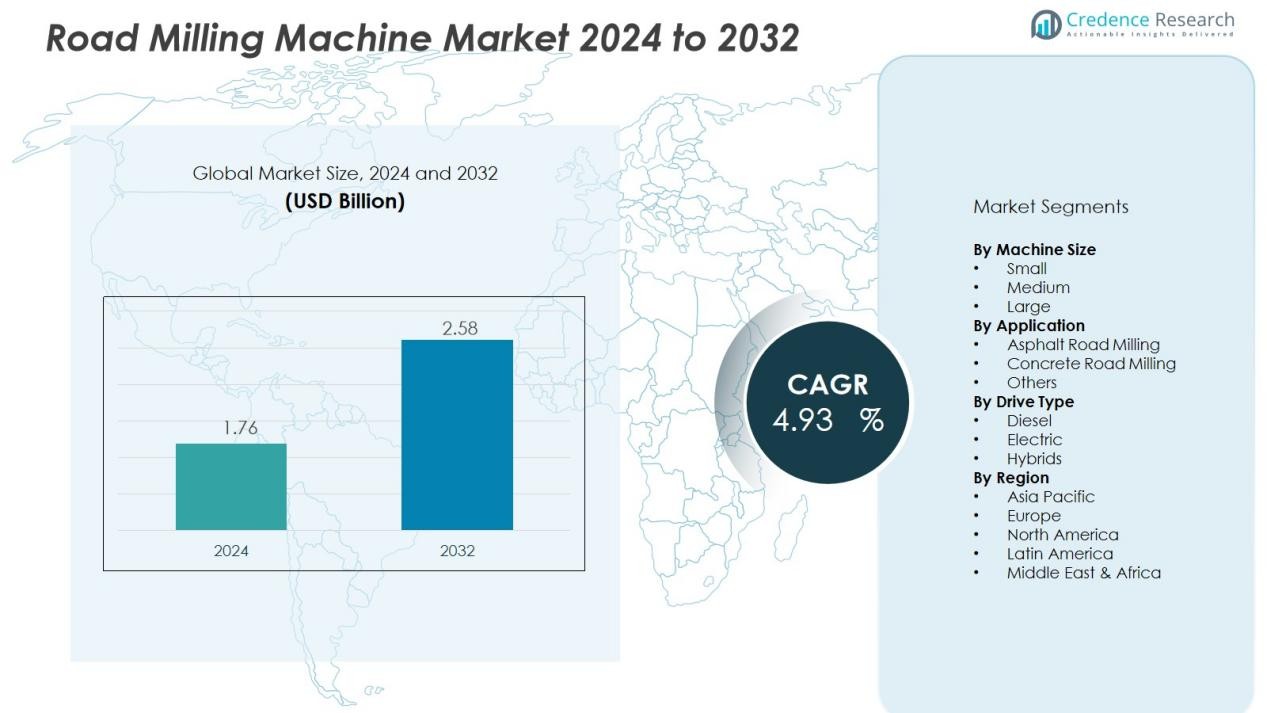

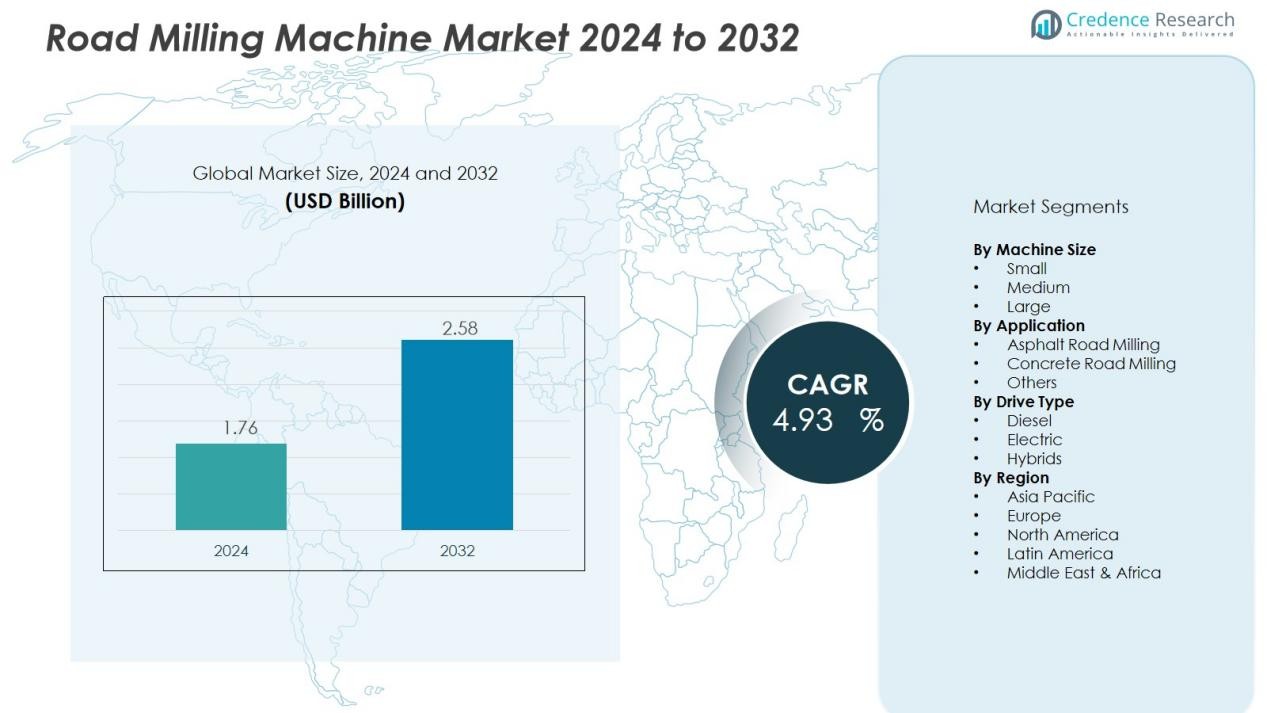

The Road Milling Machine Market size was valued at USD 1.76 billion in 2024 and is anticipated to reach USD 2.58 billion by 2032, at a CAGR of 4.93 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Road Milling Machine Market Size 2024 |

USD 1.76 Billion |

| Road Milling Machine Market, CAGR |

4.93% |

| Road Milling Machine Market Size 2032 |

USD 2.58 Billion |

Several factors are fueling the growth of the road milling machine market. Key drivers include significant infrastructure investments aimed at modernizing and repairing aging road networks, especially in emerging and developed economies. Rapid urbanization and rising vehicular traffic are also straining existing road systems, necessitating frequent road repairs and resurfacing. Furthermore, technological advancements, such as semi-autonomous operations, electric or low-emission machines, and intelligent control systems, are enhancing operational efficiency and driving the replacement and adoption cycles of milling machines.

The Asia-Pacific region dominates the global market, driven by large-scale road construction projects in countries like China, India, and other Southeast Asian nations. These regions are also heavily invested in smart city development and infrastructure upgrades. North America and Europe maintain significant market shares, supported by ongoing infrastructure maintenance and replacement needs. Meanwhile, Latin America, the Middle East, and Africa represent emerging markets with moderate growth potential as investments in infrastructure ramp up in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Road Milling Machine Market was valued at USD 1.76 billion in 2024 and is projected to reach USD 2.58 billion by 2032, growing at a CAGR of 4.93% during the forecast period.

- The Asia-Pacific region holds the largest market share at 40%, driven by large-scale infrastructure projects in China, India, and Southeast Asia, with significant investments in road resurfacing and smart city developments.

- North America follows with a market share of nearly 30%, supported by extensive highway maintenance, high demand for low-emission machines, and federal infrastructure investment programs.

- Europe holds just over 30% of the market share, driven by infrastructure maintenance and adoption of emission-compliant machines across key economies like Germany, France, and the UK.

- The Asia-Pacific region remains the fastest-growing, with increasing urbanization, expanding transportation networks, and the rising need for sustainable, efficient road milling equipment as key drivers.

Market Drivers:

Market Drivers:

Rising Demand for Road Resurfacing and Rehabilitation

The growing need for road resurfacing and rehabilitation drives demand for road milling machines. Aging infrastructure and increasing traffic volumes create a pressing need for frequent road repairs and upgrades. Governments and private entities are investing heavily in road maintenance projects, particularly in urban areas with deteriorating pavement conditions. These investments stimulate market growth by increasing the use of milling machines for surface preparation, which is essential for long-lasting road repairs.

- For instance, Wirtgen Group’s latest 3D-controlled milling machine achieves a grade accuracy of ±2 mm over a 15-meter run, enabling faster surface prep for urban road repairs.

Expansion of Infrastructure Projects in Emerging Economies

Emerging economies, particularly in Asia-Pacific and Africa, are witnessing rapid urbanization and infrastructure development. The demand for road milling machines increases as countries expand their transportation networks to meet the growing needs of their populations. These regions are investing in major highway upgrades, construction of new roadways, and urban infrastructure projects, where milling machines play a crucial role in surface preparation and material recycling, thereby reducing project costs and enhancing road quality.

- For Instance, the Sany 2-meter SCM2000C-10R milling machine was used on a road renovation project in South Africa.

Technological Advancements in Road Milling Equipment

Technological innovation is enhancing the performance and efficiency of road milling machines. Newer models incorporate features such as semi-autonomous operations, automated control systems, and lower emission engines. These technological advancements increase productivity and reduce environmental impacts, making milling machines more attractive to contractors. The availability of advanced machines is boosting market growth, as they improve the quality of road construction and maintenance projects.

Regulatory Pressure for Sustainable and Efficient Road Maintenance

Stricter environmental regulations and sustainability goals are influencing the demand for road milling machines. Governments worldwide are focusing on reducing carbon emissions and enhancing energy efficiency in construction operations. Milling machines that use less fuel and produce fewer emissions are becoming the preferred choice for road maintenance projects. These regulations are pushing manufacturers to innovate and provide machines that meet environmental standards, further supporting market growth.

Market Trends:

Integration of Automated and Connected Technologies

The Road Milling Machine Market is moving toward greater automation, and it is integrating connected technologies into core equipment operations. Manufacturers are embedding GPS‑based guidance, telematics dashboards, and semi‑autonomous drive systems to improve machine precision and operator productivity. Contractors receive real‑time diagnostics and performance data, enabling proactive maintenance and reducing downtime. It is becoming standard for large‑scale users to demand these features to meet tighter project timelines and cost targets. Investment in such technologies increases the differentiation among machine vendors and elevates the baseline for competitive offerings.

- For instance, specific applications like highway platooning for freight trucks have demonstrated a 10% to 30% reduction in fuel consumption in some trials, while AI-driven improvements in general business processes (such as data entry or software development) have shown labor productivity growth in the range of 30% to 50%, or even higher in specific applications.

Emphasis on Sustainability and Emission‑Friendly Equipment

The road milling machine market is experiencing increasing pressure from regulatory bodies and infrastructure owners to adopt machines with lower emissions and higher energy efficiency. It is now common for new models to incorporate electric drives or hybrid systems, and for manufacturers to highlight reduced fuel consumption and recycling capability of milled material. Contractors promote these features when bidding for public‑sector contracts that mandate sustainable equipment usage. Environmental responsibility therefore shifts from a niche feature to a core requirement, driving suppliers to redesign machines and adopt cleaner technologies.

- For instance, Wirtgen reports operational fuel savings and emissions reductions through these innovations, and MILL ASSIST contributes to lower energy use per ton milled.

Market Challenges Analysis:

High Initial Acquisition Cost and Ownership Burden

The Road Milling Machine Market faces a major challenge from the high upfront cost of specialized milling equipment and associated ownership expenses. Many small‑ and medium‑sized contractors struggle to allocate capital for machines that require substantial investment in purchase, transport and commissioning. It also demands ongoing expenditures for fuel, parts, and preventive maintenance, which weigh heavily on operating budgets. Procurement of advanced models with automation or hybrid drives compounds financial commitment and slows replacement cycles. The capital intensity limits fleet expansion and restricts market penetration in regions with tighter budgets or lower project margins.

Skilled Operator Shortage and Technology Adoption Gap

The market encounters a parallel challenge in the limited availability of trained operators and slower adoption of newer technologies in some areas. Milling machines now integrate telematics, automated controls and connected systems, but many contractors lack the workforce or training infrastructure to deploy and maintain them effectively. It hampers the realisation of full productivity gains and may reduce the appeal of advanced models in price‑sensitive segments. Regulatory requirements for emissions and safety impose additional complexity on machine operation and upkeep. Some markets therefore lag in uptake of modern equipment, which constrains growth opportunities and delays transition from legacy machines.

Market Opportunities:

Expansion into Emerging Infrastructure Markets

The road milling machine market presents significant opportunity in regions where infrastructure remains under‑invested. Many countries in Asia‑Pacific, Latin America and Africa allocate fresh budgets for major roadway upgrades and urban development. It allows manufacturers and service providers to introduce machine models suited to varying scales of projects—from large highways to secondary roads. Contractors in these regions show growing interest in efficient resurfacing and rehabilitation machinery that lowers downtime and extends pavement life. It opens channels for local distribution, rental fleets and after‑sales services that tailor to regional needs.

Adoption of Digital, Eco‑Efficient and Hybrid Machinery

Another compelling opportunity lies in equipment innovation that aligns with sustainability goals and technological upgrades. The road milling machine market can capitalise on rising demand for machines equipped with telematics, automation and hybrid or electric drives. It enables equipment makers to offer solutions that yield lower fuel consumption, reduced emissions and higher productivity. Rental companies and large contractors increasingly favour modern machines capable of remote monitoring and predictive maintenance. It encourages collaboration between OEMs, technology firms and infrastructure leaders to set new standards of operational efficiency and environmental performance.

Market Segmentation Analysis:

By Machine Size

The Road Milling Machine Market distinguishes machines into small, medium and large size categories to meet varied project demands. Small machines deliver high manoeuvrability in restricted urban sites and narrower roadways. Medium machines provide a balance between mobility and capacity, making them the preferred choice for a range of resurfacing and rehabilitation jobs. Large machines carry the highest throughput and serve major highways or extensive milling operations where time and scale matter most. Each size class exhibits distinct cost structures, deployment patterns and fleet utilisation models.

- For Instance, The Wirtgen W 200 Hi features zero-clearance sides and advanced engine technology for precise milling flush to kerbs in urban environments. It has a standard milling width of 2.1 meters and complies with US Tier 4f (EU Stage 4/5) emission standards.

By Application

The market categorises application primarily into asphalt road milling, concrete road milling and other specialised uses. Asphalt milling dominates thanks to the prevalence of asphalt pavements in many regions and regular resurfacing cycles. Concrete milling addresses refurbishment of rigid pavements, removal of damaged sections and full‑depth reconstruction, demanding higher machine robustness. Other applications include utility cut‑outs, trench restoration and niche surface preparation tasks that require tailored machines. Service providers and contractors select machine types and attachments according to the condition of the pavement and project scope.

By Drive Type

Drive type segmentation in the road milling machine market includes diesel‑powered systems, electric drives and hybrid combinations. Diesel remains the mainstream choice because of global availability of fuel and mature engine infrastructure. Electric drive machines gain traction in regions with strong emission regulation or where infrastructure supports charging and power supply. Hybrid systems bridge performance and sustainability, offering reduced fuel consumption and lower emissions without full dependence on grid power. Machine OEMs emphasise drive‑type innovation to address contractor demand for lower operating costs and regulatory compliance.

- For instance, Wirtgen’s large milling machines deploy a high-torque diesel engine rated to deliver peak power efficiently, enabling milling depths up to 330 mm in demanding pavements.

Segmentations:

By Machine Size

By Application

- Asphalt Road Milling

- Concrete Road Milling

- Others

By Drive Type

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia‑Pacific Region

The Asia‑Pacific region commands roughly 40 % share of the global Road Milling Machine Market, positioning it as the most influential regional segment. Growth stems from widespread urbanisation, large‑scale highway construction programmes and aggressive government funding for road infrastructure and smart‑city projects. It benefits from robust demand in China, India and Southeast Asian nations where older road networks require frequent resurfacing and rehabilitation. Contractors in the region increasingly deploy milling machines equipped with modern automation and recycling capabilities to optimise project timelines and budgets. The presence of local OEMs and cost‑competitive manufacturing further supports market penetration. It faces challenges related to operator skill gaps and inconsistent maintenance ecosystems, yet the region remains the fastest‑growing in the forecast period.

North America

North America holds a market share nearing one‑third of the global Road Milling Machine Market and remains a mature yet dynamic region. The region’s demand is driven by renewal and repair of extensive highway systems, ageing high‑volume urban roadways and stringent environmental standards that favour machines with low‑emission drives. It sees heightened adoption of telematics, hybrid power systems and advanced milling attachments to meet contractor productivity targets. A strong aftermarket ecosystem for servicing and retrofitting supports continued utilisation of milling fleets. The United States leads regional volume, supported by federal infrastructure investment programmes. It contends however with tight labour markets and high machine ownership costs that constrain smaller contractors.

Europe

Europe registers slightly over 30 % share of the global Road Milling Machine Market and features a balance of replacement‑cycle demand and new construction projects. Infrastructure maintenance across major economies such as Germany, France and the UK creates dependable demand for milling equipment, especially machines compliant with emission regulations. It encourages migration to electric drives, autonomous controls and material‑recycling systems to fulfil sustainability mandates. It boasts well‑developed rental fleets and service networks that extend machine lifecycles and improve utilisation rates. Growth is steady but slower compared to Asia‑Pacific and North America due to mature market conditions and reduced large‑scale greenfield highway projects. It must also navigate regulatory complexity and high cost of ownership in several jurisdictions.

Key Player Analysis:

- Caterpillar Inc.

- Astec Industries Inc. (Roadtec)

- Xuzhou Construction Machinery Group Co. Ltd

- Sakai Heavy Industries Ltd

- Volvo Construction Equipment

- BOMAG GmbH (FAYAT Group)

- Sany Heavy Industry Co Ltd.;

Competitive Analysis:

The competitive landscape of the Road Milling Machine Market demonstrates strong concentration among key global players. Major firms such as Caterpillar Inc., Astec Industries Inc. (including its Roadtec division), and Xuzhou Construction Machinery Group Co. Ltd account for roughly 45 % to 50 % of market share in many regions. These companies maintain competitive advantage through broad product portfolios that cover small to large‑scale milling equipment and support services.

Caterpillar secures its position with an extensive global dealer and service network, offering machines such as the PM‑series cold planers designed for high productivity and long service life. Astec Industries (Roadtec) focuses on advanced milling solutions, emphasising versatility in compact and high‑production machines tailored for multiple job‑site conditions. Xuzhou Construction Machinery Group leverages cost‑competitive manufacturing and strong regional presence in Asia‑Pacific to capture growth in emerging markets. Competitors differentiate by technology features, local service infrastructure, rental fleet partnerships and regulatory‑compliance capabilities. The ongoing push for automation, electric or hybrid drives and telematics places pressure on manufacturers to innovate or lose relevance in this dynamic market environment.

Recent Developments:

- In October 2025, Caterpillar Inc. entered into an agreement to acquire RPMGlobal Holdings Limited, an Australian-based mining software company, with the transaction expected to close in the first quarter of 2026 pending regulatory and shareholder approvals.

- In September 2025, Sakai Heavy Industries strengthened its partnership with Thailand by hosting a Road Paving Technology Seminar, aimed at sharing advanced road construction technology and increasing regional collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Machine Size, Application, Drive Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Road Milling Machine Market will experience continued innovation, with a growing emphasis on automation and telematics in equipment functionality.

- Advancements in hybrid and electric drive systems will contribute to reducing fuel consumption and lowering carbon emissions, responding to tightening environmental regulations.

- A shift toward more sustainable and efficient machines will encourage greater adoption of road milling equipment in urban areas with stringent emission standards.

- The demand for highly versatile, all-terrain machines will increase as contractors look for equipment capable of handling a variety of pavement conditions and job-site requirements.

- Technological enhancements such as GPS-based guidance systems, autonomous milling controls, and real-time performance monitoring will enhance operational efficiency and reduce costs for contractors.

- Emerging markets in Asia-Pacific and Latin America will drive demand, with infrastructure upgrades and road development projects taking priority.

- The trend of machine rental will continue to rise, especially in regions where contractors prefer cost-effective solutions rather than long-term ownership.

- There will be a growing need for specialized milling machines designed for niche applications, such as concrete milling or utility trench restoration.

- Increasing collaborations between OEMs and tech companies will lead to innovations in machine controls, predictive maintenance, and fuel efficiency.

- The rise in infrastructure investment globally, particularly in smart cities, will support sustained growth in the demand for advanced road milling machinery.

Market Drivers:

Market Drivers: