Market Overview

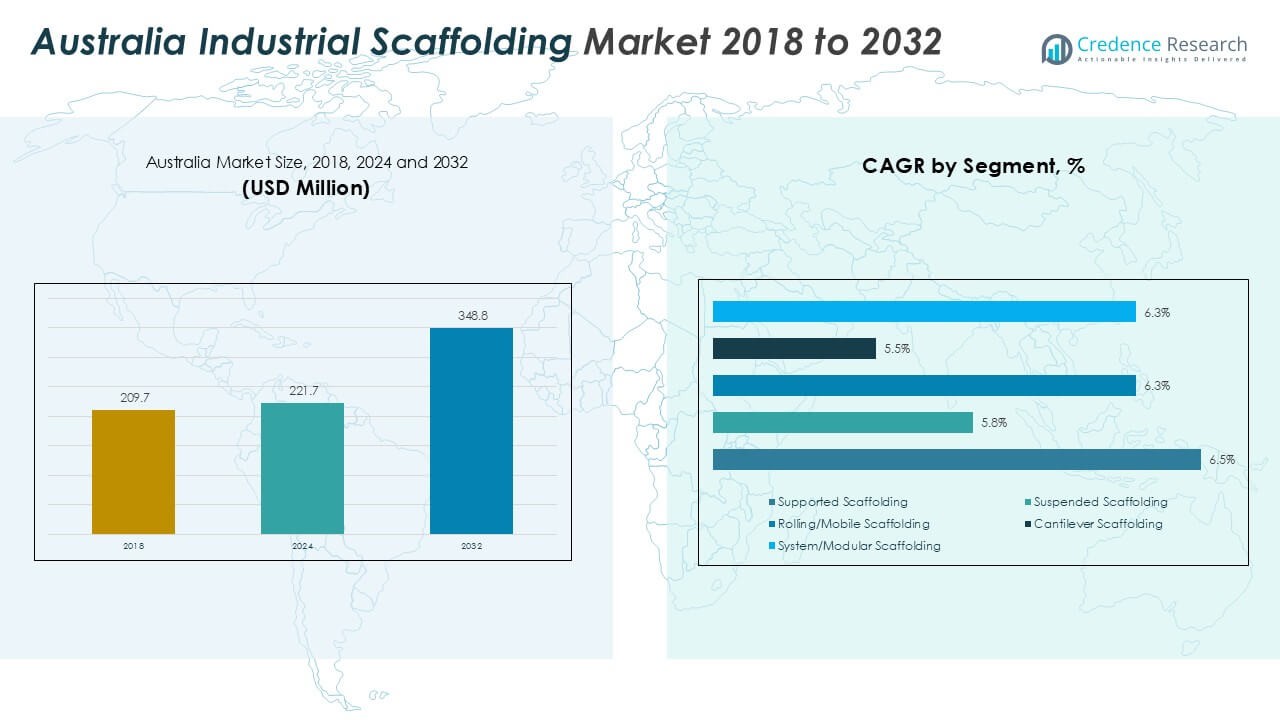

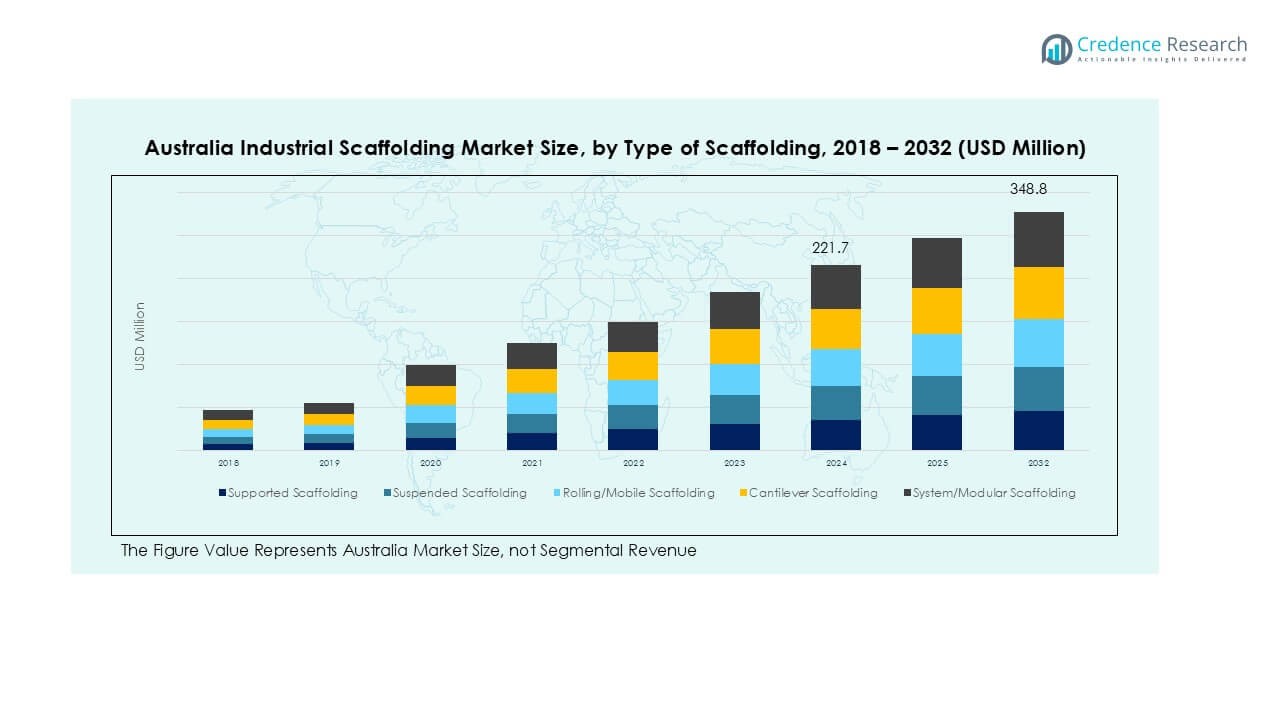

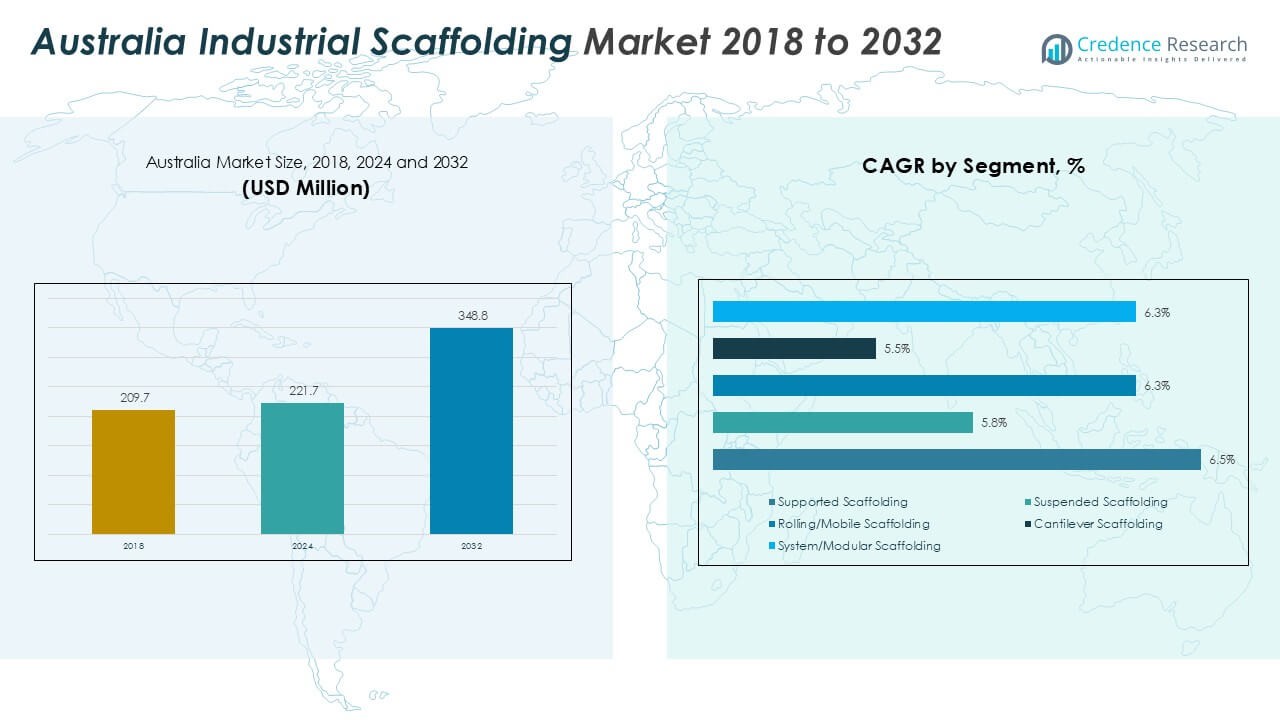

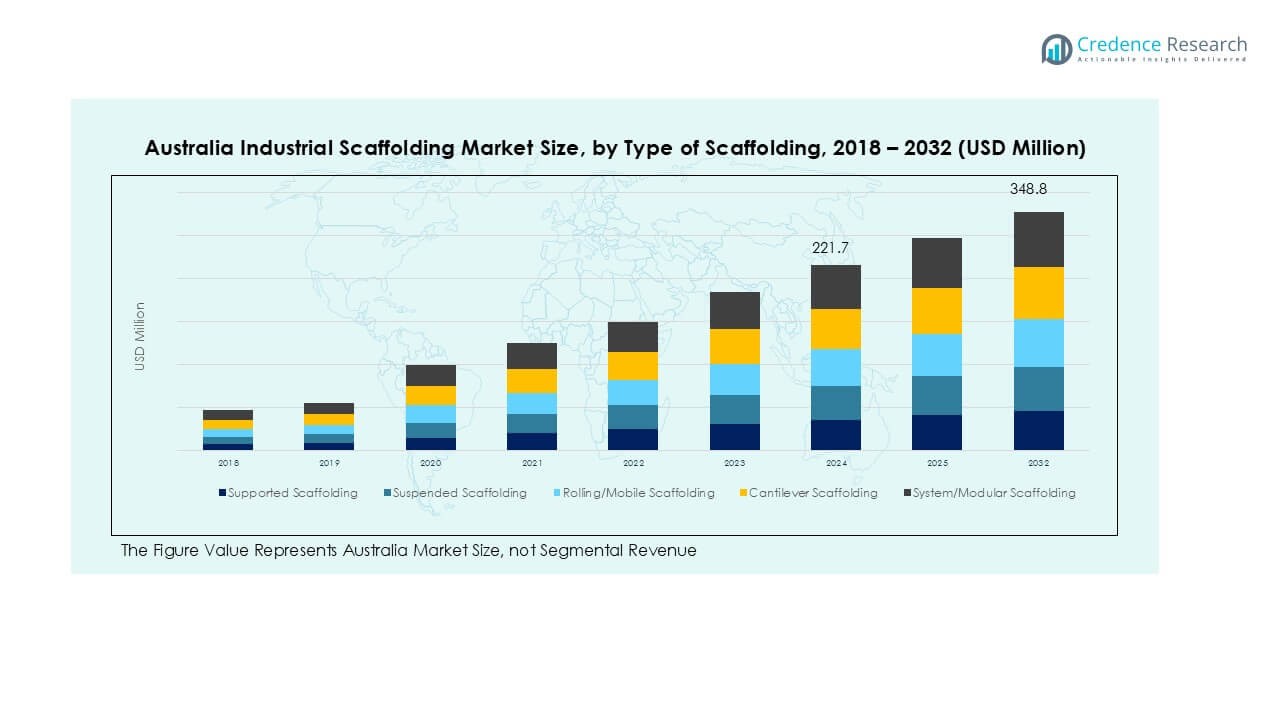

Australia Industrial Scaffolding market size was valued at USD 209.7 million in 2018 to USD 221.7 million in 2024 and is anticipated to reach USD 348.8 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Industrial Scaffolding Market Size 2024 |

USD 221.7 Million |

| Australia Industrial Scaffolding Market, CAGR |

5.8% |

| Australia Industrial Scaffolding Market Size 2032 |

USD 348.8 Million |

The Australia industrial scaffolding market is led by key players such as Caledonia Group, KJ Industrial Scaffolding, Mr Scaffold, FAB Industrial Scaffolding, KwikUp, Turbo Aluminium, Oceania Access, Western Scaffold Pty Ltd, AZL Holdings Pty Ltd, and Integral Scaffolding. These companies dominate through strong rental networks, modular system offerings, and turnkey project services across construction, energy, and mining sectors. New South Wales emerges as the leading region, accounting for 30% of the total market share, driven by extensive infrastructure projects, power generation assets, and refinery maintenance programs. Victoria and Queensland follow with significant shares, supported by manufacturing plants, LNG facilities, and mining operations. Competitive strategies focus on expanding equipment fleets, adopting digital project planning tools, and maintaining strict WHS compliance. Leading players continue to invest in workforce training and sustainable solutions to strengthen their market position and capture growing opportunities in infrastructure and industrial maintenance projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia industrial scaffolding market was valued at USD 7 million in 2024 and is projected to grow at a CAGR of 5.8% through 2032, driven by infrastructure expansion and industrial maintenance demand.

- Key drivers include rising investment in oil & gas, mining, and power generation projects, along with strict WHS compliance pushing demand for modular and supported scaffolding systems.

- Trends highlight growing adoption of lightweight aluminum and modular scaffolding for faster assembly, as well as digital tools for planning, inspection, and project monitoring.

- The market is moderately fragmented with players like Caledonia Group, Mr Scaffold, KwikUp, and Oceania Access focusing on rental fleet expansion, skilled workforce training, and safety certifications to stay competitive.

- New South Wales holds 30% share, followed by Victoria at 20% and Queensland at 18%; by type, supported scaffolding leads with over 40% share, followed by system/modular scaffolding.

Market Segmentation Analysis:

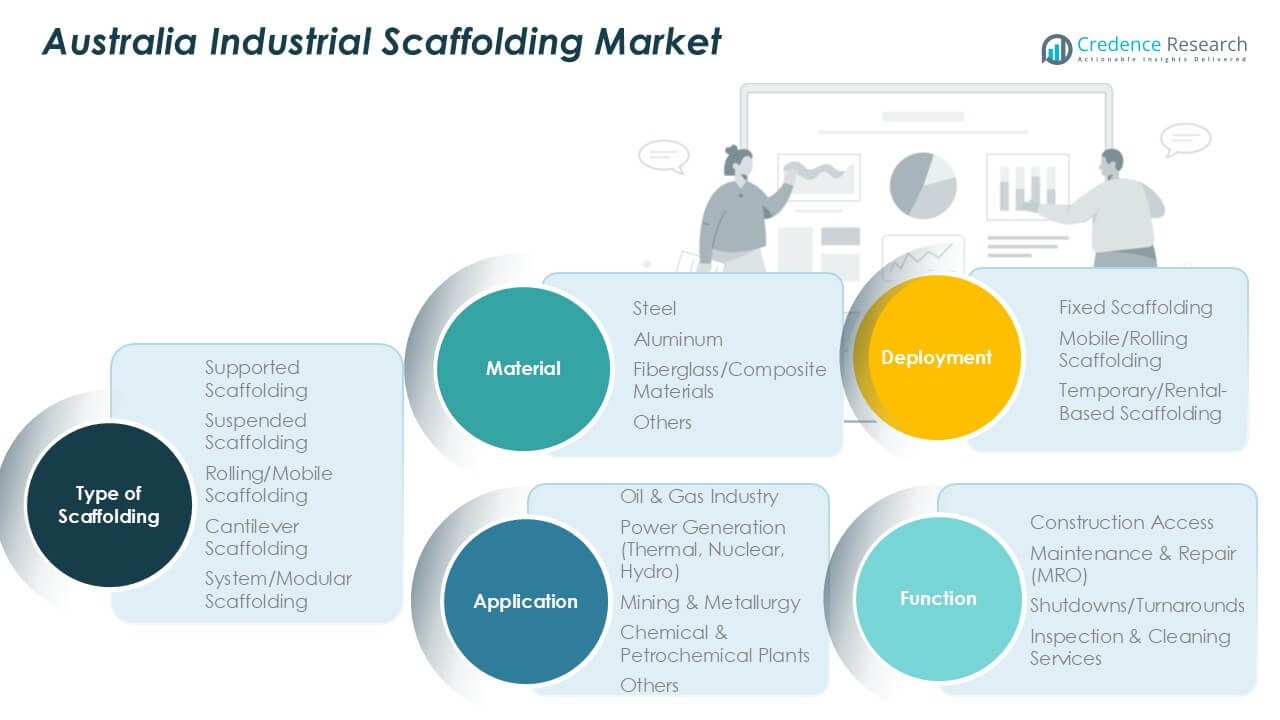

By Type of Scaffolding

Supported scaffolding holds the largest share of the Australia industrial scaffolding market, accounting for over 40% of total demand. Its dominance is driven by ease of assembly, high load-bearing capacity, and suitability for large construction and maintenance projects. System and modular scaffolding follow closely, gaining traction due to their standardization and faster installation, reducing downtime. Rolling scaffolding sees demand in power and mining projects for mobility advantages. Cantilever and suspended types serve niche applications, particularly in projects with limited ground access, supporting safety compliance and productivity.

- For instance, APS Industrial Services, an Australian company, owns over 10,000 tons of Layher supported scaffolding systems and is equipped to handle heavy-duty industrial projects with high static loads.

By Application

The oil and gas industry is the leading application segment, representing more than 30% of market share. Continuous maintenance and turnaround projects in refineries and LNG facilities drive demand for durable scaffolding systems. Power generation, including thermal and hydro plants, also contributes significantly, with a focus on safe access solutions during overhauls. Mining and metallurgy projects add steady demand, especially for modular scaffolding used in difficult terrains. Chemical and petrochemical facilities rely on corrosion-resistant materials, ensuring operational efficiency and reducing downtime during plant shutdowns.

- For instance, Layher’s Lightweight system increased truck payload volume from about 6,400 m³ to 7,200 m³ for birdcage scaffolding under a 23-tonne payload limit.

By Material

Steel dominates the material segment with a share exceeding 60%, favored for its durability, load capacity, and compliance with Australian safety standards. Aluminum is the fastest-growing sub-segment, driven by its lightweight structure and ease of transportation, reducing labor costs. Fiberglass and composite materials are increasingly adopted in chemical and petrochemical plants where non-conductive and corrosion-resistant properties are critical. The shift toward modular steel systems and hybrid materials supports higher safety, longer lifecycle use, and improved cost-effectiveness for contractors and plant operators across industrial sectors.

Key Growth Drivers

Expanding Infrastructure and Industrial Projects

Australia’s ongoing infrastructure development and industrial expansion drive scaffolding demand. Major investments in oil & gas facilities, power generation, and mining projects require reliable access solutions for construction and maintenance. Government-backed infrastructure spending boosts project pipelines, creating consistent demand for supported and modular scaffolding systems. Industrial maintenance, shutdowns, and turnarounds further support market growth, as scaffolding remains critical for worker safety and project timelines. The increasing focus on efficiency and compliance reinforces the preference for standardized and high-load scaffolding systems across industries.

- For instance, the maximum permissible load for a Layher Allround deck, when fully configured for heavy-duty applications, can be up to 7.5 kN/m². In contrast, a standard Kwikstage deck, when configured for general construction work, has a maximum capacity of around 3.0 kN/m² (or 240 kg/m²). Both systems’ actual working loads depend on the specific configuration, bay length, and load class.

Stringent Workplace Safety Regulations

Strict safety regulations under Australian Standards and Work Health and Safety (WHS) laws fuel demand for high-quality scaffolding solutions. Industrial players invest in compliant scaffolding systems to mitigate risks and meet inspection requirements. This focus drives adoption of modular scaffolding, which offers standardized components and enhanced safety features. Regulatory audits during shutdown projects encourage the use of robust platforms to reduce accidents and downtime. Rising emphasis on worker protection and liability reduction continues to shape procurement decisions, supporting market expansion and modernization of scaffolding equipment.

- For instance, Safe Work Australia requires design registration under Part 1 of Schedule 5 WHS Regulations for all prefabricated scaffolding systems.

Growing Adoption of Modular and Lightweight Systems

Contractors are increasingly choosing modular and lightweight scaffolding systems to save time and reduce labor costs. Prefabricated modular systems allow quicker assembly and disassembly, improving project turnaround times. Aluminum and composite materials are gaining traction due to their portability and reduced transportation effort. Industrial users value these solutions for minimizing project delays during maintenance cycles. The demand for productivity-enhancing equipment supports technological upgrades, making modular scaffolding a preferred option for large-scale projects in power generation, oil & gas, and mining sectors across Australia.

Key Trends & Opportunities

Digitalization and Smart Monitoring

The market is seeing increased integration of digital tools for scaffolding project planning and monitoring. Software-enabled design and inventory management optimize material use and reduce project costs. Smart sensors and inspection tools improve structural safety and help detect wear or instability early. Contractors benefit from data-driven insights to schedule maintenance more effectively. This trend aligns with Australia’s Industry 4.0 initiatives, creating opportunities for technology providers to deliver end-to-end digital solutions that enhance compliance, safety, and operational efficiency across scaffolding-intensive industries.

- For instance, Tacuna Systems offers wireless load/strain sensors, including load cells and strain gauges, that measure force, weight, tension, and compression in various applications. The company also produces wireless transmitters and displays for use with their sensors, which are designed for high-accuracy force measurement in industries such as construction and robotics.

Rising Demand for Sustainable Materials

Environmental sustainability is emerging as a key opportunity for scaffolding manufacturers. Companies are exploring recyclable steel, lightweight aluminum, and hybrid composite materials with lower carbon footprints. Demand is increasing for longer-life systems that minimize waste during frequent assembly cycles. Clients in oil & gas and mining sectors favor environmentally responsible suppliers to meet corporate ESG commitments. This shift opens opportunities for innovation in material science and encourages the development of eco-certified scaffolding systems that meet both operational and environmental compliance requirements.

- For instance, Turbo Scaffolding in Australia supplies aluminum scaffolding, which is significantly lighter than steel. This eases the burden of transport and assembly, though the exact weight difference per bay can vary depending on the specific components.

Key Challenges

High Initial Investment and Maintenance Costs

Scaffolding systems require significant upfront capital for purchase and ongoing maintenance. Smaller contractors often face financial pressure when investing in high-quality modular or steel scaffolding. Frequent inspections and repairs further add to operating expenses. Rental services offer alternatives but can increase costs for long-term projects. This challenge impacts market growth for SMEs, as budget constraints may delay upgrades to modern, safer systems, despite regulatory compliance pressures driving adoption of advanced scaffolding technologies.

Labor Shortages and Skilled Workforce Gaps

Australia faces a persistent shortage of skilled scaffolders, which limits the pace of project execution. The industry depends on trained personnel for safe assembly, inspection, and dismantling of scaffolding systems. Labor scarcity increases project costs and leads to delays, especially during plant shutdowns and infrastructure peaks. Companies must invest in training and certification programs to meet WHS standards. Addressing this challenge is critical for supporting growth, reducing safety risks, and maintaining efficiency across large-scale industrial projects and maintenance cycles.

Regional Analysis

New South Wales (NSW)

New South Wales leads the Australia industrial scaffolding market with a market share of about 30%. Strong activity in oil and gas terminals, power generation assets, and major infrastructure projects supports consistent demand. Supported and modular scaffolding systems dominate as they ensure safety compliance and fast installation. Ongoing transport network upgrades and urban redevelopment projects generate recurring maintenance needs. Contractors compete on response time, rental availability, and certified workforce deployment. NSW remains the most competitive and mature scaffolding market, setting standards for pricing, equipment quality, and compliance, making it a key revenue hub for leading service providers.

Victoria (VIC)

Victoria accounts for roughly 20% of the market share, supported by refinery turnarounds, manufacturing plant maintenance, and large power station overhauls. Steel and modular scaffolding systems are widely adopted for their reliability and regulatory compliance. Long-term infrastructure programs and asset renewal projects provide a steady stream of demand. Contractors focus on lightweight solutions to reduce labor requirements and improve project timelines. The region benefits from a well-developed rental network, enabling flexible deployment for both scheduled and urgent works. Competition centers on cost efficiency, system availability, and adherence to safety standards across multiple industrial sectors.

Queensland (QLD)

Queensland holds around 18% of the market share, driven by LNG projects, mining operations, and port expansions. High-load modular scaffolding is used extensively for plant shutdowns, maintenance cycles, and capacity expansions. The state’s large geographic area makes logistics and trained labor crucial to successful execution. Contractors prioritize modular solutions to minimize downtime and improve worker safety in remote sites. Demand remains consistent due to ongoing mining production and periodic oil and gas maintenance programs. QLD continues to be a growth hub, with service providers investing in equipment and workforce training to meet project demand effectively.

Western Australia (WA)

Western Australia contributes about 15% of the market share, primarily from mining, mineral processing, and offshore energy projects. Harsh site conditions favor robust steel scaffolding with corrosion protection. Modular prefabricated systems are preferred to reduce assembly time and improve on-site safety. The region sees concentrated demand peaks during major turnarounds, requiring careful inventory and workforce planning. Providers increasingly use digital project management tools for efficiency. WA remains one of the most resource-intensive scaffolding markets, with steady opportunities for suppliers as the state continues to invest in mining expansions and energy infrastructure development.

South Australia (SA)

South Australia represents nearly 7% of the market share, driven by defense manufacturing, energy infrastructure, and industrial facility maintenance. Regular shutdowns and upgrades create steady scaffolding requirements, with engineered access solutions in high demand. Lightweight aluminum platforms are used where mobility and multi-trade site access are essential. WHS compliance strongly influences system choice and contractor performance. Providers focus on rapid mobilization, skilled crew availability, and thorough documentation for inspections. SA’s defense and asset renewal programs ensure a consistent demand base, supporting a stable business environment for scaffolding rental and service companies.

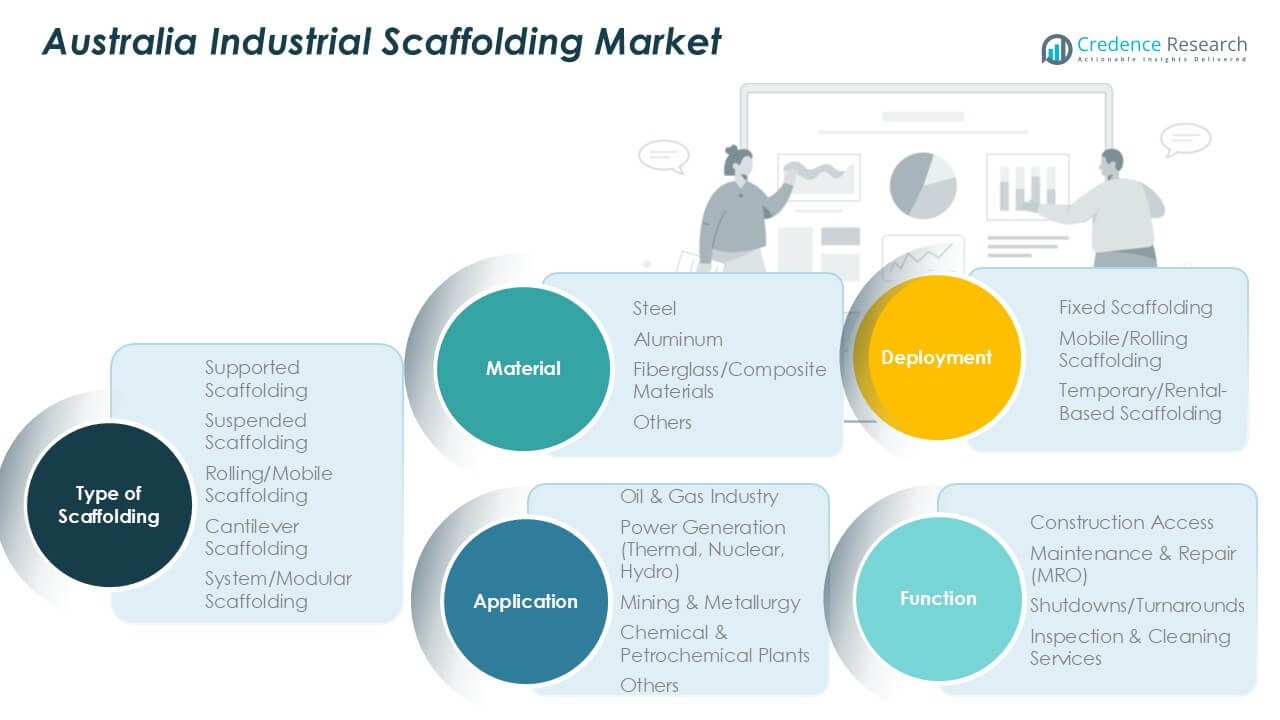

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- New South Wales (NSW)

- Victoria (VIC)

- Queensland (QLD)

- Western Australia (WA)

- South Australia (SA)

Competitive Landscape

The Australia industrial scaffolding market is moderately fragmented, with several regional and national players competing on service quality, safety compliance, and project execution speed. Leading companies such as Caledonia Group, KJ Industrial Scaffolding, Mr Scaffold, FAB Industrial Scaffolding, KwikUp, Turbo Aluminium, Oceania Access, Western Scaffold Pty Ltd, AZL Holdings Pty Ltd, and Integral Scaffolding dominate market activity across infrastructure, energy, and mining sectors. These firms focus on expanding rental fleets, adopting modular and lightweight systems, and offering turnkey solutions including design, erection, and dismantling. Investment in workforce training, WHS compliance, and digital project management platforms is a key differentiator. Strategic partnerships with EPC contractors and asset operators strengthen their market presence. Players also emphasize sustainability through recyclable materials and low-emission logistics. The competitive environment is expected to intensify as companies invest in technology-driven planning tools and safety innovations to capture larger maintenance and turnaround project contracts nationwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caledonia Group

- KJ Industrial Scaffolding

- Mr Scaffold

- FAB Industrial Scaffolding

- KwikUp

- Turbo Aluminium

- Oceania Access

- Western Scaffold Pty Ltd

- AZL Holdings Pty Ltd

- Integral Scaffolding

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice.

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by ongoing infrastructure and industrial expansion projects.

- Adoption of modular and lightweight scaffolding systems will increase to reduce project timelines.

- Demand from oil & gas, mining, and power generation sectors will remain strong.

- Digital project management tools and smart monitoring systems will see higher adoption.

- Safety compliance will continue to drive investment in certified and standardized scaffolding systems.

- Workforce training initiatives will expand to address skilled labor shortages in scaffolding assembly.

- Rental services will gain preference due to cost efficiency and project flexibility.

- Use of recyclable materials and sustainable solutions will rise to meet ESG goals.

- Regional demand will remain highest in New South Wales, Victoria, and Queensland.

- Competition will intensify as players invest in technology and expand service capabilities nationwide.