Market Overview

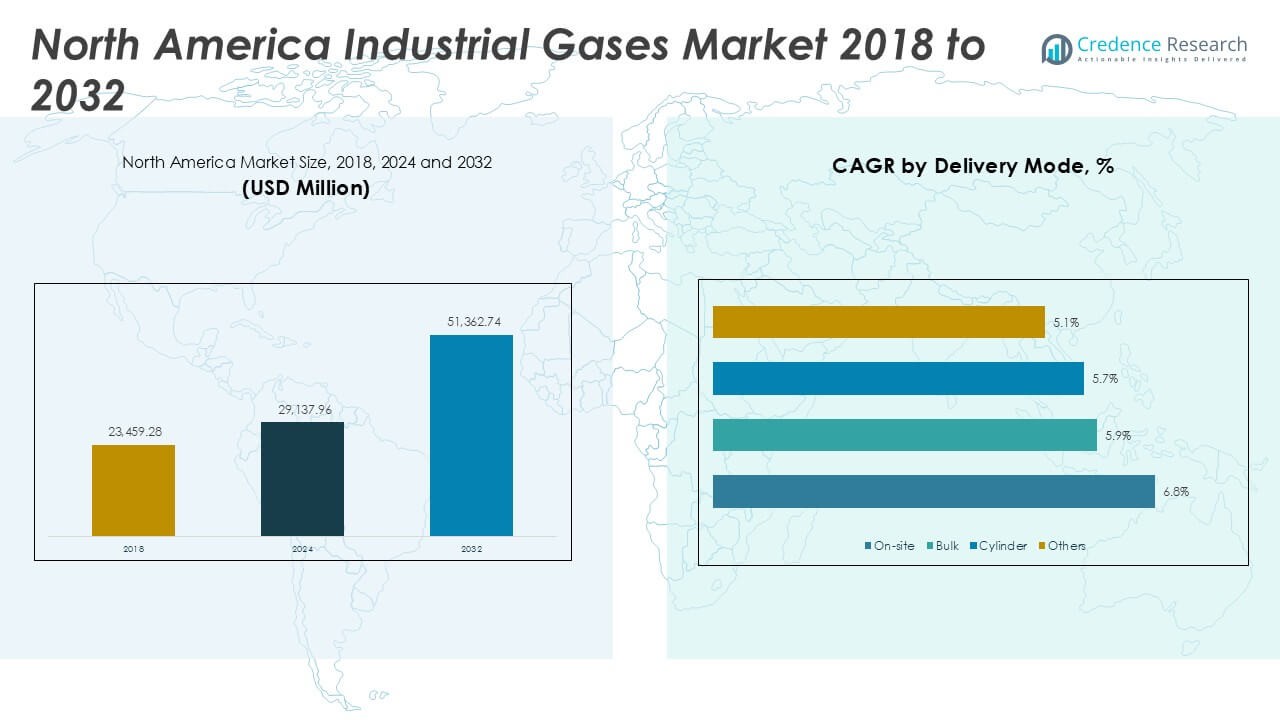

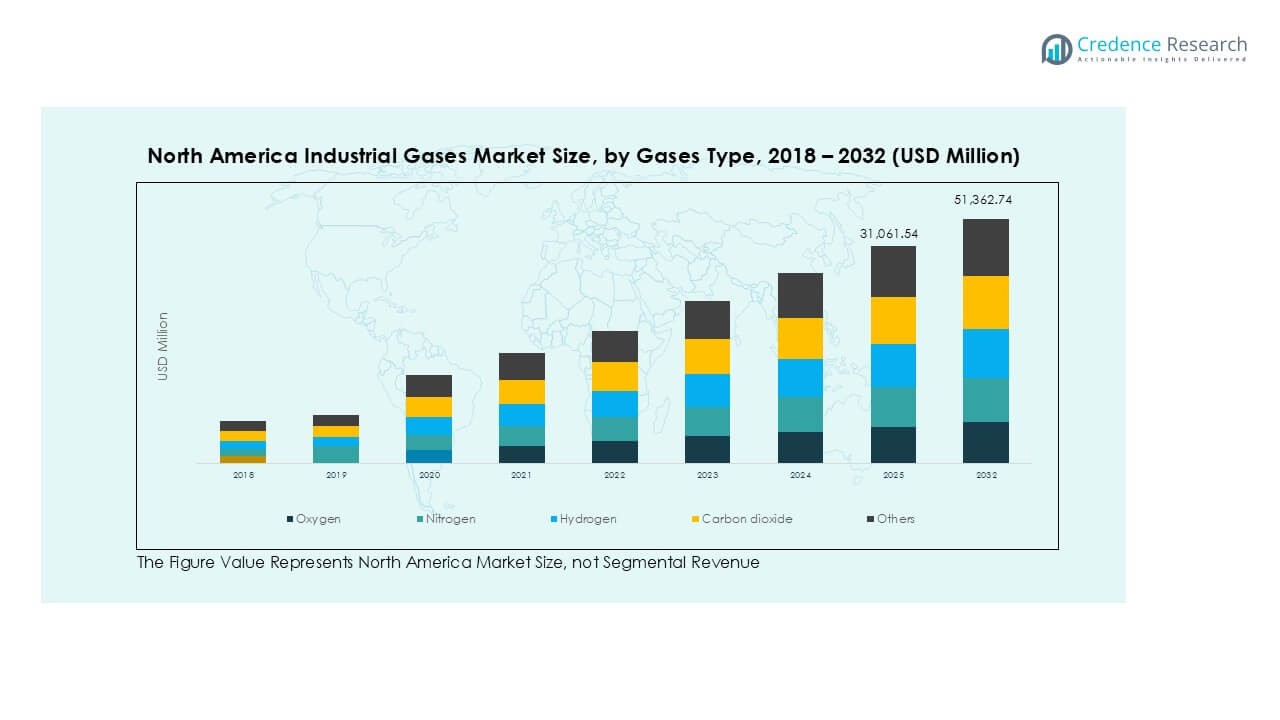

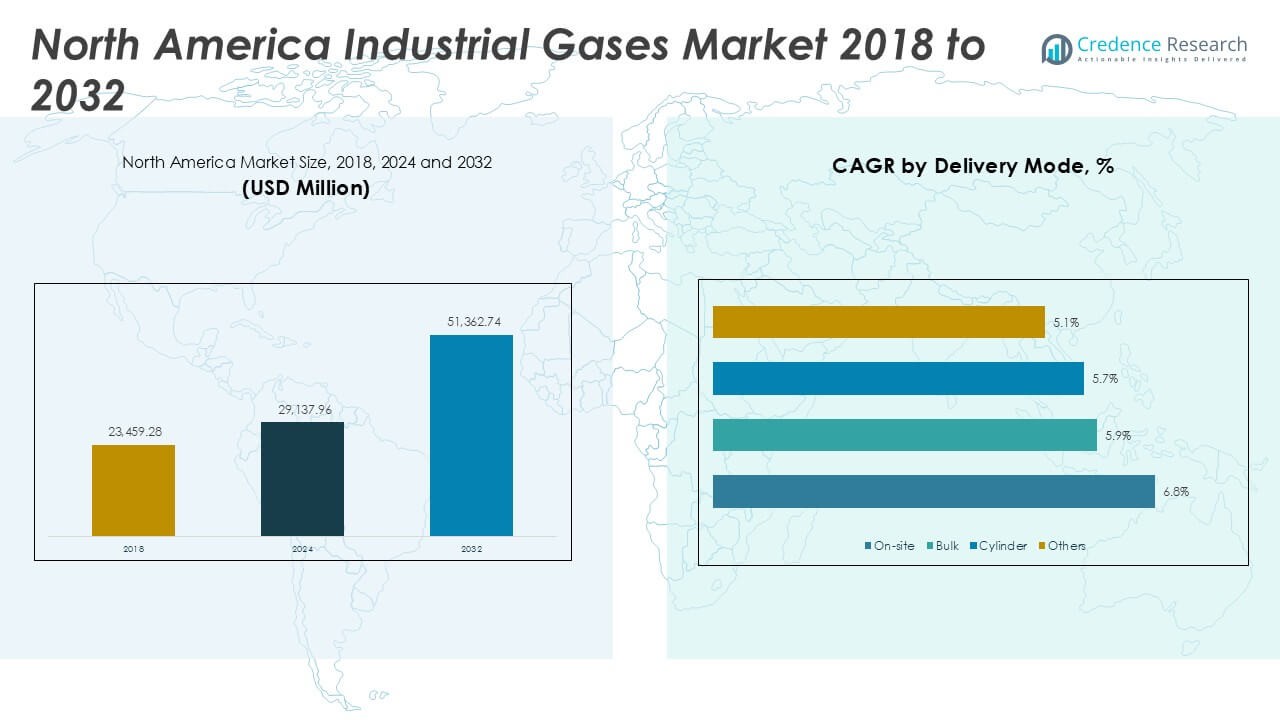

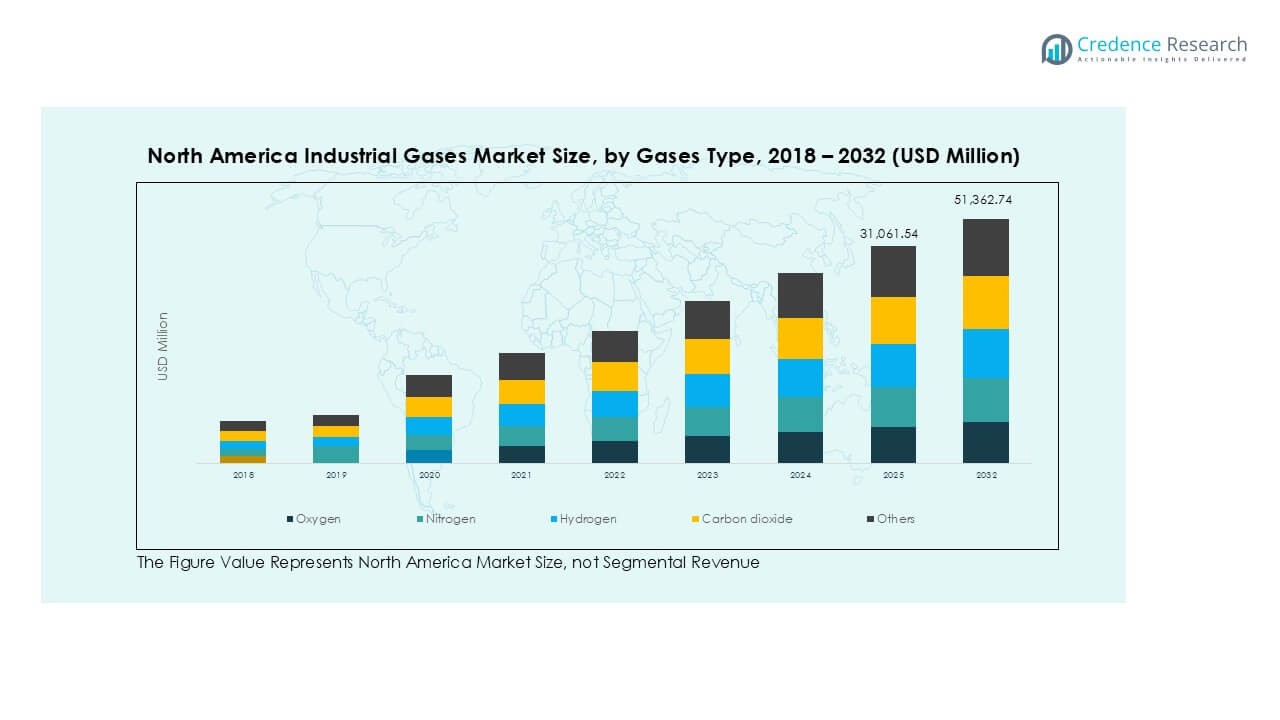

North America Industrial Gases market size was valued at USD 23,459.28 million in 2018, increased to USD 29,137.96 million in 2024, and is anticipated to reach USD 51,362.74 million by 2032, at a CAGR of 7.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Industrial Gases Market Size 2024 |

USD 29,137.96 Million |

| North America Industrial Gases Market, CAGR |

7.34% |

| North America Industrial Gases Market Size 2032 |

USD 51,362.74 Million |

The North America industrial gases market is led by Air Liquide USA, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, Messer Group GmbH, and Iwatani Corporation, supported by regional players such as nexAir, LLC, Cryogenic Industrial Solutions, and Universal Industrial Gases, Inc. These companies focus on large-scale production, bulk distribution, and specialty gas solutions for healthcare, manufacturing, and energy sectors. The United States dominated with 78% market share in 2024, driven by its strong healthcare demand, robust manufacturing activity, and clean energy projects. Canada followed with 15% share, supported by LNG and hydrogen infrastructure development, while Mexico accounted for 7%, fueled by automotive and nearshoring-driven manufacturing growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America industrial gases market was valued at USD 29,137.96 million in 2024 and is projected to reach USD 51,362.74 million by 2032, growing at a CAGR of 7.34%.

- Demand is driven by rising consumption of medical oxygen in hospitals, growing manufacturing output, and investments in hydrogen infrastructure supporting clean energy transition.

- Key trends include adoption of IoT-enabled monitoring systems, expansion of carbon capture and utilization projects, and rising use of high-purity gases in semiconductor and pharmaceutical manufacturing.

- The market is led by Air Liquide USA, Air Products and Chemicals, Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, and Iwatani Corporation, focusing on capacity expansions and strategic collaborations.

- United States dominated with 78% share, followed by Canada at 15% and Mexico at 7%; oxygen led by gas type with 32% share, while cutting & welding dominated applications with 28% share.

Market Segmentation Analysis:

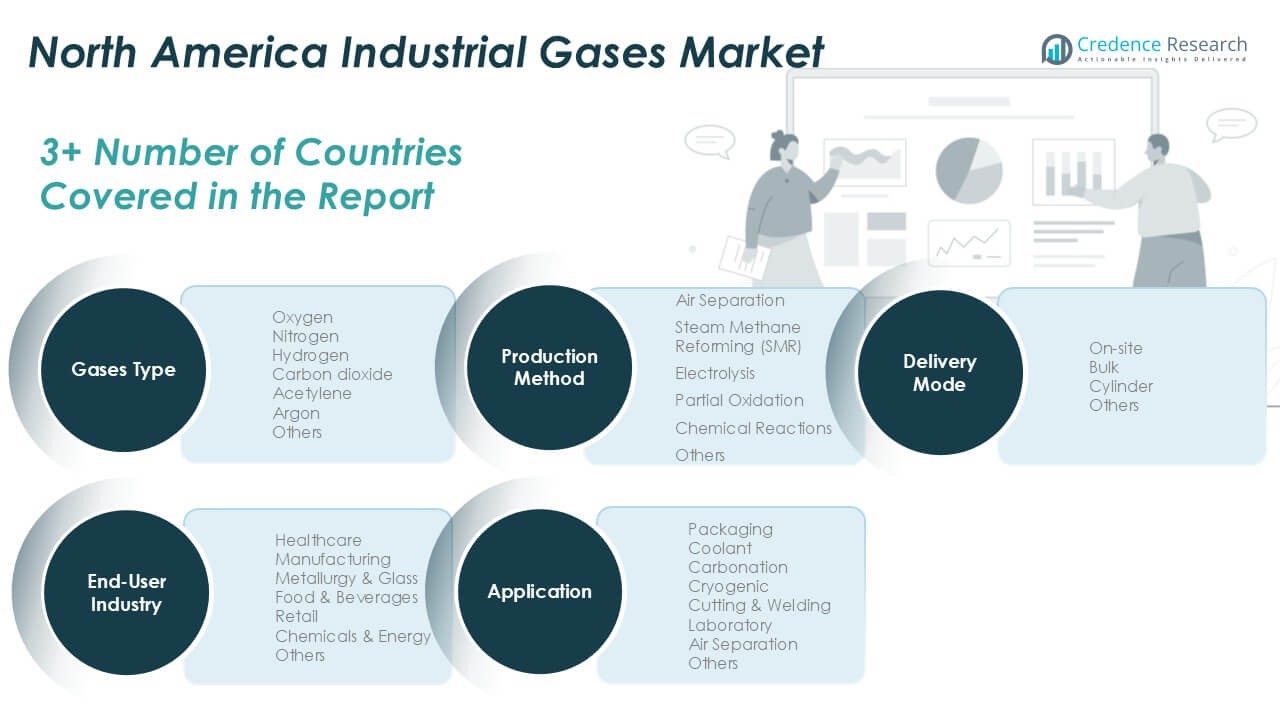

By Gases Type

Oxygen held the dominant share of 32% in the North America industrial gases market in 2024. Its strong presence is driven by extensive use in healthcare for respiratory therapy, surgical procedures, and medical device sterilization. Oxygen is also widely applied in steelmaking and wastewater treatment, creating steady demand. Nitrogen followed closely, driven by its role in food preservation and electronics manufacturing. Rising demand for high-purity gases in pharmaceuticals and energy sectors continues to support growth across hydrogen, carbon dioxide, and argon, with hydrogen gaining traction due to clean energy projects and fuel cell technology deployment.

- For instance, Air Products operates the world’s largest hydrogen pipeline network along the U.S. Gulf Coast, extending approximately 700 miles and supplying more than 1.7 billion standard cubic feet per day to refineries and chemical plants.

By Application

Cutting & welding was the leading application segment with 28% market share in 2024. The segment benefits from rising infrastructure projects, automotive production, and metal fabrication activities. Industrial gases such as oxygen, acetylene, and argon are essential for precision cutting, welding, and heat treatment processes. Carbonation applications in beverages and cryogenic processes in LNG storage also contribute significantly to overall demand. The growth of the food industry supports packaging applications using nitrogen and carbon dioxide to extend shelf life, while laboratory and air separation applications see rising use in R&D and specialty gas production.

- For example, Praxair (now part of Linde) supplies oxygen and acetylene to more than 200 automotive and fabrication plants across North America, enabling precision welding and cutting operations.

By End-User Industry

Healthcare accounted for the largest share of 30% in 2024, fueled by increasing demand for medical oxygen, anesthetic gases, and advanced respiratory therapies. Expanding hospital infrastructure and rising prevalence of respiratory diseases drive consistent consumption. The manufacturing sector is another key consumer, using gases for welding, heat treatment, and cooling applications. Food and beverages follow, relying on nitrogen and carbon dioxide for carbonation and modified atmosphere packaging. Growth in chemicals and energy further supports market expansion as hydrogen adoption rises for clean fuel production and argon use increases in refining and chemical processes.

Key Growth Drivers

Expanding Healthcare and Medical Applications

Rising demand for medical oxygen and specialty gases is a major growth driver. North America’s growing aging population and increasing prevalence of respiratory diseases such as COPD and asthma boost consumption. Hospitals, clinics, and homecare providers use oxygen, nitrous oxide, and medical air for life support and surgical procedures. Additionally, the growth of biotechnology and pharmaceutical research increases the need for high-purity gases in drug manufacturing and laboratory testing, creating a strong, recurring demand base across the healthcare sector.

- For instance, during peak pandemic demand, the U.S. healthcare system faced unprecedented surges in medical oxygen consumption, straining existing infrastructure. In response, hospital networks expanded their oxygen infrastructure, which they continue to maintain and develop in 2024.

Industrial and Manufacturing Sector Growth

The robust manufacturing industry across the U.S. and Canada drives demand for industrial gases in metal fabrication, automotive production, and electronics. Oxygen, nitrogen, and argon are essential for cutting, welding, and heat treatment operations. The resurgence of domestic manufacturing and reshoring initiatives encourages capacity expansions and investments in modern facilities. This results in higher consumption of bulk and cylinder gases to support production efficiency, energy optimization, and enhanced process quality across diverse industries such as aerospace, heavy machinery, and semiconductors.

- For instance, in 2024, North American automotive production reached approximately 16.1 million vehicles. A typical assembly plant uses significant volumes of welding gas daily, but specific consumption varies depending on factors like production volume and welding processes.

Energy Transition and Hydrogen Adoption

The clean energy transition is fueling demand for hydrogen as a low-carbon fuel alternative. North America is witnessing investments in green hydrogen projects, electrolyzer capacity, and hydrogen refueling stations. Industrial gas suppliers are scaling up production and distribution networks to serve mobility, refining, and chemical sectors. Government incentives and net-zero targets encourage adoption, while partnerships between energy companies and gas producers accelerate deployment of hydrogen infrastructure, establishing a strong long-term growth trajectory for hydrogen within the industrial gases portfolio.

Key Trends & Opportunities

Digitalization and Smart Gas Delivery Systems

There is a rising adoption of digital technologies to monitor gas usage and optimize supply chains. IoT-enabled cylinders and bulk delivery systems provide real-time consumption data, predictive maintenance alerts, and automated replenishment scheduling. This improves operational efficiency for end users and reduces downtime. Gas producers are investing in telemetry solutions to strengthen customer engagement, create value-added services, and increase contract retention rates. This trend aligns with Industry 4.0 adoption across manufacturing and healthcare sectors, presenting a significant opportunity for technology-driven differentiation.

- For instance, Air Liquide uses digital technology, including its Integrated Bulk Operations (IBO) program, to monitor tanks at customer sites. By collecting and analyzing data, Air Liquide can predict demand, optimize delivery routes, and improve operational performance for its bulk industrial gas supply chain.

Focus on Sustainability and Carbon Capture

Industrial gas companies are increasingly involved in carbon capture, utilization, and storage (CCUS) projects. Captured CO₂ is used for enhanced oil recovery, beverage carbonation, and chemical production, turning emissions into valuable resources. Regulatory pressure to reduce greenhouse gas emissions and corporate ESG commitments are accelerating CCUS deployment. This creates an opportunity for gas suppliers to expand CO₂ capture infrastructure and offer carbon-neutral solutions, positioning them as critical enablers in North America’s decarbonization and circular economy initiatives.

- For instance, Linde has a carbon capture and hydrogen production facility at its Clear Lake, Texas plant, which supplies captured CO₂ to Celanese to produce lower-carbon methanol. This project is part of a broader carbon capture and storage (CCS) effort with BP across the Texas Gulf Coast, which aims to store up to 15 million metric tons of CO₂ per year across multiple sites. The captured CO₂ is purified and sold for commercial use, including for food and beverages.

Key Challenges

Price Volatility and Production Costs

The market faces challenges from fluctuating energy and feedstock prices, which directly impact gas production costs. Electricity and natural gas are key inputs for air separation units and hydrogen production. Sudden price hikes can compress margins and force suppliers to adjust contract pricing, affecting competitiveness. Companies must focus on energy efficiency, diversify sourcing, and invest in low-carbon production technologies to mitigate volatility and maintain stable supply to end users.

Stringent Safety and Regulatory Compliance

Industrial gases require strict handling, storage, and transport protocols due to their hazardous nature. Compliance with OSHA, DOT, and EPA regulations increases operational complexity and costs. Failure to meet safety standards can lead to accidents, fines, and reputational damage. Companies must invest in employee training, advanced monitoring systems, and regular audits to minimize risks. The challenge is to balance safety compliance with cost-effectiveness while ensuring uninterrupted service to customers across critical sectors like healthcare and manufacturing.

Regional Analysis

United States

The United States accounted for the largest share of 78% of the North America industrial gases market in 2024. Strong demand stems from the country’s extensive healthcare network, robust manufacturing base, and advanced research facilities. The U.S. leads in medical oxygen consumption, driven by a growing elderly population and high prevalence of chronic respiratory diseases. Expanding semiconductor and automotive production increases nitrogen and argon usage for fabrication and welding. Hydrogen adoption is accelerating through government-backed clean energy projects and tax incentives, strengthening the U.S. position as the dominant growth contributor within the regional industrial gases landscape.

Canada

Canada represented 15% of the regional market share in 2024, supported by growing industrial activities and healthcare investments. The country’s focus on LNG production and export drives demand for cryogenic gases, while the food and beverage industry continues to expand nitrogen use for packaging and preservation. Healthcare demand for medical gases remains steady, supported by government funding for hospital infrastructure. Additionally, Canada is actively investing in hydrogen infrastructure, including electrolyzer projects and pilot fuel cell programs, which creates opportunities for industrial gas suppliers and strengthens the country’s role in the low-carbon energy transition.

Mexico

Mexico held 7% of the North America industrial gases market in 2024, with growth fueled by its thriving automotive and manufacturing industries. Major global automakers and electronics manufacturers rely on oxygen, acetylene, and argon for welding and assembly operations. Rising FDI in manufacturing, coupled with nearshoring trends, is expanding demand for bulk and cylinder gases. Mexico’s beverage industry also contributes significantly through high consumption of carbonation gases. Infrastructure development and growing healthcare services drive additional demand for medical oxygen, making Mexico a key emerging market with strong growth potential in the industrial gases sector.

Market Segmentations:

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The North America industrial gases market is highly consolidated, with leading players such as Air Liquide USA, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, Messer Group GmbH, and Iwatani Corporation dominating supply. These companies operate extensive production facilities and distribution networks, ensuring reliable delivery across diverse industries including healthcare, manufacturing, and energy. Key players focus on capacity expansion, digital monitoring solutions, and strategic partnerships to strengthen regional presence. For instance, Air Liquide has invested in new hydrogen production units to support clean energy initiatives, while Air Products is expanding its cryogenic plant network. Emerging participants such as nexAir, LLC, Cryogenic Industrial Solutions, and Universal Industrial Gases, Inc. cater to niche regional demands with specialized services. Competitive differentiation increasingly relies on sustainability efforts, carbon capture projects, and technological integration, aligning with customer expectations for low-carbon solutions and seamless supply chain management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Air Liquide USA

- Air Products and Chemicals, Inc.

- Taiyo Nippon Sanso Corporation

- Messer Group GmbH

- Iwatani Corporation

- SIAD S.p.A.

- nexAir, LLC

- Cryogenic Industrial Solutions, LLC

- Universal Industrial Gases, Inc.

Recent Developments

- In October 2024, Air Liquide announced to supply oxygen to LG Chem for their electric vehicle battery plant in the U.S. Supplying oxygen to LG Chem’s future cathode active material plant, the Group will be supporting the growth of the battery ecosystem in the U.S. This investment will increase the Group’s footprint in a key region and support the development of its industrial merchant market.

- In October 2024, Linde announced an agreement with Tata Steel to obtain and manage two additional Air Separation Units (ASUs) and enhance industrial gas supply to Tata Steel in Odisha, India. This arrangement will more than double Linde’s on-site capacity at Tata Steel’s Kalinganagar facility, where it presently runs two plants. The new ASUs, anticipated to be operational by 2025, will deliver oxygen, nitrogen, and argon to aid Tata Steel’s expansion project and cater to the local merchant market. Linde has additionally acquired renewable energy agreements to lower its scope emissions, in line with its 2035 GHG reduction goals.

- In July 2024, Air Liquide announced an investment of USD 104.914 million to support Aurubis AG, a major global provider of non-ferrous metals and one of the largest recyclers of copper worldwide, in Bulgaria and Germany. This investment will finance a new Air Separation Unit (ASU) in Bulgaria and the upgrading of four existing units in Germany. Besides supplying substantial amounts of oxygen and nitrogen for the rising copper and other metal production by Aurubis, these facilities will also assist in the growth of industrial merchant markets in both areas.

- In January 2024, Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- In July 2023, Nippon Sanso Holdings Corporation announced that Matheson Tri-Gas, Inc, NSHD’s U. S. operating entity, has entered into a gas supply contract with PointFive to deliver oxygen for the carbon capture, utilization, and sequestration company’s inaugural Direct Air Capture (DAC*) facility in Texas. MATHESON will invest in and set up an Air Separation Unit to provide oxygen to “Stratos,” PointFive’s DAC facility currently under construction in Ector County, Texas. The oxygen is utilized in the DAC process to generate a pure stream of CO2, which is subsequently securely sequestered in geological reservoirs.

Report Coverage

The research report offers an in-depth analysis based on Gases Type, Application, End-User Industry, Production Method, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for medical gases will rise with aging population and advanced healthcare infrastructure.

- Hydrogen adoption will accelerate with clean energy projects and government decarbonization goals.

- Digital monitoring and IoT-enabled delivery systems will improve efficiency and reduce downtime.

- Carbon capture and utilization will expand, creating new revenue streams for CO₂ suppliers.

- Growth in semiconductor and electronics manufacturing will boost high-purity gas consumption.

- Food and beverage sector will increase use of nitrogen and CO₂ for packaging and carbonation.

- Regional players will invest in localized production to reduce logistics costs and improve supply reliability.

- Partnerships between industrial gas producers and energy companies will scale hydrogen infrastructure.

- Cryogenic and specialty gas applications will grow with R&D and biotech advancements.

- Sustainability initiatives will push producers to adopt low-carbon production technologies and renewable power sources.