Market Overview

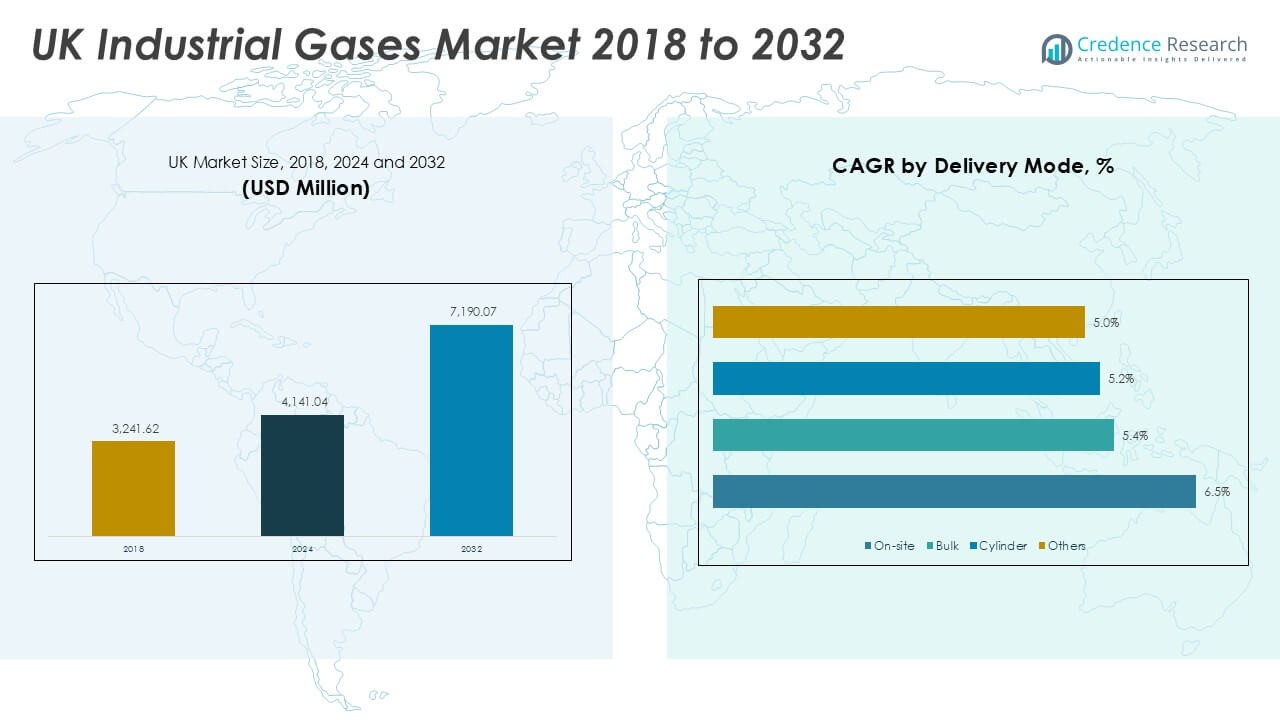

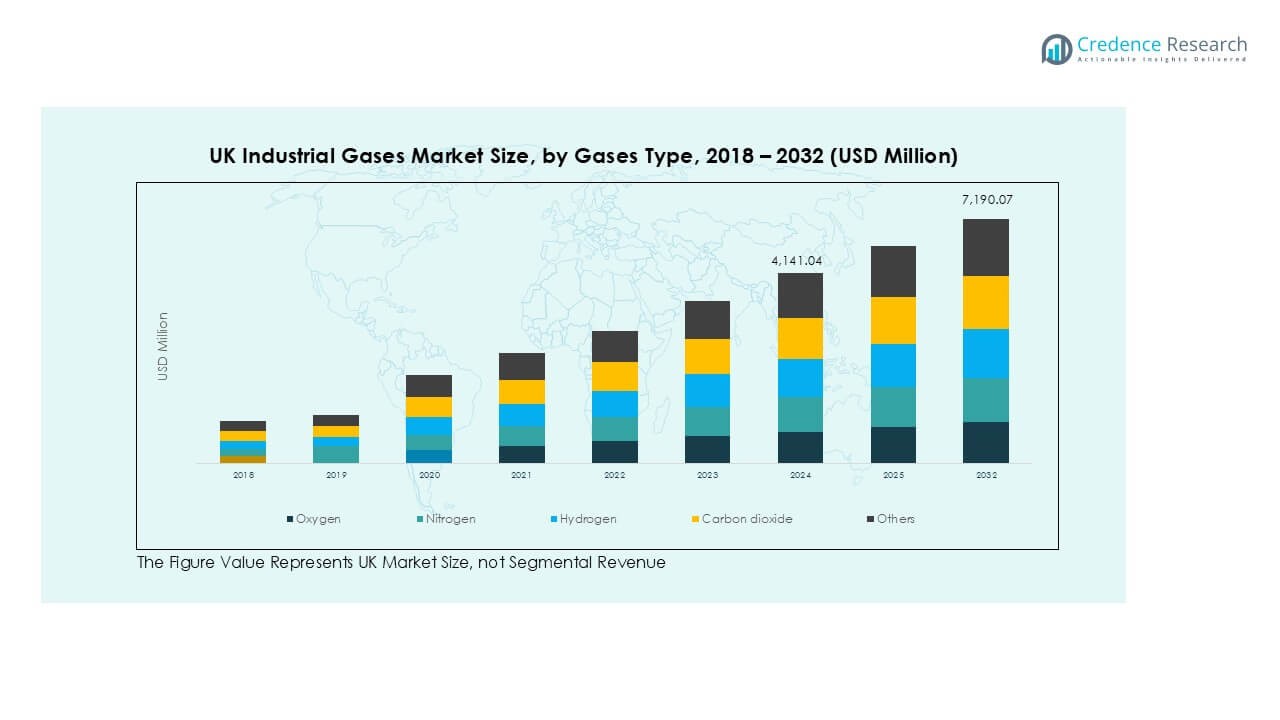

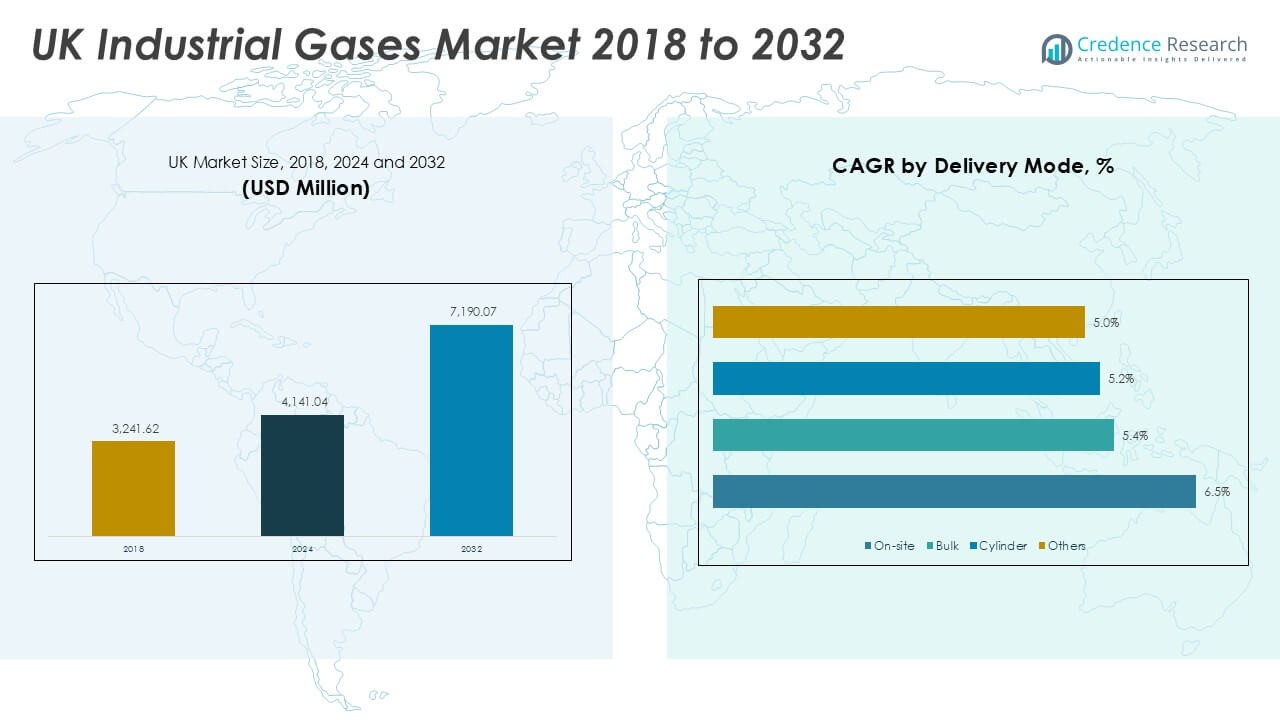

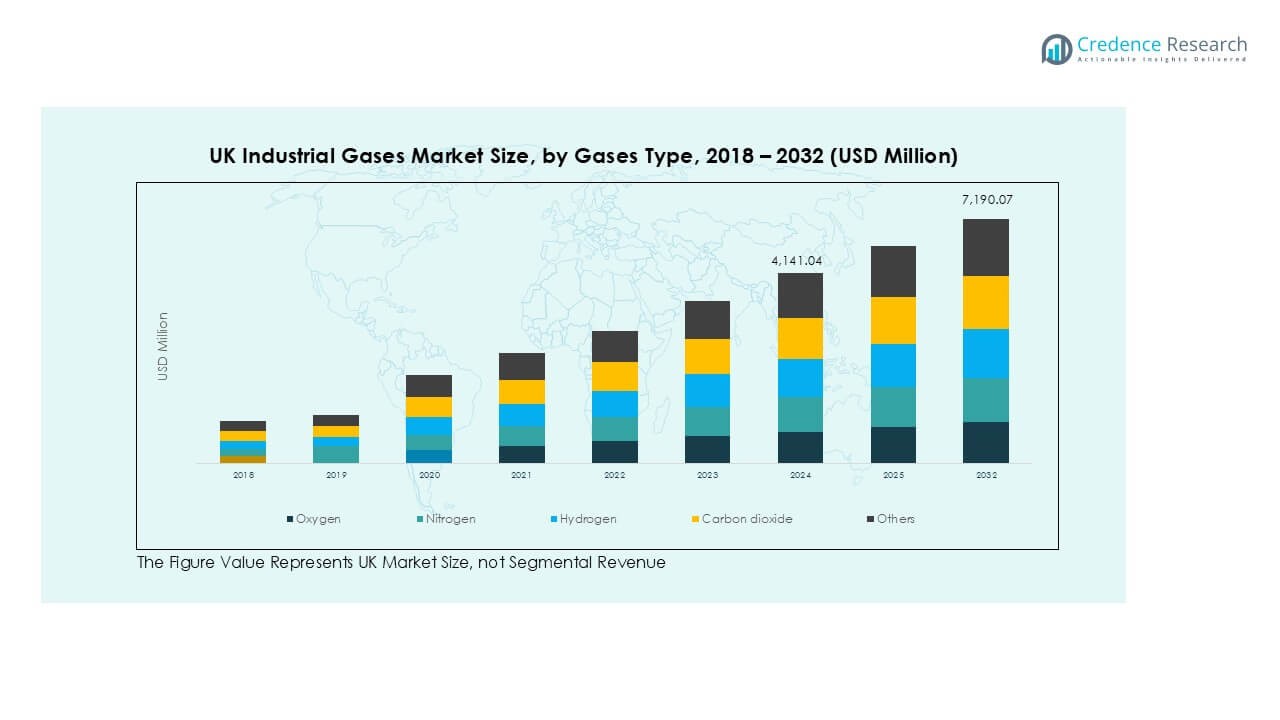

UK Industrial Gases market size was valued at USD 3,241.62 million in 2018, reached USD 4,141.04 million in 2024, and is anticipated to reach USD 7,190.07 million by 2032, at a CAGR of 7.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Industrial Gases Market Size 2024 |

USD 4,141.04 Million |

| UK Industrial Gases Market, CAGR |

7.14% |

| UK Industrial Gases Market Size 2032 |

USD 7,190.07 Million |

The UK industrial gases market is led by major players such as Linde plc (BOC Ltd), Air Liquide UK Ltd., Air Products PLC, Praxair UK, and Messer UK Ltd. Linde plc holds the largest share, supported by its nationwide production facilities and strong supply chain network. Air Liquide and Air Products strengthen their positions through on-site generation systems and partnerships with key manufacturing and healthcare clients. Regionally, London dominates the market with 35% share, driven by high demand from healthcare and food processing sectors. Manchester follows with 22%, supported by strong manufacturing and aerospace activity, while Birmingham and Scotland account for 18% and 15%, respectively, fueled by metal fabrication, energy, and green hydrogen projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK industrial gases market was valued at USD 4,141.04 million in 2024 and is projected to reach USD 7,190.07 million by 2032, growing at a CAGR of 7.14%.

- Rising demand from healthcare for medical oxygen and from manufacturing for welding and cutting gases is a key growth driver.

- Key trends include growing adoption of green hydrogen projects, digital monitoring, and on-site gas generation systems for cost efficiency.

- The market is moderately consolidated with major players like Linde plc, Air Liquide UK Ltd., Air Products PLC, Praxair UK, and Messer UK Ltd. focusing on capacity expansion and sustainable solutions.

- London leads regionally with 35% share, followed by Manchester at 22%, Birmingham at 18%, and Scotland at 15%; oxygen remains the dominant gas type with over 30% share, while cutting & welding applications account for the largest application segment.

Market Segmentation Analysis:

By Gases Type

Oxygen dominated the UK industrial gases market in 2024 with over 30% share, driven by its critical role in healthcare, metallurgy, and water treatment. Demand from hospitals and clinics for medical oxygen has surged due to rising respiratory treatments and surgical procedures. Nitrogen and hydrogen also hold significant shares, supported by their use in packaging, electronics, and energy sectors. Carbon dioxide is widely used in food carbonation and welding, while argon supports metal fabrication. Growing investments in clean hydrogen production further accelerate market expansion, aligning with UK’s net-zero carbon targets.

- For instance, during the COVID-19 pandemic, the UK’s NHS experienced unprecedented surges in oxygen demand, which strained some hospitals’ internal distribution systems and on-site storage facilities. This prompted significant investments in upgrading infrastructure, including bulk storage and on-site generation systems, to increase resilience for future events.

By Application

Cutting & welding emerged as the leading application segment, capturing over 28% share in 2024, fueled by the growth of UK manufacturing and construction projects. Cryogenic applications are expanding quickly due to the rising adoption of liquefied natural gas and cold-chain storage in pharmaceuticals. Carbonation drives steady demand from the beverage sector, while packaging applications benefit from extended shelf-life needs. Laboratory and air separation uses are growing, driven by R&D in healthcare and chemicals. Industrial automation and rising welding precision requirements also contribute to application-specific gas consumption.

- For instance, UK shipyards and fabrication shops consume thousands of cubic meters of oxygen and argon daily, given the scale of naval and offshore wind projects. These gases are essential for the welding and cutting of metals, making significant daily consumption rates standard practice in such heavy fabrication industries.

By End-User Industry

Healthcare remained the largest end-user industry, accounting for more than 32% share in 2024, driven by continuous demand for medical oxygen and specialty gases. The food and beverages sector follows closely, supported by carbonation, packaging, and preservation needs. Manufacturing and metallurgy industries consume large volumes of argon, oxygen, and acetylene for welding, cutting, and glass production. Chemicals & energy sectors leverage hydrogen and nitrogen for process optimization. The rise of retail cold-chain infrastructure and pharmaceutical production is expected to further strengthen demand across these sectors, supporting robust market growth through 2032.

Key Growth Drivers

Rising Healthcare Demand

Healthcare is a major growth driver for the UK industrial gases market, with medical oxygen demand steadily increasing. Rising surgical procedures, aging population, and chronic respiratory diseases fuel continuous consumption in hospitals and clinics. Specialty gases are also critical for anesthesia and imaging applications. Government focus on strengthening healthcare infrastructure and emergency preparedness supports higher bulk supply contracts. The expansion of home healthcare services is further boosting the adoption of portable oxygen systems, ensuring long-term growth opportunities for gas suppliers across the country.

- For instance,BOC Healthcare (a Linde company) ensures an uninterrupted supply of bulk liquid oxygen to NHS hospitals across the UK through its network of production facilities, distribution centers, and a fleet of cryogenic road tankers. The company operates nine air separation plants in the UK and Ireland that produce the liquefied gas, which is then delivered to on-site storage tanks located at customer facilities, including NHS hospitals.

Manufacturing and Construction Expansion

Growth in UK manufacturing and construction sectors significantly drives industrial gas demand. Oxygen, nitrogen, and acetylene are widely used in welding, cutting, and metal fabrication activities. The ongoing shift toward smart factories and automation is creating demand for precise gas mixtures to enhance process efficiency. Infrastructure development projects, including transport and renewable energy facilities, contribute to rising consumption. Additionally, growing investments in automotive, aerospace, and heavy engineering sectors are ensuring steady growth in gas usage, strengthening market prospects through 2032.

- For instance,in 2023, UK crude steel production was approximately 5.6 million tonnes, a decrease from the previous year. The traditional, carbon-intensive blast furnace steelmaking process primarily consumes coke but also uses some natural gas.

Transition to Clean Energy and Hydrogen Economy

The UK’s commitment to net-zero emissions by 2050 is accelerating the adoption of clean energy gases, particularly hydrogen. Investments in green hydrogen production and infrastructure create new demand for industrial gas suppliers. Energy transition projects require large-scale gas storage and distribution solutions, driving innovation in cryogenic systems. Partnerships between energy companies and gas producers are supporting pilot projects for hydrogen fuel in transportation and power generation. This trend is reshaping the market and opening long-term opportunities for suppliers offering low-carbon gas solutions.

Key Trends & Opportunities

Growth in Food and Beverage Applications

Rising consumption of packaged and carbonated beverages is boosting demand for nitrogen and carbon dioxide. Food processors use these gases for modified atmosphere packaging to extend product shelf life and reduce spoilage. The increasing popularity of ready-to-eat meals and frozen foods in the UK supports consistent gas usage. Opportunities are emerging for suppliers offering food-grade gases with high purity and compliance to stringent safety regulations. This trend positions the food and beverage industry as a stable and growing revenue stream for market participants.

- For instance, the UK produced billions of liters of carbonated soft drinks in 2023, driving strong CO₂ demand for carbonation.

Advancements in Gas Production and Distribution

Technological advancements in air separation units and on-site gas generation are transforming supply chains. On-site generation solutions reduce dependency on bulk gas deliveries, improving cost efficiency for end-users. Digital monitoring and automation of distribution networks ensure uninterrupted supply and better inventory management. Suppliers investing in these technologies can enhance service reliability and win long-term contracts. The trend toward decentralised production also creates opportunities for smaller players to cater to regional demand efficiently, increasing competition and innovation in the UK market.

- For example, BOC (Linde) operates multiple on-site nitrogen plants in the UK, each producing thousands of Nm³ per hour for electronics and food customers, reducing road tanker traffic significantly.

Key Challenges

High Production and Distribution Costs

Fluctuations in energy prices directly affect the cost of producing industrial gases, particularly oxygen and nitrogen through cryogenic distillation. Rising transportation and logistics costs also impact profit margins, especially for bulk liquid deliveries. Smaller companies face challenges in maintaining cost competitiveness against established players with large-scale production facilities. Market participants must focus on energy-efficient technologies and optimized delivery networks to mitigate cost pressures and maintain profitability in an increasingly competitive market environment.

Regulatory Compliance and Safety Concerns

Stringent safety and environmental regulations govern the production, storage, and transportation of industrial gases in the UK. Compliance requires significant investment in equipment, training, and monitoring systems. Failure to meet standards can result in penalties, operational delays, and reputational damage. Handling of hazardous gases like hydrogen and acetylene also involves strict safety protocols. These regulatory demands can be a barrier for new entrants and increase operational complexity, requiring suppliers to maintain robust compliance frameworks and continuous workforce training.

Regional Analysis

London

London held the largest share of the UK industrial gases market, accounting for around 35% in 2024. The region’s dominance is driven by a high concentration of healthcare facilities, research institutions, and pharmaceutical manufacturing units requiring large volumes of oxygen, nitrogen, and specialty gases. Demand is also strong from the food and beverage industry, where carbonation and packaging gases support large-scale production. London’s thriving construction sector and infrastructure projects further drive consumption of welding and cutting gases. The city’s strong focus on sustainability initiatives also encourages the adoption of low-carbon and green hydrogen solutions, supporting long-term market growth.

Manchester

Manchester captured nearly 22% of the UK industrial gases market in 2024, supported by its robust manufacturing and engineering base. The city is a hub for advanced manufacturing, automotive components, and aerospace industries that depend on oxygen, argon, and acetylene for welding and fabrication. Local food processing plants also contribute to carbon dioxide and nitrogen demand for packaging and preservation. Investments in innovation parks and research centers drive laboratory gas consumption. Manchester’s regional growth is further fueled by public and private projects focused on clean energy and hydrogen development, positioning it as an important contributor to future market expansion.

Birmingham

Birmingham accounted for approximately 18% of the UK industrial gases market in 2024, driven by its strong presence in metallurgy, automotive, and industrial manufacturing. The city’s demand for oxygen, argon, and acetylene is supported by large-scale metalworking, welding, and fabrication activities. The healthcare sector remains a steady consumer of medical oxygen, while local breweries and beverage producers sustain carbon dioxide usage. Birmingham’s proximity to major distribution networks ensures efficient gas supply to surrounding industrial areas. Ongoing infrastructure modernization and adoption of Industry 4.0 practices further boost demand for high-purity gases and on-site generation systems in the region.

Scotland

Scotland represented about 15% of the UK industrial gases market in 2024, with significant demand coming from the energy, chemicals, and healthcare sectors. The region is a key hub for oil and gas operations, requiring nitrogen and hydrogen for various applications. Growing investments in offshore wind and green hydrogen projects are creating new opportunities for industrial gas suppliers. The food and beverage sector, particularly whisky distilleries, also contributes to carbon dioxide consumption. Scotland’s strong research base supports demand for laboratory gases, while government-backed decarbonization initiatives encourage the adoption of cleaner and more sustainable gas production technologies.

Market Segmentations:

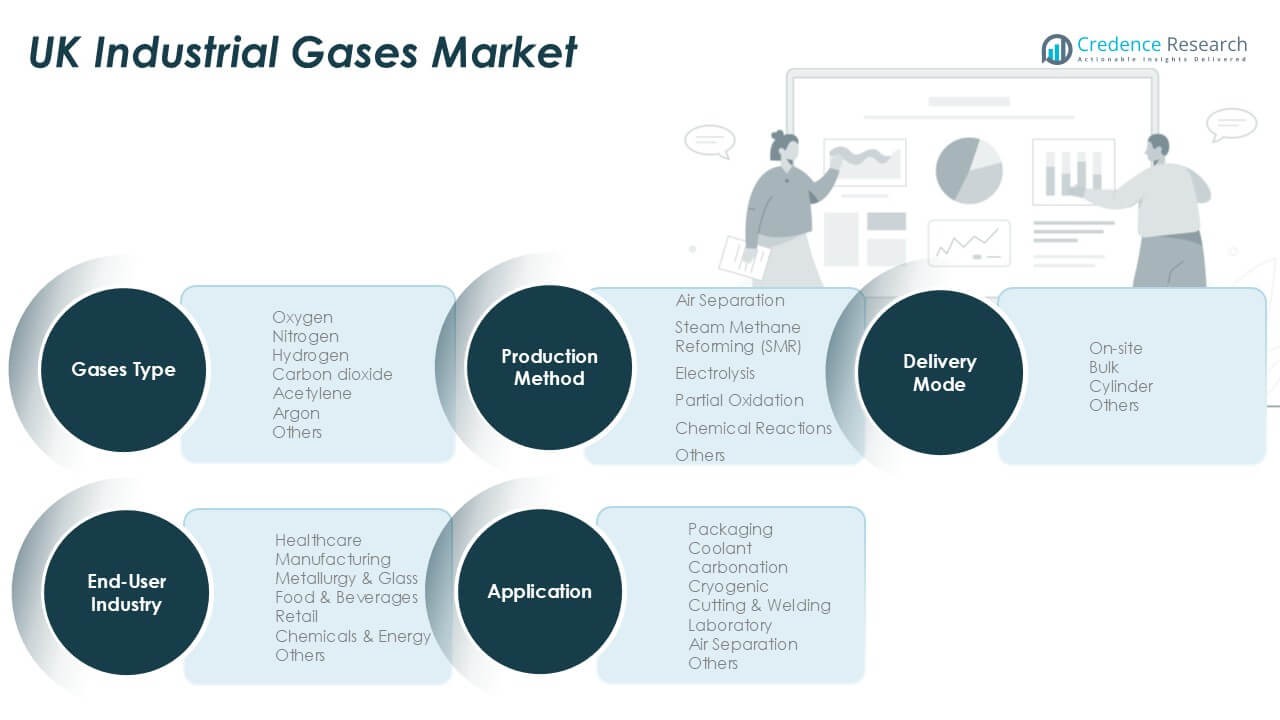

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

By Geography

- London

- Manchester

- Birmingham

- Scotland

Competitive Landscape

The UK industrial gases market is moderately consolidated, with key players including Linde plc (BOC Ltd), Air Liquide UK Ltd., Air Products PLC, Praxair UK, and Messer UK Ltd. holding a significant combined market share. Linde plc leads the market with its extensive production facilities, strong distribution network, and diverse portfolio covering oxygen, nitrogen, hydrogen, and specialty gases. Air Liquide and Air Products focus on strategic partnerships and expansion of on-site gas generation systems to enhance supply reliability for manufacturing and healthcare clients. Messer UK emphasizes customized solutions for small and medium-scale industries, while Praxair UK leverages its global expertise in cryogenics and industrial gas technologies. These companies invest heavily in clean hydrogen production, digital monitoring systems, and energy-efficient air separation technologies to align with the UK’s net-zero carbon goals. Competitive differentiation is driven by pricing, reliability, product purity, and value-added services such as cylinder tracking and just-in-time delivery models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Air Liquide announced to supply oxygen to LG Chem for their electric vehicle battery plant in the U.S. Supplying oxygen to LG Chem’s future cathode active material plant, the Group will be supporting the growth of the battery ecosystem in the U.S. This investment will increase the Group’s footprint in a key region and support the development of its industrial merchant market.

- In October 2024, Linde announced an agreement with Tata Steel to obtain and manage two additional Air Separation Units (ASUs) and enhance industrial gas supply to Tata Steel in Odisha, India. This arrangement will more than double Linde’s on-site capacity at Tata Steel’s Kalinganagar facility, where it presently runs two plants. The new ASUs, anticipated to be operational by 2025, will deliver oxygen, nitrogen, and argon to aid Tata Steel’s expansion project and cater to the local merchant market. Linde has additionally acquired renewable energy agreements to lower its scope emissions, in line with its 2035 GHG reduction goals.

- In July 2024, Air Liquide announced an investment of USD 104.914 million to support Aurubis AG, a major global provider of non-ferrous metals and one of the largest recyclers of copper worldwide, in Bulgaria and Germany. This investment will finance a new Air Separation Unit (ASU) in Bulgaria and the upgrading of four existing units in Germany. Besides supplying substantial amounts of oxygen and nitrogen for the rising copper and other metal production by Aurubis, these facilities will also assist in the growth of industrial merchant markets in both areas.

- In January 2024, Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- In July 2023, Nippon Sanso Holdings Corporation announced that Matheson Tri-Gas, Inc, NSHD’s U. S. operating entity, has entered into a gas supply contract with PointFive to deliver oxygen for the carbon capture, utilization, and sequestration company’s inaugural Direct Air Capture (DAC*) facility in Texas. MATHESON will invest in and set up an Air Separation Unit to provide oxygen to “Stratos,” PointFive’s DAC facility currently under construction in Ector County, Texas. The oxygen is utilized in the DAC process to generate a pure stream of CO2, which is subsequently securely sequestered in geological reservoirs.

Report Coverage

The research report offers an in-depth analysis based on Gases Type, Application, End-User Industry, Production Method, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK industrial gases market will see steady growth driven by healthcare and manufacturing demand.

- Green hydrogen production will gain momentum as the UK advances toward net-zero emissions goals.

- On-site gas generation systems will expand to reduce logistics costs and improve supply reliability.

- Adoption of digital monitoring and automation will enhance operational efficiency and safety.

- Food and beverage sector demand for packaging and carbonation gases will continue rising.

- Investment in cryogenic technologies will support LNG, pharmaceuticals, and cold-chain infrastructure growth.

- Partnerships between gas producers and energy companies will accelerate hydrogen fuel projects.

- Rising R&D activities will boost consumption of high-purity specialty gases across laboratories.

- Market players will focus on energy-efficient air separation technologies to lower production costs.

- Regional growth will be led by London and Manchester, supported by healthcare, manufacturing, and clean energy projects.