Market Overview

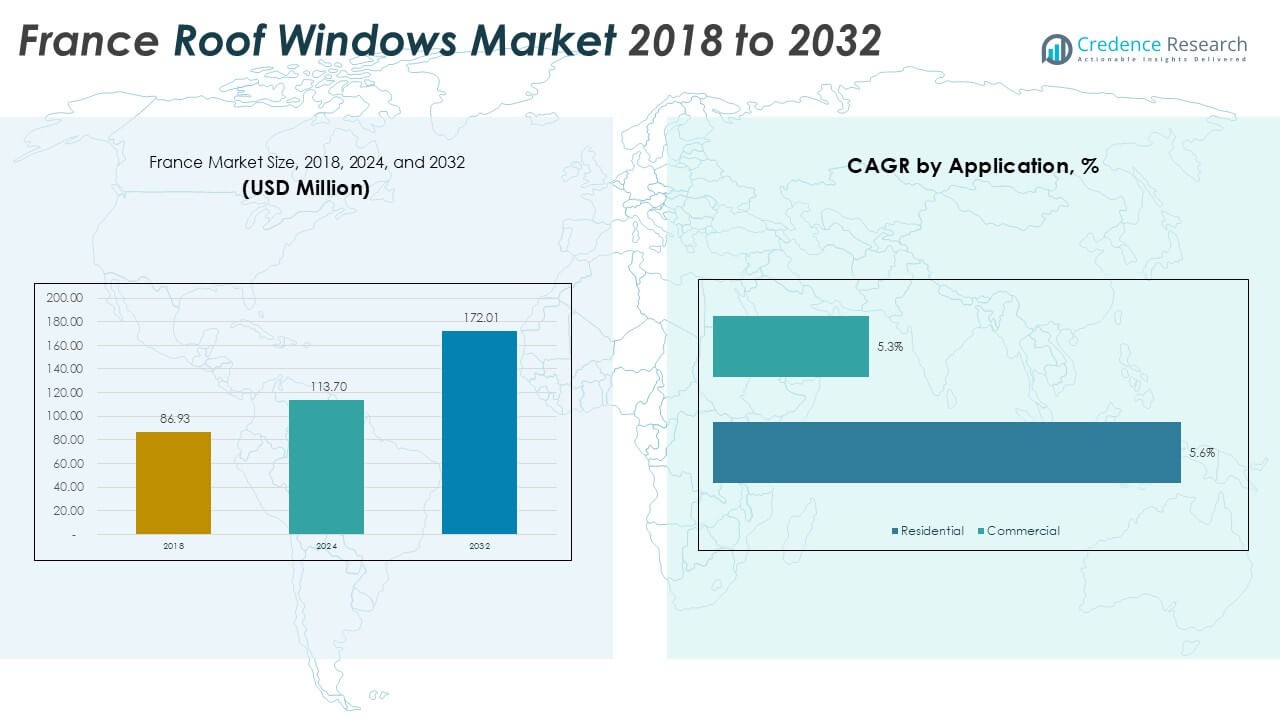

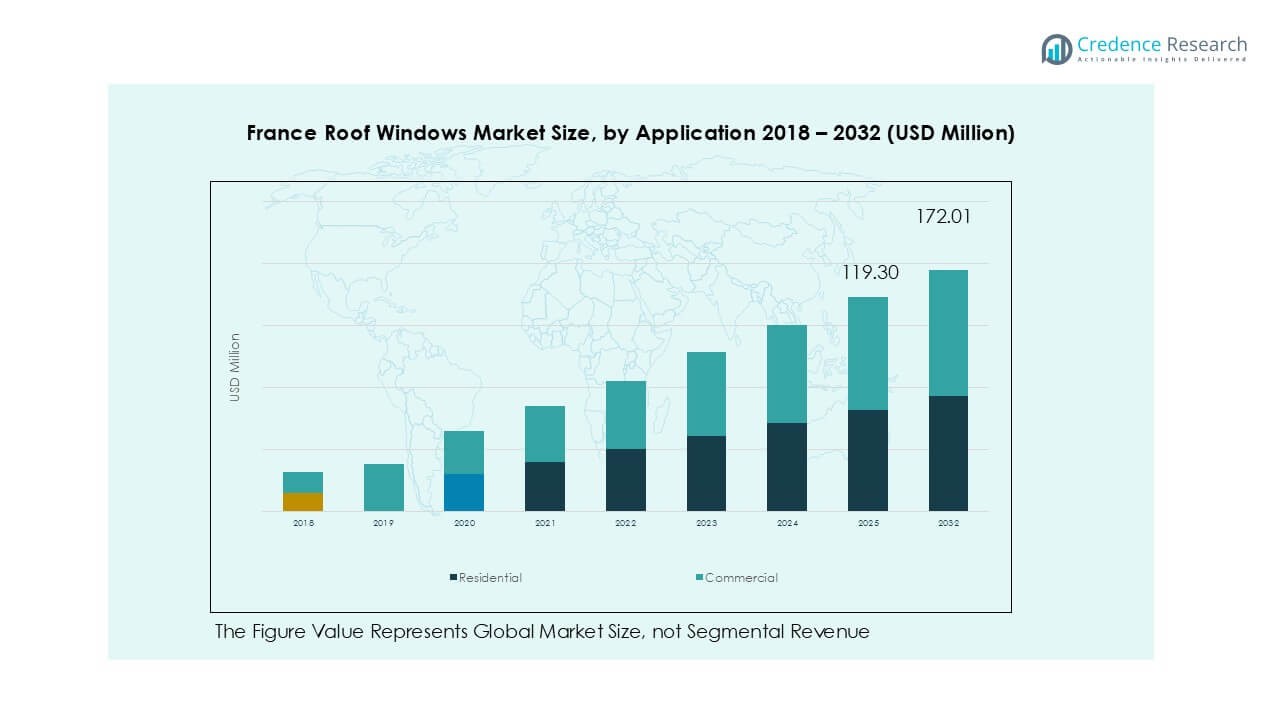

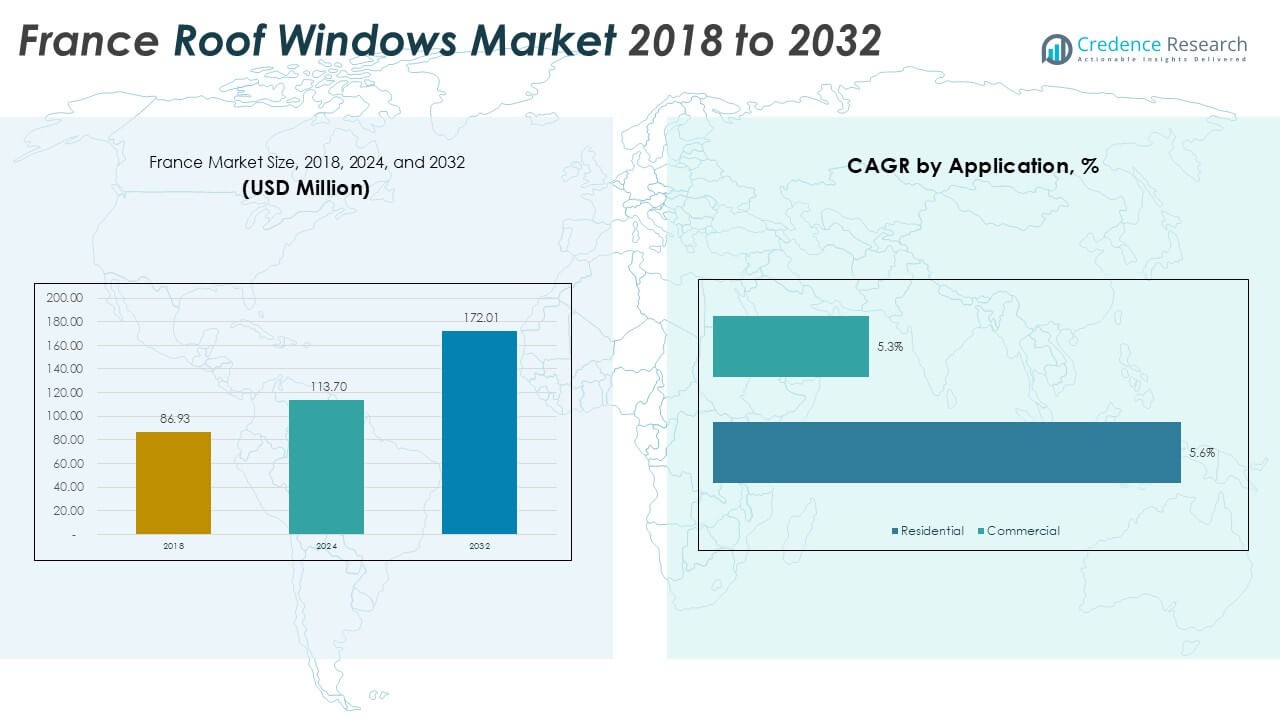

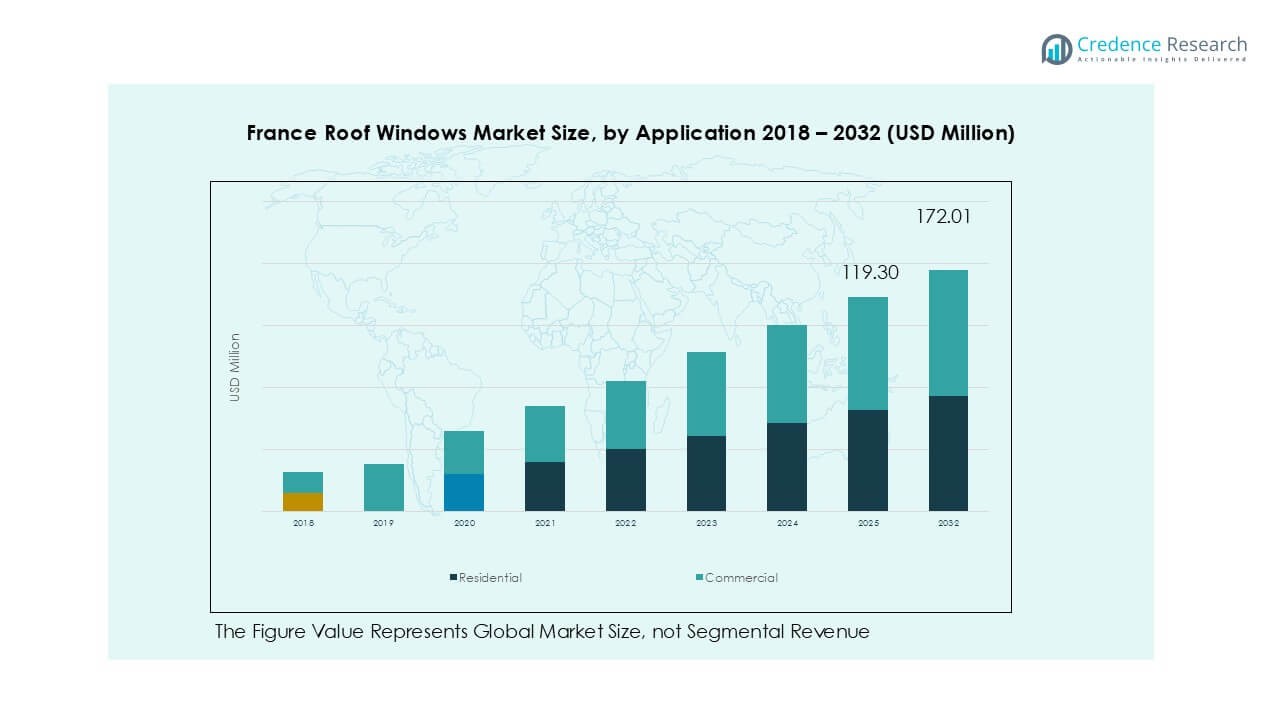

France Roof Windows market size was valued at USD 86.93 million in 2018 to USD 113.70 million in 2024 and is anticipated to reach USD 172.01 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Roof Windows Market Size 2024 |

USD 113.70 Million |

| France Roof Windows Market, CAGR |

5.2% |

| France Roof Windows Market Size 2032 |

USD 172.01 Million |

The France roof windows market is led by Velux Group, Fakro, Keylite, Tryba, and K-LINE, with Velux holding a significant share through its advanced double- and triple-glazed product range and smart home solutions. Fakro emphasizes energy-efficient wooden frames and innovative designs, while Keylite competes with easy-installation systems appealing to residential renovations. Tryba and K-LINE strengthen regional presence with customized solutions for heritage and modern projects. North France leads with over 30% market share, driven by strong renovation demand and strict insulation regulations, followed by Central France at nearly 20%, supported by heritage restoration projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Roof Windows market was valued at USD 113.70 million in 2024 and is projected to reach USD 172.01 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Rising renovation activities and RE2020 regulations drive demand for double- and triple-glazed roof windows, improving thermal performance and reducing energy costs.

- Key trends include adoption of smart, automated roof windows with rain sensors and solar-powered solutions, along with growing preference for FSC-certified wood and eco-friendly materials.

- The market is moderately consolidated, with major players such as Velux Group, Fakro, and Keylite leading through innovation, distribution networks, and partnerships with contractors and builders.

- North France holds over 30% share, followed by Central France at nearly 20%, while the residential segment dominates with around 70% share, driven by attic conversions, housing upgrades, and demand for energy-efficient daylighting solutions.

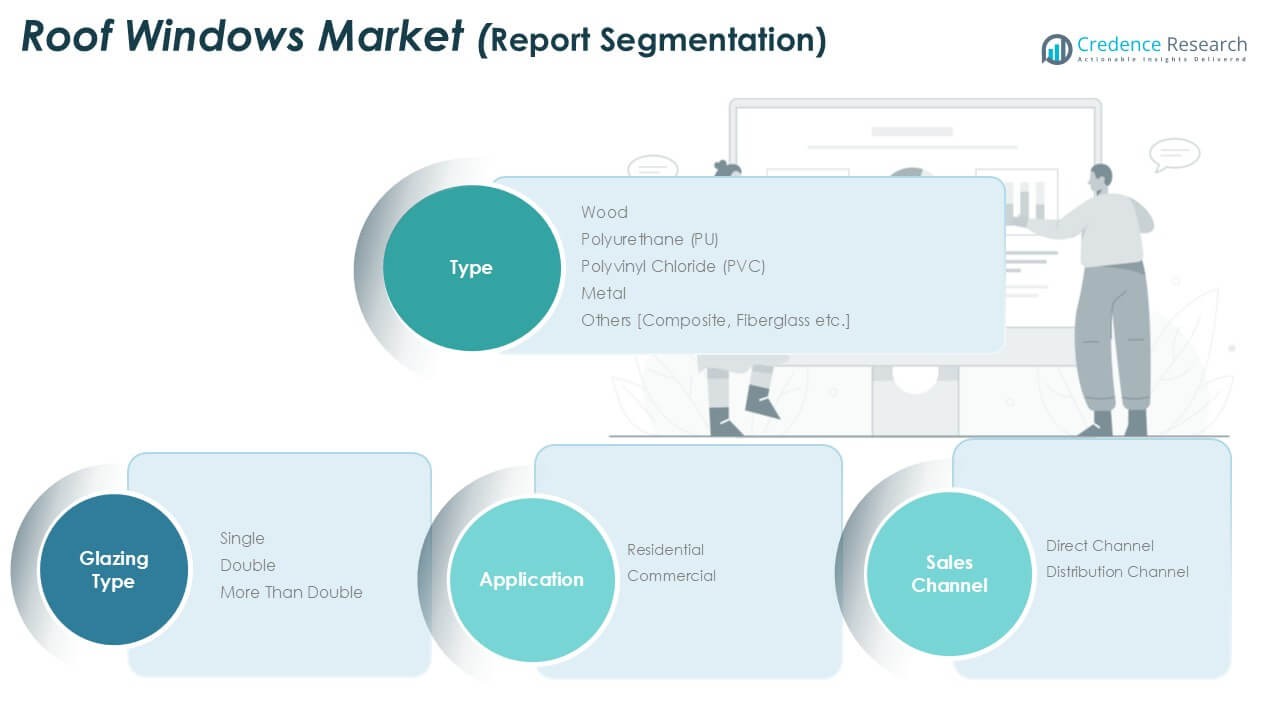

Market Segmentation Analysis:

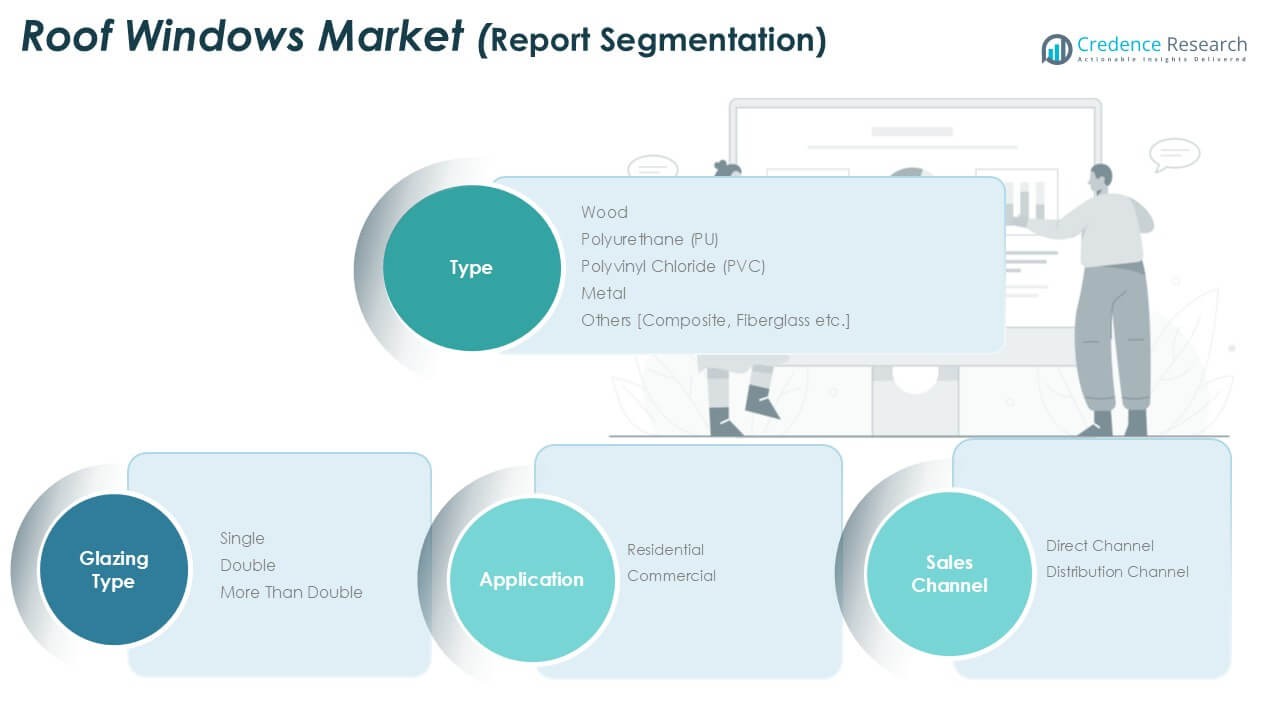

By Type

Wood roof windows dominate the France market, accounting for over 40% share due to their aesthetic appeal and superior insulation properties. Rising demand for eco-friendly and sustainable materials drives the adoption of certified timber frames. Polyurethane (PU) roof windows follow, preferred in moisture-prone areas such as kitchens and bathrooms due to their resistance to humidity. PVC and metal variants serve cost-conscious buyers and industrial projects seeking durability. The shift toward energy-efficient buildings and renovation incentives further strengthens demand for wooden and PU roof windows, especially in premium residential and heritage restoration projects.

- For instance, Accoya wooden window frames carry a 50-year above-ground warranty and a service life expectancy of 60 years for exterior applications.

By Application

The residential segment holds around 70% share of the France roof windows market, driven by strong renovation activities and rising urban housing demand. Government incentives for improving energy efficiency encourage homeowners to install double- and triple-glazed roof windows. Commercial applications are steadily growing with the construction of office spaces, hotels, and educational facilities that integrate daylighting solutions to improve energy performance. Residential adoption benefits from increasing preference for natural light, enhanced ventilation, and smart automation features, making roof windows a key component in sustainable housing upgrades and home improvement projects across major French cities.

- For instance, Bereco offers double glazing with whole-window U-values as low as 1.3 W/m²K, and triple glazing down to 0.8 W/m²K in its timber windows.

By Glazing Type

Double-glazing leads the market with over 50% share, offering superior thermal insulation and noise reduction. This segment benefits from France’s stringent energy performance standards, which mandate improved building insulation. Triple-glazed windows are gaining traction in northern regions with colder climates, supporting compliance with low-energy building norms. Single-glazed products witness declining demand, largely limited to budget or temporary structures. Growth in double- and triple-glazing segments is supported by EU directives promoting near-zero energy buildings (nZEB) and the growing popularity of smart glass technologies that enhance comfort while reducing heating and cooling costs in modern households.

Key Growth Drivers

Rising Renovation and Energy-Efficiency Initiatives

France’s renovation wave strongly drives roof window demand, with programs like MaPrimeRénov encouraging homeowners to upgrade insulation and improve energy efficiency. Increased adoption of energy-efficient windows helps meet France’s 2050 carbon neutrality target. The market benefits from growing consumer awareness about thermal comfort and reduced heating costs. Roof windows with double- and triple-glazing play a vital role in complying with RT 2020 and RE2020 building regulations. This driver is most prominent in residential renovations across Northern and Central France, where energy savings remain a key motivator.

- For instance, through MaPrimeRénov, double-glazed window work can qualify under “Path by Gesture” with ceiling eligibility extending into 2025.

Urbanization and Housing Expansion

Rapid urbanization and rising demand for additional living space drive roof window installations in new housing and attic conversions. Attic renovations are popular in French cities like Paris, Lyon, and Bordeaux, where maximizing usable floor space is essential. Developers integrate roof windows to improve natural lighting, enhance ventilation, and boost property value. The market sees significant adoption in multi-family housing projects where skylights and roof windows help meet daylight regulations. This trend continues to gain traction as urban housing projects focus on sustainability and aesthetic appeal.

- For example, replacement roof windows in renovation projects cost between €450 and €1,300 per item in France.

Shift Toward Smart and Automated Solutions

Growing interest in smart homes fuels demand for automated roof windows equipped with rain sensors and remote controls. Consumers prefer systems that integrate with home automation platforms to enhance convenience and energy efficiency. Manufacturers introduce IoT-enabled solutions to provide real-time ventilation control and optimize indoor climate. Demand for solar-powered roof windows is rising, reducing reliance on grid electricity and simplifying installation. This driver supports premiumization, with homeowners increasingly investing in intelligent systems that improve comfort and align with modern sustainable living trends.

Key Trends & Opportunities

Growing Adoption of Triple-Glazed Roof Windows

Triple-glazed roof windows are gaining popularity, particularly in colder northern regions, to meet strict thermal performance standards. Their ability to reduce heat loss and provide acoustic insulation aligns with France’s near-zero energy building (nZEB) requirements. Builders and homeowners adopt triple glazing to achieve long-term energy savings and increase property value. Manufacturers invest in lightweight triple-glass solutions to simplify installation. This trend presents opportunities for suppliers offering advanced glazing technologies that balance high performance with competitive pricing to meet mass-market demand.

- For instance, LAMILUX Glass Skylight FE triple-layer glazing offers a U-value (Ug) of approximately 0.6 W/(m²·K) for triple glazing and about 39 dB sound insulation.

Integration of Solar-Powered and Sustainable Materials

There is a rising opportunity in solar-powered roof windows that combine daylighting with renewable energy generation. These solutions help homeowners cut electricity costs and comply with sustainability goals. Additionally, demand grows for roof windows made from FSC-certified wood, recycled PVC, and low-VOC coatings to minimize environmental impact. Manufacturers leveraging eco-friendly materials gain a competitive edge in public procurement and green-certified projects. This trend aligns with France’s focus on circular economy principles and supports long-term growth in the sustainable construction segment.

- For instance, FAKRO’s Solar-type Roof Window model includes a solar panel, remote control (ZRH12), and built-in rain sensor that triggers automatic

Key Challenges

High Installation and Maintenance Costs

The high upfront cost of roof windows, including installation and structural adjustments, limits adoption in budget-conscious households. Skilled labor shortages and rising construction costs further increase project expenses. Maintenance challenges, especially for manual roof windows installed at higher elevations, discourage some homeowners. These factors slow down penetration in semi-urban and rural markets. Addressing this challenge requires affordable product lines, simplified installation systems, and greater promotion of financing incentives for renovation projects.

Competition from Alternative Daylighting Solutions

The market faces competition from skylights, light tubes, and other daylighting systems that may offer lower-cost solutions. For commercial projects, architects sometimes prefer larger skylight systems to meet illumination requirements, bypassing roof windows. This challenge impacts demand in segments where budget constraints dominate purchasing decisions. To overcome this, roof window manufacturers need to highlight advantages such as ventilation, energy efficiency, and automation capabilities, differentiating their products from basic alternatives and ensuring their relevance in both residential and commercial applications.

Regional Analysis

North France

North France holds over 30% market share of the France roof windows market, supported by high renovation activity and strict energy regulations. The region’s colder climate drives demand for double- and triple-glazed roof windows to improve thermal insulation and meet RE2020 standards. Urban centers like Lille and Rouen show strong adoption, especially in attic conversions and residential upgrades. Incentives for energy-efficient renovations encourage homeowners to replace old windows with modern solutions. Key players like Velux and Roto Frank AG focus on distributing high-performance wood and PU roof windows to cater to rising demand in sustainable housing projects.

West France

West France accounts for around 18% market share, driven by demand in coastal areas where humidity-resistant PU and PVC roof windows are preferred. Cities like Nantes and Rennes see growth in new residential construction and home improvement projects. The region’s moderate climate supports adoption of double-glazed roof windows, offering both thermal comfort and noise reduction. Renovation programs further boost installations, especially in older housing stock. Manufacturers expand dealer networks in western France to improve product availability and capture growing demand from property developers focusing on energy-efficient housing aligned with government sustainability targets.

Central France

Central France represents nearly 20% market share, driven by strong participation in heritage restoration and rural renovation projects. The presence of historic towns encourages installation of wood-framed roof windows that match traditional architecture while improving energy performance. Double-glazed solutions dominate as homeowners seek cost-effective ways to meet insulation standards. The market benefits from steady demand in residential upgrades and small commercial buildings. Local authorities promote programs to improve building efficiency, supporting higher adoption rates. Key suppliers collaborate with contractors to deliver customized solutions for attic conversions and historic building compliance in the region.

South France

South France holds about 17% market share, with demand driven by growing residential construction and second-home renovations along the Mediterranean coast. The warm climate leads to strong adoption of roof windows with solar-control glazing to manage indoor temperature. PVC and metal variants see higher preference due to their durability and low maintenance in coastal conditions. Urban centers like Marseille, Toulouse, and Montpellier contribute to rising installations in both residential and tourism-related commercial projects. The market benefits from government subsidies encouraging energy-efficient retrofits, which stimulate adoption of advanced, automation-ready roof window solutions.

Eastern France

Eastern France captures around 15% market share, supported by demand in colder areas like Alsace and Lorraine, where triple-glazed windows are highly preferred. The region’s proximity to Germany drives adoption of high-performance, energy-efficient roof windows that meet stringent European standards. Residential renovation projects dominate, with a focus on thermal comfort and noise reduction. Commercial buildings such as schools and office spaces also integrate daylighting solutions. Market players strengthen distribution networks in this region to meet increasing demand for premium products, especially in energy-conscious households seeking long-term cost savings through improved insulation.

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- North France

- West France

- Central France

- South France

- Eastern France

Competitive Landscape

The France roof windows market is moderately consolidated, with global players such as Velux Group, Fakro, and Keylite leading the competition through wide product portfolios and strong distribution networks. Velux Group maintains a dominant presence with advanced double- and triple-glazed solutions and smart automation features, catering to both new construction and renovation projects. Fakro focuses on innovative designs and energy-efficient wooden frames, expanding its footprint across residential segments. Keylite strengthens its position through cost-effective solutions and ease-of-installation systems, appealing to contractors and DIY users. Regional manufacturers like Tryba, K-LINE, and Dakota Group provide localized solutions, supporting restoration projects and customized installations. Strategic initiatives include partnerships with builders, expanding online sales channels, and introducing eco-friendly materials to align with France’s RE2020 regulations. Competitive intensity is expected to rise as companies invest in automation-ready, solar-powered, and sustainable roof window offerings to capture the growing demand from energy-conscious homeowners and commercial developers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fakro

- Velux Group

- Keylite

- Tryba

- Tiivi

- Skler

- Skylights Plus

- K-LINE

- Lonsdale Metal Co

- Technal

- Dakota Group

- Glazing Vision Ltd

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth supported by energy-efficiency regulations and renovation programs.

- Demand for double- and triple-glazed roof windows will continue to dominate new installations.

- Smart and automated roof windows will gain wider adoption in connected homes.

- Solar-powered roof windows will see rising demand to reduce grid dependency.

- Manufacturers will focus on eco-friendly materials such as FSC-certified wood and recycled PVC.

- Residential renovations will remain the largest contributor to overall market demand.

- Commercial projects like hotels and offices will increasingly integrate daylighting solutions.

- Northern and Central France will remain the leading regions for market share.

- Competition will intensify with players introducing cost-effective, easy-to-install solutions.

- Online sales channels and direct-to-consumer strategies will expand market accessibility.