Market Overview

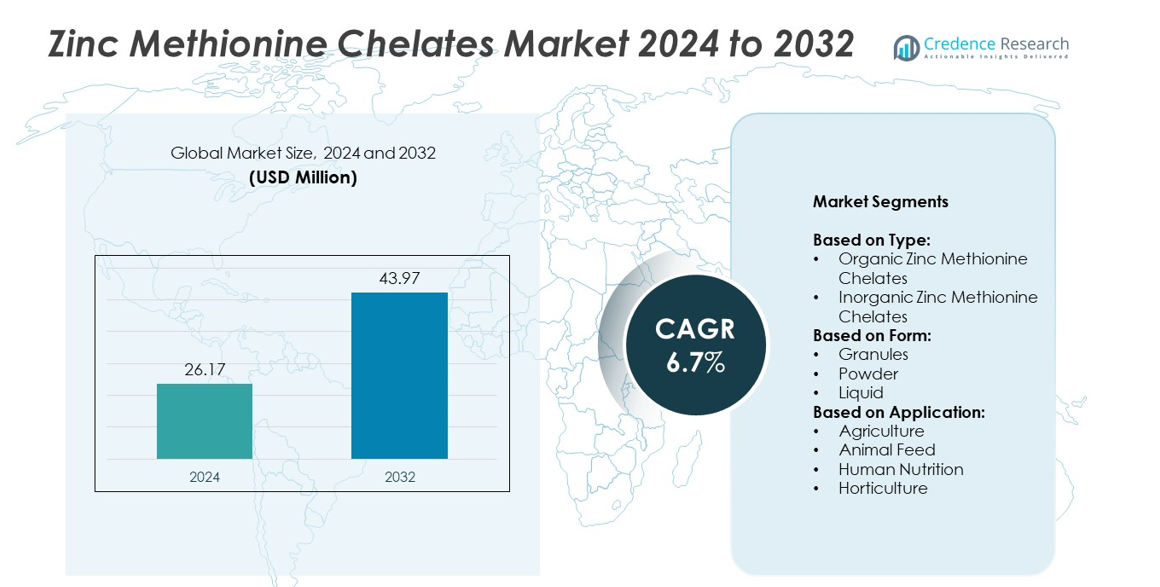

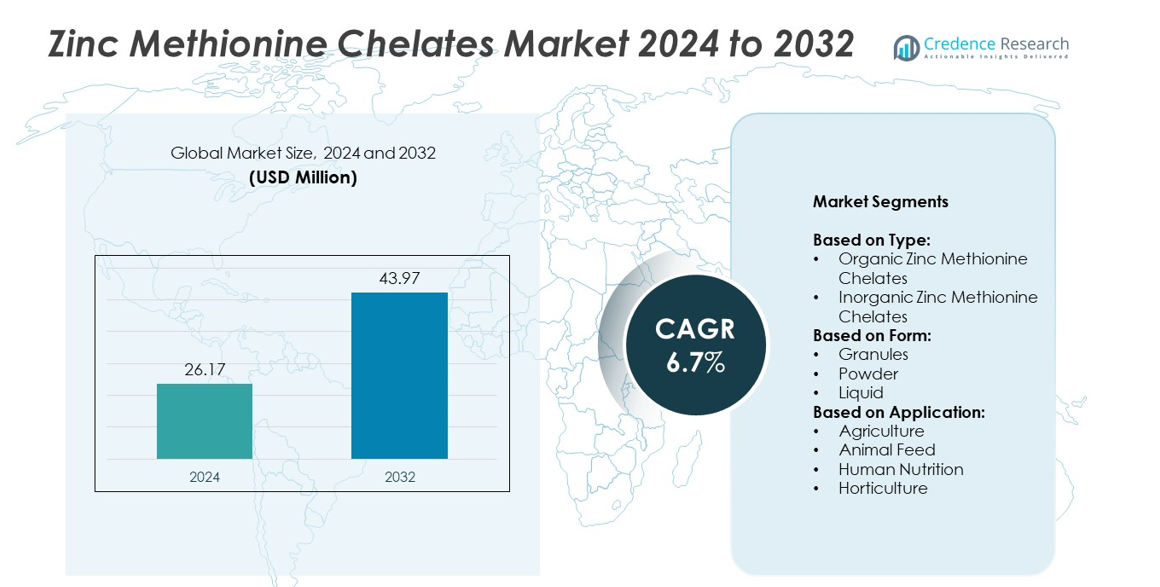

Zinc Methionine Chelates market size was valued USD 26.17 Million in 2024 and is anticipated to reach USD 43.97 Million by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zinc Methionine Chelates Market Size 2024 |

USD 26.17 Million |

| Zinc Methionine Chelates Market ,CAGR |

6.7% |

| Zinc Methionine Chelates Market Size 2032 |

USD 43.97 Million |

The zinc methionine chelates market is led by major players including Zinpro Corporation, Evonik Industries, Hunan Wens Foodstuff Group, BASF, NOVUS International, Pancosma, Lallemand Animal Nutrition, Tanke Biosciences Corporation, Nutrient Technology, Trouw Nutrition (Nutreco), SAB Biotherapeutics, Alltech, Kemin Industries, Groupe Grimaud, and Chongqing Zohar Chemical. These companies focus on developing highly bioavailable and sustainable chelated mineral solutions to meet growing demand from livestock, agriculture, and nutraceutical sectors. North America dominated the market with 38% share in 2024, driven by strong feed production capacity and growing use of trace mineral supplements. Europe accounted for 27%, supported by stringent feed safety regulations, while Asia-Pacific captured 25% with rapid growth in livestock and aquaculture industries.

Market Insights

- The zinc methionine chelates market was valued at USD 26.17 million in 2024 and is projected to reach USD 43.97 million by 2032, growing at a CAGR of 6.7% between 2025 and 2032.

- Rising demand for high-performance animal nutrition and improved feed efficiency is a key growth driver, supported by the need to enhance livestock productivity and immunity.

- Growing preference for organic and eco-friendly chelated minerals, along with innovations in microencapsulation and nano-formulations, are shaping market trends.

- The market is moderately consolidated, with global players focusing on R&D, strategic partnerships, and capacity expansion to strengthen their position and meet rising demand.

- North America led with 38% share in 2024, followed by Europe with 27% and Asia-Pacific with 25%; the animal feed segment held the dominant share, driven by large-scale poultry, swine, and dairy industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Organic Zinc Methionine Chelates held the dominant share of over 62% in 2024, driven by rising demand for highly bioavailable and easily absorbable trace minerals in livestock and human nutrition. These chelates enhance zinc uptake, supporting better immune function and growth rates in animals, which is crucial for commercial farming operations. Inorganic variants, while cost-effective, are witnessing slower adoption due to lower absorption efficiency and environmental concerns related to excretion. Growth in organic farming and premium feed formulations is expected to further boost demand for organic zinc methionine chelates during the forecast period.

- For instance, Novus International showed that its MINTREX® bis-chelated zinc (as Zn(HMTBa)₂) produced about 2 % higher body weight gain in broiler chickens compared to inorganic zinc sources in trials.

By Form

Powder form accounted for nearly 55% market share in 2024, supported by its ease of blending with feed, fertilizers, and nutritional supplements. The powder format offers uniform distribution, better stability, and longer shelf life, making it the preferred choice for animal feed producers and agricultural applications. Granules and liquid forms cater to specialized uses but represent smaller shares. Increased mechanization of feed manufacturing and growing demand for homogenous micronutrient distribution in crops and livestock diets continue to propel the adoption of powder-based zinc methionine chelates globally.

- For instance, Silva et al. (2024) studied zinc amino-acid complex (an organic chelate) in laying pullets and found optimal dietary inclusion of 43.10 mg Zn-AAC per kg diet to maximize body zinc retention.

By Application

Animal feed remained the dominant application segment with over 68% market share in 2024, driven by growing awareness of trace mineral deficiencies affecting livestock productivity. Supplementation with zinc methionine chelates improves reproduction, feed conversion ratios, and overall herd health, leading to higher yields in dairy, poultry, and swine industries. Agriculture and horticulture use is expanding as farmers focus on micronutrient-enriched fertilizers to boost crop quality and resistance. Human nutrition is a growing niche segment, supported by rising consumer interest in bioavailable zinc supplements for immunity and wellness.

Market Overview

Rising Demand for High-Performance Animal Nutrition

The primary growth driver is the rising demand for efficient animal nutrition solutions. Zinc methionine chelates enhance bioavailability, leading to better immunity, reproductive health, and feed efficiency in livestock. This is crucial for poultry, swine, and dairy producers aiming to maximize productivity and reduce veterinary costs. With the global meat and dairy industry focusing on improved yields, demand for chelated trace minerals is increasing steadily. This driver accounts for the largest share of market expansion, influencing feed manufacturers to integrate chelated zinc into premium formulations.

- For instance, Novus International reported that broiler breeders fed MINTREX® trace minerals had “improved laying rates and hatchability” and observed up to 12 % better livability compared to conventional mineral sources.

Shift Toward Sustainable and Organic Farming

The shift toward organic farming and sustainable agricultural practices strongly supports market growth. Organic zinc methionine chelates are preferred because they minimize heavy metal excretion and environmental contamination compared to inorganic alternatives. Growing government support for sustainable farming and consumer demand for residue-free food products drive adoption. Farmers are increasingly investing in micronutrient-enriched fertilizers to boost soil health and crop productivity. This shift creates consistent demand for organic and eco-friendly chelated trace minerals, reinforcing their role in crop nutrition management strategies.

- For instance, in a study using MINTREX® organic trace minerals at 40-10-50 ppm Zn-Cu-Mn levels, feed efficiency (feed conversion ratio) improved and body weight gain increased compared to inorganic sources.

Increasing Focus on Human Health and Wellness

Growing awareness about zinc’s role in human immunity and metabolic health is driving demand for dietary supplements containing zinc methionine chelates. These chelates offer superior absorption and reduced gastrointestinal irritation compared to zinc salts, making them attractive for nutraceutical formulations. Rising incidence of zinc deficiency, especially in developing regions, and growing preventive healthcare trends are expanding the human nutrition segment. This driver is becoming a significant growth contributor as supplement manufacturers launch fortified products targeting immunity support and healthy growth in children and adults.

Key Trends & Opportunities

Innovation in Chelated Mineral Formulations

A major trend is the growing innovation in chelated mineral formulations with enhanced stability and targeted release. Companies are investing in R&D to develop next-generation zinc methionine chelates that improve solubility and maintain stability under high-temperature feed processing. These innovations help optimize nutrient delivery and reduce wastage, creating cost-effective solutions for feed and supplement producers. The trend opens opportunities for differentiation and premiumization in a competitive market, encouraging partnerships between feed producers and mineral solution providers for customized applications.

- For instance, Novus International’s MINTREX® Zn has a ligand HMTBa with 80 % by weight content, making the chelate more bioavailable and reducing mineral excretion.

Growing Demand in Emerging Markets

Emerging economies in Asia-Pacific and Latin America present significant opportunities for market players. Rapid growth of poultry and dairy industries, combined with rising disposable incomes, is fueling demand for high-quality animal feed supplements. Governments in these regions are actively promoting micronutrient-fortified fertilizers and animal nutrition programs. This creates a favorable environment for zinc methionine chelate adoption. Market participants focusing on regional expansions, localized production, and cost-effective distribution networks are likely to capture substantial growth in these high-potential markets over the forecast period.

- For instance, the study “Evaluating the effect of Zn amino-acid complex in white-layer pullets” by Silva et al. (2024) used 360 pullets. It showed that optimal productive performance was achieved with a dietary inclusion of ~5.42–7.87 mg Zn-AAC/kg, but found that a much higher level of 43.10 mg Zn-AAC/kg was optimal for maximizing body zinc retention. This illustrates that farms relying solely on performance outcomes without considering factors like zinc retention may under-supplement for the long-term health of the birds.

Key Challenges

High Production and Raw Material Costs

A major challenge is the relatively high production cost of zinc methionine chelates compared to inorganic zinc sources. The synthesis process and raw material prices contribute to higher overall costs, which can limit adoption among cost-sensitive livestock producers. Price volatility in methionine and zinc feedstocks further affects market stability. To remain competitive, manufacturers must optimize production efficiency and explore strategic sourcing to reduce costs without compromising quality, making affordability a key barrier to widespread adoption in developing regions.

Lack of Awareness Among Small-Scale Farmers

Another key challenge is the limited awareness among small and medium-scale farmers about the benefits of chelated zinc. Many continue using traditional zinc sulfate or oxide due to lower prices, despite their reduced bioavailability. The lack of technical knowledge about dosage optimization and long-term productivity benefits hinders market penetration. Industry stakeholders need to invest in farmer education programs and extension services to highlight the economic advantages of switching to zinc methionine chelates for improved livestock and crop health outcomes.

Regional Analysis

North America

North America held the largest share of around 38% in 2024, supported by strong demand from the animal feed and nutraceutical industries. The region’s focus on high-performance livestock nutrition and preventive healthcare drives significant uptake of zinc methionine chelates. The United States leads consumption due to well-developed feed manufacturing infrastructure and rising consumer demand for meat and dairy products. Regulatory support for trace mineral supplementation in feed formulations also contributes to growth. Continuous investments in R&D for chelated minerals by key market players further strengthen North America’s position as the leading regional market during the forecast period.

Europe

Europe accounted for nearly 27% of the market share in 2024, driven by stringent regulations promoting sustainable agriculture and animal health. Countries like Germany, France, and the Netherlands are at the forefront of adopting organic chelated minerals to reduce environmental impact. Growth is supported by rising demand for high-quality meat and dairy products and strict compliance with feed safety standards such as FEFANA guidelines. The region is also seeing increased use in human nutrition applications, particularly in dietary supplements. Continuous emphasis on animal welfare and clean-label feed solutions is expected to sustain Europe’s steady market growth.

Asia-Pacific

Asia-Pacific captured around 25% of the market share in 2024 and is projected to register the fastest growth rate. Rapid expansion of poultry, aquaculture, and dairy industries in China, India, and Southeast Asia drives significant demand. Rising awareness about trace mineral deficiencies and increasing adoption of fortified feed formulations boost market uptake. Government initiatives to promote balanced animal nutrition and improve productivity further support growth. The growing middle-class population and rising disposable incomes also contribute to higher meat and dairy consumption, creating strong opportunities for zinc methionine chelate suppliers across the Asia-Pacific region.

Latin America

Latin America held a market share of approximately 6% in 2024, with Brazil and Mexico dominating regional consumption. The region’s robust livestock sector, particularly poultry and beef production, fuels demand for bioavailable trace mineral supplements. Adoption is increasing as producers focus on improving feed efficiency and export competitiveness. Local feed manufacturers are gradually shifting toward premium chelated mineral formulations to meet international quality standards. Rising awareness of animal health management and productivity gains from chelated trace minerals is expected to drive steady growth of the zinc methionine chelates market in Latin America over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for about 4% of the market share in 2024, representing a smaller but growing segment. Demand is driven by expanding poultry and dairy industries in countries like Saudi Arabia, South Africa, and Egypt. Increasing investments in modern livestock farming and gradual shift toward fortified feed formulations are creating opportunities for suppliers. Challenges include price sensitivity and limited awareness among small-scale farmers, which slightly slow adoption. However, rising focus on food security and improving animal productivity is expected to support gradual but consistent growth for zinc methionine chelates in this region.

Market Segmentations:

By Type:

- Organic Zinc Methionine Chelates

- Inorganic Zinc Methionine Chelates

By Form:

By Application:

- Agriculture

- Animal Feed

- Human Nutrition

- Horticulture

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the zinc methionine chelates market is shaped by key players such as Zinpro Corporation, Evonik Industries, Hunan Wens Foodstuff Group, BASF, NOVUS International, Pancosma, Lallemand Animal Nutrition, Tanke Biosciences Corporation, Nutrient Technology, Trouw Nutrition (Nutreco), SAB Biotherapeutics, Alltech, Kemin Industries, Groupe Grimaud, and Chongqing Zohar Chemical. The market is moderately consolidated, with a mix of global manufacturers and specialized regional suppliers focusing on innovation and cost efficiency. Companies are investing heavily in research to improve bioavailability and develop sustainable chelation technologies. Strategic initiatives include capacity expansions, partnerships with feed producers, and the launch of fortified nutritional solutions targeting livestock productivity and crop health. Increasing emphasis on compliance with environmental and feed safety standards is driving producers to offer clean-label, eco-friendly solutions. Mergers and acquisitions, alongside geographic expansion into high-growth emerging markets, are common strategies to strengthen market presence and address rising global demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zinpro Corporation

- Evonik Industries

- Hunan Wens Foodstuff Group

- BASF

- NOVUS International

- Pancosma

- Lallemand Animal Nutrition

- Tanke Biosciences Corporation

- Nutrient Technology

- Trouw Nutrition (Nutreco)

- SAB Biotherapeutics

- Alltech

- Kemin Industries

- Groupe Grimaud

- Chongqing Zohar Chemical

Recent Developments

- In 2025, Novus participating in discussions about mineral bioavailability at the International Poultry Scientific Forum (IPSF).

- In 2024, Balchem introduced zinc methionine-based mineral blends in new encapsulated formats to improve stability and palatability.

- In 2024, Alltech focused on sustainable animal nutrition solutions by integrating organic trace minerals, including zinc methionine, into feed programs. This reflects a commitment to sustainability in animal nutrition.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for zinc methionine chelates will grow as livestock producers aim to improve animal health and productivity.

- Asia-Pacific region will record the fastest growth due to rising meat, dairy, and aquaculture production.

- Liquid and water-soluble forms will gain popularity for ease of use in modern feeding systems.

- Organic chelated zinc methionine will see higher adoption due to better bioavailability and sustainability benefits.

- Stricter regulations on feed safety and environmental impact will encourage advanced chelation technologies.

- Innovation in microencapsulation and nano-formulations will enhance nutrient stability and absorption efficiency.

- Human nutrition applications will expand as zinc deficiency awareness and preventive healthcare trends increase.

- Production capacity expansion in emerging markets will lower costs and improve farmer accessibility.

- Distribution models will adapt, with stronger networks supporting small farms and direct sales for large producers.

- R&D investments will rise to develop more stable and efficient chelates suited for various feed processing conditions.