Market Overview

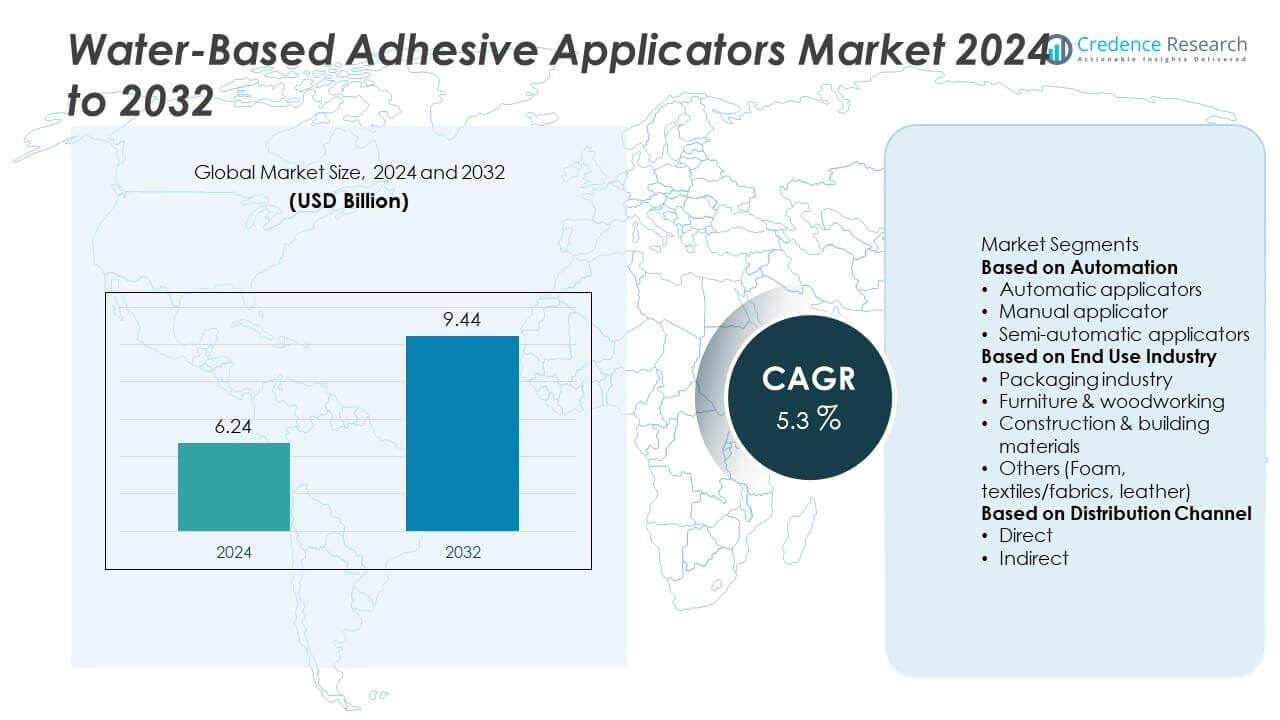

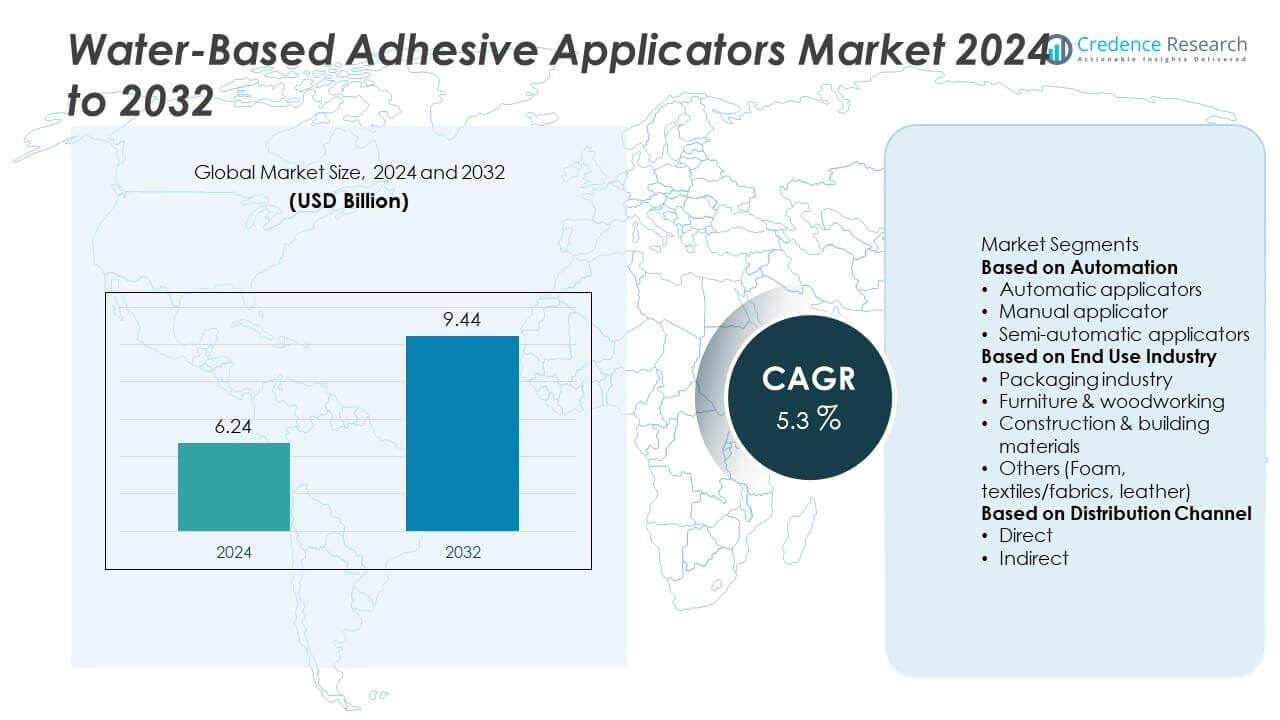

The water-based adhesive applicators market was valued at USD 6.24 billion in 2024 and is projected to reach USD 9.44 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water-Based Adhesive Applicators Market Size 2024 |

USD 6.24 Billion |

| Water-Based Adhesive Applicators Market, CAGR |

5.3% |

| Water-Based Adhesive Applicators Market Size 2032 |

USD 9.44 Billion |

The water-based adhesive applicators market is led by key players including Bayer AG, Henkel AG & Co. KgaA, 3M, Arkema, Dow, Sika AG, H.B. Fuller, PPG Industries, Akzo Nobel N.V., and Ashland. These companies dominate through innovative applicator designs, automation integration, and strong global distribution networks. Asia-Pacific led the market with 38% share in 2024, driven by rapid industrialization, booming packaging demand, and growth in furniture manufacturing. Europe held 29% share, supported by strict sustainability regulations and adoption of eco-friendly adhesives. North America captured 24% share, benefiting from advanced manufacturing and automation trends across packaging and construction sectors.

Market Insights

Market Insights

- The water-based adhesive applicators market was valued at USD 6.24 billion in 2024 and is projected to reach USD 9.44 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising demand from the packaging industry and furniture manufacturing drives market growth, supported by the shift toward eco-friendly adhesives.

- Key trends include automation in applicator systems, adoption of precision dispensing technology, and development of energy-efficient equipment to improve operational productivity.

- The market is competitive with major players such as Bayer AG, Henkel AG & Co. KgaA, 3M, Arkema, and Dow focusing on product innovation, global expansion, and partnerships with end-use industries.

- Asia-Pacific led with 38% share in 2024, followed by Europe at 29% and North America at 24%; by automation, automatic applicators dominated with more than 50% share due to their efficiency and ability to reduce labor costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Automation

Automatic applicators dominated the water-based adhesive applicators market in 2024, holding over 55% share, driven by rising demand for precision, speed, and reduced labor dependency in production processes. Automatic applicators are widely adopted in packaging, woodworking, and automotive assembly lines for consistent adhesive application and minimal material wastage. Their integration with PLC-controlled systems and IoT-enabled monitoring enhances process efficiency and quality control. Semi-automatic applicators follow, preferred by mid-sized manufacturers seeking cost-effective automation solutions, while manual applicators retain demand in small-scale operations and for specialized, low-volume adhesive applications.

- For instance, in fiscal 2024, Nordson Corporation’s Industrial Precision Solutions (IPS) segment reported sales of $1.484 billion, which was driven primarily by a 6.6% favorable acquisition impact. The IPS segment’s organic sales growth was nearly flat at 0.1% for the year, with growth in product lines such as packaging offsetting weakness in areas like industrial coatings and polymer processing.

By End Use Industry

The packaging industry accounted for more than 40% share in 2024, supported by growing e-commerce shipments, FMCG production, and demand for sustainable packaging solutions. Water-based adhesive applicators are extensively used for case sealing, labeling, and carton assembly, ensuring eco-friendly and safe bonding. The furniture and woodworking sector is a key contributor, driven by rising demand for flat-pack furniture and customized wood products. Construction and building materials applications are expanding due to increasing use of adhesives for flooring, panels, and insulation systems.

- For instance, Graco Inc. is a leading manufacturer of fluid handling equipment, including systems used for applying water-based adhesives in wood furniture manufacturing. The company’s precision technologies are designed to optimize application and reduce material waste, and they have expanded their product portfolio through strategic acquisitions to increase market presence.

By Distribution Channel

The direct sales channel led the market with over 60% share in 2024, as manufacturers prefer direct engagement with OEMs and large-scale end users for customized solutions, installation services, and aftersales support. Direct distribution ensures better customer relationships, technical assistance, and reduced lead times. Indirect channels, including distributors and online platforms, are gaining traction, particularly among small and medium enterprises seeking flexible procurement and quick delivery. The growth of e-commerce platforms offering adhesive equipment is expected to further support the indirect channel’s expansion in emerging markets.

Key Growth Drivers

Rising Demand from Packaging Industry

The growing e-commerce sector and rising demand for FMCG products are driving the use of water-based adhesive applicators in packaging applications. These applicators provide strong, clean, and environmentally safe bonding for cartons, cases, and labels. Manufacturers favor water-based solutions due to their low VOC emissions and compliance with sustainability regulations. Automated applicators further enhance production speed and reduce material wastage. The packaging industry’s shift toward recyclable and biodegradable materials strengthens demand for water-based adhesives, as they offer compatibility with eco-friendly substrates and contribute to greener supply chains.

- For instance, in 2024, Henkel continued to advance its portfolio of sustainable adhesive solutions for eco-friendly packaging, which includes its range of water-based AQUENCE adhesives. This supported the industry shift toward more sustainable materials and VOC standards. By the end of 2024, as confirmed in its 2024 Sustainability Report, 89% of its consumer goods packaging was designed for recycling or reuse.

Adoption of Automation in Manufacturing

Manufacturers are increasingly adopting automated water-based adhesive applicators to improve efficiency, accuracy, and cost savings in production lines. Automated systems reduce manual labor dependency, minimize errors, and ensure consistent adhesive distribution. Their integration with PLCs and IoT systems enables real-time monitoring and predictive maintenance, boosting operational uptime. The push for Industry 4.0 adoption is accelerating investments in smart applicators that improve quality control and optimize adhesive consumption. This trend is particularly strong in packaging, furniture, and automotive sectors where high-volume production requires precision and speed.

- For instance, Bostik develops advanced, water-based adhesive systems for industrial applications in sectors such as furniture and automotive manufacturing, which feature automation, precision application, and IoT-enabled predictive maintenance.

Focus on Sustainable and Safe Adhesive Solutions

Stricter environmental regulations and rising consumer demand for eco-friendly products are driving the use of water-based adhesives over solvent-based alternatives. These adhesives are free from harmful solvents, reduce VOC emissions, and support workplace safety. Industries such as food packaging and furniture manufacturing prefer water-based solutions for their compliance with FDA and REACH standards. The growing emphasis on sustainability in construction and packaging sectors further promotes adoption, as manufacturers aim to lower their carbon footprint and meet global ESG goals through greener adhesive technologies.

Key Trends & Opportunities

Integration of Smart and IoT-Enabled Applicators

The adoption of smart adhesive applicators with IoT-enabled features is rising, allowing remote monitoring, process optimization, and data-driven decision-making. These systems help track adhesive usage, reduce wastage, and detect performance issues before they disrupt production. Integration with enterprise software enables predictive maintenance and lowers downtime, enhancing overall equipment efficiency. This trend presents opportunities for suppliers offering connected solutions that support Industry 4.0 initiatives and improve transparency in manufacturing processes.

- For instance, Nordson Corporation uses its proprietary Adhesive Tracking System (ATS) with its applicators in packaging manufacturing plants, which enables customers to monitor adhesive consumption in real-time to help reduce waste and improve process control. Customers can download historical usage data from the systems to analyze and improve their processes.

Rising Demand from Furniture and Construction Sectors

The furniture and woodworking sector is witnessing growing use of water-based adhesive applicators for laminates, edge banding, and panel bonding. Similarly, construction activities use these applicators for flooring, insulation, and panel installations. Rising residential and commercial projects globally, along with demand for modular furniture and green buildings, create opportunities for manufacturers. Water-based adhesives’ non-toxic nature and strong bonding properties make them ideal for interior applications where safety and sustainability are critical.

- For instance, H.B. Fuller provided its water-based adhesive solutions and applicator systems to numerous furniture manufacturing and construction customers worldwide, supporting their production processes to achieve efficient and reliable bonding.

Key Challenges

High Initial Cost of Automation

Automated water-based adhesive applicators require significant upfront investment, which can be a barrier for small and mid-sized manufacturers. The cost includes not only equipment purchase but also installation, training, and maintenance. While automation improves long-term efficiency, limited capital budgets often delay adoption in developing regions. Manufacturers must explore leasing options or modular solutions to make technology more accessible and encourage faster transition to automated systems.

Performance Limitations in High-Stress Applications

Water-based adhesives can face limitations in high-temperature or moisture-sensitive environments, reducing their suitability for certain applications. Industries that require high-strength bonds, such as automotive or heavy-duty construction, sometimes favor solvent-based or hot-melt adhesives. This challenge pushes manufacturers to invest in R&D to improve water-based adhesive formulations, enhancing heat and water resistance to expand applicability and compete with alternative technologies in demanding operating conditions.

Regional Analysis

North America

North America held 33% share of the water-based adhesive applicators market in 2024, driven by high demand from the packaging, woodworking, and construction sectors. The U.S. leads the region with strong adoption of automated applicators in FMCG and e-commerce packaging lines. Growth is supported by stringent VOC emission regulations and sustainability initiatives encouraging water-based adhesive use. Canada is also contributing through rising demand in residential construction and furniture manufacturing. The presence of major manufacturers and technological advancements in automation further strengthen the market’s expansion across the region, ensuring consistent demand from industrial and commercial applications.

Europe

Europe accounted for 29% share in 2024, supported by the region’s strong focus on sustainable manufacturing and environmental compliance. Countries such as Germany, France, and Italy are leading adopters due to the high demand for energy-efficient and eco-friendly adhesive solutions. Growth is further fueled by investments in automated production systems across packaging and furniture industries. The region benefits from strict EU regulations encouraging low-VOC adhesives and safer workplace environments. Demand from the construction sector is rising due to increasing retrofitting projects and the push for green building certifications, further driving adoption of water-based adhesive applicators.

Asia-Pacific

Asia-Pacific captured 28% share of the water-based adhesive applicators market in 2024, making it the fastest-growing region. China and India dominate production and consumption, fueled by rapid industrialization, large-scale packaging operations, and booming construction sectors. The rise of e-commerce and consumer goods manufacturing further drives demand for efficient adhesive application systems. Southeast Asian countries are investing in automated machinery to improve productivity and meet export quality standards. The region’s cost-effective manufacturing capabilities and government initiatives to support sustainable production are accelerating adoption of water-based adhesives, making Asia-Pacific a key growth engine for global market players.

Latin America

Latin America held 6% share in 2024, with Brazil and Mexico leading market demand. The region is seeing increased adoption of water-based adhesive applicators in the packaging and woodworking sectors, driven by growth in food and beverage exports and domestic manufacturing. Construction projects focused on infrastructure and residential housing are also supporting market expansion. However, economic fluctuations and limited capital budgets in some countries can restrict investment in advanced applicators. Despite these challenges, rising interest in sustainable manufacturing and adoption of eco-friendly adhesives are expected to strengthen long-term growth in this region.

Middle East & Africa

The Middle East & Africa region accounted for 4% share in 2024, supported by growing investments in construction, packaging, and manufacturing industries. GCC countries, including Saudi Arabia and the UAE, are driving demand through large-scale infrastructure projects and urban development initiatives. Water-based adhesive applicators are increasingly preferred due to their low toxicity and compliance with environmental regulations. In Africa, South Africa and Nigeria are emerging markets with expanding industrial and packaging sectors. The adoption of automated solutions is gradually increasing, with government initiatives encouraging modern manufacturing practices and the use of safer, sustainable adhesive technologies.

Market Segmentations:

By Automation

- Automatic applicators

- Manual applicator

- Semi-automatic applicators

By End Use Industry

- Packaging industry

- Furniture & woodworking

- Construction & building materials

- Others (Foam, textiles/fabrics, leather)

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the water-based adhesive applicators market is shaped by major players such as Bayer AG, 3M, Ashland, Henkel AG & Co. KgaA, Arkema, Sika AG, PPG Industries, H.B. Fuller, Akzo Nobel N.V., and Dow. These companies focus on developing high-performance, energy-efficient applicator systems that deliver consistent adhesive distribution across packaging, furniture, and construction industries. Strategic initiatives include expanding production capacities, forming partnerships with equipment manufacturers, and launching automated applicator solutions to support high-speed manufacturing. Leading players are also investing in R&D to introduce eco-friendly and low-VOC adhesive technologies that comply with environmental regulations. Digital integration, IoT-enabled monitoring, and predictive maintenance solutions are becoming key differentiators, enhancing efficiency and reducing downtime for end users. Global players are strengthening their distribution networks and providing technical training to improve adoption rates and maximize equipment performance, driving competitiveness in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Dow won multiple Edison Awards for innovations, including ones that enhance sustainability and reduce volatile organic compounds (VOC) in adhesives.

- In April 2025, 3M’s Fastbond 1049 won the 2025 Innovation Award from the Adhesive & Sealant Council for matching or exceeding solvent-based performance while lowering VOCs.

- In December 2024, Arkema finalized its acquisition of Dow’s flexible packaging laminating adhesives business.

- In November 2024, Henkel and Celanese announced collaboration to produce water-based adhesives made from captured CO₂ emissions.

Report Coverage

The research report offers an in-depth analysis based on Automation, End Use Industry, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated applicators will rise as industries focus on precision and productivity.

- Eco-friendly and low-VOC adhesive solutions will see wider adoption across packaging and construction.

- Integration of IoT-enabled monitoring systems will enhance process control and reduce downtime.

- Growth in e-commerce will drive demand for packaging adhesives and efficient applicator systems.

- Furniture and woodworking industries will invest in advanced applicators to improve finish quality.

- Emerging markets will contribute significantly with rising manufacturing and infrastructure development.

- Manufacturers will focus on energy-efficient and cost-effective applicator technologies.

- Customizable applicators for specialized end-use industries will gain popularity.

- Collaboration between adhesive producers and applicator manufacturers will boost innovation.

- Digitalization and predictive maintenance solutions will improve equipment lifespan and reduce operational costs.

Market Insights

Market Insights