Market Overview:

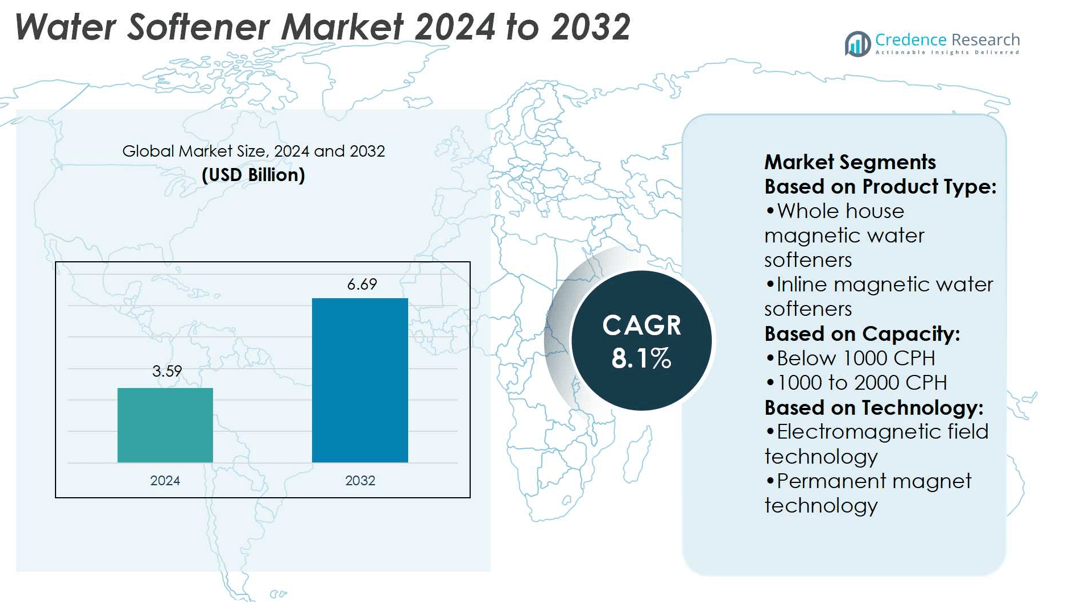

Water Softener Market size was valued USD 3.59 billion in 2024 and is anticipated to reach USD 6.69 billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Softener Market Size 2024 |

USD 3.59 billion |

| Water Softener Market , CAGR |

8.1% |

| Water Softener Market Size 2032 |

USD 6.69 billion |

The Water Softener Market is shaped by prominent players including Aquasana, GMX International, Atlas Filtri, Calmat, Linux Magnetics, Kinetico Water Systems, Ethix Water Conditioner, Alfa Engineering Solutions, Autofill Systems, and Advanced Watertek. These companies drive competition through technological innovation, eco-friendly product development, and expansion into both residential and industrial applications. North America emerges as the leading region, holding a 34% share in 2024, supported by high consumer awareness, strict regulatory frameworks, and strong adoption of smart, connected water softeners. Strategic partnerships, product diversification, and sustainability-driven designs strengthen competitiveness, positioning these players to capture long-term growth opportunities.

Market Insights

- The Water Softener Market size was USD 3.59 billion in 2024 and will reach USD 6.69 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Rising demand for clean and safe water in residential, industrial, and commercial applications drives strong market adoption, supported by urbanization and water contamination concerns.

- The market shows clear trends in smart, connected, and eco-friendly systems, with players like Aquasana and Kinetico introducing advanced technologies and salt-free alternatives to meet sustainability goals.

- High installation and maintenance costs remain restraints, along with environmental concerns linked to brine discharge from traditional salt-based systems, pushing manufacturers toward innovative solutions.

- Regionally, North America leads with 34% share, driven by awareness and regulations, while Asia-Pacific grows fastest; by segment, residential users dominate with increasing adoption of compact, automated softeners, strengthening the global market outlook.]

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Whole house magnetic water softeners lead this segment with a 46% market share. Their dominance is driven by high adoption in residential settings, where users seek comprehensive treatment for all household water outlets. These systems prevent limescale buildup in plumbing and appliances, ensuring longer equipment life and reduced maintenance costs. Inline and portable magnetic softeners serve niche needs, but their limited capacity and application scope restrict widespread use. Rising consumer awareness of water quality and the convenience of a single-unit solution strengthen the preference for whole house systems.

- For instance, Aquasana’s Rhino EQ-1000 the product is marketed with a 1,000,000-gallon capacity.Aquasana advertises a 10-year filter life for the main filter tanks, which contain the carbon filtration media.

By Capacity

The below 1000 CPH segment holds the largest share at 38%, reflecting strong demand in residential and small commercial spaces. Households and small offices often prefer compact units due to cost efficiency, ease of installation, and sufficient capacity for daily water consumption. Larger capacity ranges, such as 2000 to 4000 CPH and above 4000 CPH, find adoption in industrial and institutional facilities but face slower growth due to higher upfront costs. Increasing urbanization and consumer focus on low-maintenance domestic solutions drive the growth of the below 1000 CPH segment.

- For instance, GMX International’s Model 800 magnetic water conditioner is marketed for residential and light commercial users. However, independent scientific research has not been able to validate the effectiveness of magnetic water conditioning for treating hard water or preventing scale.

By Technology

Permanent magnet technology dominates with a 41% share, supported by its durability and low operating costs. These systems function without electricity, offering energy savings and reliability for both households and small businesses. Electromagnetic field technology is expanding in industrial and commercial settings due to its higher efficiency in hard water treatment, but dependence on electricity limits wider residential adoption. Other technologies, such as magnetic descaling methods, remain in early adoption stages. Rising emphasis on sustainable and maintenance-free water treatment strengthens the permanent magnet segment’s position in the global market.

Market Overview

Rising Demand for Clean and Safe Water

The global rise in water contamination levels has increased demand for water softeners. Households and industries prioritize safe, clean water for drinking, cooking, and operational use. The presence of calcium and magnesium causes hardness, which negatively impacts appliances, plumbing, and health. Growing awareness of these risks encourages adoption of softening systems. Expanding urbanization and higher living standards strengthen this demand further. The residential sector is a key driver, with consumer preference for advanced, automated solutions pushing market adoption significantly.

- For instance, Atlas Filtri’s DP BIG product specifications indicate that the system can accommodate flow rates of up to 20 gallons per minute (GPM) for a single housing and up to 40 GPM for a dual or triple housing configuration, depending on the specific model.

Expanding Industrial and Commercial Applications

Industries such as food and beverage, healthcare, and hospitality require consistent water quality to maintain equipment efficiency and product safety. Hard water reduces operational performance and raises maintenance costs, creating a strong case for water softeners. Commercial establishments including hotels, restaurants, and laundries are increasingly adopting these systems to enhance service quality and customer satisfaction. Strict quality standards in manufacturing and healthcare further accelerate installations. Growing industrialization in developing economies ensures long-term opportunities, strengthening the role of commercial and industrial applications as growth drivers.

- For instance, Calmat’s PLUS Electronic Anti-Scale System, model 1-6005-000, handles a water flow up to 15 m³/h (66 US gallons per minute), treats hardness above 1000 ppm, works on pipes up to 3-inch (76 mm) diameter, and uses only 4.3 watts of power while operating over a frequency range of 3-32 kHz.

Supportive Government Regulations and Initiatives

Government policies promoting water conservation and quality improvement fuel market growth. Regulations limiting the discharge of untreated water and encouraging sustainable practices create a favorable environment for water softener adoption. Subsidies and incentive programs in some regions further promote installations at both household and industrial levels. Rising investments in smart city projects often include water treatment infrastructure, strengthening market scope. Educational campaigns on water quality awareness increase consumer adoption, making regulatory support a key driver of growth across global regions.

Key Trends & Opportunities

Adoption of Smart and Connected Water Softeners

The integration of IoT and smart technologies into water softeners is reshaping the market. Connected devices provide real-time monitoring, predictive maintenance, and improved efficiency. Users can track water consumption, salt levels, and filter performance through mobile apps, enhancing convenience. Manufacturers are launching AI-enabled models with automated regeneration cycles, reducing resource waste. This trend aligns with consumer preference for energy-efficient, sustainable, and technologically advanced solutions. The smart water softener segment is expected to see significant traction, particularly in developed markets with high digital adoption.

- For instance, Kinetico’s Premier S650 OD XP softener features OverDrive technology enabling both tanks to operate simultaneously, with an operating flow of 11-15 gallons per minute, regeneration time of 11 minutes, water usage per regeneration set at 7 gallons, and salt usage per regeneration between 0.8-1.25 pounds.

Rising Preference for Eco-Friendly and Salt-Free Solutions

Growing environmental concerns and regulatory restrictions on salt discharge support demand for salt-free water softeners. Consumers are shifting toward eco-friendly alternatives that prevent scale buildup without chemicals or excessive water waste. These systems reduce maintenance costs and meet sustainability goals, appealing to both households and industries. Manufacturers are investing in innovative filtration media and alternative technologies to meet this demand. The eco-friendly segment presents a major opportunity for players aiming to capture environmentally conscious consumers and comply with stricter regulations globally.

- For instance, Alfa Magnolith Water Conditioner (from the German Magnetic Water Solutions) are available in sizes from 1-inch to 8-inch with flow rates ranging from 300 to 300,000 litres per hour (LPH).

Key Challenges

High Installation and Maintenance Costs

Despite benefits, water softener systems involve significant upfront costs and ongoing expenses for salt, filters, and servicing. These costs discourage adoption, especially in cost-sensitive regions and among small-scale users. Installation complexity often requires professional expertise, further increasing expenses. In emerging markets, this cost barrier limits penetration outside urban areas. While premium consumers and industries justify the investment, widespread affordability remains a challenge. Reducing costs through technological innovation and scalable solutions is essential to overcome this obstacle and boost adoption rates.

Environmental Concerns Linked to Salt-Based Systems

Salt-based water softeners, while effective, face criticism for their environmental impact. They discharge brine into wastewater, contributing to salinity issues and regulatory restrictions in some regions. Growing sustainability concerns are pressuring manufacturers to explore alternatives. In areas with water scarcity, the additional water used for regeneration cycles compounds the issue. These environmental drawbacks pose a significant barrier to long-term adoption of traditional systems. Companies must innovate with salt-free technologies and eco-friendly designs to address regulatory pressures and sustainability goals effectively.

Regional Analysis

North America

North America leads the water softener market with a 34% share in 2024. The region benefits from high awareness of water quality, advanced technology adoption, and strict regulatory frameworks supporting water treatment solutions. The U.S. dominates with widespread residential adoption and significant industrial demand from healthcare, food, and manufacturing sectors. Growth in smart, connected water softeners further strengthens the market. Canada contributes with rising installations in urban households and hospitality. Strong consumer preference for eco-friendly, energy-efficient products supports sustained expansion, making North America a key revenue-generating hub.

Europe

Europe accounts for 27% of the water softener market in 2024, driven by stringent EU water quality standards and sustainability regulations. Countries like Germany, the UK, and France lead adoption due to advanced infrastructure and consumer emphasis on energy-efficient, eco-friendly solutions. Salt-free and magnetic softeners are gaining traction as regulatory restrictions on brine discharge tighten. Industrial and commercial sectors, particularly hospitality and healthcare, remain major users. Eastern Europe is witnessing gradual growth, supported by rising urbanization and improved water infrastructure. Overall, Europe maintains strong momentum with sustainability-focused innovations.

Asia-Pacific

Asia-Pacific holds a 23% market share in 2024 and is the fastest-growing region. Rising urbanization, population growth, and rapid industrialization fuel demand for water softeners across residential, industrial, and commercial sectors. China, India, and Japan drive adoption with large-scale construction activities and expanding middle-class consumer bases. Increasing water pollution and awareness of health risks from hard water support installations in households. Industrial users in power, pharmaceuticals, and food industries strengthen adoption further. Technological advancements and rising investment in smart water solutions create long-term opportunities, positioning Asia-Pacific as a key growth engine.

Latin America

Latin America represents 9% of the water softener market in 2024. Growth is driven by rising urbanization, water scarcity issues, and the need for reliable treatment systems in countries like Brazil, Mexico, and Argentina. Industrial demand from food processing, beverage production, and hospitality sectors is expanding. Residential adoption remains limited due to cost barriers but is increasing in middle-income urban households. Government efforts to improve water infrastructure and promote sustainable technologies also aid market penetration. With improving economic conditions, Latin America shows steady growth potential, particularly for eco-friendly and affordable water softener systems.

Middle East & Africa (MEA)

The Middle East & Africa accounts for 7% of the water softener market in 2024. Water scarcity and high hardness levels in groundwater make softening systems essential across the region. The Gulf Cooperation Council (GCC) countries lead adoption, supported by heavy demand from residential complexes, hotels, and industrial users. Africa’s adoption remains slower due to affordability challenges but is expected to grow with urbanization and infrastructure development. Desalination projects and government initiatives on water treatment provide new opportunities. The MEA region is poised for gradual but steady expansion, particularly for energy-efficient and salt-free solutions.

Market Segmentations:

By Product Type:

- Whole house magnetic water softeners

- Inline magnetic water softeners

By Capacity:

- Below 1000 CPH

- 1000 to 2000 CPH

By Technology:

- Electromagnetic field technology

- Permanent magnet technology

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the Water Softener Market features key players such as Aquasana, GMX International, Atlas Filtri, Calmat, Linux Magnetics, Kinetico Water Systems, Ethix Water Conditioner, Alfa Engineering Solutions, Autofill Systems, and Advanced Watertek. The competitive landscape of the Water Softener Market is defined by continuous innovation, sustainability focus, and regional expansion. Companies emphasize smart and connected technologies, offering solutions that allow remote monitoring, predictive maintenance, and improved energy efficiency. Eco-friendly and salt-free systems are gaining prominence as environmental regulations tighten, pushing manufacturers to invest in alternative technologies that reduce brine discharge and water waste. Strategic partnerships and collaborations across supply chains enhance market penetration, while mergers and acquisitions expand portfolios and global presence. Intense competition drives focus on cost efficiency, customer service, and differentiated product designs to meet diverse residential, commercial, and industrial needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aquasana

- GMX International

- Atlas Filtri

- Calmat

- Linux Magnetics

- Kinetico Water Systems

- Ethix Water Conditioner

- Alfa Engineering Solutions

- Autofill Systems

- Advanced Watertek

Recent Developments

- In May 2025, Dr. Beckmann introduced Magic Leaves fabric conditioner sheets. The product contains 75% less plastic than standard fabric conditioner bottles, uses packaging made from over 90% recyclable materials, and features sheets composed of 72% natural ingredients.

- In May 2025, Unilever launched the Pure Heaven Scent range, which includes Persil Pure Heaven Scent Non-Bio Capsules, Persil Wonder Wash Sensitive, Comfort Pure Heaven Scent Fabric Conditioner, and Comfort Pure Heaven Scent Booster Elixir. The entire range has received approval from the Skin Health Alliance.

- In May 2024, P&G Professional expanded its laundry care lineup with Downy Professional Fabric Softener. The product softens fibers in one wash and delivers long-lasting freshness on uniforms, towels, linens, and more.

- In March 2024, Panasonic Corporation’s Heating & Ventilation A/C Company launched a new Water Purification System that removes iron from well water using proprietary technology. In August, it plans to introduce a Water Softener to convert hard water into soft water

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for clean and safe water.

- Smart and connected water softeners will gain stronger consumer adoption.

- Eco-friendly and salt-free systems will become a preferred choice globally.

- Industrial sectors will continue driving installations for efficiency and compliance.

- Urbanization and infrastructure growth will support wider residential adoption.

- Strict regulations on water quality will accelerate technology upgrades.

- Emerging economies will offer high-growth opportunities for cost-effective solutions.

- Innovation in filtration media will enhance performance and reduce maintenance.

- Partnerships and mergers will strengthen global presence of leading companies.

- Sustainability goals will push manufacturers to develop energy-efficient systems.