Market Overview

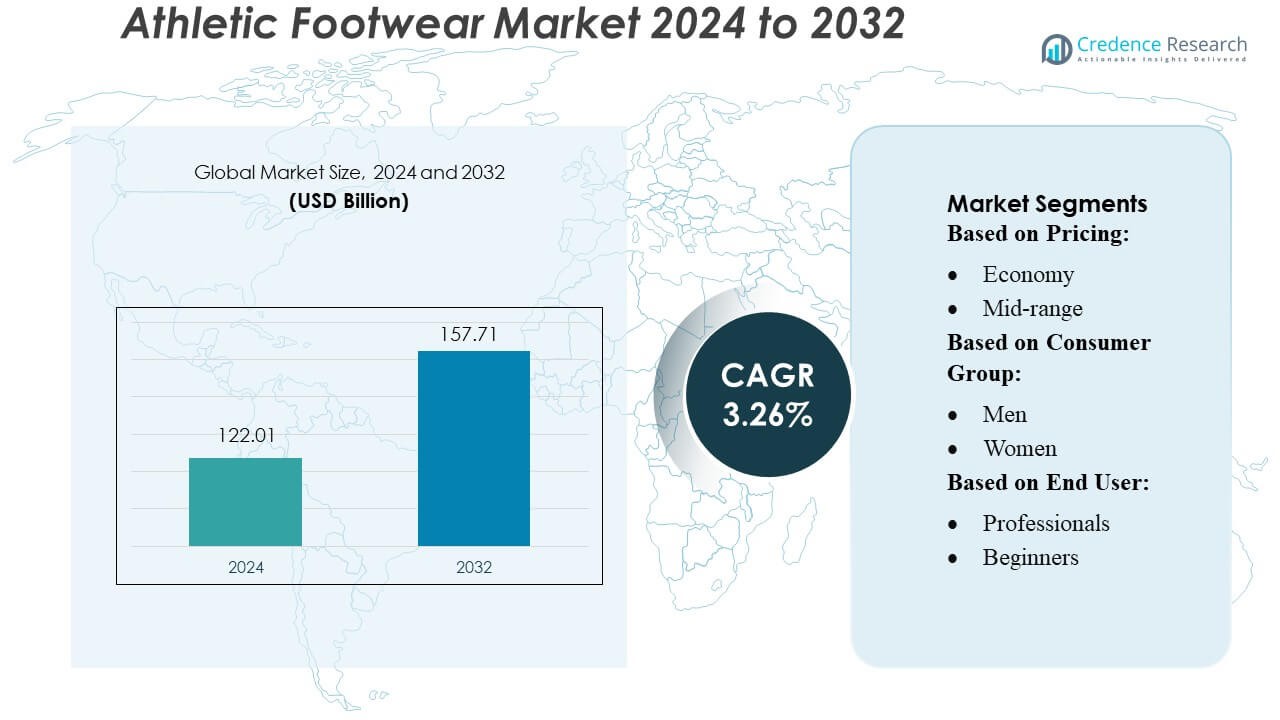

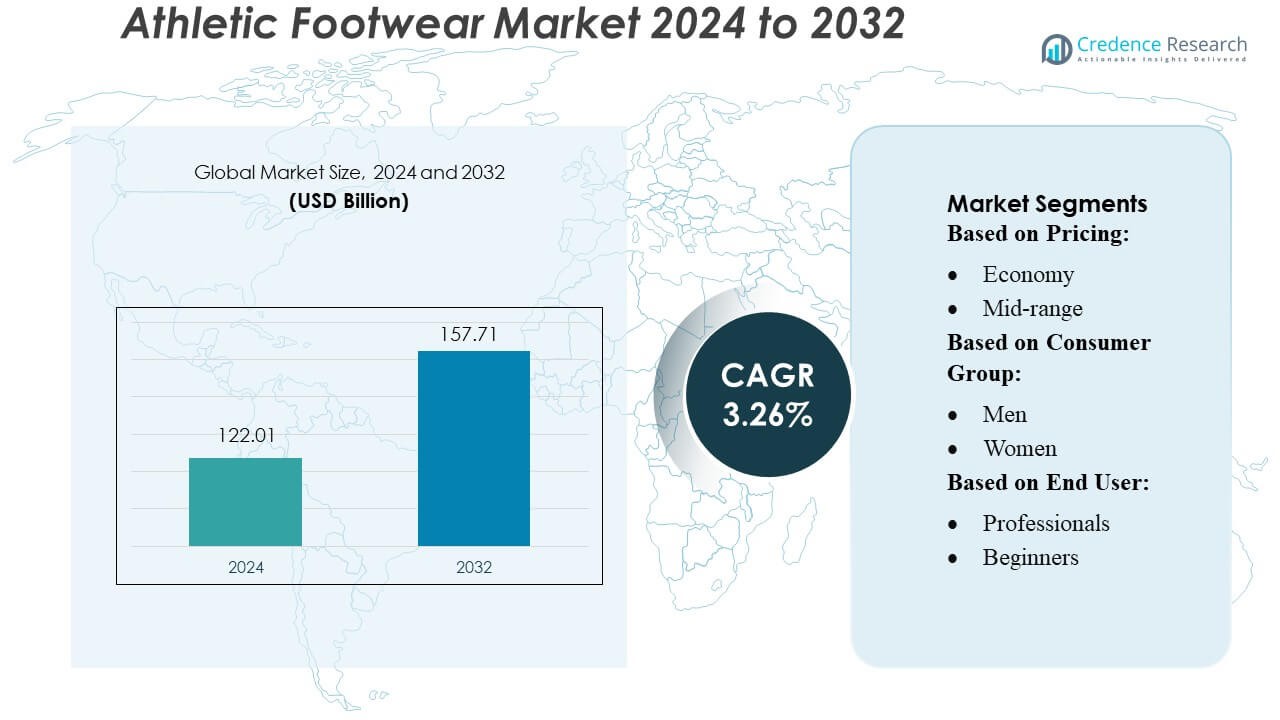

Athletic Footwear Market size was valued USD 122.01 billion in 2024 and is anticipated to reach USD 157.71 billion by 2032, at a CAGR of 3.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Athletic Footwear Market Size 2024 |

USD 122.01 Billion |

| Athletic Footwear Market, CAGR |

3.26% |

| Athletic Footwear Market Size 2032 |

USD 157.71 Billion |

The athletic footwear market is shaped by strong competition among global brands that continually invest in performance innovation, sustainability, and consumer-focused design. Top players maintain significant influence through extensive product portfolios, advanced cushioning technologies, and strong distribution networks across retail and digital channels. Strategic collaborations and athlete endorsements further strengthen brand visibility and consumer loyalty. North America leads the global market with approximately 32% market share, supported by high sports participation, strong adoption of athleisure fashion, and a mature e-commerce ecosystem. Continuous innovation and expanding fitness trends reinforce the region’s dominant position in the global athletic footwear landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Athletic Footwear Market was valued at USD 122.01 billion in 2024 and is projected to reach USD 157.71 billion by 2032, expanding at a CAGR of 3.26%.

- Rising fitness participation, athleisure adoption, and growing demand for performance-enhancing technologies drive market expansion, with premium and mid-range segments jointly accounting for a significant share due to strong consumer preference for comfort and durability.

- Key trends include increased investment in sustainable materials, rapid digital commerce growth, and brand collaborations that boost product visibility; top players leverage advanced cushioning systems, smart footwear features, and influencer partnerships to strengthen competitive positioning.

- Market restraints emerge from fluctuating raw material costs, intense price competition, and counterfeit product circulation, which affect margins and weaken brand equity in price-sensitive regions.

- North America dominates with nearly 32% market share, while men’s footwear remains the leading consumer segment globally; the professional end-user segment shows steady momentum supported by sports culture and performance-driven purchases.

Market Segmentation Analysis:

By Pricing

The pricing structure in the athletic footwear market shows strong demand across tiers, with the mid-range segment dominating at around 45–50% market share due to its balance of affordability, performance, and brand value. Consumers increasingly prefer mid-range shoes featuring enhanced cushioning, durable materials, and versatile designs suitable for sports and casual wear. The economy segment benefits from budget-conscious buyers, particularly in emerging markets, while the premium segment grows steadily, driven by high-income consumers seeking advanced technology, exclusive collaborations, and superior comfort. Innovation and brand positioning continue to strengthen the mid-range segment’s leadership.

- For instance, New Balance integrates its Fresh Foam X midsole—engineered with approximately 3% bio-based EVA—and uses precision laser-cut patterns to deliver consistent cushioning, while some of its performance models, such as the FuelCell SuperComp Trainer v2, include a full-length Energy Arc carbon plate and feature an official 40 mm in stack height (at the heel) to boost propulsion efficiency.

By Consumer Group

Among consumer groups, men account for the largest share, contributing approximately 50–55% of the athletic footwear market, driven by higher participation in fitness activities, running, and competitive sports. Men’s demand is reinforced by strong brand loyalty and frequent product upgrades aligned with performance requirements. The women’s segment is expanding rapidly as health awareness and athleisure adoption increase, while the kids segment grows due to rising school sports participation and the need for supportive footwear. However, the men’s segment maintains dominance due to broader product availability and higher spending on performance-oriented designs.

- For instance, the Reebok FloatZig 2 Running Shoes use SuperFloat+, a nitrogen-injected foam in the midsole, and the refined Zig-Tech geometry delivers a 33 mm heel stack height and 6 mm drop, with an official men’s size 9 weight listed as 10.4 oz on the Reebok website for a springy, high-energy feel.

By End User

In terms of end users, professionals lead the market with an estimated 55–60% share, fueled by specialized footwear requirements for running, training, basketball, football, and other sports. This segment benefits from constant innovations in stability, energy return, and lightweight materials tailored to competitive performance. The beginners segment continues to rise as fitness adoption increases among casual users and first-time runners, strengthened by accessible pricing and comfort-focused designs. Despite this growth, professionals remain dominant due to consistent demand for sport-specific technology, premium construction, and brand-driven performance enhancements.

Key Growth Drivers

- Rising Global Participation in Sports and Fitness

Growing participation in sports, fitness training, and recreational activities significantly accelerates demand for athletic footwear. Consumers increasingly adopt active lifestyles, driven by greater health awareness and the popularity of running, gym workouts, and outdoor sports. Government-led fitness campaigns and expanding school-level sports programs further support market expansion. Additionally, the rise of boutique fitness studios and marathons broadens the consumer base. Brands respond with performance-focused designs, cushioning technologies, and sport-specific categories, enabling accelerated market penetration across both developed and emerging regions.

- For instance, Vans is scaling sustainability: its biobased foams are made with at least 25% plant-derived material, as certified by USDA, to reduce environmental impact while still offering responsive cushioning.

- Rapid Expansion of E-commerce and Direct-to-Consumer Channels

The expansion of e-commerce platforms and brand-owned direct-to-consumer (D2C) channels serves as a strong growth driver for athletic footwear. Online retail enables greater accessibility, product variety, and convenience while offering competitive pricing and customization options. Virtual product trials, AI-driven size recommendations, and targeted marketing enhance customer engagement and conversion rates. D2C strategies allow brands to improve margins and gather valuable consumer insights. As smartphone penetration increases globally, online sales continue to outpace traditional channels, strengthening the market’s long-term growth trajectory.

- For instance, ASICS’ OneASICS platform continues to grow, with membership reaching approximately 17.64 million members as of the end of the 2024 fiscal year, according to the company’s Integrated Report 2024.

- Technological Advancements in Footwear Design and Materials

Innovations in lightweight materials, sustainable fabrics, 3D-printed midsoles, and enhanced cushioning systems drive significant demand for performance-oriented athletic footwear. Brands invest heavily in R&D to improve flexibility, energy return, breathability, and durability, catering to both professional athletes and everyday users. Smart footwear with embedded sensors and biometric tracking capabilities adds value for performance monitoring. Additionally, advancements in eco-friendly materials contribute to sustainability goals, appealing to environmentally conscious consumers. These innovations bolster premiumization trends and differentiate brands in an increasingly competitive market.

Key Trends & Opportunities

1. Growing Demand for Sustainable and Eco-friendly Footwear

Sustainability has emerged as a pivotal trend, creating significant opportunities for brands to introduce eco-friendly product lines. Consumers increasingly prefer footwear made from recycled plastics, natural fibers, and biodegradable materials. Major manufacturers implement circular design principles, carbon-neutral production, and water-saving technologies to reduce environmental impact. Transparency in sourcing and lifecycle assessments strengthens brand credibility. This shift toward green innovation not only meets regulatory expectations but also drives premium pricing and customer loyalty, positioning sustainability as a differentiating factor in market competition.

- For instance, Adidas reported that it used 249,743 tons of recycled material in its products, which accounted for 42.7% of its total material weight, according to its annual sustainability statement.

2. Rising Popularity of Athleisure and Lifestyle-oriented Footwear

The athleisure trend continues to reshape the athletic footwear landscape, as consumers seek versatile shoes that blend performance and style. Demand for lightweight, comfortable, and fashion-forward designs expands beyond sports to daily wear, travel, and workplace environments. Influencer-driven marketing and celebrity collaborations amplify visibility and accelerate trend adoption. This shift enables brands to tap into non-sporting segments and diversify their portfolios. As casualization becomes mainstream globally, the athleisure segment presents strong growth opportunities across age groups and urban markets.

- For instance, Puma is also driving sustainability: it reached its 2024 goal by producing 90% of its products using recycled or certified materials—including 75% recycled polyester in its fabrics.

3. Customization and Personalization Gains Momentum

Advanced manufacturing technologies and digital interfaces enable customizable athletic footwear, enhancing consumer engagement. Brands now offer personalized colorways, fit adjustments, insoles, and traction patterns tailored to individual preferences or performance needs. AI-enabled design tools and 3D foot scanning improve accuracy while reducing return rates. Customization increases perceived product value and strengthens brand affinity, particularly among younger consumers seeking unique experiences. As on-demand production scales, this trend provides a strategic opportunity for differentiation in a competitive landscape.

Key Challenges

1. Intense Competitive Pressure and Price Sensitivity

The athletic footwear market faces intense competition from global leaders, regional brands, and low-cost manufacturers. High R&D investments and marketing expenditures pressure profitability, while price-sensitive consumers often shift toward budget alternatives. Frequent product launches and short fashion cycles make inventory management complex. Additionally, counterfeit products pose a threat to brand equity and revenue. Companies must balance innovation, pricing strategies, and supply chain efficiency to sustain market share in a crowded and rapidly evolving environment.

2. Supply Chain Disruptions and Rising Raw Material Costs

Fluctuations in raw material prices, logistics delays, and geopolitical uncertainties pose significant challenges for manufacturers. Dependence on global supply networks makes the industry vulnerable to disruptions in shipping, labor shortages, and regulatory changes. Rising costs of synthetic fabrics, rubber, and sustainable materials further compress margins. Environmental regulations and sustainability compliance add additional complexities to production planning. Companies must invest in supply chain resilience, nearshoring, and material innovation to mitigate risks and ensure consistent product availability.

Regional Analysis

North America

North America holds around 32% of the athletic footwear market, driven by strong participation in sports, fitness training, and outdoor recreational activities. The region benefits from high consumer spending power, rapid adoption of performance-enhancing technologies, and a mature retail ecosystem supported by strong e-commerce penetration. Leading brands maintain a dominant presence through continuous innovation, collaborations, and athlete endorsements. The U.S. remains the largest contributor due to rising demand for running, basketball, and athleisure footwear. Growing health awareness and an expanding youth sports culture continue to reinforce regional market strength.

Europe

Europe accounts for nearly 25% of the athletic footwear market, supported by established sports infrastructure, strong interest in football, running, and fitness training, and high adoption of premium footwear. Consumers increasingly prioritize sustainability, prompting brands to expand eco-friendly product lines. The region benefits from robust retail networks across Germany, the U.K., France, and Italy, along with a growing preference for athleisure wear in urban centers. Demand for technologically advanced and stylish footwear continues to rise, while international and regional brands compete through localized designs and targeted marketing strategies.

Asia-Pacific

Asia-Pacific captures approximately 30% of the global market and remains the fastest-growing region due to its expanding middle-class population, rising disposable incomes, and increased participation in sports and fitness activities. Countries like China, India, Japan, and South Korea contribute significantly, driven by urbanization, youth engagement in sports, and government initiatives promoting active lifestyles. E-commerce acceleration and affordable product availability further boost adoption. International brands aggressively expand retail footprints, while local brands strengthen price competitiveness. The region’s demographic advantage and sustained interest in athleisure position it as a long-term growth engine.

Latin America

Latin America holds around 8% of the athletic footwear market, influenced by rising interest in football, running, and gym culture across Brazil, Mexico, and Argentina. Increasing urbanization, improving economic stability, and expanding retail channels support market growth. E-commerce adoption continues to accelerate, offering consumers broader product access and competitive pricing. While price sensitivity remains high, demand for durable and stylish footwear is steadily increasing. International brands gain traction through localized marketing, while domestic manufacturers compete in economy and mid-range segments. The region shows strong long-term potential despite periodic economic fluctuations.

Middle East & Africa

The Middle East & Africa region represents nearly 5% of the athletic footwear market, with growth driven by rising fitness participation, expanding sports infrastructure, and increasing youth populations. Countries such as the UAE, Saudi Arabia, and South Africa lead demand due to growing interest in running, football, and lifestyle-oriented footwear. Premiumization trends are strong in urban centers, supported by mall-based retail expansion and global brand presence. Economic diversification initiatives and government-backed sports programs further stimulate market activity. However, uneven income distribution and limited retail penetration in rural areas continue to challenge broader market expansion.

Market Segmentations:

By Pricing:

By Consumer Group:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The athletic footwear market remains highly competitive, with leading brands such as New Balance Athletics, Inc., Lotto Sport Italia S.p.A, Reebok International Ltd., Vans, Inc., ASICS Corporation, Adidas AG, Puma SE, Nike, Inc., Under Armour, Inc., and Fila Inc. The athletic footwear market demonstrates strong competitive intensity driven by continuous innovation, rapid product cycles, and evolving consumer expectations. Brands increasingly focus on advanced performance technologies such as improved cushioning, energy-return midsoles, and breathable materials to differentiate their offerings. The shift toward athleisure further expands competition, as companies blend functionality with lifestyle-oriented designs to capture a broader audience. Sustainability has become a key competitive lever, prompting manufacturers to adopt recycled materials and eco-efficient production methods. Digital transformation also plays a significant role, with e-commerce growth, virtual try-on tools, and personalized recommendations enhancing consumer engagement and loyalty. As market dynamics evolve, companies prioritize agility, design innovation, and omnichannel strategies to sustain market relevance.

Key Player Analysis

Recent Developments

- In March 2024, Timberland Pro broadened its product range to include footwear tailored for the hospitality sector. Through its specialized division for skilled trade professionals, Timberland launched the Burbank Collection, marking the brand’s inaugural line of footwear designed specifically for workers in the restaurant and hotel sectors.

- In February 2024, Crocs Retail, LLC teamed up with Famous Footwear for its newest project. Together, they introduced two exclusive designs in support of the Ticket to Dream Foundation. This non-profit organization is committed to offering assistance and opportunities to children in foster care and their foster families.

- In September 2023, Peloton and leading athletic wear brand Lululemon revealed a strategic five-year partnership, marking a significant development in the fitness industry. This collaboration signaled the end of Lululemon’s venture into connected fitness devices, particularly its recently acquired Mirror platform.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Pricing, Consumer Group, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate as consumers increasingly adopt fitness-focused and active lifestyles worldwide.

- Demand for sustainable and recycled materials will rise as brands prioritize eco-friendly manufacturing.

- Athleisure footwear will continue to expand, driven by preferences for versatile and style-oriented designs.

- Digital sales channels will grow rapidly as e-commerce and direct-to-consumer platforms gain prominence.

- Customization and personalized footwear solutions will become more common with advancements in digital design tools.

- Smart and sensor-enabled footwear will gain traction for performance tracking and injury prevention.

- Emerging markets in Asia-Pacific and Latin America will drive significant long-term volume growth.

- Premium footwear segments will expand as consumers seek advanced comfort and performance features.

- Collaborations with athletes, designers, and influencers will strengthen brand positioning and consumer engagement.

- Companies will increase investment in supply chain resilience to mitigate disruptions and maintain product availability.