Market Overview:

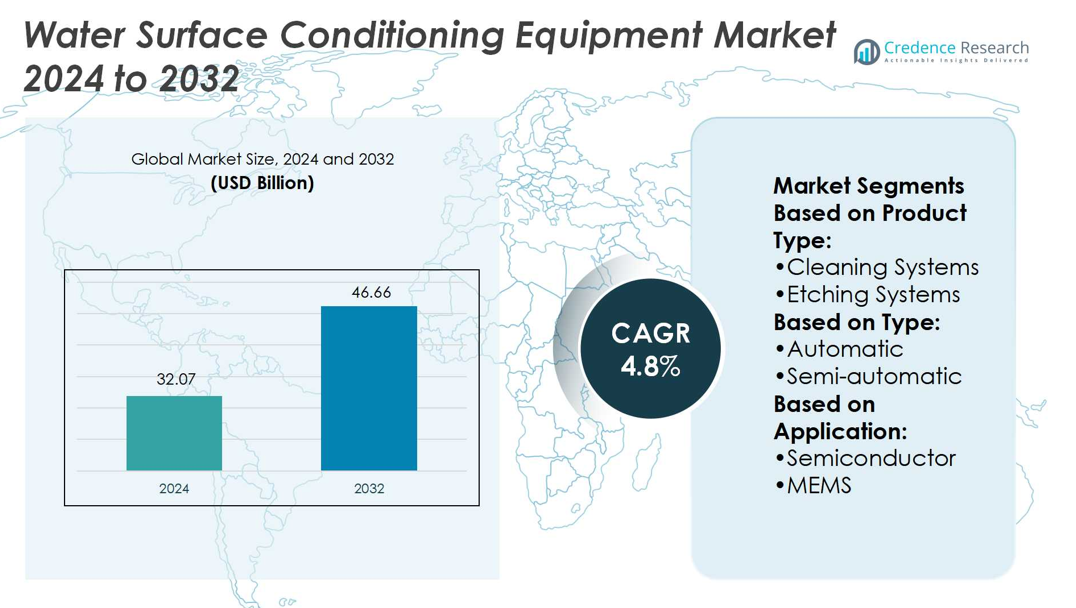

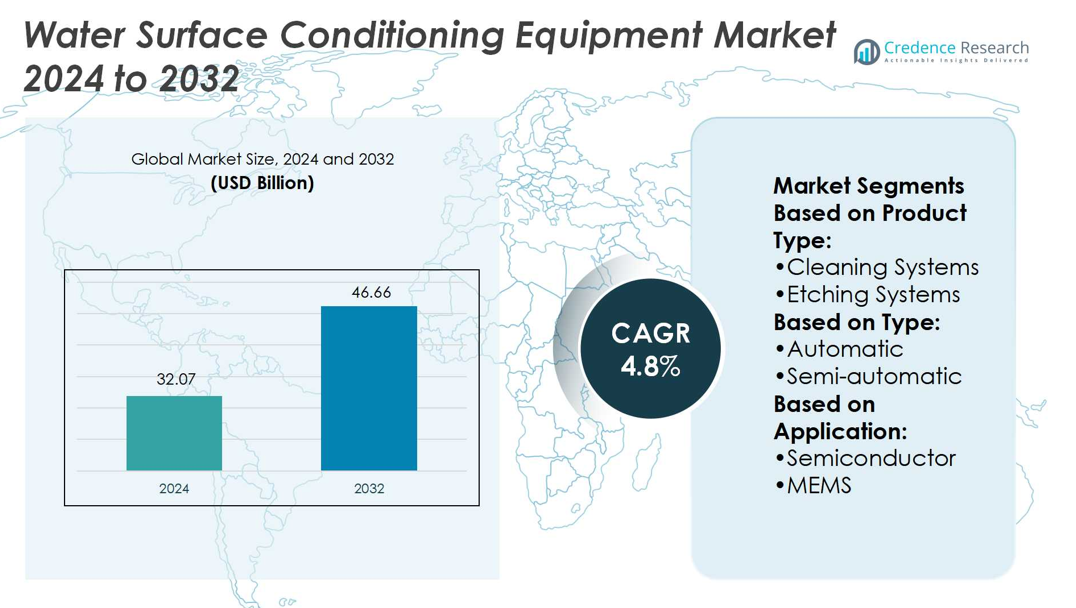

Water Surface Conditioning Equipment Market size was valued USD 32.07 billion in 2024 and is anticipated to reach USD 46.66 billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Surface Conditioning Equipment Market Size 2024 |

USD 32.07 billion |

| Water Surface Conditioning Equipment Market, CAGR |

4.8% |

| Water Surface Conditioning Equipment Market Size 2032 |

USD 46.66 billion |

The water surface conditioning equipment market is shaped by top players such as Johnson Outdoors Inc., Marine Products Corp., BomBoard LLC, Blue Sea Watersports, Imagine Nation Sports LLC, Kent Water Sports LLC, Decathlon SA, Belassi GmbH, Escalade Inc., and KJK Sports. These companies compete through technological innovation, automation integration, and advanced wafer processing solutions that cater to semiconductor, MEMS, and solar industries. North America leads the global market with a 34% share in 2024, supported by strong semiconductor manufacturing and government-backed initiatives. The region’s emphasis on precision, efficiency, and sustainability reinforces its dominance, positioning it as the key growth hub.

Market Insights

- The Water Surface Conditioning Equipment Market size was USD 32.07 billion in 2024 and will reach USD 46.66 billion by 2032, registering a CAGR of 4.8%.

- Rising semiconductor demand and solar energy expansion are driving equipment adoption, supported by automation and Industry 4.0 technologies.

- Companies such as Johnson Outdoors Inc., Marine Products Corp., BomBoard LLC, Blue Sea Watersports, Imagine Nation Sports LLC, Kent Water Sports LLC, Decathlon SA, Belassi GmbH, Escalade Inc., and KJK Sports compete through innovation and global expansion.

- High capital investment and complex integration with existing production lines act as restraints, limiting adoption among small and mid-scale manufacturers.

- North America leads with a 34% market share, followed by Asia-Pacific at 30% and Europe at 24%, while Rest of the World accounts for 12%; semiconductors dominate applications with 58% share, followed by MEMS and solar segments, ensuring diversified growth across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Cleaning systems dominate the water surface conditioning equipment market, holding a 45% share in 2024. Their leadership stems from widespread use in semiconductor manufacturing, where high-precision cleaning prevents contamination and ensures device reliability. Advanced cleaning technologies, such as single-wafer and batch immersion systems, support smaller geometries and higher yields. Growing demand for defect-free wafers in consumer electronics and automotive applications drives adoption. Stripping and etching systems also show notable growth, supported by rising complexity in integrated circuits and MEMS device production, but cleaning remains the most critical sub-segment.

- For instance, BomBoard’s promotional materials specify the engine, pump, and electronics are contained in a single module, with the heaviest of the four modules weighing approximately 90 lbs (41 kg). The assembled craft is 7 feet long, with the power pod representing a significant portion of that length.

By Type

Automatic equipment leads this segment with a 52% share in 2024, supported by the industry’s shift toward automation. Manufacturers prioritize fully automated systems to enhance throughput, reduce labor dependence, and maintain uniform quality. These systems provide precise process control, critical for semiconductor and solar applications requiring consistent wafer surface preparation. Semi-automatic and manual systems remain relevant in research settings and low-volume production but face declining preference due to slower processing speed. The growing focus on Industry 4.0, integration with robotics, and cost-efficiency measures further consolidate the dominance of automatic systems in the market.

- For instance, Honeywell’s HWP2013W table top the purifier’s filter system is capable of reducing 99.97% of bacteria commonly found in water, specifically mentioning E. coli and Pseudomonas aeruginosa.

By Application

The semiconductor industry accounts for the largest share at 58% in 2024, driven by escalating demand for advanced chips in computing, telecommunications, and automotive sectors. Equipment used in wafer cleaning, stripping, and etching supports critical steps in chip fabrication, making this segment indispensable. The growth of 5G, AI, and electric vehicles reinforces semiconductor investments, boosting equipment demand. MEMS applications are expanding in sensors and medical devices, while the solar sector benefits from rising renewable energy adoption. However, semiconductor manufacturing remains the most dominant application, ensuring steady revenue growth for equipment suppliers worldwide.

Market Overview

Rising Semiconductor Demand

The expansion of semiconductor manufacturing acts as the primary growth driver for the water surface conditioning equipment market. Increasing adoption of advanced chips in smartphones, electric vehicles, and 5G networks demands highly precise wafer cleaning and conditioning systems. Equipment manufacturers are focusing on delivering contamination-free surfaces, enabling higher yield and efficiency. With global investments in semiconductor fabs, particularly in Asia-Pacific and North America, the demand for advanced cleaning and etching equipment continues to grow, reinforcing this segment’s critical role in supporting technological innovation.

- For instance, Kent’s “Zero Water Wastage Technology” pushes back rejected water into the overhead tank using an internal pump, achieving a recovery rate of 50 % (i.e. half of intake becomes purified water) rather than traditional rates where much more is rejected.

Automation and Process Efficiency

Automation in wafer processing strengthens market growth by improving throughput and consistency. Automatic water surface conditioning equipment minimizes manual intervention, reduces labor costs, and ensures precise control during wafer cleaning and etching. Semiconductor and solar industries demand higher productivity with minimal defect rates, which automated systems address effectively. Integration of robotics and AI further enhances real-time process monitoring and optimization. As industries adopt smart manufacturing practices, investment in fully automated conditioning equipment grows, fueling demand across large-scale semiconductor and renewable energy production facilities.

- For instance, LG’s model WW155NPB has an 8-litre dual-protection stainless steel tank, an ‘in-tank UV’ cycle that runs every 6 hours to prevent bacterial growth, and comes with a 1-year comprehensive warranty and a 9-year warranty on the steel tank.

Growth in Renewable Energy Sector

The rapid expansion of the solar industry drives demand for surface conditioning equipment. Solar cell production requires uniform wafer preparation to achieve high energy conversion efficiency. Governments worldwide are supporting renewable energy initiatives, creating strong demand for advanced conditioning systems that support mass-scale photovoltaic manufacturing. Equipment providers are developing solutions tailored for solar wafer cleaning and etching, ensuring minimal surface damage and higher performance. As solar power adoption grows globally, this segment provides a significant growth avenue for the water surface conditioning equipment market.

Key Trends & Opportunities

Shift Toward Advanced MEMS Applications

The rise of MEMS devices in consumer electronics, automotive sensors, and medical equipment presents new opportunities for the market. MEMS fabrication requires specialized wafer surface conditioning to achieve high sensitivity and reliability. Growing demand for smart wearables, autonomous vehicles, and implantable devices fuels MEMS growth. Equipment suppliers offering tailored solutions for MEMS applications are well-positioned to capitalize on this expanding segment. This trend diversifies revenue sources beyond semiconductors and enhances the market’s long-term stability.

- For instance, Ashland has commercialized the easy-wet™ 300 n super wetting agent platform. This product is biodegradable per OECD Test No. 302B; field trials over a full year demonstrated substantial reduction in spray drift and superior wettability at lower concentrations when compared to benchmark non‐ionic surfactants.

Integration of Industry 4.0 Technologies

Adoption of Industry 4.0 practices is reshaping the market by enabling smarter, data-driven equipment solutions. Manufacturers are integrating IoT sensors, AI-driven analytics, and cloud platforms into water surface conditioning systems. These innovations support predictive maintenance, real-time monitoring, and process optimization, reducing downtime and improving wafer yield. The shift toward digitalized manufacturing environments offers significant opportunities for companies developing intelligent conditioning systems. This trend positions advanced solutions as essential tools for future semiconductor, MEMS, and solar production facilities.

- For instance, DuPont’s ultrafiltration membrane product line, PES In-Out (Multibore™), features inner pores of approximately 20 nanometers, enabling virus rejection above 4 log units without pre-coagulation.

Key Challenges

High Capital Investment Requirements

The market faces challenges due to high upfront costs associated with advanced equipment. Fully automated conditioning systems require significant capital expenditure, limiting adoption among smaller semiconductor and solar manufacturers. Long payback periods and frequent upgrades further strain budgets, especially in developing markets. This cost barrier restricts entry for new players and slows widespread adoption, creating challenges for growth despite rising demand. Vendors need to develop cost-efficient solutions to address the affordability concerns of medium and small-scale manufacturers.

Complexity in Process Integration

Integrating advanced water surface conditioning equipment into existing production lines presents technical challenges. Semiconductor and MEMS fabrication involve highly sensitive processes, where improper integration may cause contamination, yield loss, or downtime. Manufacturers must ensure seamless compatibility with other wafer processing systems, requiring specialized expertise and customization. This complexity often increases installation timelines and operational risks, discouraging smaller players from adopting advanced solutions. Overcoming these integration challenges is crucial for market players to expand adoption and build stronger trust with end users.

Regional Analysis

North America

North America leads the water surface conditioning equipment market with a 34% share in 2024. The region benefits from strong semiconductor manufacturing in the U.S., supported by government funding under initiatives like the CHIPS Act. Major technology players invest heavily in advanced wafer processing equipment to meet rising demand in 5G, automotive electronics, and AI applications. Additionally, solar energy expansion in the U.S. drives adoption of wafer conditioning systems. The presence of leading equipment manufacturers, combined with a focus on automation and Industry 4.0 integration, further consolidates North America’s dominant position in the global market.

Europe

Europe accounts for 24% of the global water surface conditioning equipment market in 2024. The region’s growth is driven by strong investments in microelectronics, automotive semiconductor technologies, and renewable energy. Germany and France lead semiconductor adoption, supported by robust industrial policies promoting digitalization and sustainable manufacturing. European solar initiatives, aligned with the EU’s Green Deal, further accelerate demand for wafer cleaning and conditioning equipment. The presence of major automotive manufacturers also boosts MEMS sensor production. With rising demand for eco-efficient technologies and sustainable practices, Europe continues to strengthen its position in the global market landscape.

Asia-Pacific

Asia-Pacific holds a 30% market share in 2024, making it a critical growth hub for the water surface conditioning equipment market. The region is home to leading semiconductor manufacturers in China, Japan, South Korea, and Taiwan. Rapid expansion of chip fabrication facilities, driven by electronics and automotive demand, accelerates equipment adoption. Strong investments in solar energy projects also boost demand for wafer conditioning systems. Government support, low-cost manufacturing, and large-scale production capacity reinforce Asia-Pacific’s competitive edge. As regional players invest in automation and advanced wafer technologies, Asia-Pacific is expected to expand its market share further during the forecast period.

Latin America

Latin America holds 7% of the global water surface conditioning equipment market in 2024. Growth is supported by increasing solar energy adoption in Brazil, Chile, and Mexico, where large-scale photovoltaic projects require advanced wafer conditioning equipment. The region’s semiconductor presence is still small, but demand is rising in automotive electronics and consumer devices. Governments encourage renewable energy development, creating opportunities for equipment suppliers targeting solar applications. Despite challenges such as high import costs and limited local manufacturing, Latin America shows steady potential, with Brazil leading investments that drive future adoption across energy and electronics sectors.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the market share in 2024. Strong investments in solar energy, particularly in the UAE, Saudi Arabia, and South Africa, drive equipment demand. These nations prioritize renewable power generation, pushing adoption of wafer conditioning systems in photovoltaic production. While semiconductor manufacturing remains limited, regional demand for MEMS-based sensors in industrial automation and defense is growing. Challenges include high capital costs and reliance on imported equipment. However, government-backed initiatives for energy diversification and industrial modernization are expected to create long-term opportunities for market growth in the region.

Market Segmentations:

By Product Type:

- Cleaning Systems

- Etching Systems

By Type:

By Application:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the water surface conditioning equipment market features leading players such as Johnson Outdoors Inc., Marine Products Corp., BomBoard LLC, Blue Sea Watersports, Imagine Nation Sports LLC, Kent Water Sports LLC, Decathlon SA, Belassi GmbH, Escalade Inc., and KJK Sports. The water surface conditioning equipment market is defined by continuous innovation, technological advancements, and strategic expansions. Companies in the sector are focusing on developing advanced cleaning, etching, and stripping systems that ensure high precision and reliability for semiconductor, MEMS, and solar applications. Automation and integration of Industry 4.0 technologies such as IoT and AI are becoming critical differentiators, enabling predictive maintenance and improved process efficiency. Market participants are also prioritizing eco-friendly and energy-efficient solutions to align with global sustainability goals. Expansion into high-growth regions like Asia-Pacific and North America, supported by increasing semiconductor production and renewable energy investments, remains a central strategy. By emphasizing R&D investments, customization capabilities, and strong service offerings, industry players are enhancing competitiveness while meeting the evolving needs of end users in advanced manufacturing environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Tokyo Electron Miyagi completed its new development building to support growing semiconductor demand. As digital transformation accelerates, advanced patterning technologies for complex, smaller chips are vital.

- In March 2025, S-based Yield Engineering Systems (YES), a leading manufacturer of process equipment for artificial intelligence (AI) and high-performance computing (HPC) semiconductor solutions, has announced the shipment of the first commercial VeroTherm Formic Acid Reflow tool to a leading global semiconductor manufacturer from its manufacturing facility.

- In October 2024, ULVAC, Inc., the world’s leading comprehensive vacuum manufacturer, launches technology center PYEONGTAEK for next-gen semiconductor manufacturing equipment in South Korea.

- In August 2024, SNF announced that it has signed agreements to acquire Ace Fluid Solutions and PfP Industries. The company aims to offer advanced solutions to its upstream oil and gas customers. PfP Industries specializes in slurry friction reducer technologies and related applications, while Ace Fluid Solutions develops innovative products in fluid management.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising semiconductor fabrication across Asia-Pacific and North America.

- Automation will dominate equipment demand as manufacturers seek higher productivity and yield.

- Integration of AI and IoT will enhance predictive maintenance and process optimization.

- MEMS applications will create new opportunities in automotive, healthcare, and consumer electronics.

- Solar wafer processing will drive steady growth with global renewable energy adoption.

- Companies will focus on eco-friendly equipment designs to meet sustainability requirements.

- Regional governments will support market expansion through funding and policy initiatives.

- High precision equipment will remain critical as chip designs move toward smaller geometries.

- Strategic partnerships and mergers will strengthen technological capabilities and market reach.

- Customizable and flexible systems will gain traction to serve diverse industrial applications.