Market Overview

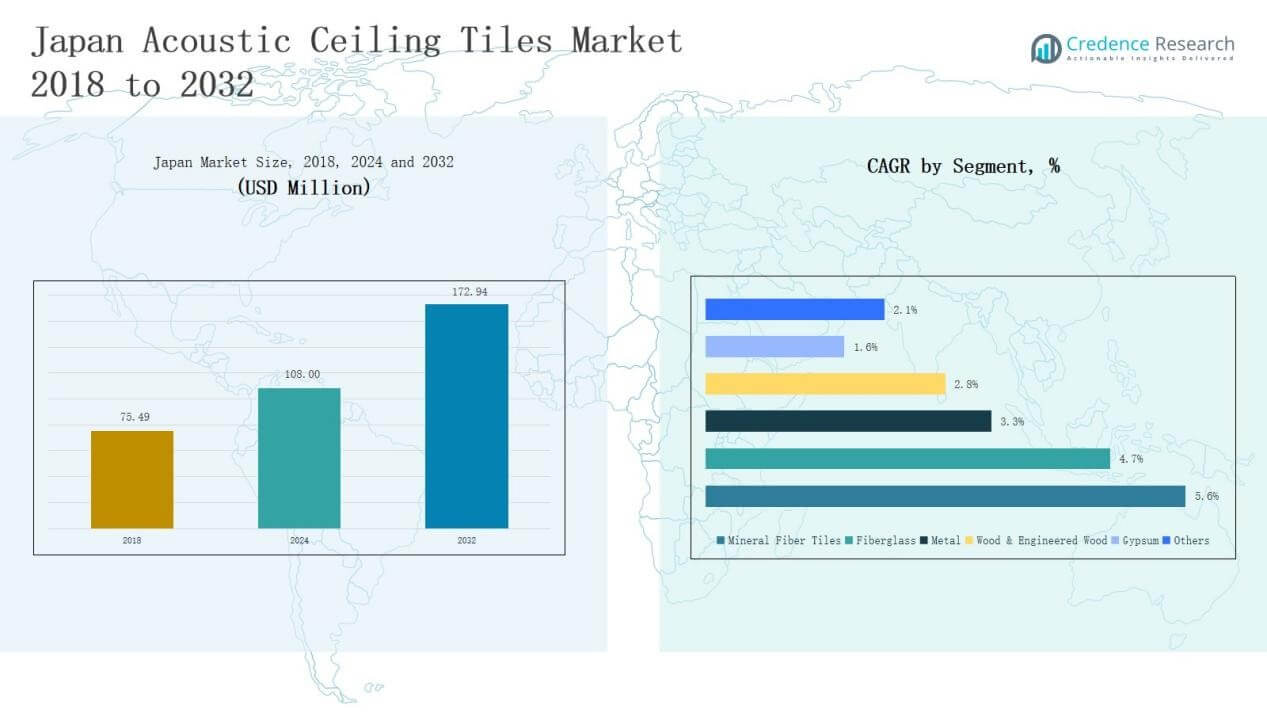

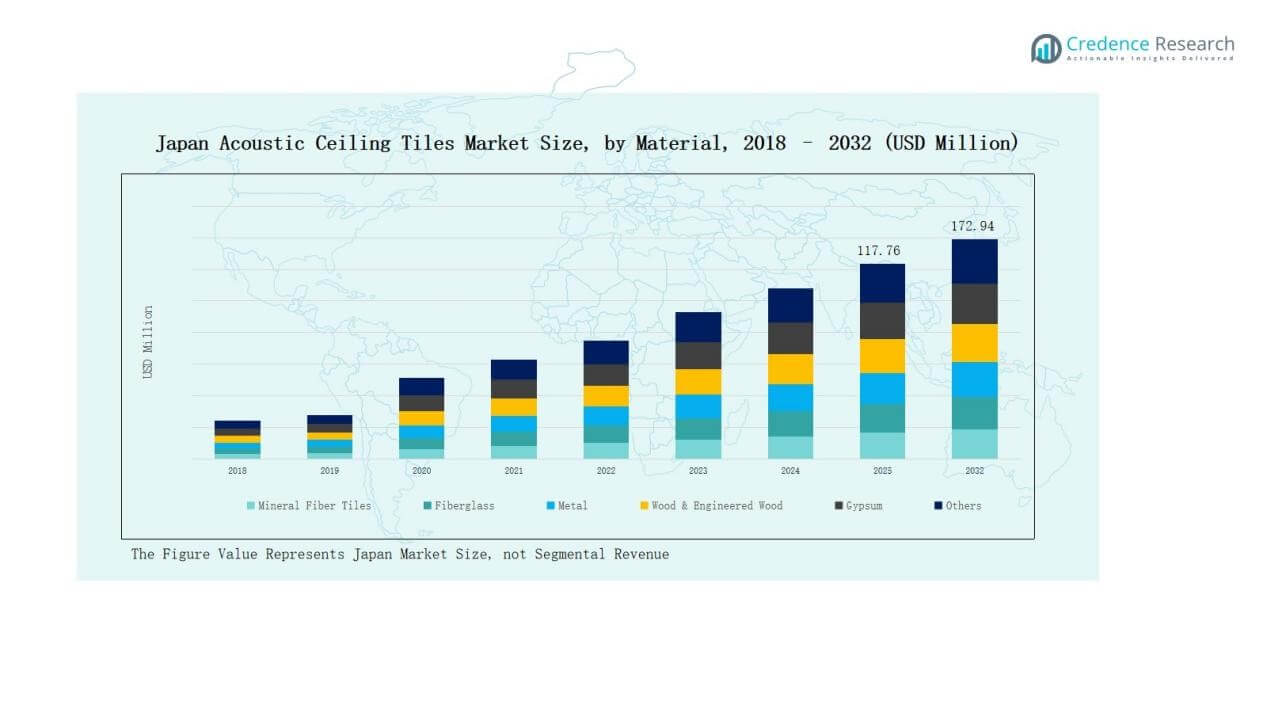

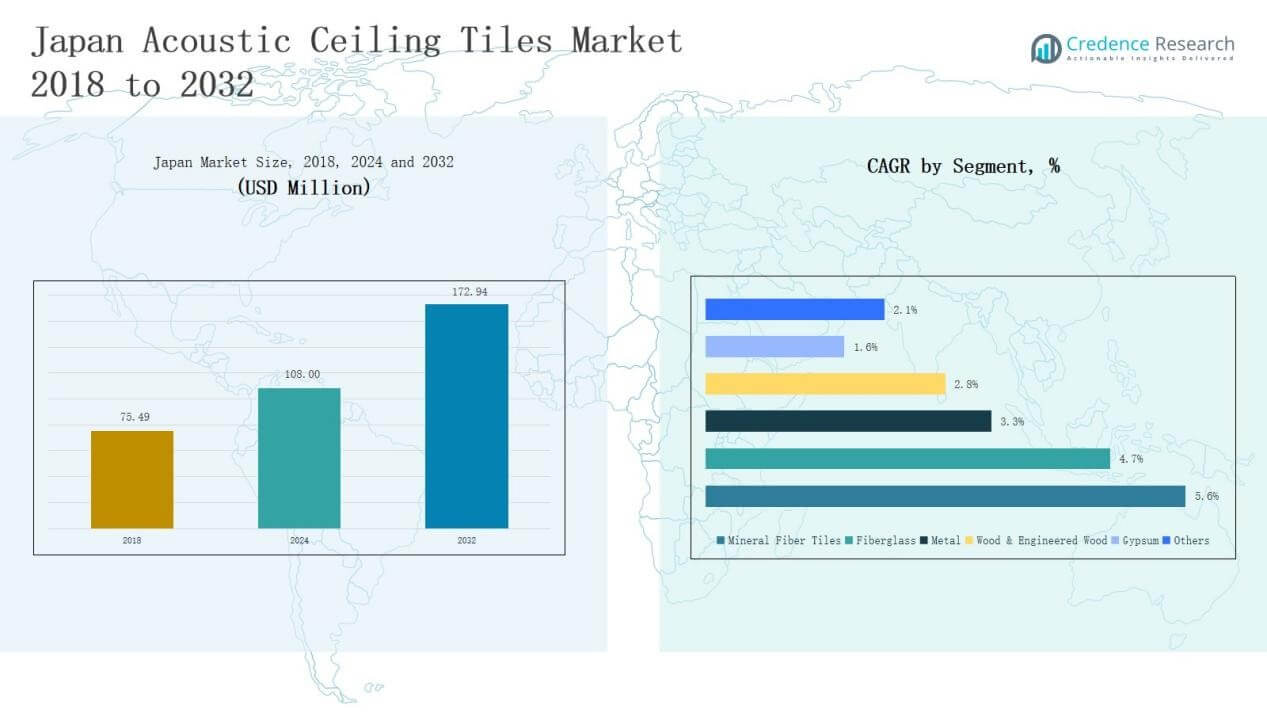

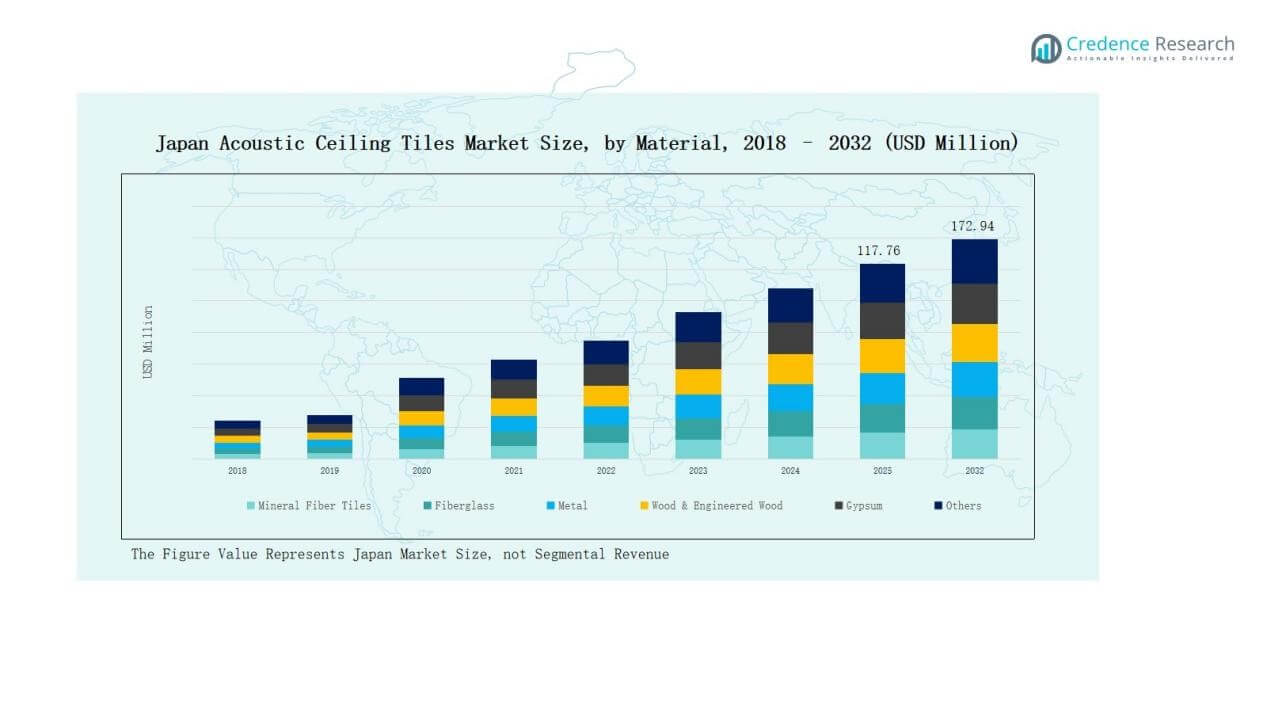

Japan Acoustic Ceiling Tiles Market size was valued at USD 75.49 million in 2018, reached USD 108.00 million in 2024, and is anticipated to reach USD 172.94 million by 2032, growing at a CAGR of 5.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Acoustic Ceiling Tiles Market Size 2024 |

USD 108.00 Million |

| Japan Acoustic Ceiling Tiles Market, CAGR |

5.64% |

| Japan Acoustic Ceiling Tiles Market Size 2032 |

USD 172.94 Million |

The Japan Acoustic Ceiling Tiles Market is shaped by a combination of domestic and international players focusing on product performance, sustainability, and design innovation. Leading companies such as Nichiha Corporation, Equal Japan Inc., Hokuetsu Corporation, Luxalon Japan, Ube Industries Ltd., Aica Kogyo Co., Ltd., KMEW Co., Ltd., KVK Corporation, Saint-Gobain Japan, and Knauf Japan maintain strong market positions through advanced acoustic technologies, energy-efficient solutions, and diverse portfolios. Competition centers on mineral fiber and fiberglass tiles due to their widespread adoption in commercial and institutional projects. Among regions, Kanto leads with a 37% market share in 2024, supported by Tokyo’s extensive commercial infrastructure, government-backed smart city projects, and strong demand for energy-efficient building materials. This dominance highlights Kanto as the key growth hub, while other regions steadily expand through renovation and infrastructure modernization.

Market Insights

Market Insights

- Japan Acoustic Ceiling Tiles Market grew from USD 75.49 million in 2018 to USD 108.00 million in 2024 and is projected to reach USD 172.94 million by 2032.

- Mineral fiber tiles led with 41% share in 2024, supported by strong acoustic performance, fire resistance, and cost-effectiveness, followed by fiberglass at 23% and metal at 15%.

- Suspended ceiling tiles dominated with 68% share in 2024, favored for flexibility, duct coverage, and sound absorption across offices, schools, and healthcare facilities.

- Building contractors held the largest end-user share at 44% in 2024, while architects and interior designers followed with 28%, supported by design-driven acoustic solutions.

- Kanto led regional demand with 37% share in 2024, driven by Tokyo’s commercial infrastructure, smart city initiatives, and adoption of energy-efficient ceiling systems across urban projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Material

Mineral fiber tiles dominate the Japan Acoustic Ceiling Tiles Market with a 41% share in 2024. Their leadership stems from strong acoustic performance, fire resistance, and cost-effectiveness in commercial and institutional projects. Fiberglass follows with 23%, supported by lightweight properties and ease of installation in modern office spaces. Metal tiles hold 15%, driven by durability and design flexibility, while wood and engineered wood account for 9%, appealing to premium interiors. Gypsum captures 7% due to affordability in residential renovations, and other materials comprise 5%, including sustainable composites gaining attention.

For instance, Armstrong World Industries expanded its mineral fiber ceiling tile portfolio in Japan with products engineered for enhanced sound absorption in healthcare and office environments

By Installation Type

Suspended ceiling tiles lead the market with a 68% share in 2024, favored for their flexibility in covering ducts, wiring, and HVAC systems in commercial spaces. Their ease of maintenance and superior sound absorption drive widespread adoption across corporate offices, schools, and hospitals. Surface-mounted ceiling tiles hold the remaining 32% share, driven by demand in residential projects and retrofits where suspended systems are not feasible. The growth of compact urban homes and aesthetic upgrades supports this sub-segment.

For instance, Knauf Ceiling Solutions launched HERADESIGN acoustic tiles, which gained adoption in educational buildings for combining sound control with sustainability.

By End User

Building contractors account for the largest share at 44% in 2024, supported by their role in large-scale commercial and infrastructure developments. Architects and interior designers represent 28%, as design-driven demand for acoustic solutions increases in premium projects. Facility managers capture 18%, focusing on renovation, compliance with building codes, and acoustic upgrades in offices and public buildings. Others, including DIY users and small-scale builders, hold the remaining 10%, reflecting niche but growing adoption in residential upgrades.

Key Growth Drivers

Rising Demand for Energy-Efficient Building Materials

Japan Acoustic Ceiling Tiles Market benefits from rising demand for sustainable and energy-efficient construction solutions. Mineral fiber and fiberglass tiles enhance thermal insulation, reduce energy costs, and align with Japan’s strict building codes for green infrastructure. Commercial projects, schools, and healthcare facilities increasingly specify ceiling tiles to improve energy performance. Government-backed programs promoting sustainable architecture further accelerate adoption, positioning acoustic ceiling tiles as a preferred choice in both new construction and renovation projects across urban centers.

For instance, Armstrong World Industries introduced its Ultima Mineral Fiber Tiles in Japan, designed with high sound absorption and low VOC emissions to meet sustainability standards in public buildings.

Expanding Commercial and Institutional Construction

Strong growth in commercial and institutional construction drives the market forward. Office buildings, hospitals, universities, and public facilities continue to integrate acoustic ceiling tiles to meet noise reduction and fire safety requirements. Developers prioritize ceiling systems that combine cost-efficiency with superior performance. Rapid urbanization and ongoing investments in smart city projects also create demand. With urban spaces requiring effective sound management, acoustic ceiling tiles gain widespread adoption across high-density construction zones in Japan.

For instance, Rockfon, a subsidiary of ROCKWOOL, supplied stone wool acoustic ceiling panels for the Tokyo Midtown Hibiya redevelopment project, ensuring fire resistance and optimal sound insulation in high-traffic commercial spaces.

Technological Advancements in Acoustic Solutions

Continuous product innovation strengthens the Japan Acoustic Ceiling Tiles Market. Manufacturers introduce advanced acoustic solutions with enhanced sound absorption, lightweight design, and improved durability. Metal and engineered wood tiles with modern finishes cater to both performance and aesthetic requirements. Smart ceiling systems integrated with HVAC and lighting controls are emerging, appealing to architects and contractors. These innovations expand applications beyond commercial projects, encouraging adoption in high-end residential developments and modern retail spaces where design and performance converge.

Key Trends & Opportunities

Key Trends & Opportunities

Growing Adoption of Sustainable and Recyclable Materials

Sustainability is shaping product choices, with manufacturers introducing recyclable materials and eco-friendly coatings. Mineral fiber and gypsum tiles increasingly use recycled content, supporting Japan’s circular economy goals. Demand for low-VOC products also rises, particularly in schools and healthcare facilities. Companies focusing on green certifications and compliance gain a competitive edge, as end users prioritize sustainable acoustic solutions. This trend creates opportunities for regional and global players to strengthen their presence with environmentally responsible product lines.

For instance, Saint-Gobain expanded its Ecophon range with low-VOC acoustic ceiling panels designed for healthcare and education spaces.

Rising Demand in Renovation and Retrofit Projects

Renovation and retrofit projects present a strong growth opportunity in the Japan Acoustic Ceiling Tiles Market. Aging office complexes, educational institutions, and healthcare facilities require upgrades to meet modern acoustic, fire safety, and energy efficiency standards. Surface-mounted tiles are increasingly favored in retrofits due to easy installation without major structural changes. Government initiatives promoting energy efficiency in older buildings further encourage adoption. As Japan’s urban infrastructure ages, demand for acoustic ceiling tiles in renovation projects continues to expand steadily.

For instance, Takenaka Corporation renovated its Higashi Kanto Branch Office into a net-zero energy building, resulting in a net-positive annual energy balance.

Key Challenges

High Installation and Maintenance Costs

Despite functional benefits, high installation and maintenance costs limit adoption in smaller projects. Suspended ceiling systems require professional labor and structural support, raising upfront expenses. Facility managers in budget-constrained sectors often hesitate to replace or upgrade ceiling systems, especially in older buildings. Frequent maintenance and replacement of tiles in high-use areas add long-term costs. This cost sensitivity slows penetration in the residential and small commercial segments, where low-cost alternatives often gain preference over acoustic ceiling tiles.

Intense Market Competition from Alternatives

Acoustic ceiling tiles face competition from alternative noise control solutions such as wall panels, acoustic baffles, and spray-on insulation. These substitutes are sometimes more cost-effective and flexible in design, attracting small contractors and DIY projects. Metal and wood ceiling options also compete with advanced wall-based acoustic treatments. This competitive landscape pressures tile manufacturers to differentiate through innovation, aesthetics, or pricing. Without strong product differentiation, acoustic ceiling tiles risk losing share to alternative soundproofing methods in both new and retrofit applications.

Fluctuating Raw Material Prices

Volatility in raw material prices poses a significant challenge for manufacturers. Costs of mineral fibers, metals, and engineered wood fluctuate with global supply chain dynamics and energy prices. Rising raw material expenses directly impact production costs and margins, forcing companies to adjust pricing strategies. Frequent fluctuations also complicate long-term procurement planning for contractors and distributors. These uncertainties affect profitability across the value chain, creating risk for both domestic and international players operating in the Japan Acoustic Ceiling Tiles Market.

Regional Analysis

Kanto

Kanto dominates the Japan Acoustic Ceiling Tiles Market with a 37% share in 2024. The region’s strength comes from Tokyo’s dense commercial infrastructure and continuous investments in corporate offices, hospitals, and educational institutions. Architects and contractors favor mineral fiber and fiberglass tiles due to their cost efficiency and high acoustic performance. Government-driven smart city projects in Tokyo and Yokohama further support adoption of energy-efficient ceiling systems. The growing trend of green buildings in urban centers enhances demand. It remains the central hub for innovation and distribution across Japan.

Kansai

Kansai holds a 24% market share supported by large-scale construction activities in Osaka, Kyoto, and Kobe. The region’s strong manufacturing and retail presence drives demand for suspended ceiling tiles in industrial and commercial facilities. Universities and cultural institutions also adopt high-performance acoustic materials to improve learning and visitor experiences. Rising renovation projects in historical districts push demand for surface-mounted ceiling solutions. It benefits from steady investments in both new construction and retrofits. The region’s diverse building mix supports long-term growth of acoustic ceiling tile usage.

Chubu

Chubu accounts for a 17% share with Nagoya acting as a central growth driver. The automotive and industrial base in the region promotes demand for durable ceiling materials such as metal and engineered wood tiles. Growing urban development projects encourage the use of modern acoustic solutions in office spaces and commercial centers. Facility managers increasingly specify mineral fiber tiles to achieve compliance with noise and fire safety standards. The region also benefits from government infrastructure spending. It shows steady adoption across both industrial and commercial applications.

Kyushu

Kyushu represents a 12% share with growth supported by healthcare and educational infrastructure. Regional cities such as Fukuoka continue to expand public and private construction projects, fueling demand for suspended ceiling systems. Surface-mounted tiles gain popularity in residential upgrades across suburban areas. Facility managers in the region prioritize low-maintenance ceiling solutions, supporting demand for fiberglass and gypsum. The region attracts attention from domestic players focused on cost-effective solutions. It is emerging as a promising growth area for both commercial and residential applications.

Tohoku and Others

Tohoku and other smaller regions collectively hold a 10% share of the market. Post-earthquake reconstruction and infrastructure modernization projects stimulate demand for acoustic ceiling tiles in public buildings. Architects and contractors prefer mineral fiber and gypsum tiles due to affordability and compliance with seismic safety standards. The residential sector gradually adopts acoustic ceiling systems in urbanizing pockets. It remains a developing market segment where government-backed construction initiatives create new opportunities. Regional demand is expected to rise steadily with infrastructure-focused growth.

Market Segmentations:

Market Segmentations:

By Material

- Mineral Fiber Tiles

- Fiberglass

- Metal

- Wood & Engineered Wood

- Gypsum

- Others

By Installation Type

- Suspended Ceiling Tiles

- Surface Mounted Ceiling Tiles

By End User

- Architects and Interior Designers

- Building Contractors

- Facility Managers

- Others

By Region

- Kanto

- Kansai

- Chubu

- Kyushu

- Thoku

Competitive Landscape

The Japan Acoustic Ceiling Tiles Market features a mix of domestic manufacturers and international players competing across innovation, distribution, and product performance. Leading companies such as Nichiha Corporation, Equal Japan Inc., Hokuetsu Corporation, and Luxalon Japan maintain strong regional networks, focusing on cost-effective mineral fiber and fiberglass solutions. Global brands including Saint-Gobain Japan and Knauf Japan strengthen competition by offering advanced acoustic technologies, sustainable materials, and premium design options that appeal to high-end commercial and institutional projects. Companies emphasize energy efficiency, recyclable content, and compliance with stringent building codes to capture demand in green construction. Strategic collaborations with architects, contractors, and facility managers enhance brand positioning and support long-term contracts in commercial infrastructure. Continuous product differentiation, expanding distribution channels, and after-sales services remain critical to maintaining market presence. Intense rivalry encourages steady innovation and ensures a dynamic competitive environment where both local and global firms strive to expand market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In May 2025, Impact Acoustic entered a partnership with NCS+ to enhance integration of colors, designs, and acoustic materials.

- In February 2025, Laminam acquired a majority stake in LAMINAM Japan, strengthening its footprint in the Japanese architectural and design surfaces market.

- In 2025, BAUX launched Acoustic X-FELT, a sustainable collection inspired by Japanese Zen garden aesthetics.

Report Coverage

The research report offers an in-depth analysis based on Material, Installation Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow in commercial and institutional projects driven by stricter building codes.

- Green construction initiatives will increase adoption of recyclable and low-VOC ceiling tiles.

- Mineral fiber tiles will retain dominance, while fiberglass and metal gain traction in urban spaces.

- Renovation and retrofit projects will support strong demand in aging office and healthcare facilities.

- Surface-mounted tiles will expand in compact residential buildings and smaller commercial projects.

- Architects and designers will influence growth by favoring aesthetic and functional ceiling solutions.

- Facility managers will drive adoption of easy-maintenance tiles in public and corporate buildings.

- Technological advances will integrate ceiling systems with smart lighting and HVAC solutions.

- Regional manufacturers will strengthen positions through cost-competitive offerings and local supply chains.

- Global players will expand presence by introducing innovative, premium, and sustainable ceiling products.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: