Market Overview:

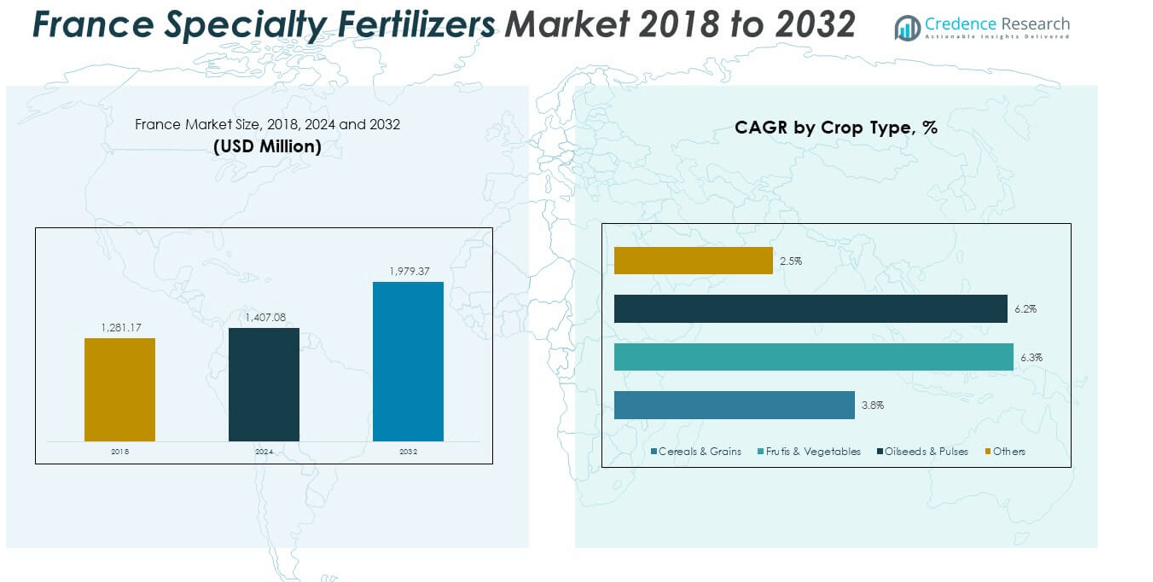

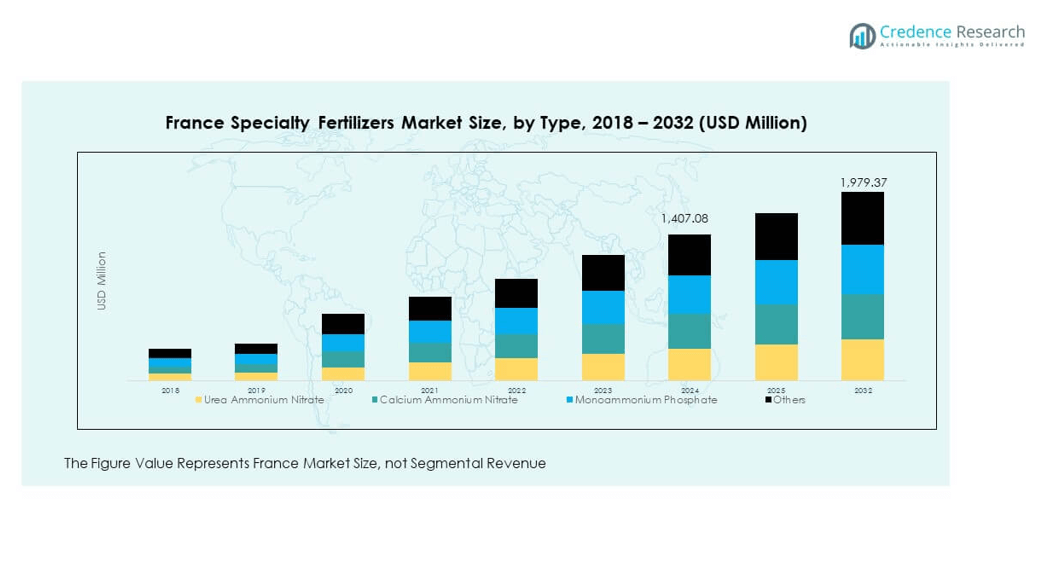

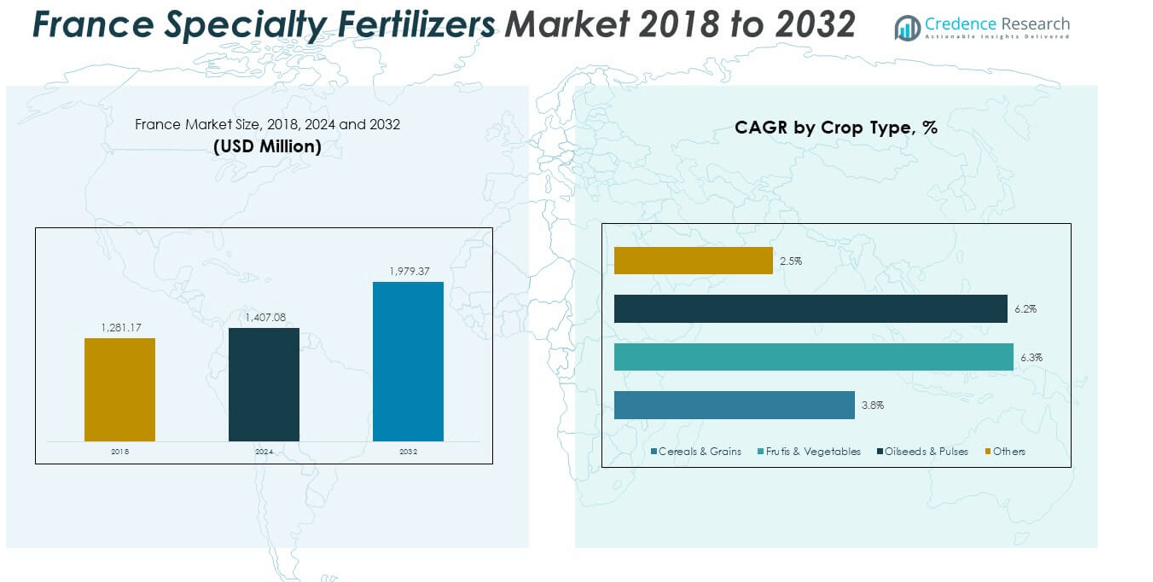

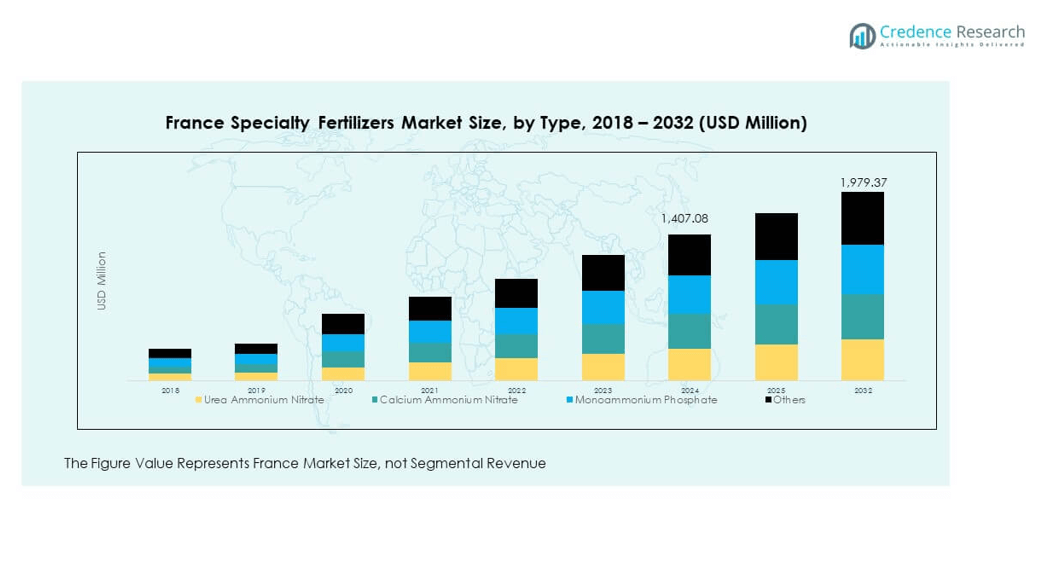

The France Specialty Fertilizers Market size was valued at USD 1,281.17 million in 2018 to USD 1,407.08 million in 2024 and is anticipated to reach USD 1,979.37 million by 2032, at a CAGR of 4.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Specialty Fertilizers Market Size 2024 |

USD 1,407.08 million |

| France Specialty Fertilizers Market, CAGR |

4.36% |

| France Specialty Fertilizers Market Size 2032 |

USD 1,979.37 million |

Growth in the France Specialty Fertilizers Market is driven by the adoption of sustainable agriculture practices, precision farming, and modern irrigation systems. Farmers prioritize controlled-release and water-soluble fertilizers to improve efficiency and reduce nutrient losses. Rising awareness about soil health and micronutrient deficiencies increases demand for tailored fertilizer blends. Government initiatives promoting eco-friendly inputs encourage farmers to shift toward advanced formulations. Expanding greenhouse farming and high-value crop production further reinforce demand. It highlights the sector’s alignment with both productivity and environmental sustainability.

Regionally, Western France leads the market due to extensive cereal, vegetable, and vineyard cultivation supported by modern irrigation. Northern France emerges with growing adoption of precision agriculture and greenhouse farming techniques. Southern France shows strong demand for potassium-rich and soluble fertilizers in vineyards and fruit production. Central France, though smaller in share, contributes through diversified horticulture and specialty crops. The France Specialty Fertilizers Market benefits from this regional diversity, ensuring demand across varying crop patterns and climatic conditions. It underscores the importance of tailored fertilizer solutions across subregions.

Market Insights

- The France Specialty Fertilizers Market was valued at USD 1,281.17 million in 2018, reached USD 1,407.08 million in 2024, and is projected to attain USD 1,979.37 million by 2032, growing at a CAGR of 4.36%.

- Western France leads with 38% share due to strong cereal, vegetable, and vineyard production supported by advanced irrigation and greenhouse infrastructure.

- Northern France holds 32% share, driven by large-scale cereal farming and expanding horticulture supported by precision agriculture and cooperative networks.

- Southern and Central France together account for 30% share, dominated by vineyards, orchards, and fruit production that demand potassium-rich and soluble fertilizers.

- From the type segmentation, blends of NPK account for 29% share, while water-soluble fertilizers hold 26% share, highlighting farmers’ preference for balanced nutrient mixes and compatibility with fertigation systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Sustainable Agricultural Inputs and Nutrient Efficiency

The France Specialty Fertilizers Market benefits from increasing focus on sustainable farming practices supported by European policies. Farmers seek nutrient efficiency solutions that reduce wastage and maintain soil health for long-term productivity. Controlled-release and water-soluble fertilizers provide higher nutrient uptake and minimize leaching into groundwater. Awareness among growers about soil degradation drives interest in targeted nutrition products. Adoption is supported by government subsidies promoting eco-friendly inputs. This focus directly supports productivity goals while addressing environmental concerns. It strengthens the role of specialty fertilizers in intensive farming systems. Rising adoption of precision farming tools complements this growth trajectory.

Expansion of Greenhouse and Horticultural Cultivation Across Diverse Crops

Greenhouse cultivation and horticultural farming are expanding steadily across France due to rising demand for fruits, vegetables, and flowers. Specialty fertilizers designed for drip irrigation and fertigation systems are gaining wider acceptance in controlled environments. These products deliver precise nutrient combinations that align with diverse crop requirements. Growers value formulations that improve plant health, enhance flowering, and support high-yield cycles. The France Specialty Fertilizers Market is influenced strongly by these specialized applications. Technological improvements in irrigation systems encourage greater reliance on soluble nutrient blends. Farmers adopt tailored formulations that optimize crop-specific growth. This shift reflects a stronger link between innovation and yield optimization.

Growing Role of Micronutrients in Addressing Soil Deficiency Patterns

Soil micronutrient deficiencies across agricultural zones highlight the need for balanced fertilizer blends. Farmers increasingly recognize the importance of zinc, boron, and iron to maintain crop quality and resistance. Specialty fertilizers provide these elements in controlled concentrations, supporting sustainable output. Modern agronomic practices integrate these solutions into overall crop nutrient strategies. The France Specialty Fertilizers Market responds to this demand with fortified and balanced product lines. Research-driven input solutions strengthen crop resilience against climatic stress. Fertilizer suppliers introduce innovations with proven efficiency levels validated through field trials. It creates value by improving both yield and nutritional quality outcomes for producers.

- For instance, Mosaic’s MicroEssentials SZ fertilizer has shown an average yield increase of 4.2 bushels per acre compared to MAP blends in multi-year trials, while improving phosphorus, sulfur, and zinc uptake through its Fusion® technology.

Governmental Support Through Incentives and Policy Frameworks

National and European Union frameworks encourage eco-friendly inputs and sustainable agricultural practices. Policy incentives promote environmentally safe fertilizers and discourage heavy reliance on conventional chemical products. Programs support the use of controlled-release and biodegradable formulations that reduce greenhouse gas emissions. The France Specialty Fertilizers Market benefits from these strategic shifts in policymaking. Collaboration between research institutes and fertilizer producers drives awareness about sustainable inputs. State-led educational campaigns encourage farmers to adopt efficient formulations. Industry partnerships highlight the benefits of advanced fertilizer technologies through extension programs. It ensures long-term adoption by reducing barriers to entry for small and medium farmers.

- For instance, EuroChem’s Nitrophoska® complex fertilizer, produced at its Antwerp facility, ensures immediate nutrient availability and has demonstrated uniform spreading patterns at widths over 40 meters, even under wind speeds above 5 m/second.

Market Trends

Integration of Digital Agriculture and Smart Farming Tools

Digital agriculture continues to transform fertilizer usage across farms in France. Smart sensors, satellite imagery, and data-driven platforms support farmers in monitoring soil health precisely. Specialty fertilizers are increasingly applied through automated systems to ensure nutrient delivery at the right stage. This trend reduces manual errors and improves efficiency across farming cycles. The France Specialty Fertilizers Market incorporates digital integration to align with evolving farmer needs. Farmers adopt variable rate technologies that apply fertilizers in real time based on soil data. Technology providers expand collaborations with fertilizer manufacturers to optimize results. It strengthens adoption rates and enhances productivity across agricultural regions.

Emergence of Bio-Based and Organic Specialty Fertilizer Solutions

Growing demand for chemical-free food is driving adoption of bio-based inputs. Specialty fertilizers derived from natural sources such as seaweed extracts, compost blends, and organic minerals are gaining wider use. Consumers increasingly prefer food grown under sustainable nutrient management practices. The France Specialty Fertilizers Market adapts to this by introducing certified organic blends. Farmers see higher returns when adopting inputs that align with organic labeling standards. Bio-based fertilizers promote soil biodiversity while ensuring stable crop yields. Local producers and cooperatives play a role in expanding availability across markets. It creates a competitive edge for eco-certified suppliers catering to evolving consumer demand.

- For instance, DE SANGOSSE reports that 35% of official CEPP sustainable use records in France now include at least one of its biosolutions, reflecting the company’s strong presence in biostimulants and biofertilization products.

Rising Customization of Fertilizer Formulations for Crop-Specific Needs

Customization emerges as a strong trend across diverse agricultural zones. Farmers demand blends tailored to specific crop nutrient profiles for cereals, vineyards, and vegetables. Specialty fertilizers allow adjustments in nutrient release rates to optimize growth cycles. This enhances yield performance and improves product quality. The France Specialty Fertilizers Market reflects this by developing flexible formulations addressing diverse soil and crop demands. Fertilizer companies invest in R&D to produce solutions that match localized requirements. Demand grows for fertilizers compatible with drip irrigation and greenhouse applications. It aligns innovation with farmer-centric approaches, reinforcing stronger adoption across the sector.

Focus on Climate-Resilient Inputs to Address Extreme Weather Variability

Climate change impacts agriculture across France, intensifying droughts, floods, and irregular rainfall. Specialty fertilizers designed to improve root strength and crop resilience gain preference among farmers. Formulations that enhance water-use efficiency and nutrient retention become central to farming strategies. Farmers adapt practices to protect crops against stress while maintaining productivity. The France Specialty Fertilizers Market highlights these climate-ready inputs as essential growth factors. Research partnerships strengthen innovation pipelines for developing stress-tolerant formulations. Fertilizer adoption shifts toward products offering resilience benefits beyond yield enhancement. It supports sustainability while ensuring food security in changing climatic conditions.

- For instance, ICL launched the eqo.x® biodegradable controlled-release fertilizer technology in September 2022, designed to meet future European standards and improve nutrient use efficiency by up to 80%.

Market Challenges Analysis

Regulatory Pressures and Rising Environmental Concerns Impacting Growth

Strict regulations surrounding fertilizer usage present a major challenge for suppliers. Environmental concerns regarding groundwater contamination and nitrogen emissions require constant compliance adjustments. The France Specialty Fertilizers Market faces scrutiny as regulators tighten standards for input quality and application. Companies invest in reformulating products to reduce ecological impact while maintaining effectiveness. Farmers often face high costs in transitioning to compliant specialty inputs. Regulatory complexity also delays product approvals, slowing innovation cycles. It creates tension between sustainability goals and affordability for small-scale farmers. Ensuring balance between productivity and compliance remains a long-term challenge for the sector.

High Cost of Production and Limited Farmer Awareness Restraining Adoption

Specialty fertilizers are more expensive than traditional fertilizers due to advanced formulations and production processes. Farmers with limited financial resources hesitate to adopt high-value inputs despite proven benefits. The France Specialty Fertilizers Market must address this challenge to expand adoption across smallholders. Lack of awareness regarding the benefits of micronutrient and controlled-release fertilizers further limits demand. Extension services and demonstration programs remain insufficient in many regions. Companies struggle to build strong distribution networks that reach fragmented rural areas. It restricts accessibility and reduces growth potential in emerging zones. Awareness-building initiatives are critical to bridge knowledge and affordability gaps.

Market Opportunities

Expansion of Precision Farming Practices Creating Scope for Advanced Inputs

Precision farming practices are expanding rapidly, supported by modern technologies and farmer education. Specialty fertilizers designed for drip irrigation, fertigation, and automated systems align with these developments. The France Specialty Fertilizers Market leverages these opportunities by delivering products optimized for data-driven applications. Farmers value the cost savings achieved through precise nutrient delivery. It strengthens efficiency while reducing environmental losses. Companies expand portfolios with advanced formulations suited for integration into precision systems. Broader adoption across vineyards, horticulture, and greenhouse farming enhances demand. This trend ensures consistent opportunities for long-term industry growth.

Rising Popularity of Sustainable Food Systems Encouraging New Market Segments

Consumer preference for sustainable food creates fresh opportunities for certified fertilizer products. Farmers adopting organic or eco-friendly inputs position themselves to capture higher-value markets. The France Specialty Fertilizers Market benefits from this growing alignment between agriculture and consumer demand. It encourages suppliers to invest in bio-based and eco-labeled products. Export potential for sustainable produce further increases adoption of certified fertilizers. Strong EU-wide initiatives supporting green farming practices reinforce this demand. Companies with diversified product lines gain a competitive edge in this environment. Opportunities continue to expand as sustainability becomes central to agricultural value chains.

Market Segmentation Analysis

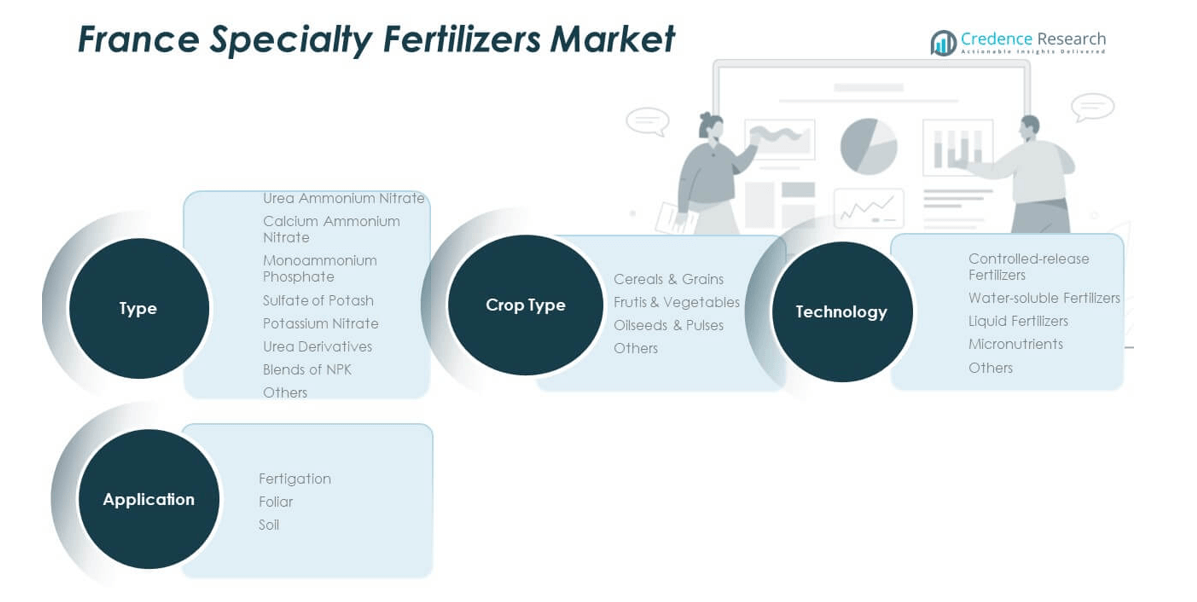

By type, blends of NPK dominate the France Specialty Fertilizers Market due to their balanced nutrient profiles that serve a wide range of crops. Urea ammonium nitrate and calcium ammonium nitrate are also widely adopted in cereal production, while monoammonium phosphate and sulfate of potash are preferred for high-value fruits and vegetables. Potassium nitrate and urea derivatives hold importance in intensive farming systems, while other specialized formulations address niche soil and crop requirements. It reflects strong demand diversity across the fertilizer landscape.

- For instance, Groupe Roullier, headquartered in France, highlighted in its 2024 Non-Financial Performance Statement investments in decarbonization and energy efficiency at its production sites, including biomass boiler projects to support sustainable specialty fertilizer operations.

By application, fertigation leads adoption due to its compatibility with advanced irrigation systems in greenhouses and vineyards. Foliar applications gain traction in horticulture for faster nutrient uptake and yield improvement. Soil applications remain relevant in traditional farming zones, though they face increasing competition from precision-driven methods. The France Specialty Fertilizers Market benefits from the strong integration of modern application techniques across crops.

- For instance, Timac Agro’s Fertiactyl series is formulated for use in both foliar and in-furrow applications, embodying the shift towards flexible, multi-mode specialty solutions, as highlighted in the official 2025 technology brochure.

By technology, water-soluble fertilizers account for the highest share due to their role in fertigation and controlled dosing. Controlled-release fertilizers grow steadily, supported by demand for sustainable inputs and reduced nutrient loss. Liquid fertilizers see high uptake in greenhouse and specialty crop cultivation, while micronutrients address critical soil deficiencies across regions. It highlights the sector’s alignment with efficiency and sustainability goals.

By crop type, cereals and grains hold the largest share due to their extensive cultivation across the country. Fruits and vegetables contribute significantly in southern and western regions, while pulses and oilseeds support diversification. Specialty crops under the others category continue to expand demand for customized formulations. It underscores the adaptability of specialty fertilizers across diverse agricultural practices.

Segmentation

By Type

- Urea Ammonium Nitrate

- Calcium Ammonium Nitrate

- Monoammonium Phosphate

- Sulfate of Potash

- Potassium Nitrate

- Urea Derivatives

- Blends of NPK

- Others

By Application

By Technology

- Controlled-release Fertilizers

- Water-soluble Fertilizers

- Liquid Fertilizers

- Micronutrients

- Others

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Regional Analysis

Western France

Western France dominates the France Specialty Fertilizers Market with 38% share, supported by extensive cereal, vegetable, and vineyard production. Farmers adopt controlled-release and water-soluble fertilizers to optimize yields under precision farming methods. High levels of greenhouse cultivation strengthen demand for fertigation-based inputs. Government-backed initiatives promoting sustainability further reinforce adoption in this subregion. It benefits from advanced irrigation systems and strong distribution networks. Western producers lead in integrating specialty fertilizers with digital tools for nutrient management.

Northern France

Northern France holds 32% share, driven by large-scale cereal farming and rising adoption of horticultural practices. Growers increasingly depend on foliar and micronutrient-based fertilizers to enhance soil health and crop resilience. The subregion is marked by growing acceptance of climate-resilient inputs as weather conditions fluctuate. Strong infrastructure for greenhouse farming boosts demand for liquid fertilizers across high-value crops. The France Specialty Fertilizers Market benefits from advanced cooperatives that promote customized blends. It supports wider penetration of specialty products among both large and small-scale farmers.

Southern and Central France

Southern and Central France together account for 30% share, influenced by vineyards, orchards, and specialty crops. Farmers prioritize potassium-rich and water-soluble fertilizers to improve quality and flavor profiles in fruits and grapes. Expansion of horticultural exports from these regions boosts reliance on customized formulations. Specialty fertilizers tailored to drip irrigation gain significant traction among vineyard operators. The France Specialty Fertilizers Market in this region is reinforced by strong linkages between cooperatives and research institutions. It highlights the importance of tailored solutions for maintaining competitiveness in high-value agricultural exports.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nutrien Ltd.

- ICL Group Ltd.

- Yara International ASA

- The Mosaic Company

- CF Industries Holdings, Inc.

- EuroChem Group AG

- OCP Group

- Haifa Chemicals Ltd.

- Roullier Group

- Fargro Ltd.

Competitive Analysis

The France Specialty Fertilizers Market features a competitive landscape defined by global leaders and regional specialists. Companies such as Yara International ASA, Nutrien Ltd., ICL Group, and The Mosaic Company maintain strong market presence through diversified product portfolios. Their focus on controlled-release, micronutrient-rich, and water-soluble fertilizers drives adoption across intensive farming zones. EuroChem, OCP Group, and CF Industries expand their footprint by leveraging robust supply chains and tailored crop solutions. Roullier Group and Haifa Chemicals strengthen domestic and European positions with innovation in fertigation-compatible products. It reflects competition not only in pricing but also in product performance and sustainability. Strategic alliances, regional expansions, and targeted product launches define the industry’s direction, making innovation and adaptability critical for long-term leadership.

Recent Developments

- In May 2025, Yara International announced plans to double production capacity for its specialty fertilizers and biostimulants. A state-of-the-art global plant near Yorkshire, UK, will start operations by the end of 2025, serving key export markets including France through its YaraVita crop nutrition product lineup.

- In May 2025, ICL Growing Solutions completed the acquisition of Lavie Bio, a specialist in microbiome-based agricultural solutions. This strategic move infuses ICL’s product portfolio with Lavie Bio’s expertise in biologicals, expanding ICL’s capabilities in specialty fertilizers and sustainable farming technologies.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Crop Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Precision agriculture adoption will expand, creating stronger demand for fertilizers compatible with smart farming systems.

- Climate-resilient formulations will gain preference as farmers adapt to changing weather patterns.

- Customized blends tailored to crop-specific nutrient needs will see wider acceptance among growers.

- Organic and bio-based specialty fertilizers will gain momentum due to rising sustainable food demand.

- Vineyard and horticultural sectors will increase uptake of potassium-rich and soluble fertilizers for quality improvement.

- Stronger partnerships between cooperatives, research institutes, and manufacturers will accelerate innovation.

- Fertigation and foliar applications will dominate due to their compatibility with modern irrigation systems.

- Domestic producers will invest in localized solutions, improving competitiveness against multinational suppliers.

- EU regulatory frameworks promoting eco-friendly agriculture will shape product development and market positioning.

- Digital integration with farm management platforms will enhance product adoption and create long-term growth pathways.