Market Overview

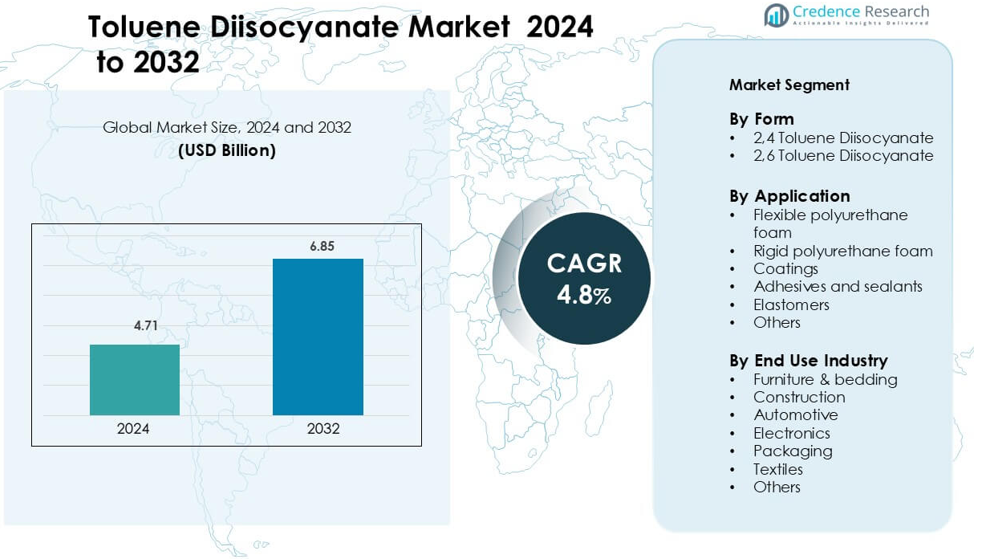

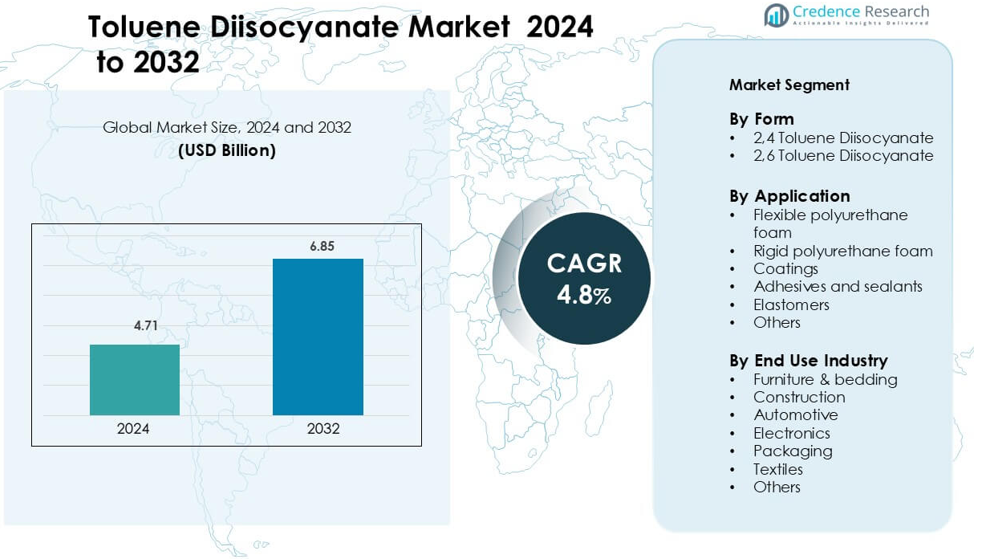

Toluene Diisocyanates Market was valued at USD 4.71 billion in 2024 and is anticipated to reach USD 6.85 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Toluene Diisocyanates Market Size 2024 |

USD 4.71 billion |

| Toluene Diisocyanates Market, CAGR |

4.8% |

| Toluene Diisocyanates Market Size 2032 |

USD 6.85 billion |

Leading players in the Toluene Diisocyanates market include Covestro AG, BASF SE, Dow, SABIC, Evonik, Cangzhou Dahua Group, Merck KGaA, KH Chemicals, Redox, and IBI Chematur. These companies maintain strong positions through large-scale production facilities, global distribution networks, and long-term supply agreements with polyurethane foam manufacturers. Covestro AG and BASF SE remain among the most influential due to advanced purification technologies and high production capacity supporting bedding, automotive, and insulation applications. Asia-Pacific leads the global market with a 45% share, driven by rapid industrialization, large furniture production bases, and expanding automotive manufacturing in China, India, Japan, and South Korea.

Market Insights

- The Toluene Diisocyanates market is valued at USD 4.71 billion in 2024 and is projected to reach USD 6.85 billion by 2032, growing at a CAGR of 4.8%.

- Demand rises due to high consumption of flexible polyurethane foam in mattresses, automotive seats, furniture, and insulation applications.

- Sustainability trends drive interest in low-emission and high-performance TDI systems, while producers invest in cleaner processing and advanced foam technologies.

- Competition remains strong with key players such as Covestro AG, BASF SE, Dow, SABIC, and Evonik, supported by regional suppliers offering cost-efficient grades.

- Asia-Pacific dominates with 45% market share, followed by Europe and North America; flexible polyurethane foam holds the largest segment share, driven by construction growth, premium bedding demand, and automotive production across global economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

2,4 Toluene Diisocyanate holds the dominant share of the market with nearly 78% participation, driven by its extensive use in flexible foam production. Manufacturers prefer 2,4 TDI because it delivers better reactivity, improved curing speed, and consistent foam quality for large-scale output. The 2,6 Toluene Diisocyanate sub-segment remains smaller due to limited consumption, mainly in specialty foams and elastomers. Demand growth in the 2,4 TDI segment is also supported by rising production of mattresses, furniture, and automotive seats, where comfort, density control, and form stability are critical performance advantages.

- For instance, BASF did build and operate a new, integrated TDI plant in Ludwigshafen with an annual capacity of 300,000 metric tons. It was officially inaugurated in November 2015 and was considered the world’s largest single-train TDI plant.

By Application

Flexible polyurethane foam is the largest application segment, accounting for close to 80% of total TDI consumption. The segment expands due to rising mattress manufacturing, automotive seating production, and comfort-driven furniture designs. Flexible foam offers durability, softness, and strong load-bearing performance, making it vital in bedding and upholstered products. Rigid foams, adhesives, elastomers, and coatings follow, but remain smaller due to specific industrial use cases. However, growth in coatings and elastomers benefits from construction and automotive refurbishing, where lightweight and impact-resistant materials are preferred.

- For instance, Huntsman does manufacture Thermoplastic Polyurethanes (TPU) under the Irogran® brand, used in a variety of applications including industrial and automotive parts.

By End-Use Industry

Furniture and bedding lead the market with around 65% share, supported by high consumption of flexible polyurethane foam in sofas, mattresses, pillows, and cushions. Growing household income, urban housing projects, and e-commerce furniture sales drive demand. The automotive sector also influences market growth through increasing seat production and interior cushioning demand. Construction, electronics, textiles, and packaging follow, benefiting from TDI-based foams in insulation, gasketing, and vibration-damping components. As comfort, energy efficiency, and lightweight materials gain priority, downstream industries continue to expand their TDI adoption.

Key Growth Drivers

Rising Demand for Flexible Polyurethane Foam

The rapid expansion of flexible polyurethane foam drives consistent growth in the Toluene Diisocyanates market. Growing production of mattresses, pillows, sofas, and automotive seating strengthens bulk consumption of TDI due to its high reactivity, comfort properties, and cushioning performance. Demand is also rising in e-commerce furniture sales and premium bedding products that use high-resilience foam for durability. Automotive manufacturers deploy flexible foam to reduce seat weight, enhance comfort, and improve fuel efficiency. Urbanization, home renovation activities, and expanding residential construction reinforce long-term demand. As consumer preference shifts toward softer, ergonomically designed furniture, flexible foam remains the primary application segment supporting TDI consumption in global markets.

- For instance, Sheela Foam Limited, a major polyurethane foam manufacturer in India, produces over 123,000 metric tons of flexible foam annually using TDI-based formulations to supply bedding and furniture brands such as Sleepwell and Feather Foam.

Expansion of Construction and Insulation Activities

Increasing use of polyurethane foams in building insulation, roofing, and structural components enhances TDI adoption across the construction sector. Builders prefer polyurethane insulation because it reduces heat loss, supports energy-efficient buildings, and complies with green building codes. Developing economies invest heavily in commercial and residential infrastructure, creating a steady need for rigid and semi-rigid foams. The rise of smart cities, industrial warehousing, and cold chain logistics further boosts demand for high-performance insulation materials. Construction regulations promoting lower carbon emissions accelerate usage of polyurethane systems that offer strong thermal resistance and low weight. These factors create sustained opportunities for TDI producers serving architectural and industrial insulation applications.

- For instance, Baytherm is a legitimate Covestro product, a rigid polyurethane (PU) foam used for insulation applications like pipes, appliances, and in construction, known for good insulating properties.

Growth of Automotive and Transportation Industries

The automotive industry contributes significantly to TDI growth due to high consumption of lightweight foams in seating and interior components. Automakers adopt polyurethane seats, headrests, roof liners, and vibration-damping pads to improve safety, comfort, and passenger experience. Lightweight foam supports fuel savings and emission reduction goals, making polyurethane an essential material in vehicle manufacturing. Electric vehicle production also benefits from polyurethane components used in sound insulation and vibration control. Additionally, the aftermarket demand for seat replacement, upholstery refurbishment, and commercial vehicle seating upgrades contributes to steady consumption. With rising vehicle ownership, logistics activity, and premium interior preferences, automotive applications continue to strengthen TDI demand.

Key Trend & Opportunity

Growth of Bio-Based and Low-Emission TDI Systems

Sustainability pressure and emission-control regulations encourage TDI suppliers to develop greener and safer polyurethane systems. Manufacturers invest in bio-based feedstocks, reduced VOC formulations, and cleaner production technologies. End users in bedding, automotive, and packaging industries increasingly prefer low-emission foams that comply with global indoor air quality standards. Green building certifications also create opportunities for eco-friendly polyurethane insulation. Companies focusing on recyclable foams and odor-free products gain competitive advantage in markets with strict consumer safety standards. As sustainability turns into a purchasing factor, demand shifts toward TDI systems that deliver performance with reduced environmental impact.

- For instance, BASF’s Elastoflex® E portfolio incorporates partially bio-based polyols in TDI systems, reducing VOC levels to below 50 µg/m³ while maintaining the same mechanical performance in automotive interior and mattress applications.

Technological Advancements in Foam Production

Advances in catalyst technology, processing automation, and high-resilience foam chemistry create growth opportunities for TDI-based materials. Flexible foams now offer better load bearing, improved breathability, and longer life, which boosts usage in premium furniture and high-durability automotive seats. Modern molding technologies reduce production waste and improve consistency for mass-manufactured mattresses and upholstered products. Smart foam designs, including memory foam hybrids and cooling-gel foams, also increase consumption in the bedding industry. As manufacturers automate large-scale foam plants and optimize curing cycles, production efficiency strengthens, supporting faster market expansion.

- For instance, Dow does produce various VORANOL™ polyether polyols used in TDI-based flexible polyurethane foams for furniture and bedding applications, with a focus on improving performance characteristics and sustainability.

Key Challenge

Volatile Raw Material Prices and Supply Chain Risks

TDI prices fluctuate due to changes in feedstock availability, crude oil volatility, and production shutdowns. Regulatory restrictions on chemical handling and emissions can slow plant operations or increase manufacturing costs. Any disruption in supply—such as maintenance outages, accidents, or geopolitical tensions—creates shortages that impact downstream industries. Foam producers are sensitive to price changes, often shifting procurement strategies or reducing production volumes. Smaller manufacturers face margin pressure during periods of high raw material cost. Managing price volatility remains a major challenge that affects long-term capacity planning and revenue forecasts.

Environmental and Health Safety Regulations

Toluene Diisocyanates fall under strict regulatory scrutiny due to concerns around toxicity, emissions, and workplace exposure. Governments enforce guidelines related to safe storage, ventilation, and worker protection in foam and coating plants. Compliance increases operational costs and often requires investment in protective equipment, closed-loop systems, and emission-control technologies. Some regions promote alternatives such as MDI or bio-based polyurethane, creating substitution risk for TDI. Consumer awareness of chemical sensitivity in bedding and furniture also leads retailers to demand low-emission products. These regulatory and perception challenges require manufacturers to innovate cleaner, safer TDI solutions to maintain market growth.

Regional Analysis

North America

North America holds nearly 20% of the Toluene Diisocyanates market, supported by well-established production of mattresses, upholstered furniture, and automotive seating. The U.S. drives most consumption due to large domestic furniture brands, strong home renovation spending, and premium bedding sales. Automakers also use flexible polyurethane foams to improve comfort, reduce vehicle weight, and enhance fuel efficiency. Strict environmental policies encourage low-emission and low-VOC TDI systems, pushing suppliers to upgrade processing standards. A strong manufacturing base, steady retail demand, and growth in insulated building materials help maintain regional stability and ensure long-term TDI utilization across key end-use industries.

Europe

Europe accounts for around 21% of the global TDI market, backed by mature automotive, furniture, and construction ecosystems. Germany, France, Italy, and the U.K. record high consumption of polyurethane foams for luxury bedding, high-performance insulation, and seating applications. EU sustainability standards increase the use of low-emission TDI products and promote thermally efficient building materials. Growth in green housing projects and retrofitting initiatives supports polyurethane insulation demand. Although regulations increase operating costs, Europe retains steady consumption due to strong industrial infrastructure, premium furniture exports, and a long-standing polyurethane manufacturing base.

Asia-Pacific

Asia-Pacific dominates the global TDI market with close to 45% share, led by China, India, Japan, and South Korea. Surging furniture production, large-scale mattress manufacturing, and rapid urban housing growth drive flexible polyurethane foam demand. The region also benefits from high automotive production, increasing use of lightweight seating foams, and expanding consumer goods manufacturing. Low labor costs and large polymer production clusters attract international foam producers to shift capacity into Asia. Rising e-commerce furniture sales, expanding commercial real estate, and continuous construction investments ensure long-term growth, making Asia-Pacific the fastest-growing market for TDI consumption.

Latin America

Latin America holds roughly 8% of global market share, supported by Mexico and Brazil as key consumers. Growing mattress manufacturing, demand for economical bedding products, and expansion of regional furniture brands boost flexible foam usage. The automotive sector also contributes through seating and interior cushioning materials. Although economic fluctuations and limited local production capability slow rapid growth, urban housing projects and government-backed building initiatives sustain market demand. Import dependence affects pricing trends, but increasing construction of insulated commercial spaces and rising middle-class furniture purchases provide continued opportunities for TDI suppliers.

Middle East & Africa

The Middle East & Africa region represents nearly 6% of TDI consumption, with Saudi Arabia, the UAE, and South Africa as primary demand hubs. Large infrastructure investments drive use of polyurethane insulation in commercial and residential projects, supporting rigid and semi-rigid foam applications. Rising adoption of modern furniture, hospitality sector growth, and expansion of retail mattress production add to regional demand. Most TDI is imported from Europe and Asia, influencing logistics costs and pricing. However, ongoing urban development, new housing programs, and increasing automotive assembly activities are steadily strengthening long-term market potential in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Form

- 2,4 Toluene Diisocyanate

- 2,6 Toluene Diisocyanate

By Application

- Flexible polyurethane foam

- Rigid polyurethane foam

- Coatings

- Adhesives and sealants

- Elastomers

- Others

By End Use Industry

- Furniture & bedding

- Construction

- Automotive

- Electronics

- Packaging

- Textiles

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Toluene Diisocyanates market features a mix of global chemical manufacturers and regional suppliers focused on polyurethane intermediates. Leading companies such as Covestro AG, BASF SE, Dow, SABIC, and Evonik control a major share through integrated production plants, advanced processing technologies, and long-term partnerships with foam manufacturers. These companies invest in capacity expansion, product purity improvement, and low-emission formulations to meet regulatory and sustainability demands. Regional firms including Cangzhou Dahua Group, KH Chemicals, Redox, and IBI Chematur strengthen competition by supplying cost-effective grades across Asia-Pacific, the Middle East, and Latin America. Strategic actions such as backward integration, feedstock supply agreements, and modernization of TDI facilities remain common, helping producers maintain price stability and secure market positioning. Increasing demand for flexible polyurethane foam in bedding, automotive seating, and construction insulation ensures strong competition among established players, while emerging manufacturers focus on capacity upgrades and environmental compliance to capture new opportunities.

Key Player Analysis

- Covestro AG

- BASF SE

- SABIC

- Redox

- Evonik

- Dow

- Merck KGaA

- KH Chemicals

- Cangzhou Dahua Group

- IBI Chematur

Recent Developments

- In August 2025, SABIC: India extended anti-dumping duty on TDI from the EU and Saudi Arabia to March 1, 2026. This affects Saudi-origin TDI shipments to India.

- In March 2025, Covestro AG: Completed modernization of the Dormagen TDI plant. New reactor and energy-efficiency upgrades now commissioned.

- In January 2025, BASF SE: Raised Lupranate® TDI prices by $300/ton in ASEAN and South Asia. Cited higher transport, energy, and regulatory costs.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for flexible polyurethane foam will continue to rise in bedding and furniture manufacturing.

- Automotive producers will adopt lightweight polyurethane components to improve comfort and fuel efficiency.

- Construction insulation materials will expand as energy-efficient building standards grow worldwide.

- Manufacturers will invest in cleaner and low-emission TDI production technologies to meet safety regulations.

- Asia-Pacific will remain the fastest-growing region, supported by large furniture and automotive industries.

- Companies will explore bio-based feedstocks and greener additives to enhance sustainability.

- Technological upgrades will improve foam durability, breathability, and load-bearing performance.

- Consolidation and capacity expansion will strengthen the position of leading TDI producers.

- Import-dependent regions will increase local production to reduce supply chain risks.

- The market will gain stability as end-use sectors like packaging, electronics, and textiles adopt more polyurethane applications.