Market Overview

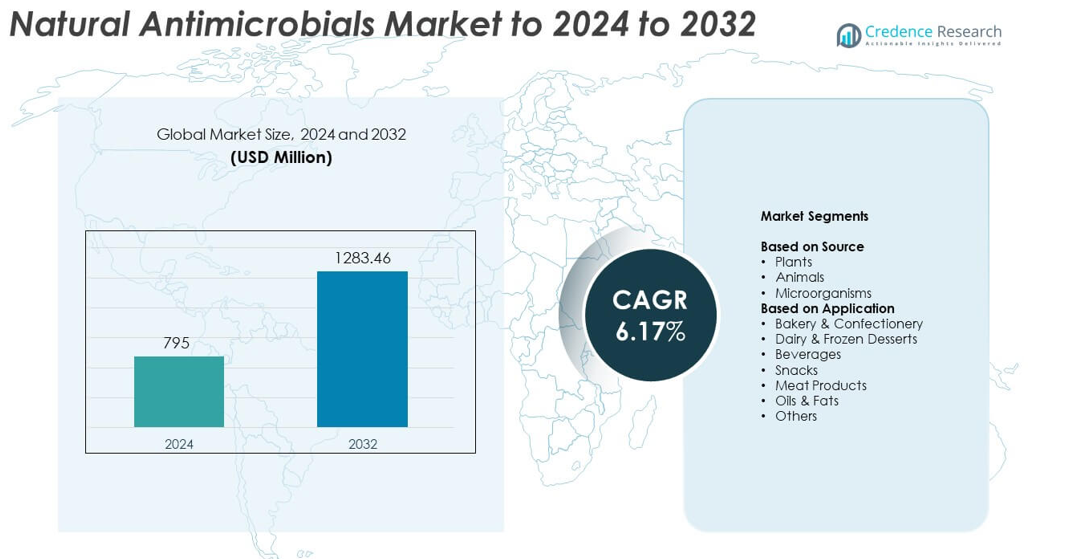

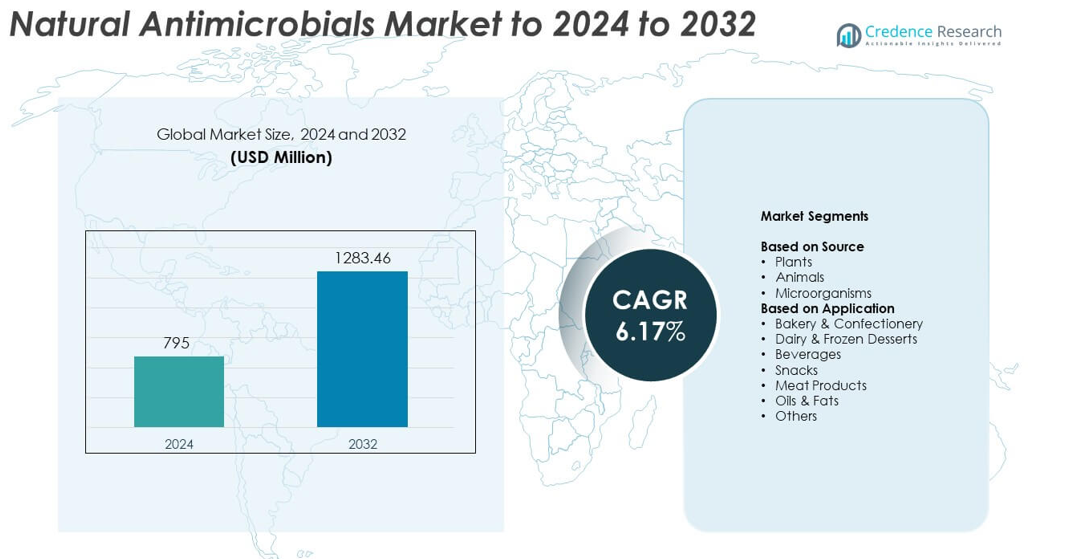

Natural Antimicrobials Market size was valued at USD 795 million in 2024 and is anticipated to reach USD 1283.46 million by 2032, at a CAGR of 6.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Antimicrobials Market Size 2024 |

USD 795 million |

| Natural Antimicrobials Market, CAGR |

6.17% |

| Natural Antimicrobials Market Size 2032 |

USD 1283.46 million |

The Natural Antimicrobials Market includes major players such as BASF, Kemin Industries, Galactic, Chr. Hansen, Handary, DowDupont, Brenntag, Royal DSM, Cargill, Celanese Corp, Siveele, and Univar, each expanding portfolios to meet clean-label and safety demands. These companies focus on advanced botanical extracts, microbial metabolites, and encapsulated systems that support shelf-life extension across meat, dairy, bakery, and beverage categories. North America leads the market with about 34% share, driven by strict safety regulations and strong adoption of natural ingredients. Europe follows with a sizable share supported by consumer preference for transparent and natural formulations across packaged and processed foods.

Market Insights

- The Natural Antimicrobials Market was valued at USD 795 million in 2024 and is projected to reach USD 1283.46 million by 2032, growing at a CAGR of 6.17%.

• Market growth is driven by rising demand for clean-label products, with the plants segment holding about 58% share as food makers shift from synthetic preservatives toward botanical ingredients.

• Trends highlight strong uptake of natural antimicrobials in meat products, which lead applications with nearly 33% share due to strict safety needs and rising processed meat consumption.

• Competition is shaped by global ingredient suppliers expanding natural extract portfolios, improving extraction technologies, and adopting encapsulation systems to enhance stability and performance.

• Regional analysis shows North America leading with 34% share, followed by Europe at 29% driven by regulatory support, while Asia Pacific grows fastest with 25% share due to rising packaged food demand; Latin America and the Middle East & Africa account for 7% and 5% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Plants lead this segment with about 58% share in 2024 due to strong use in clean-label food protection. Manufacturers choose plant-based antimicrobials such as essential oils, phenolics, and botanical extracts because they offer broad antimicrobial action and align with natural ingredient demands. Growth rises as food processors replace synthetic preservatives in bakery, dairy, and ready-to-eat items. Microorganism-derived antimicrobials expand in fermented foods, while animal-based options grow slowly due to regulatory limits and higher cost. Rising interest in bioactive plant compounds supports long-term adoption across large food categories.

- For instance, the Kerry Group’s preliminary results for the year ended December 31, 2024, mention “Progress on sustainability commitments including nutritional reach to 1.36 billion consumers”.

By Application

Meat products dominate this segment with around 33% share in 2024 as producers rely on natural antimicrobials to extend shelf life and control pathogens such as Listeria and Salmonella. The category expands because clean-label preservation is essential in processed and fresh meat. Growing protein consumption and stricter safety rules also boost uptake of natural preservatives. Dairy and bakery applications follow due to demand for mold inhibitors and freshness enhancers. Snacks and beverages adopt natural antimicrobials at a steady rate as brands shift toward ingredient transparency across packaged foods.

- For instance, the Corbion 2023 Annual Report discloses total sales of €1,443.8 million for the year, with an organic sales growth of 1.2%.

Key Growth Drivers

Rising Demand for Clean-Label Ingredients

Consumers prefer foods with simple, transparent, and natural ingredient lists. This shift drives strong adoption of natural antimicrobials across bakery, dairy, meat, and beverage products. Brands replace synthetic preservatives to meet retailer standards and regulatory expectations. Clean-label product launches continue to increase across major markets, which boosts long-term demand. The trend strengthens as manufacturers position natural antimicrobials as safe, plant-based solutions for shelf-life extension and microbial control.

- For instance, the Givaudan 2023 Integrated Report highlights that the company has a global presence with 162 locations worldwide, including 78 production sites, where it develops a broad range of natural and synthetic solutions in partnership with a global network of producers and suppliers.

Expansion of Processed and Convenience Foods

Consumption of ready-to-eat meals, packaged snacks, and chilled foods grows rapidly in urban areas. These formats require reliable microbial protection to maintain freshness during transport and storage. Natural antimicrobials offer broad functionality and support cleaner formulations without synthetic additives. Rising cold-chain capacity and growing retail penetration increase dependence on natural preservation systems. Food producers adopt natural agents to enhance safety, reduce wastage, and sustain product quality across longer distribution cycles.

- For instance, Tyson Foods operates approximately 123 food processing plants for animal-based and plant-based products.

Stricter Food Safety Regulations

Global authorities continue to tighten microbial safety standards across meat, dairy, and fresh produce sectors. These rules push manufacturers to use effective and compliant preservation solutions. Natural antimicrobials gain traction because they reduce pathogen risk while supporting healthier labels. Regulators also encourage reduced chemical additive usage, which supports natural alternatives. Stricter oversight on contamination incidents further accelerates the adoption of natural antimicrobial systems across major food-processing industries.

Key Trends and Opportunities

Growth in Plant-Based Preservation Technologies

Plant-derived antimicrobials gain momentum due to their multifunctional roles in oxidation control and microbial suppression. Innovation in botanical blends, essential oil encapsulation, and natural extract standardization enhances stability and usability. Food producers adopt these solutions to improve shelf life while aligning with plant-based clean-label strategies. Rising consumer preference for botanical ingredients creates strong opportunities for new product development across bakery, meat, and dairy categories.

- For instance, Symrise stated in its 2023 Corporate Report that it manufactures about 35,000 products from around 10,000 (mostly natural) raw materials such as plant-based ingredients, many of which are used in food protection and preservation solutions.

Advancements in Encapsulation and Controlled-Release Systems

New delivery technologies improve the effectiveness of natural antimicrobials in food matrices. Microencapsulation and nano-emulsion systems enhance flavor protection, reduce volatility, and allow controlled microbial inhibition. These advancements enable wider use in sensitive applications such as beverages and dairy formulations. Technology providers collaborate with food processors to design targeted release profiles that boost efficiency and reduce dosage levels, supporting higher adoption across commercial food production.

- For instance, IFF (International Flavors & Fragrances) operates 160+ manufacturing facilities globally and holds thousands of patents related to its technologies

Rising Use in High-Protein and Functional Foods

Demand for protein-rich snacks, fortified foods, and functional beverages supports new applications for natural antimicrobials. These foods often contain moisture and nutrients that enable microbial growth, creating a need for safe natural protection. Brands incorporate antimicrobial extracts to maintain stability without synthetic preservatives. Growing interest in health-focused products creates opportunities for companies offering natural antimicrobial blends optimized for sports nutrition, dairy alternatives, and high-protein snacks.

Key Challenges

High Cost Compared to Synthetic Preservatives

Natural antimicrobial agents often require complex extraction, purification, and stabilization processes, which raise production costs. Food manufacturers face higher formulation expenses when replacing low-cost synthetic preservatives. Small and mid-size processors struggle to adopt natural options due to price sensitivity. Cost barriers slow penetration in developing markets, where affordability strongly influences ingredient selection. Producers must improve efficiency and scale to reduce pricing gaps.

Variability in Composition and Performance

Plant- and microbe-derived antimicrobials often show natural variation due to differences in source quality, geography, and extraction methods. This inconsistency affects antimicrobial strength and stability, creating formulation challenges for food manufacturers. Companies must invest in standardization, encapsulation, and testing to ensure predictable performance. Variability also complicates regulatory approvals, as authorities require consistent safety and efficacy data. These issues slow adoption in high-sensitivity applications such as dairy and meat processing.

Regional Analysis

North America

North America holds about 34% share in the Natural Antimicrobials Market due to strong demand for clean-label and minimally processed foods. Large food processors in the US and Canada adopt natural preservation systems to comply with strict safety rules and reformulation targets. Growth rises as retailers expand natural and organic product portfolios. Meat, dairy, and bakery manufacturers use plant-based antimicrobials to reduce synthetic additives. Innovation in encapsulated extracts and essential oil blends further supports adoption, strengthening the region’s leadership.

Europe

Europe accounts for nearly 29% share in 2024, supported by stringent regulatory frameworks promoting natural and safe food ingredients. Consumers show high awareness of label transparency, which accelerates reformulation across bakery, confectionery, and dairy products. Manufacturers adopt natural antimicrobials to meet EU safety standards and sustainability targets. Rising demand for plant-based foods boosts usage in meat alternatives and functional snacks. Investments in controlled-release technologies and botanical extraction strengthen growth across major food companies in Germany, France, and the UK.

Asia Pacific

Asia Pacific holds about 25% share and shows the fastest growth, driven by expanding packaged food consumption in China, India, Japan, and Southeast Asia. Food processors adopt natural antimicrobials to improve safety in meat, dairy, and ready-to-eat products. Rising disposable income and urbanization increase demand for healthier formulations. Regional suppliers invest in plant-derived extracts to support clean-label trends. Strong government focus on contamination control and rising exports of processed foods also boost adoption across manufacturing hubs.

Latin America

Latin America captures roughly 7% share, supported by steady adoption of natural ingredients in meat processing, bakery, and snacks. Brazil, Mexico, and Argentina lead the region due to large food production bases and rising consumer interest in healthier preservatives. Growth remains moderate as cost sensitivity affects uptake among small processors. However, multinational brands introduce more natural and clean-label lines, which drives demand for botanical and microbial antimicrobials. Improved cold-chain expansion further enhances adoption across processed food categories.

Middle East and Africa

The Middle East and Africa region holds around 5% share, with growth driven by rising packaged food demand and stricter safety oversight in the Gulf countries. Food manufacturers in Saudi Arabia, the UAE, and South Africa adopt natural antimicrobials to enhance stability in meat, bakery, and beverage products. Clean-label preferences expand across premium retail segments. Limited regional production and higher import reliance slow broader adoption, but investments in food processing and tourism-driven demand for high-quality packaged foods support gradual market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Source

- Plants

- Animals

- Microorganisms

By Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Natural Antimicrobials Market is shaped by leading companies such as BASF, Kemin Industries, Galactic, Chr. Hansen, Handary, DowDupont, Brenntag, Royal DSM, Cargill, Celanese Corp, Siveele, and Univar. These companies compete by expanding advanced ingredient portfolios, improving extraction processes, and developing natural preservation systems that fit clean-label requirements. Producers focus on plant-derived compounds, microbial metabolites, and controlled-release technologies to offer high stability and broad-spectrum protection. Many suppliers strengthen global distribution to meet rising demand across meat, dairy, snacks, and beverages. Strategic partnerships with food manufacturers help enhance formulation performance and optimize application-specific blends. Companies also invest in research to improve consistency, reduce variability, and support regulatory compliance in major markets. Rising competition pushes innovation in multifunctional natural antimicrobials that combine freshness protection with antioxidant benefits.

Key Player Analysis

- BASF (Germany)

- Kemin Industries (U.S.)

- Galactic (Belgium)

- Chr. Hansen (Denmark)

- Handary (Taiwan)

- DowDupont (U.S.)

- Brenntag (Germany)

- Royal DSM (Netherlands)

- Cargill (U.S.)

- Celanese Corp (U.S.)

- Siveele (France)

- Univar (U.S.)

Recent Developments

- In 2025, Cargill launched NOTOX, a new brand within its Micronutrition & Health Solutions portfolio, focusing on advanced mycotoxin risk management.

- In 2025, Kemin Industries launched PROSIDIUM™, a novel feed pathogen control antimicrobial solution designed to mitigate risks from Salmonella and viruses in animal feed.

- In 2022, Cargill completed its acquisition of Delacon. The deal expanded Cargill’s phytogenic feed additives, which act as natural antimicrobials in animal nutrition.

Report Coverage

The research report offers an in-depth analysis based on Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as food makers expand clean-label product lines worldwide.

- Demand will rise in meat, dairy, and snacks due to stronger food safety rules.

- Plant-based antimicrobials will gain wider use as extraction methods improve.

- Encapsulation and controlled-release systems will boost efficiency and stability.

- Adoption will increase in high-protein and functional foods as shelf-life needs rise.

- Asia Pacific will expand fastest with growth in packaged and convenience foods.

- Partnerships between ingredient suppliers and food processors will strengthen innovation.

- Natural blends that combine antioxidants and antimicrobials will gain popularity.

- Standardization and quality control improvements will reduce performance variability.

- Cost optimization and scale-up will help natural antimicrobials penetrate price-sensitive markets.