Market Overview

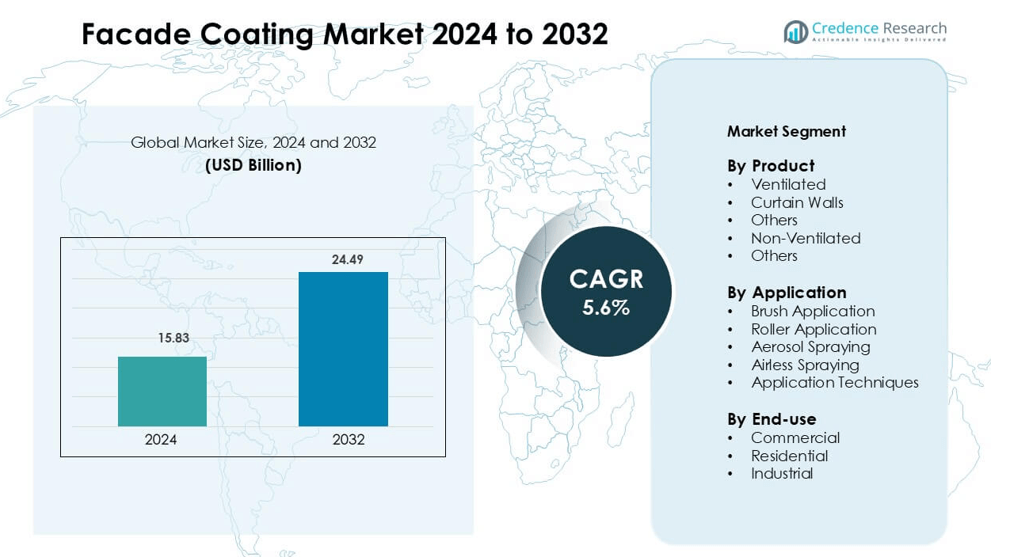

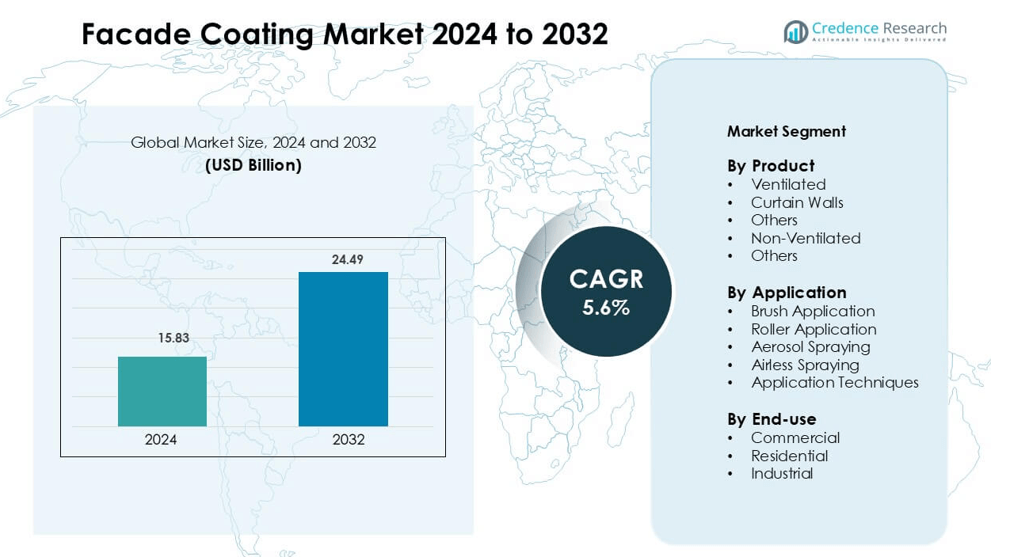

Facade Coating Market was valued at USD 15.83 billion in 2024 and is anticipated to reach USD 24.49 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Facade Coating Market Size 2024 |

USD 15.83 billion |

| Facade Coating Market, CAGR |

5.6% |

| Facade Coating Market Size 2032 |

USD 24.49 billion |

In the global façade‑coating market, leading players such as Saint‑Gobain Group, Kingspan Group, Lindner Group, Enclos Corp. and Aluplex dominate through diversified product lines, global manufacturing footprints and strong R&D. They invest heavily in high‑performance coatings, energy‑efficient materials and durable finishes to meet evolving construction standards. Among regions, the Asia‑Pacific region leads with a market share of precisely 38% in 2024. This dominance reflects rapid urbanization, large infrastructure spending and elevated adoption of premium facade coatings in countries like China and India.

Market Insights

- The global façade coating market reached USD 15.83 billion in 2024 and is projected to grow at a CAGR of 5.6% through 2034.

- Demand accelerates as ventilated product types hold the dominant segment share, and the Asia‑Pacific region accounts for roughly 32% of market revenue.

- Trends include strong uptake of waterborne and low‑VOC coatings, self‑cleaning facade technologies, and digital colour‑matching systems driving differentiation and premium pricing.

- Competitive pressure rises as major players invest in acquisitions and joint ventures to expand geographically, innovate rapidly, and address green‑building regulations.

- Restraints include volatility in raw‑material prices and stringent environmental regulations that increase formulation costs and slow entry in price‑sensitive markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

Ventilated facade coatings held the largest share at 42% in 2024. Demand stayed strong because ventilated systems improve thermal insulation and prevent moisture buildup across high-rise and commercial buildings. Builders prefer these coatings due to lower maintenance and longer service life. Curtain wall coatings followed, driven by aesthetic flexibility and lightweight designs used in airports, malls, and office towers. Non-ventilated systems served cost-focused residential projects but showed slower growth due to moisture and temperature limitations. Product innovation in weather-resistant pigments and self-cleaning formulations further pushed adoption in modern infrastructure projects.

- For instance, Kingspan Group’ Dri‑Design ventilated cassette system installs in at least half the time of comparable systems and achieves fire compliance to BS 8414/BR 135

By Application

Roller application dominated with a 38% share in 2024 due to wide use in residential and commercial refurbishment. Rollers deliver even coating, high efficiency, and reduced wastage, making them ideal for large walls and textured surfaces. Brush application ranked next for detail work and small-scale projects. Airless spraying gained traction in industrial sites because it reduces labor time and provides smooth finishes on concrete and metal. Aerosol spraying stayed relevant for spot repairs. Application demand increased as green coatings and low-VOC formulations improved bonding and weather resistance.

- For instance, according to Sherwin-Williams product data sheets and general guidelines, ProMar 200 paint typically covers between 350-400 square feet (sq. ft.) per gallon.

By End-use

Commercial buildings led the market with a 44% share in 2024. Corporate offices, malls, hospitals, and educational structures adopted durable and decorative coatings that resist heat, UV radiation, and pollution. Developers invested in high-performance solutions to reduce long-term maintenance and improve energy efficiency. Residential demand grew in multi-story housing, aided by government housing programs and urban renovation. Industrial users adopted heavy-duty facade coatings for chemical resistance and long service intervals. Growth strengthened as smart cities, logistics centers, and public infrastructure projects used advanced facade systems for safety and aesthetics.

Key Growth Drivers

Rising Construction of Commercial and Residential Infrastructure

Rapid urban expansion, smart city projects, and large-scale commercial development increase demand for durable facade coatings. Builders and contractors seek coatings that offer thermal insulation, crack resistance, and weather protection to extend building life and reduce maintenance. Governments invest in economic zones, logistics hubs, airports, and high-rise housing, driving large-volume consumption. The rise of façade restoration and repainting in aging city centers also boosts sales, as property owners upgrade aesthetics to attract tenants and meet safety codes. Manufacturers benefit from recurring demand in both new construction and renovation cycles. Growing real estate investments in emerging economies sustain long-term growth across Asia-Pacific, the Middle East, and Africa.

- For instance, Saint-Gobain is a major supplier of construction materials (including insulation and glass) in the region.

Transition Toward Energy-Efficient and Low-Maintenance Buildings

Sustainable architecture encourages adoption of facade coatings with thermal reflectivity, UV resistance, and anti-fungal properties. Modern buildings use coatings as a functional layer that reduces heat absorption and lowers air-conditioning loads, improving energy performance. Product advances such as elastomeric coatings, self-cleaning nanoparticles, and breathable membranes reduce repainting frequency and lifecycle cost. Builders aim to meet green building standards, LEED certification, and emission regulations, pushing the shift from solvent-based to waterborne, low-VOC, and bio-based alternatives. Demand rises in regions with harsh heat, humidity, pollution, or coastal corrosion. Smart infrastructure programs and eco-friendly public projects create strong institutional demand for high-performance coatings.

- For instance, “Therma” range from Kingspan consists of PIR (Polyisocyanurate) insulation boards used within roof, wall, and floor constructions, often with low-emissivity foil facings to enhance thermal resistance in adjacent unventilated cavities.

Rapid Adoption of Advanced Coating Technologies

Technological innovation strengthens market expansion by improving durability, adhesion, and weather resistance. Nano-engineered coatings enhance self-cleaning, anti-microbial, and anti-graffiti capabilities, making them suitable for public buildings and urban structures. Airless spray application speeds up project timelines and reduces labor needs, helping contractors meet tight deadlines. Digital color-matching tools and customizable textures support architects seeking modern aesthetics. Industrial-grade coatings with fire retardancy, chemical resistance, and crack-bridging properties gain preference in warehouses and logistics hubs. Growing R&D spending by global manufacturers leads to longer warranties and better thermal performance, increasing adoption in premium construction.

Key Trend & Opportunity

Growing Shift Toward Waterborne and Low-VOC Products

Regulatory pressure and rising environmental awareness accelerate the move toward eco-friendly coatings. Waterborne systems reduce emissions, odor, and worker exposure, making them compliant for schools, hospitals, and residential buildings. Manufacturers enhance pigment stability, UV shielding, and water repellence to match or exceed solvent-based performance. The trend also enables government procurement of sustainable paint systems for public infrastructure and heritage renovation. Green-certified products help real estate developers meet energy and environmental regulations, opening premium pricing opportunities. Countries strengthening indoor air quality standards expand the market for low-VOC formulations and bio-based binders.

- For instance, The Envirobase High Performance system is specifically designed for automotive refinishing (car body shops/collision centers).

Demand for Smart and Self-Healing Facade Coatings

Smart facade coatings integrate photocatalytic layers, hydrophobic surfaces, and microcapsule healing agents. These materials clean pollutants, repair microscopic cracks, and prevent fungal growth, extending building service life. Urban landscapes with high dust and pollution adopt these coatings to maintain appearance and reduce manual cleaning. Real estate developers seek solutions that lower maintenance budgets, especially across airports, shopping complexes, hotels, and corporate parks. Smart coatings give suppliers a competitive edge through warranties and value-added performance, encouraging adoption in high-end and government-funded projects. Continued R&D creates opportunities in robotic application and sensor-integrated facades.

- For instance, Saint-Gobain’s self-cleaning glass (such as the SGG BIOCLEAN® range) does use a photocatalytic and hydrophilic coating to break down organic dirt and wash it away with rain, resulting in a cleaner surface.

Key Challenge

High Cost of Advanced Coatings and Professional Application

Premium façade coatings require specialized raw materials, lab testing, certifications, and expert application procedures. High-performance systems such as elastomeric, silicon-based, or nano-coatings cost more than conventional exterior paints. Contractors must invest in trained workers, airless spray tools, and safety equipment, raising project budgets. Price-sensitive residential buyers and small contractors often choose low-cost products, slowing premium adoption in developing markets. Fluctuating construction budgets during economic slowdowns also restrict demand for high-end coatings. Manufacturers need cost-optimized formulations and financing programs to increase penetration in price-sensitive regions.

Volatile Raw Material Prices and Supply Constraints

Facade coatings rely on petrochemical-based resins, titanium dioxide pigments, additives, and specialty chemicals. Global price swings, freight disruptions, and geopolitical issues affect raw material availability. Shortages lead to higher production costs, reduced margin, and delayed deliveries. Small manufacturers face competitive pressure as large players secure bulk contracts and supplier agreements. Environmental regulations on solvents and chemicals also limit supply, forcing reformulation and higher R&D spending. Market participants depend on supply chain resilience, local sourcing, recycling, and alternative materials to reduce vulnerability and maintain production stability.

Regional Analysis

North America

North America led the facade coating market with a 29% share in 2024, driven by extensive commercial construction and urban infrastructure development. High adoption of energy-efficient buildings, LEED-certified projects, and advanced coating technologies bolstered demand. The U.S. and Canada favored waterborne and low-VOC coatings to meet strict environmental regulations and indoor air quality standards. Renovation projects in aging city centers and growing investment in smart buildings further contributed to growth. Manufacturers such as Sherwin-Williams and PPG Industries expanded product portfolios to offer high-performance, weather-resistant, and decorative coatings, reinforcing the region’s dominance in premium facade solutions.

Europe

Europe accounted for 25% of the facade coating market in 2024, supported by sustainable construction initiatives and strict environmental regulations. Germany, France, and the U.K. drove demand for low-VOC, energy-efficient, and self-cleaning coatings in residential and commercial projects. Renovation of heritage buildings and urban regeneration programs created recurring consumption. Advanced application techniques, including airless spraying and roller systems, accelerated project completion. Manufacturers focused on product innovation, durability, and aesthetic flexibility to meet European architectural standards. Public infrastructure projects and high-rise office developments sustained growth, while regulatory incentives for green building certifications encouraged adoption of eco-friendly coatings.

Asia-Pacific

Asia-Pacific held the largest share at 32% in 2024, fueled by rapid urbanization, industrial expansion, and real estate growth. China, India, Japan, and Southeast Asia drove demand for both ventilated and curtain wall coatings in commercial, residential, and industrial buildings. Government investments in smart city projects, metro expansions, and economic zones boosted large-volume consumption. Rising preference for energy-efficient, self-cleaning, and anti-corrosion coatings strengthened premium adoption. Local and international manufacturers expanded production capacities to meet growing infrastructure and high-rise construction needs. Fast-paced urban development, combined with awareness of sustainable construction practices, positioned the region as a primary growth engine.

Middle East & Africa

Middle East & Africa captured 8% of the market in 2024, driven by large-scale commercial projects, luxury residential complexes, and infrastructure modernization. Countries like the UAE, Saudi Arabia, and South Africa invested in smart city development, airport expansions, and tourism-driven construction. Harsh climatic conditions elevated demand for UV-resistant, heat-reflective, and anti-corrosion facade coatings. Contractors favored durable, low-maintenance systems for long-term performance. Government initiatives supporting sustainable and energy-efficient construction increased adoption of low-VOC and waterborne coatings. Despite slower urbanization in some African regions, high-value projects in metropolitan hubs ensured consistent growth and encouraged entry of global coating suppliers.

Latin America

Latin America held 6% market share in 2024, driven by urban housing expansion and commercial infrastructure projects in Brazil, Mexico, and Chile. Residential renovation and new construction fueled demand for low-maintenance, weather-resistant facade coatings. Governments promoted energy-efficient building practices and green construction initiatives, supporting waterborne and eco-friendly coating adoption. Economic fluctuations and raw material cost volatility posed challenges but did not hinder premium segment growth in metropolitan areas. Local contractors and developers increasingly adopted airless spray and roller application methods for efficiency. Manufacturers focused on durable, decorative, and climate-adapted coatings to meet regional architectural and environmental needs.

Market Segmentations:

By Product

- Ventilated

- Curtain Walls

- Others

- Non-Ventilated

- Others

By Application

- Brush Application

- Roller Application

- Aerosol Spraying

- Airless Spraying

- Application Techniques

By End-use

- Commercial

- Residential

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the global façade coating market features a moderate concentration of leading players, yet maintains dynamic competition from regional and niche specialists. Industry heavyweights such as PPG Industries, The Sherwin‑Williams Company and AkzoNobel NV each command significant market shares by leveraging extensive R&D, global production networks and high‑performance coating portfolios. Meanwhile, regional challengers and specialized manufacturers focus on local markets, customised formulations and fast‑application technologies to win contracts in renovation and retrofit projects. Profitability remains under pressure due to volatile raw material prices, stringent environmental regulations around VOCs and high investments required for innovation and compliance. To sustain growth, incumbent firms pursue strategies such as strategic acquisitions, joint ventures and new product launches aimed at self‑cleaning, fire‑retardant and low‑VOC coatings that cater to emerging green building standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Lindner Group highlighted circular construction practices at EXPO REAL 2025, Munich.

- In January 2025, Lindner Group presented building-envelope and digital solutions at BAU 2025, Munich

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth will accelerate as urbanization and commercial construction expand in emerging economies.

- Demand for low‑VOC and waterborne facade coatings will increase due to stricter environmental regulations.

- Coatings with thermal insulation and reflectivity will gain traction as energy efficiency becomes a priority in building design.

- Smart and self‑healing coating technologies will become more common in premium projects and infrastructure assets.

- Renovation and retrofit of aging buildings will drive repeat purchases of facade coatings in mature markets.

- Market players will invest in advanced application methods like airless spraying and robotic systems to improve efficiency.

- Regional supply chains will become more localized to mitigate raw material price fluctuations and logistics disruptions.

- Manufacturers will expand service offerings including colour consulting and maintenance programs to differentiate from commodity suppliers.

- Collaboration between coating producers and construction firms will increase to integrate coatings at early design stages.

- Digital tools such as BIM (Building Information Modelling) will embed facade coatings into project planning, boosting specification rates