Market Overview

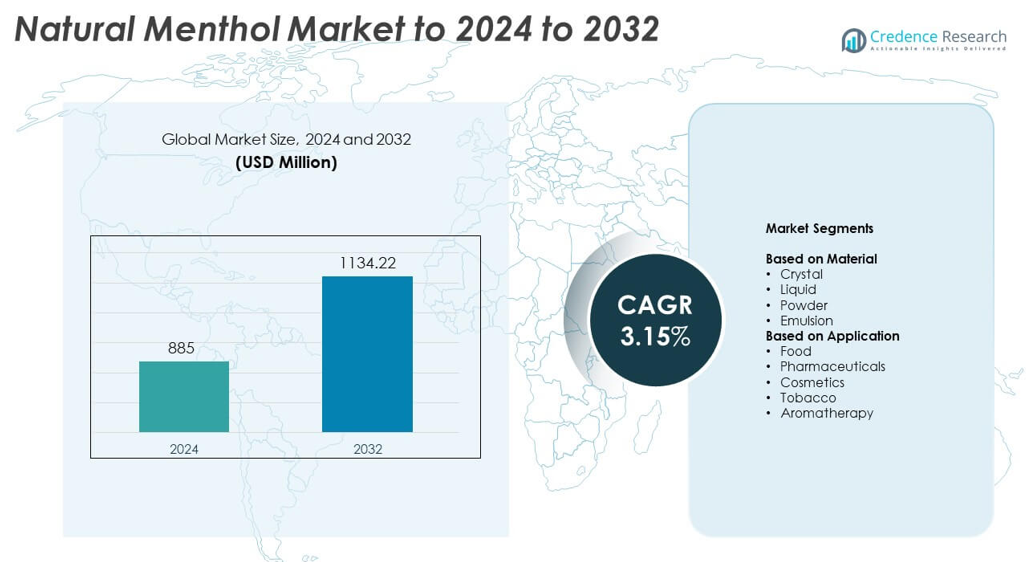

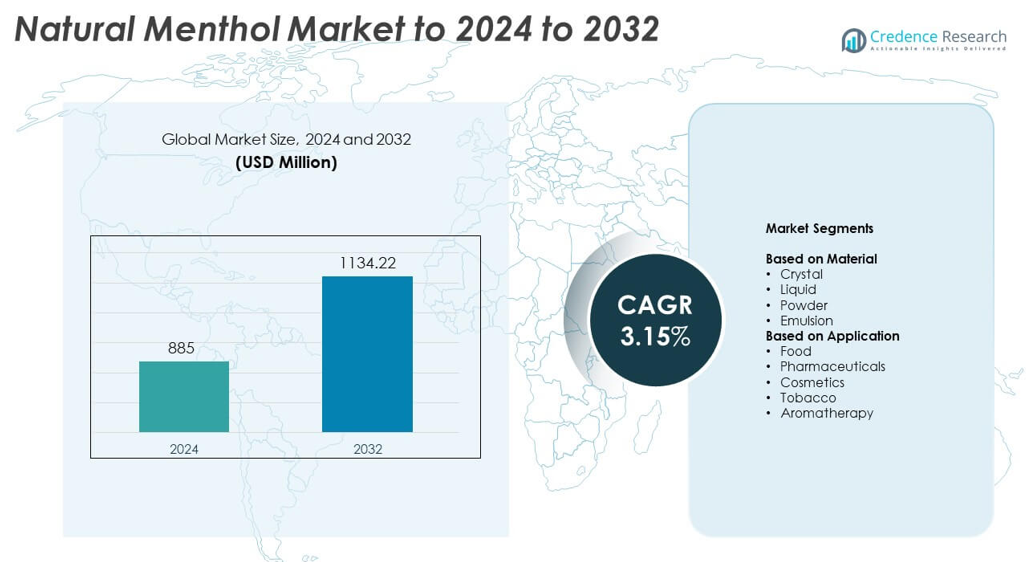

Natural Menthol Market size was valued USD 885 million in 2024 and is anticipated to reach USD 1134.22 million by 2032, at a CAGR of 3.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Menthol Market Size 2024 |

USD 885 million |

| Natural Menthol Market, CAGR |

3.15% |

| Natural Menthol Market Size 2032 |

USD 1134.22 million |

The Natural Menthol Market features key players such as Takasago International Corporation, Silverline Chemicals Ltd., Symrise AG, Agson Global Pvt. Ltd., Fengle Perfume Co., Ltd., KM Chemicals, Bhagat Aromatics Ltd., Arora Aromatics Pvt. Ltd., BASF SE, and Nectar Lifesciences Ltd. These companies compete through high-purity production, strong supply capabilities, and expanding applications in pharmaceuticals, cosmetics, and food products. North America leads the global market with about 32% share in 2024, driven by strong OTC drug demand and advanced personal care manufacturing. Asia Pacific follows closely with roughly 29% share, supported by large-scale menthol extraction, strong peppermint cultivation, and rising consumer demand across regional industries.

Market Insights

- The Natural Menthol Market was valued at USD 885 million in 2024 and is projected to reach USD 1134.22 million by 2032, growing at a CAGR of 3.15% during the forecast period.

• Rising demand from pharmaceuticals acts as the main driver, as menthol is widely used in lozenges, balms, inhalants, and topical pain-relief products, supported by strong OTC drug consumption across major economies.

• Market trends focus on clean-label ingredients, higher adoption in cosmetic cooling formulations, and rapid growth in aromatherapy and wellness products using natural cooling agents.

• Competition intensifies as leading companies expand high-purity extraction, strengthen global sourcing networks, and increase supply stability while facing cost pressure from synthetic menthol alternatives.

• North America leads with 32% share due to strong pharmaceutical demand, followed by Asia Pacific at 29% supported by large-scale production; the crystal material segment dominates with about 58% share across global applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The crystal category leads the material segment with about 58% share in 2024. Crystal menthol dominates because manufacturers use it widely in pharmaceuticals, oral care, and high-grade flavor blends. Strong purity, stable aroma release, and easy solubility support broad adoption across regulated sectors. Demand rises as crystal menthol meets strict quality standards for cough syrups, lozenges, and topical analgesics. Liquid and powder forms grow in food and cosmetic use, but they remain secondary due to lower concentration and limited suitability for medical applications. Emulsion formats expand slowly in personal care and aromatherapy blends.

- For instance, Takasago has the capacity to manufacture L-menthol via an asymmetric synthesis pathway at a rate of 3,000 tonnes per year.

By Application

Pharmaceuticals hold the dominant application share at roughly 39% in 2024. This segment leads because menthol supports analgesic, cooling, and decongestant effects in over-the-counter drugs. Strong uptake in lozenges, inhalants, balms, and topical creams drives consistent demand. The food category grows through use in confectionery and beverages, while cosmetics expand with rising mint-based skincare lines. Tobacco applications remain stable due to regulated flavor inclusion, and aromatherapy sees steady interest from wellness products. Pharmaceuticals maintain leadership due to strict quality needs that match natural menthol’s high purity profile.

- For instance, Warner Lambert Co. holds 144 menthol-related patents for over-the-counter medicinal and analgesic formulations.

Key Growth Drivers

Rising Pharmaceutical Demand

Pharmaceutical companies use natural menthol in cough syrups, lozenges, and pain-relief creams. Strong cooling action and high purity levels make menthol a preferred choice across regulated drug formats. Growth increases as respiratory illnesses, cold-related cases, and self-medication habits rise. Global demand for OTC remedies strengthens long-term use of natural menthol. The pharmaceutical sector continues to anchor market expansion due to strict quality needs aligned with natural menthol’s chemical stability and safety profile.

- For instance, Procter & Gamble holds 583 menthol-related patents across pharmaceutical, personal-care, and hygiene applications.

Expansion in Cosmetics and Personal Care

Cosmetic brands adopt natural menthol for skincare, oral care, and haircare lines. Cooling effects, mint fragrance, and soothing properties enhance consumer appeal across mass and premium products. Growth rises with demand for natural ingredients and clean-label formulations. Menthol’s role in irritation relief and freshness benefits supports wider use in moisturizers, cleansers, and shampoos. Personal grooming trends also raise demand for mint-based creams and gels. This shift creates strong momentum for the personal care industry.

- For instance, Kao Corp holds 192 menthol-related patents focused on cosmetics, haircare, and personal-care products.

Growth in Food and Flavor Applications

Food producers use natural menthol in confectionery, chewing gum, and beverages. The flavor market grows as brands expand mint profiles across sugar-free and functional products. Rising demand for natural flavoring ingredients boosts adoption over synthetic blends. Menthol’s stable sensory impact supports consistent taste output in large-scale production. Changing consumer preferences toward fresh and aromatic flavors further strengthen segment growth. Major producers rely on natural menthol to enhance brand differentiation within the food and beverage industry.

Key Trends and Opportunities

Shift Toward Natural and Clean-Label Ingredients

Global consumers prefer plant-based ingredients across food, cosmetics, and wellness sectors. Natural menthol benefits from this shift due to its botanical sourcing and safety profile. Brands reformulate products to replace synthetic menthol, creating new opportunities for premium lines. Clean-label trends expand use in oral care, topical balms, and functional foods. Regulatory support for natural ingredients further strengthens long-term growth. This trend positions natural menthol as a core ingredient in next-generation formulations.

- For instance, Reckitt’s Moov Cool menthol cold-therapy range in India was developed after a pain survey of over 4,000 respondents(specifically, the “Reckitt Pain India DCG Demand Survey” conducted in December 2021) and is sold in multiple menthol-based SKUs, including 10 g and 20 g gels plus 15 g and 35 g sprays that start cooling pain in approximately 15 seconds.

Innovation in Aromatherapy and Wellness Products

Aromatherapy gains traction through stress-relief, relaxation, and home fragrance demand. Natural menthol delivers strong cooling and respiratory-ease effects that support new product launches. Growth rises in diffusers, essential-oil blends, and wellness balms. Wellness brands use menthol to expand calming formulations and functional inhalers. Rising consumer interest in personal care rituals opens room for premium aromatherapy ranges. The wellness sector creates steady opportunity for high-purity natural menthol producers.

- For instance, Young Living specifies that producing a single 15 ml bottle of Peppermint essential oil for aromatherapy requires steam distillation of about 1 pound of peppermint leaves and flowering tops.

Expansion of Menthol-Infused Functional Products

Brands integrate menthol into sports recovery gels, herbal patches, toothpastes, and cold-relief strips. Functional product categories grow as consumers seek targeted benefits such as cooling, soothing, and pain relief. Food and beverage brands explore menthol in energy mints and refreshing drinks. Evolving lifestyle trends push demand for multi-use products with quick action and natural profiles. This expansion broadens menthol’s reach across diverse consumer segments.

Key Challenges

Supply Limitations and Crop Sensitivity

Natural menthol relies on mint crops that face weather risk, low yield phases, and disease exposure. Supply variability raises raw material prices and squeezes margins for producers. Seasonal fluctuations disrupt steady output, challenging companies that depend on consistent availability. Farmers require stable climatic conditions for high-quality peppermint harvests. These factors create uncertainty for long-term supply planning and export commitments.

Competition from Synthetic Menthol

Synthetic menthol offers stable pricing, large-scale output, and wide industrial use. Many manufacturers prefer synthetic versions for cost control, reducing growth for natural menthol in some sectors. High purity grades of synthetic menthol intensify competition in pharmaceuticals and personal care. Price gaps between natural and synthetic grades also discourage mass-market adoption. This challenge pressures natural menthol producers to improve efficiency and secure premium-focused demand.

Regional Analysis

North America

North America holds about 32% share in the Natural Menthol Market in 2024. Demand rises as pharmaceutical companies increase use of menthol in cough remedies, lozenges, and topical analgesics. Strong consumption of mint-based oral care and cosmetic products also supports growth. The United States leads due to advanced OTC drug manufacturing and steady demand for natural flavoring ingredients. Expanding clean-label trends and higher adoption in personal wellness items boost long-term use. The region maintains steady growth through strong retail distribution and high product standard requirements.

Europe

Europe accounts for nearly 27% share of the Natural Menthol Market in 2024. Adoption remains strong across pharmaceuticals, confectionery, and personal care products regulated under strict quality frameworks. Germany, the United Kingdom, and France lead consumption due to demand for natural cooling agents in lozenges and skincare lines. Growth also rises from expanding mint-based confectionery and sugar-free products. The region benefits from established flavor houses and advanced cosmetic manufacturing. Clean-label preferences and rising interest in aromatherapy strengthen natural menthol’s position across European industries.

Asia Pacific

Asia Pacific leads several end-use sectors and holds about 29% share in 2024. India and China dominate production due to large peppermint cultivation and established menthol extraction facilities. Demand grows across pharmaceuticals, cosmetics, and confectionery as regional consumers prefer stronger mint flavors and herbal formulations. Expanding OTC drug demand and rising use in topical balms boost consumption. Growth in personal care products with cooling effects also enhances product uptake. The region maintains strong supply capabilities and remains the largest global manufacturing hub for natural menthol.

Latin America

Latin America holds close to 6% share of the Natural Menthol Market in 2024. Brazil and Mexico lead consumption due to growing demand in confectionery, oral care, and topical pain-relief products. Increasing interest in herbal and mint-based wellness items supports higher adoption across retail channels. Pharmaceutical usage rises as menthol-based balms and inhalants gain popularity for respiratory relief. Cosmetic brands in the region also incorporate mint fragrances in skincare products. Local production is limited, so imports remain important for meeting industry needs.

Middle East and Africa

The Middle East and Africa account for about 6% share in 2024. Demand grows gradually as pharmaceutical and personal care sectors expand across Gulf countries and South Africa. Use in topical creams, cough remedies, and oral care products strengthens market presence. Growth in aromatherapy and relaxation products also increases interest in natural menthol. Limited local mint cultivation encourages reliance on imports from Asia. Rising consumer preference for natural cooling agents supports broader application across wellness, cosmetics, and OTC drug categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Material

- Crystal

- Liquid

- Powder

- Emulsion

By Application

- Food

- Pharmaceuticals

- Cosmetics

- Tobacco

- Aromatherapy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Natural Menthol Market is shaped by leading companies such as Takasago International Corporation, Silverline Chemicals Ltd., Symrise AG, Agson Global Pvt. Ltd., Fengle Perfume Co., Ltd., KM Chemicals, Bhagat Aromatics Ltd., Arora Aromatics Pvt. Ltd., BASF SE, and Nectar Lifesciences Ltd. These companies focus on expanding high-purity menthol production, improving extraction efficiency, and strengthening their global distribution networks. Market competition intensifies as producers enhance crop sourcing, invest in sustainability programs, and adopt advanced crystallization technologies to ensure consistent quality. Firms also expand into pharmaceuticals, personal care, and flavor segments to secure broader market coverage. Partnerships with fragrance houses, OTC drug manufacturers, and food brands support long-term revenue stability. Many players pursue backward integration to manage raw material volatility and reduce dependency on external suppliers. Continuous innovation in cooling formulations, sensory enhancement applications, and natural ingredient portfolios remains central to achieving competitive differentiation across global markets.

Key Player Analysis

Recent Developments

- In 2025, BASF launched L-Menthol FCC with a reduced Product Carbon Footprint (rPCF), its first product aimed at reducing Scope 3 carbon emissions for customers.

- In 2025, Symrise received Unilever’s Partner to Win Award for transforming India’s mint supply chain for oral-care ingredients, reinforcing its role in responsible menthol supply.

- In 2025, Nectar Lifesciences Limited (NecLife) announced the sale of its menthol and mint derivatives business to Ceph Lifesciences Private Limited.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as pharmaceutical firms expand menthol-based cough and pain-relief products.

- Personal care brands will increase use of natural menthol in cooling and soothing skincare lines.

- Growth will strengthen as clean-label trends shift companies toward natural mint ingredients.

- Food and beverage producers will adopt menthol for new mint-focused confectionery and gum products.

- Aromatherapy and wellness markets will use more menthol in inhalers, oils, and relaxation products.

- Producers will improve extraction efficiency to reduce cost gaps with synthetic menthol.

- Supply chains will stabilize through better peppermint crop management and farmer support programs.

- Regulatory focus on natural ingredients will encourage broader use across oral and topical formats.

- Emerging markets will adopt menthol faster as OTC drug consumption and cosmetic use increase.

- Companies will expand premium product lines centered on high-purity natural menthol.