Market Overview:

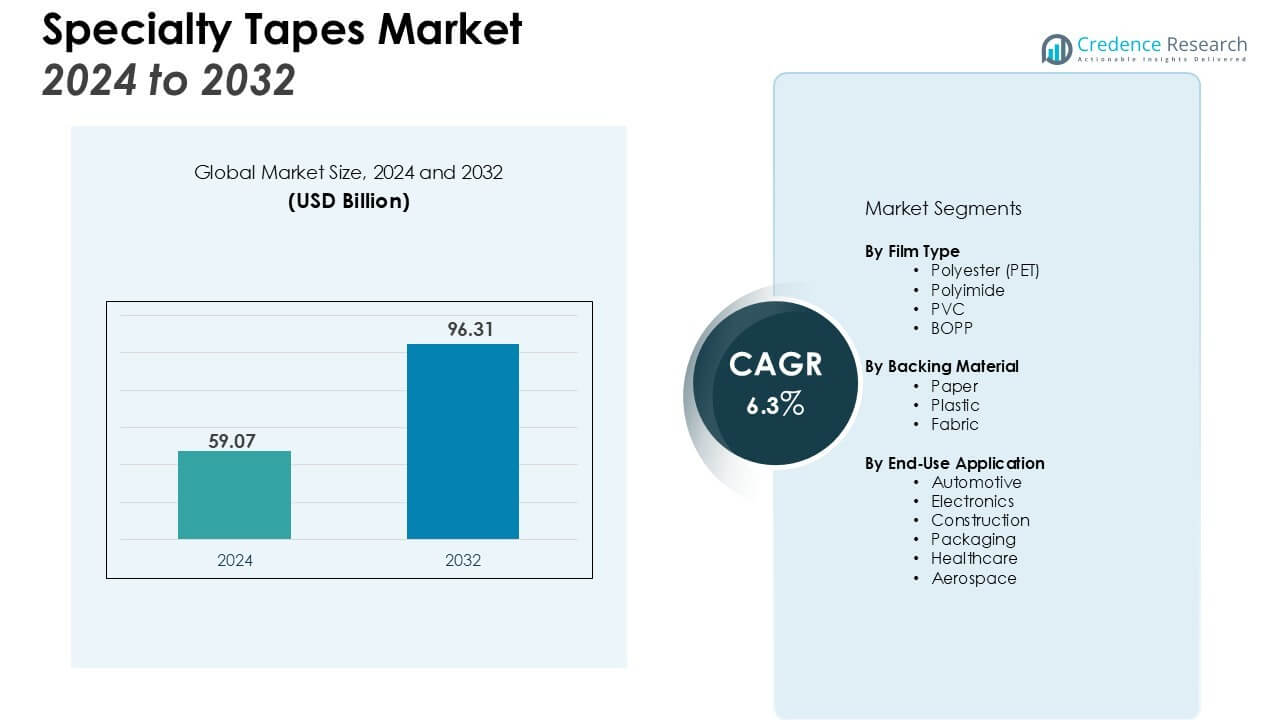

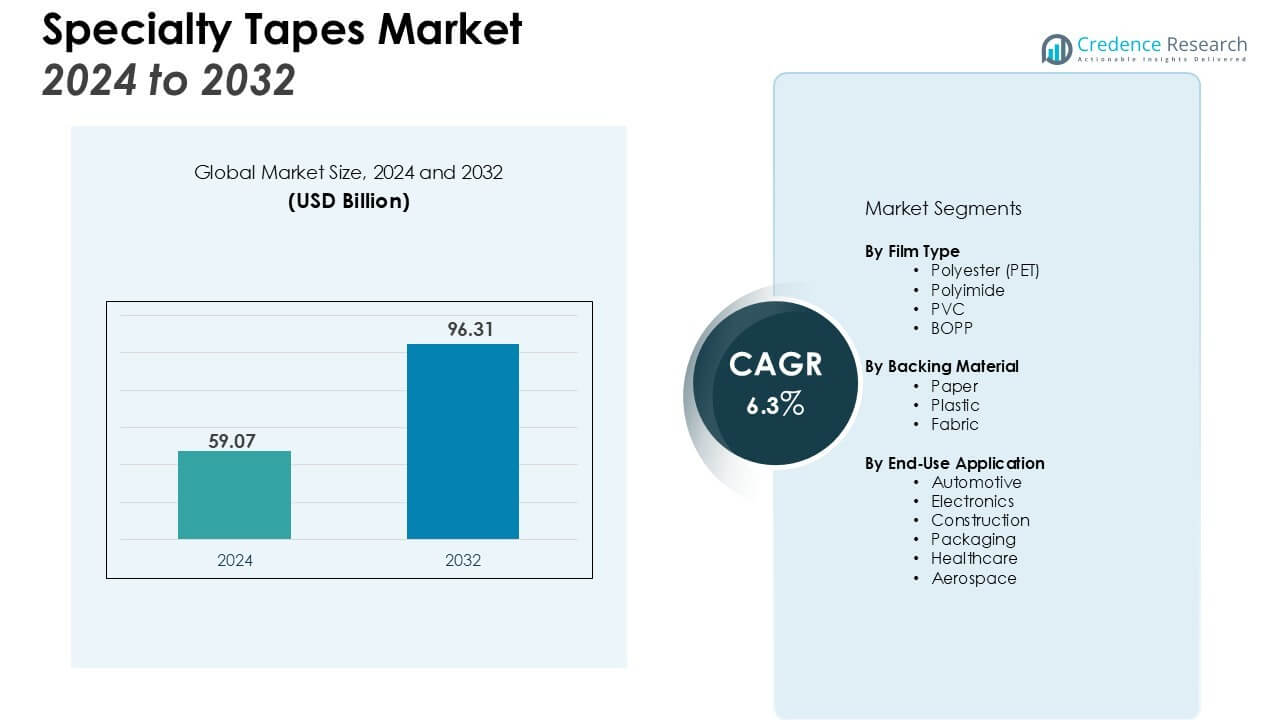

The Specialty Tapes Market size was valued at USD 59.07 billion in 2024 and is anticipated to reach USD 96.31 billion by 2032, at a CAGR of 6.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Tapes Market Size 2024 |

USD 59.07 Billion |

| Specialty Tapes Market, CAGR |

6.3% |

| Specialty Tapes Market Size 2032 |

USD 96.31 Billion |

Key drivers of the specialty tapes market include the rising adoption of these tapes in high-performance applications, such as insulation, masking, and bonding. Industries such as automotive and electronics are increasingly using specialty tapes for their durability, heat resistance, and high adhesive properties. The growing trend toward lightweight and sustainable materials also supports market expansion, as specialty tapes are often more eco-friendly compared to traditional alternatives. Additionally, innovations in product formulations and advancements in adhesive technologies are expected to further propel the market.

Regionally, North America holds the largest share of the specialty tapes market, driven by strong demand from industries such as automotive and construction. Europe follows closely, with growing applications in electronics and packaging. The Asia Pacific region is anticipated to experience the highest growth rate due to the rapid expansion of manufacturing industries, particularly in China and India, along with increasing infrastructure development in emerging markets.

Market Insights:

Market Insights:

- The Specialty Tapes Market was valued at USD 59.07 billion in 2024 and is expected to reach USD 96.31 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Industries such as automotive, electronics, and construction are increasingly adopting specialty tapes for their high-performance attributes, driving market growth. These tapes are crucial for applications like insulation, bonding, and masking due to their heat resistance and durability.

- Technological advancements in adhesive materials are expanding the application scope of specialty tapes. Innovations, such as tapes with superior bonding capabilities and resistance to extreme temperatures, support increased demand across sectors like aerospace and healthcare.

- The growing trend toward sustainable materials is fueling the demand for specialty tapes. With their eco-friendly properties, such as recyclability and biodegradability, these tapes offer a more sustainable alternative to traditional materials, aligning with the rise in green solutions.

- Emerging markets, particularly in Asia Pacific, are experiencing significant infrastructure development, boosting the demand for specialty tapes. Rapid growth in construction and automotive industries, especially in China and India, continues to drive consumption.

- North America dominates the specialty tapes market with a 35% share, led by high demand from the automotive, aerospace, and electronics sectors, alongside regulatory standards encouraging energy-efficient solutions.

- Europe holds a 30% market share, driven by the automotive sector’s focus on lightweight materials and the growing demand for eco-friendly products, while Asia Pacific’s 25% share is expected to grow the fastest due to expanding manufacturing and infrastructure in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand Across End-Use Industries

The increasing demand for specialty tapes in industries such as automotive, construction, and electronics is a key market driver. These tapes are widely used for insulation, bonding, and masking applications due to their high-performance attributes like heat resistance and durability. As industries seek efficient solutions for lightweight materials and long-lasting applications, specialty tapes are becoming a preferred choice. The rising need for robust and reliable products in critical applications continues to drive its adoption across multiple sectors.

For instance, 3M’s VHB™ Tapes offer excellent durability and resistance to solvents and moisture, making them suitable for various industrial and automotive applications where strong, long-lasting bonds are critical.

Technological Advancements in Adhesive Materials

Technological innovations in adhesive materials are another significant driver for the specialty tapes market. Advances in tape formulations and adhesive technologies have resulted in the development of highly effective products that meet the demands of industries such as aerospace, electronics, and healthcare. The introduction of tape products with superior bonding capabilities, resistance to extreme temperatures, and flexibility is expanding the scope of its application. This continuous innovation fuels market growth as businesses look for high-performance solutions to improve operational efficiency.

Shift Toward Lightweight and Sustainable Solutions

A growing preference for lightweight and sustainable materials is driving the demand for specialty tapes. Compared to traditional alternatives, specialty tapes often offer reduced weight and superior performance, contributing to energy efficiency in various applications, especially in automotive and packaging sectors. Their eco-friendly nature, often comprising recyclable or biodegradable components, aligns with the rising focus on sustainability. As industries increasingly prioritize green solutions, specialty tapes become a go-to choice for manufacturers and end-users alike.

Growing Infrastructure Development in Emerging Markets

Emerging economies, particularly in Asia Pacific, are experiencing rapid infrastructure development, which is fueling the demand for specialty tapes. The growing construction and automotive sectors in regions like China and India are increasing the consumption of these tapes. As industrial activities expand and infrastructure projects progress, the demand for reliable materials that offer both durability and cost-effectiveness is rising. Specialty tapes, with their versatility and long-lasting performance, are well-positioned to meet these growing needs.

For instance, Nitto Denko Materials (Shenzhen) Co., Ltd. was established in China to provide a full line of Nitto tapes, including those for the electronics and automotive industries, and has operated a 10K grade clean room since 2007 to support these sectors.

Market Trends:

Increasing Adoption of Smart and High-Performance Specialty Tapes

One of the key trends in the specialty tapes market is the growing demand for smart and high-performance tapes designed for specific industrial applications. Manufacturers are increasingly developing tapes with enhanced properties, such as heat resistance, flame retardancy, and chemical resistance, to cater to the evolving needs of industries like aerospace, automotive, and electronics. These advanced specialty tapes are engineered to provide higher durability and precision, meeting the stringent performance requirements of these sectors. Innovations such as conductive and reflective tapes are gaining traction in electronics and telecommunications, where precise and reliable performance is critical. The rising demand for specialized applications continues to drive the market for these high-tech solutions.

For instance, 3M’s VHB™ Tape 4611 is a high-performance specialty tape engineered for durability in demanding industrial applications.

Focus on Sustainable and Eco-Friendly Specialty Tapes

Sustainability is a growing trend influencing the specialty tapes market. With increasing pressure to reduce environmental impact, manufacturers are focusing on creating eco-friendly tapes made from biodegradable, recyclable, or renewable materials. The packaging and automotive industries are leading this shift, as companies adopt green alternatives to meet regulatory requirements and consumer preferences for sustainable products. The move towards sustainable specialty tapes is also driven by the need for compliance with global environmental regulations, which encourage the use of recyclable materials in industrial applications. This shift toward sustainability enhances the market’s growth potential as industries seek innovative and environmentally responsible alternatives.

For instance, Avery Dennison has developed the SP 1504 Easy Apply RS™, an eco-friendly vehicle wrapping film that is free of PVC, chlorine, and phthalates.

Market Challenges Analysis:

Rising Raw Material Costs

One of the primary challenges facing the specialty tapes market is the fluctuation in raw material costs. The production of specialty tapes depends heavily on materials such as adhesives, films, and substrates, which are subject to price volatility. Factors like global supply chain disruptions, increased demand for raw materials, and rising transportation costs can lead to higher production costs. This puts pressure on manufacturers to maintain profitability while offering competitive pricing to customers. Companies must find ways to manage these costs without compromising on product quality or performance, which can limit their ability to scale operations efficiently.

Intense Competition and Market Fragmentation

The specialty tapes market is highly competitive, with numerous players offering a wide range of products catering to different industrial needs. The presence of both established global manufacturers and local players results in a fragmented market. This intense competition makes it difficult for companies to differentiate themselves solely on product offerings. Companies are increasingly focused on product innovation and customer service to gain a competitive edge. However, the pressure to innovate and the challenge of managing market share often make it difficult to sustain long-term growth without significant investment in research and development.

Market Opportunities:

Expansion in Emerging Markets

The growing industrialization in emerging markets presents a significant opportunity for the specialty tapes market. Regions such as Asia Pacific, particularly China and India, are witnessing rapid infrastructure development, creating demand for a wide range of industrial products, including specialty tapes. The automotive, construction, and electronics industries in these regions are increasingly adopting high-performance and eco-friendly tapes for their applications. As these markets continue to grow, the demand for specialty tapes that offer superior performance and sustainability will expand, providing significant growth opportunities for manufacturers.

Advancements in Sustainable Product Offerings

Sustainability continues to drive market growth, offering opportunities for manufacturers to develop eco-friendly specialty tapes. With increasing regulatory pressures and consumer demand for greener products, manufacturers can tap into this market by innovating with biodegradable, recyclable, or renewable materials. Specialty tapes with lower environmental impact can cater to industries like packaging, automotive, and construction, which are actively pursuing sustainable solutions. This trend presents an opportunity for companies to gain a competitive edge by aligning their product offerings with global sustainability goals while meeting the needs of environmentally-conscious consumers and industries.

Market Segmentation Analysis:

By Film Type

The specialty tapes market is segmented by film type, with polyester (PET) and polyimide films leading the market. PET films are widely used due to their high tensile strength, chemical resistance, and excellent thermal stability, making them ideal for applications in electronics and automotive industries. Polyimide films are used in high-temperature applications, particularly in the aerospace sector, due to their superior heat resistance. Other film types, such as PVC and BOPP, are also used but have a smaller market share compared to PET and polyimide films.

For instance, 3M’s Polyester Tape 8992, used for high-temperature powder coat masking, is engineered with a polyester backing that provides a tensile strength of 998 N/100mm. This ensures it performs reliably under demanding industrial conditions.

By Backing Material

The backing material segment includes paper, plastic, and fabric. Plastic backings dominate the market due to their durability, flexibility, and wide range of applications. PET and BOPP are the most common plastic materials used. Paper backings are preferred for applications requiring easy tearing and are widely used in masking and packaging tapes. Fabric backings, such as cotton or fiberglass, are often used in heavy-duty applications like automotive and construction, where added strength and tear resistance are crucial.

By End-Use Application

In the end-use application segment, the automotive industry leads the market, utilizing specialty tapes for insulation, bonding, and protection. Electronics and construction sectors follow closely, with applications ranging from circuit board insulation to sealing and bonding materials. Other significant sectors include packaging, where specialty tapes are used for sealing and security purposes, and healthcare, where they serve in medical applications like wound care and surgical tapes. Each industry drives the demand for specific features such as heat resistance, adhesive strength, and flexibility in the tapes.

- For instance, in the healthcare sector, 3M provides advanced solutions for medical devices. The 3M™ Medical Tape 1522 is a double-sided tape with an overall thickness of 0.16 mm, designed for reliable performance in various medical applications.

Segmentations:

By Film Type

- Polyester (PET)

- Polyimide

- PVC

- BOPP

By Backing Material

By End-Use Application

- Automotive

- Electronics

- Construction

- Packaging

- Healthcare

- Aerospace

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Market Analysis

North America holds a market share of 35% in the specialty tapes sector. This region leads in demand due to robust industries like automotive, aerospace, and electronics. The U.S. is the largest consumer, driven by its advanced manufacturing sector and ongoing product innovations. The region’s focus on high-performance and sustainable materials supports the growth of specialty tapes. Strict regulatory standards and a growing emphasis on energy-efficient solutions further boost demand for specialized tapes that offer durability, heat resistance, and low environmental impact. The presence of leading manufacturers strengthens North America’s dominance in the market.

Europe Market Analysis

Europe accounts for 30% of the global specialty tapes market share, with significant growth driven by the automotive and electronics sectors. The automotive industry’s shift towards lightweight, fuel-efficient materials has increased the adoption of specialty tapes for bonding and insulation. Germany, a key player in this sector, contributes substantially to the region’s dominance. The increasing demand for eco-friendly solutions and stringent environmental regulations further accelerate the use of sustainable specialty tapes. Manufacturers in Europe are focusing on developing innovative products to meet the evolving needs of these industries, enhancing their market position.

Asia Pacific Market Analysis

Asia Pacific represents 25% of the global market share for specialty tapes and is projected to witness the highest growth rate. Rapid industrialization and infrastructure development in countries like China and India are driving demand for high-performance materials. The electronics, automotive, and construction industries in these countries are major consumers due to the tapes’ ability to provide effective insulation, bonding, and packaging solutions. The region’s expanding manufacturing base, coupled with increasing consumer demand for advanced materials, positions Asia Pacific as a high-growth market with considerable potential for future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The Dow Chemical Company

- 3M

- Lintec Corporation

- Nitto Denko Corporation

- tesa SE

- Intertape Polymer Group, Inc

- STM

- Nichiban Co. Ltd.

- Lohmann GMBH & Co. KG

- Berry Global Inc.

- Avery Dennison Corporation

- Scapa Group Plc

- Saint-Gobain Performance Plastics

Competitive Analysis:

The specialty tapes market is highly competitive, with major players like 3M, Avery Dennison, and Tesa SE leading through innovation and broad product offerings. These companies focus on advanced adhesive technologies, sustainability, and expanding their reach across industries such as automotive, electronics, and construction. 3M offers diverse tape solutions, while Avery Dennison is increasingly focusing on eco-friendly products and Tesa SE emphasizes automation and customization. Smaller regional players also contribute by targeting niche markets and specialized applications, often differentiating themselves through localized offerings. The competition remains strong as companies work to meet the evolving demands of various sectors, including healthcare, aerospace, and packaging, with an ongoing focus on product innovation and cost-effectiveness.

Recent Developments:

- In May 2025, Dow Personal Care launched a new portfolio of sustainable products for skin, hair, and color cosmetics, including its first low-carbon silicone elastomer blends under the Decarbia™ brand.

- In March 2025, 3M announced its plan to launch 1,000 new products and invest $3.5 billion in research and development over the next three years.

- In September 2025, Nitto entered into a strategic partnership, including a significant equity investment, with Aqualung Carbon Capture to jointly develop and commercialize membrane-based CO2 separation technology.

Report Coverage:

The research report offers an in-depth analysis based on Film Type, Backing Material, End-Use Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The specialty tapes market is expected to continue expanding as industries increasingly adopt high-performance and sustainable materials.

- Technological advancements in adhesive formulations will drive innovation, enhancing the versatility of specialty tapes across diverse applications.

- The automotive sector will remain a key growth driver, with increased demand for lightweight and energy-efficient materials in vehicles.

- Growth in the construction industry, particularly in emerging markets, will contribute to higher demand for insulation and bonding solutions.

- The electronics industry will further boost market growth due to the rising need for advanced tapes in electronics manufacturing and circuit board insulation.

- Eco-friendly and recyclable specialty tapes will see increased adoption as industries focus on reducing their environmental footprint.

- The healthcare sector will continue to drive demand for medical-grade tapes, with innovations in wound care and surgical applications.

- Asia Pacific will emerge as the fastest-growing region, driven by rapid industrialization and infrastructure development in countries like China and India.

- The packaging sector will see rising demand for specialty tapes due to the need for secure, tamper-proof, and sustainable packaging solutions.

- Increased focus on regulatory compliance and product safety will push companies to develop specialized tapes that meet strict industry standards.

Market Insights:

Market Insights: