Market Overview:

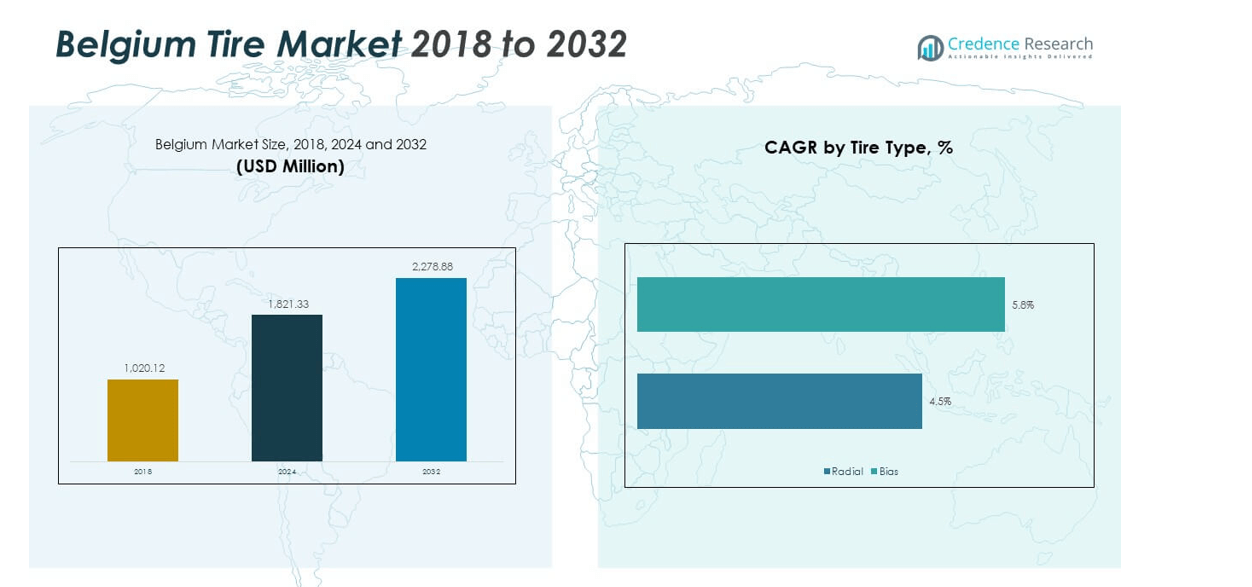

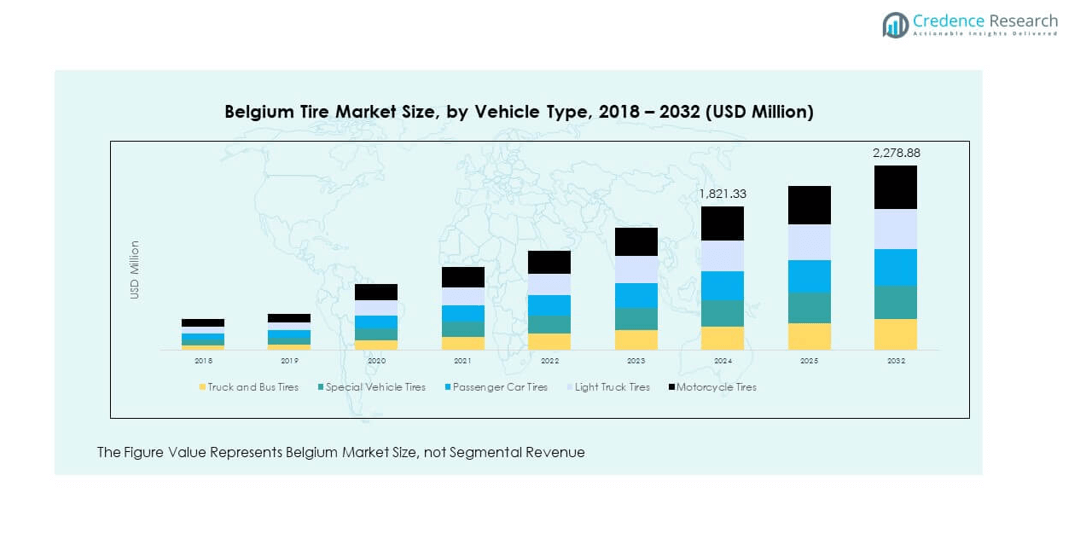

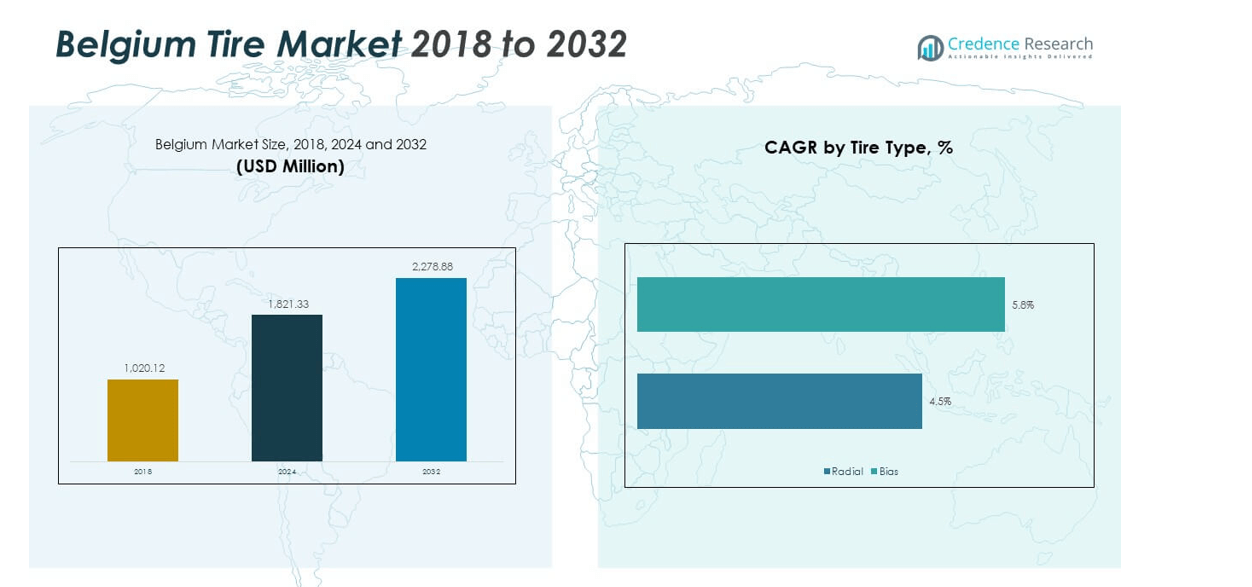

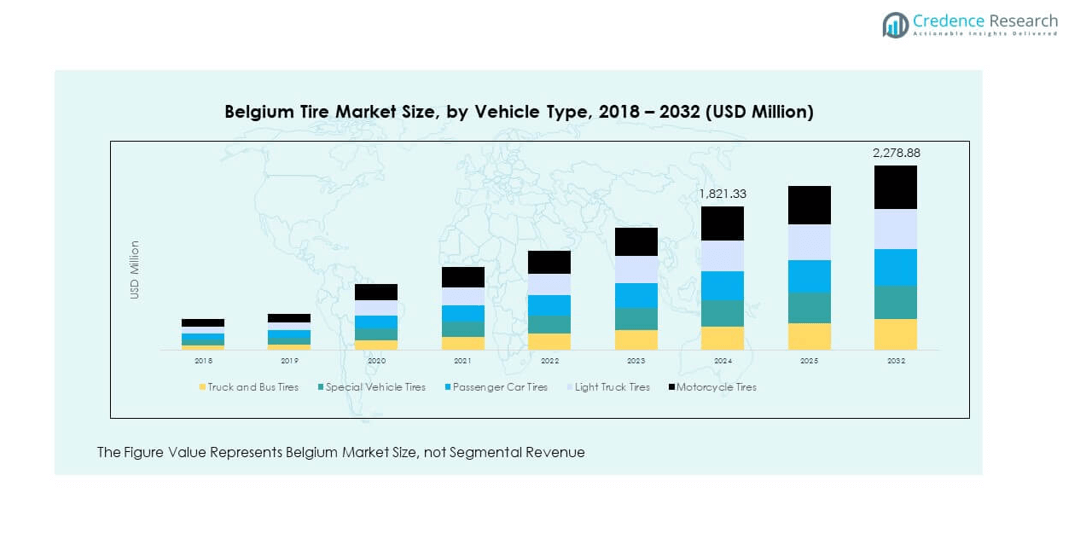

The Belgium Tire Market size was valued at USD 1,020.12 million in 2018 to USD 1,821.33 million in 2024 and is anticipated to reach USD 2,278.88 million by 2032, at a CAGR of 2.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Belgium Tire Market Size 2024 |

USD 1,821.33 million |

| Belgium Tire Market, CAGR |

2.84% |

| Belgium Tire Market Size 2032 |

USD 2,278.88 million |

Growth in the Belgium Tire Market is driven by rising vehicle ownership, frequent replacement cycles, and consumer demand for premium quality tires. Strong adoption of eco-friendly and fuel-efficient models reflects increasing awareness of sustainability. Expansion of e-commerce platforms enhances accessibility, while specialized tires for electric vehicles and advanced designs for safety continue to strengthen market competitiveness. Leading manufacturers invest in research to meet evolving consumer and regulatory expectations.

Regionally, Western Europe holds the leading position with strong infrastructure, high premium car ownership, and advanced distribution networks. Northern Europe demonstrates steady demand for winter and all-season tires due to climatic conditions. Southern Europe remains supported by replacement demand and mid-range brand adoption, while Eastern Europe emerges as a growing hub with rising vehicle ownership and opportunities for OEM supply. This regional diversity strengthens the market’s overall outlook.

Market Insights:

- The Belgium Tire Market size was USD 1,020.12 million in 2018, USD 1,821.33 million in 2024, and is projected to reach USD 2,278.88 million by 2032, growing at a CAGR of 2.84%.

- Western Europe leads with 38% share due to strong infrastructure, premium car ownership, and advanced distribution networks, while Northern Europe follows with 24% share supported by winter tire adoption.

- Southern Europe holds 20% share, reflecting replacement demand and mid-range tire adoption, making it the third-largest subregion.

- Eastern Europe, with an 18% share, is the fastest-growing subregion, driven by rising car ownership, expanding middle-class demand, and OEM opportunities.

- Passenger car tires hold the largest segment share at 41%, followed by truck and bus tires at 27%, supported by logistics and transport demand. Light truck tires represent 14%, motorcycle tires 10%, and special vehicle tires 8%, reflecting balanced distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Vehicle Ownership and Expanding Automobile Fleet Strengthening Tire Replacement Demand

The steady rise in vehicle ownership has created a sustained demand for tire replacement. Growing disposable income levels in Belgium are encouraging consumers to purchase passenger and commercial vehicles. The replacement cycle for tires remains shorter due to urban traffic, rough road surfaces, and higher mileage. Consumers are prioritizing safety, which pushes demand for premium quality tires. Seasonal variations such as winter increase the replacement rate and keep demand consistent. Fleet operators contribute significantly through bulk purchases and maintenance cycles. The Belgium Tire Market continues to benefit from this recurring replacement demand. It remains a key factor ensuring market resilience against economic fluctuations.

- For example, Bridgestone introduced the M-Steer 002 and M-Drive 002 truck tyres across Europe in January 2025. The new tyres deliver over 20% improved wear performance compared to the previous generation.

Growing Adoption of Premium and High-Performance Tires Driven by Consumer Preferences

Consumers are becoming more aware of tire performance, safety, and efficiency benefits. Rising interest in advanced tread designs and innovative compounds has strengthened demand for premium brands. Manufacturers are offering superior grip, longer durability, and optimized braking efficiency to meet expectations. Electric and hybrid vehicles further drive need for specialized tires with low rolling resistance. The trend toward sustainable mobility increases interest in eco-friendly and fuel-efficient options. Premium tire sales are supported by a strong retail and dealership network. The Belgium Tire Market leverages consumer trust in leading international brands. It strengthens the competitive landscape by attracting global and regional players.

Increasing Focus on Sustainability and Environmental Regulations Shaping Product Innovation

Belgium’s regulatory environment emphasizes sustainability and strict compliance with European standards. Tire manufacturers are compelled to introduce products with lower emissions and recyclable materials. Consumers are showing strong acceptance of green tires that improve energy efficiency. Governments promote policies encouraging reduced carbon footprint in transportation. Eco-label certifications and safety checks reinforce consumer trust. Manufacturers invest in R&D to design tires with reduced wear and enhanced recyclability. The Belgium Tire Market adapts quickly to align with evolving environmental policies. It reinforces industry growth through innovation and product advancement.

Rapid Expansion of E-Commerce Platforms Enhancing Tire Distribution and Consumer Reach

The growing e-commerce industry has transformed tire sales channels across Belgium. Online platforms allow customers to compare specifications, prices, and brands with ease. Tire companies collaborate with digital retailers and service providers to expand visibility. Consumers benefit from home delivery and doorstep installation services. Discounts and promotional offers online attract both individual buyers and fleet operators. Improved logistics networks ensure timely distribution across urban and rural regions. The Belgium Tire Market gains traction by capturing a wider digital customer base. It improves accessibility and contributes to consistent sales growth.

- For example, Goodyear launched an integrated online tire sales and installation platform in Germany, allowing customers to purchase tires and schedule installation with local retail partners. The company reported coverage reaching over half of German households within a 30-minute drive of a partner location.

Market Trends

Emergence of Smart Tire Technology Integrating Sensors and Real-Time Data Monitoring

Smart tire technology is gaining momentum with demand for advanced driving solutions. Integration of sensors enables real-time monitoring of pressure, temperature, and wear conditions. Drivers benefit from improved safety and reduced maintenance risks. Automakers are integrating connected tire systems into high-end vehicles. Fleet managers also adopt this technology to optimize operational efficiency. Consumers show interest in digital solutions that enhance driving experience. The Belgium Tire Market aligns with innovation by adopting smart tire offerings. It reinforces its position in advanced mobility ecosystems.

- For instance, in September 2024, Bosch and Pirelli announced a partnership to develop software-based solutions using in-tire MEMS sensors, with Pirelli’s Cyber Tyre transmitting tire data in real-time to a vehicle’s electronic stability program and delivering enhanced safety and custom driving dynamics for models like the Pagani Utopia Roadster.

Growing Popularity of All-Season Tires Due to Shifts in Consumer Behavior

Consumer preferences are shifting toward tires that perform across varying seasonal conditions. All-season tires reduce the need for frequent replacements between winter and summer. These tires appeal to cost-conscious buyers looking for value and convenience. Automobile dealers actively promote them as practical solutions for everyday use. Advancements in rubber compounds improve their performance under changing weather. Demand remains high among urban consumers with moderate driving patterns. The Belgium Tire Market reflects this trend through expanding all-season product lines. It reshapes market demand dynamics with broader consumer acceptance.

Strong Growth of Electric Vehicle Adoption Increasing Need for Specialized Tire Models

Electric vehicle adoption in Belgium is boosting demand for tailored tire solutions. EV tires require low rolling resistance, enhanced durability, and reduced noise levels. Manufacturers are designing innovative products to meet specific EV needs. Consumers expect longer lifespan and efficiency from these models. Charging infrastructure expansion supports the rapid uptake of EV-friendly tires. Public policy incentives further reinforce consumer adoption. The Belgium Tire Market positions itself at the forefront of this mobility transition. It attracts attention from global companies specializing in EV-compatible tires.

Expansion of Tire Recycling and Circular Economy Initiatives Driving Sustainability Focus

Circular economy principles are reshaping tire lifecycle management in Belgium. Recycling initiatives reduce waste and strengthen resource efficiency. Companies invest in new technologies for reprocessing used tires into usable materials. Government policies support extended producer responsibility frameworks. Consumers show preference for eco-conscious products aligned with sustainability goals. Energy recovery from end-of-life tires is also gaining attention. The Belgium Tire Market embraces these initiatives to align with global sustainability objectives. It fosters growth while maintaining environmental accountability.

- For instance, in September 2023, Belgian company RISORCE secured €12.5 million in funding to build a new plant in Liège capable of using a pyrolysis process to recycle up to half of all Belgium’s end-of-life car tires (estimated at 2.4 million tires annually) into oil, carbon black, and gas, marking a major local advance in tire circularity.

Market Challenges Analysis

Rising Raw Material Costs and Supply Chain Volatility Impacting Tire Manufacturing Operations

Tire production heavily depends on raw materials such as natural rubber, synthetic rubber, and carbon black. Price volatility in global commodity markets creates cost instability for manufacturers. Supply chain disruptions further intensify challenges by delaying shipments and increasing lead times. Rising energy and transportation expenses add pressure to operating margins. Smaller companies struggle to absorb these fluctuations compared to larger brands. The Belgium Tire Market experiences pressure in maintaining competitive pricing strategies. It highlights the need for efficient procurement and stronger supplier relationships.

Intense Competitive Pressure and Price Sensitivity Among Consumers Reducing Profit Margins

The tire industry in Belgium faces intense competition among global and regional brands. Consumers often compare products based on price rather than long-term performance. Aggressive discounting strategies by retailers reduce profitability across the supply chain. Market fragmentation makes differentiation difficult for mid-tier manufacturers. Tire imports from low-cost regions intensify competitive pressure. Maintaining innovation while keeping prices affordable remains a key challenge. The Belgium Tire Market must balance cost efficiency with value-driven innovation. It drives companies to adopt flexible strategies and strengthen brand loyalty.

Market Opportunities

Growing Demand for Specialized Tires for Electric Vehicles and Next-Generation Mobility

The rapid adoption of electric and hybrid vehicles is creating demand for tailored tire solutions. Specialized designs with low rolling resistance and enhanced durability appeal to eco-conscious buyers. Global manufacturers are investing in R&D for noise-reducing and efficiency-enhancing models. Public incentives for EV ownership encourage long-term growth in this category. Consumers show readiness to adopt advanced mobility products with proven benefits. The Belgium Tire Market benefits by expanding offerings for EV-friendly tire lines. It strengthens its role in next-generation transportation markets.

Expanding Aftermarket Services and Digital Platforms Enhancing Consumer Access and Engagement

Aftermarket services are becoming vital to the tire industry’s competitive growth strategy. Digital platforms allow customers to access tire fitting, repair, and replacement services quickly. Companies offering value-added services increase customer loyalty and recurring sales. Collaborations with garages and service centers further strengthen the aftermarket ecosystem. Online tire customization tools enhance consumer engagement with brand offerings. The Belgium Tire Market expands reach through innovation in service models. It improves consumer satisfaction and positions itself as a service-driven industry.

Market Segmentation Analysis:

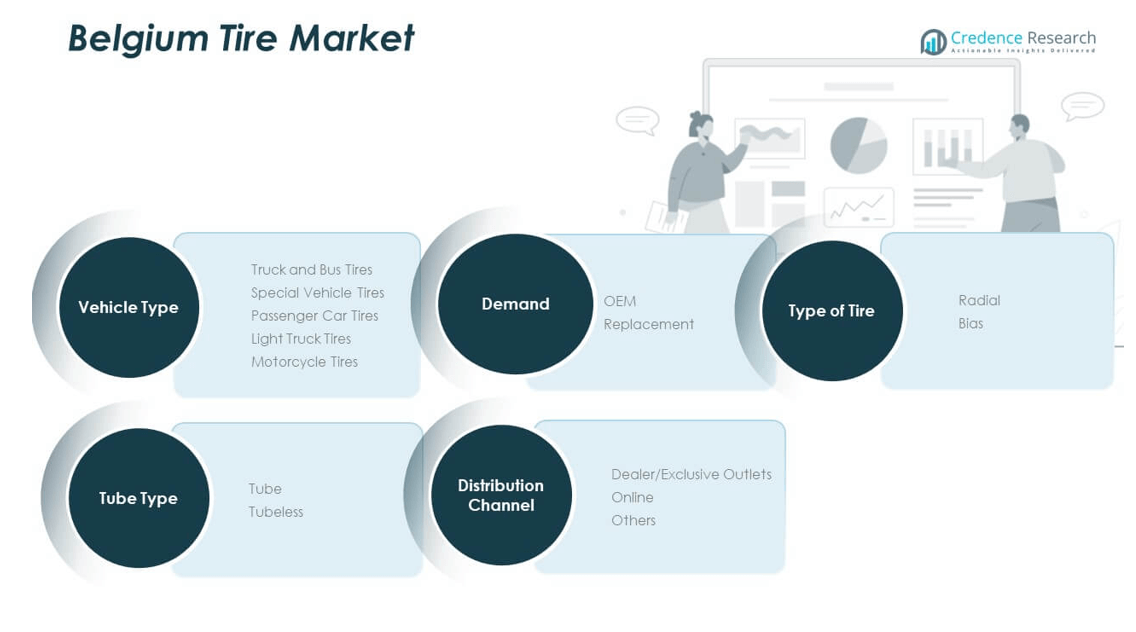

By vehicle type, passenger car tires dominate the Belgium Tire Market due to high car ownership and strong replacement demand. Truck and bus tires contribute steadily through logistics and public transport fleets, while light truck tires serve growing commercial applications. Motorcycle tires hold a smaller share but maintain relevance among urban commuters. Special vehicle tires remain niche but support industrial and agricultural operations. It demonstrates balanced growth across categories, though passenger and commercial segments remain primary revenue drivers.

- For example, Goodyear offers the KMAX GEN-2 range of radial truck tyres across Europe, designed for fleets that demand high mileage and fuel efficiency. The tyres feature low rolling resistance compounds and advanced tread designs to maximize fuel economy during operations. They also include RFID tags to enable tyre tracking and better fleet management.

By demand segment, replacement tires lead due to frequent wear, safety requirements, and seasonal shifts. OEM demand remains steady with new vehicle sales but represents a smaller proportion of overall volume. It highlights the market’s reliance on recurring consumer demand cycles.

- For instance, Volvo XC40 electric vehicles sold in Belgium in 2024 were factory-fitted with A-rated tires verified by European regulatory documents and tire performance databases, demonstrating compliance with stringent safety and efficiency labeling requirements.

By type, radial tires dominate due to durability, efficiency, and compliance with European standards, while bias tires retain limited applications in specific vehicles.

By tube type, tubeless tires lead, supported by safety, convenience, and growing consumer preference.

By distribution channel, dealer and exclusive outlets maintain leadership with strong networks, while online sales expand rapidly, supported by digital adoption. Others, including small retailers, sustain niche demand but face pressure from organized channels.

Segmentation:

By Vehicle Type

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

By Demand Segment

By Type of Tires

By Tube Type

By Distribution Channel

- Dealer/Exclusive Outlets

- Online

- Others

Regional Analysis:

Western Europe holds a 38% share of the Belgium Tire Market, driven by premium car ownership, advanced infrastructure, and strong automotive manufacturing bases in nearby regions. Consumers in this subregion prefer high-performance, eco-friendly, and all-season tires that meet European safety and sustainability standards. The established presence of global brands supports steady supply and wide availability of premium models. Retail and distribution networks remain highly developed, creating consistent access for both urban and rural customers. Regulatory focus on carbon reduction encourages greater demand for green tires. It benefits from innovation and partnerships between tire manufacturers and automotive OEMs.

Northern Europe accounts for 24% share, with demand strongly linked to winter and all-season tires that match the region’s cold climate. The subregion demonstrates strong consumer acceptance of advanced tread designs and specialized tire technologies for safety in snow and icy conditions. Passenger car ownership rates remain high, sustaining consistent tire replacement cycles. Local consumers show interest in premium European and Nordic brands known for durability. The Belgium Tire Market reflects this demand pattern through strategic alignment of product portfolios. It also benefits from cross-border distribution that enhances availability in neighboring countries.

Southern Europe holds 20% share, supported by steady growth in replacement demand and the popularity of mid-range and budget tire brands. Warmer climates reduce winter tire demand but sustain strong sales for all-season and summer tires. Rising adoption of light commercial vehicles fuels demand for durable, cost-effective tire models. Distribution through dealer networks ensures accessibility across urban centers and semi-urban markets. The Belgium Tire Market benefits from consumer focus on affordability and performance balance in this subregion. Eastern Europe contributes 18% share, driven by rising car ownership, an expanding middle class, and growing imports of cost-effective tire solutions. It remains a developing hub with emerging opportunities for OEM supply and low-cost production bases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Belgium Tire Market is highly competitive with the presence of global and regional players. Leading companies such as Michelin, Continental, Bridgestone, Goodyear Dunlop, and Pirelli dominate through advanced product portfolios and strong brand presence. Firms like Yokohama, Toyo, Nokian, and Kumho target niche segments with specialized tires and cost-efficient models. Companies compete on product innovation, distribution strength, and aftersales services to gain consumer loyalty. Strategic investments focus on expanding all-season, winter, and electric vehicle-compatible tires. Mergers, partnerships, and digital sales platforms enhance market penetration. It experiences constant rivalry, pushing manufacturers to innovate in materials, tread designs, and sustainability.

Recent Developments:

- In September 2025, Michelin announced the launch of its new global employee share ownership plan, “BIB’Action 2025,” as part of its ongoing commitment to value sharing and employee engagement. This initiative, open to approximately 115,000 active employees across 44 countries, aims to deepen employee shareholding, with a target for 4% of the company’s shares to be held by employees by 2030.

- In August 2025, Bridgestone was selected as the exclusive tire partner for Lamborghini’s limited-edition Fenomeno, leveraging its Virtual Tyre Development technology to improve sustainability and reduce development times. This partnership further strengthens Bridgestone’s premium presence in the high-performance segment in the Belgian tire market.

- In February 2024, Davanti Tyres announced a strategic partnership with Deli Tyres BV, granting the Belgian wholesaler exclusive distribution rights for Davanti’s DX, Protoura Sport, and Alltoura tire ranges. This collaboration includes an upgraded depot that can store up to 50,000 tires, significantly strengthening Davanti’s position in the mid‑range segment across Benelux.

- In June 2024, Pirelli showcased its new P Zero Winter 2 tire at the Tire Cologne event, which is now available in Belgium with Class A wet-grip rating and over 50% bio‑based and recycled materials in the EV-specific versions. The range features 13 sizes with Elect technology, catering to luxury EV models and offering advanced noise-reduction capabilities.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle Type, Demand Segment, Type of Tires, Tube Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for premium and eco-friendly tires will increase as consumers prioritize safety and sustainability.

- Electric vehicle adoption will create stronger demand for specialized tire designs with low rolling resistance.

- Digital platforms will expand tire sales channels, boosting aftermarket services and consumer engagement.

- Smart tire technology adoption will rise, offering real-time data on pressure, temperature, and wear.

- All-season tire demand will expand as buyers seek convenience and cost-efficient solutions.

- Regulatory policies will drive manufacturers toward recyclable and environmentally compliant tire materials.

- Competition among global brands will intensify, encouraging innovations in tread design and fuel efficiency.

- Tire recycling initiatives will strengthen, aligning with circular economy principles across the region.

- Strategic partnerships with automotive OEMs will enhance supply chain integration and product innovation.

- Regional expansion will continue, with emerging Eastern European demand contributing to overall market growth.