Market Overview:

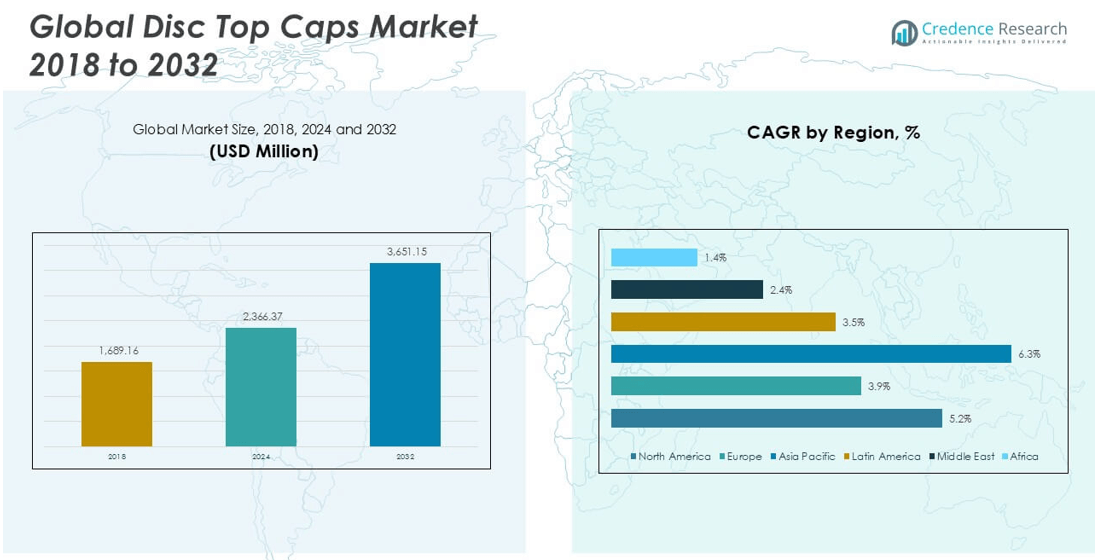

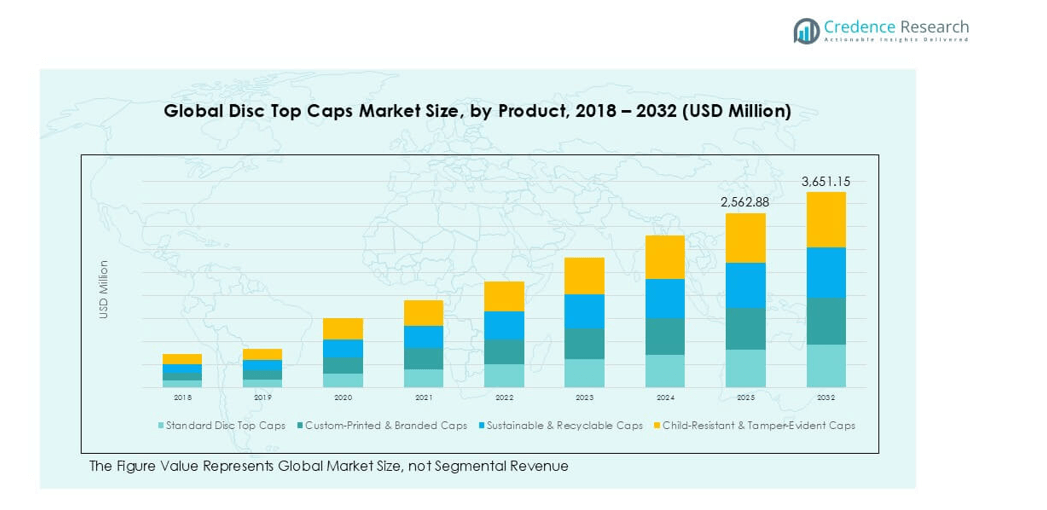

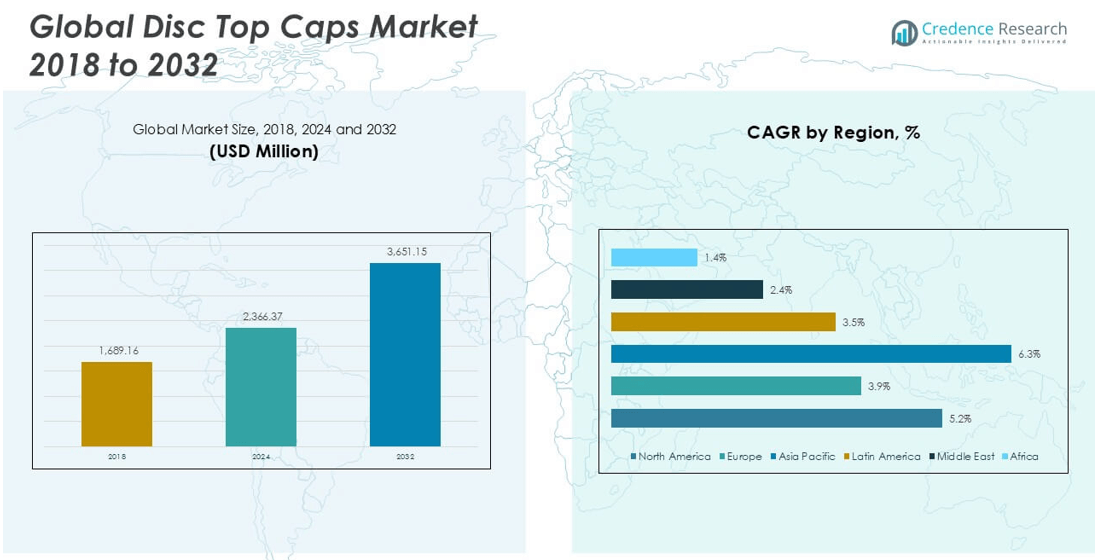

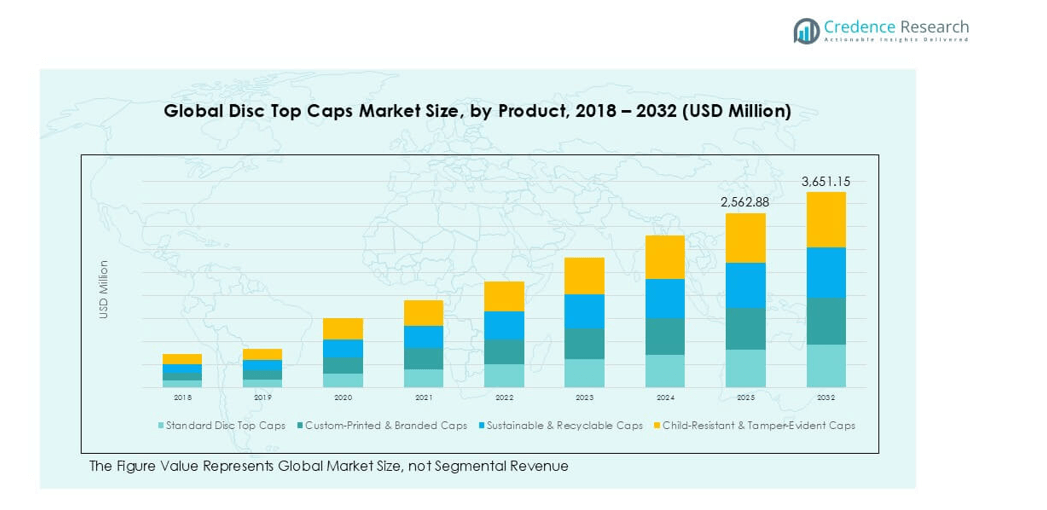

Global Disc Top Caps market size was valued at USD 1,689.16 million in 2018 and grew to USD 2,366.37 million in 2024. It is anticipated to reach USD 3,651.15 million by 2032, at a CAGR of 5.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disc Top Caps Market Size 2024 |

USD 2,366.37 million |

| Disc Top Caps Market, CAGR |

5.19% |

| Disc Top Caps Market Size 2032 |

USD 3,651.15 million |

The global disc top caps market is shaped by leading players such as Dhiren Plastic Industries, Shine Poly Packs Pvt. Ltd., Prabhoti Plastic Industries, Maheshwari Caps Private Limited, and Syscom Packaging Company, which emphasize innovation in sustainable materials and branded packaging solutions. These companies strengthen their market position through diverse product portfolios serving cosmetics, personal care, and household sectors. Regionally, North America led the market in 2024 with 43% share, driven by strong demand from premium beauty and personal care brands. Asia Pacific followed with 31% share, supported by rapid urbanization, growing disposable incomes, and rising adoption of mass and premium personal care products across China, India, and Southeast Asia.

Market Insights

- The global disc top caps market was valued at USD 1,689.16 million in 2018, reached USD 2,366.37 million in 2024, and is projected to hit USD 3,651.15 million by 2032, expanding at a CAGR of 5.19%.

- Growth is driven by rising demand from cosmetics and personal care sectors, which dominate application share, supported by consumer preference for convenience, safety, and premium packaging.

- Key trends include a strong shift toward sustainable and recyclable caps, along with customization and branding features that enhance product differentiation and appeal in competitive markets.

- The competitive landscape features companies such as Dhiren Plastic Industries, Shine Poly Packs Pvt. Ltd., Maheshwari Caps Private Limited, and Syscom Packaging Company, which focus on recyclable materials, child-resistant closures, and cost-effective solutions.

- Regionally, North America leads with 43% share in 2024, followed by Asia Pacific at 31%, while cosmetics hold the largest application share at 35%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Standard disc top caps dominated the product segment in 2024, accounting for over 40% market share. Their dominance is driven by wide adoption in cosmetics and personal care packaging due to ease of use, cost-effectiveness, and compatibility with a variety of bottles. Growing demand from mid-range and mass-market product manufacturers further strengthens this category. However, sustainable and recyclable caps are rapidly emerging, supported by rising environmental regulations and consumer preference for eco-friendly packaging. Child-resistant and tamper-evident caps also gain attention in food, pharmaceutical, and household products, ensuring product safety and compliance.

- For instance, Berry Global produced more than 3 billion plastic closures, including disc top caps, in 2023, supplying global personal care and household product companies.

By Application

Cosmetics emerged as the leading application segment, holding nearly 35% of market share in 2024. The strong presence of global beauty brands and increasing demand for premium packaging design are key growth drivers. Personal care follows closely, supported by rising use of lotions, shampoos, and skincare products packaged with disc top caps. Household products also contribute significantly, particularly in cleaning liquids and detergents, while food and beverage applications remain niche but growing in areas like sauces and syrups. The “Others” category, including healthcare packaging, offers potential for steady adoption in regulated markets.

- For instance in 2023, AptarGroup reported total company sales of $3.5 billion, and its Aptar Closures segment offers disc top cap solutions for various applications, including personal care.

Market Overview

Rising Demand from Cosmetics and Personal Care Industry

The cosmetics and personal care industry remains the largest driver of the global disc top caps market, accounting for a significant share of overall demand. These caps are widely used in lotions, shampoos, serums, and skincare products due to their convenient dispensing mechanism and sleek packaging appeal. Growing consumer spending on beauty and grooming, especially in Asia-Pacific markets like China and India, is fueling adoption. Premium brands increasingly favor disc top caps for their aesthetic value, while mid-range products rely on them for cost efficiency. Expansion of e-commerce platforms also supports growth, as brands require durable and leak-resistant packaging during shipping. With the cosmetics sector projected to expand at steady rates, the use of disc top caps is expected to grow in parallel, making this segment a central growth pillar for manufacturers.

- For instance, Aptar Beauty supplied over 2.5 billion closures and dispensing solutions in 2023, including disc top caps for global brands such as Estée Lauder and L’Oréal.

Shift Toward Sustainable and Eco-Friendly Packaging

Sustainability is a crucial growth driver as regulators and consumers demand eco-friendly packaging solutions. Disc top caps made from recyclable plastics, biodegradable materials, or post-consumer resins are gaining prominence in the market. Companies across industries are moving away from conventional single-use plastics due to rising concerns over waste and carbon footprint. In response, packaging suppliers are investing in material innovation to create lightweight, reusable, and fully recyclable cap solutions. Brands in cosmetics and personal care are leading this transition, aligning packaging strategies with global sustainability goals. For example, stricter European Union packaging directives and North American recycling policies are pushing adoption of recyclable disc top caps. As consumers increasingly prioritize products with minimal environmental impact, sustainable caps are becoming a competitive differentiator. This ongoing shift ensures a long-term growth pathway for manufacturers investing in green packaging technologies.

- For instance, Berry Global has worked with major brands, including Unilever and Procter & Gamble, to supply packaging that incorporates post-consumer recycled (PCR) plastic. An earlier claim that the company produced over 600 million PCR closures in 2023 for these companies was a misunderstanding of a 2021 announcement that stated Berry would have access to 600 million pounds of PCR content annually by 2025.

Growth in Household and Healthcare Applications

Beyond personal care, household cleaning and healthcare packaging are emerging as major contributors to disc top cap demand. Household products such as detergents, disinfectants, and surface cleaners rely on disc top caps for controlled dispensing and spill prevention, particularly in bulk and refill formats. The healthcare industry, though smaller in volume, uses disc top caps for pharmaceutical liquids, sanitizers, and antiseptics, emphasizing hygiene and safety. Rising awareness of hygiene after the COVID-19 pandemic has accelerated demand in both sectors. Manufacturers are now designing caps with tamper-evident and child-resistant features to meet strict regulatory requirements in healthcare packaging. Additionally, the increasing popularity of refill packs in household cleaning supports higher adoption of these caps, as they offer reusability and durability. This expanding use across diverse end-user categories creates new revenue streams, reinforcing market growth beyond cosmetics and personal care.

Key Trends & Opportunities

Customization and Branding as Differentiators

Customization and branding are becoming essential trends in the disc top caps market. Brands increasingly view caps not just as functional closures but also as a tool for product differentiation. Customized printing, embossing, and unique color options allow companies to create branded packaging that enhances consumer recognition on retail shelves. Premium beauty and personal care brands use custom disc top caps to signal exclusivity and align with luxury positioning. This trend also extends to mid-range segments, where branded caps provide cost-effective ways to stand out in competitive markets. With consumer preferences shifting toward personalized and visually appealing packaging, the demand for custom-printed and branded disc top caps continues to rise. Manufacturers offering flexible, design-focused solutions stand to gain from this opportunity, especially as e-commerce platforms amplify the importance of attractive packaging.

- For instance, Albea produced more than 500 million customized closures in 2023, including branded disc top caps for L’Oréal and Estée Lauder, supporting premium packaging differentiation in global beauty markets.

Expansion in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa are creating new opportunities for disc top cap manufacturers. Rapid urbanization, rising disposable incomes, and changing lifestyles are boosting demand for cosmetics, personal care, and household products in these regions. Local and global brands are expanding their product portfolios to tap into these high-growth markets, which in turn drives packaging demand. For instance, rising penetration of international beauty brands in India and Southeast Asia is accelerating adoption of disc top caps due to their premium appearance and convenience. Growing populations and the expansion of retail infrastructure further amplify this demand. As Western markets move toward saturation, emerging economies provide a crucial growth avenue for packaging companies. Disc top cap suppliers focusing on affordable, sustainable, and innovative designs tailored for these regions will capture significant opportunities in the forecast period.

Key Challenges

Raw Material Price Volatility

One of the major challenges in the disc top caps market is raw material price volatility, particularly in plastics and resins. Fluctuations in crude oil prices directly impact the cost of polypropylene (PP) and polyethylene (PE), which are the primary materials used in manufacturing caps. These unpredictable price movements squeeze profit margins for packaging suppliers, especially those unable to pass increased costs onto end-users. Volatility also affects long-term supply contracts, creating uncertainty in pricing strategies. While some manufacturers explore alternatives like bio-based plastics, these materials often come at higher costs, limiting widespread adoption. Managing supply chain disruptions and raw material inflation remains a critical challenge that can slow market growth.

Competition from Alternative Packaging Solutions

The growing presence of alternative packaging solutions poses another key challenge for disc top caps. Pump dispensers, flip-top caps, and spray closures are gaining traction across cosmetics, personal care, and household segments, offering convenience and differentiation. Some consumers prefer pumps for lotions or sprays for disinfectants, which reduces reliance on disc top caps in certain applications. Additionally, innovative closures with built-in dosing mechanisms or ergonomic designs threaten to replace standard disc top caps in niche categories. To remain competitive, manufacturers must continuously innovate in design, functionality, and sustainability. Failure to address these shifting preferences could lead to market share erosion in the long term.

Regional Analysis

North America

North America dominated the global disc top caps market in 2024, holding nearly 43% share, with a market value of USD 1,024.19 million, up from USD 738.74 million in 2018. The region is projected to reach USD 1,584.64 million by 2032, growing at a CAGR of 5.2%. Strong demand from cosmetics and personal care brands, coupled with advanced packaging innovations, drives growth. Leading manufacturers in the U.S. prioritize product safety, child-resistant designs, and sustainable materials, which further support expansion. High consumer spending on premium grooming products ensures North America’s continued leadership.

Europe

Europe accounted for 18% of the global market in 2024, reaching USD 419.39 million, compared to USD 316.64 million in 2018. By 2032, the market is forecasted to grow to USD 588.67 million at a CAGR of 3.9%. Growth is supported by stringent environmental regulations, encouraging the adoption of recyclable and eco-friendly disc top caps. The cosmetics sector in Germany, France, and Italy plays a key role, as premium brands increasingly demand sustainable closures. Despite moderate growth, Europe remains a vital market due to its innovation-driven approach and strong regulatory influence on packaging practices.

Asia Pacific

Asia Pacific held around 31% of the market share in 2024, with revenues of USD 732.61 million, rising from USD 495.69 million in 2018. The market is expected to reach USD 1,231.28 million by 2032, the highest regional CAGR at 6.3%. Rapid urbanization, expanding middle-class incomes, and the boom in cosmetics and personal care consumption in China, India, and Southeast Asia fuel demand. Global and regional brands are expanding aggressively in this market, using disc top caps for mass and premium product lines. Asia Pacific’s fast-paced adoption makes it the most attractive growth hub globally.

Latin America

Latin America represented nearly 5% of the global disc top caps market in 2024, valued at USD 108.02 million, up from USD 78.10 million in 2018. By 2032, the market will likely reach USD 147.10 million, growing at a CAGR of 3.5%. Regional demand is concentrated in Brazil and Mexico, where increasing awareness of personal care and household products is supporting packaging growth. Despite slower economic growth compared to Asia Pacific, expanding retail networks and rising consumption of affordable beauty and hygiene products ensure steady adoption of disc top caps in this region.

Middle East

The Middle East accounted for about 2% of the global market in 2024, with revenues of USD 49.55 million, up from USD 39.43 million in 2018. The market is forecast to grow to USD 61.85 million by 2032, registering a CAGR of 2.4%. Demand is supported by the premium cosmetics and personal care industry, especially in the UAE and Saudi Arabia, where consumers prefer luxury packaging. However, overall growth remains moderate due to limited manufacturing presence and reliance on imports. Increasing tourism-driven retail sales in beauty and healthcare support future adoption of disc top caps.

Africa

Africa contributed the smallest share, about 1% of the global market in 2024, valued at USD 32.62 million, rising from USD 20.54 million in 2018. By 2032, the market is expected to reach USD 37.60 million, growing at a CAGR of 1.4%. Demand is largely driven by essential personal care and household cleaning products. Limited disposable income and slower adoption of premium cosmetics restrain growth compared to other regions. However, the gradual rise in urbanization and entry of global brands in South Africa and Nigeria provide opportunities for steady but slow expansion in the disc top caps market.

Market Segmentations:

By Product

- Standard Disc Top Caps

- Custom-Printed & Branded Caps

- Sustainable & Recyclable Caps

- Child-Resistant & Tamper-Evident Caps

By Application

- Cosmetics

- Personal Care

- Household Products

- Food & Beverage

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The global disc top caps market is moderately fragmented, with a mix of regional manufacturers and specialized packaging companies competing for market share. Key players such as Dhiren Plastic Industries, Shine Poly Packs Pvt. Ltd., Prabhoti Plastic Industries, and Maheshwari Caps Private Limited focus on delivering a broad product portfolio that includes standard, branded, and sustainable cap solutions. Companies are increasingly investing in recyclable materials and custom designs to align with sustainability trends and brand differentiation. Local firms like J K Plastics, Mks Anand Enterprises, and Syscom Packaging Company strengthen their presence by serving domestic cosmetics, personal care, and household segments with cost-effective solutions. Meanwhile, A.T. Manufacturing Company, Komal Pharma, and Shri Balaji Enterprises emphasize innovation in child-resistant and tamper-evident designs, targeting regulated sectors such as healthcare and food packaging. Intense competition drives continuous improvements in product functionality, lightweight materials, and branding features, positioning sustainability and customization as key strategic priorities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Kimberly-Clark Corporation announced its plan to invest USD 2 billion in building a new manufacturing facility in Warren, Ohio, and expanding its operations in Beech Island, South Carolina. The company is investing in projects expected to create more than 900 new jobs in industrial automation and advanced manufacturing. The new facility in Warren will span over one million square feet and is designed to support growth in Kimberly-Clark’s personal care product categories.

- In June 2024, BERICAP, a Closure solution provider, announced its plan to expand production in Africa, South America, and Southeast Asia. BERICAP has announced new plants in Nairobi (Kenya), Ho Chi Minh City (Vietnam), and acquired production facilities in Lima (Peru) and Durban (South Africa). The company operates 30 production sites in 25 countries, aiming to be close to its customers in terms of project support, logistics, and services. Closures for the lubricant industry and food and beverage manufacturers will be produced there and also exported to 10 African countries.

- In May 2024, Aptar Closures launched a new e-commerce disc top closure for beauty, personal, and home care applications. The company’s E-Disc Top securely protects against in-transit leakage while eliminating the need for liners and extra shipping preparation fees. E-Disc Top can also contribute to improved sustainability for brands. The fully recyclable closure is comprised of polypropylene (PP) and is available in post-consumer recycled (PCR) content.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from cosmetics and personal care.

- Sustainable and recyclable disc top caps will gain wider adoption across all regions.

- Custom-printed and branded caps will become a key differentiator for premium products.

- Child-resistant and tamper-evident designs will see higher demand in healthcare and food.

- Asia Pacific will remain the fastest-growing region with rising consumer spending.

- North America will maintain leadership with innovation-driven packaging solutions.

- Europe will push growth through strict sustainability and recycling regulations.

- Emerging markets in Latin America and Africa will offer steady growth opportunities.

- Manufacturers will invest in lightweight materials and advanced molding technologies.

- Competitive pressure will drive continuous innovation in design and functionality.