Market Overview:

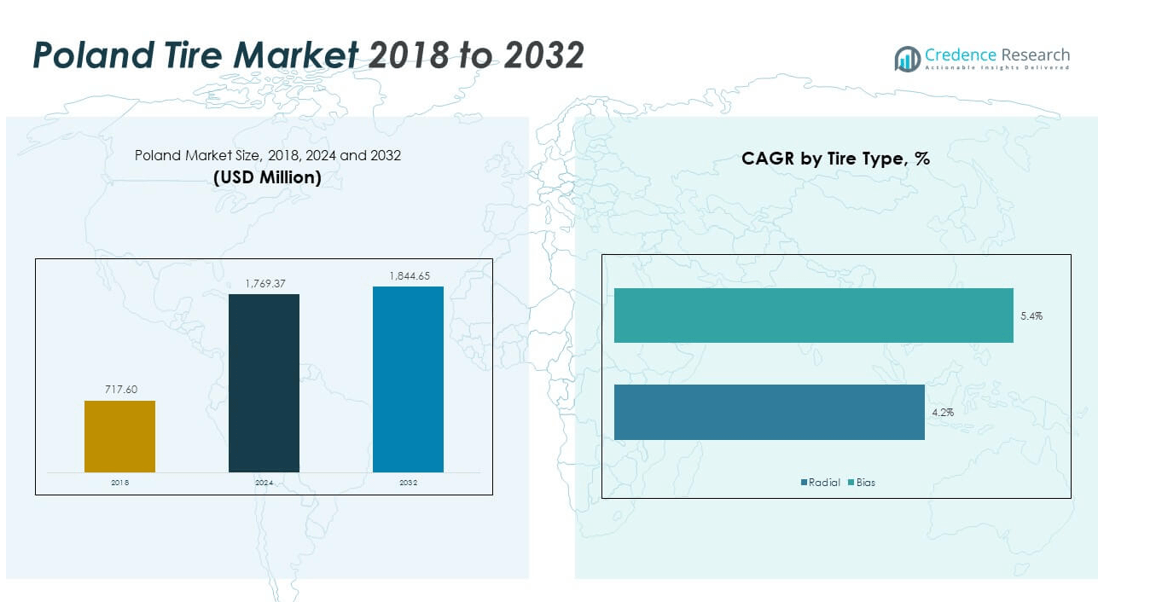

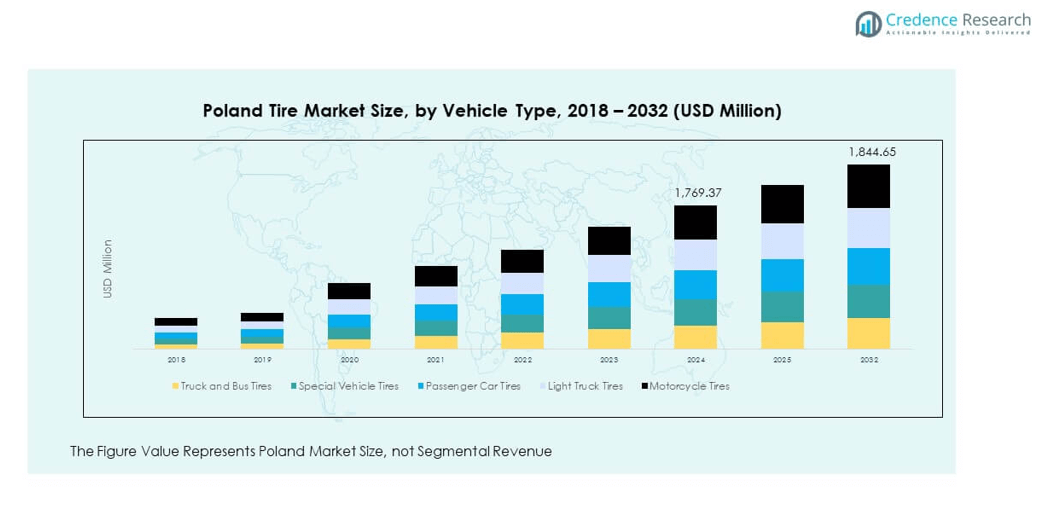

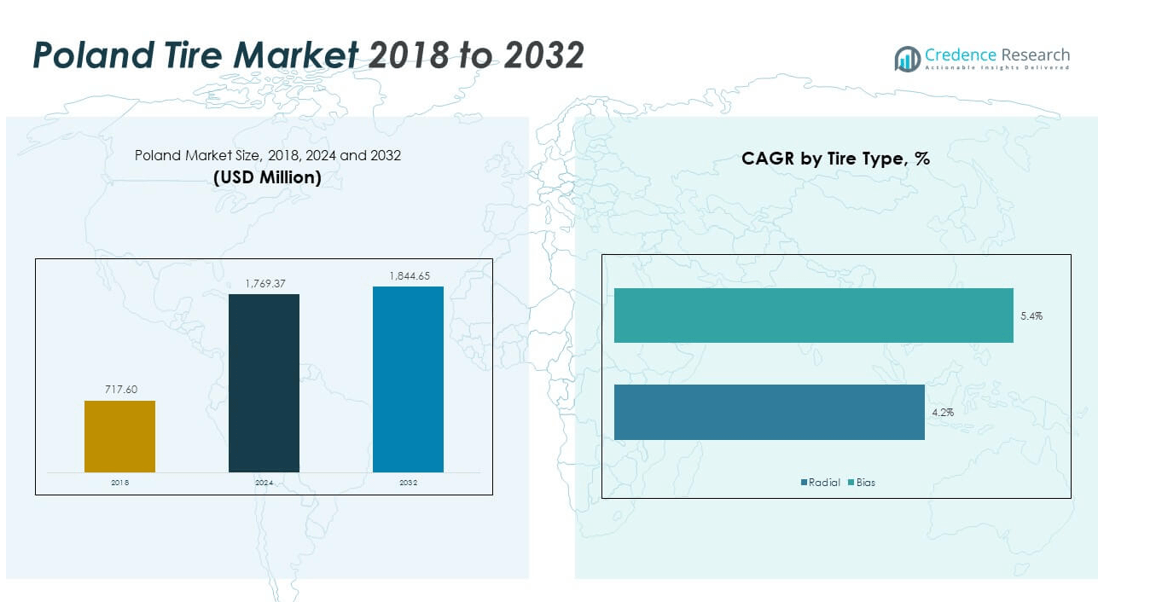

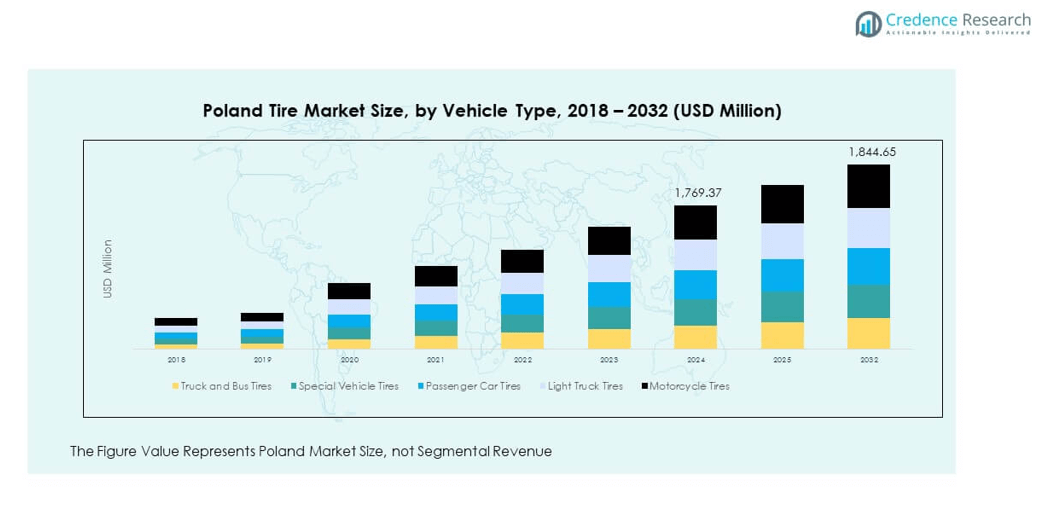

The Poland Tire Market size was valued at USD 717.60 million in 2018 to USD 1,769.37 million in 2024 and is anticipated to reach USD 1,844.65 million by 2032, at a CAGR of 0.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Poland Tire Market Size 2024 |

USD 1,769.37 million |

| Poland Tire Market, CAGR |

0.52% |

| Poland Tire Market Size 2032 |

USD 1,844.65 million |

The market is driven by the steady increase in vehicle ownership, replacement cycles, and strong logistics activities. Seasonal tire switching regulations, particularly the widespread use of winter tires, create recurring demand across consumer segments. Rising adoption of premium and durable tires supports market growth, while expanding fleet operations fuel demand for commercial vehicle tires. Advancements in radial and tubeless technologies further strengthen consumer preference. Innovation in eco-friendly designs and smart tire features also shapes the industry’s long-term development.

Western Poland leads the market due to strong industrial bases and its proximity to Germany, supporting cross-border trade and manufacturing. Central Poland emerges as a key consumption hub with Warsaw and Łódź driving demand through dense passenger car ownership and distribution networks. Eastern Poland, though less industrialized, shows growth potential with rising infrastructure projects and cross-border trade with Ukraine and the Baltic states. Regional dynamics highlight the balance between established hubs and emerging markets, shaping future expansion opportunities for manufacturers and distributors.

Market Insights

- The Poland Tire Market size was valued at USD 717.60 million in 2018, reached USD 1,769.37 million in 2024, and is projected to hit USD 1,844.65 million by 2032, registering a CAGR of 0.52% during the forecast period.

- Western Poland leads with 36% share, supported by industrial clusters and cross-border trade with Germany; Central Poland follows with 34% share due to Warsaw’s vehicle density and consumer demand; Eastern Poland holds 30% share, reflecting steady growth from infrastructure development and trade links.

- Eastern Poland is the fastest-growing region, supported by rising road investments, cross-border commerce with Ukraine and the Baltic states, and increasing demand for replacement tires across passenger and light truck segments.

- Passenger car tires dominate segmental demand with 41% share in 2024, reflecting high private vehicle ownership in urban areas, while truck and bus tires hold 27% share driven by logistics and freight transport.

- Motorcycle tires contribute 13% share in 2024, supported by rural mobility and affordable commuting, while light truck and special vehicle tires together represent 19%, reflecting steady adoption across agriculture, construction, and utility applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Vehicle Ownership and Expanding Passenger Car Fleet

The Poland Tire Market benefits from steady growth in passenger vehicle ownership across urban and semi-urban regions. Increased purchasing power and easy financing options push consumers to buy new vehicles. Passenger cars contribute the highest share to overall tire sales, creating recurring demand for replacement cycles. Seasonal weather conditions also amplify the need for winter tires. Strong consumer awareness about safety and performance drives preference for branded products. It continues to see higher replacement frequencies due to road wear and traffic intensity. Expansion of vehicle leasing services further strengthens replacement demand. This dynamic creates a consistent base for both global and regional tire manufacturers.

Growth in Logistics, Freight, and Commercial Transport Demand

Logistics and freight transport form another significant driver for the Poland Tire Market. Growing e-commerce activities and industrial output have raised the need for efficient truck and bus fleets. The demand for heavy-duty and durable tires has increased alongside road freight expansion. Poland’s central location in Europe strengthens its role as a transit hub, increasing wear and tear on truck tires. Continuous upgrades in highways and trade routes further support freight activities. Tire replacement cycles in commercial fleets remain frequent due to longer routes and higher loads. It benefits from fleet operators opting for premium tires to reduce downtime and fuel costs. This segment ensures stable long-term growth.

- For instance, Bridgestone’s Duravis R002 truck tires tested with 17 fleets across Europe deliver up to 45% improved wear life and 15% lower cost per kilometer versus the previous generation, a result confirmed by both company data and independent European fleet testing since their introduction to the Polish logistics sector.

Impact of Regulatory Standards and Seasonal Tire Switching Policies

Government regulations mandating seasonal tire use strongly impact the Poland Tire Market. Winter tire adoption is high due to cold weather conditions and strict compliance requirements. Consumers are compelled to purchase both summer and winter sets, increasing overall sales volume. Road safety campaigns highlight the importance of using appropriate tires across different seasons. Regulatory frameworks ensure continuous demand even when vehicle sales slow. It reflects a unique characteristic of the Polish market compared to Western Europe. Insurance companies also promote seasonal compliance, further stimulating tire replacement. This regulatory environment gives both global and regional brands consistent business opportunities.

Technological Advancements in Tire Durability and Safety Features

Innovation plays a key role in strengthening the Poland Tire Market. Manufacturers continue investing in tires with longer tread life, better grip, and improved rolling resistance. Advancements in radial and tubeless technologies improve performance and safety across vehicles. Smart tire solutions with sensors enhance monitoring and predictive maintenance for fleets. Companies leverage R&D to reduce fuel consumption and environmental impact. Demand for sustainable materials also pushes product diversification in the premium segment. It benefits from global innovation trends, bringing advanced designs into Poland’s competitive market. Growing consumer awareness of technology-driven features supports adoption. These advancements ensure long-term product differentiation and growth.

- For instance, Goodyear’s SightLine intelligent tire technology, deployed on commercial fleets in 2024, provides real-time tire-road friction estimates successfully detecting low grip conditions and helping autonomous delivery fleets optimize braking and handling under wintry conditions, as proven in collaboration with Gatik and PlusAI.

Market Trends

Increasing Digital Transformation Across Tire Sales and Distribution Channels

The Poland Tire Market is witnessing significant changes in sales models driven by digitalization. Online platforms are gaining traction as consumers value convenience and broader product selection. Exclusive dealers still dominate, but e-commerce channels are expanding their reach rapidly. Growth of digital payment solutions enhances consumer trust in online tire purchasing. It benefits from improved logistics networks that support faster delivery. Market players are investing in online portals and apps to strengthen customer loyalty. Independent dealers are also adopting hybrid models to compete with larger online retailers. This digital trend reshapes how consumers access tires across the country.

Sustainability and Eco-Friendly Tire Manufacturing Practices

Global sustainability initiatives strongly influence the Poland Tire Market. Manufacturers are adopting eco-friendly raw materials and energy-efficient production techniques. Consumer preference for low-emission and recyclable products creates a strong pull for sustainable tires. It benefits from EU environmental regulations that emphasize greener mobility solutions. Companies invest in R&D to launch tires with reduced rolling resistance for better fuel efficiency. The shift toward electric vehicles also fuels demand for specialized eco-tires. Green branding strategies help tire companies gain a competitive edge in urban markets. This trend ensures alignment between market demand and environmental priorities.

- For instance, Michelin reported in its 2024 Sustainability Progress update a 37% reduction in CO₂ emissions (Scopes 1 and 2) since 2019 across global manufacturing, including Poland, along with increasing the share of recycled or renewable materials in its tires to 31% as of June 2025. The company further debuted two tires approved for road use one for cars and one for buses using 45% and 58% sustainable materials.

Adoption of Smart Tire Technologies for Performance Monitoring

Smart tire technologies are gaining momentum in the Poland Tire Market. Embedded sensors and IoT solutions support predictive maintenance and improve safety for fleets. Fleet operators adopt these technologies to minimize operational downtime. Advanced monitoring tools track pressure, temperature, and tread wear in real time. It strengthens fleet management efficiency while reducing fuel costs and accidents. Global players lead this trend by integrating AI-based platforms into tire products. Consumers also show interest in advanced safety features, boosting retail demand. The smart tire segment evolves as a critical innovation area in Poland.

- For instance, Continental publicly announced at TOC Europe 2025 the rollout of smart tire and digital fleet service solutions for Polish logistics and fleet operators, emphasizing embedded sensors and real-time data monitoring for improved efficiency, safety, and predictive maintenance. The company’s smart tire technologies are being implemented in Poland as a part of its broader European digital transformation drive for fleets.

Rising Popularity of Premium Tire Brands Among Urban Consumers

The Poland Tire Market shows strong traction for premium tire brands in major cities. Rising disposable incomes and awareness of quality products fuel demand in Warsaw, Kraków, and Wrocław. Consumers increasingly value durability, safety, and branded performance features. It benefits from global tire companies expanding retail footprints in Poland. Luxury car ownership and corporate fleets support premium tire adoption. Seasonal tire switching further strengthens demand for high-quality products. Marketing strategies focus on brand trust and innovation to capture urban buyers. This trend solidifies premium positioning in Poland’s competitive tire market.

Market Challenges Analysis

Rising Competition and Pricing Pressure Across Distribution Channels

The Poland Tire Market faces challenges from intensifying competition between global leaders and regional players. Price sensitivity among consumers forces companies to balance premium offerings with affordability. Local distributors introduce low-cost alternatives, increasing pressure on global brands. It struggles with balancing high R&D investment against market price expectations. Smaller players adopt aggressive pricing, creating margin constraints. Dealer loyalty programs and online discounts deepen price competition. Companies need to differentiate through service, durability, and innovation to stay competitive. Sustaining profitability under these conditions remains a pressing challenge for the market.

Economic Volatility and Dependence on Seasonal Demand Patterns

The Poland Tire Market is highly dependent on seasonal demand cycles. Economic uncertainties such as inflation and slower vehicle sales directly impact consumer spending. Seasonal tire regulations boost volumes but create fluctuations in quarterly demand. It relies on stable economic conditions to sustain premium tire growth. Rising raw material costs increase manufacturing expenses, squeezing margins further. Global supply chain disruptions affect availability and delivery schedules. Fluctuations in fuel and transport prices create further instability. Managing these risks remains critical to ensuring long-term stability in the tire industry.

Market Opportunities

Expansion of Infrastructure and Growth in Logistics Activities

The Poland Tire Market has growth opportunities driven by infrastructure upgrades and expanding logistics activities. New highways and cross-border trade routes stimulate higher demand for commercial vehicle tires. Logistics operators prefer premium and durable tires for long-haul operations. It benefits from Poland’s position as a key European transit hub. Expansion of warehousing and distribution centers creates demand for efficient fleet operations. Continuous growth in e-commerce further raises freight volumes. This combination enhances long-term growth prospects for truck and bus tire sales.

Rising Demand for Innovative and Sustainable Tire Solutions

The Poland Tire Market has significant opportunities in innovative and sustainable tire offerings. Consumers increasingly seek tires with longer life, better efficiency, and eco-friendly attributes. Manufacturers investing in advanced radial and smart tire technologies can secure competitive advantages. It benefits from EU regulations promoting sustainable practices across the automotive sector. Demand for specialized tires for electric vehicles is expected to expand further. Expansion of premium product portfolios can capture growing urban consumer interest. Sustainable product strategies will create lasting opportunities for both global and regional players.

Market Segmentation Analysis

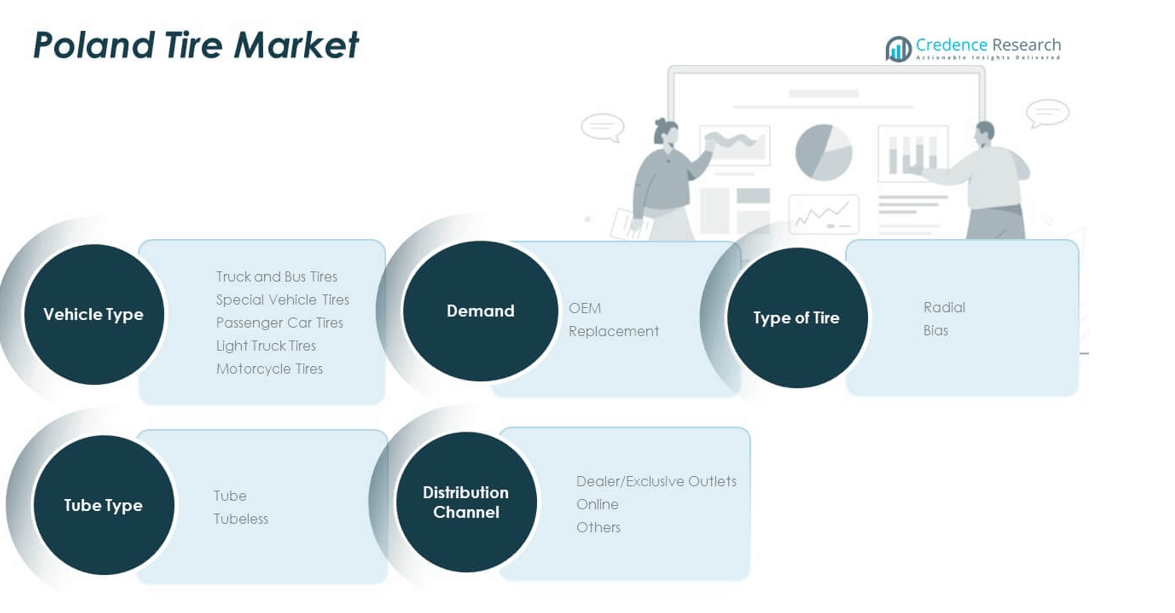

The Poland Tire Market is segmented by vehicle type, demand, tire type, tube type, and distribution channel.

By vehicle type, passenger car tires dominate due to high private vehicle ownership in urban centers. Truck and bus tires hold steady demand from freight and logistics, while light truck and motorcycle tires contribute niche growth. Special vehicle tires remain a smaller segment but show potential in construction and agriculture.

By demand, replacement tires account for the majority share, driven by an aging vehicle fleet and seasonal changes, especially the widespread use of winter tires. OEM tires support growth through Poland’s automotive production base but remain smaller compared to the replacement segment. It benefits from consistent replacement cycles, which ensure stable market performance.

By tire type, radial tires lead due to their durability and efficiency, while bias tires serve specific applications in older or specialized vehicles.

- For instance, Bridgestone unveiled its new R273 Ecopia and Duravis M705 radial tires with ENLITEN technology at TMC 2025, verified to provide improved fuel economy and increased tread durability for high-mileage fleets.

By tube type, tubeless tires outpace tube-type tires, supported by performance advantages and safety benefits.

- For instance, Apollo Tyres’ five-year strategic plan in Europe includes doubling truck and bus radial tire (TBR) output at its Hungary plant, with verified expansion to cover 90% of TBR market size and specification requirements by 2025.

By distribution channel, dealer and exclusive outlets dominate through established networks, while online sales are rising quickly with the expansion of e-commerce platforms. Other channels contribute smaller volumes but improve accessibility in rural areas. These segmental dynamics highlight a market shaped by consumer preferences, regulatory requirements, and evolving distribution models.

Segmentation

By Vehicle Type

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

By Demand

By Type of Tires

By Tube Type

By Distribution Channel

- Dealer/Exclusive Outlets

- Online

- Others

Regional Analysis

Western Poland accounts for 36% share of the Poland Tire Market, driven by strong automotive clusters and industrial bases in Poznań and Wrocław. The concentration of manufacturing plants and logistics hubs supports demand for both passenger car and truck tires. It benefits from access to Germany and Czechia, which strengthens trade flows. Tire replacement demand remains steady due to high vehicle density and advanced road infrastructure. Local distributors expand their footprint to serve both retail and fleet customers. The region’s industrial activities create consistent opportunities for tire manufacturers.

Central Poland holds 34% market share, anchored by Warsaw and Łódź as key consumption centers. Rising passenger vehicle ownership and expanding commercial transport fuel demand for diverse tire categories. OEM supply networks support regional automotive production, while replacement tires remain a major revenue stream. Distribution channels, including exclusive dealers and online platforms, enhance availability. It benefits from infrastructure modernization projects that increase road traffic. Consumers show preference for premium tire brands in urban centers. This mix sustains long-term stability in the central region.

Eastern Poland contributes 30% market share, led by emerging demand in Lublin, Białystok, and border regions. It faces slower industrialization compared to western and central regions but shows growth potential from rising cross-border trade with Ukraine, Belarus, and the Baltic states. Rural demand supports motorcycle and light truck tires, while urban centers drive passenger car tire sales. Replacement demand is higher due to older vehicle fleets. Distribution expansion by regional players improves availability of radial and tubeless tires. Growth prospects remain attractive as infrastructure investments progress.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Poland Tire Market features strong competition among global and regional manufacturers. Leading companies such as Goodyear Dunlop, Michelin, Continental, Bridgestone, and Pirelli dominate through established brand presence and advanced product portfolios. These players leverage investments in research and development to enhance durability, safety, and fuel efficiency. It reflects a market where premium tire makers strengthen positions by meeting demand for high-performance products. Hankook, Kumho, and Nokian focus on competitive pricing and niche offerings, particularly in winter and radial segments. Regional distributors strengthen their presence by improving aftersales services and expanding dealer networks. Market competition also intensifies with rising demand for replacement tires, giving both global and local brands opportunities to capture share. Companies pursue mergers, product launches, and regional expansions to maintain growth momentum. Competitive intensity remains high, shaping strategies across distribution, technology adoption, and service innovation.

Recent Developments

- In September 2025, Bridgestone launched the Alenza Prestige tire, a premium highway tire for crossovers, SUVs, and trucks, reflecting the company’s push to optimize its product range across key markets, including Poland. In addition, Bridgestone has continued to invest in capacity upgrades at its Poznan, Poland site to expand manufacturing volume and efficiency, with substantial investments in state-of-the-art equipment.

- In September 2025, Nokian Tyres issued its latest press releases, highlighting ongoing expansion in Eastern Europe and its focus on sustainable tire technologies targeting winter and premium vehicle segments. Nokian has increased investments and partnerships to grow its dealer and service network in Poland ahead of the winter season.

- In August 2025, Grupa Recykl, a leading Polish tire recycling company, completed the acquisition of Lithuanian logistics firm APG. This strategic move, finalized August 14, 2025, expands Grupa Recykl’s reach across the Baltic and Scandinavian regions and leverages a €6 million foreign-expansion loan from PFR TFI to boost its European collection operations and processing capacity for end-of-life tires. The company now processes 140,000 tonnes annually at its Polish sites.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Demand, Type of Tires, Tube Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium passenger car tires will expand due to rising vehicle ownership.

- Replacement tires will remain the strongest revenue stream with steady consumer adoption.

- Winter tire regulations will sustain seasonal sales, benefiting global and regional brands.

- Growth in logistics and freight transport will increase demand for truck and bus tires.

- Online distribution will gain traction as digital retail channels strengthen market presence.

- OEM supply will expand alongside Poland’s role as an automotive production hub.

- Tubeless tire adoption will grow rapidly, supported by safety and performance advantages.

- Regional trade flows with Germany, Czechia, and Ukraine will boost cross-border tire sales.

- Technological advancements in radial tires will shape product innovation strategies.

- Competitive intensity will stay high, with players focusing on pricing, branding, and service.