Market Overview:

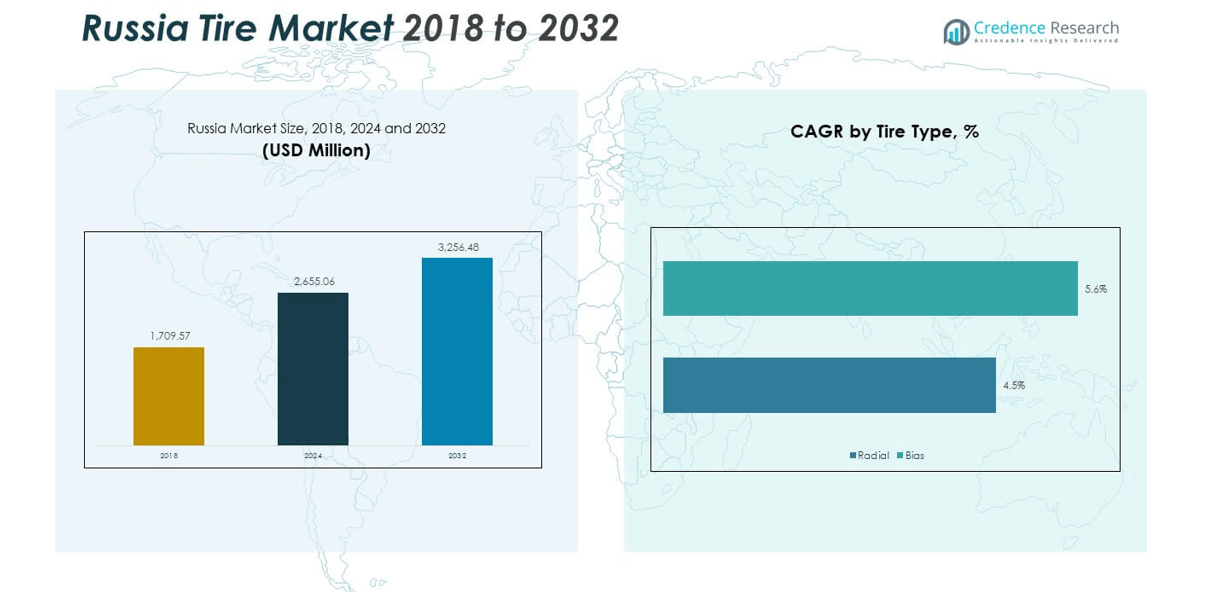

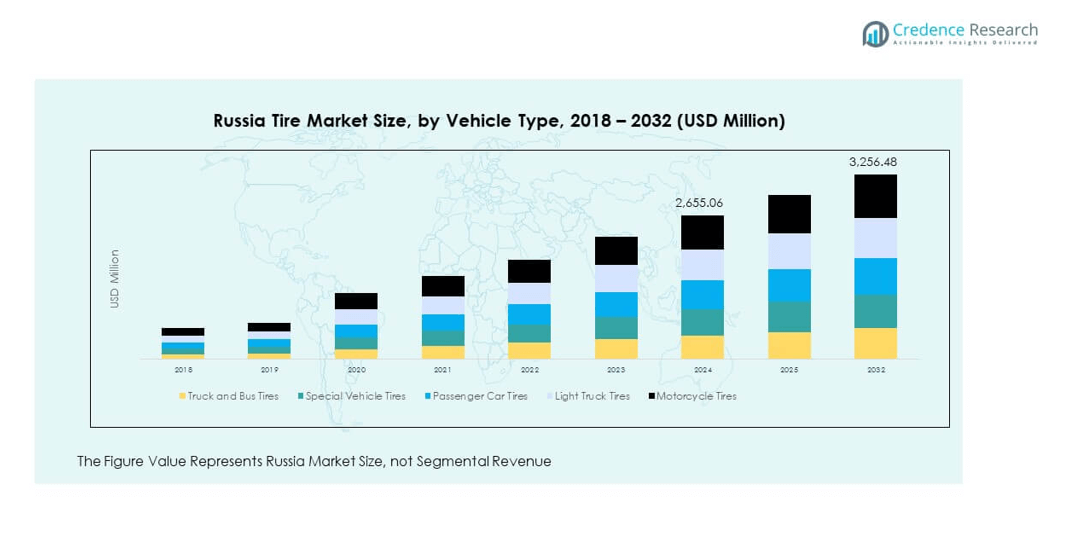

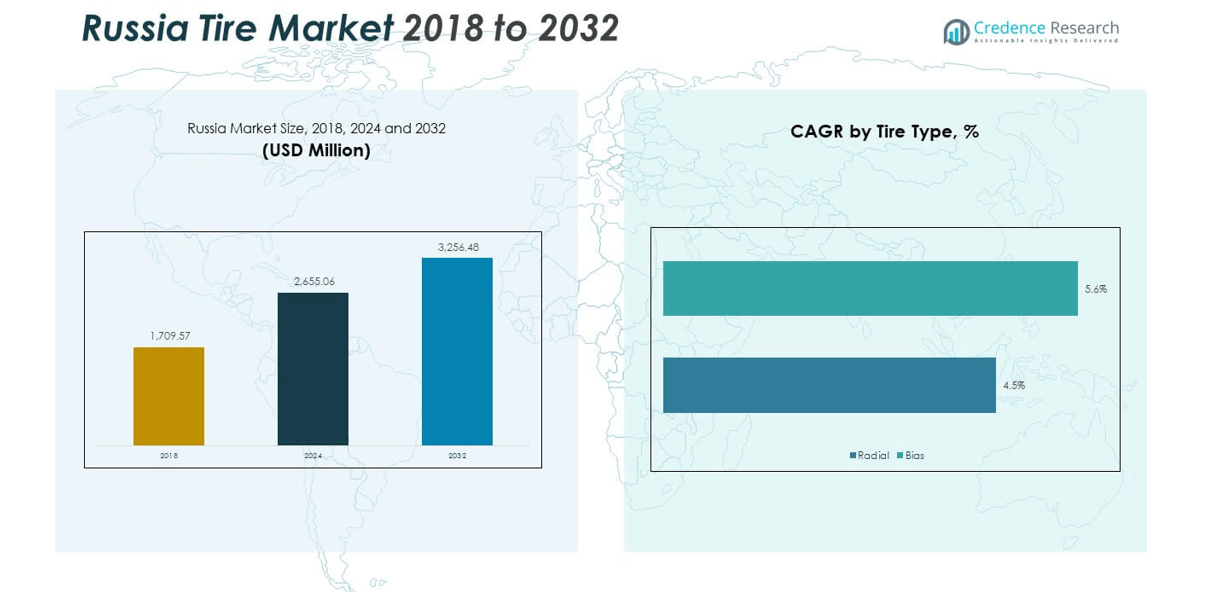

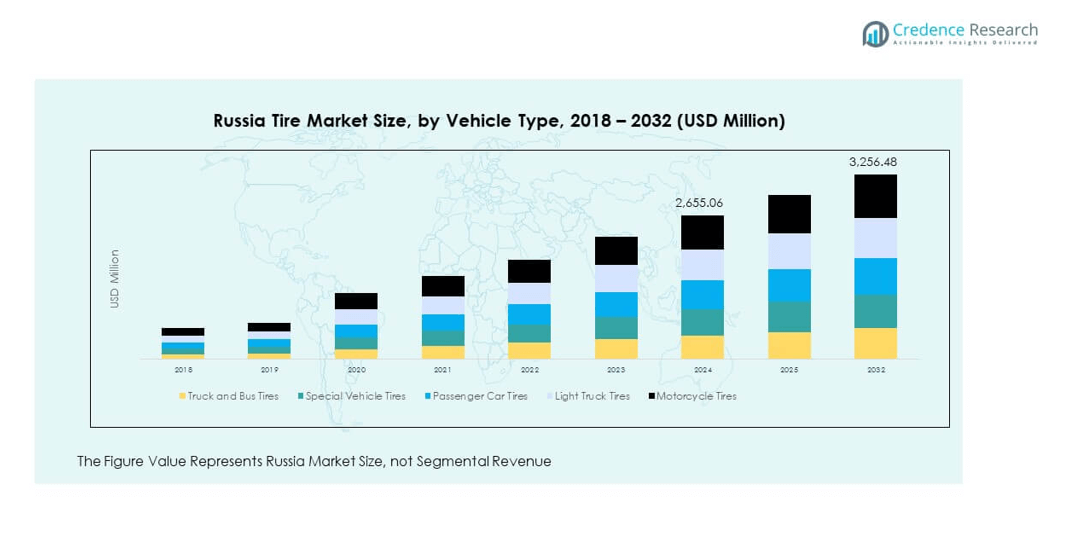

The Russia Tire Market size was valued at USD 1,709.57 million in 2018 to USD 2,655.06 million in 2024 and is anticipated to reach USD 3,256.48 million by 2032, at a CAGR of 2.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Tire Market Size 2024 |

USD 2,655.06 million |

| Russia Tire Market, CAGR |

2.59% |

| Russia Tire Market Size 2032 |

USD 3,256.48 million |

The Russia Tire Market is driven by steady vehicle ownership growth, rising replacement cycles, and strong demand for winter tires. Expanding road infrastructure and industrial development create consistent need for commercial and heavy-duty vehicle tires. Consumers increasingly prefer advanced radial and tubeless designs that enhance performance, safety, and fuel efficiency. Strict safety regulations and mandatory winter tire usage further accelerate demand. It also benefits from e-commerce expansion, which strengthens product accessibility across urban and rural areas. Manufacturers focus on product innovation and localized production to capture market share.

Western Russia remains the leading region due to high population density, modern infrastructure, and strong consumer purchasing power. Moscow and St. Petersburg dominate with large fleets of passenger and commercial vehicles, supported by organized dealership networks. Central Russia holds a strong share, with industrial hubs and logistics driving truck and bus tire demand. Eastern Russia emerges gradually, supported by infrastructure projects, resource exploration, and seasonal tire replacement requirements. It holds strong potential for long-term growth as distribution networks improve and consumer demand diversifies across rural and urban centers.

Market Insights

- The Russia Tire Market size was USD 1,709.57 million in 2018, reached USD 2,655.06 million in 2024, and is projected to hit USD 3,256.48 million by 2032, growing at a CAGR of 2.59%.

- Western Russia held the largest share at 42% in 2024, driven by higher vehicle density and strong purchasing power. Central Russia followed with 35%, supported by industrial hubs and logistics activity. Eastern Russia contributed 23%, reflecting infrastructure expansion and mining operations.

- Eastern Russia is the fastest-growing region with 23% share, supported by trade routes, construction projects, and resource-driven industries that demand specialized tires.

- Passenger car tires held the largest segment share at 46% in 2024, supported by high ownership rates and frequent replacement cycles.

- Truck and bus tires accounted for 27% share, fueled by logistics, freight transport, and heavy construction demand across industrial corridors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Vehicle Ownership and Expanding Replacement Demand

The Russia Tire Market is strongly influenced by the steady increase in vehicle ownership. More households purchase cars, raising demand for both new and replacement tires. It benefits from growing disposable income in urban regions where personal mobility is a priority. Higher replacement cycles boost sales, especially for winter tires that wear quickly under severe conditions. Passenger vehicle growth is a consistent driver, supported by financing and dealership promotions. Commercial fleet operators also contribute, replacing tires regularly to ensure safety standards. The replacement segment forms a large portion of the market’s revenue base. Strong consumer awareness of tire performance and safety sustains steady product turnover.

- For example, Cordiant introduced the Polar SL winter tire with its two-component SMART-MIX compound, designed to enhance grip on ice and snow by 7% compared with previous models (Cordiant official product description).

Infrastructure Development and Expansion of Commercial Transport Networks

Infrastructure development across Russia is shaping demand for commercial and heavy-duty tires. Road construction projects expand long-distance freight networks, increasing stress on logistics vehicles. It creates higher consumption of durable and specialized truck tires suited for rough terrains. Government focus on modernizing highways and intercity transport corridors adds to sustained demand. Mining and construction activities in remote regions also elevate tire requirements for heavy equipment. The Russia Tire Market benefits from reliable demand generated by industrial expansion. Transport companies aim for tires that improve fuel efficiency and reduce downtime. The commercial vehicle fleet continues to expand, reinforcing long-term growth in the tire sector.

Technological Advancement in Tire Manufacturing and Product Innovation

Tire manufacturers introduce advanced designs that strengthen traction, durability, and fuel efficiency. The Russia Tire Market experiences demand for radial and tubeless tires that enhance performance. Consumers prefer tires with improved safety features, particularly in icy and wet conditions. It drives producers to focus on tread patterns and advanced rubber compounds. Local manufacturing bases collaborate with global players to integrate modern production technologies. Advanced testing facilities allow companies to validate performance under extreme weather. Higher adoption of smart tires with embedded sensors signals a shift toward connected mobility. Consumers adopt such products for monitoring tire health and preventing accidents. Tire innovations help improve customer satisfaction and brand loyalty.

- For instance, Bridgestone’s Ecopia ENLITEN range, launched in November 2023, delivers a 12% reduction in rolling resistance for truck drive axles and 8% for steer axles compared to the previous Ecopia generation, boosting fuel efficiency for commercial fleets.

Regulatory Influence and Focus on Road Safety Standards

Government regulations on vehicle safety encourage consistent tire replacements. The Russia Tire Market gains from rules enforcing winter tire usage during harsh months. Road safety campaigns raise awareness about the role of tire performance in accident prevention. Consumers respond by purchasing quality products certified under local and international standards. It strengthens the position of companies offering reliable safety-compliant tires. Import restrictions on certain categories also stimulate domestic production and sourcing. Policy frameworks promote innovation in environmentally sustainable tire designs. Strict compliance pressures ensure that producers continuously adapt to evolving market regulations. The regulatory framework aligns consumer behavior with safer tire adoption.

Market Trends

Growing Adoption of Winter-Specific and All-Season Tire Solutions

Consumer preference is shifting toward winter-specific and all-season tires. The Russia Tire Market reflects strong demand in regions with prolonged cold seasons. It shows growth in specialized tires offering grip and safety in snow. Global and domestic producers target urban and rural markets with seasonal variants. Consumers increasingly value safety and adaptability over low-cost alternatives. Fleet operators purchase winter tires in bulk to meet compliance standards. Availability of premium tread compounds ensures steady adoption of innovative solutions. Seasonal patterns of demand make winter and all-season products key growth drivers for suppliers.

- For instance, Nokian Tyres captured a 19% share of studded winter tire sales on Avito in Russia in September 2024 more than double Pirelli’s 8% highlighting its advanced grip and winter technology performance favored by Russian consumers.

Increasing Popularity of Online Retail Channels for Tire Purchases

The retail landscape is changing with the growth of online tire sales. The Russia Tire Market is supported by digital platforms offering a wide range of models. Consumers use online tools to compare performance, price, and warranty options. It allows easy scheduling of installation services through integrated dealer networks. E-commerce growth ensures wider product accessibility, especially outside urban centers. Price transparency drives competition, encouraging manufacturers to enhance product visibility. Digital promotions increase consumer trust and adoption of premium brands. Rising internet penetration across regions enhances the long-term potential of online tire distribution.

Emphasis on Sustainable Tire Manufacturing and Eco-Friendly Materials

Tire producers are investing in sustainable designs and raw materials. The Russia Tire Market reflects rising demand for eco-friendly products. It leads to development of tires with reduced rolling resistance and recyclable content. Regulations push manufacturers to minimize carbon emissions in production. Consumers show preference for brands highlighting environmental responsibility. Global firms share expertise in integrating renewable materials into manufacturing processes. Domestic companies adapt to eco-driven preferences by innovating designs. A strong focus on sustainability sets a long-term trend shaping consumer and producer strategies.

- For instance, EcoStar Factory LLC opened the largest tire recycling facility in Russia’s Far East near Vladivostok in June 2024, with an annual capacity to recycle up to 10,000 tonnes of end-of-life tires into rubber crumb, demonstrating significant progress in regional tire recycling infrastructure.

Adoption of Smart Tire Technologies and Connected Mobility Solutions

Smart tire technologies are gaining attention in commercial and passenger segments. The Russia Tire Market benefits from the rise of digital monitoring solutions. It improves safety through sensors that track tire pressure and tread wear. Fleet operators adopt smart tires to reduce downtime and increase efficiency. Automakers integrate connected tires into new vehicle models, enhancing performance and control. Consumers embrace advanced technology for real-time monitoring of driving safety. Manufacturers collaborate with tech firms to deliver embedded sensor solutions. Smart tires mark the beginning of a trend aligning the market with intelligent mobility systems.

Market Challenges Analysis

Geopolitical Tensions and Supply Chain Disruptions Impacting Market Stability

The Russia Tire Market faces challenges linked to geopolitical conditions and trade restrictions. Sanctions and import limitations disrupt supply chains, affecting raw material availability. It pushes manufacturers to rely on local suppliers, raising production costs. Foreign investment in tire production declines due to political uncertainties. Logistics networks experience volatility, delaying distribution schedules. Small-scale producers find it difficult to compete with established players. Dependence on external machinery and technologies creates risks of operational inefficiency. These challenges make stability and consistent supply a pressing concern for the industry.

Intense Competition and Price Pressure Affecting Profit Margins

High competition among domestic and international tire manufacturers creates pricing pressure. The Russia Tire Market sees new entrants offering budget-friendly alternatives to established brands. It forces companies to cut costs while sustaining quality. Premium tire brands face difficulty in convincing consumers to pay higher prices. Rising material and energy costs strain margins further. Producers seek to differentiate through innovation, yet consumers remain highly price-sensitive. Smaller firms lack the capacity to invest in research or advanced facilities. Competition creates a market environment where profit margins remain under pressure.

Market Opportunities

Expansion of Local Manufacturing and Strengthening of Domestic Capabilities

Investment in domestic production offers strong opportunities for the Russia Tire Market. It reduces reliance on imports and improves supply chain resilience. Companies expand factories to meet rising demand for passenger and commercial vehicle tires. Modernization of facilities with automation enhances efficiency and cost competitiveness. Local producers strengthen partnerships with international firms for knowledge transfer. Government support in terms of subsidies encourages capacity expansion. Tire manufacturers that invest in regional hubs secure better access to emerging markets. Domestic expansion opens pathways for sustainable long-term growth in the sector.

Innovation in Premium and Specialized Tire Segments for Long-Term Growth

Demand for premium and specialized tires creates space for innovation. The Russia Tire Market benefits from consumer preference for safety, performance, and durability. It pushes companies to focus on advanced winter tires, eco-friendly options, and smart solutions. Premium brands differentiate themselves by highlighting unique performance features. Niche segments like off-road and heavy-duty equipment tires present growth opportunities. Collaboration with automotive manufacturers strengthens innovation pipelines. Companies offering specialized products build strong consumer trust and higher brand recognition. Premiumization offers a route for sustainable revenue growth in a competitive environment.

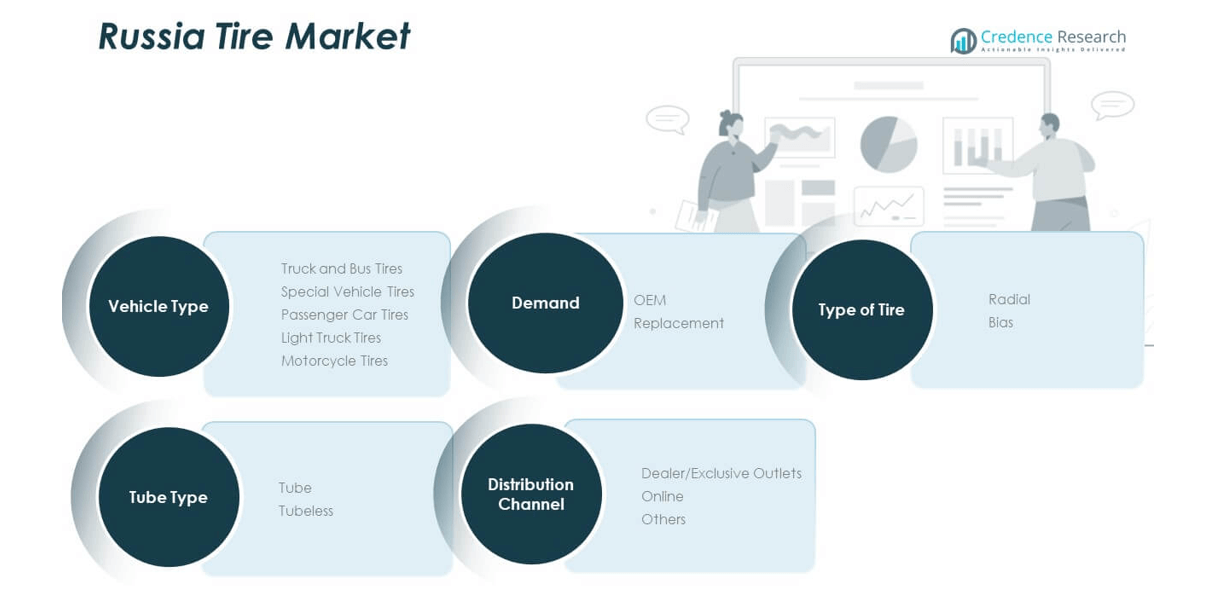

Market Segmentation Analysis

By vehicle type, passenger car tires dominate the Russia Tire Market, supported by high ownership rates and frequent replacement cycles. Truck and bus tires form the next significant category, driven by logistics, freight transport, and construction activities. Light truck tires gain momentum through rising demand for small commercial vehicles, while motorcycle tires remain niche with steady adoption. Special vehicle tires serve industries like mining and agriculture, creating consistent demand for durable and heavy-duty designs.

- For example, Nokian Tyres launched the Hakkapeliitta R5 in 2022, featuring a tread design that shortens braking distance on ice by up to 6 metres (0–80 km/h) compared to its predecessor, with an overall 4% improvement in winter performance.

By demand, the replacement segment leads the market, reflecting the country’s harsh climate and seasonal need for winter tires. It generates recurring sales as consumers replace worn products more frequently. OEM demand remains stable, supported by ongoing automotive manufacturing and assembly operations in domestic plants. Vehicle production levels influence this segment’s performance but replacement maintains dominance due to established cycles.

By type of tires, radial tires hold the majority share, driven by superior performance, fuel efficiency, and safety. Bias tires still find applications in heavy-duty and off-road vehicles where durability under extreme conditions is required.

By tube type, tubeless tires gain preference for passenger and light vehicles because of safety and convenience, while tube tires maintain use in commercial fleets and rural areas.

- For example, Bridgestone Americas launched the W920 tire in August 2025, built with next-generation ENLITEN technology to provide extended wear life and improved traction for commercial fleet trucks, replacing the previous W919 model.

By distribution channel, dealer and exclusive outlets dominate through established networks offering reliability and service. Online channels expand steadily, offering convenience, price comparison, and wider product access. Other channels include retail partnerships in regional markets, ensuring broader accessibility to diverse consumer groups.

Segmentation

By Vehicle Type

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

By Demand

- OEM (Original Equipment Manufacturer)

- Replacement

By Type of Tires

By Tube Type

By Distribution Channel

- Dealer/Exclusive Outlets

- Online

- Others

Regional Analysis

Western Russia holds the largest share of the Russia Tire Market, accounting for 42%. The region benefits from higher population density, advanced infrastructure, and strong vehicle ownership. Moscow and St. Petersburg remain the main hubs of demand, with passenger and commercial segments driving sales. Strong economic activity in these cities ensures steady replacement demand. It maintains dominance through high purchasing power and strong dealership networks. Global tire manufacturers prioritize this region for premium and mid-range product lines.

Central Russia captures 35% of the market, supported by industrial hubs and logistics operations. The segment grows on the back of road freight and heavy-duty vehicle activity. OEM demand remains stable with automobile plants located in key cities. Tire sales are influenced by strong activity in mining and manufacturing sectors. It also benefits from replacement cycles in both passenger and commercial categories. Consumers in these regions value durable and cost-effective tire solutions. Central Russia continues to strengthen its market base by balancing industrial and consumer demand.

Eastern Russia contributes 23% share, with rising activity in trade, resource exploration, and infrastructure expansion. The vast geography requires specialized tires for heavy vehicles, particularly in construction and mining. Demand is also supported by growing mobility in regional cities. It shows strong opportunities for growth as infrastructure projects increase. Seasonal tire demand remains high due to extreme climatic conditions. Distribution networks are less developed, but digital platforms expand accessibility. Eastern Russia is gradually emerging as a high-potential growth corridor.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Russia Tire Market features strong competition between global and domestic players. Leading companies such as Michelin, Bridgestone, Continental, and Pirelli maintain a solid presence by offering premium and mid-range solutions. Domestic producers and regional brands compete aggressively in price-sensitive segments, targeting replacement demand. It benefits from consumer diversity, where some prioritize safety and performance while others seek affordability. Global players leverage advanced technologies, eco-friendly materials, and smart tire innovations to maintain their edge. Local manufacturers, however, respond by expanding production capacity and improving distribution networks. Strong competition pushes companies to strengthen after-sales services and warranty offerings. The market structure remains fragmented, with both established leaders and niche specialists competing for share. Tire manufacturers focus on building customer loyalty and expanding into underserved regions. Competitive intensity ensures innovation and cost optimization stay central to growth strategies.

Recent Developments

- In March 2025, JSC Cordiant launched commercial tire production at the former Bridgestone facility in Ulyanovsk, Russia, following the acquisition of the plant after Bridgestone’s exit from the country. This restart allows the renamed Gislaved Ulyanovsk factory to deliver up to 2.4 million passenger vehicle tires annually, boosting Cordiant’s ability to meet the rising domestic demand and stabilizing the Russian tire market during a period of significant transition.

- In June 2024, Ecostar Factory opened a second facility in Vladivostok, aiming to recycle more than 10,000 tonnes of end-of-life tires per year and tripling its capacity in five years. This expansion, with a total investment of USD 500,000, highlights Russia’s growing emphasis on sustainability and the burgeoning demand for eco-friendly and retreaded tires within the market.

- In March 2023, Nokian Tyres completed the sale of its Russian operations to Tatneft PJSC, fully exiting the market and transferring all local personnel to the new owner. The company has since increased capacity at its Finnish and U.S. factories and invested €650 million in new zero-carbon supply capability to strengthen its European supply network.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Demand, Type of Tires, Tube Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Russia Tire Market will witness steady growth supported by passenger and commercial vehicle expansion.

- Seasonal demand for winter and all-season tires will remain a consistent driver of replacement sales.

- Local manufacturing will strengthen as producers reduce reliance on imports and build resilience.

- Premium tire adoption will increase, driven by urban consumers prioritizing safety and performance.

- Online retail channels will expand reach, offering competitive prices and wider product accessibility.

- Technological integration such as smart tire sensors will gain traction among fleets and high-end consumers.

- Sustainability initiatives will shape product development, with eco-friendly designs gaining broader acceptance.

- Competition will intensify, pushing companies to focus on after-sales service and brand loyalty.

- Regional expansion into eastern territories will create long-term opportunities through infrastructure projects.

- Innovation in specialized categories such as off-road and heavy-duty equipment tires will enhance growth.