Market Overview:

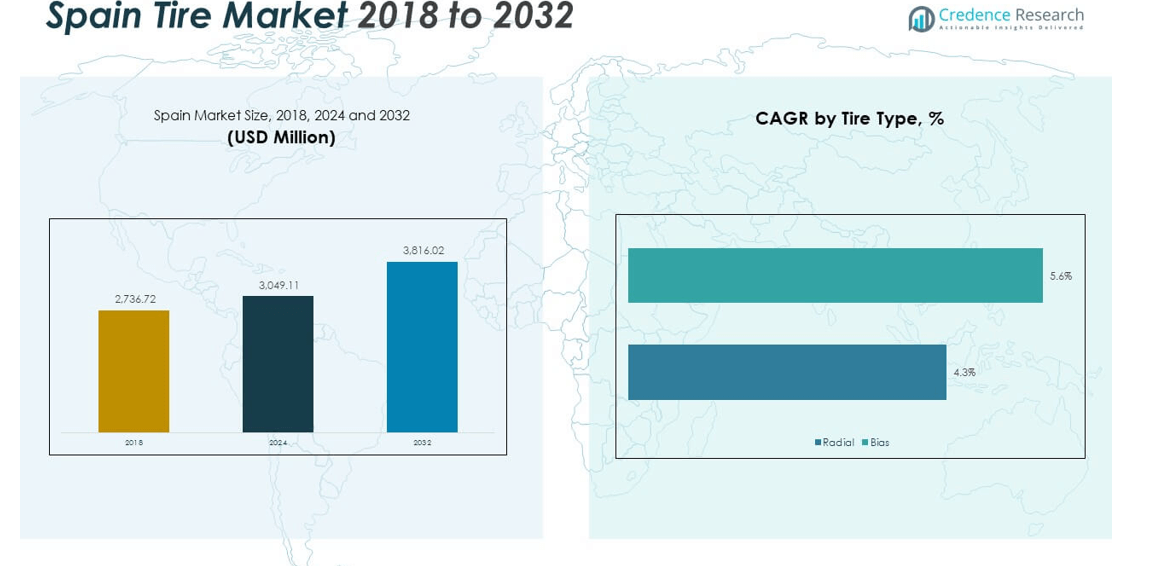

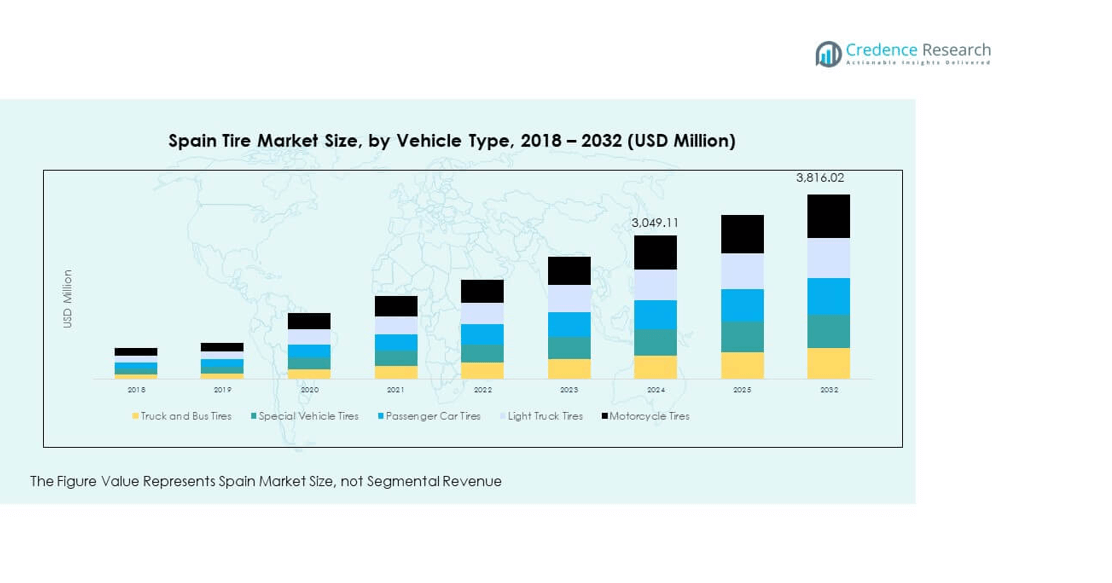

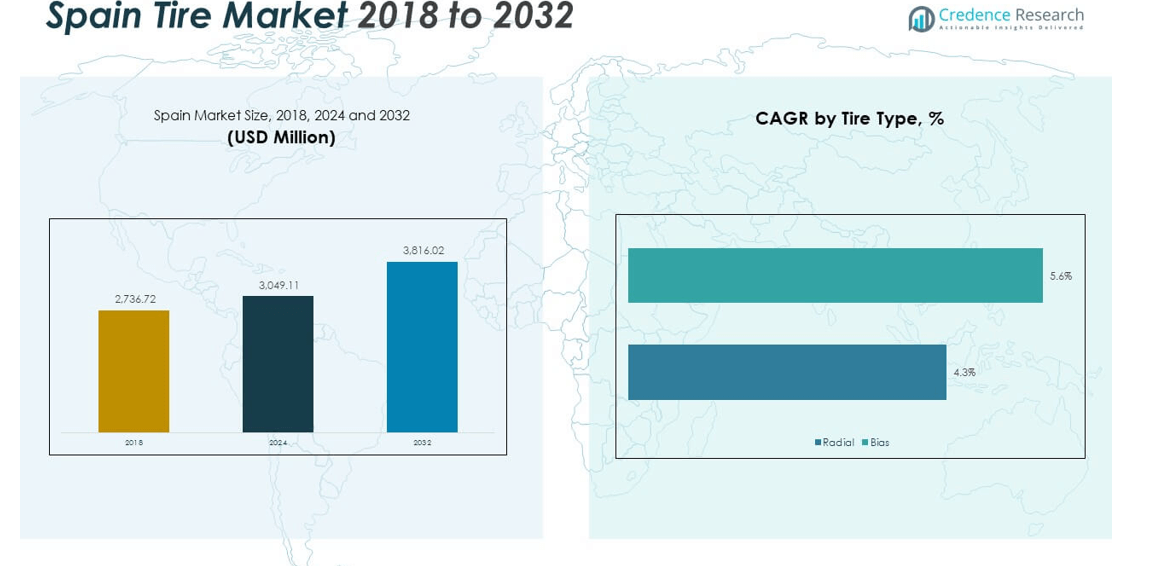

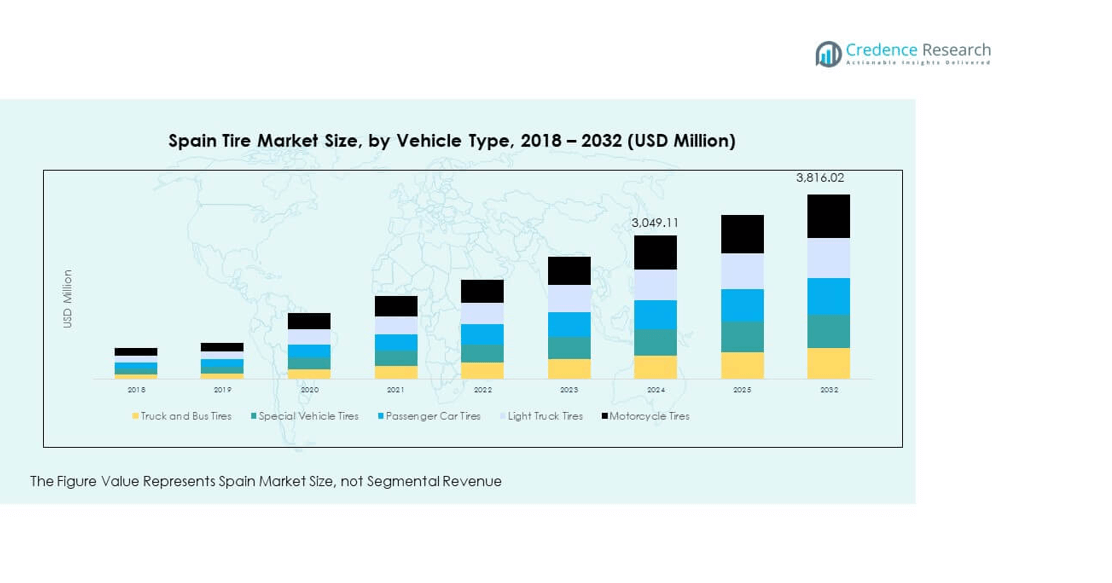

The Spain Tire Market size was valued at USD 2,736.72 million in 2018 to USD 3,049.11 million in 2024 and is anticipated to reach USD 3,816.02 million by 2032, at a CAGR of 2.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Tire Market Size 2024 |

USD 3,049.11 million |

| Spain Tire Market, CAGR |

2.84% |

| Spain Tire Market Size 2032 |

USD 3,816.02 million |

Growth in the Spain Tire Market is fueled by increasing vehicle ownership, expansion of the logistics industry, and rising demand for passenger and commercial vehicles. Strong replacement needs driven by road conditions and mileage contribute to steady aftermarket sales. It also benefits from government regulations promoting advanced tire technologies that improve fuel efficiency and safety standards. Seasonal requirements, such as winter and summer tire preferences, further stimulate consistent product turnover. Continuous consumer awareness toward branded and durable tires strengthens the market outlook.

Northern and Central Spain lead the market with a strong share due to dense vehicle fleets, industrial activity, and greater access to premium tire brands. Southern coastal areas are emerging, supported by tourism-related car rental demand and logistics through major ports. Eastern and Western regions contribute steadily with rising transportation corridors and agricultural activities requiring diverse tire categories. It benefits from Spain’s geographic position, enabling regional trade and distribution networks across Europe and the Mediterranean. Together, these regional dynamics create a balanced growth pattern in the national tire market.

Market Insights

- The Spain Tire Market was valued at USD 2,736.72 million in 2018, reached USD 3,049.11 million in 2024, and is projected to achieve USD 3,816.02 million by 2032, growing at a CAGR of 2.84%.

- Northern and Central Spain lead with 38% share, supported by dense vehicle ownership and industrial activity, while Southern Spain and coastal regions hold 34% driven by tourism and logistics.

- Eastern and Western Spain account for 28% share, with growth fueled by transportation corridors and freight activity, though they expand at a slower pace.

- Passenger car tires dominate the market with more than 40% share in 2024, reflecting high ownership and consistent replacement demand.

- Truck and bus tires capture close to 25% share, supported by freight movement, while motorcycle tires maintain a smaller but stable contribution to overall demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Vehicle Ownership and Expanding Passenger Car Sales Supporting Tire Demand

The Spain Tire Market continues to gain momentum from steady growth in vehicle ownership across urban and semi-urban regions. Rising disposable income and better financing options have encouraged consumers to purchase new vehicles. Passenger cars dominate tire demand, supported by the rising popularity of SUVs and compact models. It also benefits from higher replacement frequency due to road conditions and driving patterns. Regulatory support for modern vehicles equipped with advanced tire specifications strengthens consumer confidence. Long-distance commuting and intercity travel create a continuous requirement for durable and performance-oriented tires. The commercial vehicle segment supplements growth by driving bulk tire usage. Together, these factors ensure consistent tire demand across retail and wholesale channels.

Growing Logistics and E-Commerce Sectors Driving Commercial Tire Consumption

Expansion of logistics and e-commerce sectors boosts tire requirements for trucks, vans, and light commercial vehicles. The increasing flow of goods across Spain places greater pressure on transportation fleets. Fleet operators prioritize high-quality and long-lasting tires to optimize efficiency. It fuels consistent tire replacement cycles, especially in freight-intensive corridors. Spain’s strategic role as a hub between Europe and North Africa strengthens demand for commercial tires. Enhanced highway networks and logistics parks accelerate this momentum further. Urban delivery services powered by e-commerce growth require reliable tire performance under heavy load conditions. The Spain Tire Market benefits directly from these evolving transportation needs.

Government Safety Regulations and Adoption of Advanced Tire Technologies

Regulatory mandates focusing on safety, emission reduction, and fuel efficiency promote the use of advanced tires. Spain’s government encourages compliance with European Union standards, including low rolling resistance and eco-friendly tires. It pushes manufacturers to invest in innovative tire designs with improved durability. Tire labeling regulations increase consumer awareness of energy efficiency and performance ratings. The adoption of run-flat, tubeless, and noise-reducing tires reflects this regulatory shift. Automotive safety campaigns also drive consumer preference for premium products. Manufacturers gain opportunities to develop tires that balance sustainability and performance. These measures collectively support the upward trajectory of the Spain Tire Market.

- For instance, in July 2023, Continental introduced the UltraContact NXT in Europe, made with up to 65% renewable, recycled, and ISCC PLUS-certified materials, with all 19 sizes achieving the EU tire label’s highest “A” rating for rolling resistance, wet braking, and exterior noise.

Seasonal Tire Demand and Rising Replacement Cycles Increasing Market Activity

Spain experiences diverse climates across its regions, creating demand for seasonal tire categories. Consumers in colder areas increasingly adopt winter tires, while summer tires dominate coastal markets. Rising awareness of safety under changing conditions promotes adoption of specialized tires. It ensures higher replacement rates as drivers shift between tire categories. Regular wear-and-tear also contributes to a growing aftermarket, creating opportunities for service networks. Spain’s increasing preference for branded replacement tires strengthens market value. Distribution partnerships with garages and dealerships expand accessibility to premium products. This replacement-driven cycle adds sustainable momentum to the Spain Tire Market.

- For example, Pirelli’s Cinturato Winter 2 tire is certified with the 3PMSF winter standard, featuring an innovative compound designed to improve grip, braking, and control in snow and wet conditions, making it suitable for European winter driving needs.

Market Trends

Shift Toward Sustainable and Eco-Friendly Tire Manufacturing Practices

Sustainability is emerging as a major trend across the Spain Tire Market. Consumers and manufacturers focus on eco-friendly products that reduce environmental impact. It drives adoption of tires made from recycled and renewable raw materials. Companies invest in green manufacturing processes that minimize carbon emissions. Growing support from European Union policies accelerates sustainable initiatives in Spain. Retailers promote eco-friendly tire options, making them more visible to customers. Increasing consumer awareness strengthens acceptance of environmentally responsible products. This sustainability trend creates a long-term competitive advantage for innovative tire makers.

Integration of Digital Tools and Smart Tire Technologies Enhancing Market Growth

Digitalization is influencing tire design and aftersales services across Spain. Smart tires equipped with sensors deliver real-time data on wear, temperature, and pressure. It improves safety and performance for both passenger and commercial vehicles. Predictive maintenance platforms supported by digital solutions enhance fleet management. Companies integrate IoT-enabled monitoring systems to extend tire life and optimize fuel efficiency. Spain’s growing connected vehicle ecosystem supports widespread adoption of such products. The demand for technologically advanced tires aligns with the preferences of modern consumers. This digital trend positions the Spain Tire Market as a hub for innovation.

- For example, Continental introduced ContiConnect Lite and ContiConnect Pro in 2024, expanding its digital fleet tire-management offerings. The system monitors tire pressure, temperature, and mileage data, with Pro adding predictive maintenance and automated alerts. Remote monitoring helps fleets reduce downtime and optimize their tire service schedules.

Growth in Premiumization and Rising Preference for High-Performance Tires

Spanish consumers are increasingly willing to pay more for premium tire products. The rise in luxury and performance vehicle ownership boosts demand for high-performance tires. It reflects a shift toward superior grip, handling, and driving comfort. Brands offering specialized tire categories such as run-flat or all-season gain traction. Younger consumers also show preference for brands that enhance safety and design appeal. Retailers respond by expanding their premium tire portfolios across outlets. The Spain Tire Market is benefiting from this shift in purchasing behavior. Premiumization remains a significant trend shaping the competitive landscape.

- For example, in August 2025, Bridgestone became the exclusive tire partner for Lamborghini’s Fenomeno, equipping the supercar with bespoke Potenza Sport tires featuring Run Flat Technology that enables driving up to 80 km at 80 km/h after a puncture, supporting its 0–100 km/h acceleration in 2.4 seconds.

Expansion of Online Tire Sales Channels and Direct-to-Consumer Platforms

Online channels are transforming how consumers purchase and replace tires in Spain. Digital platforms provide easy comparisons, transparent pricing, and home delivery services. It strengthens consumer confidence and streamlines the buying process. Tire makers partner with e-commerce firms to broaden their reach. Specialized websites offering booking of installation services improve convenience further. Retailers expand digital footprints with integrated online and offline strategies. Consumers embrace online tire purchases for both replacement and seasonal needs. This trend increases accessibility and supports faster adoption in the Spain Tire Market.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Constraints Affecting Profitability

The Spain Tire Market faces challenges from volatility in raw material prices such as rubber and petroleum derivatives. Unpredictable fluctuations raise production costs, pressuring both manufacturers and distributors. It affects profit margins and limits competitive pricing strategies in the local market. Dependence on imports further complicates cost stability, especially under global trade disruptions. Shortages or delays in raw material supply impact tire availability. Manufacturers must adapt to these uncertainties through sourcing diversification and inventory management. The unpredictable cost structure creates difficulties in long-term planning. Market participants continue to face uncertainty from these recurring challenges.

Intense Market Competition and Rising Influence of Low-Cost Imports

Competition remains high due to the presence of global brands and emerging local players. The Spain Tire Market witnesses increasing pressure from low-cost imports that attract budget-conscious buyers. It reduces the market share of premium brands and limits pricing flexibility. Counterfeit tire products also add to consumer safety risks and brand dilution. Established companies need to differentiate through innovation and marketing strategies. Competition extends across retail, wholesale, and online channels, intensifying overall pressure. Smaller distributors struggle to compete with larger networks offering better deals. The competitive landscape remains one of the most significant hurdles to long-term stability.

Market Opportunities

Adoption of Electric Vehicles Driving Demand for Specialized Tire Solutions

The rapid adoption of electric vehicles creates new opportunities for tire manufacturers in Spain. EVs require specialized tires designed to handle higher torque and efficiency needs. It drives demand for products with enhanced durability and noise reduction. Government policies encouraging EV adoption further strengthen this opportunity. Global brands are already investing in EV-specific tire lines tailored for Spain. The Spain Tire Market gains momentum from this emerging product category. Aftermarket services also expand with growing replacement requirements for EV tires. This opportunity helps diversify portfolios for both local and international manufacturers.

Advancement in Tire Recycling and Circular Economy Practices in Spain

Tire recycling and circular economy practices offer significant growth opportunities for the industry. Spain emphasizes reducing landfill waste and supporting sustainable practices. It promotes innovations in recycling technologies that transform old tires into new products. Manufacturers investing in these processes improve brand reputation and meet regulatory standards. Partnerships with recycling firms create new value streams and reduce environmental impact. The Spain Tire Market gains long-term benefits from these initiatives. Consumers also appreciate sustainable solutions, improving acceptance of recycled tire products. Recycling initiatives position Spain as a progressive market in the tire industry.

Market segment analysis

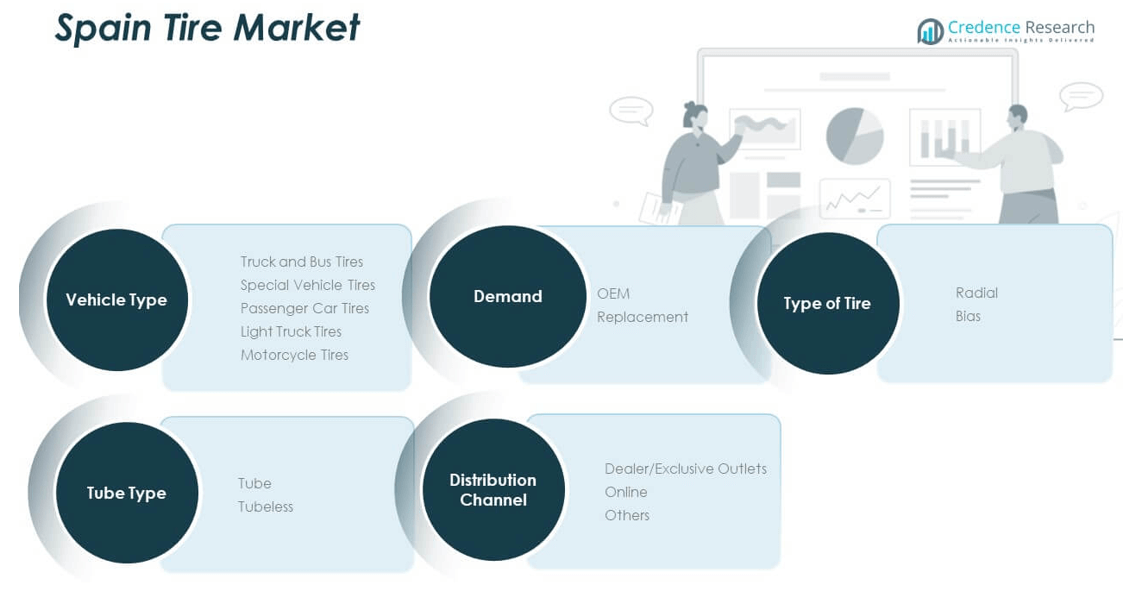

The Spain Tire Market is segmented

By vehicle type, with passenger car tires holding the dominant share due to high private vehicle ownership and steady replacement demand. Truck and bus tires also contribute strongly, driven by logistics and freight activity, while motorcycle tires cater to urban mobility needs. Light truck tires maintain consistent demand from delivery fleets, and special vehicle tires serve niche industrial and agricultural applications.

By demand segment, replacement leads the market, reflecting frequent tire wear and consumer preference for branded aftermarket products. OEM demand remains important, supported by Spain’s automotive production and partnerships with international manufacturers. It reflects steady alignment between automakers and tire suppliers to meet regulatory and performance standards.

- For example, Continental’s EcoContact 6 replacement summer tire delivers up to 20% higher mileage and 15% lower rolling resistance than its predecessor, improving fuel efficiency and durability according to independent tire performance assessments.

By type of tire, radial tires dominate by type, offering better fuel efficiency and durability, while bias tires continue to serve specific commercial and agricultural applications.

- For example, Michelin’s Primacy 4 / Primacy 4+ models outlast many competitors by an average of ~18,000 km in wear tests, offering exceptional longevity. They also earn top rankings in wet braking and safety across multiple performance trials.

By tube type, tubeless tires lead due to enhanced safety and convenience, though traditional tube tires retain presence in older vehicle fleets.

By distribution channel, dealer and exclusive outlets remain the primary sales point, ensuring customer service and brand trust. Online platforms are expanding their share, offering convenience and competitive pricing. Other channels, including local retailers and workshops, continue to support demand in smaller towns and semi-urban areas.

Segmentation

By Vehicle Type

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

By Demand Segment

By Type of Tires

By Tube Type

By Distribution Channel

- Dealer/Exclusive Outlets

- Online

- Others

Regional Analysis

Northern and Central Spain

Northern and Central Spain dominate the Spain Tire Market with a 38% share, supported by dense automotive ownership and established manufacturing bases. Strong demand arises from Madrid and surrounding industrial corridors where both passenger and commercial vehicle sales remain high. It benefits from robust infrastructure and fleet operations that require frequent tire replacements. The concentration of dealerships and service centers further increases accessibility to premium brands. Cold-weather regions in the north contribute to seasonal tire demand, boosting aftermarket sales. This subregion continues to set the pace for steady volume and value growth.

Southern Spain and Coastal Areas

Southern Spain and the coastal regions hold 34% of the market share, driven by tourism activity and high car rental demand. Seasonal variations, including higher summer travel, support replacement cycles for passenger car and light truck tires. It benefits from growing logistics activity across ports in Valencia and Andalusia. The presence of urban centers also drives online tire purchases, strengthening distribution networks. Road infrastructure projects and heavy traffic flow in coastal areas increase demand for durable and fuel-efficient tires. This subregion’s growth is supported by both consumer and commercial activity.

Eastern and Western Spain

Eastern and Western Spain account for 28% of the Spain Tire Market, with growth supported by expanding transportation corridors and cross-border trade. The subregion sees steady adoption of tires for trucks and buses due to higher freight movement. It benefits from moderate but consistent motorcycle tire demand in semi-urban areas. Competitive pricing strategies by international and local brands play a key role in this subregion. Distribution expansion in smaller cities strengthens aftermarket activity. While growth is slower compared to northern and southern regions, it remains a stable contributor to national tire demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Continental (Spain)

- Michelin (Spain & Portugal)

- Pirelli (Spain)

- Bridgestone (Hispania)

- Goodyear Dunlop Tires (Spain)

- Hankook (Spain)

- Yokohama (Iberia)

- Cooper Tire & Rubber Company (Spain)

- Apollo Tyres

- Sumitomo Rubber Industries

- MRF Ltd.

Competitive Analysis

The Spain Tire Market is highly competitive, led by global companies such as Michelin, Continental, Pirelli, Bridgestone, and Goodyear Dunlop Tires. These brands dominate passenger and premium tire categories, supported by wide distribution networks and advanced technologies. It also includes strong participation from Asian manufacturers like Hankook, Yokohama, Apollo, and Sumitomo, which focus on cost-effective offerings and expanding market share. Local operations ensure tailored product lines suited for Spanish driving conditions. Competitive strategies include new product launches, dealership expansions, and integration of smart tire technologies. Market rivalry remains intense, as premium brands compete with mid-range and budget alternatives across OEM and replacement segments. Companies that innovate in sustainable and EV-compatible tires strengthen their positioning in Spain’s evolving automotive landscape.

Recent Developments

- In September 2025, Pirelli and Aston Martin formed a technology partnership to integrate exclusive Pirelli Cyber™ Tyre technology into Aston Martin’s next-generation ultra-luxury vehicles. The Cyber™ Tyre system uses sensors embedded in the tread to provide real-time tire data, optimizing performance and safety for advanced electronic vehicle dynamic systems.

- In September 2025, Bridgestone launched the premium Alenza Prestige highway tire for CUVs, SUVs, and trucks. The tire, equipped with next-generation ENLITEN™ Technology and QuietTrack™ noise reduction, boasts a limited mileage warranty of up to 70,000 miles, providing a balance of luxury and longevity for Spanish drivers.

- In May 2025, Goodyear completed the sale of its Dunlop brand for four-wheel vehicles in Europe to Sumitomo Rubber Industries, in a $701 million transaction. Goodyear will continue to supply Dunlop tires to Sumitomo for a five-year transition period, ensuring product continuity for Spanish customers amid brand realignment.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Demand, Type of Tires, Tube Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain Tire Market will expand steadily, supported by replacement demand in passenger and commercial vehicles.

- Growth in electric vehicle adoption will create opportunities for specialized tire designs with higher durability.

- Seasonal tire adoption will strengthen in colder regions, boosting aftermarket service networks.

- Premium tire demand will rise with increasing ownership of SUVs and luxury vehicles.

- Digital and smart tire technologies will gain traction in fleet management and connected vehicles.

- E-commerce and online channels will capture a larger share of tire distribution.

- Competitive pressure from low-cost imports will drive innovation and localized strategies.

- Recycling initiatives and circular economy practices will become integral to industry operations.

- OEM partnerships will expand as automakers push for eco-friendly and fuel-efficient tire solutions.

- Strong logistics and freight activity will sustain demand for truck and bus tire categories.