Market Overview:

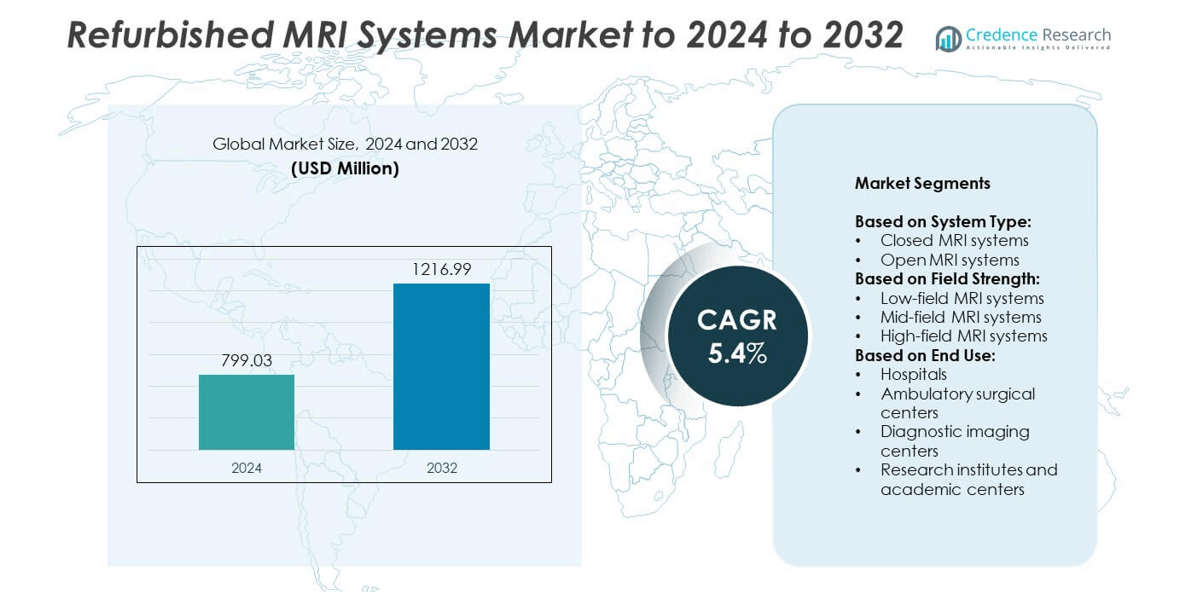

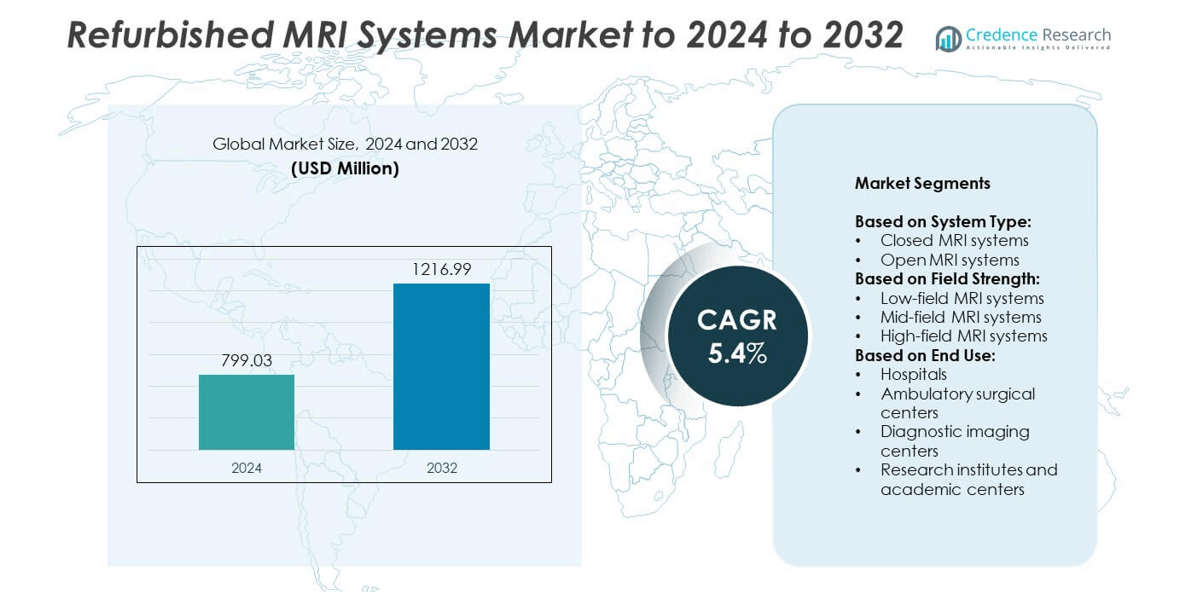

Refurbished MRI Systems Market size was valued at USD 799.03 million in 2024 and is anticipated to reach USD 1216.99 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refurbished MRI Systems Market Size 2024 |

USD 799.03 million |

| Refurbished MRI Systems Market, CAGR |

5.4% |

| Refurbished MRI Systems Market Size 2032 |

USD 1216.99 million |

The refurbished MRI systems market is driven by leading players such as GE HealthCare, Siemens Healthineers, Koninklijke Philips, Fujifilm Healthcare, Canon Medical Systems, Avante Health Solutions, Block Imaging, and SOMA Technology. These companies focus on certified refurbishment processes, service expansion, and sustainability initiatives to provide cost-effective imaging solutions. Their competitive strategies emphasize enhancing diagnostic reliability while supporting healthcare providers in managing budget constraints. Regionally, North America led the market in 2024 with a 37% share, supported by strong healthcare infrastructure and high imaging demand, followed by Europe with 29% and Asia Pacific with 23%, reflecting expanding adoption in emerging economies.

Market Insights

- The refurbished MRI systems market was valued at USD 799.03 million in 2024 and is projected to reach USD 1216.99 million by 2032, growing at a CAGR of 5.4%.

- Rising demand for affordable diagnostic imaging and cost-effective solutions is driving the adoption of refurbished MRI systems across hospitals and diagnostic centers.

- Key trends include sustainability initiatives, advanced refurbishment technologies, and growing adoption in emerging economies where budget constraints limit access to new systems.

- The market is competitive, with major players focusing on certified refurbishment, service network expansion, and partnerships to strengthen their global presence.

- North America led with 37% share in 2024, followed by Europe with 29% and Asia Pacific with 23%, while Latin America accounted for 7% and the Middle East & Africa 4%; closed MRI systems and high-field systems dominated segment-wise due to advanced imaging capabilities and higher diagnostic reliability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By System Type

Closed MRI systems dominated the refurbished MRI systems market in 2024, accounting for the largest share due to their superior image resolution and broad clinical applications. These systems are widely preferred in diagnostic imaging for neurological, musculoskeletal, and cardiovascular examinations. Their strong demand stems from the ability to provide detailed scans essential for accurate diagnosis, especially in critical cases. Refurbished closed MRI systems are cost-effective alternatives for hospitals and diagnostic centers, making advanced imaging accessible without high capital investment. Open MRI systems, though growing, remain niche due to lower resolution capabilities.

- For instance, GE HealthCare’s SIGNA Explorer 1.5T has a 60 cm bore, 33 mT/m gradients, and 120 T/m/s slew rate, matching high-volume diagnostic needs.

By Field Strength

High-field MRI systems held the largest share in 2024, driven by their capability to deliver faster scans and higher image quality, which is vital for complex clinical applications such as oncology and neurology. Their adoption is particularly high in large hospitals and research centers seeking advanced diagnostic precision. Refurbished high-field MRI systems offer an affordable option for facilities aiming to upgrade diagnostic capabilities without incurring the full cost of new equipment. Mid-field and low-field systems continue to serve smaller healthcare providers where budget and operational needs differ.

- For instance, United Imaging’s uMR 790 (3.0 T) offers 100 mT/m gradient strength and 200 T/m/s slew rate; the uMR Omega (3.0 T) uses a 75 cm bore cleared by the FDA.

By End Use

Hospitals emerged as the leading end-use segment, commanding the largest market share in 2024 due to the high patient volume and broad demand for advanced imaging services. Hospitals often invest in refurbished MRI systems to expand imaging capacity while managing budget constraints, particularly in developing regions. These systems help hospitals balance cost efficiency with the need for advanced diagnostic accuracy. While diagnostic imaging centers and ambulatory surgical centers are expanding adoption, hospitals remain dominant as they handle diverse cases requiring reliable imaging solutions. Research institutes also contribute steadily, focusing on clinical studies and training applications.

Market Overview

Cost-Effectiveness and Accessibility

One of the primary growth drivers for the refurbished MRI systems market is the cost-effectiveness of refurbished units, which makes advanced imaging technology accessible to smaller hospitals and diagnostic centers. With rising healthcare costs, many facilities are unable to afford new MRI systems, driving demand for refurbished alternatives. These systems provide comparable performance at reduced prices, allowing healthcare providers to expand diagnostic services. Growing adoption in emerging economies, where budget constraints are significant, further strengthens market penetration and contributes to the steady growth trajectory.

- For instance, Canon Medical Systems USA announced the commercial release of the Vantage Galan 3T / Supreme Edition MRI system on November 26, 2024.

Rising Demand for Diagnostic Imaging

The increasing burden of chronic diseases, such as cancer, neurological disorders, and musculoskeletal conditions, has boosted demand for advanced imaging solutions. MRI scans play a crucial role in early disease detection and treatment planning, creating consistent market demand. Refurbished MRI systems enable healthcare providers to meet growing patient volumes without large investments in new machines. As imaging volumes rise globally, particularly in developing nations, refurbished systems offer an effective solution to improve diagnostic capacity while supporting healthcare infrastructure expansion.

- For instance, DirectMed’s acquisition of LBN Medical was announced in February 2022. At the time of the acquisition, DirectMed already had over 60,000 parts in its inventory.

Sustainability and Equipment Lifecycle Extension

Sustainability in healthcare is a growing priority, and refurbished MRI systems support this trend by extending the lifecycle of high-value medical equipment. Facilities benefit from reduced electronic waste and lower carbon footprints, aligning with global environmental goals. Manufacturers and refurbishing companies ensure compliance with safety and performance standards, providing reliable systems at lower costs. This focus on sustainable practices, combined with strong demand for eco-friendly solutions, positions refurbished MRI systems as an attractive choice for healthcare institutions committed to green initiatives and responsible technology use.

Key Trends and Opportunities

Technological Advancements in Refurbishment

A key trend shaping the market is the integration of advanced refurbishment techniques that enhance system reliability and performance. Modern refurbishing processes now include upgrading software, coils, and imaging components, allowing refurbished MRI systems to meet clinical standards closer to new machines. This innovation expands the appeal of refurbished units, making them more attractive to hospitals seeking advanced diagnostics at lower costs. Enhanced quality assurance practices also improve trust and adoption among healthcare providers, creating long-term growth opportunities in the market.

- For instance, Philips reclaimed more than 11,500 systems or pieces of equipment in 2023, according to its Annual Report 2023.

Expanding Adoption in Emerging Economies

An important opportunity lies in the growing adoption of refurbished MRI systems in emerging economies where budgetary constraints limit access to new machines. Healthcare facilities in regions such as Asia-Pacific, Latin America, and parts of Africa are increasingly investing in refurbished imaging solutions to expand diagnostic capacity. The rising prevalence of chronic diseases, coupled with government initiatives to improve healthcare access, supports this growth. This opportunity is strengthened by the cost savings and sustainability benefits that refurbished systems bring to resource-constrained settings.

- For instance, according to the Canadian Medical Imaging Inventory, the number of MRI units in Canada rose from 378 in 2019–2020 to 432 in 2022–2023. In the fiscal year 2022–2023, Canada recorded an average of 55.6 publicly funded MRI exams per 1,000 people, which was lower than the OECD average of 83.6 exams per 1,000 population.

Increasing Private Sector Investment

Another notable trend is the increasing investment from private healthcare providers in refurbished MRI systems to enhance service offerings. With rising competition in the healthcare industry, diagnostic centers and private hospitals are adopting refurbished machines to provide advanced imaging at affordable costs. This trend also reflects the growing importance of outpatient diagnostic services, where refurbished MRI units play a critical role in delivering timely and efficient care. Such investments accelerate market growth while diversifying the customer base across regions.

Key Challenges

Concerns Over Quality and Reliability

A major challenge in the refurbished MRI systems market is lingering concerns over the quality and reliability of refurbished equipment. Some healthcare providers hesitate to invest in pre-owned systems due to doubts about performance consistency and longevity. Although certified refurbishment processes address many of these issues, the perception gap remains a barrier to adoption. Overcoming this challenge requires stronger awareness, standardized certification practices, and transparent warranties to build confidence among buyers in both developed and developing markets.

Regulatory and Compliance Barriers

Strict regulations governing refurbished medical devices present another challenge for market growth. Different countries impose varying safety, quality, and certification standards, making it difficult for refurbishing companies to maintain compliance across global markets. These regulatory complexities can delay market entry and increase costs for suppliers. Smaller refurbishing firms often struggle to meet such requirements, limiting their reach. Addressing these challenges will require harmonized international standards and stronger collaboration between regulators and industry players to ensure safe and compliant equipment supply.

Regional Analysis

North America

North America held the largest share of the refurbished MRI systems market in 2024, accounting for 37%. The region’s dominance is driven by advanced healthcare infrastructure, high adoption of diagnostic imaging, and strong presence of refurbishing companies. Hospitals and diagnostic centers in the United States and Canada increasingly opt for refurbished MRI systems to manage costs while meeting rising imaging demand. Favorable regulatory frameworks supporting certified refurbished equipment further encourage adoption. The growing patient pool with chronic diseases and technological improvements in refurbishment processes are expected to sustain North America’s leadership throughout the forecast period.

Europe

Europe captured 29% of the refurbished MRI systems market in 2024, driven by increasing demand for affordable imaging solutions across both public and private healthcare facilities. Countries such as Germany, the UK, and France are leading adopters, supported by government healthcare budgets and sustainability initiatives. Refurbished MRI systems align with Europe’s strong focus on reducing electronic waste and promoting eco-friendly healthcare solutions. The presence of established refurbishing companies ensures reliable supply and compliance with safety standards. Rising diagnostic imaging demand, particularly in oncology and neurology, further contributes to Europe’s significant market share and continued growth.

Asia Pacific

Asia Pacific accounted for 23% of the refurbished MRI systems market in 2024, reflecting growing investments in healthcare infrastructure and increasing adoption of cost-effective imaging solutions. Emerging economies such as China, India, and Southeast Asian countries are key growth engines, driven by rising chronic disease prevalence and government efforts to improve diagnostic access. Limited budgets in many hospitals make refurbished MRI systems attractive, particularly for expanding rural and semi-urban healthcare facilities. Increasing collaborations with international refurbishing companies and rising private healthcare investments are expected to accelerate Asia Pacific’s market growth during the forecast period.

Latin America

Latin America represented 7% of the refurbished MRI systems market in 2024, with demand driven by cost-conscious healthcare systems in countries such as Brazil, Mexico, and Argentina. Budget limitations and uneven access to advanced medical equipment make refurbished MRI systems a practical choice for expanding diagnostic imaging capacity. Growing prevalence of chronic diseases and rising adoption in private healthcare facilities support regional growth. However, regulatory complexities and economic instability limit wider penetration. Efforts by global refurbishing companies to strengthen distribution and service networks in Latin America are expected to boost adoption in the coming years.

Middle East and Africa

The Middle East and Africa held a 4% share of the refurbished MRI systems market in 2024, reflecting gradual adoption in developing healthcare systems. High costs of new imaging equipment and limited healthcare budgets make refurbished systems appealing, particularly in African nations. Gulf countries such as Saudi Arabia and the UAE show stronger adoption due to ongoing healthcare modernization initiatives. However, infrastructural limitations and weak distribution networks remain challenges. Increasing partnerships with refurbishing firms and international aid programs aimed at improving diagnostic capabilities are likely to drive steady but moderate growth in the region.

Market Segmentations:

By System Type:

- Closed MRI systems

- Open MRI systems

By Field Strength:

- Low-field MRI systems

- Mid-field MRI systems

- High-field MRI systems

By End Use:

- Hospitals

- Ambulatory surgical centers

- Diagnostic imaging centers

- Research institutes and academic centers

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The refurbished MRI systems market is shaped by prominent players such as MedScanner, GE HealthCare, Avante Health Solutions, SOMA Technology, Radon Medical Imaging (Radon), Block Imaging, Amber Diagnostics, LBN Medical, Integrity Medical Systems, Canon Medical Systems, Fujifilm Healthcare, Aegys, Siemens Healthineers, Providian Medical, and Koninklijke Philips. These companies collectively focus on extending the lifecycle of imaging equipment through certified refurbishment processes while ensuring compliance with safety and performance standards. Their strategies emphasize offering cost-effective diagnostic solutions to healthcare facilities across developed and emerging markets. Competitive dynamics are marked by investments in advanced refurbishment technologies, expansion of service networks, and partnerships with hospitals and diagnostic centers to strengthen market reach. Sustainability initiatives and the growing need for affordable imaging solutions further enhance competition, with companies increasingly aligning portfolios to meet global healthcare demands. The market is expected to remain competitive as players continue to innovate and expand their presence worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MedScanner

- GE HealthCare

- Avante Health Solutions

- SOMA Technology

- Radon Medical Imaging (Radon)

- Block Imaging

- Amber Diagnostics

- LBN Medical

- Integrity Medical Systems

- Canon Medical Systems

- Fujifilm Healthcare

- Aegys

- Siemens Healthineers

- Providian Medical

- Koninklijke Philips

Recent Developments

- In 2024, General Electric (GE Healthcare) expanded its refurbished imaging equipment portfolio, including newer MRI models with software upgrades. This enabled the company to offer refurbished equipment with advanced functionalities at a lower cost compared to new systems.

- In 2023, Siemens Healthineers collaborated with CommonSpirit Health to acquire Block Imaging. Block Imaging provides refurbished medical equipment, servicing, and parts. The acquisition aimed to encourage efforts to repair and reuse equipment, provide greater value to consumers and their patients, and reduce waste.

- In 2023, Radon Medical Imaging (Radon) acquired Premier Imaging Medical Systems (Premier), a company specializing in the sale and maintenance of new, used, and refurbished imaging and biomedical equipment.

Report Coverage

The research report offers an in-depth analysis based on System Type, Field Strength, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily, driven by rising demand for cost-effective imaging solutions.

- Hospitals will remain the dominant end users due to high patient volumes and diverse diagnostic needs.

- Closed MRI systems will sustain their lead because of superior imaging capabilities and wider adoption.

- High-field refurbished MRI systems will see growing demand for complex diagnostic and research applications.

- Emerging economies will drive significant growth as healthcare infrastructure investments increase.

- Sustainability initiatives will strengthen adoption by extending equipment lifecycle and reducing electronic waste.

- Technological advancements in refurbishment will enhance system performance and reliability.

- Private diagnostic centers will increasingly invest in refurbished MRI systems to stay competitive.

- Regulatory clarity and certification improvements will build greater trust among healthcare providers.

- The market will evolve with stronger collaborations between refurbishing companies and global healthcare institutions.