Market Overview:

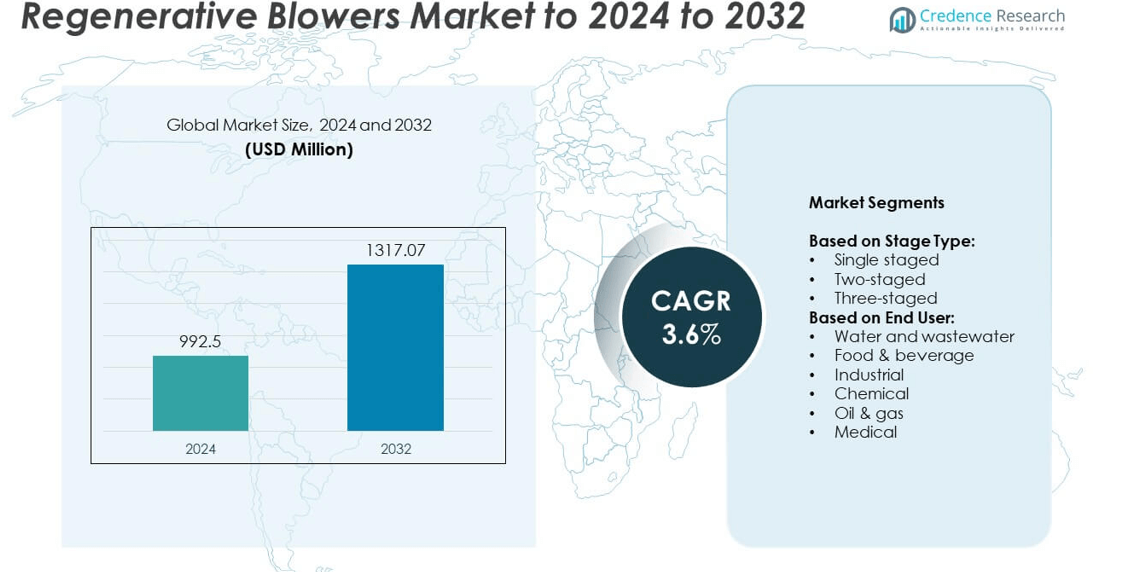

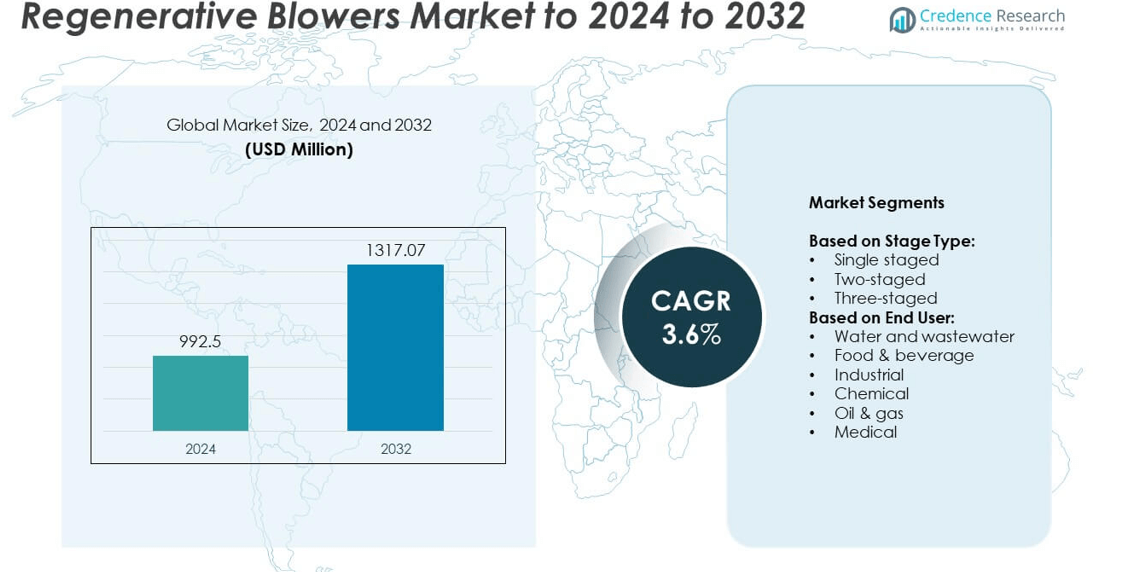

Regenerative Blowers Market size was valued USD 992.5 Million in 2024 and is anticipated to reach USD 1317.07 Million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Regenerative Blowers Market Size 2024 |

USD 992.5 Million |

| Regenerative Blowers Market, CAGR |

3.6% |

| Regenerative Blowers Market Size 2032 |

USD 1317.07 Million |

The regenerative blowers market is shaped by leading players such as Gast Manufacturing, Eurus Blowers, Busch SE, Atlas Copco, Becker Pump Corporation, Hitachi Limited, Aerzen, and Ametek Inc., which focus on product innovation and global expansion strategies. These companies compete by developing energy-efficient, compact, and low-maintenance blowers to address diverse industrial needs. Regionally, North America commanded the largest share of 34% in 2024, supported by strong demand in wastewater treatment, chemical, and oil and gas industries. Europe followed with 29%, driven by strict environmental regulations, while Asia Pacific accounted for 27%, fueled by rapid industrialization and infrastructure growth.

Market Insights

- The regenerative blowers market was valued at USD 992.5 Million in 2024 and is projected to reach USD 1317.07 Million by 2032, growing at a CAGR of 3.6% during 2025–2032.

- Growth is driven by rising demand in wastewater treatment, food and beverage processing, and industrial automation, supported by regulations that require efficient and sustainable air-handling solutions.

- A key trend is the integration of energy-efficient and compact designs, with manufacturers focusing on noise reduction and eco-friendly technologies to meet industry sustainability goals.

- The market is competitive with global players focusing on innovation, partnerships, and regional expansions to strengthen their positions across diverse applications, particularly in water treatment and medical equipment.

- Regionally, North America led with 34% share in 2024, followed by Europe at 29% and Asia Pacific at 27%, while Latin America and the Middle East & Africa accounted for smaller portions; single-staged blowers held 58% share by stage type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Stage Type

The stage type segment in the regenerative blowers market is divided into single-staged, two-staged, and three-staged units. Single-staged blowers held the dominant share of 58% in 2024, driven by their simple design, cost-effectiveness, and wide use in aeration, drying, and pneumatic conveying. Their lower maintenance needs and efficiency in handling medium-pressure applications also support adoption across small to mid-scale industries. While two-staged and three-staged blowers cater to higher pressure requirements, single-staged blowers remain the preferred choice due to affordability and versatility in diverse end-use sectors.

- For instance, Busch’s Samos SB 1100 D0 delivers 1050–1250 m³/h flow, suiting single-stage pneumatic conveying and aeration uses.

By End User

The end user segment includes water and wastewater, food and beverage, industrial, chemical, oil and gas, and medical sectors. Water and wastewater applications commanded the largest share of 36% in 2024, supported by rising global investments in sewage treatment and environmental compliance. Regenerative blowers are critical for aeration processes, sludge treatment, and maintaining oxygen levels, making them vital in wastewater management. Growing urbanization, stricter discharge regulations, and government-backed infrastructure projects further accelerate demand in this segment, keeping it ahead of food and beverage and other industrial applications.

- For instance, FPZ’s twin-impeller single-stage MOR IE3 blower provides up to 2400 m³/h airflow for wastewater aeration systems.

Market Overview

Rising Demand in Water and Wastewater Treatment

Water and wastewater treatment is the key growth driver for the regenerative blowers market, supported by strict environmental standards and expanding municipal infrastructure. These blowers provide reliable aeration and oxygen supply for sewage treatment plants, enabling efficient biological processes. With rapid urbanization and growing industrial effluents, demand for energy-efficient, low-maintenance blowers continues to increase. Government-led investments in wastewater recycling and treatment facilities further boost adoption, positioning this segment as the central driver of long-term market expansion.

- For instance, AERZEN is a major supplier of blower technology for wastewater treatment plants worldwide, including many in China, where their equipment contributes to the energy-efficient aeration of sewage.In 2013, China’s total wastewater treatment capacity already exceeded 148 million m³/day, utilizing various technologies. By 2019, the total capacity had increased to over 190 million m³/day.

Expansion in Food and Beverage Industry

The food and beverage sector is fueling growth through rising automation and hygiene-focused operations. Regenerative blowers are widely used in processes like drying, conveying, and packaging due to their oil-free operation and low contamination risk. Increasing demand for packaged food and stricter quality regulations drive the adoption of clean-air solutions. Furthermore, the growing global focus on sustainable manufacturing and energy efficiency strengthens the use of regenerative blowers in food processing plants, supporting steady growth in this end-user vertical.

- For instance, Busch’s oil-free Samos blowers, with flow rates up to 1,500 m³/h, are installed in beverage plants for conveyor drying systems in Germany.

Industrial Diversification and Process Efficiency

Industrial diversification is expanding regenerative blower applications in chemicals, oil and gas, and manufacturing. These industries benefit from blowers’ ability to deliver consistent airflow, low noise levels, and compact design. As companies prioritize energy-efficient and reliable systems, regenerative blowers provide cost savings by reducing operational downtime. Their suitability for diverse tasks such as fume extraction, cooling, and pneumatic conveying drives adoption. The ongoing shift toward smart factories and process automation enhances the role of regenerative blowers in achieving productivity and compliance goals.

Key Trends & Opportunities

Integration of Energy-Efficient Technologies

A key trend in the regenerative blowers market is the integration of energy-efficient technologies, driven by sustainability goals and cost reduction efforts. Manufacturers are developing blowers with optimized impeller designs and improved motor efficiency, lowering overall energy consumption. Growing awareness of carbon footprint reduction encourages industries to adopt such systems. This trend also opens opportunities for vendors to differentiate products through eco-certifications and advanced designs, appealing to sectors like wastewater and chemicals where long-term operational savings are critical.

- For instance, Elmo Rietschle’s G-BH1 series offers operation up to 2,450 m³/h volume flow with variable frequency control, allowing better matching to load and reducing energy waste.

Adoption in Medical and Healthcare Applications

An emerging opportunity lies in medical and healthcare applications, where regenerative blowers support respiratory equipment, dental suction systems, and laboratory devices. The demand is increasing due to rising healthcare investments and expanding hospital infrastructure. Their oil-free, low-maintenance, and quiet operation makes them ideal for sensitive environments. Post-pandemic emphasis on advanced medical equipment further accelerates adoption. This opportunity creates new revenue streams for manufacturers, encouraging them to design compact, high-performance models suited to medical standards and regulatory requirements.

- For instance, Aerzen’s Turbo G5plus AT35-0.8S and AT60-0.9S models achieve up to 10% higher energy efficiency compared to conventional turbo blowers. The AT35-0.8S delivers a volume flow of up to 1,200 m³/h with a differential pressure of up to 800 mbar, while the AT60-0.9S provides a flow of up to 2,650 m³/h at a maximum differential pressure of 900 mbar. The broader G5plus series, encompassing more models, covers a wider flow range from 360 to 9,400 m³/h.

Key Challenges

High Initial Cost and Energy Consumption

A key challenge in the regenerative blowers market is their relatively high initial cost and energy usage compared to alternatives. While they offer long operational life and low maintenance, the upfront investment can discourage small-scale users. Additionally, continuous operation in energy-intensive industries can raise utility costs. These limitations often push buyers to consider cheaper or more energy-efficient substitutes, reducing the competitiveness of regenerative blowers in cost-sensitive markets unless innovations address efficiency and affordability gaps.

Competition from Alternative Technologies

Another major challenge is competition from alternative blower technologies such as centrifugal and positive displacement blowers. These options often provide higher efficiency or greater suitability for specific high-pressure or large-volume applications. As industries adopt customized air-handling solutions, regenerative blowers face limits in broader adoption. The availability of diverse blower technologies intensifies competition, compelling manufacturers to innovate and differentiate their products. Without continuous improvements, regenerative blowers risk losing share in niche applications to technologically advanced alternatives.

Regional Analysis

North America

North America held the largest share of 34% in the regenerative blowers market in 2024, supported by strong adoption across water and wastewater treatment plants, chemical industries, and oil and gas operations. The region benefits from stringent environmental regulations and heavy investments in sustainable infrastructure projects. Growing focus on industrial automation and energy efficiency further supports adoption across manufacturing sectors. The United States dominates regional demand, with Canada contributing through rising wastewater treatment capacity. Ongoing investments in renewable energy and process industries will sustain growth, keeping North America at the forefront of the global regenerative blowers market.

Europe

Europe accounted for 29% share of the regenerative blowers market in 2024, driven by increasing emphasis on clean technologies and energy-efficient solutions. Strict EU environmental directives encourage greater use of regenerative blowers in wastewater treatment, industrial processes, and food and beverage industries. Countries such as Germany, the UK, and France lead adoption due to well-developed industrial bases and advanced water treatment infrastructure. Rising demand for sustainable packaging and medical device production also boosts blower applications. With supportive regulatory frameworks and rising demand for eco-friendly solutions, Europe continues to be a significant contributor to global market revenues.

Asia Pacific

Asia Pacific captured 27% share of the regenerative blowers market in 2024, fueled by rapid industrialization and urban expansion. China, India, and Japan remain the leading contributors due to their large-scale wastewater treatment projects and robust manufacturing sectors. Growing investments in chemical production, electronics, and food processing industries enhance blower adoption. Rising concerns over air pollution and water quality have also driven stricter government initiatives in wastewater management. With expanding industrial bases and increasing infrastructure spending, Asia Pacific is expected to grow faster than mature regions, strengthening its position as a key market hub by 2032.

Latin America

Latin America represented 6% share of the regenerative blowers market in 2024, supported mainly by Brazil and Mexico. Expanding food and beverage processing facilities and rising industrial automation are the major demand drivers in the region. Governments are investing in wastewater treatment infrastructure to address urban water shortages and environmental concerns. However, slower economic growth and budget limitations in several countries pose challenges. Despite these factors, industries seeking affordable, low-maintenance air solutions are creating opportunities. Increasing participation from international suppliers and growing adoption in oil and gas industries will gradually strengthen the regional market presence.

Middle East and Africa

The Middle East and Africa accounted for 4% share of the regenerative blowers market in 2024, largely driven by oil and gas, chemical, and water treatment sectors. Countries like Saudi Arabia, the UAE, and South Africa are leading adopters due to growing industrial infrastructure. Strong demand for water reuse and desalination projects further supports blower applications. However, reliance on oil economies and limited manufacturing diversification restrict overall market expansion. Global players are entering through partnerships to supply cost-efficient solutions. Rising focus on environmental compliance and infrastructure development is expected to create steady opportunities in the long term.

Market Segmentations:

By Stage Type:

- Single staged

- Two-staged

- Three-staged

By End User:

- Water and wastewater

- Food & beverage

- Industrial

- Chemical

- Oil & gas

- Medical

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The regenerative blowers market is characterized by the presence of established players such as Gast Manufacturing, Inc., Eurus Blowers, Busch SE, Atlas Copco, Becker Pump Corporation, Hitachi Limited, Aerzen, Air Control Industries Ltd. (ACI), Rietschle Thomas, Ametek Inc., FPZ Spa, Busch Vacuum Solutions, KNB Group, Garden Denver Nash, Elektor Airsystems GmbH, and Airtech Vacuum Incorporated. Market competition is driven by product innovation, energy-efficient technologies, and diversification of applications across wastewater treatment, food and beverage, medical, and industrial sectors. Companies are focusing on enhancing design efficiency, noise reduction, and compact structures to meet the demands of sustainability and regulatory compliance. Strategic partnerships, mergers, and regional expansions remain common approaches to strengthening market presence. Increasing adoption in Asia Pacific and rising investments in automation and process efficiency are shaping competitive strategies. With evolving end-user requirements, the market is expected to witness continued innovation and stronger global competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gast Manufacturing, Inc.

- Eurus Blowers

- Busch SE

- Atlas Copco

- Becker Pump Corporation

- Hitachi Limited

- Aerzen

- Air Control Industries Ltd. (ACI)

- Rietschle Thomas

- Ametek Inc.

- FPZ Spa

- Busch Vacuum Solutions

- KNB Group

- Garden Denver Nash

- Elektor Airsystems GmbH

- Airtech Vacuum Incorporated

- FPZ Spa

Recent Developments

- In March 2024, Aerzen established a new manufacturing facility for its high-performance turbo blowers in South Korea.

- In 2023, Atlas Copco announced a new line of regenerative blowers designed for the food and beverage industry.

- In 2023, AMETEK Dynamic Fluid Solutions merged with Bison Gear and Engineering Corporation to form a more customer-centric organization named Bison, under AMETEK Inc.. This strategic move enhanced the company’s ability to serve various sectors globally by consolidating expertise and strengthening product offerings in motors, pumps, and blowers

Report Coverage

The research report offers an in-depth analysis based on Stage Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with consistent demand from water and wastewater treatment plants.

- Industrial automation will increase adoption of regenerative blowers for process efficiency.

- Energy-efficient blower designs will gain higher preference due to sustainability requirements.

- Food and beverage industries will continue driving growth through hygienic and oil-free applications.

- Medical and healthcare applications will emerge as a promising growth avenue.

- Asia Pacific will show the fastest growth, supported by rapid industrialization and infrastructure spending.

- Manufacturers will invest in compact and low-noise blower technologies to improve performance.

- Competition with centrifugal and displacement blowers will push innovation in regenerative designs.

- Expansion in oil and gas sectors will create stable demand for high-pressure blower solutions.

- Global players will focus on mergers and partnerships to strengthen regional market presence.