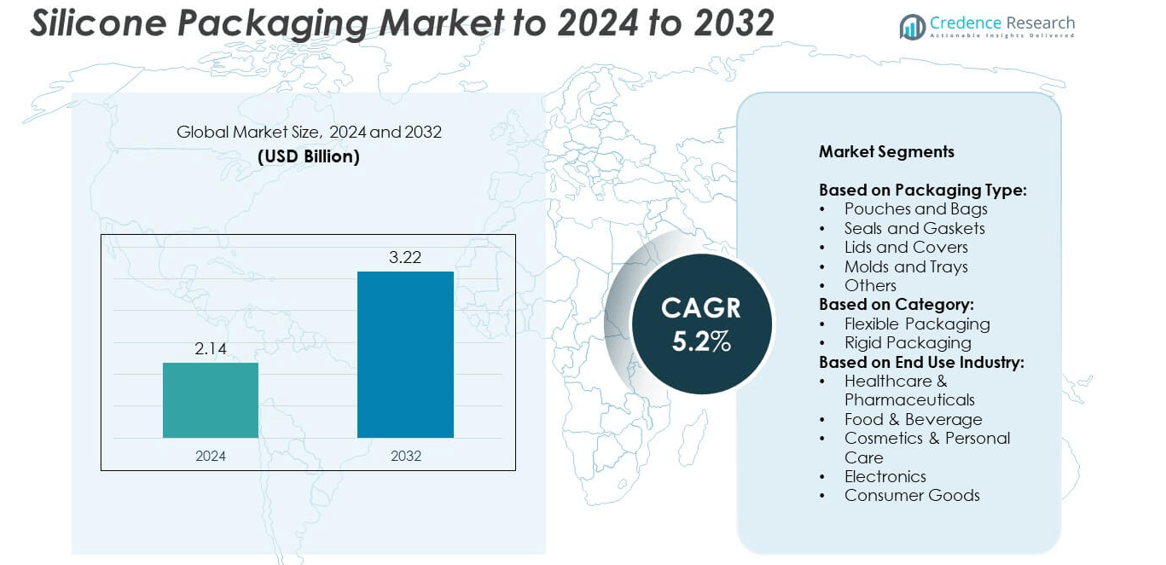

Silicone Packaging Market size was valued USD 2.14 Billion in 2024 and is anticipated to reach USD 3.22 Billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Packaging Market Size 2024 |

USD 2.14 Billion |

| Silicone Packaging Market, CAGR |

5.2% |

| Silicone Packaging Market Size 2032 |

USD 3.22 Billion |

The silicone packaging market is shaped by key players such as Dow Inc., Elkem ASA, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Saint-Gobain, Stasher, Zip Top, Stockwell Elastomerics, Momentive Performance Materials, and Merlin Packaging Technologies, Inc. These companies compete through innovation, product diversification, and strategic expansion into emerging applications across healthcare, food and beverage, and personal care industries. North America emerged as the leading region in 2024, holding 34% of the global share, supported by strong healthcare demand, advanced manufacturing infrastructure, and high adoption of sustainable packaging solutions. Europe and Asia Pacific followed, driven by regulatory compliance and rising consumer consumption.

Market Insights

- The silicone packaging market was valued at USD 2.14 Billion in 2024 and is projected to reach USD 3.22 Billion by 2032, expanding at a CAGR of 5.2% during the forecast period.

- Growth is driven by rising demand in healthcare and pharmaceuticals, accounting for nearly 40% share, along with expanding applications in food and beverage packaging that rely on durability, sterility, and high barrier properties.

- Market trends highlight increasing adoption of flexible packaging, which held over 55% share in 2024, supported by sustainability goals, lightweight design, and growing use in personal care and consumer goods.

- The competitive landscape features global leaders and niche innovators focusing on recyclable and reusable solutions, mergers, and technological integration such as smart packaging to strengthen market presence.

- Regionally, North America led with 34% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Latin America, the Middle East, and Africa collectively accounted for the remaining share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Packaging Type

Pouches and bags represented the largest share of the silicone packaging market in 2024, accounting for over 35%. Their dominance comes from widespread use in food, beverage, and healthcare applications where high barrier protection and flexibility are essential. Silicone-based pouches provide superior resistance to temperature variation, moisture, and chemical interaction, making them suitable for pharmaceuticals and ready-to-eat products. Increasing demand for lightweight and recyclable packaging further strengthens adoption. Seals and gaskets, lids and covers, molds and trays, and other formats continue to expand but remain secondary in terms of overall share.

- For instance, Stasher reported that its reusable silicone bags had prevented over 1 billion single-use plastic bags from disposal by April 2021. The company has since updated this figure, stating that by late 2024, the number had reached 5.5 billion single-use plastic bags prevented from entering waterways and oceans.

By Category

Flexible packaging dominated the category segment in 2024 with more than 55% share. Its leadership is driven by the growing adoption of silicone-based films and laminates that enhance durability and extend product shelf life. Flexible formats reduce transportation costs, offer design adaptability, and are compatible with high-speed packaging lines, making them preferred by food, healthcare, and personal care industries. Rising consumer demand for convenience packaging, combined with industry focus on material efficiency and waste reduction, ensures flexible packaging maintains its lead over rigid packaging alternatives through the forecast period.

- For instance, Ahlstrom announced in March 2023 its intention to divest or consider closing its Stenay specialty paper plant in France, which had an annual capacity of approximately 55,000 tons.

By End Use Industry

Healthcare and pharmaceuticals led the silicone packaging market in 2024, capturing nearly 40% of total demand. This dominance is fueled by the sector’s strict requirements for sterile, chemically resistant, and heat-stable packaging. Silicone packaging ensures product integrity for critical items such as medical devices, injectable drugs, and diagnostic kits. The rise in biologics and injectable therapies further supports this segment. Food and beverage, cosmetics and personal care, electronics, and consumer goods also contribute steadily, but healthcare maintains the largest share due to its regulatory-driven demand and high safety standards.

Market Overview

Rising Demand in Healthcare and Pharmaceuticals

The healthcare and pharmaceutical sector is a key growth driver of the silicone packaging market, accounting for nearly 40% of total demand in 2024. Packaging requirements in this industry emphasize sterility, chemical resistance, and durability, making silicone the material of choice. Growing use of injectable drugs, biologics, and diagnostic kits further expands adoption. As regulatory standards tighten and new therapies emerge, healthcare providers increasingly rely on silicone packaging to ensure product safety, reduce contamination risks, and support the global expansion of advanced pharmaceutical supply chains.

- For instance, Catalent, a global provider of manufacturing solutions for drugs and biologics, reported in its fiscal year 2023 Corporate Responsibility Report that its global manufacturing platforms supplied approximately 70 billion doses of nearly 8,000 products annually, covering a wide range of formats including biologics, oral doses, and others.

Shift Toward Sustainable and Flexible Packaging

The move toward flexible, sustainable packaging solutions is another key growth driver. Flexible silicone packaging such as pouches, films, and laminates holds over 55% market share due to its lightweight design, recyclability, and reduced transportation costs. Growing environmental concerns push industries to replace rigid formats with resource-efficient alternatives that extend product shelf life. Rising demand for convenience packaging in food, beverages, and personal care further accelerates this transition. With governments promoting eco-friendly solutions, silicone-based flexible formats continue to gain traction, reinforcing their leadership in packaging applications across industries.

- For instance, while specialized coatings, including those incorporating silicon oxide (SiOx), have achieved ultra-low oxygen transmission rates (OTR) of less than 0.05 cc/m²·

Expansion in Food and Beverage Applications

Food and beverage packaging represents a significant growth driver in the silicone packaging market. Increasing demand for ready-to-eat meals, packaged beverages, and perishable goods has accelerated adoption of silicone pouches, seals, and trays. The segment benefits from silicone’s resistance to extreme temperatures, ensuring safety during freezing, heating, and transportation. As global consumption of packaged food rises, manufacturers focus on extending shelf life and preventing contamination. Silicone packaging meets these needs while supporting regulatory compliance, making food and beverage applications one of the fastest-growing contributors to market expansion.

Key Trends & Opportunities

Integration of Smart Packaging Solutions

A key trend in the silicone packaging market is the integration of smart packaging technologies. Manufacturers are incorporating sensors, QR codes, and tracking systems into silicone-based packaging to enhance product safety and traceability. In healthcare, smart silicone packaging ensures monitoring of temperature-sensitive drugs, while in food and beverages, it helps track freshness and reduce waste. Growing adoption of Internet of Things (IoT) platforms creates opportunities for value-added packaging solutions, allowing companies to differentiate their products while meeting consumer demand for transparency and quality assurance.

- For instance, Schreiner MediPharm’s RFID labels have enabled tracking of over 325 million injectable drug units through their KitCheck system in 900 hospitals.

Growth of Cosmetic and Personal Care Segment

An emerging opportunity lies in the cosmetics and personal care sector, where demand for silicone packaging is steadily increasing. The segment benefits from silicone’s flexibility, lightweight nature, and resistance to moisture and chemical degradation. Brands are adopting silicone-based pouches, tubes, and lids to deliver premium aesthetics and improved product preservation. Rising disposable income, combined with consumer preference for portable and travel-friendly packaging, supports this trend. With growing emphasis on sustainable and reusable packaging formats, silicone solutions offer strong opportunities for expansion within the beauty and personal care industry.

- For instance, Beiersdorf reported its consumer business segment generated sales of €7.8 billion in 2023, reflecting double-digit organic sales growth of 12.5%. The company’s NIVEA brand exceeded €5 billion in sales for the first time, and significant investments were made in supply chain and infrastructure, including a new production site in Leipzig, Germany, with a capacity of up to 450 million products per year.

Key Challenges

High Raw Material Costs

A major challenge in the silicone packaging market is the high cost of raw materials, which limits affordability for manufacturers and end-users. Volatility in silicone feedstock prices directly impacts production expenses, reducing profit margins for packaging companies. Small and mid-sized manufacturers face greater difficulties in absorbing these costs, leading to price-sensitive customers shifting to alternative materials. This cost barrier restricts large-scale adoption in emerging markets and creates competitive pressure, making affordability a critical hurdle to long-term growth and wider acceptance of silicone-based packaging.

Environmental and Recycling Limitations

Recycling limitations present another key challenge in the silicone packaging market. Although silicone offers durability and reusability, its recycling infrastructure is underdeveloped compared to traditional plastics. Limited recycling facilities and complex material recovery processes reduce its appeal in regions with strict environmental regulations. Rising focus on circular economy practices puts additional pressure on manufacturers to address end-of-life waste management. Without scalable recycling solutions, silicone packaging risks losing favor in highly regulated industries, restricting growth opportunities despite its technical advantages in durability and performance.

Regional Analysis

North America

North America held the largest share of the silicone packaging market in 2024, accounting for 34%. The region benefits from strong demand in healthcare, pharmaceuticals, and food and beverage sectors, where strict safety standards drive adoption. High investments in research and development, along with the presence of leading packaging innovators, further strengthen the market. Growth in e-commerce and rising preference for sustainable, flexible packaging formats add to momentum. The United States remains the primary contributor, supported by advanced infrastructure, strict regulatory compliance, and increasing focus on innovative silicone-based solutions across consumer and industrial applications.

Europe

Europe accounted for 28% of the silicone packaging market in 2024, driven by strict environmental regulations and growing demand for sustainable solutions. The region emphasizes eco-friendly packaging practices under directives such as the EU Green Deal, which encourages wider adoption of silicone-based formats. High consumption in food, beverage, and personal care industries boosts growth, while healthcare applications add steady demand. Germany, France, and the United Kingdom lead the market, supported by advanced manufacturing and strong regulatory compliance. The shift toward flexible, recyclable packaging continues to accelerate regional adoption and strengthens Europe’s position in global demand.

Asia Pacific

Asia Pacific captured 25% of the silicone packaging market in 2024, fueled by rising consumption in food, beverages, and personal care. Rapid industrialization, urbanization, and growing healthcare investments across China, India, and Japan support strong growth. Expanding middle-class populations and rising disposable incomes further increase demand for packaged goods. The region benefits from cost-efficient production capabilities and large-scale manufacturing, driving competitive exports of silicone-based packaging products. Increasing adoption of flexible packaging solutions and government focus on improving food safety standards enhance regional market strength, making Asia Pacific the fastest-growing contributor to global demand.

Latin America

Latin America represented 7% of the silicone packaging market in 2024, with demand concentrated in food, beverage, and healthcare applications. Brazil and Mexico drive most of the consumption, supported by growing packaged food exports and healthcare modernization efforts. Rising consumer preference for durable, flexible packaging formats encourages adoption of silicone solutions across industries. However, economic volatility and higher material costs limit rapid expansion. Gradual regulatory improvements and growing partnerships with multinational packaging companies create opportunities for growth. Despite its smaller share, Latin America demonstrates potential as industries adapt to global sustainability and safety standards.

Middle East

The Middle East accounted for 4% of the silicone packaging market in 2024, driven by expanding healthcare infrastructure and rising demand for packaged food and beverages. Countries such as the United Arab Emirates and Saudi Arabia are investing heavily in modernizing medical and pharmaceutical sectors, creating opportunities for silicone packaging adoption. The region also benefits from growing retail and e-commerce channels, increasing demand for durable and protective packaging. However, dependence on imports for raw materials and limited recycling infrastructure pose challenges. Despite these hurdles, rising consumer demand supports steady growth in silicone packaging applications.

Africa

Africa held a 2% share of the silicone packaging market in 2024, the smallest among regions but showing gradual growth. Rising urbanization and increasing demand for packaged food and beverages contribute to adoption. Healthcare applications also expand steadily, supported by government investment in improving medical infrastructure across countries such as South Africa and Nigeria. Limited availability of advanced manufacturing facilities and high costs of silicone packaging remain challenges. However, rising foreign investments and growing awareness of safe and durable packaging solutions are expected to create new opportunities, supporting Africa’s role as an emerging market.

Market Segmentations:

By Packaging Type:

- Pouches and Bags

- Seals and Gaskets

- Lids and Covers

- Molds and Trays

- Others

By Category:

- Flexible Packaging

- Rigid Packaging

By End Use Industry:

- Healthcare & Pharmaceuticals

- Food & Beverage

- Cosmetics & Personal Care

- Electronics

- Consumer Goods

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Dow Inc., Elkem ASA, Zip Top, Wacker Chemie AG, Stockwell Elastomerics, Saint-Gobain, Shin-Etsu Chemical Co., Ltd., Stasher, Momentive Performance Materials, and Merlin Packaging Technologies, Inc. are among the prominent players shaping the silicone packaging market. The competitive landscape is characterized by continuous innovation in packaging formats, focusing on durability, flexibility, and sustainability. Companies are actively investing in product development to enhance barrier properties, improve recyclability, and meet regulatory standards across healthcare, food, and personal care sectors. Strategic partnerships, mergers, and expansions into emerging markets support stronger global footprints and increased production capacity. With rising demand for eco-friendly and reusable packaging, players are focusing on developing solutions that align with circular economy initiatives. Growing emphasis on premium packaging aesthetics and integration of smart features further intensifies competition. The market remains fragmented, with global leaders and niche innovators competing through differentiated products, advanced materials, and customer-centric solutions tailored to industry-specific requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow Inc.

- Elkem ASA

- Zip Top

- Wacker Chemie AG

- Stockwell Elastomerics

- Saint-Gobain

- Shin-Etsu Chemical Co., Ltd.

- Stasher

- Momentive Performance Materials

- Merlin Packaging Technologies, Inc.

Recent Developments

- In 2025, Dow introduced a silicone-based solution for film packaging as a PFAS-free alternative.

- In 2025, WACKER launched its POWERSIL® 1900 A/B high-consistency silicone rubber for composite insulators at the K 2025 trade fair.

- In 2025, Shin-Etsu Chemical released new silicone emulsifiers, KF-6080W and a corresponding product, which are designed to improve the texture and functionality of water-based and Oil-in-Water (O/W) personal care products, including hair care, skin care, and base makeup.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Category, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The silicone packaging market will expand steadily, driven by healthcare and pharmaceutical demand.

- Flexible packaging formats will maintain dominance due to lightweight design and recyclability.

- Food and beverage applications will see strong growth with rising packaged meal consumption.

- Cosmetics and personal care will adopt silicone packaging for premium and sustainable solutions.

- Smart packaging integration with tracking and monitoring features will gain wider adoption.

- Sustainability initiatives will push innovation in recyclable and reusable silicone packaging formats.

- Asia Pacific will emerge as the fastest-growing region supported by industrialization and urbanization.

- North America will retain leadership with advanced healthcare and packaging infrastructure.

- High raw material costs will continue to challenge affordability for small manufacturers.

- Investments in recycling technologies will become critical for long-term market acceptance.