Market Overview

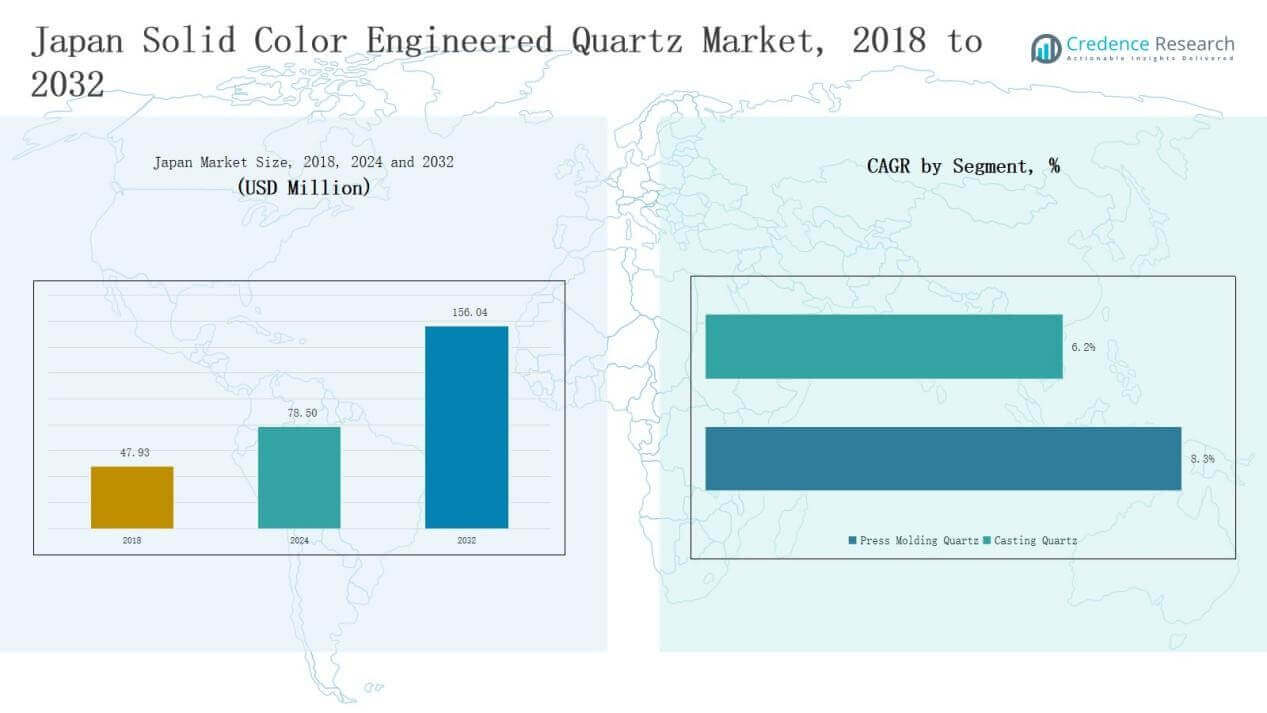

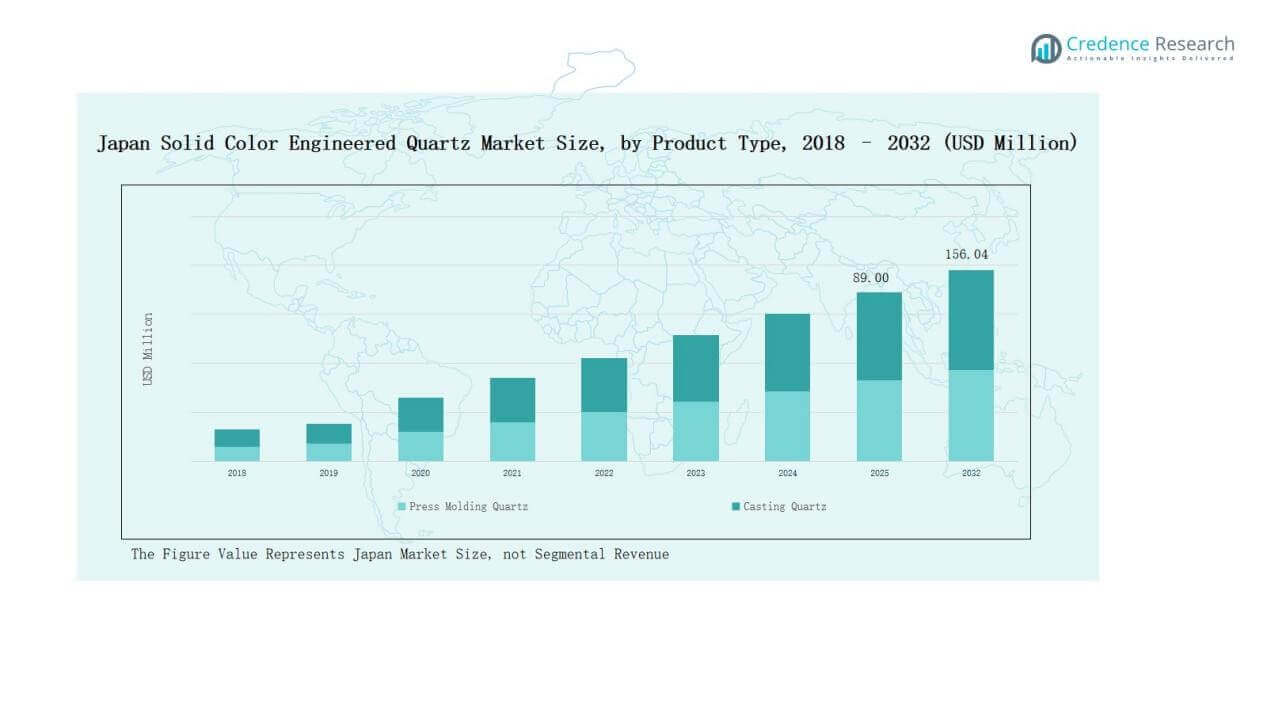

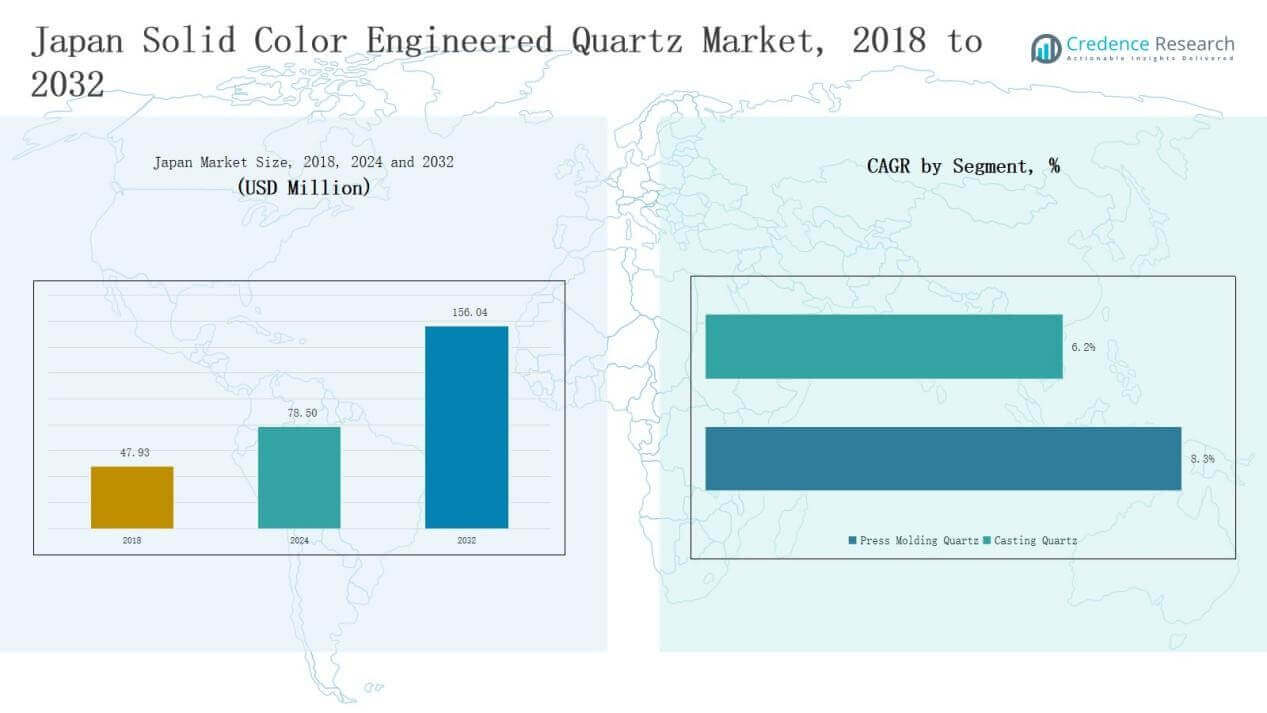

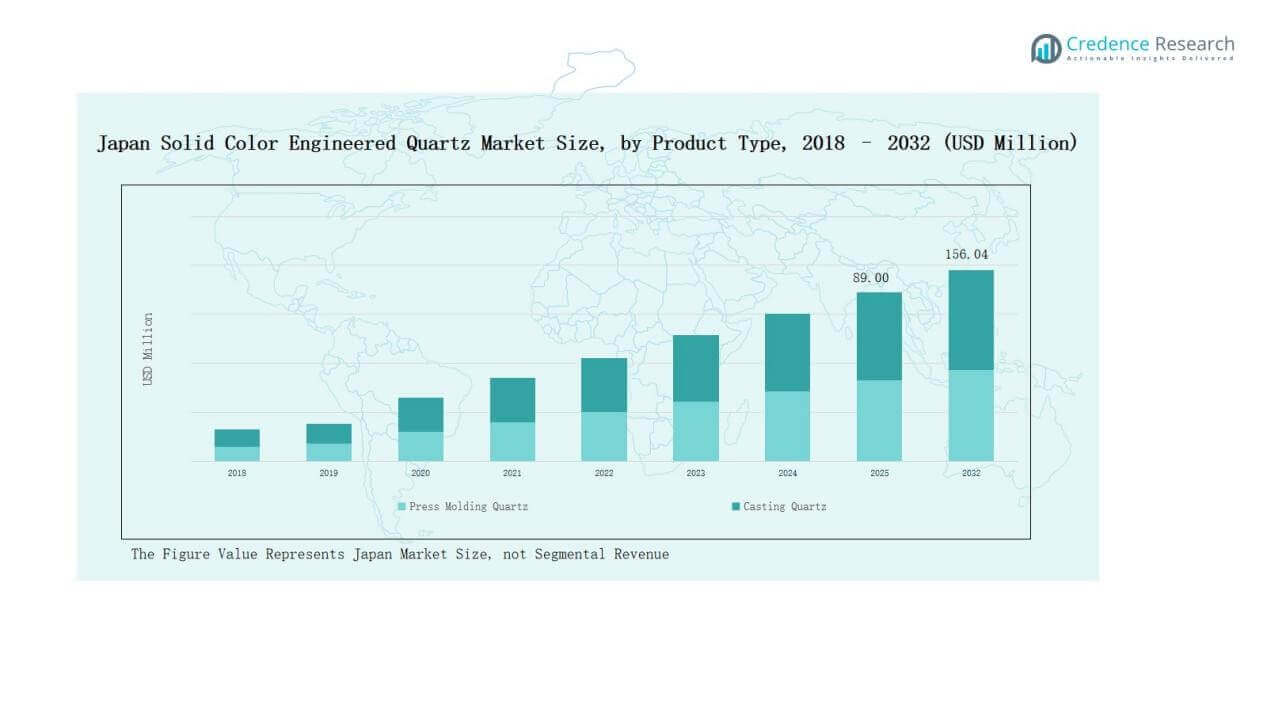

The Japan Solid Color Engineered Quartz Market size was valued at USD 47.93 million in 2018, reached USD 78.50 million in 2024, and is anticipated to reach USD 156.04 million by 2032, growing at a CAGR of 8.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Solid Color Engineered Quartz Market Size 2024 |

USD 78.50 Million |

| Japan Solid Color Engineered Quartz Market, CAGR |

8.35% |

| Japan Solid Color Engineered Quartz Market Size 2032 |

USD 156.04 Million |

The Japan Solid Color Engineered Quartz Market features strong competition among both domestic and global players, with Tostem Corporation, INAX (LIXIL Group), and Toto Ltd. leading the local landscape through established distribution networks and brand strength. International companies such as Cosentino, Caesarstone, Vicostone, HanStone Quartz, Technistone, Quarella, and Wilsonart enhance market rivalry by offering premium designs, sustainable solutions, and advanced customization. These players focus on innovation, eco-friendly production, and collaboration with architects to expand adoption across applications. Regionally, the Kanto region dominated with 38% share in 2024, supported by Tokyo’s urban development, luxury housing projects, and strong commercial infrastructure growth.

Market Insights

Market Insights

- The Japan Solid Color Engineered Quartz Market grew from USD 47.93 million in 2018 to USD 78.50 million in 2024, and will reach USD 156.04 million by 2032.

- Press molding quartz dominated by product type with 63% share in 2024, driven by durability, uniform finish, and suitability for flooring, countertops, and wall applications.

- Countertops led applications with 54% share in 2024, supported by rising demand in kitchens, bathrooms, and remodeling projects across residential and premium housing developments.

- Residential end users held 67% share in 2024, driven by urbanization, disposable incomes, and demand for stylish, long-lasting surfaces, while commercial adoption grew in hospitality and offices.

- Regionally, Kanto commanded 38% share in 2024, followed by Kansai with 24%, Chubu with 16%, Kyushu & Okinawa with 12%, and Hokkaido & Tohoku with 10%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz accounted for 63% share of the Japan Solid Color Engineered Quartz Market in 2024, establishing itself as the dominant product type. Its strength, consistent finish, and adaptability across flooring, countertops, and walls drive demand. Casting quartz, though smaller in share, benefits from growing applications in customized and decorative surfaces. Rising consumer preference for durable, low-maintenance engineered stone supports steady growth across both categories, with press molding quartz maintaining a strong competitive edge.

For instance, Caesarstone introduced its premium quartz surfaces with heat and scratch resistance, catering to Japan’s residential kitchen segment with higher durability.

By Application

Countertops led the application segment with 54% share in 2024, highlighting their dominant role in the Japan Solid Color Engineered Quartz Market. Strong adoption in residential kitchens and bathrooms, supported by remodeling activities and premium housing projects, drives this leadership. Flooring and walls follow as attractive applications due to demand in modern interiors. Door jambs and other uses remain niche but expand gradually with rising design flexibility. Countertops continue to anchor growth, supported by durability and aesthetic value.

For instance, LG Hausys promoted its HIMACS acrylic solid surface for wall cladding projects, citing its stain resistance and versatile design appeal in contemporary interiors.

By End User

The residential segment held 67% share in 2024, making it the leading end-user segment in the Japan Solid Color Engineered Quartz Market. Increasing urbanization, rising disposable incomes, and strong demand for stylish, long-lasting surfaces in homes support this dominance. Commercial adoption, though smaller, is gaining momentum in hotels, offices, and retail spaces due to its modern appeal and ease of upkeep. Both sectors benefit from engineered quartz’s durability, but residential projects remain the core growth driver.

Key Growth Drivers

Rising Demand for Premium Housing Projects

The Japan Solid Color Engineered Quartz Market benefits from a surge in premium housing and luxury apartments. Consumers increasingly prefer durable, low-maintenance surfaces for kitchens and bathrooms. Press molding quartz dominates due to its strength, consistent finish, and design appeal. Remodeling activities in urban households further strengthen demand for countertops and flooring. Government-backed housing modernization programs also boost installations, reinforcing engineered quartz as a preferred alternative to natural stone. This shift continues to drive market expansion in residential projects.

For instance, AICA Kogyo Co., Ltd. offers Fiore stone, an engineered quartz material that features natural quartz crystals and is widely used in luxury residential and commercial projects across Japan for its durability and elegant appearance.

Expanding Commercial Infrastructure Investments

Rapid growth in Japan’s commercial real estate sector acts as a strong driver. Engineered quartz is widely used in hotels, offices, and retail spaces due to its long lifespan, ease of maintenance, and modern design flexibility. With rising foreign investments and urban development, demand for durable interior materials grows steadily. Applications in walls, flooring, and countertops dominate commercial installations. Market growth is further supported by architects and contractors increasingly recommending quartz for cost efficiency and sustainable performance in high-traffic projects.

For instance, Technistone launched its La Natura 2025 collection in May 2025, featuring eco-friendly quartz surfaces increasingly adopted in Japanese retail and corporate developments.

Growing Preference for Sustainable and Low-Maintenance Surfaces

Environmental awareness and consumer preference for eco-friendly products strongly influence demand. Engineered quartz offers durability, stain resistance, and long-lasting performance with less maintenance compared to natural stone. Japanese consumers increasingly value sustainability and practicality in home and commercial design. Manufacturers focus on introducing greener production methods and recyclable components, aligning with national sustainability goals. This eco-friendly advantage enhances its adoption across residential and commercial sectors, making sustainability and low maintenance one of the primary growth drivers in the market.

Key Trends & Opportunities

Key Trends & Opportunities

Rising Popularity of Customized Designs

Customization is an emerging trend shaping the Japan Solid Color Engineered Quartz Market. Consumers demand unique patterns, textures, and finishes to match modern interiors. This preference opens opportunities for manufacturers to expand product lines with marble-look, matte, and specialty designs. Growth in smart homes and luxury apartments further supports customized demand, especially in countertops and flooring applications. As Japanese homeowners prioritize individuality and premium aesthetics, customization becomes a strong differentiator, offering companies an opportunity to capture niche segments and boost profitability.

For instance, Cosentino launched its Silestone Sunlit Days collection, which offers quartz surfaces with a wide range of colors and eco-friendly finishes, catering to customers who value both sustainability and individuality.

Opportunities in Technological Advancements and Automation

Advanced manufacturing technologies, such as automated casting and precision cutting, are creating opportunities for market players. These innovations improve product consistency, reduce production costs, and expand design capabilities. Companies in Japan are investing in automation to scale production and meet rising demand from residential and commercial sectors. The ability to deliver high-quality, defect-free products at competitive prices supports growth. Integration of digital technologies in product design also opens new opportunities, allowing suppliers to cater to evolving consumer expectations efficiently.

For instance, TOTO Ltd. invested in automated casting systems for sanitary ware production, ensuring defect-free products while cutting water and material waste during manufacturing.

Key Challenges

High Production and Material Costs

One of the key challenges for the Japan Solid Color Engineered Quartz Market is the high cost of raw materials and production. Imported quartz components add to overall expenses, making products less competitive against alternatives. Rising energy prices and labor costs further strain profitability. This restricts wider adoption among cost-sensitive buyers, particularly in mid-range housing projects. Companies must focus on optimizing supply chains and exploring local sourcing to mitigate cost-related challenges and ensure long-term market sustainability.

Intense Competition from Alternatives

Engineered quartz faces significant competition from substitutes like granite, marble, ceramics, and laminates. These alternatives often appeal to budget-conscious customers or those preferring natural stone aesthetics. While quartz offers durability and low maintenance, competing products sometimes provide better cost advantages or wider availability. This competitive environment challenges market players to differentiate through product innovation and branding. Without clear value-added features, quartz risks losing share in both residential and commercial segments, especially in price-sensitive projects across Japan.

Limited Awareness in Niche Applications

Although engineered quartz is well-established in countertops and flooring, awareness remains limited in applications such as door jambs and specialty wall surfaces. Many contractors and consumers still prefer traditional materials due to familiarity. This limits potential growth in smaller but emerging niches. Manufacturers must increase marketing efforts, demonstrate long-term benefits, and collaborate with designers to expand adoption. Without strong promotion, untapped applications may continue to lag, preventing the market from realizing its full potential in diversified usage.

Regional Analysis

Kanto

The Kanto region commanded 38% share of the Japan Solid Color Engineered Quartz Market in 2024. Strong urbanization in Tokyo and surrounding cities supports demand for engineered quartz in both residential and commercial projects. Countertops and flooring installations dominate due to growing luxury apartment construction and office space development. It benefits from a strong network of distributors and retailers that ensures product availability. High disposable income levels further encourage adoption of premium quartz designs. The region remains the central hub for growth, driven by modernization and large-scale real estate investments.

Kansai

Kansai held 24% share in 2024, making it the second-largest market in the country. Osaka and Kyoto drive strong adoption through expanding commercial infrastructure and cultural tourism projects. It benefits from rising demand in hospitality and retail spaces, where quartz is valued for durability and aesthetics. Residential remodeling also adds to growth, with families preferring long-lasting surfaces. Government-backed urban renewal programs continue to boost construction activities. Kansai’s mix of commercial expansion and residential demand secures its strong position in the market.

Chubu

The Chubu region accounted for 16% share in 2024, led by industrial hubs and mid-sized urban centers. Growing household demand for modern kitchens and bathrooms supports steady sales of quartz countertops. It also sees adoption in commercial projects linked to manufacturing offices and retail outlets. Distributors target this region with cost-effective quartz solutions to attract middle-income groups. Awareness of eco-friendly materials is rising, pushing adoption further. Chubu is emerging as a balanced market with both residential and commercial potential.

Kyushu & Okinawa

Kyushu and Okinawa together represented 12% share in 2024. Growth is supported by rising investments in tourism and hospitality, where engineered quartz is increasingly used in hotels and resorts. Residential adoption is growing as modern housing expands in urban centers. It also benefits from expanding retail infrastructure that promotes premium home improvement materials. Market penetration remains lower compared to Kanto and Kansai, but steady demand from coastal developments provides future opportunities. The region is positioned for gradual expansion driven by tourism-led construction.

Hokkaido & Tohoku

Hokkaido and Tohoku held 10% share in 2024, reflecting smaller but growing adoption. Cold climate housing projects prioritize durable and low-maintenance surfaces, supporting demand for engineered quartz. It also sees niche adoption in ski resorts and hospitality establishments. Distribution networks are less dense, creating challenges for broader reach. However, rising interest in modern interiors among urban households fuels adoption. Hokkaido and Tohoku are expected to remain smaller contributors but hold steady growth prospects within the overall Japan Solid Color Engineered Quartz Market.

Market Segmentations:

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Region

- Kanto

- Kansai

- Chubu

- Hokkaido & Tohoku

- Kyushu & Okinawa

Competitive Landscape

The Japan Solid Color Engineered Quartz Market is characterized by strong competition among domestic and international players striving to capture a growing customer base. Key domestic companies such as Tostem Corporation, INAX (LIXIL Group), and Toto Ltd. lead the market with established brand presence, advanced distribution networks, and strong alignment with consumer preferences for durable and stylish surfaces. Global leaders including Cosentino, Caesarstone, Vicostone, and HanStone Quartz strengthen competition by introducing premium designs, eco-friendly products, and technological innovations. These players invest heavily in customization, modern finishes, and sustainable production to meet rising demand across residential and commercial applications. Partnerships with contractors, architects, and distributors enhance market penetration, while continuous product innovation helps differentiate offerings in a crowded landscape. The competitive environment remains intense, driving companies to balance quality, price, and sustainability while addressing evolving consumer expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Tostem Corporation

- INAX (LIXIL Group)

- Toto Ltd.

- Cosentino

- Caesarstone

- Vicostone

- HanStone Quartz

- Technistone

- Quarella

- Wilsonart

Recent Developments

- In May 2025, Aica Kogyo Co., Ltd. announced the acquisition of TAKARAINC Co., Ltd. through a partial share exchange. The move aims to strengthen synergy in resin technologies and expand its presence in the Japanese quartz surfaces market.

- In July 2025, Vicostone introduced ten new quartz colors as part of its latest collection.

- In August 2025, Wilsonart launched 10 new quartz designs with bold green and blue colorways.

- In 2023, Wilsonart introduced a new quartz line with natural matte finishes at KBIS 2023.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium quartz countertops will continue to rise in residential projects.

- Commercial adoption will expand in hotels, offices, and retail spaces.

- Customization in colors, textures, and finishes will gain stronger consumer preference.

- Sustainable and eco-friendly production methods will become a competitive differentiator.

- Technological advancements in automated manufacturing will enhance product consistency.

- Regional growth will strengthen in Kanto and Kansai due to urban development.

- Awareness campaigns will increase adoption in niche applications like door jambs.

- Collaborations with architects and contractors will drive wider product penetration.

- Competition from natural stone and laminates will push innovation in quartz surfaces.

- Distribution networks will expand to improve product availability across mid-sized cities.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: