Market Overview

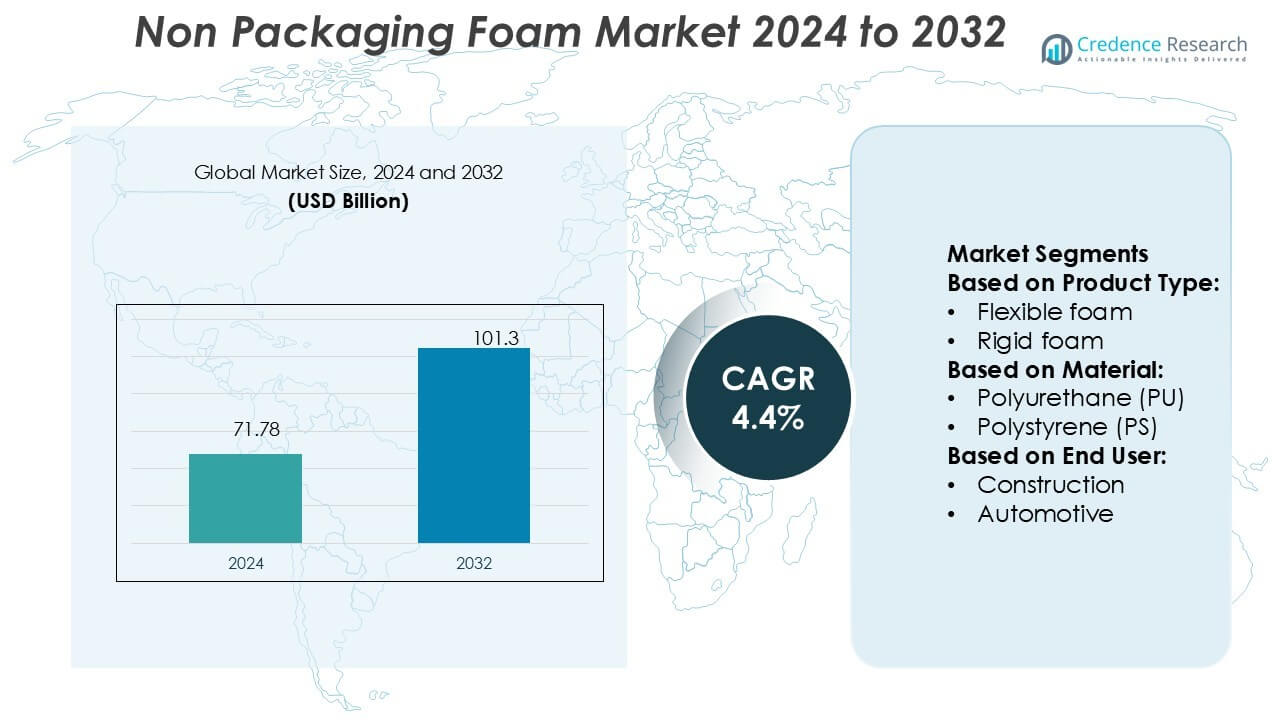

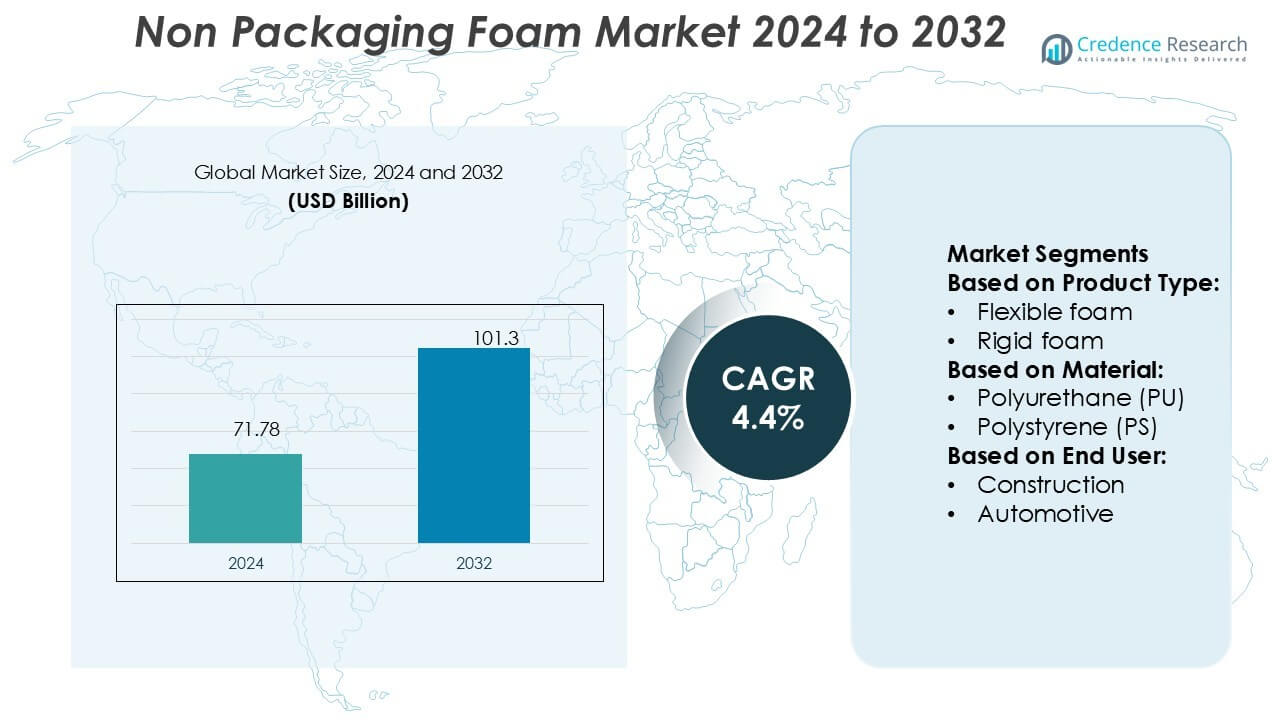

Non Packaging Foam Market size was valued USD 71.78 billion in 2024 and is anticipated to reach USD 101.3 billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Packaging Foam Market Size 2024 |

USD 71.78 Billion |

| Non Packaging Foam Market, CAGR |

4.4% |

| Non Packaging Foam Market Size 2032 |

USD 101.3 Billion |

The non-packaging foam market is highly competitive, with key players including INOAC Corporation, Saint-Gobain, Armacell International, Dow, Huntsman Corporation, JSP Corporation, Recticel, Covestro, FXI Holdings, and BASF. These companies focus on innovation, sustainability, and product diversification to strengthen their positions across industries such as construction, automotive, furniture, and healthcare. Asia-Pacific leads the global market with a 34% share in 2024, driven by rapid urbanization, strong manufacturing capacity, and rising consumer demand in emerging economies. Strategic investments in bio-based foams, advanced insulation solutions, and lightweight automotive applications enable leading players to capture growth opportunities and expand their regional footprint.

Market Insights

Market Insights

- The non-packaging foam market size was valued at USD 71.78 billion in 2024 and is expected to reach USD 101.3 billion by 2032, registering a CAGR of 4.4% during the forecast period.

- Rising demand from construction, automotive, and healthcare industries drives steady growth, with flexible foam holding the largest share due to its wide applications in bedding, seating, and interiors.

- Market trends highlight a strong shift toward bio-based and recyclable foams, with companies investing in sustainable solutions to meet regulatory standards and consumer preferences.

- Competitive dynamics remain intense, with leading players focusing on innovation, partnerships, and capacity expansions, while challenges such as raw material price volatility and environmental restrictions limit faster adoption.

- Asia-Pacific leads with a 34% regional share in 2024, fueled by urbanization and industrial growth, while North America and Europe strengthen positions with sustainability-focused initiatives and advanced foam applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Flexible foam holds the largest share in the non-packaging foam market, capturing nearly 60% of revenue in 2024. Its dominance comes from high usage across furniture, bedding, and automotive interiors where comfort, cushioning, and durability are critical. Flexible foam also benefits from recyclability and lightweight properties, supporting sustainability goals in construction and healthcare applications. Rigid foam, while smaller, is gaining traction in insulation and industrial uses due to superior thermal resistance. Growth in energy-efficient building projects is driving demand for rigid foam, especially in North America and Europe.

- For instance, Saint-Gobain’s Norseal PS-V0 micro-cellular polyurethane foam achieves UL94 V-0 rating in thicknesses from 3.5 mm up to 12 mm, and when compressed by 30 % it remains airtight up to 10 kPa (1.5 psi).

By Material

Polyurethane (PU) foam is the leading material, accounting for over 45% market share in 2024. Its wide adaptability, cost-effectiveness, and strong cushioning qualities make it the preferred choice in construction, furniture, and healthcare sectors. PU foam also benefits from advancements in bio-based formulations, aligning with green building and eco-friendly product trends. Polystyrene (PS) and polyethylene (PE) foams are expanding in automotive and electronics due to high shock absorption. Rubber foam, with strong insulation properties, finds demand in HVAC and medical applications, while polypropylene (PP) foams grow steadily in lightweight automotive parts.

- For instance, Armacell’s ArmaComfort NR-P combines polyurethane (PU) foam with mass loading to provide acoustic insulation. The product is rated with a weighted sound absorption coefficient of 0.25 (H) for its 12 mm thick variant, according to ISO 354 and EN ISO 11654.

By End User

The furniture and bedding sector dominates the market, holding 35% share in 2024, supported by strong demand for mattresses, cushions, and seating solutions. Rising consumer focus on comfort, health, and home décor trends continues to push growth. The construction industry also contributes significantly, leveraging foams for insulation, soundproofing, and structural support. Automotive applications are expanding due to lightweighting initiatives and passenger comfort features, while healthcare uses such as medical mattresses and prosthetics show steady gains. Electronics, though smaller, benefit from foams’ protective and shock-resistant qualities, especially in portable devices and smart appliances.

Key Growth Drivers

Rising Demand in Construction and Infrastructure

The construction sector drives strong demand for non-packaging foam, particularly for insulation and soundproofing applications. With governments and private developers emphasizing energy-efficient buildings, rigid foams gain significant traction due to their thermal resistance. Growing urbanization in Asia-Pacific and increasing renovation projects in Europe strengthen the market outlook. Additionally, green building certifications and sustainability regulations are encouraging the adoption of eco-friendly foam materials. These factors collectively enhance market growth, making construction one of the most influential demand drivers.

- For instance, Dow’s STYROFOAM™ Highload XPS insulation delivers compressive strengths of 40, 60, and 100 psi (275, 415, 690 kPa) while maintaining R-value of 5.0 per inch.

Expanding Automotive and Transportation Applications

Automotive manufacturers increasingly rely on non-packaging foams for lightweighting, comfort, and safety. Flexible foams are widely used in seating, interiors, and headliners, while PE and PP foams serve in noise and vibration reduction. Electric vehicle adoption further boosts demand, as automakers prioritize energy efficiency and improved passenger experience. Regulatory pressures to lower emissions reinforce the need for lightweight materials, directly favoring foam applications. This broad adoption across passenger and commercial vehicles positions the automotive industry as a major driver for market expansion.

- For instance, Huntsman’s ACOUSTIFLEX® VEF BIO system incorporates up to 20 % bio-based content while still achieving the same acoustic attenuation magnitude as their standard VEF foams (< 500 Hz).

Growth in Healthcare and Medical Applications

Healthcare represents a fast-growing end-user segment for non-packaging foam, especially in medical mattresses, prosthetics, and cushioning aids. Demand is fueled by rising healthcare spending, aging populations, and increasing focus on patient comfort. Rubber and PU foams are preferred for their hypoallergenic properties, durability, and ease of sterilization. Innovations in antimicrobial and high-resilience foams further expand adoption in hospitals and home care. As healthcare infrastructure improves in emerging economies, foam usage in medical equipment and rehabilitation products continues to accelerate, driving long-term growth.

Key Trends & Opportunities

Sustainability and Bio-Based Foam Development

Sustainability trends are reshaping the market, with growing interest in bio-based and recyclable foams. Manufacturers are investing in polyurethane derived from renewable feedstocks and circular economy initiatives to reduce environmental impact. Green building programs and corporate ESG goals support demand for eco-friendly materials. This shift creates opportunities for companies that can innovate in biodegradable or low-carbon foam solutions. As environmental regulations tighten globally, sustainable foam technologies will become a critical differentiator for competitive advantage.

- For instance, JSP’s ARPRO REvolution grade is made with near 100 % recycled content, built upon earlier lines using 25 % recycled end-of-life EPP parts.

Smart Foams and Advanced Applications

Technological advancements are opening opportunities in smart foams with enhanced functionalities, such as memory retention, shock absorption, and thermal regulation. Electronics and healthcare industries are adopting these innovative foams for wearables, prosthetics, and medical support systems. In automotive, smart foams enable improved passenger safety and adaptive comfort solutions. This trend toward multifunctional materials positions advanced foams as high-value solutions, attracting investment from both manufacturers and end users. Companies leveraging R&D for such applications can capture significant growth potential.

- For instance, Covestro leads chemical innovation with CO₂-based rigid polyurethane foam precursors. In its latest R&D, up to 20 % of petroleum feedstock is replaced by CO₂-derived intermediates, and prototype insulation boards built from CO₂-based polyols matched conventional foam’s thermal and mechanical benchmarks.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of petrochemical-based raw materials such as polyurethane and polystyrene pose a major challenge for foam producers. Dependency on crude oil markets creates cost instability, directly affecting profit margins. Small and medium enterprises are particularly vulnerable to price swings, limiting their ability to compete with large-scale players. These fluctuations also disrupt supply chain planning and long-term contract agreements. Developing bio-based alternatives may help reduce dependency, but higher production costs remain a barrier to widespread adoption.

Environmental Regulations and Disposal Issues

Strict environmental regulations regarding plastic and foam disposal present significant challenges to market growth. Non-biodegradable foams, particularly polystyrene, face restrictions in multiple regions due to landfill and pollution concerns. Recycling infrastructure for foams remains underdeveloped in many countries, limiting effective waste management. Compliance with evolving regulations increases operational costs for manufacturers, who must invest in cleaner technologies. Balancing performance, cost, and sustainability will be critical for foam producers to remain competitive under stringent environmental scrutiny.

Regional Analysis

North America

North America holds 28% share of the non-packaging foam market in 2024, driven by high demand in construction, automotive, and healthcare industries. The U.S. leads the region, supported by infrastructure modernization projects and strong adoption of energy-efficient insulation solutions. Automotive manufacturers increasingly use flexible and PU foams for lightweighting and comfort, while the healthcare sector contributes with growing demand for medical mattresses and prosthetics. Regulatory focus on sustainable materials encourages manufacturers to develop recyclable and bio-based foams. With steady innovation and industrial applications, North America maintains a mature yet growth-oriented market outlook.

Europe

Europe accounts for 24% market share in 2024, anchored by strict environmental regulations and sustainability-focused demand. Countries such as Germany, France, and the UK drive adoption of eco-friendly and recyclable foam materials, particularly in construction and automotive sectors. The furniture and bedding industry is a strong consumer, supported by lifestyle trends emphasizing comfort and durability. EU initiatives promoting green building and circular economy practices further enhance foam usage. While polystyrene faces regulatory restrictions, polyurethane and rubber foams find expanding roles in insulation, bedding, and healthcare. Europe’s innovation-led approach sustains its competitive regional presence.

Asia-Pacific

Asia-Pacific dominates the non-packaging foam market with a commanding 34% share in 2024. Rapid urbanization, population growth, and industrialization in China, India, and Southeast Asia fuel strong demand in construction, furniture, and automotive applications. Rising disposable incomes drive furniture and bedding sales, while expanding healthcare infrastructure increases usage of medical-grade foams. The region’s cost-effective manufacturing base supports global supply chains, particularly in polyurethane and polyethylene foam production. Government-backed initiatives for energy-efficient construction further strengthen growth. Asia-Pacific remains the fastest-growing region, combining strong domestic demand with export potential, positioning it as the key driver of global market expansion.

Latin America

Latin America represents 7% market share in 2024, with Brazil and Mexico leading regional demand. The construction sector drives foam consumption, supported by urban housing projects and commercial development. Automotive production also contributes, with rising adoption of lightweight PU and PP foams in interiors and seating. Furniture and bedding demand is expanding, driven by improving consumer lifestyles and increased home décor spending. However, limited recycling infrastructure and price sensitivity slow adoption of sustainable foams. Despite challenges, opportunities exist for global manufacturers to expand through strategic partnerships and localized production facilities across Latin America.

Middle East & Africa

The Middle East & Africa accounts for 7% share of the non-packaging foam market in 2024, with growth concentrated in the Gulf Cooperation Council (GCC) countries and South Africa. Large-scale infrastructure projects and energy-efficient construction drive significant demand for rigid foams. Healthcare expansion and rising automotive imports contribute additional opportunities. However, limited local manufacturing capacity and reliance on imports present challenges. Governments are increasingly investing in industrial diversification and green building practices, opening opportunities for sustainable foam products. While the region’s market is smaller, its rising investments in infrastructure and healthcare ensure consistent growth potential.

Market Segmentations:

By Product Type:

By Material:

- Polyurethane (PU)

- Polystyrene (PS)

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the non-packaging foam market is shaped by leading players including INOAC Corporation, Saint-Gobain, Armacell International, Dow, Huntsman Corporation, JSP Corporation, Recticel, Covestro, FXI Holdings, and BASF. The landscape of the non-packaging foam market is characterized by intense rivalry, driven by product innovation, sustainability initiatives, and expanding end-user demand. Companies are investing in research and development to deliver advanced foams with improved durability, lightweight properties, and recyclability. A strong emphasis on bio-based and eco-friendly solutions reflects the market’s alignment with global environmental regulations and customer preferences for sustainable materials. Market participants also pursue strategic collaborations, mergers, and regional expansions to strengthen supply chains and capture growth opportunities. Additionally, diversification across industries such as construction, automotive, furniture, and healthcare ensures broader market reach and resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Armacell is investing in one of the major and highly advanced plants worldwide, ArmaGel XG production, which is relatively expanding and holds the potential to enlarge further in the foreseeable period.

- In April 2025, Zotefoams – a world leader in supercritical foams announced Ecozote PE/R LD24 FR, the latest addition to its Ecozote Sustainability+ foams range, at this year’s AIX show on stand 5E36.

- In September 2024, BASF and Future Foam announced the first commercial production of flexible foam for the bedding industry made with 100% domestically produced Biomass Balance (BMB) Lupranate T 80 toluene diisocyanate (TDI).

- In May 2024, Suzhou Shincell New Materials Co., Ltd and Zotefoams signed a global alliance agreement. The agreement involves product development. Shincell’s technology will be shared and collaboratively perform marketing of Shinell’s product with Zotefoams offerings.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand from construction and insulation applications.

- Automotive lightweighting initiatives will increase foam usage in interiors and safety components.

- Healthcare adoption will grow with demand for medical mattresses, prosthetics, and cushioning aids.

- Furniture and bedding applications will sustain steady growth supported by lifestyle and comfort trends.

- Bio-based and recyclable foams will gain traction under stricter sustainability regulations.

- Technological innovations will drive development of smart foams with multifunctional properties.

- Asia-Pacific will remain the fastest-growing region with strong industrial and consumer demand.

- North America and Europe will focus on sustainable materials and advanced applications.

- Supply chain optimization and regional manufacturing will strengthen competitiveness in emerging markets.

- Strategic mergers, partnerships, and R&D investments will define long-term industry positioning.

Market Insights

Market Insights