Market Overview

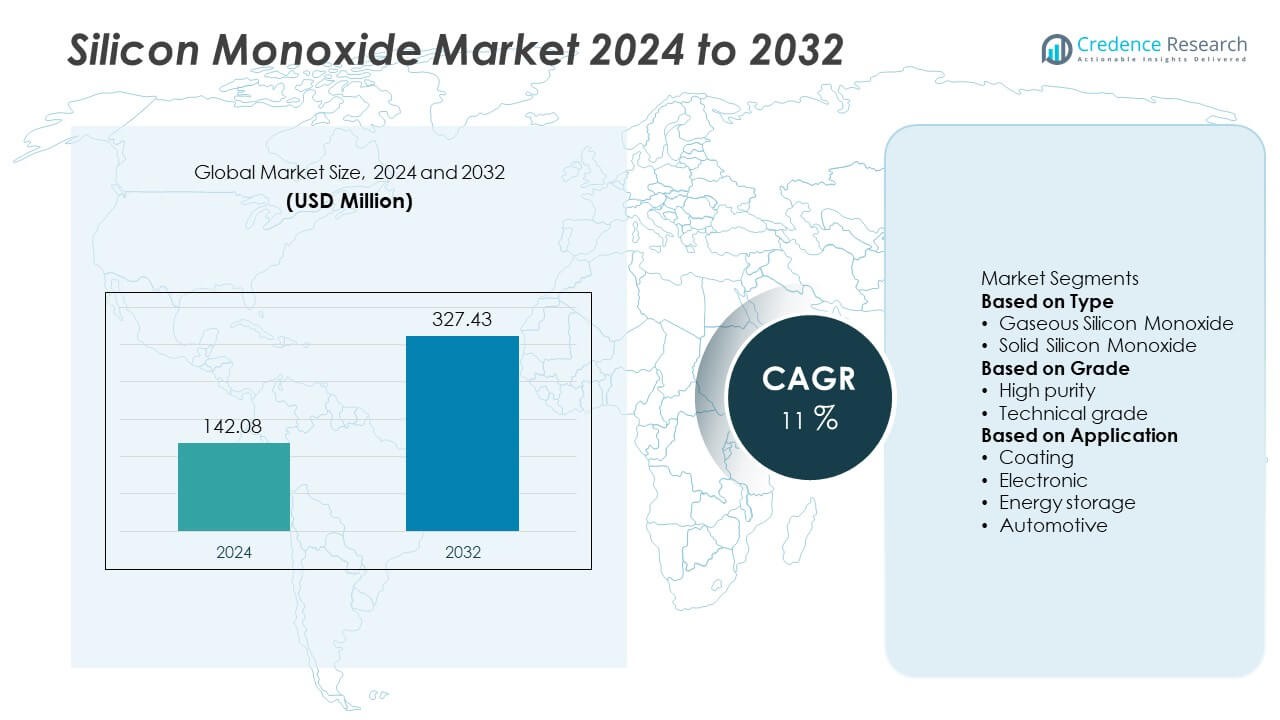

The Silicon Monoxide market was valued at USD 142.08 million in 2024 and is projected to reach USD 327.43 million by 2032, growing at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon Monoxide Market Size 2024 |

USD 142.08 Million |

| Silicon Monoxide Market, CAGR |

11% |

| Silicon Monoxide Market Size 2032 |

USD 327.43 Million |

The silicon monoxide market is driven by major players such as Lorad Chemical Corporation, Nanoshel LLC, Fujifilm Wako Pure Chemical Corporation, ACS Material, Merck, Materion, OSAKA Titanium Technologies Co Ltd, Nanochemazone, American Elements, and Jayu Optical Material Co., Ltd. These companies focus on developing high-purity silicon monoxide for electronics, coatings, and energy storage applications. Regionally, Asia-Pacific led with 30% share in 2024, supported by strong semiconductor and battery manufacturing industries. North America followed with 33% share, driven by demand in advanced coatings and research. Europe held 27% share, benefitting from automotive and green energy transitions, while other regions showed gradual adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The silicon monoxide market was valued at USD 142.08 million in 2024 and is projected to reach USD 327.43 million by 2032, growing at a CAGR of 11% during the forecast period.

- Rising demand from electronics and semiconductor industries is a key driver, with the solid type segment holding 65% share in 2024 due to its stability and suitability in thin-film and coating applications.

- High-purity silicon monoxide is a major trend, commanding 70% share in 2024, supported by growing use in advanced coatings, semiconductors, and energy storage solutions.

- The competitive landscape features leading players such as Lorad Chemical Corporation, Nanoshel LLC, Fujifilm Wako Pure Chemical Corporation, ACS Material, Merck, Materion, OSAKA Titanium Technologies Co Ltd, Nanochemazone, American Elements, and Jayu Optical Material Co., Ltd, focusing on purity improvements and global expansion.

- Regionally, North America led with 33% share, followed by Asia-Pacific at 30% as the fastest-growing market, while Europe held 27%, supported by automotive, coatings, and renewable energy initiatives.

Market Segmentation Analysis:

By Type

The solid silicon monoxide segment dominated the market in 2024 with over 65% share, driven by its widespread use in electronic components, thin-film deposition, and protective coatings. Solid SiO offers high stability, making it suitable for precision applications in semiconductors and optical devices. Its compatibility with vacuum evaporation processes further supports adoption in advanced electronics manufacturing. While gaseous silicon monoxide is used in niche applications such as chemical synthesis and research, its demand remains limited compared to the solid form, which continues to lead due to reliability and scalability in industrial applications.

- For instance, Materion produces high-purity solid silicon monoxide for critical semiconductor coating applications, meeting strict industry requirements for quality and consistency.

By Grade

High-purity silicon monoxide held a commanding 70% share of the market in 2024, reflecting strong demand from electronics, coatings, and energy storage industries where purity levels are critical for performance. Semiconductor manufacturers prefer high-purity SiO for producing defect-free thin films and optical coatings with enhanced durability. The technical grade segment, while cost-effective, caters mainly to less sensitive industrial applications where performance specifications are not as stringent. The dominance of high-purity products underscores the growing emphasis on advanced technologies requiring superior material properties and consistency.

- For instance, Merck (EMD Electronics) is a major supplier of materials for semiconductor manufacturing and reported strong growth in this area in 2024, driven by high-value materials for advanced nodes and demand for AI chip systems.

By Application

The coating application segment accounted for more than 40% share of the silicon monoxide market in 2024, establishing itself as the leading sub-segment. Its strong position stems from the extensive use of SiO in optical coatings, barrier layers, and thin films across electronics and packaging industries. Demand is reinforced by its ability to improve scratch resistance, enhance durability, and provide protective layers for high-value devices. Electronic and energy storage applications are expanding rapidly, particularly in batteries and semiconductors, but coatings remain the largest consumer segment due to established industrial use and wide functional applicability.

Key Growth Drivers

Expanding Electronics and Semiconductor Industry

The rapid growth of the electronics and semiconductor industry is a major driver for the silicon monoxide market. Solid SiO is widely used in thin-film deposition, optical coatings, and protective layers in semiconductors, smartphones, and display devices. Rising consumer demand for high-performance electronics and miniaturized components further accelerates adoption. With global investments in advanced fabrication facilities and microelectronics, silicon monoxide remains a critical material for ensuring durability, efficiency, and performance of modern devices, strengthening its role in the electronics supply chain.

- For instance, Osaka Titanium Technologies Co Ltd expanded its production capacity for titanium sponge, in previous years. The company does produce solid silicon monoxide for the electronics industry with high purity.

Rising Demand in Energy Storage Applications

Energy storage is emerging as a strong growth driver, with silicon monoxide being integrated into lithium-ion and next-generation batteries. SiO enhances energy density and cycle life, addressing limitations of traditional graphite anodes. The surge in demand for electric vehicles, portable electronics, and renewable energy storage systems significantly boosts SiO usage. Manufacturers are investing in research to optimize SiO-based anode materials, improving performance and scalability. This rising adoption positions silicon monoxide as a vital material in the global transition toward clean energy and sustainable mobility.

- For instance, in laboratory studies of nanostructured silicon and silicon monoxide composites, researchers have demonstrated reversible specific capacities exceeding 1000 mAh/g under cycling conditions.

Increasing Adoption in Coatings Industry

The coatings industry represents another important growth area for silicon monoxide. SiO is widely applied in protective, optical, and barrier coatings, especially in packaging, automotive, and display technologies. Its properties improve scratch resistance, moisture protection, and durability of high-value products. Growing demand for advanced packaging solutions and high-performance displays drives strong consumption of SiO coatings. With industries seeking longer-lasting and higher-quality surfaces, the coatings application of silicon monoxide continues to expand, contributing significantly to overall market growth across developed and emerging regions.

Key Trends & Opportunities

Adoption of High-Purity Silicon Monoxide

A major trend shaping the market is the increasing adoption of high-purity silicon monoxide, which held 70% share in 2024. Electronics and semiconductor manufacturers prefer high-purity grades for defect-free coatings and consistent performance. Growing investments in high-tech manufacturing, particularly in Asia-Pacific, are creating new opportunities for suppliers of high-purity SiO. Companies focusing on improved refining techniques and production efficiency are well-positioned to capitalize on this trend, as demand for purity-driven materials continues to rise across high-value applications.

- For instance, American Elements announced a significant expansion in December 2024 of its production facilities for several high-demand materials, including gallium, germanium, and antimony.

Integration into Next-Generation Battery Technologies

The integration of silicon monoxide into next-generation battery technologies presents a major opportunity. As EV adoption accelerates, manufacturers are actively developing SiO-based anodes that offer higher energy density and faster charging compared to conventional materials. Collaborations between material producers and battery makers are intensifying, aiming to bring scalable solutions to market. This trend not only enhances the performance of consumer electronics but also supports global energy transition goals. Silicon monoxide’s growing role in advanced batteries positions it as a critical enabler of future energy storage solutions.

- For instance, Nanochemazone provides high-purity silicon monoxide powder primarily for research and development into advanced lithium-ion battery anodes. The company offers materials with customizable size ranges.

Key Challenges

High Production Costs and Processing Complexity

One of the key challenges in the silicon monoxide market is its high production cost and complex processing requirements. Manufacturing SiO with consistent purity and stability demands advanced equipment and energy-intensive processes, which increase overall expenses. This limits adoption in cost-sensitive applications and poses challenges for smaller producers. Without scalable and cost-effective production technologies, broader market penetration may face constraints, particularly in developing regions with limited investment capacity.

Limited Awareness and Application Constraints

Another challenge is the limited awareness of silicon monoxide’s potential outside specialized industries. While its use in coatings, electronics, and energy storage is established, many sectors still rely on conventional materials due to familiarity and lower cost. Application constraints, such as handling difficulties and material stability under certain conditions, also restrict usage. To overcome this, manufacturers need to invest in awareness programs and application research, demonstrating SiO’s benefits in diverse sectors. Expanding knowledge and practical applicability will be critical for unlocking its full market potential.

Regional Analysis

North America

North America held 33% share of the silicon monoxide market in 2024, supported by strong demand from electronics, semiconductors, and coatings industries. The United States leads regional consumption due to its advanced semiconductor manufacturing base and high adoption of silicon monoxide in thin-film applications. Growth is also driven by research and development investments in energy storage materials, particularly for electric vehicles. Canada and Mexico contribute through expanding industrial and automotive sectors. Robust technological infrastructure, strong research networks, and increasing use of SiO in protective coatings continue to strengthen North America’s dominance in the global market.

Europe

Europe accounted for 27% share of the silicon monoxide market in 2024, driven by established automotive, packaging, and electronics industries. Germany, France, and the U.K. are key consumers due to their strong semiconductor and coatings sectors. The region’s push toward sustainable materials and eco-friendly coatings has further boosted demand for high-purity SiO. Europe also benefits from rising use in energy storage, as the region accelerates electric vehicle production under its green transition policies. Collaborative projects between research institutes and material producers support innovation, ensuring steady growth and positioning Europe as a key market hub.

Asia-Pacific

Asia-Pacific captured 30% share of the silicon monoxide market in 2024, emerging as the fastest-growing regional market. China, Japan, and South Korea dominate consumption due to their large semiconductor, electronics, and display manufacturing industries. Strong demand from lithium-ion battery production for electric vehicles and consumer electronics significantly contributes to market expansion. Government support for renewable energy storage solutions and rising local production capacities further drive growth. Asia-Pacific’s expanding industrial base, coupled with cost-efficient manufacturing, positions it as a critical center for global silicon monoxide supply and application development across multiple high-tech sectors.

Latin America

Latin America represented 6% share of the silicon monoxide market in 2024, with Brazil and Mexico leading regional demand. Growth is supported by expanding automotive production and rising investments in coatings and packaging sectors. The electronics industry remains limited compared to other regions, but increasing imports of advanced devices indirectly drive demand for SiO in thin-film applications. Government initiatives to strengthen renewable energy and storage capacity create additional opportunities. Despite challenges related to limited manufacturing infrastructure, gradual improvements in industrial activity are expected to support steady market growth in Latin America during the forecast period.

Middle East & Africa

The Middle East & Africa region held 4% share of the silicon monoxide market in 2024, reflecting modest but growing adoption. Demand is concentrated in countries such as the UAE, Saudi Arabia, and South Africa, where industrial development and electronics consumption are rising. Coatings and packaging industries contribute significantly to usage, while energy storage adoption is gradually increasing with renewable energy projects. However, limited production capacity and dependence on imports restrict wider penetration. Ongoing investments in industrial infrastructure and collaborations with international material suppliers are expected to improve accessibility and support steady market growth in the region.

Market Segmentations:

By Type

- Gaseous Silicon Monoxide

- Solid Silicon Monoxide

By Grade

- High purity

- Technical grade

By Application

- Coating

- Electronic

- Energy storage

- Automotive

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the silicon monoxide market is shaped by key players including Lorad Chemical Corporation, Nanoshel LLC, Fujifilm Wako Pure Chemical Corporation, ACS Material, Merck, Materion, OSAKA Titanium Technologies Co Ltd, Nanochemazone, American Elements, and Jayu Optical Material Co., Ltd. These companies compete through innovations in high-purity production, advanced thin-film applications, and energy storage solutions. Strong focus is placed on supplying materials for semiconductors, coatings, and next-generation lithium-ion batteries. Leading firms are expanding production capacity, improving refining technologies, and forming strategic partnerships with electronics and battery manufacturers to secure long-term demand. The market is also witnessing rising investments in nanotechnology and custom material development to meet specialized industry requirements. Players are targeting Asia-Pacific and Europe for expansion, capitalizing on strong electronics manufacturing bases and green energy initiatives. Sustainability, material purity, and performance optimization remain central strategies for strengthening market presence in a competitive global environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lorad Chemical Corporation

- Nanoshel LLC

- Fujifilm Wako Pure Chemical Corporation

- ACS Material

- Merck

- Materion

- OSAKA Titanium Technologies Co Ltd

- Nanochemazone

- American Elements

- Jayu Optical Material Co., Ltd

Recent Developments

- In April 2024, Shin-Etsu Chemical Co., Ltd stated that it will develop a new plant in Isesaki City, Gunma Prefecture, Japan, to expand its semiconductor lithography materials business. The new factory will be Shin-Etsu’s fourth production base in this business.

- In January 2024, Das Solar achieved a world-record open-circuit voltage of 742 mV for an n-type TOPCon solar cell, confirmed by China’s National PV Industry Measurement and Testing Center.

- In October 2023, Ionblox debuted its extremely fast-charging lithium-silicon cells for EVs, achieving 60% charge in 5 minutes and extending range by 30-50%. The cells-maintained performance over 1,000 cycles with minimal degradation.

Report Coverage

The research report offers an in-depth analysis based on Type, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising use in semiconductors and electronics.

- Solid silicon monoxide will maintain dominance due to reliability in thin-film applications.

- High-purity grades will see increasing demand across coatings and advanced electronics.

- Energy storage applications will expand with wider adoption in lithium-ion batteries.

- Automotive sector demand will rise as electric vehicle production accelerates globally.

- Asia-Pacific will remain the fastest-growing region with strong manufacturing bases.

- North America and Europe will sustain growth through research and green energy initiatives.

- Sustainability efforts will drive innovation in eco-friendly production processes.

- Strategic partnerships between material suppliers and battery makers will intensify.

- Competition will strengthen as global players expand capacities and enter new markets.