Market Overview

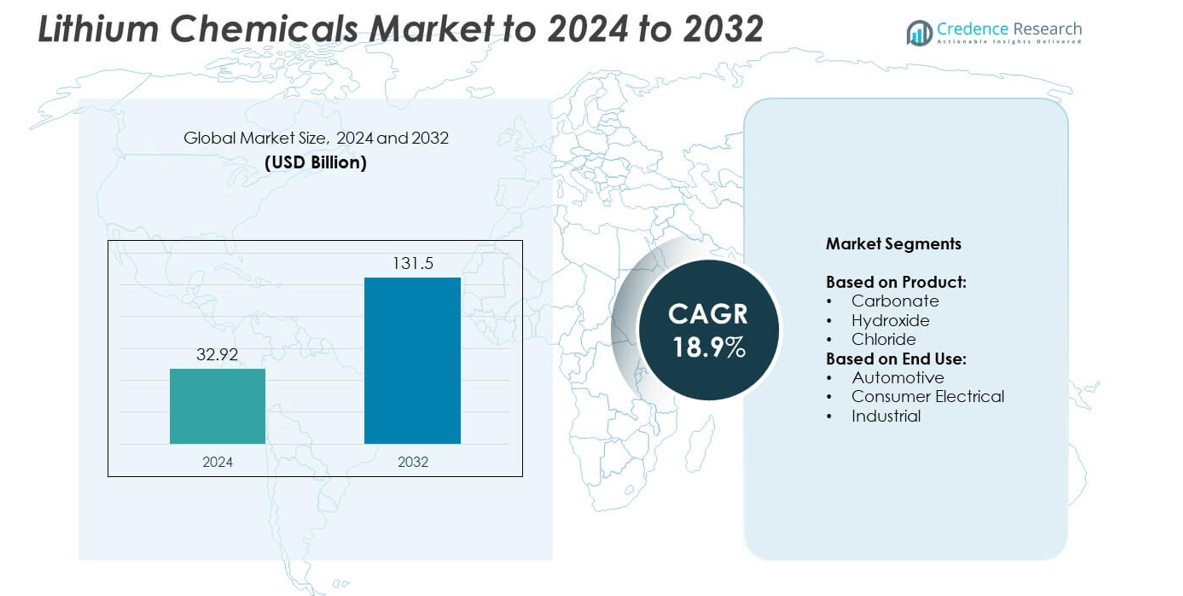

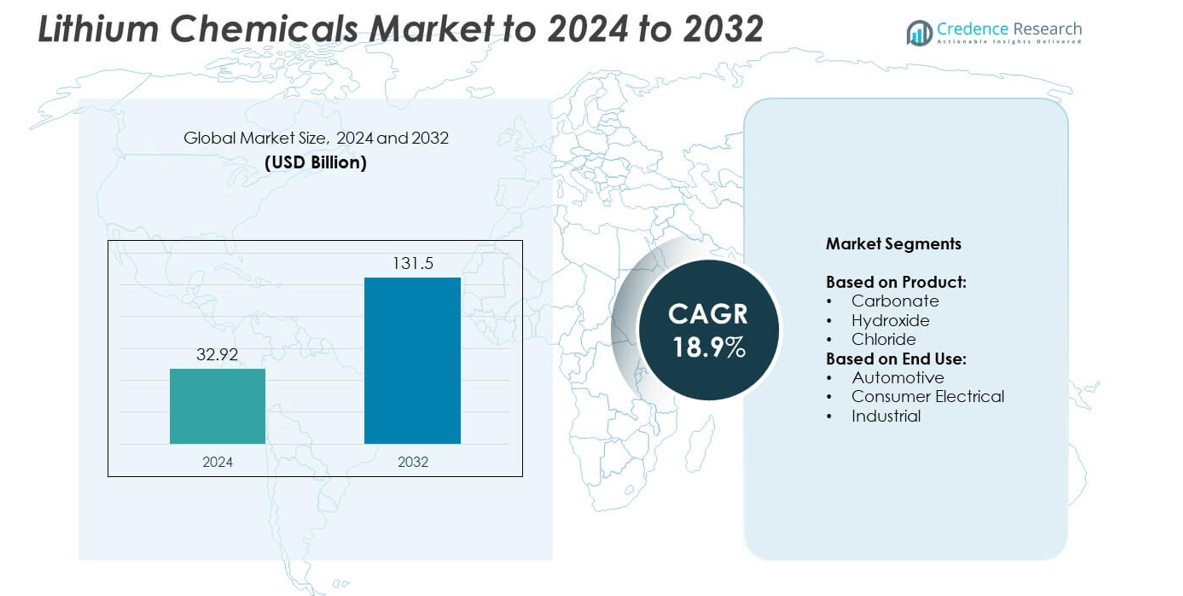

The Lithium Chemicals Market size was valued at USD 32.92 Billion in 2024 and is anticipated to reach USD 131.5 Billion by 2032, at a CAGR of 18.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Chemicals Market Size 2024 |

USD 32.92 Billion |

| Lithium Chemicals Market, CAGR |

18.9% |

| Lithium Chemicals Market Size 2032 |

USD 131.5 Billion |

The lithium chemicals market is shaped by leading players such as Ganfeng Lithium Co., Ltd., Albemarle Corporation, SQM S.A., Pilbara Minerals Limited, and Lithium Americas Corp., all of which focus on capacity expansion, technological innovation, and long-term supply agreements with battery and automotive manufacturers. These companies leverage strong global networks and sustainability-driven strategies to maintain competitive advantages in a rapidly growing sector. Regionally, Asia Pacific dominated the market with 40% share in 2024, supported by extensive EV adoption, large-scale battery production, and strong demand from consumer electronics. North America and Europe followed, driven by renewable energy integration, EV incentives, and localized supply chain development.

Market Insights

- The lithium chemicals market was valued at USD 32.92 Billion in 2024 and is projected to reach USD 131.5 Billion by 2032, growing at a CAGR of 18.9%.

- Rising demand for electric vehicles and large-scale adoption of energy storage systems are key drivers boosting the need for lithium carbonate and hydroxide.

- The market is witnessing a strong trend toward high-nickel cathode batteries that favor lithium hydroxide, along with growing opportunities in recycling and circular economy initiatives.

- Competition is intense, with companies focusing on expanding refining capacities, forming partnerships, and investing in sustainable extraction to strengthen supply security.

- Asia Pacific led with 40% share in 2024, followed by North America at 27% and Europe at 22%, while Latin America and Middle East & Africa accounted for 7% and 4% respectively, supported by resource availability and new investments in mining and processing capacities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The lithium chemicals market is segmented into carbonate, hydroxide, and chloride. Lithium carbonate held the dominant share in 2024, accounting for over 48% of the global market. Its widespread use in lithium-ion batteries, particularly for electric vehicles (EVs), has driven strong demand. The growing adoption of energy storage systems and portable electronics also supports this dominance. Lithium hydroxide is expanding rapidly, favored for high-nickel cathode batteries, while lithium chloride finds applications in industrial processing. However, carbonate continues to lead due to its versatility, cost-effectiveness, and established supply chain.

- For instance, Lithium Argentina—Cauchari-Olaroz has 40,000 t/year lithium-carbonate nameplate

By End Use

Among end-use industries, the automotive segment dominated the lithium chemicals market in 2024, securing around 55% share. Surging EV adoption worldwide has significantly increased lithium demand, particularly in battery-grade carbonate and hydroxide. Government decarbonization targets, emission regulations, and subsidies for EV production have accelerated this growth. Consumer electrical applications such as smartphones, laptops, and power tools also contribute notably, but at a smaller scale. Industrial applications, including lubricants, glass, and ceramics, remain steady yet secondary. The automotive sector’s rapid electrification ensures its continued leadership in lithium consumption.

- For instance, CATL delivered 259.7 GWh of EV batteries in 2023.

Key Growth Drivers

Rising Electric Vehicle Adoption

The rapid growth of electric vehicles has emerged as the leading driver of the lithium chemicals market. Automakers are shifting production toward EVs to meet global decarbonization targets and comply with stricter emission norms. Lithium carbonate and hydroxide are critical for producing high-performance batteries, fueling demand from this sector. With countries like China, the U.S., and members of the EU offering subsidies and incentives for EV purchases, the automotive industry continues to secure the largest share of lithium consumption. This factor remains the primary growth engine for the market.

- For instance, BYD sold over 3.02 million new energy vehicles in 2023, all of which required lithium-ion batteries. The company uses different battery chemistries across its models, which collectively require both lithium carbonate and lithium hydroxide as manufacturing inputs.

Expansion of Energy Storage Systems

The rising need for renewable energy integration has significantly boosted demand for lithium-based energy storage systems. Solar and wind power rely on efficient storage solutions to manage intermittency, making lithium-ion batteries the preferred option. Utilities and residential sectors are investing heavily in battery storage projects to ensure energy reliability. Lithium hydroxide and carbonate are especially favored for their compatibility with advanced chemistries. The global push toward clean energy transition and grid stability further accelerates investments, positioning energy storage expansion as a vital driver for market growth.

- For instance, in 2023, NextEra Energy Resources commissioned more than 5,600 MW of new renewable and storage projects, with lithium-ion batteries representing the primary storage chemistry. In the fourth quarter alone, the company added 805 MW of battery storage projects to its backlog.

Growth in Consumer Electronics Demand

The increasing demand for smartphones, laptops, tablets, and wearable devices is a consistent driver for the lithium chemicals market. Lithium-ion batteries power most portable electronics, making lithium carbonate a crucial material. With digitalization and remote working trends expanding, sales of such devices have surged globally. Emerging economies also contribute to rising penetration of affordable smart electronics. Continuous innovation in smaller, lightweight, and longer-lasting batteries further drives adoption. Although smaller in scale compared to EV demand, the consumer electronics segment remains an essential pillar of growth in the lithium chemicals industry.

Key Trends & Opportunities

Shift Toward High-Nickel Cathode Batteries

A notable trend shaping the lithium chemicals market is the shift toward high-nickel cathode batteries, which demand greater use of lithium hydroxide. These advanced batteries deliver higher energy density and improved driving range, making them critical for next-generation EVs. Leading automakers are forming supply agreements to secure steady lithium hydroxide access. This transition is creating significant opportunities for producers to scale hydroxide capacity and diversify product portfolios. As battery technologies evolve, the demand landscape is expected to increasingly favor hydroxide over carbonate, offering a strong growth path.

- For instance, In 2023, Panasonic made significant announcements regarding its production capabilities and future plans, Wakayama, Japan, It began setting up for the mass production of its next-generation 4680 battery cells, finalized in 2024.

Recycling and Circular Economy Initiatives

Lithium recycling initiatives are emerging as a key opportunity in addressing supply concerns and environmental impact. Growing investment in closed-loop systems allows recovery of lithium from spent batteries, reducing reliance on mined resources. Companies are developing advanced recycling technologies to improve efficiency and lower costs. Governments are also supporting recycling infrastructure through policy incentives. This shift not only enhances supply security but also aligns with global sustainability goals. The circular economy approach is expected to unlock new value streams while strengthening the resilience of the lithium supply chain.

- For instance, in 2023, Redwood Materials processed approximately 44,000 tons of lithium-ion batteries and production scrap, recovering materials including lithium, cobalt, and nickel for reuse.

Geographic Expansion and Supply Diversification

Another trend driving opportunities is the expansion of lithium production across new geographies. Beyond established regions such as Chile and Australia, countries like Argentina and African nations are emerging as critical suppliers. Investments in exploration and new mining projects are diversifying global supply sources. Simultaneously, downstream players are localizing production and refining to reduce reliance on imports. This geographic expansion improves market stability, mitigates geopolitical risks, and ensures consistent access for high-demand sectors. Companies leveraging regional diversification strategies are likely to capture competitive advantages in the growing lithium chemicals market.

Key Challenges

Supply Chain Constraints and Price Volatility

One of the most pressing challenges in the lithium chemicals market is supply chain instability. Rapid demand growth has outpaced the development of mining and refining capacity, creating shortages. This imbalance drives significant price volatility, affecting both producers and end users. Uncertainty in supply and costs complicates long-term agreements, particularly for automakers and battery manufacturers. Geopolitical tensions and concentrated production in a few countries amplify these risks. Addressing supply security requires accelerated investment in upstream capacity, but such projects demand high capital and long lead times, keeping this challenge critical.

Environmental and Regulatory Pressures

The environmental impact of lithium mining and processing presents another major challenge for the industry. Concerns over water usage, habitat disruption, and carbon emissions have led to increasing regulatory scrutiny. Communities and governments in producing regions are imposing stricter environmental standards and demanding sustainable practices. Compliance with these regulations often raises operational costs and limits expansion potential. Additionally, public opposition to environmentally harmful practices can delay projects and disrupt supply. To address these pressures, companies must adopt greener extraction methods and transparent sustainability practices to ensure long-term industry growth.

Regional Analysis

North America

North America accounted for 27% of the lithium chemicals market share in 2024, driven by the rapid adoption of electric vehicles and strong investments in energy storage systems. The United States leads the region with significant demand from both automotive and consumer electronics sectors. Government incentives for EV manufacturing and renewable integration have further supported lithium consumption. Canada contributes through resource development and exploration projects, strengthening supply security. The region’s established battery manufacturing ecosystem, coupled with sustainability goals, ensures continued growth, positioning North America as a vital hub for both consumption and production of lithium chemicals.

Europe

Europe captured 22% of the lithium chemicals market share in 2024, supported by aggressive decarbonization policies and expanding EV adoption. The European Union’s Green Deal and carbon neutrality targets have accelerated investments in battery plants and lithium supply chains. Countries like Germany and France dominate demand, with strong automotive industries pushing for localized battery manufacturing. Consumer electronics and industrial applications also add to the market growth. However, Europe remains dependent on imports for raw materials, which drives initiatives to secure supply through partnerships and recycling. The region’s regulatory push and sustainability focus make it a fast-evolving market.

Asia Pacific

Asia Pacific held the dominant 40% share of the lithium chemicals market in 2024, fueled by the presence of leading EV manufacturers, electronics producers, and extensive battery production capacity. China remained the largest contributor, supported by state-driven EV adoption programs and a well-integrated supply chain. Japan and South Korea also played critical roles with advanced battery technologies and consumer electronics industries. Growing investments in renewable energy and energy storage projects further boosted demand. With a strong focus on capacity expansion and innovation, Asia Pacific continues to lead global consumption, maintaining its position as the largest and most influential market.

Latin America

Latin America secured 7% of the lithium chemicals market share in 2024, largely driven by its abundant lithium reserves in the Lithium Triangle region, which includes Chile, Argentina, and Bolivia. Chile remained the key supplier with advanced mining infrastructure and established export markets. Argentina is emerging as a fast-growing player, supported by new investments and partnerships. While local consumption of lithium is relatively small, the region plays a crucial role in global supply, ensuring raw material availability for major consuming markets worldwide. Latin America’s strategic position as a resource hub makes it increasingly important in the value chain.

Middle East and Africa

The Middle East and Africa region accounted for 4% of the lithium chemicals market share in 2024, with growing interest in resource exploration and renewable energy projects. African nations, particularly Zimbabwe and Namibia, are emerging as important contributors with expanding mining operations. The Middle East, though less resource-rich in lithium, is focusing on downstream applications through investments in renewable energy storage solutions. Regional growth is also supported by increasing global partnerships to develop supply chains. While still a smaller market, the region’s resource potential and strategic investments position it for stronger involvement in future lithium supply and consumption.

Market Segmentations:

By Product:

- Carbonate

- Hydroxide

- Chloride

By End Use:

- Automotive

- Consumer Electrical

- Industrial

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The lithium chemicals market is highly competitive, with key players including Ganfeng Lithium Co., Ltd., Pilbara Minerals Limited, Lithium Americas Corp., and others leading the landscape. Companies compete on capacity expansion, technological innovation, and strategic partnerships to secure long-term supply agreements with battery manufacturers and automotive OEMs. Innovation in high-purity lithium hydroxide and carbonate production, as well as investments in recycling technologies, provide significant differentiation. Market participants are also focusing on geographic expansion, establishing processing and refining facilities closer to major demand centers to reduce logistics costs. Sustainability initiatives and adherence to environmental regulations further influence competitive positioning. Mergers, acquisitions, and joint ventures are common strategies to strengthen supply chains and ensure consistent raw material access. Overall, competition is intensified by rising EV adoption, growing energy storage needs, and evolving consumer electronics demand, making efficiency, reliability, and innovation the key success factors in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ganfeng Lithium Co., Ltd.

- Pilbara Minerals Limited

- Lithium Americas Corp.

- Talison Lithium Pty Ltd

- SQM S.A.

- Infinitylithium

- Altura Mining

- Neometals Ltd

- Albemarle Corporation

- ANDRITZ Sovema S.p.A.

- Arcadium Lithium

- Critical Elements Lithium Corporation

- The Pallinghurst Group

- Mody Chemi-Pharma Limited

- ProChem, Inc. International

- SICHUAN BRIVO LITHIUM MATERIALS CO., LTD.

Recent Developments

- In 2024, Albemarle, announced a shift in its strategy. Due to lower prices and oversupply, the company deferred spending on some of its planned expansion projects, including an advanced lithium refinery in the US, and announced cost-cutting measures and job reductions.

- In 2024, SQM advanced the process of its definitive joint venture (JV) agreement with the Chilean state-owned mining firm Codelco to continue extracting and producing lithium salts in the Salar de Atacama from 2031 to 2060, securing its long-term resource base.

- In 2024, Lithium Americas Corp. finalized a joint venture with General Motors for the Thacker Pass lithium project in Nevada.

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric vehicle adoption will continue to drive strong demand for lithium chemicals.

- Expansion of energy storage systems will boost lithium consumption globally.

- High-nickel cathode batteries will increase the use of lithium hydroxide.

- Consumer electronics growth will sustain consistent demand for lithium carbonate.

- Recycling initiatives will reduce supply pressure and improve sustainability.

- Asia Pacific will maintain dominance due to battery manufacturing and EV production.

- North America and Europe will grow with localized battery plants and incentives.

- Supply chain diversification will strengthen market resilience and reduce risks.

- Environmental regulations will encourage greener production methods.

- Technological innovations will create new applications and expand lithium chemical markets.