Market Overview

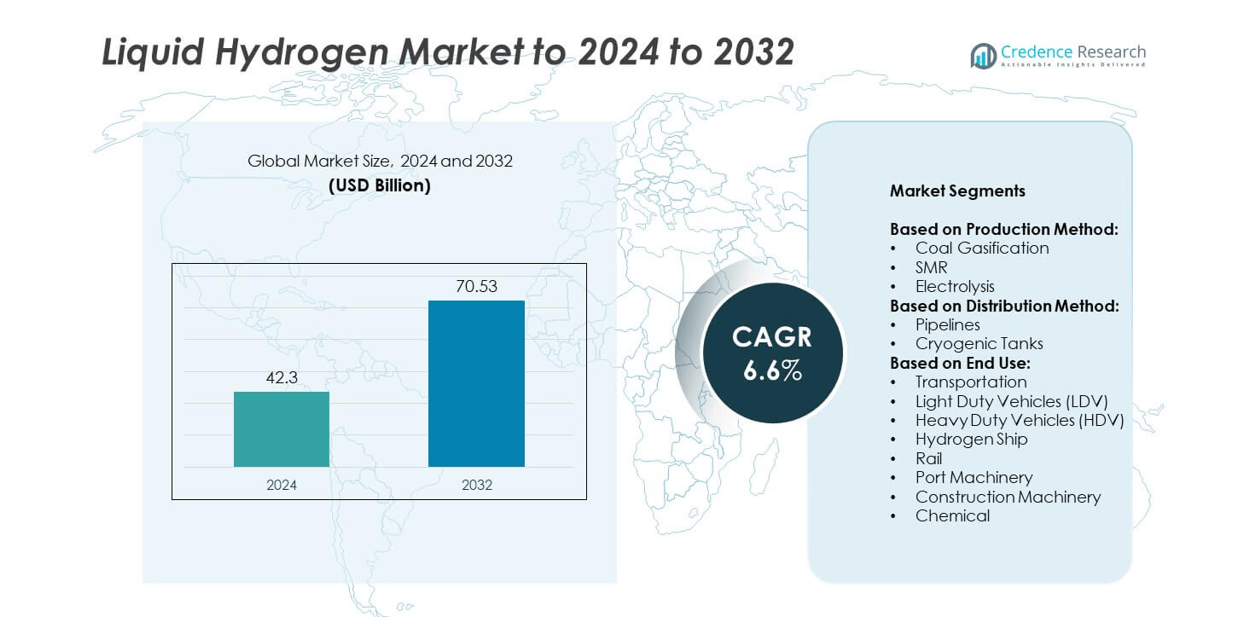

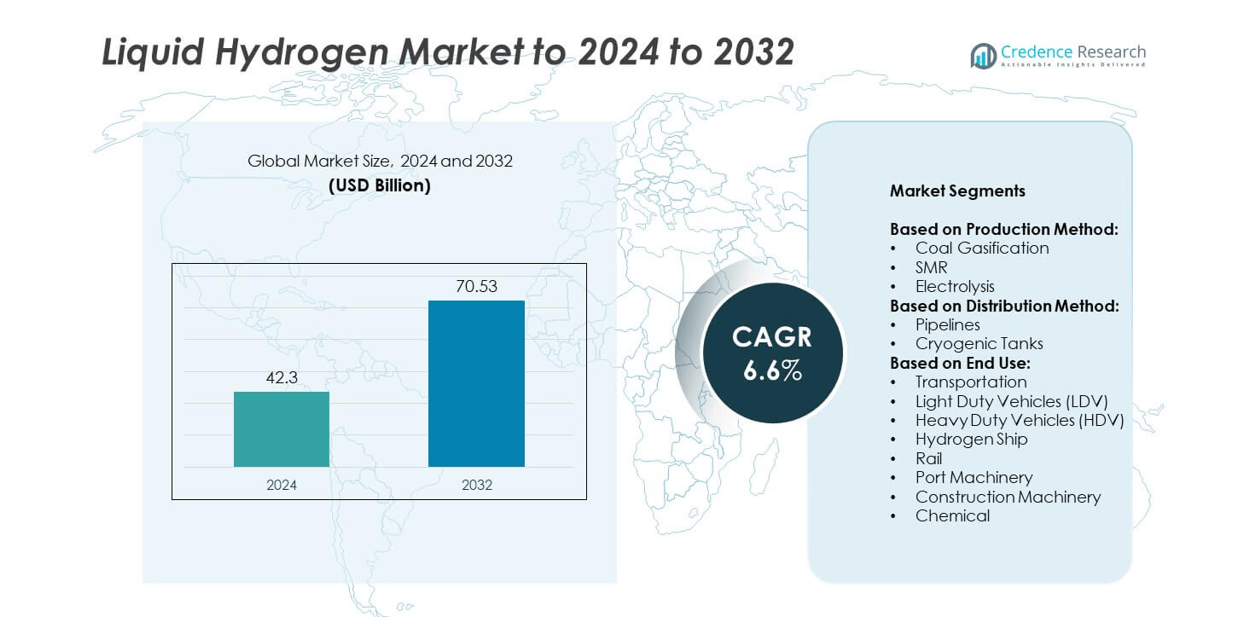

The Liquid Hydrogen Market size was valued at USD 42.3 billion in 2024 and is anticipated to reach USD 70.53 billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Hydrogen Market Size 2024 |

USD 42.3 billion |

| Liquid Hydrogen Market, CAGR |

6.6% |

| Liquid Hydrogen Market Size 2032 |

USD 70.53 billion |

The liquid hydrogen market is driven by major players such as Plug Power, Air Liquide, Linde, Shell, Air Products and Chemicals, Inc., Chart Industries, INOXCVA, Kawasaki Heavy Industries, Iwatani Corporation, and Messer. These companies are actively investing in production expansion, cryogenic storage, and distribution infrastructure to strengthen their market position. Strategic collaborations and innovations in green hydrogen projects are further shaping the competitive landscape. Regionally, North America led the market with a 34% share in 2024, supported by large-scale hydrogen mobility programs and industrial adoption. Europe followed with 28% share, driven by strong regulatory support and decarbonization targets, while Asia Pacific held 25%, fueled by aggressive infrastructure investments in Japan, China, and South Korea.

Market Insights

- The liquid hydrogen market was valued at USD 42.3 billion in 2024 and is projected to reach USD 70.53 billion by 2032, growing at a CAGR of 6.6%.

- Growth is fueled by rising adoption in transportation, particularly heavy-duty vehicles, along with strong government support for decarbonization initiatives and net-zero targets.

- Key trends include rapid development of hydrogen infrastructure, expansion of refueling networks, and increasing investment in green hydrogen production through electrolysis and renewable integration.

- The market is competitive with players focusing on production expansion, cryogenic storage technologies, and strategic partnerships, while continuous innovation in liquefaction and electrolysis strengthens their positioning.

- North America led with 34% share in 2024, followed by Europe at 28% and Asia Pacific at 25%; transportation held the largest segment share, driven by heavy-duty vehicle adoption and industrial demand from chemicals, refineries, and steel production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Production Method

The liquid hydrogen market by production method is dominated by Steam Methane Reforming (SMR), accounting for nearly 55% share in 2024. SMR remains the leading method due to its cost-effectiveness, established infrastructure, and high hydrogen yield compared to other processes. Coal gasification holds a moderate share, particularly in regions with abundant coal reserves, while electrolysis is gaining traction with advancements in renewable-powered electrolyzers. The growth of electrolysis is supported by decarbonization goals and government incentives, though high costs continue to limit large-scale adoption compared to SMR.

- For instance, ExxonMobil: Baytown project targets 1 billion cubic feet of low-carbon hydrogen per day via SMR with CCS.

By Distribution Method

In terms of distribution, cryogenic tanks dominate the market, capturing more than 65% share in 2024. Their widespread use is driven by their ability to store liquid hydrogen safely at extremely low temperatures and transport it flexibly across industries. Pipelines, while efficient for large-scale continuous supply, face infrastructure limitations and high initial investment requirements. Cryogenic tank adoption is also boosted by expanding hydrogen refueling stations and long-haul transportation needs, making them the preferred choice in both developed and developing hydrogen economies.

- For instance, Chart Industries: shipped two shop-built cryogenic LH₂ tanks of 450,000 gallons each in May 2025.

By End Use

Transportation represents the dominant end-use segment, holding nearly 60% share in 2024, with heavy-duty vehicles (HDV) leading adoption. HDVs rely heavily on liquid hydrogen due to its high energy density and suitability for long-range travel. Light-duty vehicles (LDV), hydrogen ships, and rail are growing steadily, supported by government-led hydrogen mobility initiatives. Port and construction machinery segments are still nascent but offer strong growth prospects as industries decarbonize logistics and operations. The chemical sector also plays a crucial role, leveraging liquid hydrogen as a feedstock in refining and ammonia production, though mobility remains the primary driver.

Key Growth Drivers

Rising Adoption in Transportation

Transportation is the leading growth driver for the liquid hydrogen market, supported by increasing demand from heavy-duty vehicles, aviation, and shipping sectors. Governments are pushing hydrogen-powered mobility through subsidies and infrastructure investments, particularly in Europe and Asia. The high energy density of liquid hydrogen makes it ideal for long-haul applications where batteries face limitations. With automotive giants and shipping companies expanding pilot projects, the transportation sector is expected to maintain its dominance in hydrogen consumption, fueling steady market expansion over the forecast period.

- For instance, BMW’s iX5 Hydrogen prototype uses 6 kg of hydrogen to travel 504 km (WLTP cycle) and refuels in about 3–4 minutes.

Decarbonization Policies and Net-Zero Targets

Global decarbonization goals form a major driver, as governments tighten emissions standards and introduce policies to phase out fossil fuels. The EU Green Deal, U.S. Inflation Reduction Act, and Asia-Pacific hydrogen strategies all prioritize hydrogen adoption in industrial and mobility applications. These initiatives create long-term certainty for investment in hydrogen production, storage, and distribution. Incentives for green hydrogen projects, combined with penalties for carbon emissions, are accelerating the shift from grey hydrogen to low-carbon alternatives, directly boosting demand for liquid hydrogen infrastructure.

- For instance, OMV launched a 10 MW green hydrogen plant near Vienna in April 2025, with an annual production capacity of up to 1,500 metric tons of green hydrogen for use in sustainable fuels.

Advancements in Production Technologies

Technological progress in electrolysis and carbon capture-enhanced SMR is another significant growth driver. Falling costs of renewable energy are enabling competitively priced green hydrogen, while innovations in electrolyzer efficiency improve scalability. Integration of carbon capture with SMR reduces emissions, allowing existing production methods to meet environmental standards. Companies are also investing in modular and decentralized production systems, lowering logistical costs. These advances are expanding supply while aligning with sustainability requirements, making production technology improvements a pivotal factor in the long-term growth of the liquid hydrogen market.

Key Trends & Opportunities

Expansion of Hydrogen Infrastructure

Infrastructure development is a key trend, with growing investments in liquefaction plants, refueling stations, and cryogenic storage facilities. Countries such as Japan, Germany, and South Korea are accelerating the rollout of hydrogen fueling networks to support both light- and heavy-duty vehicles. The expansion of port-based hydrogen hubs further supports the marine sector. This infrastructure push ensures reliable supply and accessibility, unlocking opportunities for broader adoption across transportation and industrial sectors, while also attracting private investment into the hydrogen value chain.

- For instance, Plug Power deployed 13 hydrogen refueling stations across Europe over the past two years.

Integration in Industrial and Chemical Applications

An emerging opportunity lies in the integration of liquid hydrogen within industrial and chemical sectors. Industries like steel, ammonia, and refining are exploring liquid hydrogen as a cleaner feedstock alternative. This shift is driven by the need to cut emissions in hard-to-abate sectors and meet ESG targets. Adoption in these industries not only diversifies end-use demand but also provides long-term stability for producers. The industrial application of liquid hydrogen represents a strong opportunity, complementing transportation-driven growth and expanding the overall market footprint.

- For instance, Eletrobras signed an MoU to build a 10 MW green hydrogen pilot plant at Port of Açu.

Key Challenges

High Production and Storage Costs

A critical challenge for the liquid hydrogen market is its high production and storage cost. Electrolysis remains expensive compared to fossil fuel-based hydrogen, while liquefaction requires significant energy input. Cryogenic storage systems also demand advanced infrastructure, which increases overall supply chain expenses. These cost barriers hinder mass adoption, particularly in emerging markets where government subsidies are limited. Unless technological innovations or policy frameworks address these expenses, the economic viability of liquid hydrogen could slow its growth trajectory in the near term.

Infrastructure and Safety Concerns

Safety and infrastructure limitations also pose major challenges. Liquid hydrogen must be stored at extremely low temperatures, raising concerns about boil-off, leakage, and handling risks. Building pipelines or cryogenic tank networks requires high capital investment and stringent regulatory approvals. These safety requirements slow infrastructure rollout and create operational complexities for suppliers. Without widespread, reliable, and safe infrastructure, scaling liquid hydrogen across transportation and industrial sectors remains difficult, restricting its ability to compete with conventional fuels and alternative clean energy sources.

Regional Analysis

North America

North America accounted for 34% share of the liquid hydrogen market in 2024, driven by strong investments in hydrogen mobility and industrial decarbonization. The United States leads regional growth with projects supporting fuel cell vehicles, aerospace applications, and clean energy integration. Canada is expanding hydrogen infrastructure, supported by government-backed roadmaps targeting net-zero emissions. Increasing demand from heavy-duty vehicles and industrial sectors continues to strengthen market adoption. Ongoing collaborations between private players and government agencies are accelerating technology deployment, making North America a key contributor to global market expansion through both infrastructure development and innovation.

Europe

Europe held 28% of the liquid hydrogen market in 2024, supported by aggressive climate targets and hydrogen-focused policies. Germany, France, and the Netherlands are leading adoption through large-scale hydrogen hubs, aviation projects, and investments in hydrogen fueling stations. The region benefits from the EU Green Deal and Horizon Europe funding, which prioritize hydrogen integration across mobility and heavy industries. Growing emphasis on green hydrogen through electrolysis projects further enhances market opportunities. Europe’s leadership in regulatory frameworks and collaborative projects positions it as one of the fastest-growing regions in the global liquid hydrogen market.

Asia Pacific

Asia Pacific captured 25% share of the liquid hydrogen market in 2024, led by Japan, China, and South Korea. Japan has been at the forefront with hydrogen-powered mobility initiatives, while China is expanding production capacity through both SMR and renewable-powered electrolysis. South Korea has committed significant investments in hydrogen refueling infrastructure and fuel cell vehicle deployment. Industrial adoption is also rising, with refineries and chemical sectors integrating hydrogen solutions. The region’s rapid urbanization, strong government policies, and growing transportation demand position Asia Pacific as a high-growth market with increasing influence in global hydrogen consumption.

Latin America

Latin America represented 7% of the liquid hydrogen market in 2024, with early-stage adoption supported by Brazil, Chile, and Argentina. Chile is emerging as a leader through its national green hydrogen strategy, leveraging abundant renewable energy resources for electrolysis projects. Brazil and Argentina are exploring hydrogen applications in transportation and chemical sectors, though infrastructure remains limited. International partnerships and investments are fueling pilot projects, particularly in export-oriented hydrogen production. While still developing, Latin America’s potential lies in renewable-powered hydrogen, offering strong long-term growth prospects as regional policies and industrial adoption mature over the next decade.

Middle East and Africa

The Middle East and Africa held 6% share of the liquid hydrogen market in 2024, driven by large-scale hydrogen projects in Saudi Arabia, the UAE, and South Africa. The region is investing heavily in green hydrogen, supported by solar and wind resources. Saudi Arabia’s NEOM project represents one of the world’s largest hydrogen initiatives, aiming to supply global markets. South Africa is focusing on hydrogen adoption in mining and industrial applications. Despite infrastructure gaps, the region’s focus on renewable hydrogen production for export positions it as a key emerging player in the global liquid hydrogen landscape.

Market Segmentations:

By Production Method:

- Coal Gasification

- SMR

- Electrolysis

By Distribution Method:

- Pipelines

- Cryogenic Tanks

By End Use:

- Transportation

- Light Duty Vehicles (LDV)

- Heavy Duty Vehicles (HDV)

- Hydrogen Ship

- Rail

- Port Machinery

- Construction Machinery

- Chemical

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The liquid hydrogen market is shaped by leading players such as Plug Power, INOXCVA, Kawasaki Heavy Industries, Shell, Salzburger Aluminium Group, Air Liquide, Messer, Chart Industries, Wuxi Yuantong Gas, Air Products and Chemicals, Inc., Iwatani Corporation, GENH2, Engie, Linde, GE Appliances, and Praxair Technology, Inc. These companies focus on expanding hydrogen production capacities, developing advanced cryogenic storage systems, and strengthening global distribution networks. Strategic partnerships with governments and industrial stakeholders are enhancing large-scale adoption across transportation, chemical, and energy sectors. Continuous investments in green hydrogen projects and liquefaction facilities highlight the competitive push toward sustainability. Many players are advancing innovations in electrolysis, liquefaction efficiency, and modular supply solutions to meet diverse end-use requirements. Market competition is also characterized by efforts to secure long-term supply contracts, expand infrastructure footprints, and leverage renewable resources for low-carbon hydrogen. This dynamic landscape reflects a strong commitment to scaling hydrogen technologies and driving the transition toward cleaner energy systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Plug Power

- INOXCVA

- Kawasaki Heavy Industries

- Shell

- Salzburger Aluminium Group

- Air Liquide

- Messer

- Chart Industries

- Wuxi Yuantong Gas

- Air Products and Chemicals, Inc.

- Iwatani Corporation

- GENH2

- Engie

- Linde

- GE Appliances

- Praxair Technology, Inc.

Recent Developments

- In 2024, Air Products and Chemicals, Inc. announced plans to build a network of permanent, commercial-scale, multi-modal hydrogen refueling stations across California, capable of fueling up to 200 heavy-duty trucks or 2,000 cars per day, demonstrating a clear focus on the mobility sector

- In 2024, Air Liquide partnered with ExxonMobil to support the world’s largest low-carbon hydrogen project at ExxonMobil’s Baytown, Texas facility.

- In 2024, Kawasaki Heavy Industries (KHI) signed a strategic collaborative agreement in September 2024 with CB&I (McDermott) to promote a commercial-use liquefied hydrogen supply chain.

Report Coverage

The research report offers an in-depth analysis based on Production Method, Distribution Method, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The liquid hydrogen market will expand steadily with rising demand in heavy-duty transportation.

- Green hydrogen production through electrolysis will gain traction with falling renewable energy costs.

- Government policies and net-zero targets will continue to drive large-scale hydrogen investments.

- Infrastructure development for storage and refueling stations will accelerate across developed regions.

- Industrial adoption in steel, ammonia, and refining will broaden hydrogen’s application base.

- Partnerships between energy companies and automakers will strengthen hydrogen mobility initiatives.

- Safety and cost reduction technologies will improve adoption in new markets.

- Asia Pacific will emerge as a high-growth hub for hydrogen production and usage.

- Export-oriented hydrogen projects in the Middle East will enhance global supply chains.

- Ongoing innovation in liquefaction and storage systems will increase efficiency and reliability.