Market Overview:

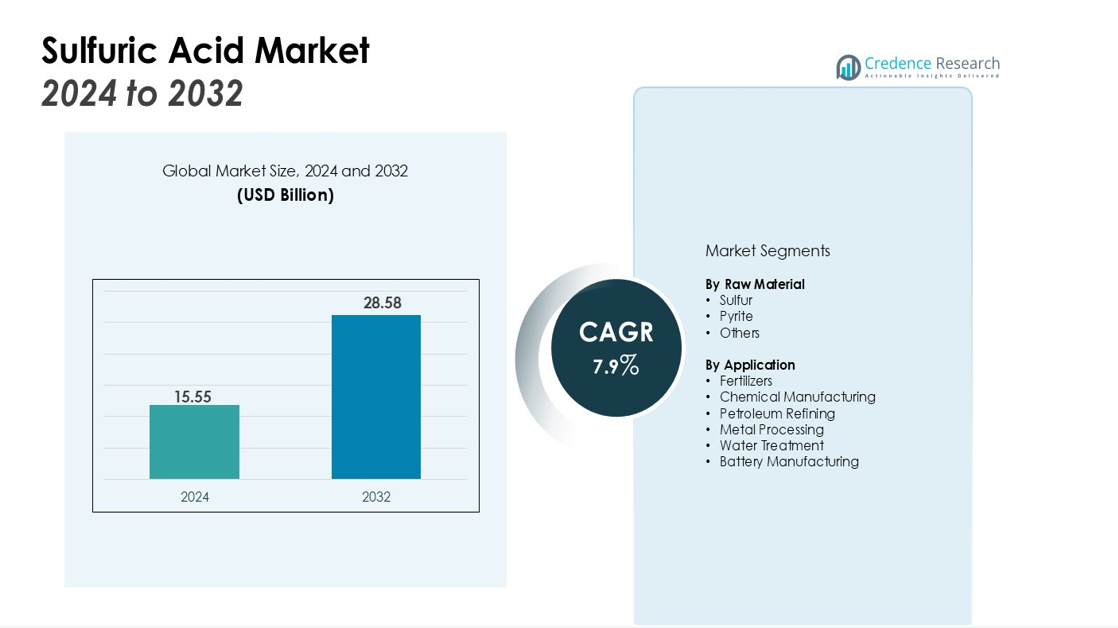

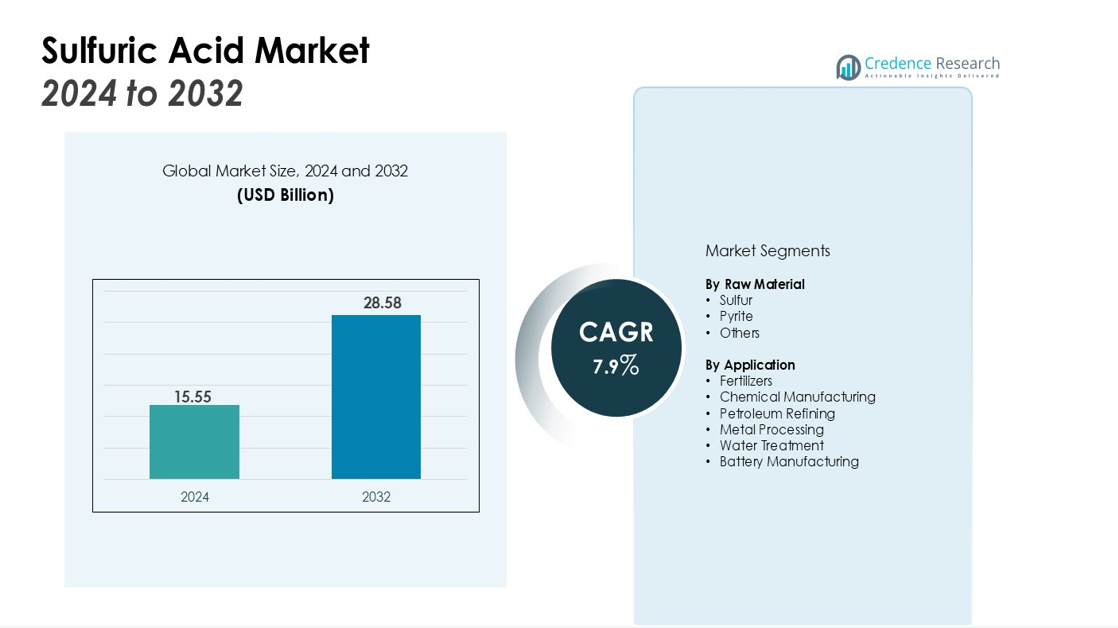

The Sulfuric Acid Market size was valued at USD 15.55 billion in 2024 and is anticipated to reach USD 28.58 billion by 2032, at a CAGR of 7.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sulfuric Acid Market Size 2024 |

USD 15.55 billion |

| Sulfuric Acid Market, CAGR |

7.9% |

| Sulfuric Acid Market Size 2032 |

USD 28.58 billion |

The key drivers of the sulfuric acid market include the growing demand for fertilizers, particularly ammonium sulfate, which is a significant end-use application. Additionally, the increasing requirement for sulfuric acid in petroleum refining, where it is used to remove impurities, is fueling market expansion. Technological advancements in sulfur recovery processes and the rising demand for sulfur-based chemicals also play an essential role in driving market growth.

Regionally, Asia-Pacific dominates the sulfuric acid market, accounting for the largest market share, primarily driven by the substantial demand from agricultural sectors in countries like China and India. North America and Europe also hold significant market shares, owing to their developed industrial sectors. The Middle East and Africa are expected to witness the highest growth rates, driven by the expansion of chemical industries and the increasing use of sulfuric acid in oil refining.

Market Insights:

- The sulfuric acid market size was valued at USD 15.55 billion in 2024 and is expected to reach USD 28.58 billion by 2032, growing at a CAGR of 7.9% during the forecast period.

- Fertilizer production is the largest end-use application for sulfuric acid, primarily in the production of phosphate fertilizers like DAP and MAP.

- Sulfuric acid is essential in various industrial applications, including metal processing, chemical manufacturing, and petroleum refining.

- Technological advancements, such as the Contact Process, enhance production efficiency and scalability, supporting market growth.

- Stricter environmental regulations are pushing sulfuric acid producers to adopt cleaner production methods, driving market dynamics.

- Supply chain disruptions, stemming from reliance on sulfur sourced from oil and gas refining, impact sulfuric acid availability and market stability.

- Asia-Pacific holds 40% of the global sulfuric acid market share, while North America and Europe account for 25% and 20%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Fertilizer Production Drives Sulfuric Acid Demand

Fertilizer manufacturing remains the largest consumer of sulfuric acid. Sulfuric acid is essential in producing phosphate fertilizers like DAP and MAP. These fertilizers are crucial for enhancing crop yields and soil fertility. The growing global population and the need for increased agricultural productivity are expected to sustain high demand in this segment. Sulfuric acid’s role in the fertilizer industry will continue to be a significant driver of market growth.

Industrial Applications Expand Market Reach

Sulfuric acid plays a vital role in various industrial processes. It is extensively used in metal processing, including copper and zinc extraction. The chemical industry relies on it for producing dyes, pigments, and detergents. Petroleum refining also utilizes sulfuric acid for hydrocarbon desulfurization and alkylation processes. These diverse applications contribute to the expanding market for sulfuric acid across multiple industries.

- For instance, the Boliden Rönnskär smelter, a major metal processor, has the capacity to produce 560,000 tonnes of sulfuric acid annually as a by-product of its smelting operations.

Technological Advancements Enhance Production Efficiency

Advancements in production technologies have improved sulfuric acid manufacturing. The Contact Process, for instance, offers high efficiency and scalability. This method enables the production of concentrated sulfuric acid, meeting the demands of various industries. Such technological improvements support the growth of the sulfuric acid market by enhancing production capabilities and reducing operational costs.

- For instance, Elessent’s MECS® catalyst technology, a critical component of the Contact Process, recently celebrated 100 years of innovation dedicated to enhancing the efficiency of sulfuric acid production.

Environmental Regulations Influence Market Dynamics

Environmental regulations impact sulfuric acid production and usage. Stricter emissions standards in various regions have led to the implementation of cleaner production methods. These regulations drive the adoption of technologies that reduce sulfur emissions and improve production efficiency. Compliance with environmental standards is becoming increasingly important for sulfuric acid producers, influencing market dynamics and encouraging sustainable practices.

Market Trends:

Technological Advancements in Sulfuric Acid Production

The sulfuric acid industry is experiencing significant technological advancements. The Contact Process remains the dominant method, accounting for over 90% of global production. This process offers high efficiency and scalability, producing concentrated sulfuric acid suitable for various industrial applications. Innovations in catalyst development and process optimization continue to enhance production efficiency and reduce environmental impact. These technological improvements are expected to support the growth of the sulfuric acid market by increasing production capabilities and meeting the evolving demands of industries.

- For instance, BASF’s X3D catalyst technology was successfully applied in a sulfonation plant, where one catalyst bed measuring 1.2 cubic meters was replaced to serve a facility with a production capacity of 32 metric tons per day.

Environmental Regulations and Sustainable Practices

Environmental regulations are increasingly influencing sulfuric acid production practices. Stricter emissions standards in regions like Europe and North America have led to the adoption of cleaner production methods. Technologies such as the Wet Sulfuric Acid (WSA) process and the SNOX process enable the recovery of sulfur from waste gases, converting pollutants into valuable sulfuric acid. These sustainable practices not only help in compliance with environmental standards but also contribute to the efficient utilization of resources, thereby supporting the growth of the sulfuric acid market in a sustainable manner.

- For instance, in October 2021, PVS Chemicals Belgium N.V. utilized DuPont’s MECS technology to upgrade its facility, increasing its sulfuric acid plant capacity to approximately 300 metric tons per day and preventing an estimated 11,700 tons of CO2 from entering the atmosphere annually.

Market Challenges Analysis:

Supply Chain Disruptions and Raw Material Volatility

Sulfuric acid production heavily relies on sulfur, which is primarily sourced as a byproduct from oil and gas refining. The global shift towards renewable energy and reduced fossil fuel consumption is diminishing the sulfur supply. This shift creates a potential imbalance between supply and demand for sulfuric acid by 2035. Geopolitical tensions and logistical challenges further complicate the procurement and distribution of sulfuric acid, impacting market stability. The combination of these factors presents a significant challenge for manufacturers relying on stable sulfur supply chains.

Environmental Regulations and Compliance Costs

Stringent environmental regulations, particularly regarding sulfur dioxide emissions, impose significant compliance costs on sulfuric acid producers. New emission standards require substantial investments in advanced technologies and equipment to reduce environmental impact. These regulations add to operational expenses, which may hinder profitability for producers, especially in regions with rigorous environmental policies. As producers navigate these challenges, compliance with evolving standards will be a key factor in maintaining market position and managing operational costs.

Market Opportunities:

Expansion in High-Purity and Specialty Applications

The demand for high-purity sulfuric acid is increasing, particularly in semiconductor, electronics, and pharmaceutical industries. This acid is essential for processes like wafer cleaning and etching. Advancements in production technologies, such as the use of Aspen Plus modeling, enhance purity levels and reduce energy consumption. The growing emphasis on precision manufacturing and stringent quality standards in these sectors is expected to drive market growth. Investments in research and development are pivotal for meeting the evolving requirements of these high-tech industries.

Adoption of Sustainable and Circular Economy Practices

Environmental regulations are prompting sulfuric acid producers to adopt sustainable practices. Technologies like the Wet Sulfuric Acid (WSA) process and the SNOX process enable the recovery of sulfur from waste gases, converting pollutants into valuable sulfuric acid. These processes not only help in compliance with environmental standards but also contribute to resource efficiency. The integration of such technologies supports the growth of the sulfuric acid market by promoting sustainable production methods.

Market Segmentation Analysis:

By Raw Material

The sulfuric acid market is primarily segmented by raw material into sulfur, pyrite, and others. Sulfur is the most widely used raw material, accounting for the largest share of sulfuric acid production. It is typically obtained as a byproduct from natural gas refining, oil refining, and metal extraction processes. Pyrite is another key raw material, used predominantly in regions where sulfur recovery from natural sources is limited. The use of sulfur in sulfuric acid production remains dominant due to its availability, lower cost, and ease of processing. The increasing demand for sulfuric acid, especially in fertilizers, continues to drive the preference for sulfur-based production.

- For instance, following reliability enhancement work at its Louisiana facilities, The Mosaic Company anticipated its operations would achieve their target annual run rate of 1.4 million tonnes in the third quarter of 2025.

By Application

Sulfuric acid has a wide range of applications across various industries. The largest share is held by the fertilizer industry, particularly in the production of phosphate fertilizers like DAP and MAP. The chemical industry follows closely, with sulfuric acid used in the manufacturing of dyes, pigments, detergents, and other chemicals. Petroleum refining also represents a significant application, where sulfuric acid is used in hydrocarbon desulfurization and alkylation processes. Other applications include metal processing, water treatment, and battery manufacturing. The demand across these industries ensures sulfuric acid’s continued importance and growth in the global market.

- For instance, in October 2022, the technology group Andritz AG successfully launched the world’s first sulfuric acid plant of its kind for Klabin’s facility in Brazil, with the capacity to produce 150 metric tons of commercial-grade sulfuric acid daily.

Segmentations:

By Raw Material

By Application

- Fertilizers

- Chemical Manufacturing

- Petroleum Refining

- Metal Processing

- Water Treatment

- Battery Manufacturing

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific: Dominant Market with Expanding Demand

Asia-Pacific holds 40% of the global sulfuric acid market share, with China, India, and Japan contributing significantly to the demand. These countries account for the highest consumption due to their extensive use in fertilizers, metal processing, and chemical manufacturing. China’s increasing sulfur production, coupled with rising industrial and agricultural demand, bolsters the region’s position. The market is expected to continue expanding with a robust compound annual growth rate (CAGR), maintaining its dominant position through 2030.

North America: Stable Market with Regulatory Influence

North America accounts for 25% of the global sulfuric acid market share, with the United States leading the demand due to its large-scale agricultural activities. The fertilizer sector is the primary driver of demand, supported by the region’s focus on sustainable practices. Investments in technologies aimed at reducing emissions and improving efficiency are becoming more prevalent. These efforts are shaping the market dynamics, ensuring continued stable demand for sulfuric acid while aligning with evolving regulatory standards.

Europe: Technologically Advanced with Sustainable Practices

Europe holds 20% of the global sulfuric acid market share, driven by its focus on technological advancements and strict environmental regulations. The region is a leader in high-purity sulfuric acid production, catering to industries such as electronics and pharmaceuticals. Compliance with stringent environmental standards drives the adoption of cleaner production methods, including waste acid regeneration technologies. These innovations solidify Europe’s position in the market, despite its smaller size relative to Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The sulfuric acid market is highly competitive, with key players focused on expanding their production capacities and improving operational efficiencies. Major producers such as BASF, Sinopec, and Solvay dominate the global market, leveraging advanced technologies to enhance sulfur recovery processes and improve product quality. These companies maintain a strong market presence through strategic acquisitions, investments in R&D, and expanding production capabilities to meet growing demand across industries like agriculture, chemicals, and petroleum refining. Sulfuric acid producers are increasingly focusing on sustainable practices and compliance with stringent environmental regulations. Smaller players in emerging regions are also gaining market share by catering to localized demand and offering cost-effective solutions. The competition in the sulfuric acid market is expected to intensify as demand from industrial and agricultural sectors continues to rise, prompting key players to enhance their offerings and capitalize on growth opportunities.

Recent Developments:

- In May 2025, The Mosaic Company’s division, Mosaic Biosciences, launched its new biostimulant product, Neptunion, in China to assist crops in withstanding environmental pressures like heat, drought, and salinity.

- In September 2025, BASF announced it will present new additive solutions for its VALERAS® portfolio at the K 2025 trade fairair.

Report Coverage:

The research report offers an in-depth analysis based on Raw Material, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for sulfuric acid will continue to grow, driven by the expanding global agricultural sector.

- Fertilizer production will remain the largest consumer of sulfuric acid, particularly in phosphate-based fertilizers.

- Technological advancements in sulfur recovery and production efficiency will enhance market growth.

- Sulfuric acid’s role in petroleum refining will increase as stricter environmental regulations drive demand for desulfurization processes.

- Industrial applications, including metal processing and chemical manufacturing, will continue to be key drivers.

- The rise of sustainable practices in sulfuric acid production will shape the future, with cleaner technologies gaining traction.

- Regions like Asia-Pacific will maintain their dominance due to growing industrialization and agricultural needs.

- North America and Europe will see steady demand, influenced by regulatory pressures and technological innovations.

- The Middle East and Africa will experience rapid market growth as the chemical industries in these regions expand.

- Emerging applications, such as battery manufacturing and water treatment, will open new opportunities for sulfuric acid consumption.