Market Overview

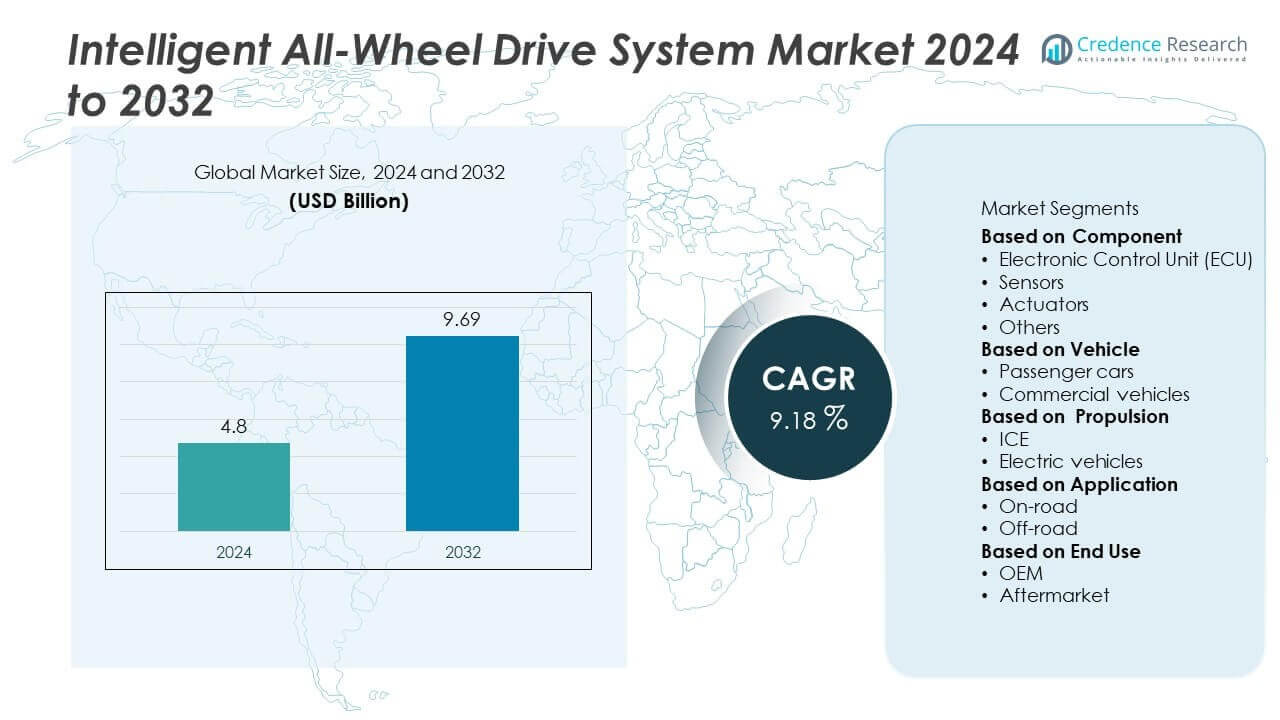

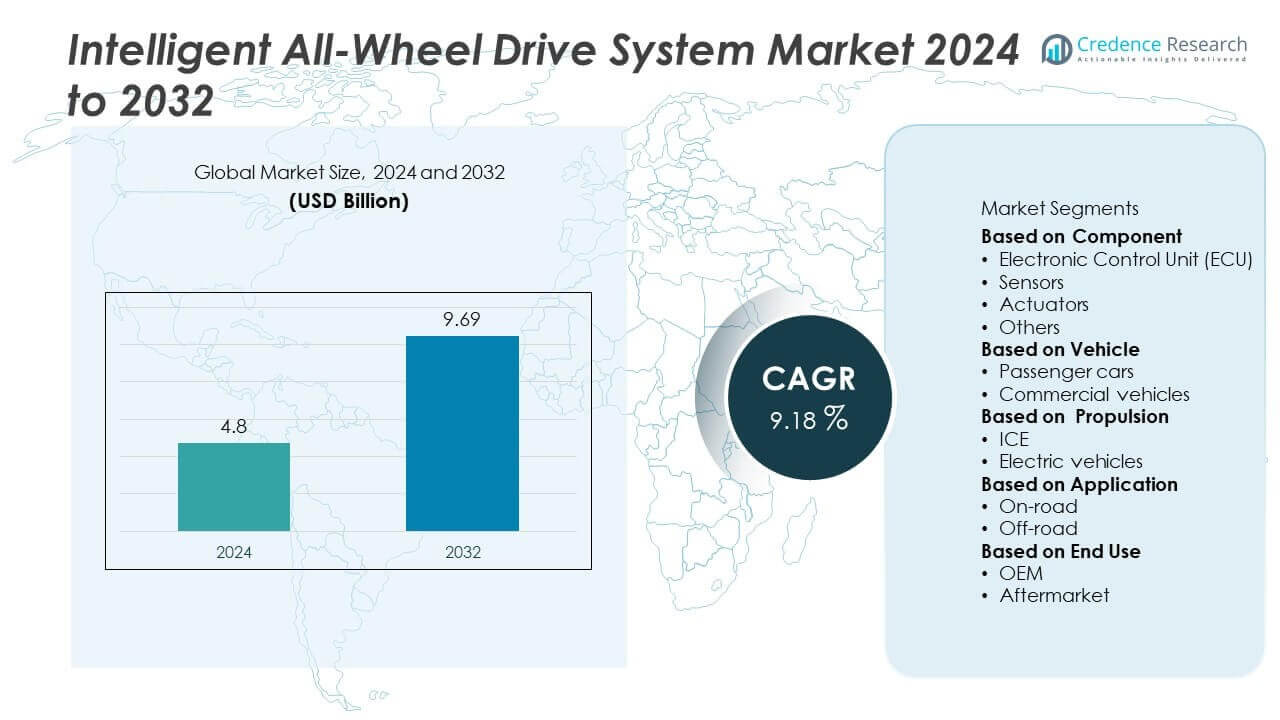

The global Intelligent All-Wheel Drive System Market was valued at USD 4.8 billion in 2024 and is projected to reach USD 9.69 billion by 2032, growing at a CAGR of 9.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent All-Wheel Drive System Market Size 2024 |

USD 4.8 Billion |

| Intelligent All-Wheel Drive System Market, CAGR |

9.18% |

| Intelligent All-Wheel Drive System Market Size 2032 |

USD 9.69 Billion |

The intelligent all-wheel drive system market is driven by top players including Jaguar, Infiniti, Tesla, Hyundai, Volvo, Acura, Volkswagen, Ford, Nissan, and GKN Automotive. These companies focus on advancing drivetrain efficiency, integrating electronic control units, and expanding AWD adoption in both ICE and electric vehicles. Tesla, Hyundai, and Volvo lead in electrified AWD development, while Ford, Nissan, and Volkswagen strengthen hybrid and conventional offerings. Premium brands such as Jaguar, Infiniti, and Acura emphasize safety and performance features. Regionally, North America held the largest share at 34% in 2024, supported by strong SUV demand, followed by Europe with 28% and Asia-Pacific with 26%, each benefiting from luxury demand and EV adoption.

Market Insights

Market Insights

- The Intelligent All-Wheel Drive System market was valued at USD 4.8 billion in 2024 and is projected to reach USD 9.69 billion by 2032, growing at a CAGR of 9.18%.

- Rising demand for SUVs, crossovers, and premium vehicles with advanced safety features is a key driver, supported by regulations promoting vehicle stability and traction control technologies.

- Electrification trends are reshaping the market, with growing adoption of e-axle and dual-motor AWD systems in electric vehicles, while integration with ADAS enhances performance and safety appeal.

- Competitive landscape is shaped by Jaguar, Infiniti, Tesla, Hyundai, Volvo, Acura, Volkswagen, Ford, Nissan, and GKN Automotive, with strong focus on innovation in both ICE and EV platforms.

- North America leads with 34% share, followed by Europe at 28% and Asia-Pacific at 26%, while by component the ECU segment holds over 40% share and passenger cars dominate with nearly 65%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

In 2024, the Electronic Control Unit (ECU) segment held the dominant share of over 40% in the intelligent all-wheel drive system market. Its leadership is supported by the ECU’s ability to process real-time driving data and optimize torque distribution, ensuring safety and performance across varying terrains. Rising adoption of advanced driver assistance systems (ADAS) and integration of predictive analytics in modern vehicles further boost ECU demand. Meanwhile, sensors and actuators are gaining traction due to the push for precision control and automation, though they currently trail behind ECU in overall market share.

- For instance, GKN Automotive introduced its eTwinsterX torque vectoring unit in 2017, which provides a maximum axle torque of 3,500 Nm and vectors up to 2,000 Nm to each rear wheel, demonstrating ECU-led advancements in intelligent AWD systems.

By Vehicle

The passenger cars segment accounted for nearly 65% share of the intelligent all-wheel drive system market in 2024. Strong growth is driven by rising consumer preference for premium vehicles with enhanced safety, comfort, and off-road capabilities. Automakers increasingly integrate advanced AWD systems in sedans, SUVs, and crossovers to differentiate offerings and address customer demand for stability in diverse driving conditions. Commercial vehicles represent a smaller share but are expanding steadily, fueled by logistics operators and fleet owners adopting AWD solutions to improve performance and reliability in challenging terrains.

- For instance, Volvo’s XC90 Recharge with the AWD Twin Motor system delivers a combined output of 335 kW (455 hp) and supports towing loads of up to 2,400 kg, highlighting passenger vehicle integration of intelligent AWD.

By Propulsion

In 2024, the internal combustion engine (ICE) vehicles segment dominated with over 70% share of the intelligent all-wheel drive system market. ICE vehicles continue to lead due to their broad adoption in global markets, well-established infrastructure, and the integration of AWD systems in high-demand SUV and crossover categories. However, the electric vehicle segment is growing rapidly, supported by rising EV adoption, advancements in e-axle technology, and consumer demand for high-performance electric SUVs. This transition signals a gradual shift where EV-based AWD systems are expected to capture stronger market presence by 2032.

Key Growth Drivers

Rising Demand for Vehicle Safety and Stability

In 2024, rising consumer awareness of road safety significantly boosted the adoption of intelligent all-wheel drive systems. These systems enhance traction, cornering stability, and braking performance under challenging road conditions, making them essential in both premium and mid-range vehicles. Growing emphasis on reducing accidents and meeting stringent safety regulations has compelled automakers to adopt advanced AWD solutions. The increased focus on safety certifications and global crash compliance standards is expected to sustain demand for intelligent AWD systems throughout the forecast period.

- For instance, Tesla’s Dual Motor All-Wheel Drive system in the Model S delivers up to 670 horsepower, enabling acceleration from 0–100 km/h in 3.2 seconds. The system manages traction by distributing power between the front and rear wheels, contributing to the vehicle’s strong safety ratings.

Growing SUV and Crossover Popularity

The surge in sales of SUVs and crossovers has driven intelligent all-wheel drive system adoption. These vehicles accounted for the largest share of AWD integration due to consumer demand for performance, comfort, and off-road capabilities. Automakers are responding with advanced AWD-equipped models in both luxury and mainstream categories. Rising disposable incomes in emerging economies and preference for versatile family vehicles further amplify this trend. The SUV segment’s dominance ensures consistent demand for AWD systems across global markets, positioning it as a key growth driver.

- For instance, Hyundai’s 2024 Palisade SUV features the HTRAC AWD system, which helps manage traction with an electronically controlled torque split, enabling a maximum towing capacity of up to 5,000 pounds (approximately 2,268 kg) when properly equipped.

Advancements in Electronics and Software Integration

Intelligent all-wheel drive systems rely heavily on precise electronic control units, sensors, and actuators. Advances in software integration, predictive analytics, and vehicle connectivity are enhancing real-time torque management, improving fuel efficiency, and reducing emissions. Automakers are investing in AI-driven and cloud-connected AWD solutions that provide adaptive responses to driving environments. The integration of intelligent AWD systems with broader vehicle electronics platforms, including ADAS and autonomous driving technologies, is accelerating adoption. This technological progress is a critical driver shaping future market growth.

Key Trends and Opportunities

Shift Toward Electrified AWD Systems

Electrification presents a major opportunity for intelligent AWD adoption. Electric vehicles increasingly use e-axles and dual-motor configurations to deliver instant torque distribution without mechanical linkages. This shift improves efficiency, reduces weight, and enhances system responsiveness. Automakers are leveraging these technologies to expand AWD features across electric SUVs and performance EVs, creating strong growth potential. With governments offering incentives for EV adoption, the electrified AWD segment is expected to grow faster than conventional systems during the forecast period.

- For instance, Volvo’s EX90 electric SUV features a dual-motor AWD system delivering 380 kW (517 hp) and 910 Nm torque, enabling a towing capacity of 2,200 kg with instant torque vectoring.

Integration with Advanced Driver Assistance Systems (ADAS)

A growing trend is the integration of AWD systems with ADAS to enhance driving intelligence. Intelligent AWD solutions, when paired with adaptive cruise control, lane-keeping, and predictive traction management, provide safer and more responsive driving. Automakers are marketing these combined systems as premium features, particularly in luxury and high-performance vehicles. This integration not only meets consumer expectations for advanced safety but also supports the long-term transition toward semi-autonomous and autonomous driving technologies, making it a strong market opportunity.

- For instance, Nissan’s ProPILOT Assist combined with its e-4ORCE AWD system in the Ariya EV manages front and rear torque distribution up to 100:0 or 0:100 and applies independent brake force at each wheel, enhancing lane-keeping precision under ADAS control.

Key Challenges

High System and Maintenance Costs

The complexity of intelligent all-wheel drive systems increases both vehicle production and ownership costs. Advanced components such as ECUs, sensors, and actuators significantly raise manufacturing expenses. For end-users, higher maintenance and repair costs often discourage adoption in price-sensitive markets. This cost factor limits penetration in lower-priced vehicle categories, creating a barrier to widespread deployment. Automakers face the challenge of balancing affordability with advanced functionality to ensure broader acceptance of these systems in global markets.

Energy Efficiency and Fuel Economy Concerns

Although intelligent AWD systems enhance performance and safety, they often add weight and energy consumption to vehicles. In ICE-powered vehicles, this translates to lower fuel efficiency, while in electric vehicles, it reduces driving range. With global regulations pushing for stricter emission standards and longer EV ranges, optimizing AWD systems for efficiency is critical. Manufacturers must innovate lightweight materials, smart torque control, and energy-efficient designs to overcome this challenge, ensuring compliance with environmental regulations and consumer expectations.

Regional Analysis

North America

In 2024, North America accounted for 34% share of the intelligent all-wheel drive system market. Strong consumer demand for SUVs, crossovers, and premium vehicles with enhanced safety features drives adoption. Automakers in the U.S. and Canada prioritize intelligent AWD integration to meet consumer expectations for stability, off-road performance, and comfort. Stringent safety and emission standards further push manufacturers to incorporate advanced systems in new models. The presence of major automotive OEMs and advanced technology providers ensures continued regional leadership, with growing adoption across both ICE and emerging electric vehicle platforms during the forecast period.

Europe

Europe held 28% share of the intelligent all-wheel drive system market in 2024, driven by strong demand for luxury and performance vehicles. German automakers, including leading premium brands, are at the forefront of AWD integration, particularly in sedans and SUVs. Strict emission regulations and high consumer safety awareness further support intelligent AWD adoption. The region also benefits from rising EV adoption, with AWD-equipped electric SUVs gaining traction. Ongoing advancements in electronics and predictive safety systems contribute to growth, making Europe a critical hub for AWD innovations and long-term technological development across the industry.

Asia-Pacific

In 2024, Asia-Pacific captured 26% share of the intelligent all-wheel drive system market, led by China, Japan, and South Korea. The region benefits from rapid SUV sales, rising disposable incomes, and growing consumer interest in advanced safety technologies. China’s booming EV sector also fuels demand for electrified AWD solutions, especially in premium electric SUVs. Japanese and Korean automakers are heavily investing in integrating intelligent AWD with connected systems and hybrid platforms. Expanding infrastructure, government incentives, and strong OEM presence ensure steady growth, making Asia-Pacific one of the fastest-growing regions for intelligent AWD adoption by 2032.

Latin America

Latin America represented 7% share of the intelligent all-wheel drive system market in 2024. Growth is supported by rising demand for SUVs and premium vehicles in countries such as Brazil and Mexico. Consumers seek advanced stability and performance features, particularly in urban areas with variable road conditions. However, adoption remains limited by high system costs and affordability concerns in mass-market segments. Multinational automakers are gradually introducing AWD-equipped models to cater to expanding middle-class demand. The region shows potential for moderate growth as awareness of safety and advanced vehicle technologies continues to improve.

Middle East & Africa

In 2024, the Middle East & Africa accounted for 5% share of the intelligent all-wheel drive system market. Demand is concentrated in Gulf countries, where luxury vehicles and SUVs dominate sales. Harsh terrain and desert driving conditions create strong requirements for advanced AWD systems, particularly in premium and off-road vehicle categories. Africa shows slower adoption due to economic constraints and limited access to advanced models. However, improving urbanization and rising consumer spending in certain regions are expected to expand growth. Global automakers targeting high-income markets in the Middle East will continue driving adoption during the forecast period.

Market Segmentations:

By Component

- Electronic Control Unit (ECU)

- Sensors

- Actuators

- Others

By Vehicle

- Passenger cars

- Commercial vehicles

By Propulsion

By Application

By End Use

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The intelligent all-wheel drive system market is shaped by leading players such as Jaguar, Infiniti, Tesla, Hyundai, Volvo, Acura, Volkswagen, Ford, Nissan, and GKN Automotive. These companies drive market competition through advanced technology integration, diverse product portfolios, and strategic investments in electrification. Automakers like Tesla, Hyundai, and Volvo are focusing on electric AWD platforms, leveraging e-axle and dual-motor systems to enhance efficiency and performance. Traditional brands including Ford, Volkswagen, and Nissan continue to strengthen their ICE-based and hybrid AWD offerings, ensuring broad market coverage. Premium players such as Jaguar, Infiniti, and Acura emphasize luxury, safety, and adaptive driving features to appeal to high-end consumers. GKN Automotive plays a vital role as a key supplier, enabling OEMs with innovative driveline technologies. Continuous innovation, partnerships, and regional expansion remain central strategies, as manufacturers seek to balance performance, safety, and efficiency to meet evolving consumer and regulatory demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jaguar

- Infiniti

- Tesla

- Hyundai

- Volvo

- Acura

- Volkswagen

- Ford

- Nissan

- GKN Automotive

Recent Developments

- In 2025, GKN Automotive showcased a next-generation electric AWD solution (e4WD) with compact rear motor integration.

- In June 2024, Volkswagen upgraded its 4MOTION AWD system in the 2025 model year for better handling.

- In 2024, Volkswagen published its 2025 AWD lineup, applying 4MOTION to models like Atlas, Tiguan, ID.4.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle, Propulsion, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from SUVs and crossovers.

- Electric vehicles will drive faster adoption of electrified AWD systems.

- Automakers will focus on integrating AWD with ADAS and autonomous features.

- ECU and software-driven torque control will remain central to system development.

- Luxury and premium vehicle demand will strengthen high-performance AWD adoption.

- Asia-Pacific will witness rapid growth supported by rising EV production.

- North America and Europe will maintain leadership through safety and emission standards.

- Partnerships between OEMs and driveline suppliers will accelerate technology upgrades.

- Lightweight and energy-efficient AWD designs will gain importance for fuel economy.

- Consumer preference for stability and safety will ensure long-term market resilience.

Market Insights

Market Insights