Market Overview:

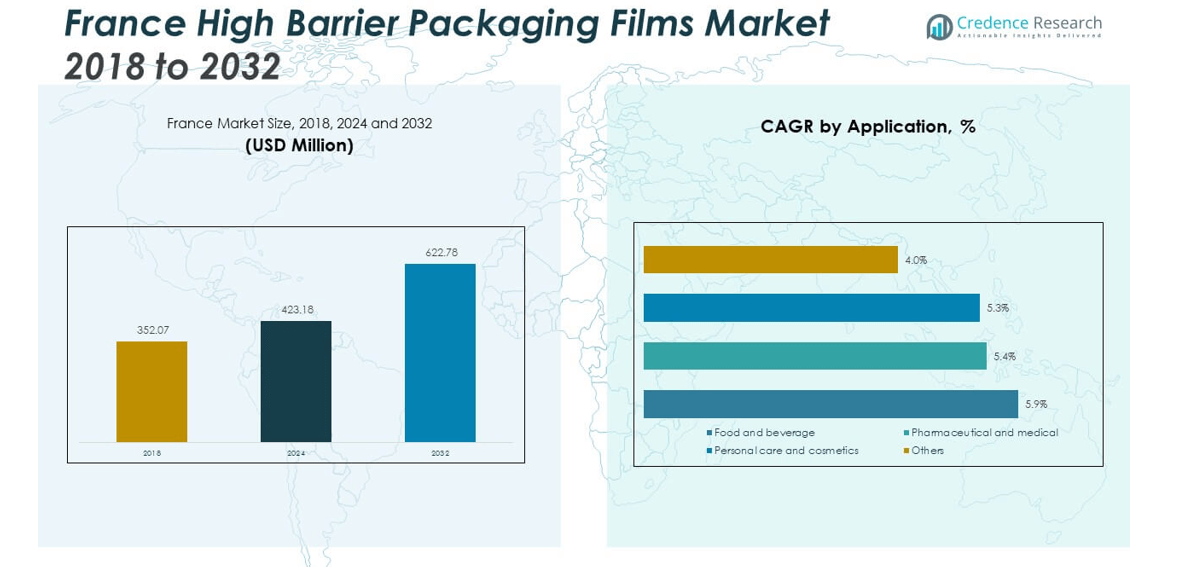

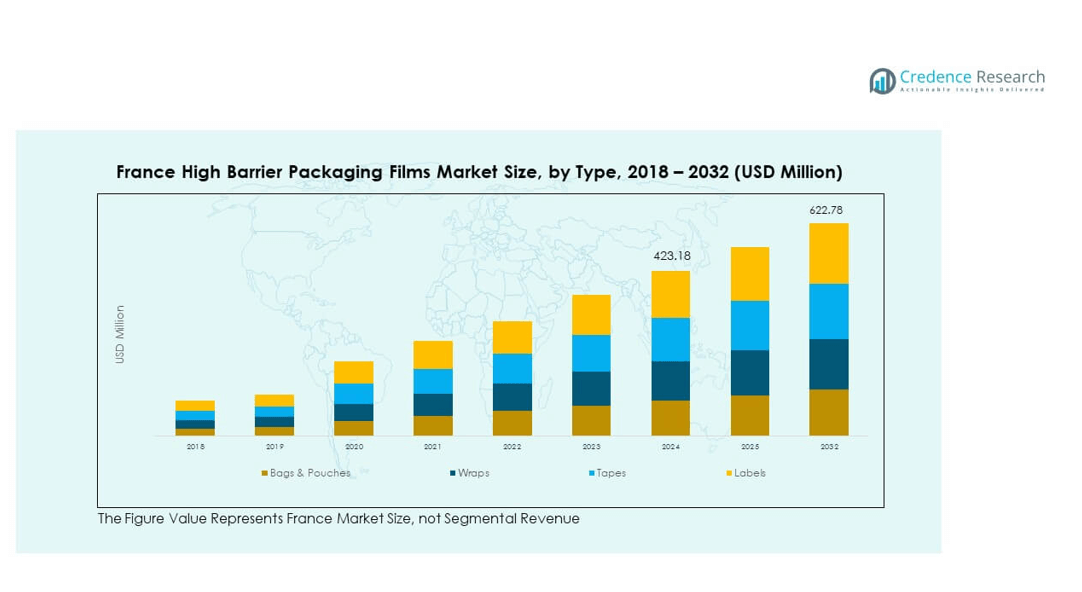

The France High Barrier Packaging Films Market size was valued at USD 352.07 million in 2018 to USD 423.18 million in 2024 and is anticipated to reach USD 622.78 million by 2032, at a CAGR of 4.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France High Barrier Packaging Films Market Size 2025 |

USD 423.18 million |

| France High Barrier Packaging Films Market, CAGR |

4.95% |

| France High Barrier Packaging Films Market Size 2032 |

USD 622.78 million |

Growth in the France High Barrier Packaging Films Market is supported by rising demand for extended shelf-life packaging, growing consumption of packaged food, and increasing focus on product safety. Manufacturers are adopting advanced materials with strong barrier properties to protect against moisture, oxygen, and UV light. The expansion of ready-to-eat meals, pharmaceutical packaging needs, and sustainable packaging trends are also fueling adoption. Companies are investing in recyclable and bio-based high barrier films to meet regulatory standards and consumer expectations for eco-friendly solutions.

Geographically, Western Europe leads the regional market due to its strong food and beverage sector, high consumer awareness, and established packaging infrastructure. France stands out with its growing adoption of advanced packaging in both food and pharmaceuticals, driven by strict safety and sustainability regulations. Emerging markets in Central and Eastern Europe are gaining traction, supported by rising urbanization, modern retail expansion, and increasing demand for packaged goods. This diverse regional landscape ensures steady growth opportunities for suppliers.

Market Insights:

- The France High Barrier Packaging Films Market was valued at USD 352.07 million in 2018, reached USD 423.18 million in 2024, and is projected to reach USD 622.78 million by 2032, growing at a CAGR of 4.95%.

- Western Europe leads with 41% share, driven by strong food and pharmaceutical sectors and strict EU packaging regulations that prioritize safety and sustainability.

- Central and Eastern Europe hold 28% share, supported by rising disposable incomes, expanding modern retail formats, and cost-efficient manufacturing attracting global players.

- The fastest-growing region is Southern Europe with 19% share, fueled by high adoption of flexible packaging for fresh produce and ready-to-eat meals, especially in Italy and Spain.

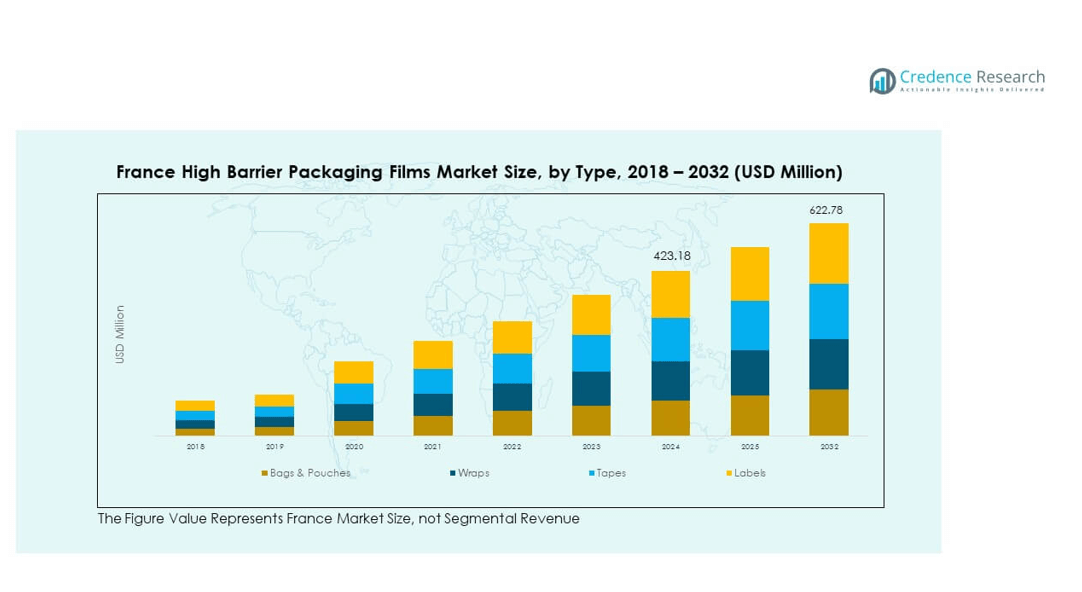

- Segment distribution from the chart shows bags & pouches at 34% and labels at 26%, together accounting for a major portion due to their versatility across retail and pharmaceutical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference For Extended Shelf-Life Packaged Foods

The France High Barrier Packaging Films Market benefits from consumer demand for long-lasting packaged goods. Food and beverage manufacturers focus on solutions that minimize spoilage and maintain product freshness. Films with strong barrier properties against oxygen and moisture gain preference in retail and convenience segments. The rise in urban living and busy lifestyles accelerates this demand. Supermarkets and hypermarkets emphasize packaging innovations to retain customer loyalty. It continues to be driven by changing eating habits and growth in ready-to-eat meals. The market is positioned strongly due to its alignment with consumer health and safety needs.

- For instance, Amcor’s retortable high-barrier films for food packaging achieve less than 1 cc oxygen and less than 1 g moisture permeability after conversion and retort, aligning with the highest performance standards for shelf-life extension in packaged foods.

Growing Adoption Across Pharmaceutical And Healthcare Packaging Applications

Pharmaceutical companies rely on high barrier films to protect sensitive drugs from external elements. These films help maintain the stability and efficacy of medications across extended supply chains. Demand has increased due to strict EU regulations requiring safety and compliance in drug packaging. It supports the healthcare sector’s need for reliable packaging of injectables and oral drugs. Rising health awareness and expanding aging populations further strengthen demand. Pharmaceutical firms in France invest in advanced materials to ensure safety in distribution. This segment adds steady growth to the overall market expansion.

- For instance, industry-accepted high barrier films used in pharmaceutical packaging in France are designed to meet oxygen transmission rate (OTR) requirements of less than or equal to 0.06 cc/m²/24hrs/atm as per the ASTM D3985 standard, ensuring the long-term stability of sensitive medications distributed through the supply chain.

Increasing Focus On Sustainability And Recyclable Packaging Films

The industry witnesses a push toward recyclable and eco-friendly high barrier solutions. Regulatory pressure drives producers to reduce environmental footprints through innovative designs. Consumers also demand packaging that aligns with green practices without compromising product safety. It motivates investments in bio-based polymers and compostable barrier films. Companies across France explore circular economy models in packaging. Adoption of lightweight structures and reduced plastic content enhances acceptance. This focus on sustainable practices helps the market maintain long-term resilience.

Expanding Retail And E-Commerce Channels Driving Packaging Innovation

E-commerce growth increases the need for secure and durable packaging solutions. High barrier films protect products against transit-related damage and environmental exposure. Retailers seek enhanced product presentation that complements protection features. It supports brand loyalty and meets consumer expectations for quality packaging. France’s digital retail boom further accelerates innovation in protective film design. The requirement for lightweight yet high-performance materials is evident. Strong partnerships between retailers and packaging suppliers ensure continuous innovation. This dynamic creates opportunities for steady growth in the sector.

Market Trends:

Integration Of Smart Packaging Technologies With Barrier Film Solutions

The France High Barrier Packaging Films Market is witnessing integration of smart packaging features. Producers add QR codes, freshness indicators, and anti-counterfeit labels to packaging designs. These innovations enhance consumer trust and brand value. It enables real-time product tracking and improved transparency across supply chains. Growing interest in digital tools within packaging further accelerates this trend. Retailers use smart features to differentiate products on crowded shelves. This convergence of barrier strength with digital intelligence creates a competitive advantage.

Rising Popularity Of Flexible And Lightweight Packaging Alternatives

Lightweight packaging films gain traction due to cost savings and convenience benefits. The industry shifts from rigid formats to flexible pouches, wraps, and sachets. It reduces logistics costs while enhancing shelf space efficiency. Consumers prefer easy-to-open and resealable packaging in daily use. Manufacturers adapt designs to balance barrier performance with flexibility. This trend also aligns with sustainability goals by minimizing material usage. Retailers support flexible formats for both online and offline retail channels.

- For instance, flexible packaging films with optimized OTR properties below 1 cc/100 in²/24 hours are increasingly adopted in France for snacks and ready-to-eat meals, reducing food spoilage and material use compared to conventional rigid formats.

Growing Demand For Premium Packaging In Luxury And Specialty Goods

Luxury and specialty goods sectors adopt high barrier films to reflect quality. These films protect premium food, cosmetics, and beverages from degradation. It enables brands to ensure both aesthetics and functional strength. Consumers link premium packaging with brand authenticity and safety. France’s luxury-focused economy accelerates this demand across retail categories. Producers experiment with metallic finishes and advanced laminations for better appeal. Rising exports of French premium goods further amplify this packaging requirement.

Adoption Of Advanced Coating Technologies To Improve Barrier Performance

The use of nanocoatings and multilayer structures expands in packaging applications. These innovations provide strong resistance against oxygen, UV, and vapor. It supports longer shelf-life for perishable and delicate items. Research institutions in Europe collaborate with companies for material breakthroughs. Advanced coatings allow thinner films with improved barrier efficiency. This reduces material costs while keeping high product safety standards. Continuous development of coatings strengthens competitiveness in the French market.

Market Challenges Analysis:

High Production Costs And Complex Manufacturing Processes For Barrier Films

The France High Barrier Packaging Films Market faces challenges from high production costs. Manufacturing processes involve multilayer structures and advanced coating technologies. It increases expenses for raw materials, machinery, and skilled labor. These costs limit adoption for small and medium enterprises. Competitive pricing pressure across retail chains adds further strain. Producers struggle to balance quality with cost-efficiency in operations. This challenge impacts profitability while slowing scalability across regional players. Companies invest heavily to optimize processes and reduce wastage.

Stringent Regulatory Standards And Environmental Compliance Requirements

Packaging regulations in France and the EU impose strict compliance burdens. Producers must adhere to guidelines on recyclability and material usage. It forces redesign of packaging structures to meet sustainability goals. The process demands significant investment in research and testing. Non-compliance risks brand reputation and financial penalties. Companies navigate multiple certification processes to validate eco-friendly claims. The pressure to innovate under regulatory control slows product launches. This challenge shapes strategic decisions across industry participants.

Market Opportunities:

Advancement In Bio-Based Polymers And Circular Packaging Models

The France High Barrier Packaging Films Market sees opportunities in bio-based solutions. Producers focus on biodegradable polymers that combine sustainability with performance. It supports the transition toward circular economy models in packaging. Retailers and consumers welcome innovations aligned with environmental goals. Investments in compostable films open doors to new customer segments. France’s emphasis on green procurement boosts adoption across industries. The opportunity creates value while strengthening compliance with EU sustainability mandates.

Expansion Of E-Commerce And Growth In Ready-To-Eat Food Products

Rapid growth of e-commerce supports higher demand for protective barrier films. Packaging must ensure product safety during long-distance deliveries. It opens new revenue streams for manufacturers catering to online retailers. Ready-to-eat food adoption further stimulates need for high barrier materials. It enables suppliers to diversify across both retail and food delivery channels. Companies with innovative protective designs gain a strong edge in this environment. This opportunity will shape the long-term trajectory of the market.

Market Segmentation Analysis:

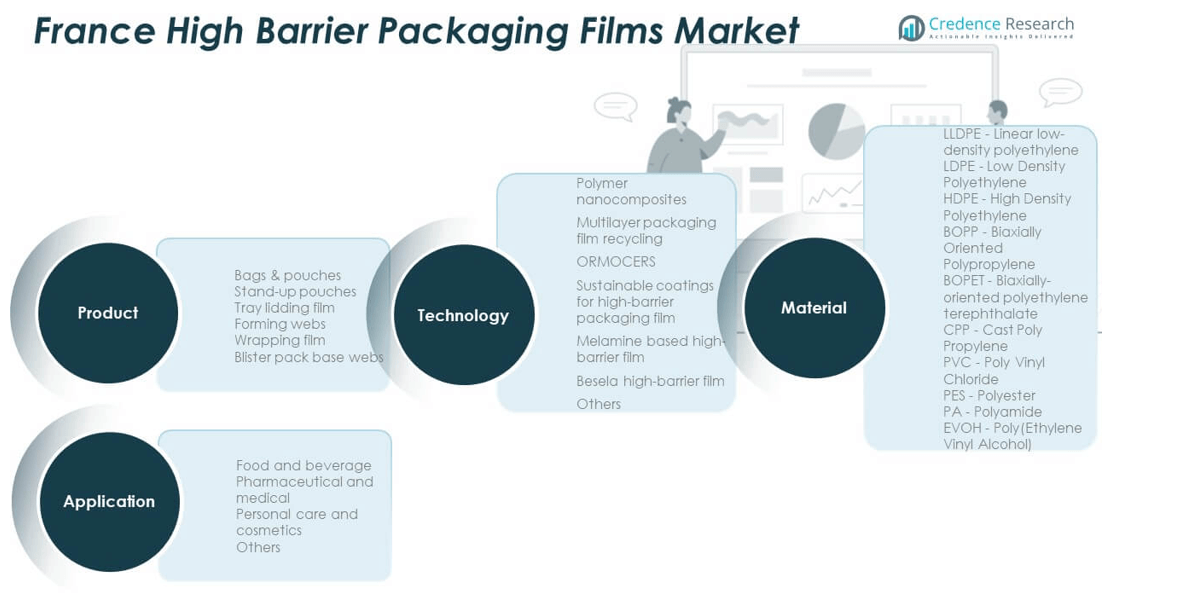

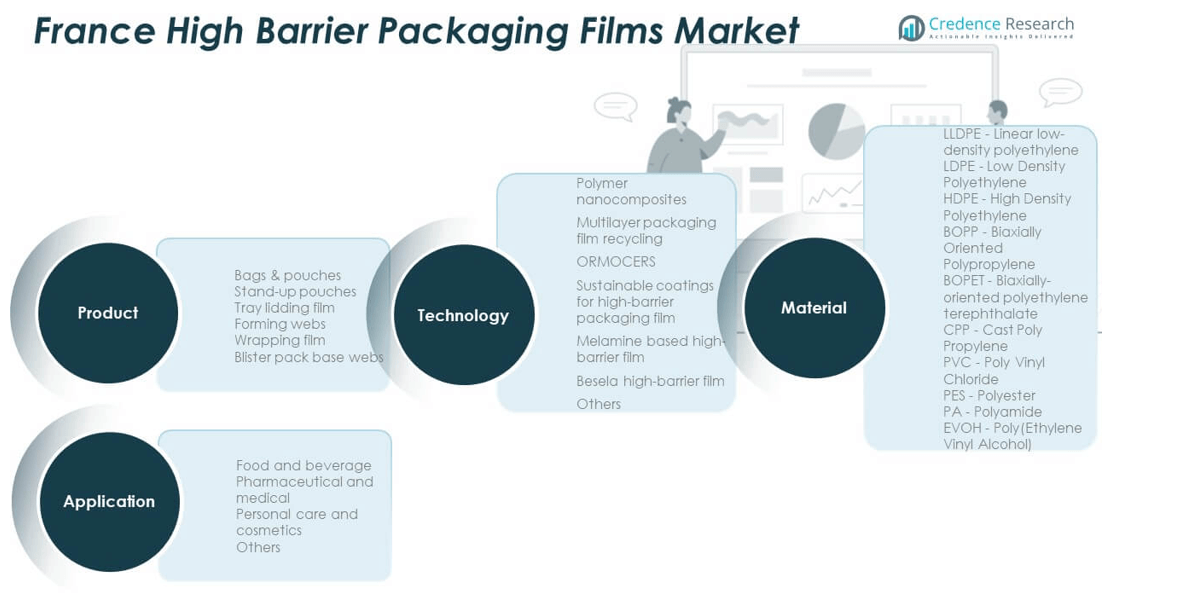

By Product

The France High Barrier Packaging Films Market is segmented into bags and pouches, stand-up pouches, tray lidding film, forming webs, wrapping film, and blister pack base webs. Bags and pouches dominate due to their versatility and suitability across food and pharmaceutical applications. Stand-up pouches show strong growth supported by retail demand for convenient and resealable formats. Tray lidding films gain traction in ready-to-eat meals, while blister pack base webs serve the pharmaceutical industry. Wrapping films and forming webs continue to expand in packaging for processed goods.

- For instance, stand-up pouches and tray lidding films that use high barrier laminates are verified to achieve OTR values below 1 cc/100 in²/24 hours, supporting both food and pharmaceutical manufacturers in France with reliable protection and extended product integrity.

By Application

Food and beverage represent the largest application, driven by growing packaged food consumption and extended shelf-life needs. Pharmaceutical and medical packaging shows steady expansion, supported by regulatory requirements for safe and sterile product storage. Personal care and cosmetics rely on barrier films for premium presentation and protection against contamination. Other applications, including industrial goods, add incremental demand but remain smaller in scale. It demonstrates a broad usage base that strengthens overall market growth.

- For instance, in food and beverage packaging, the implementation of high barrier flexible films verified to have OTR less than or equal to 1 cc/100 in²/24 hours is a key metric behind significant improvements in shelf stability and reduction of oxygen-driven spoilage across French supermarkets and pharma supply chains.

By Technology

Polymer nanocomposites and sustainable coatings drive innovation with superior performance and eco-friendly attributes. Multilayer packaging film recycling gains importance under EU sustainability mandates. ORMOCERS, melamine-based films, and Besela high-barrier films expand niche applications with advanced durability and chemical resistance. Other technologies focus on balancing cost-effectiveness with protective features. This segment highlights the industry’s investment in innovation to maintain competitiveness.

By Material

Materials such as LLDPE, LDPE, and HDPE remain widely used due to flexibility and strength. BOPP and BOPET dominate due to excellent barrier properties and broad food industry use. CPP, PVC, and PES add specialty applications requiring durability and chemical resistance. EVOH stands out for high oxygen barrier performance, supporting long shelf-life packaging. It shows a diversified material base ensuring adaptability across industries.

Segmentation:

By Product

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

By Application

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

By Technology

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine-Based High-Barrier Film

- Besela High-Barrier Film

- Others

By Material

- LLDPE – Linear Low-Density Polyethylene

- LDPE – Low-Density Polyethylene

- HDPE – High-Density Polyethylene

- BOPP – Biaxially Oriented Polypropylene

- BOPET – Biaxially-Oriented Polyethylene Terephthalate

- CPP – Cast Polypropylene

- PVC – Polyvinyl Chloride

- PES – Polyester

- EVOH – Poly(Ethylene Vinyl Alcohol)

Regional Analysis:

Western Europe – Dominant Regional Contributor

The France High Barrier Packaging Films Market is anchored in Western Europe, which holds nearly 41% share. Strong demand from food and beverage industries, combined with advanced pharmaceutical packaging standards, drives regional growth. France benefits from stringent EU packaging regulations that prioritize safety, sustainability, and recyclability. The region’s retail and e-commerce infrastructure encourages innovation in flexible pouches, tray lidding, and wrapping films. High consumer awareness around product safety further strengthens adoption. It continues to be shaped by regulatory support and strong industrial capabilities that keep Western Europe at the forefront.

Central and Eastern Europe – Emerging Growth Hub

Central and Eastern Europe account for about 28% share, supported by expanding manufacturing capacity and urbanization. Rising disposable incomes and the spread of modern retail formats fuel packaged food demand. Pharmaceutical packaging is also strengthening due to increasing healthcare investments across Poland, Czech Republic, and Hungary. The region’s relatively lower labor costs encourage investment from multinational packaging players. It benefits from supply chain integration with Western Europe, ensuring steady growth momentum. This hub demonstrates strong potential to capture more share in the near future.

Southern Europe and Northern Europe – Niche and Specialized Demand

Southern Europe represents roughly 19% share, with Italy and Spain leading in flexible packaging adoption for fresh produce and ready-to-eat meals. The Mediterranean diet culture encourages packaging solutions that preserve freshness and quality. Northern Europe holds about 12% share, driven by advanced sustainability goals in countries like Sweden, Denmark, and Norway. It supports innovation in recyclable materials and bio-based barrier films aligned with strict environmental regulations. Demand from premium personal care and cosmetics adds another layer of growth. These regions, though smaller in size, offer specialized opportunities aligned with local consumer preferences and sustainability mandates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Limited

- Sealed Air Corporation

- Coveris

- Mondi Group

- Berry Global

- Taghleef Industries

- Jindal Films Europe (Treofan)

- Klöckner Pentaplast (kp)

- Schur Flexibles Group

- Huhtamaki

Competitive Analysis:

The France High Barrier Packaging Films Market features strong competition among global and regional players. Companies such as Amcor, Mondi, Sealed Air, Berry Global, and Coveris hold significant influence through diverse product portfolios and investments in advanced technologies. It is characterized by a focus on sustainable solutions, lightweight structures, and high-performance materials to meet EU regulatory demands and consumer expectations. Firms emphasize R&D, product innovation, and acquisitions to strengthen their positions. Competitive intensity remains high, with local players also contributing to price-sensitive segments. Strategic partnerships with retailers and food producers further enhance market penetration. Continuous innovation and sustainability-driven differentiation are shaping the competitive landscape in France.

Recent Developments:

- In June 2025, Amcor Limited partnered with French food company Cofigeo Group to launch a bespoke three-compartment ready meal tray that offers a 12-month shelf life and enhanced mono-material recyclability, reflecting a commitment to sustainability in barrier packaging for the French market.

- In August 2025, Coveris introduced a new monomaterial packaging solution, MonoFlexBP tray, specifically designed for tortilla wraps and other refrigerated foods, featuring improved resealability, high gas barrier properties, and full compatibility with current packaging machinery, emphasizing sustainable innovation in France and across Europe.

- In September 2025, Coveris entered into an exclusive European agreement with TIPA to manufacture and market home compostable produce labels for fresh produce, supporting stricter EU regulatory requirements and advancing circular packaging design for France and neighboring regions.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable packaging solutions will strengthen due to EU environmental mandates.

- High-barrier films for ready-to-eat meals will expand with lifestyle changes in France.

- Pharmaceutical packaging will drive adoption of advanced multilayer and recyclable films.

- Flexible pouches will remain the fastest-growing format across retail distribution.

- E-commerce growth will increase the need for protective and lightweight packaging.

- Investments in bio-based polymers will accelerate to meet circular economy goals.

- Advanced coating technologies will improve shelf-life performance and cost efficiency.

- Strategic collaborations between packaging firms and food producers will intensify.

- Regional suppliers will focus on niche applications to stay competitive.

- Innovation in recycling technologies will define the long-term sustainability roadmap.