Market Overview

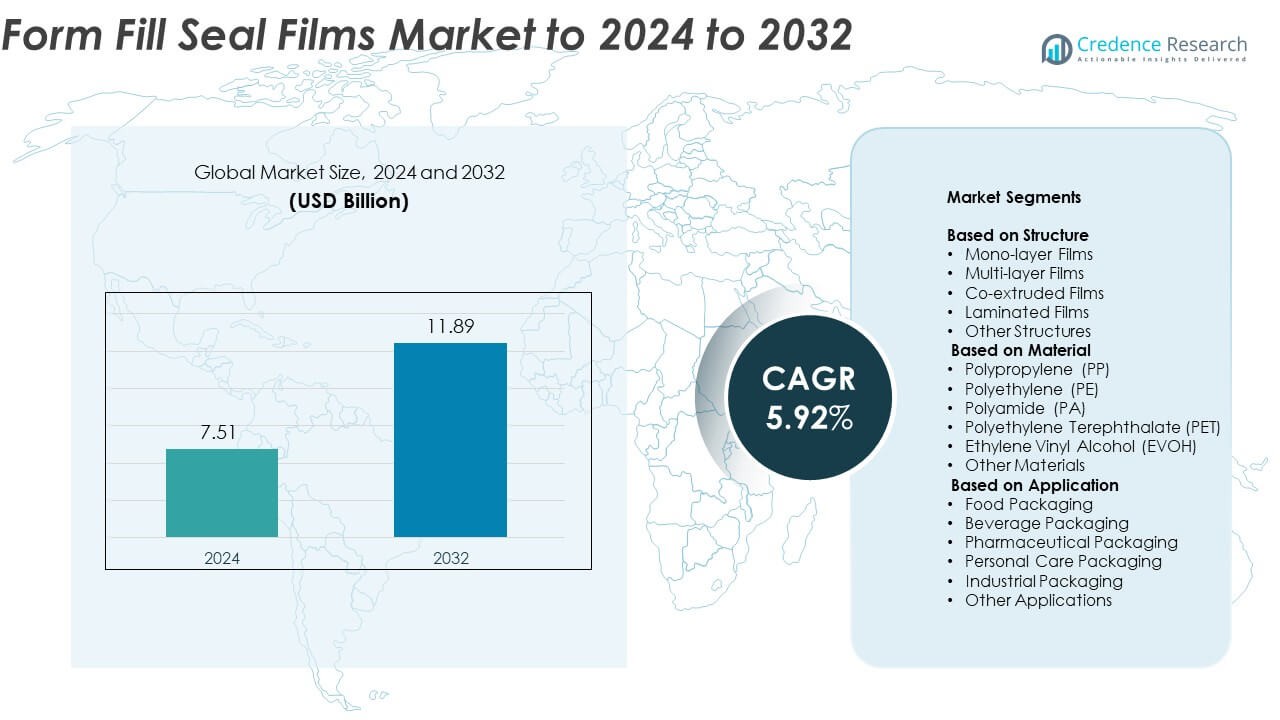

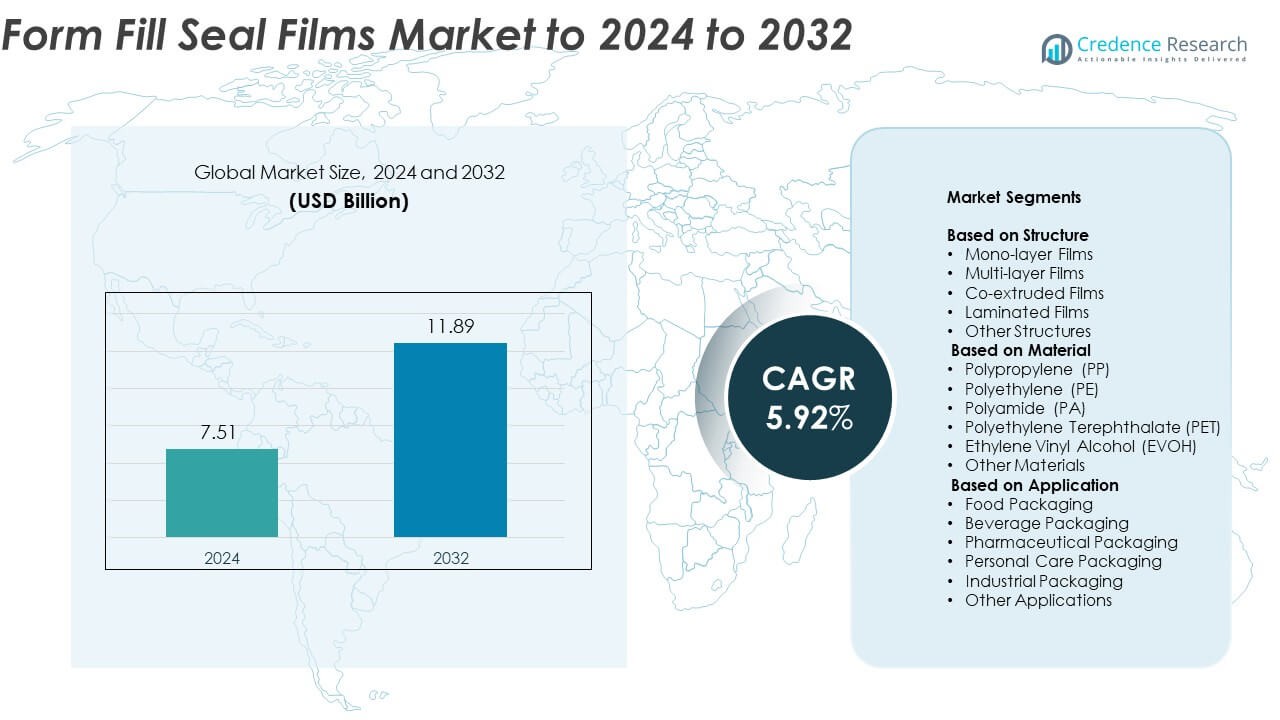

Form Fill Seal Films Market size was valued at USD 7.51 Billion in 2024 and is anticipated to reach USD 11.89 Billion by 2032, at a CAGR of 5.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Form Fill Seal Films Market Size 2024 |

USD 7.51 Billion |

| Form Fill Seal Films Market, CAGR |

5.92% |

| Form Fill Seal Films Market Size 2032 |

USD 11.89 Billion |

The Form Fill Seal Films Market is led by major players including Mondi Group, Tekni-Plex Inc., Berry Global Inc., Schott AG, Amcor Limited, Coveris Holdings S.A., Winpak Ltd., Sealed Air Corporation, Klöckner Pentaplast Group, and Toray Plastics (America) Inc. These companies dominate through strong portfolios in high-barrier, recyclable, and sustainable packaging solutions. North America leads the global market with a 34.6% share, supported by advanced packaging technologies and strong food and pharmaceutical sectors. Asia Pacific follows with 28.9% share, driven by rapid industrialization and rising packaged food consumption. Europe holds 27.8% share, benefiting from sustainability-focused regulations and mature manufacturing infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Form Fill Seal Films Market was valued at USD 7.51 billion in 2024 and is projected to reach USD 11.89 billion by 2032, growing at a CAGR of 5.92%.

• Growing demand for flexible and sustainable packaging in food, beverage, and pharmaceutical sectors is a major market driver.

• Increasing adoption of recyclable, bio-based, and mono-material films reflects a strong trend toward eco-friendly packaging solutions.

• The market remains competitive, with leading manufacturers focusing on technological innovation, lightweight materials, and regional expansion to strengthen portfolios.

• North America leads with a 34.6% share, followed by Asia Pacific at 28.9% and Europe at 27.8%, driven by strong industrial growth and evolving sustainability regulations.

Market Segmentation Analysis:

By Structure

The multi-layer films segment dominates the form fill seal films market, accounting for nearly 46.2% share in 2024. This dominance is attributed to their superior barrier properties, durability, and flexibility in packaging applications. Multi-layer films provide enhanced protection against oxygen and moisture, making them ideal for perishable goods and pharmaceuticals. Growing demand for extended shelf-life packaging across the food and beverage sector supports this segment’s growth. Manufacturers are also integrating recyclable multi-layer structures to align with sustainability regulations and consumer preferences for eco-friendly packaging materials.

- For instance, UFlex’s inline-coated and metallized ultra-high-barrier BOPP film (B-INM-M) achieves an oxygen transmission rate (OTR) of less than 0.1 cc/m²/day and a water vapor transmission rate (WVTR) of less than 0.1 g/m²/day.

By Material

Polypropylene (PP) leads the market with approximately 38.5% share in 2024, driven by its versatility, high clarity, and strong moisture resistance. PP films are extensively used in food and pharmaceutical packaging due to their heat-sealing capability and cost-effectiveness. Increasing demand for lightweight and recyclable packaging materials further propels segment growth. The rising use of biaxially oriented polypropylene (BOPP) films enhances printability and product presentation, encouraging adoption across diverse industries. Continuous advancements in polymer processing technology are supporting improved performance and sustainability of PP-based form fill seal films.

- For instance, Cosmo First operates a total BOPP capacity of 277,000 TPA (metric tonnes per annum) across its lines as of June 2025 (and continuing into July 2025), following the commissioning of a new high-capacity 81,200 TPA line.

By Application

The food packaging segment holds the largest share, accounting for about 54.8% in 2024. Its dominance is driven by growing consumption of ready-to-eat, frozen, and processed foods that require durable, airtight packaging. Form fill seal films enable efficient high-speed packaging while maintaining product freshness and safety. Increasing adoption of barrier films to reduce food waste and extend shelf life strengthens this segment’s growth. Rising hygiene standards and convenience packaging demand in emerging economies continue to expand opportunities in food applications, particularly within frozen meals, snacks, and dairy product packaging.

Key Growth Drivers

Rising Demand for Convenient and Flexible Packaging

The increasing consumer shift toward ready-to-eat and single-serve food products is driving the demand for form fill seal films. These films enable efficient, cost-effective, and high-speed packaging with extended shelf life and reduced product contamination. Manufacturers in the food, beverage, and pharmaceutical industries are adopting flexible films to improve logistics and sustainability. The growing popularity of lightweight and easy-to-handle packaging formats continues to reinforce market expansion, particularly in emerging economies experiencing rapid urbanization and lifestyle changes.

- For instance, Syntegon’s VFFS range specifies outputs up to 300 bags/min per tube, enabling fast single-serve and RTE pack formats.

Technological Advancements in Film Production

Continuous innovations in extrusion and lamination technologies are enhancing film performance, durability, and recyclability. Improved co-extrusion methods allow precise control over film thickness and barrier properties, enabling better protection against oxygen and moisture. Advanced materials such as EVOH and bio-based polymers are being integrated to meet stringent safety and sustainability standards. These technological advancements are supporting manufacturers in delivering high-quality, eco-friendly, and cost-efficient packaging solutions across diverse industrial applications.

- For instance, Brückner Maschinenbau’s “Green Line” offers a film width of 12 meters, an output of 94,000 metric tonnes per annum (TPA), and a production speed of 700 meters per minute, enabling wide-web, high-throughput film making used for advanced FFS applications.

Growing Sustainability and Regulatory Compliance

Global sustainability regulations and consumer awareness are encouraging manufacturers to develop recyclable and compostable film solutions. Companies are focusing on mono-material films and bio-based alternatives to minimize environmental impact and improve recyclability. Government initiatives promoting circular economy practices are boosting adoption across food and healthcare sectors. The push for low-carbon and resource-efficient packaging designs is transforming production processes, creating opportunities for innovation and growth within the form fill seal films market.

Key Trends & Opportunities

Adoption of Recyclable and Bio-Based Films

Sustainability has become a major focus, with growing preference for recyclable and bio-based packaging films. Manufacturers are introducing polyethylene and polypropylene-based recyclable options that maintain barrier performance while reducing waste. The demand for compostable and renewable-source materials is also expanding as brands seek eco-label certifications. This trend presents significant opportunities for companies investing in green chemistry and sustainable material innovations.

- For instance, Huhtamaki reported products in market from H1 2019 under blueloop™, expanding mono-PE/PP/PET solutions for brands.

Integration of Smart and High-Barrier Technologies

Advancements in nanotechnology and smart barrier coatings are reshaping the packaging landscape. Form fill seal films are being enhanced with active and intelligent components that extend product shelf life and monitor freshness. High-barrier multilayer films are gaining traction for sensitive products in food and pharmaceuticals. These developments enable brands to achieve greater product safety, transparency, and value-added functionality, improving consumer trust and packaging efficiency.

- For instance, Mitsubishi Gas Chemical’s (Soarnol EVOH) product line includes various grades with Oxygen Transmission Rates (OTR) ranging from 0.1 to 1.3 cc·20 µm/m²·day·atm when measured under specific test conditions (20 °C, 65 % RH), enabling the creation of thin, high-barrier FFS laminates.

Expansion in Emerging Markets

Rapid industrialization and the growth of organized retail in emerging economies such as India, China, and Brazil are creating new growth avenues. Increasing disposable income and lifestyle modernization are boosting packaged food and beverage consumption. Local manufacturing expansions and government incentives for sustainable packaging are further encouraging adoption. This trend supports strong demand for efficient, cost-effective, and environment-friendly form fill seal films.

Key Challenges

Environmental Concerns and Waste Management

Despite advancements in recyclability, plastic waste remains a critical issue for the industry. The high use of multi-layered, non-recyclable films creates disposal and recycling challenges. Stricter environmental policies in several regions are increasing pressure on producers to adopt sustainable alternatives. The need for advanced waste management infrastructure and consumer participation remains a key barrier to large-scale adoption of eco-friendly packaging solutions.

Fluctuating Raw Material Prices

Volatility in the prices of petroleum-based polymers such as polyethylene and polypropylene affects production costs and profit margins. Global supply chain disruptions and fluctuating crude oil prices further impact raw material availability. Manufacturers are under pressure to balance cost competitiveness with performance and sustainability. This challenge pushes companies to explore alternative bio-based materials and improve process efficiency to mitigate pricing instability.

Regional Analysis

North America

North America dominates the form fill seal films market with a 34.6% share in 2024. The region’s growth is supported by the strong presence of food, beverage, and pharmaceutical packaging industries. Rising adoption of automated packaging lines and demand for sustainable films drive market expansion. The United States leads due to advanced manufacturing capabilities and high investment in packaging innovation. Regulatory emphasis on recyclable materials and increasing preference for flexible packaging further strengthen regional demand across multiple consumer goods categories.

Europe

Europe accounts for nearly 27.8% share of the form fill seal films market in 2024. Growth is driven by stringent sustainability regulations and high consumer preference for eco-friendly packaging. Countries such as Germany, France, and the United Kingdom are focusing on recyclable and bio-based film solutions. The region’s mature food processing sector and increasing pharmaceutical exports contribute to steady demand. Ongoing technological advancements in barrier film design and recyclability are helping European manufacturers enhance packaging performance while meeting circular economy targets.

Asia Pacific

Asia Pacific holds a 28.9% market share in 2024, making it the fastest-growing region. Expanding food and beverage industries, urbanization, and rising disposable incomes are driving packaging consumption. China, India, and Japan are major contributors due to large-scale industrialization and growing retail sectors. The region benefits from cost-effective raw material availability and technological improvements in flexible packaging production. Increasing adoption of sustainable packaging practices and government initiatives promoting eco-friendly materials further boost market growth across the region.

Latin America

Latin America captures around 5.4% share of the global market in 2024. The region’s demand is primarily supported by the food, beverage, and personal care packaging sectors. Brazil and Mexico lead adoption due to expanding consumer markets and growing investments in flexible packaging infrastructure. Rising awareness of product shelf-life extension and sustainable materials is promoting the use of multi-layer films. However, economic fluctuations and limited recycling infrastructure pose challenges to consistent market growth in the region.

Middle East & Africa

The Middle East & Africa region accounts for approximately 3.3% share in 2024. Growth is driven by increasing demand for packaged food and healthcare products in urbanizing economies. The United Arab Emirates and Saudi Arabia are leading markets due to rapid retail development and industrial diversification. Expanding pharmaceutical production and investments in sustainable packaging solutions further stimulate market adoption. Despite infrastructure limitations, rising environmental awareness and modernization of manufacturing facilities are expected to enhance regional market performance.

Market Segmentations:

By Structure

- Mono-layer Films

- Multi-layer Films

- Co-extruded Films

- Laminated Films

- Other Structures

By Material

- Polypropylene (PP)

- Polyethylene (PE)

- Polyamide (PA)

- Polyethylene Terephthalate (PET)

- Ethylene Vinyl Alcohol (EVOH)

- Other Materials

By Application

- Food Packaging

- Beverage Packaging

- Pharmaceutical Packaging

- Personal Care Packaging

- Industrial Packaging

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Form Fill Seal Films Market features key players such as Mondi Group, Tekni-Plex Inc., Berry Global Inc., Schott AG, Amcor Limited, Coveris Holdings S.A., Winpak Ltd., Sealed Air Corporation, Klöckner Pentaplast Group, and Toray Plastics (America) Inc. The market is characterized by intense competition focused on innovation, material efficiency, and sustainability. Companies are investing in advanced film structures with enhanced barrier performance and recyclability to meet global packaging regulations. Strategic collaborations and acquisitions are strengthening their global presence and product portfolios. Leading manufacturers are also emphasizing automation, lightweight packaging, and eco-friendly materials to address rising consumer demand for sustainable solutions. Continuous R&D efforts are driving improvements in co-extrusion and lamination technologies, enabling higher production efficiency. Moreover, expanding applications in food, pharmaceutical, and personal care packaging are pushing companies to diversify product offerings and enhance technological capabilities to maintain a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mondi Group

- Tekni-Plex Inc.

- Berry Global Inc.

- Schott AG

- Amcor Limited

- Coveris Holdings S.A.

- Winpak Ltd.

- Sealed Air Corporation

- Klöckner Pentaplast Group

- Toray Plastics (America) Inc.

Recent Developments

- In 2024, Amcor collaborated with machine supplier PFM to create recycle-ready FFS packaging specifically for mozzarella, featuring improved run performance and supporting circular economy goals.

- In 2023, Berry Global showcased its latest high-performance NorDiVent® FFS film at the POWTECH exhibition, emphasizing the use of recycled content and advanced technical capability for powder and bulk product packaging.

- In 2023, Coveris unveiled Formpeel P, a new recyclable thermoforming film designed for medical clients utilizing form-fill-seal machinery to produce devices in bulk.

Report Coverage

The research report offers an in-depth analysis based on Structure, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for sustainable and recyclable packaging will drive material innovation.

- Adoption of mono-material structures will increase to improve recyclability and reduce waste.

- Growth in e-commerce and retail sectors will fuel demand for durable, high-barrier packaging.

- Automation and high-speed packaging lines will expand the use of form fill seal systems.

- Technological advancements will enable thinner yet stronger multi-layer films.

- Bio-based and compostable film solutions will gain wider commercial adoption.

- Expanding food and pharmaceutical industries in Asia Pacific will boost regional market share.

- Smart packaging features such as freshness indicators will become more common.

- Manufacturers will focus on circular economy compliance and energy-efficient production.

- Strategic partnerships and mergers will strengthen global supply chains and innovation capacity.