Market Overview

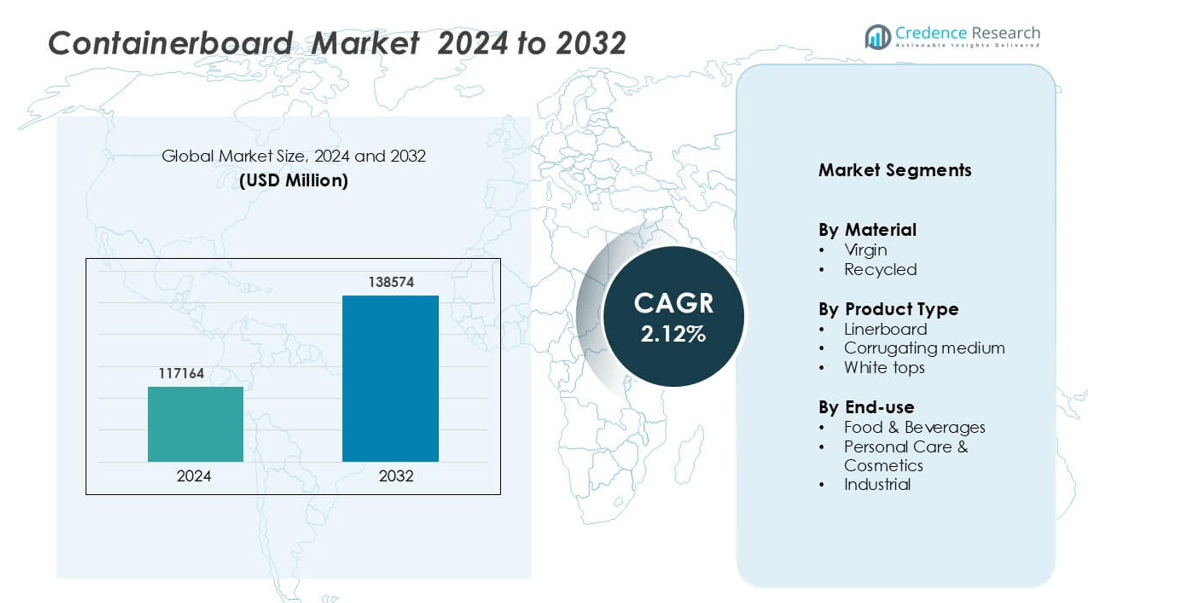

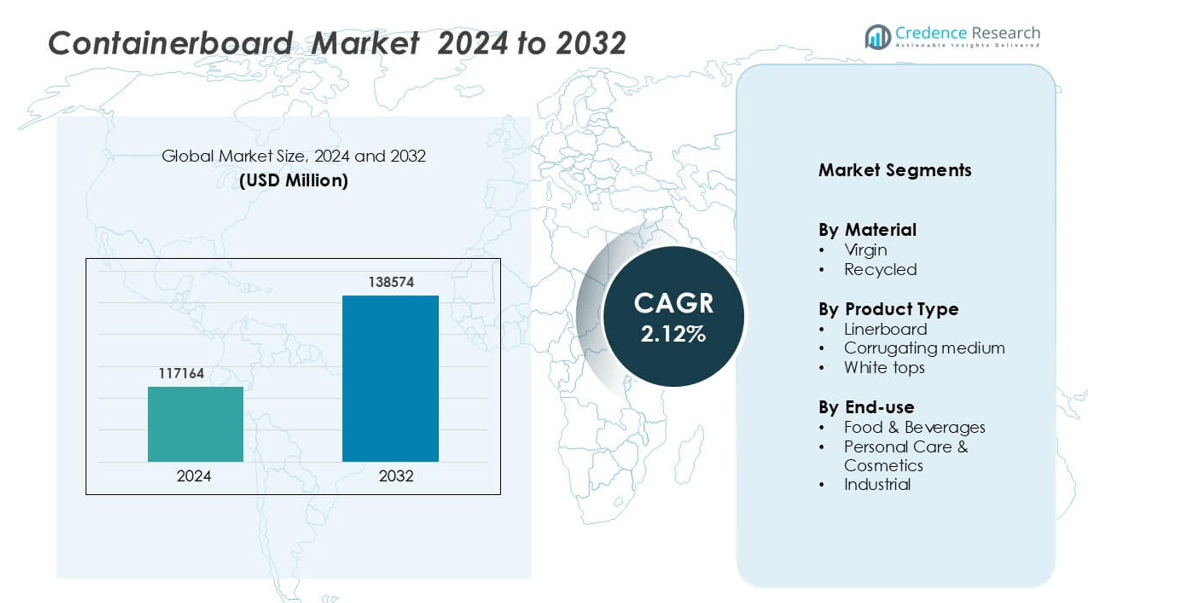

Containerboard Market was valued at USD 117164 million in 2024 and is anticipated to reach USD 138574 million by 2032, growing at a CAGR of 2.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Containerboard Market Size 2024 |

USD 117164 million |

| Containerboard Market, CAGR |

2.12% |

| Containerboard Market Size 2032 |

USD 138574 million |

The containerboard market is led by major players including Smurfit Kappa (Ireland), Georgia-Pacific LLC (U.S.), Mondi Group (U.K.), Nine Dragons Paper (Holdings) Limited (Hong Kong), DS Smith (U.K.), Rengo Co., Ltd. (Japan), WestRock Company (U.S.), Oji Fibre Solutions (NZ) Ltd. (Australia), Hamburger Containerboard (Austria), and Lee & Man Paper Manufacturing Ltd. (China). These companies focus on sustainable production, recycled fiber utilization, and capacity expansion to strengthen their market presence. Asia-Pacific emerged as the leading region in 2024, holding a 38% market share. The region’s dominance is driven by rapid industrialization, expanding e-commerce networks, and strong packaging demand from manufacturing and consumer goods sectors, supported by favorable government recycling initiatives.

Market Insights

- The global containerboard market was valued at USD 117164 million in 2024 and is projected to grow at a CAGR of 2.12 % from 2025 to 2032.

- Growth is primarily driven by increasing e-commerce packaging demand, sustainable material adoption, and expansion in food and beverage packaging applications.

- Market trends include advancements in lightweight containerboard production, recycled fiber utilization, and digital printing technologies that enhance cost efficiency and branding.

- Competitive intensity remains high with major players such as Smurfit Kappa, Mondi Group, DS Smith, Nine Dragons Paper, and WestRock investing in capacity expansion and circular economy initiatives.

- Regionally, Asia-Pacific leads the market with a 38% share, supported by rapid industrialization and rising manufacturing output, while recycled containerboard holds a 64% share among material types due to strong environmental regulations and increasing sustainability commitments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The containerboard market by material is segmented into virgin and recycled grades. The recycled segment dominated the market in 2024 with a 64% share. Rising sustainability regulations and growing demand for eco-friendly packaging drive its adoption. Manufacturers prioritize recycled fiber use to reduce production costs and carbon footprint. The segment’s growth is supported by strong recycling infrastructure and increasing circular economy initiatives. Virgin material, though costlier, remains essential for heavy-duty packaging where superior strength and durability are required, particularly in food and industrial shipping applications.

- For instance, Smurfit Kappa processes about 8 million tonnes of recovered paper annually through its recycling operations.

y Product Type

Based on product type, the linerboard segment held the largest share of 56% in 2024. Its dominance stems from extensive use in corrugated box manufacturing due to its durability and printability. Linerboards made from kraft pulp provide superior strength and protection for goods in transit. The corrugating medium segment also grows steadily, driven by e-commerce and retail packaging needs. Meanwhile, white tops gain traction in premium packaging applications demanding enhanced aesthetic appeal and branding opportunities, especially across food and cosmetic sectors.

- For instance, DS Smith operates its Kemsley UK mill with an annual capacity of about 840,000 tonnes focused on high-performing linerboard from recycled content.

By End-use

In terms of end-use, the food and beverages segment accounted for 48% of the market share in 2024. The growth is driven by increased packaged food consumption, ready-to-eat products, and sustainable packaging preferences. Containerboard offers superior protection and moisture resistance, making it ideal for food transit and storage. The personal care and cosmetics segment benefits from rising demand for branded, recyclable packaging solutions, while the industrial segment continues to grow due to expanding logistics and e-commerce activities requiring durable corrugated packaging solutions for bulk shipments.

Key Growth Drivers

Expanding E-Commerce and Packaging Demand

The rapid growth of global e-commerce has emerged as a key driver for the containerboard market. Online retailing requires durable, lightweight, and recyclable packaging materials, making containerboard an ideal choice for shipping boxes and protective packaging. Companies like Amazon and Alibaba continue expanding logistics networks, driving demand for corrugated packaging materials. Additionally, consumer preference for eco-friendly packaging amplifies containerboard adoption due to its biodegradability and recyclability. The increasing use of containerboard for secondary and tertiary packaging in food delivery, retail, and industrial shipments further strengthens market growth, positioning it as a vital component of global logistics operations.

- For instance, DS Smith opened a facility in Portugal that installed a 2,800 mm dry end corrugator specifically for large-format goods logistics.

Shift Toward Sustainable and Recyclable Packaging Solutions

Rising environmental concerns and stricter government regulations are propelling the shift toward sustainable packaging materials. Containerboard, derived largely from recycled fibers, aligns well with global sustainability goals and circular economy principles. Companies are investing in advanced pulping technologies to enhance fiber recovery and reduce waste. The European Union’s recycling targets and Asia-Pacific’s green packaging initiatives are boosting recycled containerboard production. Brand owners increasingly demand recyclable packaging to meet sustainability pledges and consumer expectations. This transition toward environmentally responsible materials enhances the market outlook while fostering innovation in low-impact, energy-efficient manufacturing processes.

- For instance, DS Smith installed a fibre-reject separation plant at its Lucca mill capable of recovering an extra 2,500 tonnes of paper fibres annually.

Growth in Food and Beverage Packaging Applications

The food and beverage sector significantly contributes to containerboard market expansion due to rising packaged food consumption and global trade. Containerboard’s superior strength, printability, and barrier coatings make it suitable for diverse packaging formats, from corrugated boxes to folding cartons. The growing demand for takeaway and ready-to-eat products, especially post-pandemic, drives increased use of corrugated solutions. Manufacturers are developing food-grade containerboards resistant to grease and moisture to ensure product safety. Additionally, demand from beverage packaging, including multipacks and transport boxes, further supports steady market growth as food logistics and export activities expand worldwide.

Key Trends and Opportunities

Technological Advancements in Lightweighting and Coating

Manufacturers are increasingly focusing on lightweight containerboard production to reduce material usage and shipping costs without compromising strength. Advanced coating technologies enhance print quality, water resistance, and durability, creating high-performance solutions for industrial and retail packaging. Companies are also adopting digital printing and nanocoating techniques for improved branding and product differentiation. The integration of moisture barriers and recyclable coatings expands the use of containerboard in perishable goods and frozen food packaging. These advancements not only optimize resource efficiency but also open opportunities for premium and specialized packaging applications.

- For instance, Rengo Co., Ltd. developed “LCCX90” corrugating medium that weighs 90 g/m² while matching the strength of a traditional 120 g/m² medium.

Rising Adoption in Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and Africa present strong growth opportunities due to expanding manufacturing, logistics, and consumer goods sectors. Rapid industrialization and the rise of middle-class populations are driving packaging consumption across food, personal care, and electronics sectors. Governments promoting sustainable waste management are further accelerating containerboard adoption. Investments in modern corrugation plants and automated production facilities across countries like India, Indonesia, and Brazil are strengthening local supply chains. This regional expansion offers lucrative prospects for global players seeking market diversification and long-term growth.

- For instance, Stora Enso Oyj launched digital printed corrugated packaging in Europe with lead times starting at 2 days, enabling similar rapid-response deployment in emerging-market hubs. Investments in modern corrugation plants and automated production facilities across countries like India, Indonesia, and Brazil are strengthening local supply-chains.

Strategic Collaborations and Capacity Expansion Initiatives

Leading manufacturers are pursuing mergers, acquisitions, and joint ventures to enhance production capabilities and expand geographic presence. For instance, containerboard producers are investing in recycled fiber-based mills and sustainable pulp sourcing. Partnerships with packaging converters and logistics providers help optimize supply chain efficiency. The development of smart packaging technologies and automation in manufacturing processes further enhances output consistency. These strategic initiatives not only strengthen market competitiveness but also enable companies to meet growing global demand for cost-effective, sustainable containerboard solutions.

Key Challenges

Volatility in Raw Material Prices

The containerboard market faces challenges due to fluctuations in raw material costs, particularly wood pulp and recovered paper. Global supply chain disruptions, inflationary pressures, and geopolitical tensions have increased input price volatility. This directly impacts production margins for manufacturers, especially in developing regions with limited access to quality recycled fiber. While recycling systems help offset some costs, inconsistent collection rates and contamination issues remain concerns. To counter this, producers are investing in waste paper recovery systems and fiber optimization technologies, though these add to capital expenditure burdens.

Competition from Alternative Packaging Materials

The growing availability of alternative packaging materials, such as plastics, flexible films, and biodegradable polymers, poses a competitive threat to containerboard. Plastic-based solutions often offer better moisture resistance and lower cost in specific applications, challenging containerboard’s dominance in some packaging segments. Moreover, ongoing innovations in compostable and bio-based plastics may further impact market share. To remain competitive, containerboard producers are enhancing performance attributes through advanced coatings, hybrid materials, and improved recyclability. Balancing cost efficiency with sustainability and strength remains a key challenge for manufacturers striving to retain market relevance.

Regional Analysis

North America

North America dominated the containerboard market with a 34% share in 2024, driven by strong demand from e-commerce, retail, and food packaging sectors. The United States leads regional growth due to high consumption of corrugated packaging and increasing investments in recycling infrastructure. Major producers focus on lightweight and high-strength containerboard grades to meet sustainability goals. The region’s strict environmental regulations and well-established waste recovery systems support recycled containerboard adoption. Expansion in quick-service food packaging and the growing preference for eco-friendly materials continue to strengthen the North American containerboard market outlook.

Europe

Europe accounted for 27% of the containerboard market share in 2024, supported by stringent environmental policies and advanced recycling systems. Germany, France, and Italy lead regional production, emphasizing circular economy principles and renewable raw materials. The demand for recycled containerboard remains high due to EU sustainability targets and consumer preference for green packaging. Manufacturers focus on lightweighting and innovation in moisture-resistant coatings for food and beverage applications. Growth in the online retail and logistics sectors, along with strong trade integration across the EU, continues to drive market expansion in the region.

Asia-Pacific

Asia-Pacific held the largest market share of 38% in 2024, positioning it as the global leader in containerboard production and consumption. China, India, and Japan dominate regional growth, fueled by rapid industrialization, manufacturing expansion, and booming e-commerce activity. The region benefits from abundant raw materials, low production costs, and rising export demand for corrugated packaging. Increasing consumer awareness of sustainability and government policies promoting paper recycling further support market development. Investments in modern paper mills and high-speed corrugation technologies continue to enhance production efficiency across the Asia-Pacific region.

Latin America

Latin America captured a 7% share of the global containerboard market in 2024. Brazil and Mexico lead regional demand, supported by growth in food processing, retail, and logistics industries. Expanding agricultural exports and the rise of packaged consumer goods are key growth factors. Manufacturers focus on upgrading facilities and incorporating recycled fibers to meet sustainability trends. However, raw material supply fluctuations and economic instability pose moderate challenges. Despite this, increasing urbanization, improved waste collection systems, and investments in eco-friendly packaging solutions continue to create growth opportunities across Latin America.

Middle East & Africa

The Middle East & Africa region accounted for 4% of the containerboard market share in 2024, with steady growth driven by expanding industrialization and retail packaging demand. The UAE, Saudi Arabia, and South Africa are major contributors due to increased infrastructure development and diversification of manufacturing bases. Growing awareness of sustainable materials and government support for recycling initiatives enhance market penetration. While limited local paper production capacity remains a challenge, rising import volumes and new mill investments indicate strong long-term potential for the regional containerboard market.

Market Segmentations:

By Material

By Product Type

- Corrugating medium

- White tops

By End-use

- Food & Beverages

- Personal Care & Cosmetics

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The containerboard market is highly competitive, with key players focusing on sustainability, capacity expansion, and technological innovation to strengthen their global footprint. Leading companies such as Smurfit Kappa, Georgia-Pacific LLC, Mondi Group, Nine Dragons Paper, DS Smith, Rengo Co., Ltd., WestRock Company, Oji Fibre Solutions, Hamburger Containerboard, and Lee & Man Paper Manufacturing dominate the market through extensive production networks and diversified product portfolios. These firms emphasize recycled fiber utilization, lightweight board development, and advanced coating technologies to meet eco-friendly packaging demand. Strategic mergers, mill upgrades, and digitalization of operations enhance efficiency and cost competitiveness. For instance, Smurfit Kappa and DS Smith have invested in high-performance corrugated packaging facilities, while Nine Dragons and Lee & Man Paper focus on expanding recycled paper capacity in Asia. Such initiatives reflect the industry’s shift toward sustainable manufacturing, operational optimization, and expanding reach across emerging markets to capture growing packaging demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Smurfit Kappa (Ireland)

- Georgia-Pacific LLC (U.S.)

- Mondi Group (U.K.)

- Nine Dragons Paper (Holdings) Limited (Hong Kong)

- DS Smith (U.K.)

- Rengo Co., Ltd. (Japan)

- WestRock Company (U.S.)

- Oji Fibre Solutions (NZ) Ltd. (Australia)

- Hamburger Containerboard (Austria)

- Lee & Man Paper Manufacturing Ltd. (China)

Recent Developments

- In January 2024, WestRock Company announced plans to build a new corrugated box plant in Pleasant Prairie, Wisconsin, to meet the growing demand from customers in the Great Lakes region. The company intends to close its existing plant in North Chicago when construction of the new facility is completed.

- In May 2023, Smurfit Kappa completed its latest investment project in Poland, resulting in a significant expansion of its Pruszków corrugated plant. The expansion made the plant Smurfit Kappa’s largest in Poland and one of the most high-tech and modern packaging plants in Europe

Report Coverage

The research report offers an in-depth analysis based on Material, Product type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The containerboard market will witness steady growth supported by rising global packaging demand.

- Increasing e-commerce penetration will continue to drive the need for corrugated and sustainable packaging.

- Manufacturers will invest in lightweighting technologies to enhance efficiency and reduce material costs.

- Recycled fiber usage will expand as sustainability regulations tighten across major economies.

- Technological innovations in coating and printing will improve product performance and design flexibility.

- Automation and digitalization of paper mills will boost production efficiency and operational precision.

- Strategic mergers and acquisitions will help companies expand capacity and market presence globally.

- Asia-Pacific will remain the leading regional hub due to strong manufacturing and export activities.

- Demand from food, beverage, and personal care sectors will fuel continuous market expansion.

- Circular economy initiatives will shape long-term growth, promoting closed-loop recycling and resource optimization.