Market Overview:

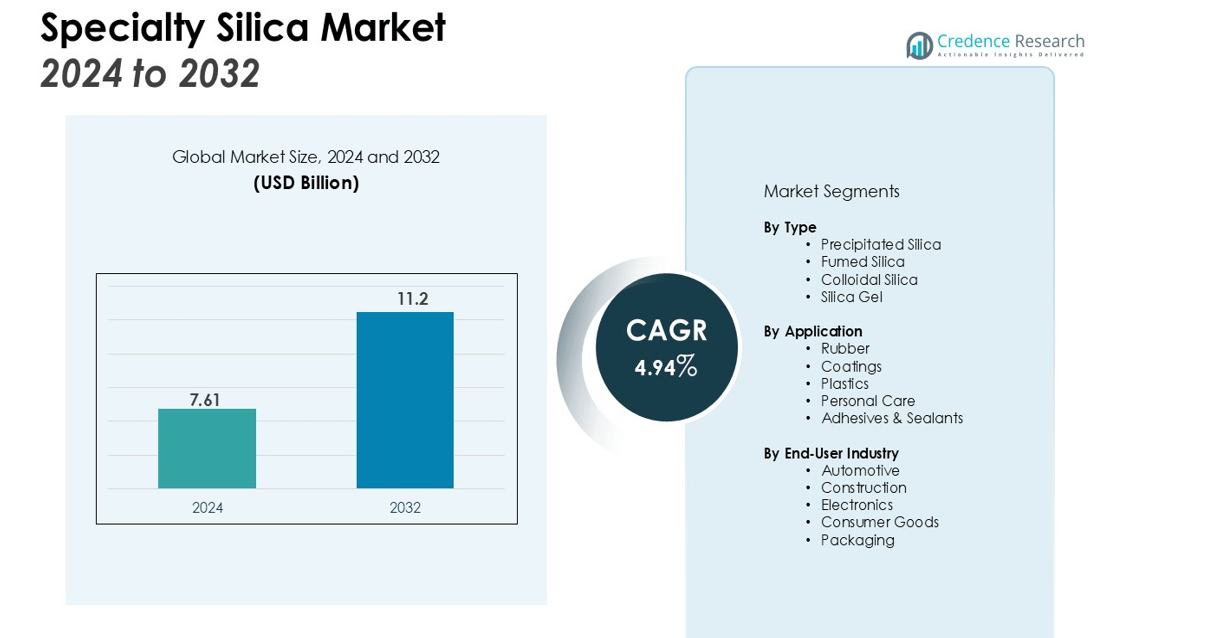

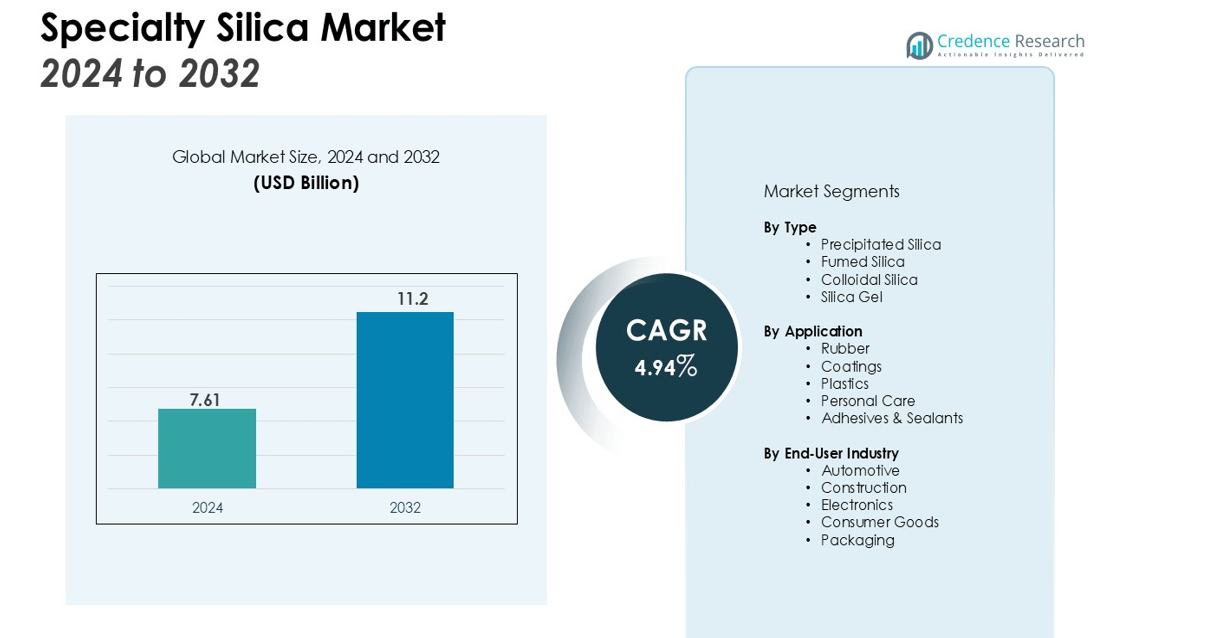

The Specialty Silica Market size was valued at USD 7.61 billion in 2024 and is anticipated to reach USD 11.2 billion by 2032, at a CAGR of 4.94% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Silica Market Size 2025 |

USD 7.61 Billion |

| Specialty Silica Market, CAGR |

4.94% |

| Specialty Silica Market Size 2032 |

USD 11.2 Billion |

Market growth is fueled by increasing demand for green tires, as specialty silica improves fuel efficiency and reduces rolling resistance. Expanding use in coatings, adhesives, and sealants enhances product performance by improving durability and dispersion. Additionally, strong uptake in personal care products, particularly in cosmetics and oral care, highlights silica’s versatility. Growing focus on lightweight materials and eco-friendly additives across industries further strengthens the market outlook.

Regionally, Asia-Pacific leads the market, supported by robust automotive production, rapid industrialization, and growing consumer goods demand. North America demonstrates steady growth due to strong investments in advanced materials and stringent regulations promoting sustainable products. Europe benefits from technological innovation and a well-established automotive sector, while emerging economies in Latin America and the Middle East & Africa are witnessing rising adoption, driven by infrastructure expansion and industrial diversification.

Market Insights:

- The Specialty Silica Market was valued at USD 7.61 billion in 2024 and will reach USD 11.2 billion by 2032, growing at a CAGR of 4.94%.

- Demand for green tires continues to rise as silica improves fuel efficiency, wet grip, and durability in automotive applications.

- Expanding use in coatings, adhesives, and sealants enhances product quality by strengthening durability and improving dispersion properties.

- The personal care industry boosts demand with silica’s role in absorption, thickening, and texture improvement in cosmetics and oral care.

- High production costs and raw material supply volatility remain key challenges, pressuring smaller producers and limiting scalability.

- Asia-Pacific dominates with 45% share, supported by strong automotive output, infrastructure growth, and consumer goods expansion.

- North America holds 23% share and Europe 21%, both driven by sustainability regulations, advanced industries, and innovation in eco-friendly applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Green Tires and Fuel-Efficient Automotive Solutions

Specialty Silica plays a vital role in the automotive industry by enhancing tire performance. It improves rolling resistance, wet grip, and durability, making it essential for green tire production. Global policies that encourage reduced carbon emissions have accelerated the adoption of silica-based tires. Automotive manufacturers view it as a strategic material for balancing performance and sustainability in high-demand markets.

- For instance, Madhu Silica Pvt. Ltd., India’s largest precipitated silica manufacturer, has an installed capacity of 270,000 metric tonnes per annum as of March 31, 2024, to meet the growing demand from the tire industry.

Expanding Applications in Personal Care and Cosmetics Industry

The personal care sector drives significant demand for Specialty Silica due to its versatile properties. It provides superior absorption, matting, and thickening functions in cosmetics and oral care products. Rising consumer preference for premium skincare and dental care boosts silica usage in formulations. It has become integral for global brands aiming to improve texture, shelf life, and product performance.

- For instance, Evonik’s SIPERNAT® 500 LS specialty silica, designed for personal care, has a high absorption capacity and can hold up to 320 grams of liquid per 100 grams of silica, which helps create dry, free-flowing powders from liquid ingredients.

Increasing Role in Coatings, Adhesives, and Sealants for Industrial Use

Specialty Silica supports the coatings, adhesives, and sealants segment by improving dispersion, mechanical strength, and anti-settling properties. Industries such as construction, packaging, and electronics rely on these materials to deliver high-quality and durable products. Growing infrastructure investment and product innovation strengthen the demand for silica-based additives. It ensures consistent performance and broad applicability in industrial environments.

Growing Focus on Lightweight Materials and Sustainable Industrial Practices

Industries increasingly seek sustainable and lightweight solutions, driving demand for Specialty Silica. It reduces environmental impact while providing superior reinforcement and processing advantages. Manufacturers leverage silica in polymer and composite applications to achieve strength without added weight. The shift toward eco-friendly materials positions it as a critical enabler of sustainable industrial growth.

Market Trends:

Advancements in High-Performance Materials and Functional Applications

Specialty Silica is witnessing strong demand from industries focused on advanced performance materials. It supports the automotive sector through green tire manufacturing and aligns with global sustainability goals. The coatings and adhesives industries adopt it for improved durability, dispersion, and strength in high-demand environments. In electronics, silica-based materials are gaining traction due to their thermal stability and insulation properties. The growing emphasis on lightweight yet strong components across manufacturing sectors continues to fuel adoption. It is increasingly viewed as a versatile enabler of performance across multiple applications.

- For instance, Evonik’s ULTRASIL® silica/silane system, when used in the production of green passenger car tires, enables a reduction of up to 1.4 metric tons of CO2 equivalent emissions over a driving distance of 150,000 km.

Shift Toward Sustainable Production and Eco-Friendly Solutions

Specialty Silica production trends highlight the industry’s focus on low-emission and sustainable practices. Companies are investing in energy-efficient manufacturing and innovative recycling methods to reduce environmental impact. Personal care and cosmetics brands prefer silica-based products due to their eco-friendly characteristics and safe formulations. Demand for renewable feedstock and biodegradable solutions strengthens its market positioning across global industries. The construction and infrastructure sectors also explore sustainable silica use to meet stricter regulations. It reflects a growing alignment between industrial innovation and environmental responsibility, driving long-term growth opportunities.

- For instance, Evonik developed its TEGO® Therm line of silica-based additives that improve the performance of thermal insulation coatings, offering heat resistance for industrial pipelines and components at continuous temperatures as high as 250 degrees Celsius, thereby reducing energy loss.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Requirements

Specialty Silica faces challenges linked to high production costs and energy-intensive processes. Manufacturers must balance the demand for quality with the expense of raw materials and advanced technologies. Strict environmental regulations on emissions and waste management further raise operational costs. Smaller producers often struggle to compete due to limited resources and higher capital requirements. It remains difficult for companies to scale efficiently while ensuring consistent quality and compliance.

Market Competition and Volatility in Raw Material Supply

Specialty Silica encounters intense competition from alternative materials that offer lower costs or easier availability. Volatility in raw material supply chains creates risks for stable production and timely delivery. Global disruptions, trade restrictions, or regional shortages can affect profitability and customer trust. It requires continuous innovation and investment to differentiate products in a crowded market. Price pressure from major buyers adds another layer of challenge for sustaining long-term margins.

Market Opportunities:

Rising Potential in Green Technologies and Automotive Applications

Specialty Silica holds strong opportunities in the global shift toward green technologies and sustainable mobility. The growing demand for fuel-efficient and eco-friendly tires creates a robust platform for silica adoption. Governments support policies that emphasize reduced emissions and energy efficiency, boosting its relevance in the automotive industry. Emerging markets with rapid vehicle production present further expansion avenues. It is expected to remain a critical enabler of performance in advanced tire and mobility solutions.

Expanding Role in High-Growth Industries and Sustainable Consumer Products

Specialty Silica is set to benefit from rising demand in personal care, electronics, and construction. Its use in cosmetics and oral care aligns with consumer preference for safer, eco-friendly products. Growth in electronics manufacturing drives opportunities for thermal insulation and enhanced material performance. Sustainable construction trends also increase reliance on silica-based additives. It is well-positioned to capture growth through innovation and alignment with environmental responsibility in consumer and industrial sectors.

Market Segmentation Analysis:

By Type

Specialty Silica is segmented into precipitated silica, fumed silica, colloidal silica, and silica gel. Precipitated silica dominates due to its extensive use in green tires and rubber applications. Fumed silica finds strong demand in adhesives, coatings, and sealants for its reinforcing and rheology control properties. Colloidal silica supports electronics, precision casting, and polishing industries with high purity and stability. Silica gel continues to be relevant in desiccants and packaging solutions.

- For instance, to meet high demand from the tire industry, Evonik Industries increased its annual production capacity for precipitated silica at its site in Adapazari, Turkey, by an additional 40,000 metric tons.

By Application

Specialty Silica supports diverse applications including rubber, coatings, plastics, and personal care. The rubber segment leads due to rising demand for low-emission and fuel-efficient tires. Coatings and adhesives benefit from silica’s role in improving dispersion, scratch resistance, and durability. Plastics adopt it to enhance strength, reduce weight, and improve surface finish. Personal care remains a fast-growing application, where it provides absorption, matting, and stability.

- For instance, Cabot Corporation is enhancing its supply for the coatings and adhesives markets by constructing a new fumed silica facility designed with a manufacturing capacity of 8,000 metric tons per year.

By End-Use Industry

Specialty Silica is adopted across automotive, construction, electronics, and consumer goods industries. Automotive leads through tire manufacturing, supported by global emission standards and demand for performance tires. Construction and infrastructure benefit from silica’s role in coatings and sealants. Electronics rely on high-purity grades for insulation and polishing. Consumer goods, particularly cosmetics and oral care, continue to expand usage, making it a versatile material across multiple industries.

Segmentations:

- By Type

- Precipitated Silica

- Fumed Silica

- Colloidal Silica

- Silica Gel

- By Application

- Rubber

- Coatings

- Plastics

- Personal Care

- Adhesives & Sealants

- By End-Use Industry

- Automotive

- Construction

- Electronics

- Consumer Goods

- Packaging

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leading Through Industrial Expansion and Automotive Growth

Asia-Pacific holds 45% share of the Specialty Silica market, making it the dominant region. Rapid industrialization, strong automotive production, and expanding construction activities continue to drive demand. Countries like China, India, and Japan lead consumption due to large-scale tire manufacturing and rising infrastructure investment. Consumer goods and personal care industries also support steady market uptake. Regional manufacturers invest heavily in capacity expansion to meet both domestic and export demand. It remains the fastest-growing region, supported by favorable government policies and cost-effective production capabilities.

North America Demonstrating Steady Adoption Across Key Industries

North America accounts for 23% share of the Specialty Silica market, supported by its advanced industries. Adoption is strong in automotive, electronics, and personal care, with companies focusing on eco-friendly applications. The region emphasizes sustainability, aligning silica use with regulations and consumer expectations. High investment in R&D encourages innovation in high-performance and specialized grades. Growth in electric vehicles further strengthens demand for green tires. It continues to benefit from technological advancements and a well-established industrial base.

Europe Advancing Through Sustainability and Technological Innovation

Europe represents 21% share of the Specialty Silica market, backed by sustainability-driven growth. The automotive sector, particularly in Germany, drives high demand for silica-based green tires. Strong growth in cosmetics and personal care markets across France and the UK supports diversified applications. Regional companies emphasize innovation in sustainable production processes to strengthen competitiveness. It remains an influential region, combining advanced infrastructure with regulatory support to enhance long-term demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M

- Cabot

- Fuji Silysia Chemical

- Imerys

- Tata Chemicals

- Wacker Chemie

- Denka Company

- Evonik Industries

- Madhu Silica

- Oriental Silicas

- Qemetica

- Nouryon

Competitive Analysis:

The Specialty Silica market is highly competitive, with global and regional players focusing on innovation, sustainability, and product quality to strengthen their position. Leading companies invest in advanced technologies to enhance performance while reducing environmental impact, while strategic mergers, acquisitions, and capacity expansions expand their market presence. Specialty Silica producers target diverse sectors such as automotive, personal care, and construction to secure growth opportunities, and it remains vital for them to balance cost efficiency with compliance to strict regulations. Competitors differentiate by offering tailored solutions for green tires, eco-friendly coatings, and advanced electronics, creating a market landscape where established corporations and emerging players compete for share. Long-term success depends on R&D investment, reliable supply chains, and alignment with sustainability-driven demand.

Recent Developments:

- In July 2025, Cabot launched its new LITX® 95F conductive carbon, a material specifically engineered for use in energy storage systems.

- In May 2025, Denka announced the indefinite suspension of operations at its Denka Performance Elastomer (DPE) facility in LaPlace, Louisiana, citing environmental regulations and increasing costs.

- In January 2025, Evonik launched Smart Effects, a new business entity created through the strategic merger of its Silica and Silanes business lines, which together employ 3,500 people globally.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Specialty Silica will gain wider acceptance in green tire manufacturing driven by global emission reduction policies.

- Demand from the personal care sector will strengthen due to its role in high-performance cosmetics and oral care products.

- It will see increased adoption in electronics where thermal stability and insulation properties are critical.

- Construction and infrastructure industries will continue integrating silica in coatings, adhesives, and sealants for improved durability.

- Producers will invest in sustainable production methods to align with tightening environmental regulations.

- It will benefit from rising demand for lightweight materials across automotive, aerospace, and packaging industries.

- Global players will expand capacity in Asia-Pacific to leverage cost advantages and serve high-growth markets.

- Continuous R&D will create advanced grades with enhanced purity and functional properties for specialized applications.

- Market competition will intensify, encouraging companies to differentiate through innovation and customer-focused product solutions.

- Emerging economies in Latin America and the Middle East & Africa will create new opportunities through industrial diversification and infrastructure projects.