Market Overview

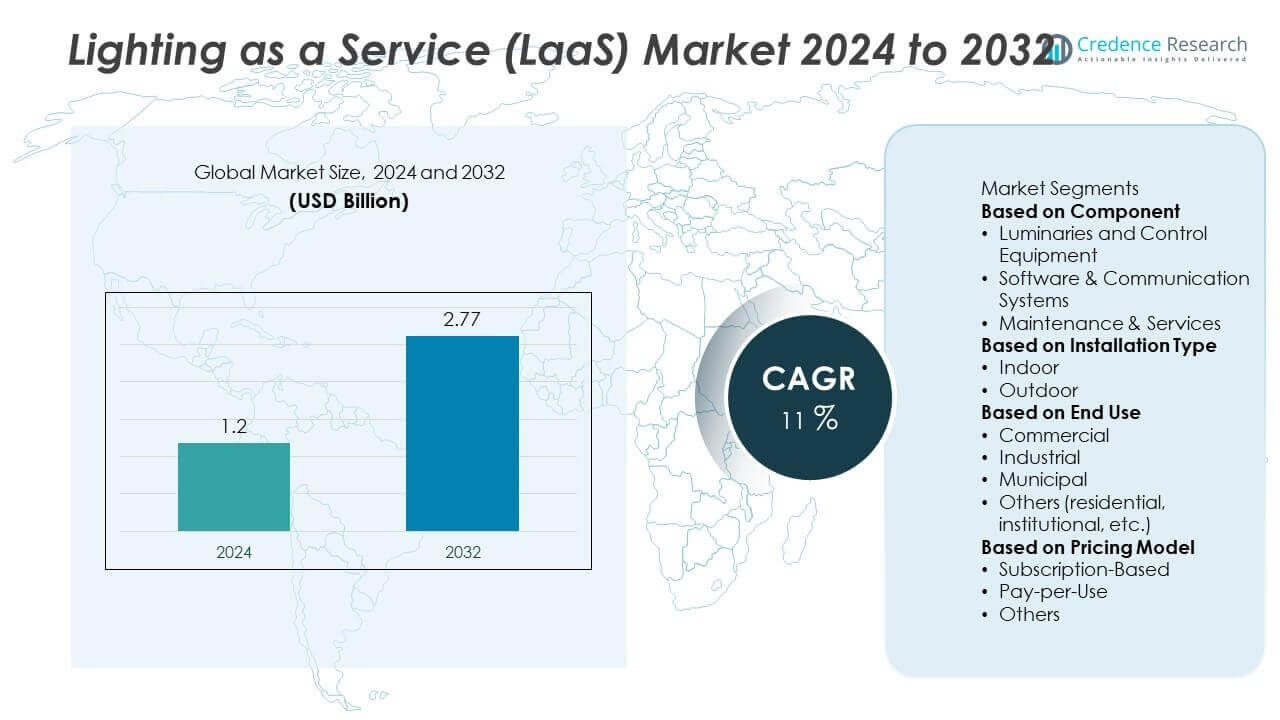

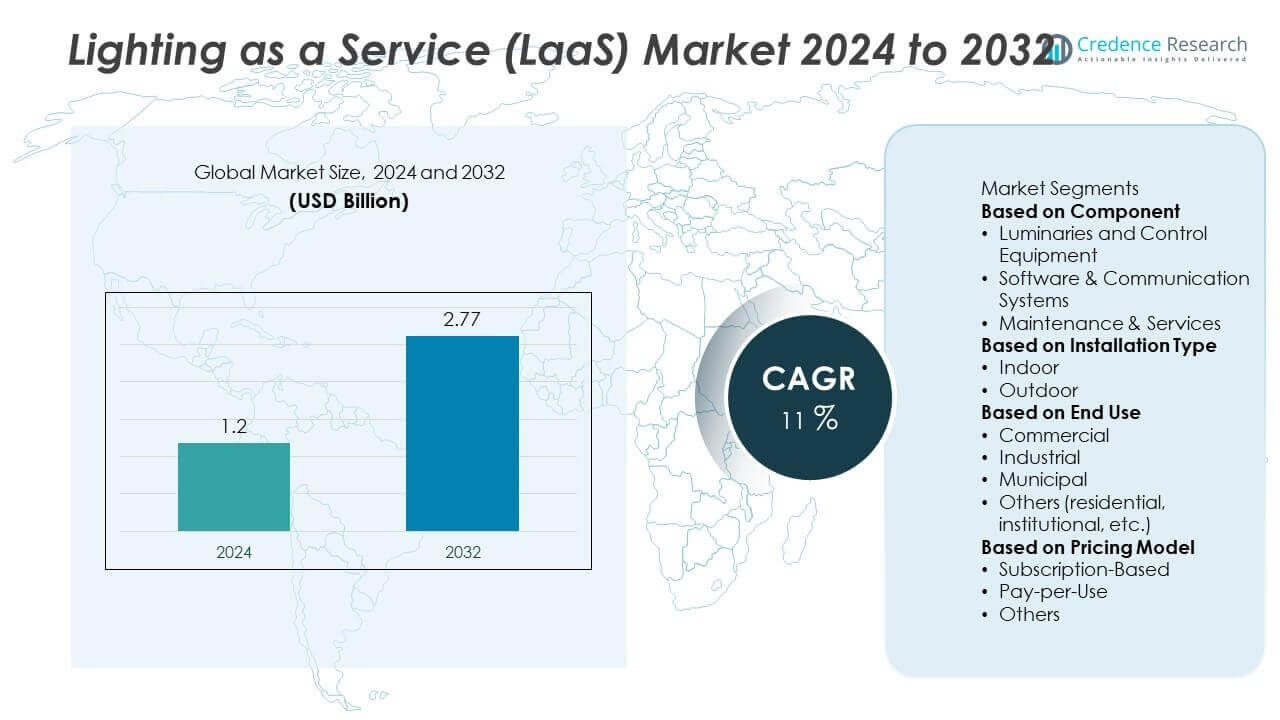

Lighting as a Service (LaaS) Market size was valued at USD 1.2 billion in 2024 and is anticipated to reach USD 2.77 billion by 2032, growing at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lighting as a Service (LaaS) Market Size 2024 |

USD 1.2 Billion |

| Lighting as a Service (LaaS) Market, CAGR |

11% |

| Lighting as a Service (LaaS) Market Size 2032 |

USD 2.77 Billion |

The Lighting as a Service (LaaS) market is shaped by leading players such as Cree Inc., Igor, Inc., Lunera, Eaton Corporation, UltraVolt, Lutron Electronics Co, RCG Lighthouse, Digital Lumens, SIB Lighting, and General Electric Company. These companies compete by focusing on energy-efficient luminaires, smart IoT-enabled systems, and flexible subscription models to meet the growing demand across commercial, industrial, and municipal sectors. Regionally, Asia-Pacific led the market with 31% share in 2024, driven by rapid urbanization and smart city projects. North America followed with 33% share, supported by widespread adoption in commercial spaces and strong energy efficiency mandates, while Europe accounted for 29% share, fueled by sustainability-focused regulations and large-scale municipal lighting upgrades.

Market Insights

Market Insights

- The Lighting as a Service (LaaS) market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.77 billion by 2032, growing at a CAGR of 11% during the forecast period.

- Rising demand for energy efficiency and cost savings drives adoption, with luminaries and control equipment holding over 50% share in 2024, supported by large-scale retrofitting projects in commercial and municipal sectors.

- A key trend is the integration of IoT and smart technologies, enabling adaptive lighting, predictive maintenance, and data-driven facility management across offices, retail, and industrial facilities.

- The market is competitive with players such as General Electric Company, Eaton Corporation, Cree Inc., Igor, Inc., and Digital Lumens focusing on smart lighting solutions, subscription-based models, and service-oriented contracts.

- North America led with 33% share, followed by Europe at 29% and Asia-Pacific at 31%, while indoor installations accounted for more than 60% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Luminaries and control equipment dominated the Lighting as a Service (LaaS) market in 2024, holding over 50% share. Their leadership is supported by widespread adoption of LED lighting and advanced control systems that deliver significant energy savings and operational efficiency. Businesses prioritize upgrading luminaires due to their direct impact on cost reduction and sustainability targets. Software and communication systems are growing rapidly with the rise of smart lighting solutions, while maintenance and services remain essential to long-term contracts. The dominance of luminaries is reinforced by regulatory pressure to replace conventional lighting with energy-efficient alternatives.

- For instance, Eaton Corporation’s WaveLinx connected lighting system integrates wireless controls across up to 150 devices per area, provides advanced reporting and analytics through its integrated software suite, and can achieve significant energy savings, often exceeding 50%, in commercial retrofits.

By Installation Type

Indoor installations accounted for more than 60% share of the LaaS market in 2024, making them the leading segment. Demand is driven by commercial offices, retail stores, and industrial facilities that seek energy savings, smart automation, and reduced upfront investment through service-based models. Indoor environments also offer strong potential for integrated IoT systems, supporting real-time monitoring and adaptive lighting. Outdoor installations, including streetlights and public infrastructure, are expanding steadily, supported by smart city initiatives and government projects. However, indoor adoption remains dominant due to higher retrofitting activity in commercial and industrial sectors.

- For instance, Digital Lumens deployed its intelligent LED fixtures in a U.S. manufacturing facility, delivering lumen packages up to 26,000 lm per fixture and cutting annual electricity use by 1.2 million kWh, supported by occupancy and daylight sensors connected through its LightRules management platform.

By End Use

The commercial sector led the LaaS market in 2024, capturing over 45% share. Its dominance is fueled by demand from office complexes, retail chains, and hospitality establishments aiming to reduce energy expenses and comply with sustainability goals. Flexible financing models and guaranteed savings attract businesses toward service-based lighting contracts. Industrial facilities follow as a strong end-use, focusing on large-scale retrofits to improve efficiency and reduce downtime. Municipal adoption is expanding with smart street lighting projects, while residential and institutional users contribute smaller shares. The commercial sector’s scale and consistent energy-saving priorities reinforce its leadership in the market.

Key Growth Drivers

Rising Demand for Energy Efficiency

The Lighting as a Service (LaaS) market is expanding as businesses and governments prioritize energy savings. LED luminaires combined with advanced controls reduce electricity consumption by up to 70%, making them attractive under cost-sensitive and sustainability-driven strategies. With stricter energy efficiency standards and carbon reduction targets globally, organizations are shifting from capital-intensive purchases to subscription-based models. The ability of LaaS to provide modern, efficient lighting without high upfront costs strongly drives adoption, particularly in commercial and industrial facilities aiming to lower operating expenses.

- For instance, GE’s “Current” entity offered integrated energy solutions, including LED lighting and IoT analytics powered by the Predix platform, to customers like Walgreens, JPMorgan Chase, Home Depot, and Hilton.

Shift Toward Service-Based Business Models

The growing preference for subscription and pay-per-use services is accelerating LaaS adoption. Organizations benefit from predictable costs, scalability, and integrated maintenance, avoiding heavy capital investment in lighting infrastructure. This service-driven model also ensures continuous technology upgrades, aligning with evolving efficiency and smart building requirements. Vendors are leveraging flexible contracts to attract small and medium enterprises alongside large corporations. This shift in ownership mindset, from products to services, supports steady demand across developed economies while creating new opportunities in emerging markets with budget constraints.

- For instance, Lutron Electronics incorporated its Vive wireless lighting control system, featuring higher-level hubs capable of supporting up to 700 devices and a distributed architecture for simple, scalable control.

Government Initiatives and Smart City Projects

Government-backed energy conservation programs and smart city initiatives are key drivers of the LaaS market. Municipal authorities are increasingly replacing conventional streetlights with smart, connected LED systems delivered under LaaS contracts. This reduces energy bills, enhances public safety, and aligns with climate action goals. Subsidies, tax incentives, and green financing further encourage adoption by lowering financial barriers for cities and businesses. With urbanization accelerating globally, LaaS is becoming a strategic solution for municipalities to modernize infrastructure, improve efficiency, and integrate intelligent lighting into broader smart city ecosystems.

Key Trends & Opportunities

Integration of IoT and Smart Technologies

A major trend in the LaaS market is the integration of IoT, sensors, and cloud-based platforms. These systems enable advanced features such as occupancy-based lighting, daylight harvesting, and predictive maintenance, offering higher efficiency and user comfort. The rise of connected buildings and smart campuses enhances demand for such intelligent lighting solutions. Vendors are bundling analytics and automation into their service offerings, creating opportunities to generate additional value for customers. As businesses prioritize data-driven facility management, IoT-enabled LaaS is gaining traction across commercial, industrial, and municipal applications.

- For instance, Igor, Inc. has deployed its Nexos IoT platform in various buildings, including healthcare-related facilities, utilizing Power-over-Ethernet (PoE) technology for LED fixtures and integrated sensors. This allows for the tracking of metrics such as occupancy and energy usage.

Expansion in Emerging Markets

Emerging economies present significant opportunities for LaaS providers due to rapid urbanization and rising electricity costs. Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in infrastructure development, creating demand for scalable, cost-effective lighting solutions. Flexible financing models make LaaS attractive for municipalities and SMEs that lack upfront capital for large lighting projects. Vendors introducing low-cost, adaptable service models tailored to local needs are positioned to capture growth. As awareness of long-term energy savings spreads, emerging markets are expected to accelerate adoption of LaaS contracts.

- For instance, RCG Lighthouse has implemented numerous “Lighting as a Service” (LaaS) projects for municipalities and other clients in Europe, including Eastern Europe. These projects typically involve installing modern, wirelessly-controlled LED luminaires that enable remote monitoring and management. The company reports achieving significant electricity savings and other benefits for its clients.

Key Challenges

High Dependence on Vendor Reliability

A key challenge in the LaaS market is the heavy reliance on service providers for equipment, software, and maintenance. Businesses and municipalities depend on vendors to ensure consistent performance, timely upgrades, and minimal downtime. Any lapse in service quality can result in operational disruptions and financial losses. Vendor lock-in also creates challenges, as switching providers often incurs additional costs and technical complications. Building trust and offering transparent, reliable service agreements are critical to addressing customer concerns and sustaining long-term LaaS contracts.

Limited Awareness and Adoption Barriers in Developing Regions

While LaaS is growing rapidly in developed economies, awareness and adoption remain limited in cost-sensitive markets. Many businesses and municipalities in developing regions are unfamiliar with service-based lighting models, preferring traditional purchase systems. High dependency on subsidies, lack of clear financing frameworks, and resistance to long-term contracts hinder adoption. Additionally, concerns about contractual commitments and hidden costs discourage smaller enterprises. Expanding awareness campaigns, financial incentives, and pilot projects will be essential to overcoming these barriers and driving wider market penetration in emerging economies.

Regional Analysis

North America

North America held over 33% share of the Lighting as a Service (LaaS) market in 2024, driven by strong adoption across commercial, industrial, and municipal sectors. The United States leads the region with rapid uptake of subscription-based lighting solutions in offices, retail chains, and public infrastructure projects. Government policies supporting energy efficiency and carbon reduction targets further accelerate adoption. The presence of leading service providers and the growing focus on smart buildings enhance regional growth. With steady investments in infrastructure modernization, North America continues to be one of the most lucrative markets for LaaS providers.

Europe

Europe accounted for more than 29% share of the LaaS market in 2024, supported by stringent energy efficiency regulations and ambitious climate action goals. Countries such as Germany, the UK, and France are leading adopters, driven by strong demand in commercial and municipal applications. Smart city initiatives, including large-scale replacement of streetlights with connected LED systems, fuel further growth. The region also benefits from widespread awareness of sustainability and government-backed financing programs. With increasing adoption of IoT-enabled lighting and circular economy practices, Europe is set to maintain steady expansion in the LaaS market.

Asia-Pacific

Asia-Pacific dominated the LaaS market with over 31% share in 2024, supported by rapid urbanization, industrial expansion, and rising electricity costs in countries such as China, India, and Japan. Commercial and municipal sectors are the leading adopters, with growing investments in smart city projects and infrastructure upgrades. The region’s cost-sensitive markets benefit from flexible pay-per-use models, making LaaS attractive for small and medium enterprises. Expanding awareness of long-term energy savings and government incentives for LED adoption further support growth. Asia-Pacific’s strong industrial base and rising digital infrastructure ensure its continued leadership in global LaaS adoption.

Latin America

Latin America captured more than 4% share of the LaaS market in 2024, supported by growing adoption in Brazil and Mexico. Municipal initiatives to replace conventional street lighting with energy-efficient systems are key growth drivers. The commercial sector, including retail and hospitality, is increasingly adopting service-based lighting to cut operational costs. However, limited awareness and financing challenges slow wider adoption. Vendors introducing cost-effective service models tailored to local markets are gaining traction. Despite barriers, urban development projects and energy efficiency policies are expected to drive moderate but steady growth in Latin America’s LaaS market.

Middle East & Africa

The Middle East & Africa region held around 3% share of the LaaS market in 2024. Growth is driven by infrastructure development, particularly in Gulf countries such as the UAE and Saudi Arabia, where smart city projects and energy diversification strategies encourage LaaS adoption. Municipalities are replacing traditional streetlights with smart LED systems under long-term service contracts. In Africa, uptake remains limited due to cost constraints and lack of awareness, but demand is growing in urban centers. With rising emphasis on sustainable infrastructure and energy efficiency, the region presents long-term opportunities for LaaS expansion.

Market Segmentations:

By Component

- Luminaries and Control Equipment

- Software & Communication Systems

- Maintenance & Services

By Installation Type

By End Use

- Commercial

- Industrial

- Municipal

- Others (residential, institutional, etc.)

By Pricing Model

- Subscription-Based

- Pay-per-Use

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the Lighting as a Service (LaaS) market includes major players such as Cree Inc., Igor, Inc., Lunera, Eaton Corporation, UltraVolt, Lutron Electronics Co, RCG Lighthouse, Digital Lumens, SIB Lighting, and General Electric Company. These companies compete by offering advanced LED solutions, integrated control systems, and flexible service models tailored to commercial, industrial, and municipal users. Leading firms like General Electric and Eaton leverage global reach and established infrastructure to dominate large-scale contracts, while players such as Igor, Inc. and Digital Lumens focus on smart, IoT-enabled solutions for connected lighting systems. Innovation in subscription-based offerings and predictive maintenance platforms remains a core strategy, helping companies address demand for efficiency and sustainability. Regional players such as SIB Lighting and RCG Lighthouse strengthen competition with cost-effective models, while firms like Cree Inc. and Lunera emphasize energy savings and customized solutions. Overall, partnerships, technology upgrades, and service flexibility drive competition in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Cree (via its LED lighting arm) began expanding partnerships with energy service companies to offer subscription lighting solutions to commercial real estate clients.

- In May 2025, Digital Lumens released its next-generation LightRules analytics software with enhanced occupancy detection and asset tracking for LaaS deployments.

- In April 2025, Cree Lighting expanded its agency network in the U.S. through Priority Solutions Group to increase regional coverage for offering LED solutions, potentially supporting service-based models.

- In October 2024, Eaton announced that its electrical division would incorporate smart lighting and control systems into its energy services portfolio, enabling bundling of power distribution and LaaS offerings.

Report Coverage

The research report offers an in-depth analysis based on Component, Installation Type, End Use, Pricing Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing adoption of energy-efficient lighting solutions.

- Luminaries and control equipment will continue to dominate due to strong demand for retrofitting.

- Indoor installations will maintain leadership as commercial and industrial sectors drive adoption.

- Commercial applications will remain the largest end-use, supported by cost-saving priorities.

- IoT-enabled and smart lighting systems will gain wider integration in service contracts.

- Subscription-based and pay-per-use models will expand, attracting SMEs and municipalities.

- North America will sustain growth with strong energy efficiency regulations and infrastructure upgrades.

- Europe will accelerate adoption through sustainability mandates and smart city initiatives.

- Asia-Pacific will lead expansion with rapid urbanization and large-scale municipal projects.

- Competition will intensify as players focus on innovation, partnerships, and customized service offerings.

Market Insights

Market Insights