Market Overviews

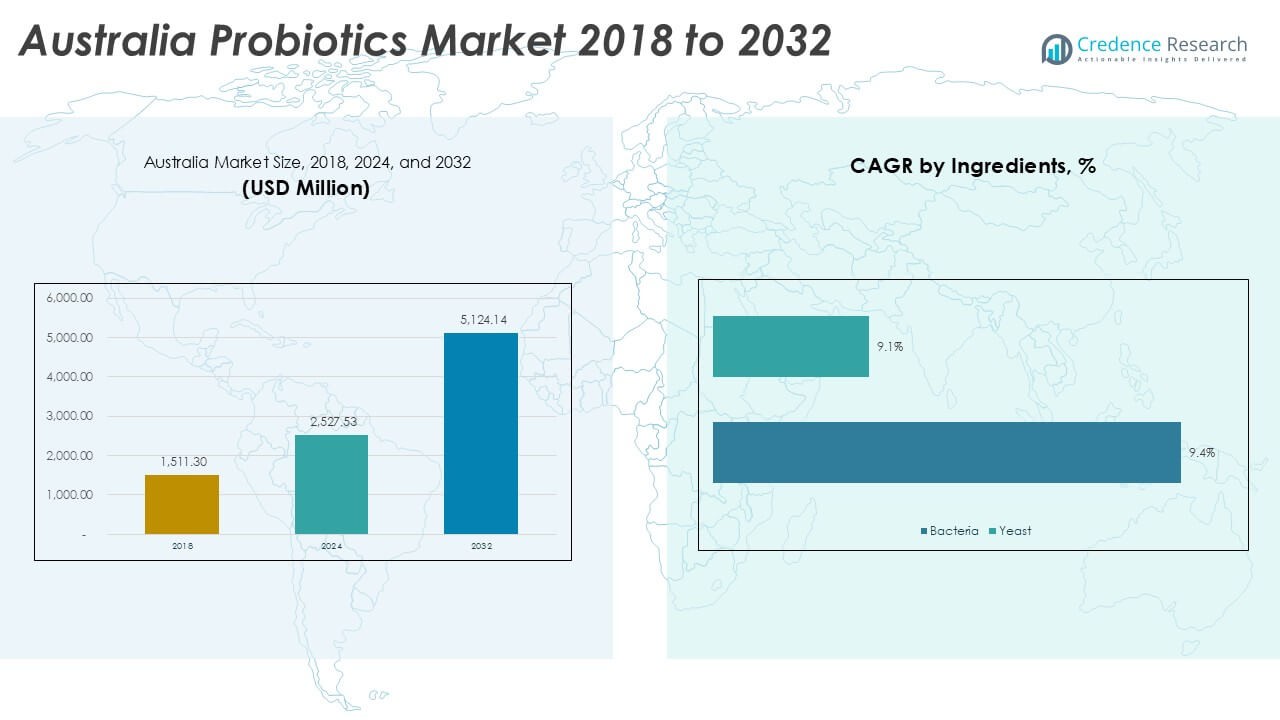

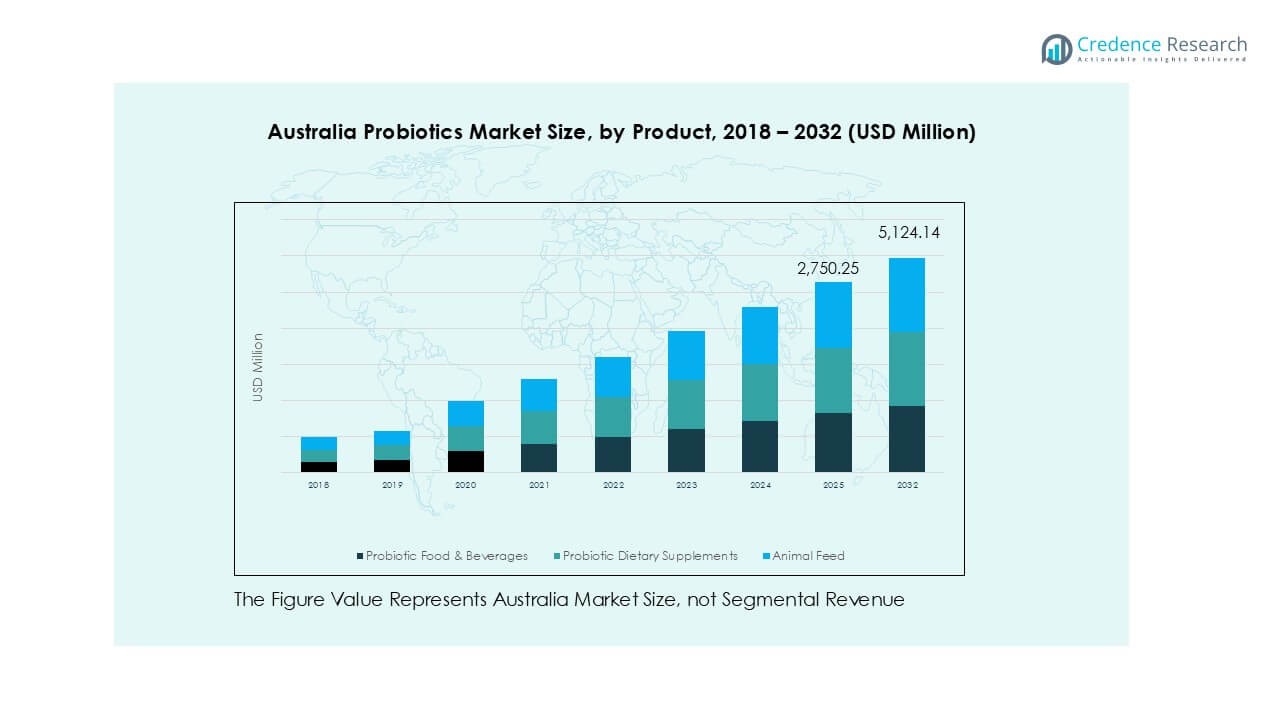

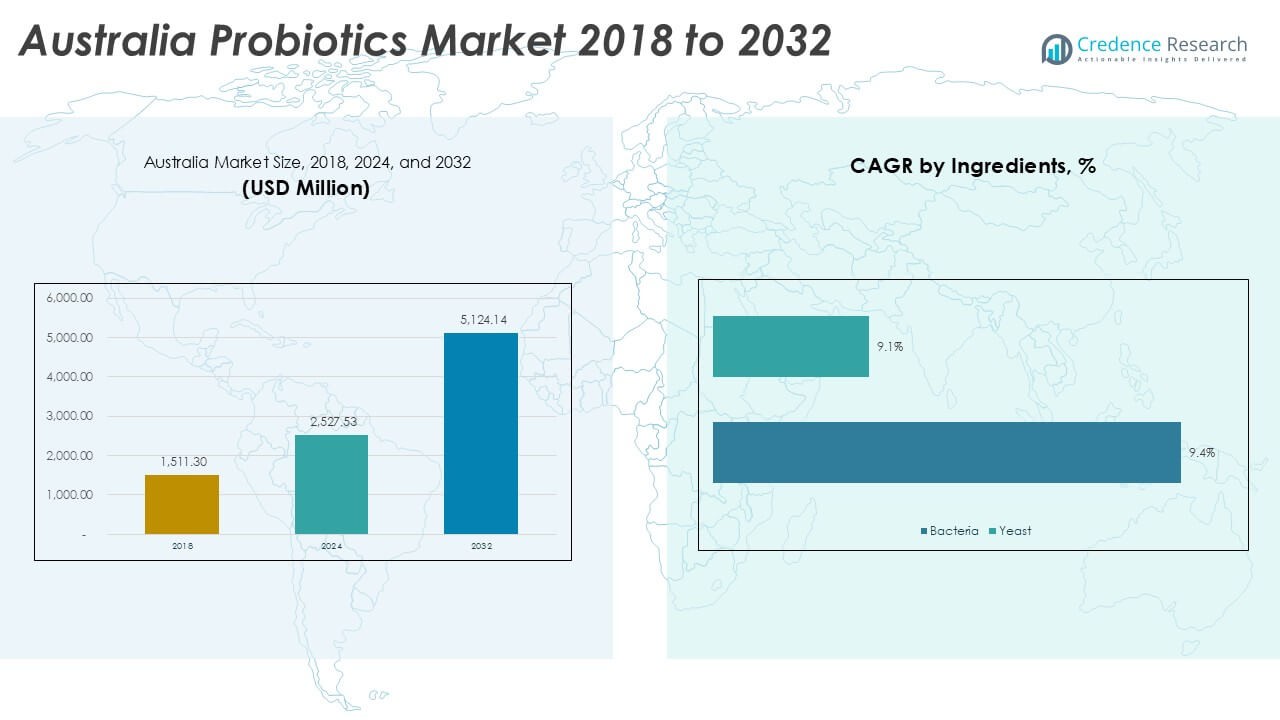

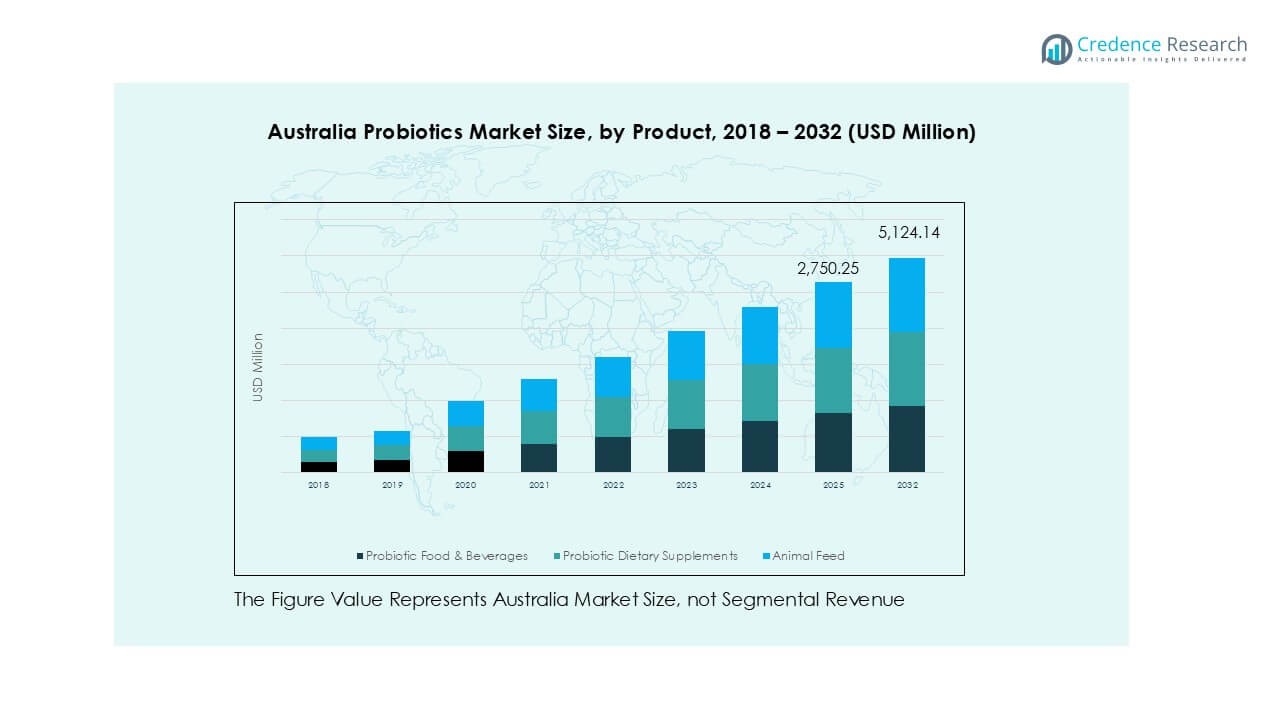

Australia Probiotics market size was valued at USD 1,511.30 million in 2018 and grew to USD 2,527.53 million in 2024. It is anticipated to reach USD 5,124.14 million by 2032, at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Probiotics Market Size 2024 |

USD 2745.8 Million |

| Australia Probiotics Market, CAGR |

9.3% |

| Australia Probiotics Market Size 2032 |

USD 5,124.14 Million |

The Australia probiotics market is driven by leading players such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., General Mills, Kerry Group, Lallemand Inc., Probi, Symprove Ltd., Bioproton, and Grainfields Australia. These companies compete through strong product portfolios spanning probiotic foods, beverages, dietary supplements, and animal feed solutions. Global giants like Nestlé, Danone, and Yakult dominate the dairy-based probiotics segment, while local firms such as Grainfields Australia and Bioproton strengthen regional supply and innovation. Regionally, New South Wales leads with 34% share in 2024, supported by high consumer awareness and retail presence. Victoria follows with 28% share, driven by wellness-focused lifestyles and expanding supplement adoption, while Queensland accounts for 18%, supported by strong demand for probiotic beverages and animal feed applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia probiotics market was valued at USD 2,527.53 million in 2024 and is projected to reach USD 5,124.14 million by 2032, growing at a CAGR of 9.3%.

- Market growth is driven by rising consumer focus on gut health, strong demand for functional foods and beverages, and expanding applications in dietary supplements and animal feed.

- Trends include innovations in delivery formats such as gummies, powders, and shelf-stable formulations, along with opportunities in personalized nutrition and premium probiotic products.

- The competitive landscape features global leaders like Nestlé, Danone, Yakult, and General Mills, alongside local firms such as Grainfields Australia and Bioproton, all competing through innovation, partnerships, and expanded product portfolios.

- Regionally, New South Wales leads with 34% share, followed by Victoria at 28%, Queensland at 18%, Western Australia at 12%, and the Rest of Australia at 8%. By product, probiotic food and beverages dominate with over 70% share in 2024.

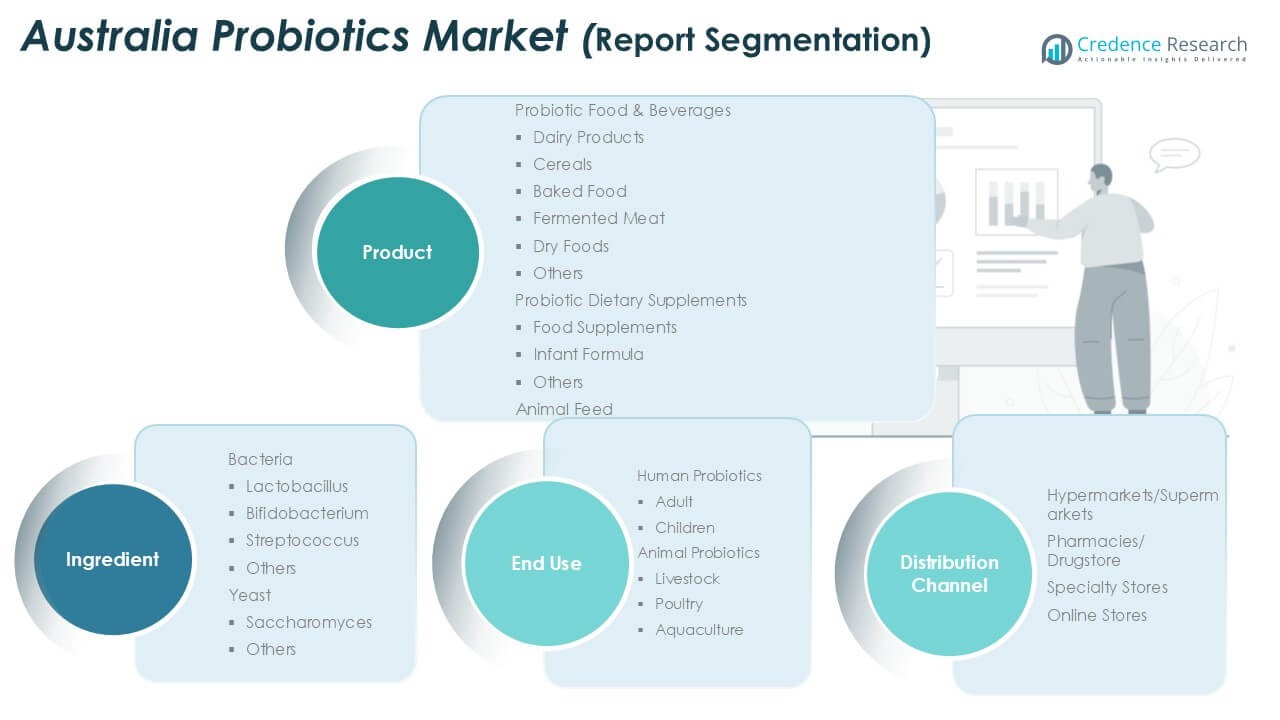

Market Segmentation Analysis:

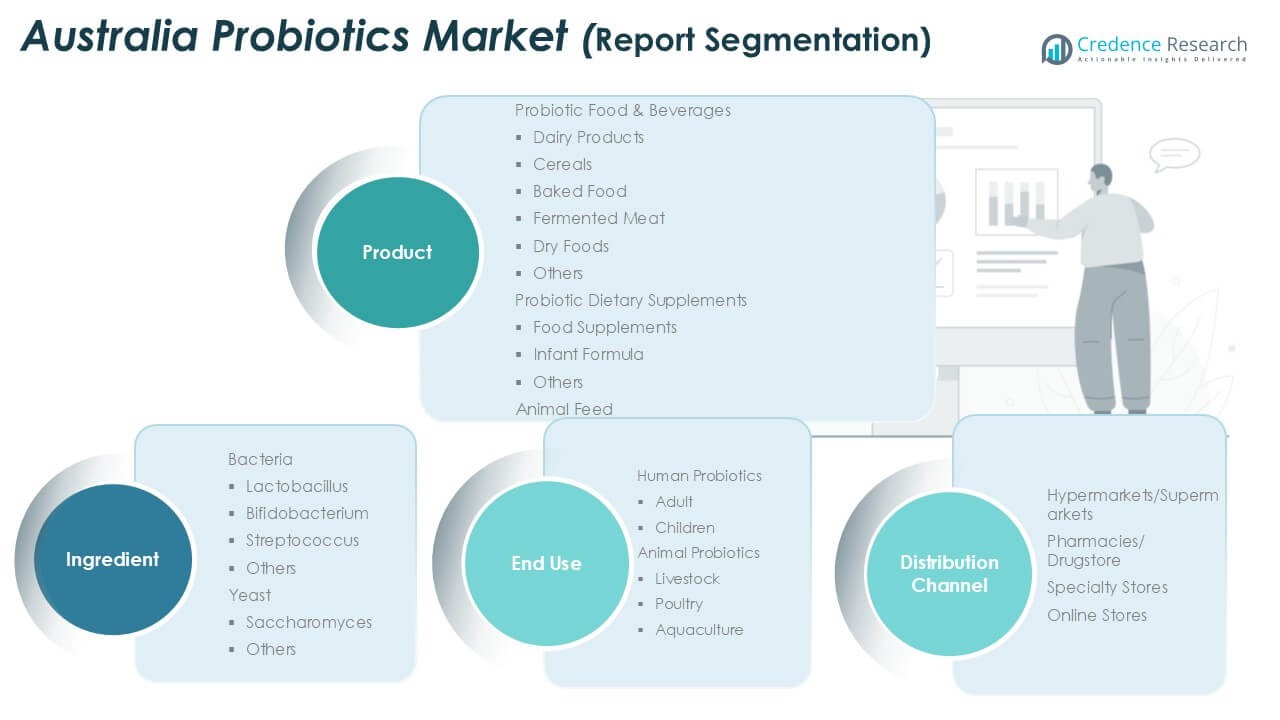

By Product

Probiotic food and beverages dominate the Australia probiotics market, contributing over 70% of total share in 2024. Within this, dairy products such as yogurts and fermented milk remain the leading sub-segment due to strong consumer trust and high daily consumption. Rising demand for functional foods, coupled with health awareness campaigns around gut health, drives growth in cereals, baked foods, and dry foods. Dietary supplements hold a smaller yet steadily rising share, supported by demand for infant formulas and lifestyle-focused nutrition. Animal feed probiotics expand gradually as livestock producers seek productivity and disease resistance.

- For instance, Sanitarium’s Up&Go breakfast drink is fortified with essential vitamins and minerals to appeal to on-the-go consumers.

By Ingredient

Bacteria-based probiotics hold the largest share, accounting for more than 80% of the ingredient segment in 2024. Lactobacillus leads due to its proven digestive benefits and wide use in dairy and supplement formulations. Bifidobacterium follows closely, particularly in infant formulas and adult digestive health products. Streptococcus and other strains add diversity, addressing oral health and immunity. Yeast-based probiotics, led by Saccharomyces boulardii, remain a niche but growing category, driven by clinical evidence supporting treatment of diarrhea and intestinal disorders, and expanding application in both supplements and functional foods.

- For instance, Life-Space’s Broad-Spectrum Probiotic contains 4 billion CFU of Lactobacillus rhamnosus GG (LGG) per capsule, a strain with strong clinical evidence supporting its benefits for digestive balance.

By End User

Human probiotics remain the dominant end-user segment, holding around 85% share in 2024, with adults contributing the largest portion. High adoption among adults is supported by preventive health trends, rising cases of digestive disorders, and wellness-driven consumption of probiotic-enriched products. Children’s probiotics, particularly in infant formula and supplements, are expanding with rising parental focus on early-life nutrition. Animal probiotics, although smaller, are gaining traction in livestock and poultry industries, where farmers seek to enhance gut health, feed efficiency, and reduce antibiotic reliance. Aquaculture applications are gradually emerging to support sustainable fish farming practices.

Key Growth Drivers

Rising Consumer Focus on Gut Health

Growing awareness of the link between gut health and overall well-being is a major driver of Australia’s probiotics market. Consumers increasingly view probiotics as preventive solutions against digestive disorders, obesity, and immunity-related issues. Dairy-based probiotic products such as yogurts and fermented milk remain popular, but dietary supplements and fortified foods are gaining steady demand. Lifestyle shifts, urban stress, and increased processed food consumption have further highlighted the importance of maintaining balanced gut microbiota. Health campaigns and professional recommendations by dietitians and doctors strengthen consumer trust. This health-driven awareness continues to push new product launches across functional foods, beverages, and supplement categories, expanding the market’s reach across diverse demographics.

- For instance, in Australia, Danone’s Activia yogurts deliver billions of the probiotic Bifidobacterium animalis subspecies lactis CNCM I-2494 per serving. When consumed as 250g daily for at least four weeks, as part of a healthy diet and lifestyle, this can help improve digestive comfort, though this does not guarantee overall ‘digestive balance’ for everyone.

Expansion of Functional Foods and Beverages

The rising popularity of functional foods and beverages is significantly boosting probiotic adoption. Australia’s consumers actively seek products that provide added health benefits beyond basic nutrition. Probiotic-enriched dairy products dominate, but innovations in cereals, baked goods, and fermented meat are diversifying choices. The growing middle-class population, with higher disposable incomes, is willing to pay premium prices for such value-added products. Supermarkets and online platforms now offer wider probiotic product ranges, making them more accessible nationwide. Government support for healthier eating and nutrition awareness also accelerates market penetration. Companies investing in product innovation and flavor diversification are tapping into this growing demand, reinforcing the role of functional foods and beverages as the strongest commercial driver.

- For instance, Nestlé’s Nan SupremePro infant formula sold in Australia contains Bifidobacterium lactis HN019 at 1×10⁷ CFU/g, aligning with national nutrition campaigns promoting early-life gut health.

Rising Pet and Livestock Probiotic Adoption

The growth of the animal health sector is another key driver. Farmers and pet owners increasingly recognize the role of probiotics in improving digestion, enhancing immunity, and reducing antibiotic dependence in animals. Livestock and poultry industries are under pressure to adopt sustainable solutions that improve feed efficiency and overall health outcomes. This shift positions probiotics as a preferred alternative to antibiotics for growth promotion. Aquaculture applications are also expanding as fish farming grows in Australia. For pets, demand for specialized supplements and fortified feeds is rising, supported by the premiumization trend in the pet care market. This dual adoption across commercial farming and household pets strengthens overall demand for probiotics, creating new revenue streams for manufacturers.

Key Trends & Opportunities

Innovation in Delivery Formats

One key trend is the diversification of probiotic delivery formats. Beyond dairy, companies now incorporate probiotics into cereals, snacks, dry foods, and beverages to appeal to convenience-driven consumers. Capsules, gummies, and powder supplements are also gaining favor for their portability and dosage precision. This innovation allows brands to target both children and adults with age-specific products. Opportunities lie in expanding shelf-stable formulations, which reduce cold chain costs and increase distribution in remote areas. Companies investing in new delivery technologies can capture rising demand while broadening their reach across supermarkets, pharmacies, and online platforms.

- For instance, Life-Space produces various freeze-dried probiotic products that are stable without refrigeration when stored correctly, typically below 30°C and in a dry place. For example, the company’s “Probiotic for 60+ Years” contains Bifidobacterium lactis HN019 at a concentration of 2 billion CFU per capsule, while its “Probiotic Powder for Children” includes the same strain and is dosed at 10 billion CFU per sachet. The specific strain and CFU count can vary depending on the product line.

Personalized Nutrition and Premium Products

The trend toward personalized nutrition is opening opportunities for premium probiotic offerings. Consumers seek tailored solutions for digestive health, immunity, skin care, and mental well-being. Probiotic strains targeting specific conditions are being integrated into functional products and supplements. Premium, science-backed formulations with clinical validation appeal to health-conscious segments willing to pay higher prices. Startups and established firms are leveraging microbiome research to introduce next-generation solutions. This trend also creates opportunities in digital health, where personalized recommendations align probiotic choices with individual health profiles, offering strong growth potential.

Key Challenges

Stringent Regulatory Environment

Australia’s probiotics market faces regulatory hurdles that slow product approvals and labeling claims. Probiotics fall under strict food and therapeutic goods regulations, making it difficult for companies to highlight specific health benefits. Manufacturers often face delays in introducing new strains or formulations due to lengthy approval timelines. Compliance costs also increase product pricing, limiting affordability for price-sensitive consumers. This regulatory burden can deter innovation and discourage smaller players from entering the market. Companies must balance scientific evidence with regulatory restrictions to maintain consumer trust while expanding product offerings.

High Production and Distribution Costs

The cost of producing and distributing probiotic products presents another challenge. Maintaining live cultures requires advanced manufacturing facilities and cold chain logistics, which add significant expenses. These costs make products less competitive against conventional alternatives and restrict accessibility in rural or remote areas. Small and medium enterprises face greater difficulties due to limited economies of scale. Additionally, shelf-life concerns increase wastage risks during distribution. Manufacturers must explore cost-effective production methods, stable formulations, and efficient supply chains to remain competitive. Without addressing these challenges, market expansion could slow despite strong consumer demand.

Regional Analysis

New South Wales

New South Wales leads the Australia probiotics market, holding around 34% share in 2024. The state benefits from high urbanization, strong consumer awareness, and wide retail availability of probiotic food and beverages. Sydney serves as a hub for health-conscious consumers and drives demand for functional foods and dietary supplements. The presence of leading supermarkets, pharmacies, and e-commerce channels ensures better product penetration compared to other regions. Demand from both adults and children has increased significantly due to preventive health trends, while innovation in dairy-based probiotics further consolidates the state’s leadership position.

Victoria

Victoria accounts for nearly 28% of the national market in 2024, making it the second-largest regional contributor. Melbourne’s population growth, rising disposable incomes, and a strong culture of wellness-focused living support high probiotic adoption. Dairy and dietary supplements dominate, but cereals, baked foods, and dry food formats are expanding rapidly in this region. The state’s diverse population, with strong interest in functional and fortified foods, provides opportunities for innovative probiotic formulations. Retail expansion and the role of local manufacturers also drive competitive advantage, positioning Victoria as a dynamic market within the country’s probiotics industry.

Queensland

Queensland represents about 18% share of the probiotics market in 2024. The region’s growing demand is supported by rising awareness of digestive health and immunity among both urban and semi-urban populations. Brisbane and coastal areas have seen a sharp increase in functional food adoption, particularly probiotic beverages and dietary supplements. Warmer climates also favor probiotic beverages such as yogurts and fermented drinks, which are consumed widely. Expanding pet care and livestock probiotic usage is another driver, as Queensland’s agricultural base supports probiotic adoption in animal feed. These combined factors continue to boost regional growth prospects.

Western Australia

Western Australia holds around 12% share of the market in 2024, with Perth being the primary consumer hub. The state’s smaller but affluent population shows rising preference for premium probiotic products, especially dietary supplements and fortified foods. Growing awareness of preventive health and the expansion of distribution through online platforms contribute to this growth. The livestock industry also creates demand for animal probiotics, particularly in poultry and cattle feed applications. Although smaller in absolute size compared to eastern states, Western Australia shows strong potential for higher per-capita consumption of probiotic products.

Rest of Australia

The Rest of Australia, including South Australia, Tasmania, and Northern Territory, collectively contributes about 8% of the total market in 2024. These regions show lower penetration due to smaller populations and limited retail reach. However, steady growth is evident as online platforms improve accessibility to probiotic supplements and functional foods. South Australia leads within this cluster, supported by consumer adoption of dairy and dietary supplements. Probiotic use in livestock and aquaculture is expanding across rural areas, creating niche growth opportunities. Despite lower shares, rising health awareness and improved logistics are gradually strengthening market prospects here.

Market Segmentations:

By Product

- Probiotic Food & Beverages

-

-

- Dairy Products

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Others

- Probiotic Dietary Supplements

-

-

- Food Supplements

- Infant Formula

- Others

By Ingredient

-

-

- Lactobacillus

- Bifidobacterium

- Streptococcus

- Others

By End User

-

-

- Livestock

- Poultry

- Aquaculture

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- Rest of Australia (South Australia, Tasmania, Northern Territory)

Competitive Landscape

The Australia probiotics market is moderately consolidated, with global leaders and local players competing across food, beverage, dietary supplement, and animal feed categories. Companies such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., and General Mills dominate with established dairy-based and supplement portfolios, leveraging strong brand recognition and nationwide distribution networks. Local firms like Grainfields Australia and Bioproton strengthen the market by offering region-specific probiotic formulations and animal feed applications tailored to Australian conditions. Innovation is a core strategy, with firms expanding into non-dairy segments such as cereals, baked foods, and dry foods to capture evolving consumer preferences. Strategic partnerships, investments in research on strain efficacy, and digital marketing campaigns are used to build consumer trust. The competitive focus is shifting toward premium, personalized, and clinically validated probiotic products. This dynamic environment drives product differentiation, but regulatory challenges and high production costs continue to shape the pace of innovation and market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nissin Food Products Co., Ltd.

- Grainfields Australia

- Nestlé S.A.

- Danone S.A.

- Yakult Honsha Co., Ltd.

- General Mills

- Kerry Group

- Lallemand Inc.

- Micro Food Co., Ltd.

- Probi

- Symprove Ltd.

- Bioproton

- Other Key Players

Recent Developments

- In October 2024, Probi launched clinically-supported probiotic solution for metabolic health.

- In August 2024, AB-Biotics launched probiotic solutions Gyntima Menopause (complex probiotic made of Lacotobacillus crispatus KABP™ Lactobacillus plantarum KABP™ 051 (CECT 7481), and Lactococcus lactis KABP™ 021 (CECT 7483). It helps to regulate estrogen level by reactivating it through β-glucuronidase (GUS) activity in women suffering from perimenopausal symptoms.

- In August 2024, ZBiotics announced the completion of venture series A (amounting to USD 12 million) in order to support the commercialization of genetically engineered probiotics.

- In February 2024, AB Biotics SA (Netherlands) expands its presence in Asia, partnering with Wonderlab for their globally marketed product, AB-LIFE. The collaboration introduces Shape100, a probiotic blend focusing on cardiometabolic health, to the Chinese market. This strategic move aims to address cholesterol-related concerns through evidence-based solutions.

- In November 2023, Nestlé (Switzerland) launched N3 milk, a breakthrough in nutritional innovation. Incorporating prebiotic fibers and reduced lactose, it enriches gut health and boasts over 15% fewer calories. Tailored for diverse dietary needs, N3 supports bone health, muscle growth, and immunity.

- In April 2022, Symrise, a r producer of cosmetic ingredients, launched SymFerment, a cutting-edge ingredient designed to enhance skin care with its moisturizing and smoothing properties. Developed in collaboration with Probi, a leading manufacturer of probiotics for the healthcare and food industries, SymFerment represents a significant advancement in sustainable cosmetic technology.

Report Coverage

The research report offers an in-depth analysis based on Product, Ingredient, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising consumer awareness of gut health.

- Functional foods and beverages will remain the leading growth driver across categories.

- Dietary supplements will gain higher adoption due to convenience and precise dosage formats.

- Animal feed probiotics will grow as livestock and poultry producers reduce antibiotic use.

- Personalized probiotic solutions will increase with advances in microbiome research.

- Premium and clinically validated products will attract health-conscious and urban consumers.

- Online platforms and pharmacies will strengthen distribution and improve product accessibility.

- Innovation in shelf-stable formulations will reduce logistics costs and expand rural reach.

- Children’s probiotics will see stronger demand with rising focus on early-life nutrition.

- Competition will intensify as global leaders and local firms expand diversified portfolios.