Market Overview

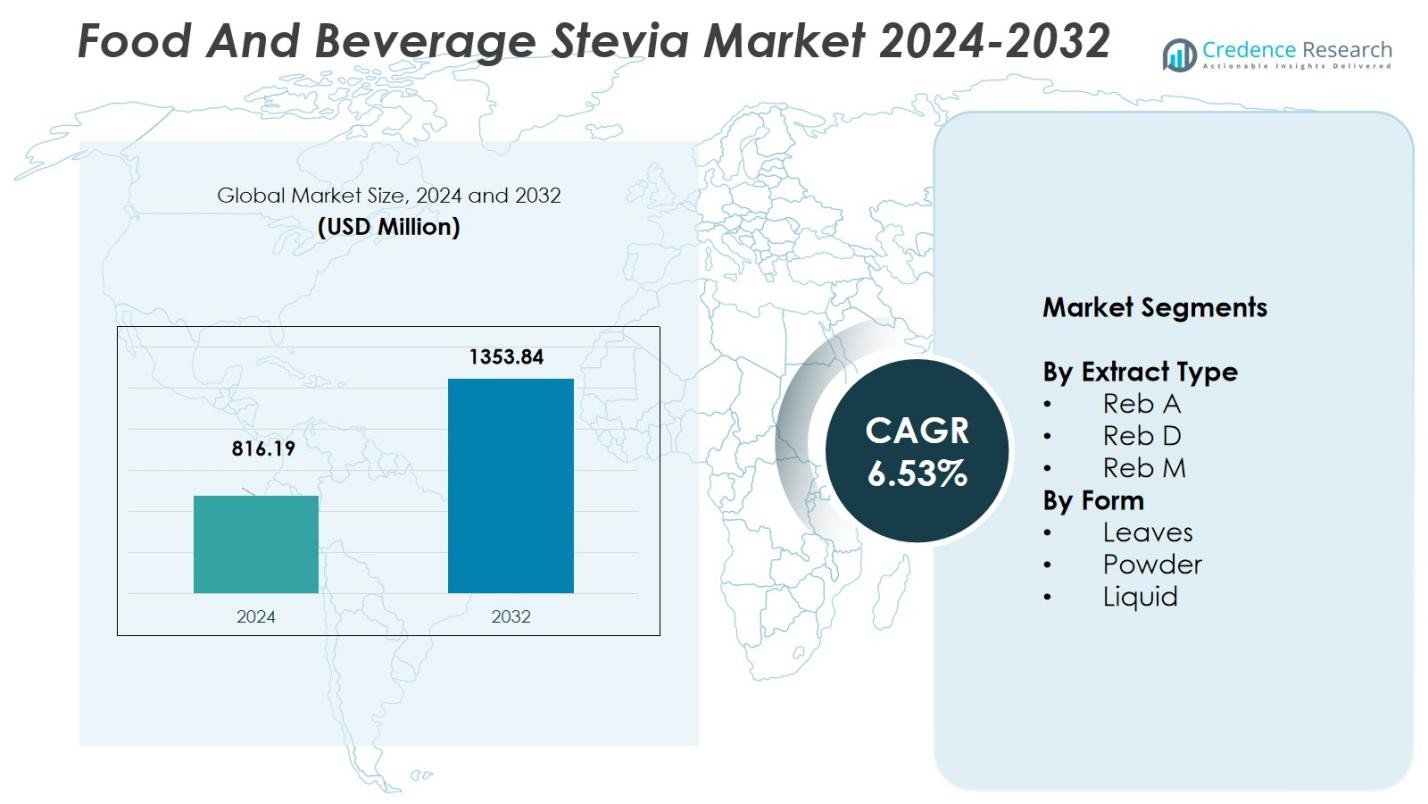

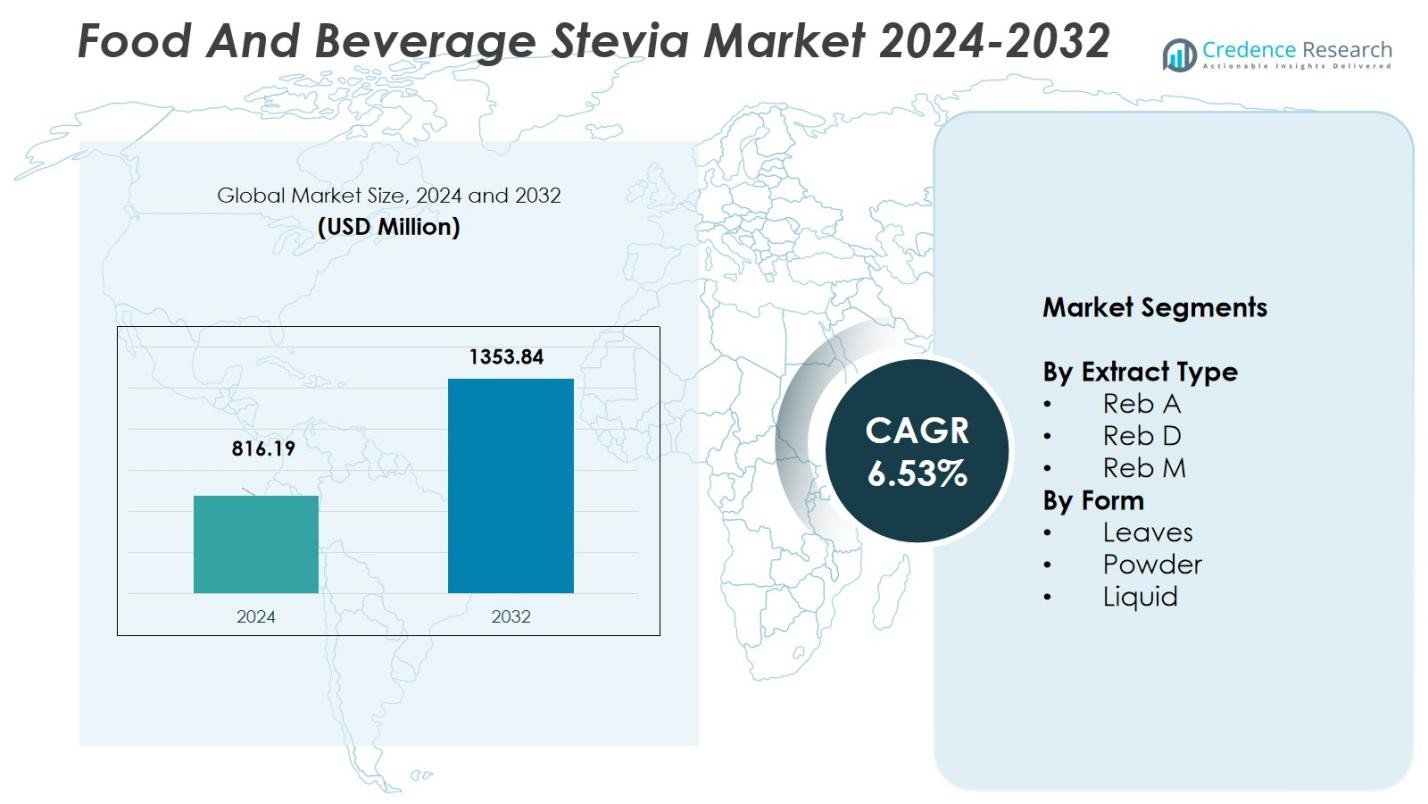

The Food and Beverage Stevia Market size was valued at USD 816.19 million in 2024 and is anticipated to reach USD 1353.84 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food and Beverage Stevia Market Size 2024 |

USD 816.19 Million |

| Food and Beverage Stevia Market, CAGR |

6.53% |

| Food and Beverage Stevia Market Size 2032 |

USD 1353.84 Million |

The Food and Beverage Stevia Market is shaped by the presence of key players such as Purecircle Limited, Layn, Qufu Xiangzhou Stevia, Zhucheng Haotian, Sunwin Stevia International, Cargill (Evolva), GLG Life Tech, Morita Kagakau Kogyo, Tate & Lyle, and HuZhou LiuYin Biological. These companies strengthen market growth through advancements in stevia glycosides, expanded production capabilities, and partnerships with global food and beverage manufacturers. North America leads the market with a 32% share, driven by strong demand for natural sweeteners, regulatory support for sugar reduction, and rapid adoption across beverage, dairy, and functional food categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food and Beverage Stevia Market reached USD 816.19 million in 2024 and is set to grow at a CAGR of 6.53%, ultimately achieving USD 1353.84 million by 2032.

- Growing adoption of natural sweeteners and rising demand for sugar-reduced products continue to drive market expansion, with Reb A holding a 60% share as the dominant extract type.

- Evolving market trends highlight increasing use of stevia in functional beverages, clean-label foods, and organic product lines, supported by improvements in advanced glycosides such as Reb D and Reb M.

- Key players, including Purecircle Limited, Cargill (Evolva), Layn, and Tate & Lyle, are strengthening their positions through technological advancements and expanded production capabilities across global markets.

- Regional analysis shows North America leading with a 32% share, followed by Asia Pacific at 29% and Europe at 27%, while powder form remains dominant with a 55% share across applications.

Market Segmentation Analysis:

By Extract Type:

The Food and Beverage Stevia Market is dominated by Reb A, which holds a 60% market share, driven by its strong sweetness intensity, cost-efficient extraction, and broad acceptance in beverages, bakery, and dairy formulations. Its clean taste profile makes it the preferred choice for large-scale manufacturers pursuing sugar-reduction strategies. Reb D and Reb M collectively account for the remaining 40%, expanding rapidly due to advances in bioconversion technologies that improve purity and flavor. Their growth is fueled by rising demand for premium, zero-calorie sweeteners with minimal aftertaste in functional and fortified food applications.

- For instance, Sweegen partners with food manufacturers by supplying them with its Reb D sweetener and taste modulation solutions, which the manufacturers then use to create their own zero-sugar products, including potentially protein bars, that appeal to health-conscious consumers.

By Form:

In terms of form, powder stevia leads the market with a 55% share, supported by its long shelf life, formulation flexibility, and ease of integration into dry mixes, confectionery, and tabletop sweeteners. Liquid stevia accounts for 35%, driven by its high solubility and suitability for ready-to-drink beverages and concentrated syrups. Stevia leaves, holding the remaining 10%, attract consumers seeking minimally processed and clean-label alternatives. Market expansion across all forms is driven by intensifying sugar-reduction initiatives and growing consumer demand for natural, plant-based sweeteners in mainstream food and beverage products.

- For instance, PureCircle’s Clean Taste Solubility Solution exemplifies innovation in liquid stevia, offering 100% solubility and improved taste for beverage formulations.

Key Growth Drivers

Rising Demand for Natural Sugar Substitutes

Growing consumer preference for clean-label and plant-based ingredients continues to propel demand for stevia in food and beverage applications. Manufacturers are increasingly reformulating products to reduce sugar content without compromising taste, positioning stevia as a leading natural sweetener. Its zero-calorie profile and regulatory approvals across major markets further accelerate adoption in beverages, snacks, and dairy products. As health-conscious consumers actively seek alternatives to artificial sweeteners, stevia’s strong safety perception and natural origin make it a central driver of market expansion.

- For instance, PureCircle by Ingredion uses proprietary stevia varietals sustainably grown and employs advanced technologies to produce Reb M, a high-quality steviol glycoside that enables zero added sugar formulations in diverse products.

Increasing Focus on Sugar Reduction Policies

Government regulations and public health initiatives aimed at addressing obesity and diabetes have intensified pressure on manufacturers to reduce added sugars. Stevia provides a viable solution, enabling product developers to meet stringent sugar-reduction targets while maintaining desirable sensory attributes. Mandatory nutritional labeling and sugar taxes across countries further encourage adoption. The regulatory environment continues to create opportunities for wider integration of stevia across mainstream categories, especially beverages, where compliance with health guidelines is critical for sustained market competitiveness.

- For instance, the European Food Safety Authority (EFSA) has approved high-purity steviol glycosides, enabling manufacturers like Cargill and Ingredion to develop stevia-based sweeteners that reduce bitterness while meeting health guidelines.

Advancements in Extraction and Bioconversion Technologies

Innovations in extraction and bioconversion processes have significantly improved the purity, taste profile, and commercial scalability of advanced steviol glycosides such as Reb D and Reb M. These technologies reduce bitterness and aftertaste, enabling stevia to closely mimic sugar in more complex formulations. Enhanced production efficiency lowers costs, increasing accessibility for global manufacturers. As next-generation glycosides become more widely available, food and beverage companies are expanding the use of stevia in premium products, driving sustained market growth and product diversification.

Key Trends & Opportunities

Expansion of Stevia Use in Functional and Health-Oriented Foods

The growing popularity of functional beverages, protein snacks, and fortified foods presents substantial opportunities for stevia-based formulations. Consumers increasingly seek products that deliver both health benefits and flavor without added sugars, positioning stevia as an ideal sweetener for nutrient-rich offerings. Its compatibility with vitamins, plant proteins, and probiotics supports product innovation across wellness-centric categories. As brands expand into natural, low-calorie functional products, stevia adoption is expected to accelerate, providing significant opportunities for market penetration.

- For instance, Coca-Cola launched a 100%-stevia-sweetened Coke in New Zealand that uses a patented steviol glycoside, Reb M, to deliver sweetness with a clean aftertaste, addressing consumer demand for lower-calorie, naturally sweetened beverages without compromising flavor.

Rising Potential in Clean-Label and Organic Product Segments

Clean-label trends continue to reshape consumer purchasing behavior, creating opportunities for stevia suppliers to expand their presence in organic and minimally processed product lines. Demand for transparency and plant-sourced ingredients is encouraging companies to incorporate leaf-derived or certified organic stevia into beverages, confectionery, and natural health products. This trend aligns with consumer expectations for sustainable and naturally derived sweeteners. As companies prioritize ingredient clarity and sustainability claims, the market sees increased investment in eco-friendly production and leaf-to-bottle stevia solutions.

- For instance, Cargill expanded its ViaTech® stevia leaf extract portfolio, focusing on precision sweetness to support sugar-reduced formulations with optimal taste and sustainability claims.

Key Challenges

Taste Profile Limitations and Formulation Complexity

Despite technological advancements, stevia’s lingering bitterness and aftertaste remain a challenge in certain applications, especially high-sweetness products. Achieving sugar-like taste often requires blending stevia with other sweeteners or flavor modulators, increasing formulation complexity and cost. These sensory limitations can restrict its adoption in categories where flavor precision is critical, such as carbonated soft drinks or delicate desserts. Manufacturers must invest in taste-masking technologies and advanced glycoside combinations to overcome these constraints and broaden application suitability.

Price Sensitivity and Supply Chain Variability

Stevia production remains vulnerable to fluctuations in leaf supply, agricultural conditions, and processing costs, contributing to price volatility. High-quality glycosides, particularly next-generation variants, can be more expensive than conventional sweeteners, posing challenges for cost-sensitive manufacturers. Additionally, reliance on specific cultivation regions can create supply chain risks and impact production consistency. Companies must invest in diversified sourcing, improved agricultural practices, and scalable biotechnological processes to mitigate pricing pressures and maintain competitive positioning in global markets.

Regional Analysis

North America

North America holds a 32% market share in the Food and Beverage Stevia Market, supported by strong consumer demand for natural, low-calorie sweeteners and widespread reformulation efforts across beverage and packaged food categories. The region’s robust regulatory framework, high awareness of diabetes and obesity, and preference for clean-label products accelerate stevia adoption. Major manufacturers continue investing in advanced steviol glycosides to meet the taste expectations of health-conscious consumers. Expanding applications in ready-to-drink beverages, sports nutrition, and functional foods further strengthen North America’s position as a leading hub for stevia-based product innovation.

Europe

Europe accounts for a 27% market share, driven by stringent regulatory standards promoting sugar reduction and the increasing popularity of natural sweeteners in processed foods. The region’s strong clean-label movement encourages manufacturers to adopt stevia as a substitute for artificial sweeteners across beverages, confectionery, and dairy products. Rising consumer preference for plant-based and organic ingredients continues to support stevia penetration in premium product lines. Ongoing investments in taste-improvement technologies and reformulation strategies help manufacturers meet evolving health expectations, positioning Europe as a key growth region for stevia-based food and beverage solutions.

Asia Pacific

Asia Pacific commands a 29% market share, emerging as one of the fastest-growing regions due to its large population base, expanding middle class, and increasing awareness of healthier dietary choices. The region benefits from strong stevia cultivation capabilities, particularly in China, which supports cost-effective production and supply stability. Growing demand for low-sugar beverages, traditional sweet goods, and functional foods accelerates market growth. Additionally, rapid urbanization and rising incidences of lifestyle diseases are prompting major food and beverage brands to integrate stevia into mainstream products, further strengthening the region’s global influence.

Latin America

Latin America holds a 7% market share, supported by growing health awareness and an increasing shift toward natural sweetener alternatives. Countries such as Brazil and Mexico are witnessing rising consumer demand for reduced-sugar carbonated beverages, juices, and confectionery, driving the adoption of stevia-based formulations. Favorable agricultural conditions and local cultivation initiatives contribute to regional production strength. Regulatory support for sugar-reduction policies is encouraging manufacturers to expand product portfolios containing stevia. As consumer lifestyles evolve and urban markets expand, Latin America continues to present strong growth potential for natural, calorie-free sweeteners.

Middle East & Africa

The Middle East & Africa region represents a 5% market share, with growth driven by increasing health consciousness and rising incidences of diabetes and obesity. Consumers are gradually shifting toward healthier beverage and food options, encouraging manufacturers to incorporate stevia into juices, flavored waters, dairy products, and confectionery. Expanding retail networks and greater exposure to global health trends support market uptake across urban centers. While adoption is still developing due to limited awareness and higher product costs, growing demand for natural, low-calorie sweeteners positions the region for steady long-term market expansion.

Market Segmentations:

By Extract Type

By Form

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Food and Beverage Stevia Market features leading players such as Purecircle Limited, Layn, Qufu Xiangzhou Stevia, Zhucheng Haotian, Sunwin Stevia International, Cargill (Evolva), GLG Life Tech, Morita Kagakau Kogyo, Tate & Lyle, and HuZhou LiuYin Biological. Competition is shaped by continuous advancements in extraction technologies, expanding production capacities, and strategic partnerships with food and beverage manufacturers. Companies are investing heavily in next-generation steviol glycosides such as Reb D and Reb M to deliver improved taste profiles and meet rising demand for sugar reduction. Sustainability initiatives, including responsible cultivation and environmentally efficient processing, are becoming central to brand differentiation. Market players also focus on regional expansion, product portfolio diversification, and competitive pricing strategies to strengthen their global presence. As consumer preference shifts toward clean-label, plant-based sweeteners, industry participants continue to enhance quality, flavor performance, and supply chain reliability to secure long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Oobli announced a strategic partnership with Ingredion Incorporated (an ingredient‐solutions provider) to co‑develop next‑generation sweetener systems that pair natural sweeteners like stevia with Oobli’s sweet‑protein ingredients.

- In April 2024, Ingredion Incorporated launched its PURECIRCLE™ Clean Taste Solubility Solution (CTSS) a stevia‑derived sweetener that is more than 100‑times more soluble than Reb M and enables full sugar reduction in beverages, syrups and other F&B applications.

- In July 2025, Layn Natural Ingredients launched a plant‑based sweetener named SteviUp M2, which is an enzymatically‑converted steviol glycoside offering improved solubility and sugar‑like taste, and received GRAS status for food & beverage use.

Report Coverage

The research report offers an in-depth analysis based on Extract Type, Form and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as consumer demand for natural, plant-based sweeteners continues to accelerate across global food and beverage categories.

- Advances in bioconversion and fermentation technologies will further improve taste profiles and expand the use of next-generation steviol glycosides.

- Manufacturers will increasingly reformulate beverages, dairy products, and snacks to meet sugar-reduction targets, enhancing stevia adoption.

- Clean-label and minimally processed product trends will drive higher demand for organic and leaf-derived stevia solutions.

- Expanded regulatory support for sugar reduction will strengthen stevia’s role in mainstream product reformulations.

- Emerging markets will present significant growth opportunities as health awareness and urbanization increase.

- Companies will invest in sustainable cultivation and processing practices to improve supply chain resilience.

- Blending stevia with complementary natural sweeteners will gain traction to achieve improved flavor performance.

- Functional beverages and wellness-focused foods will adopt stevia more widely to support low-calorie product positioning.

- Competitive pressures will push manufacturers toward cost-efficient production and broader global distribution networks.