Market Overview

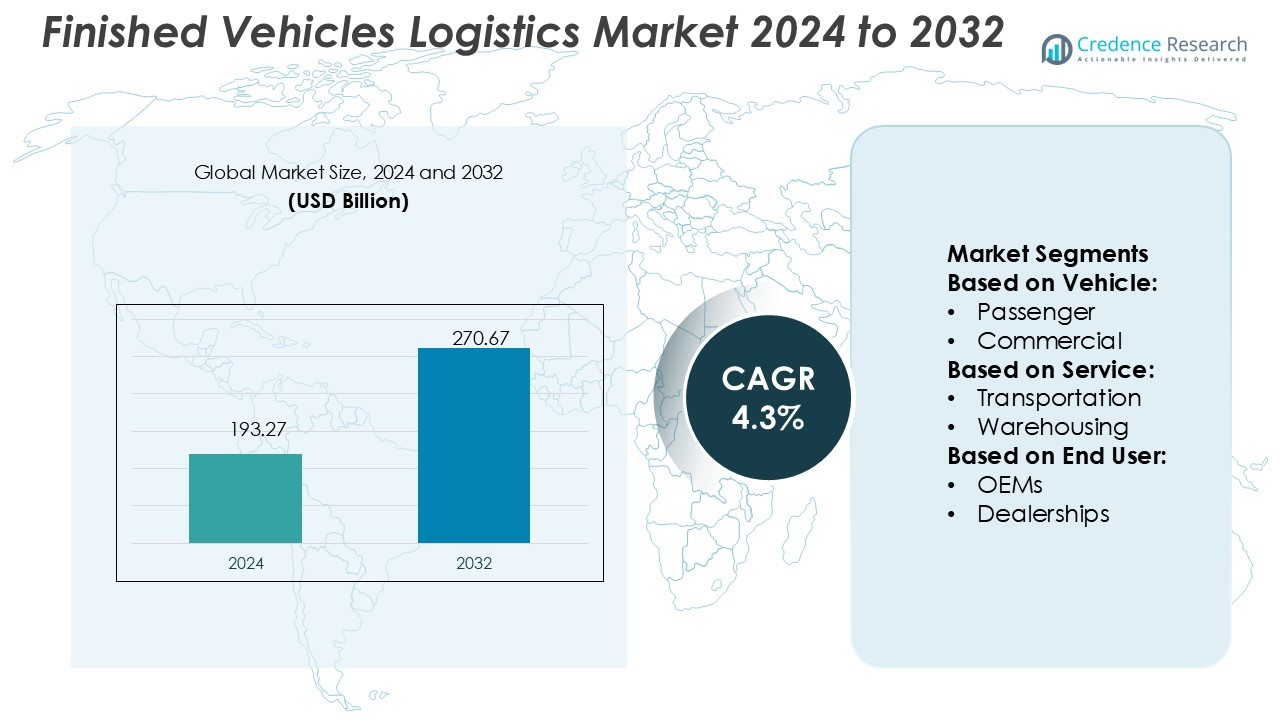

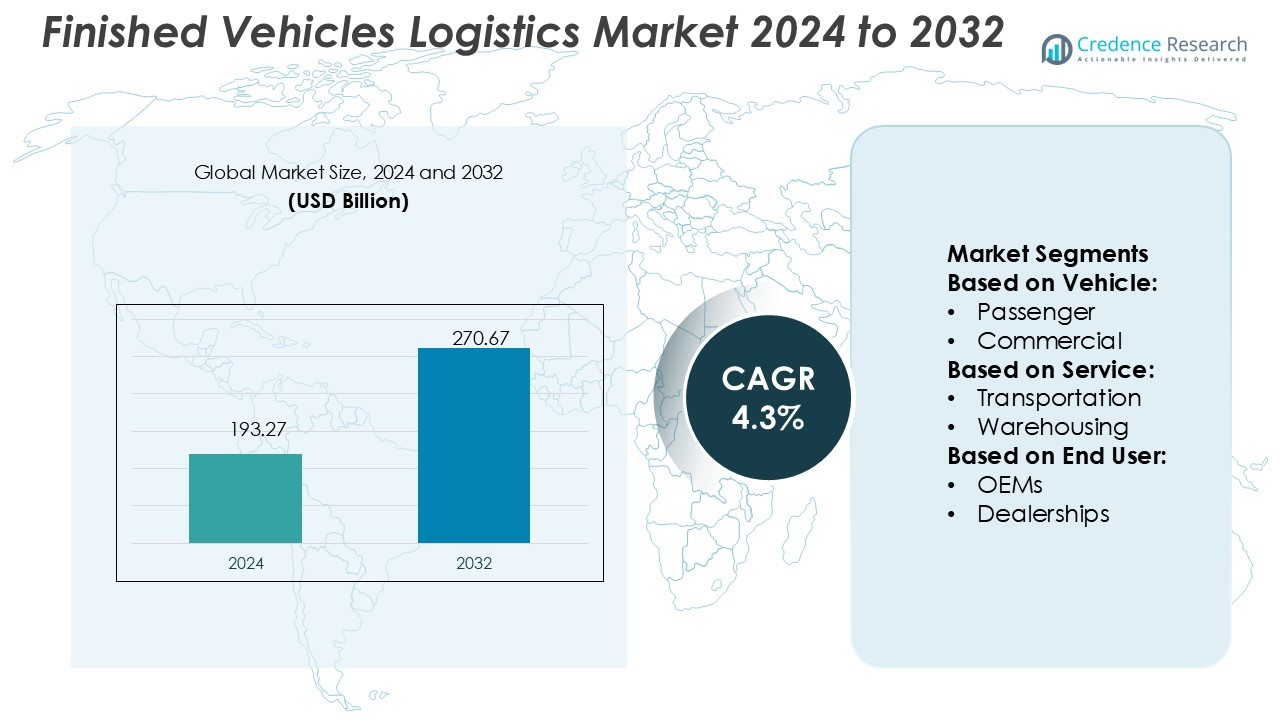

Finished Vehicles Logistics Market size was valued USD 193.27 billion in 2024 and is anticipated to reach USD 270.67 billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Finished Vehicles Logistics Market Size 2024 |

USD 193.27 Billion |

| Finished Vehicles Logistics Market, CAGR |

4.3% |

| Finished Vehicles Logistics Market Size 2032 |

USD 270.67 Billion |

The finished vehicles logistics market is driven by top players such as DB Schenker, Nippon Express, DHL Supply Chain, Ryder System, Inc., XPO Logistics, GEFCO, Kuehne + Nagel, DSV, Ceva Logistics, and United Parcel Service (UPS). These companies strengthen their positions through global networks, advanced digital solutions, and tailored automotive logistics services. Their strategies emphasize multimodal transport, warehousing efficiency, and sustainability to meet evolving OEM and dealership demands. Among regional markets, Asia-Pacific leads with a 40% share, supported by high vehicle production, expanding exports, and rapid electric vehicle adoption, solidifying its dominance in the global competitive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The finished vehicles logistics market size was USD 193.27 billion in 2024 and is projected to reach USD 270.67 billion by 2032, growing at a CAGR of 4.3%.

- Rising global vehicle production, increasing exports, and growing electric vehicle demand act as key drivers, boosting specialized logistics requirements and multimodal transport adoption.

- Digitalization, real-time tracking, predictive analytics, and sustainability initiatives such as electric fleets and green logistics define major market trends shaping competitiveness.

- High operational costs, infrastructure bottlenecks, and regulatory compliance challenges remain restraints, impacting efficiency and profitability for logistics providers.

- Asia-Pacific leads with 40% market share, followed by North America at 35% and Europe at 30%, while the passenger vehicle segment dominates with 42% share, supported by large-scale distribution networks and rising urban demand.

Market Segmentation Analysis:

By Vehicle

The passenger vehicle segment holds the dominant share at 42% of the finished vehicles logistics market. Growth is driven by rising urbanization, growing car ownership, and expanding dealership networks in emerging economies. Passenger vehicles require extensive logistics support for both domestic distribution and international trade, reinforcing their leadership position. Commercial vehicles follow, supported by demand from construction, e-commerce, and logistics fleets. Electric vehicles continue to expand as sustainability regulations intensify, while luxury vehicles occupy a niche segment with high-value logistics needs. Overall, the passenger category sets the pace due to sheer volume and consistent demand.

- For instance, DHL partnered with Daimler and Hylane to rent 30 Mercedes-Benz eActros 600 electric trucks, transitioning its heavy transport operations toward zero-emission freight.

By Service

Transportation services lead the market with a 48% share, establishing them as the dominant sub-segment. Demand is driven by large-scale movement of vehicles from OEM plants to dealerships across domestic and international networks. Robust carrier fleets, improved tracking technologies, and multimodal solutions strengthen efficiency in this area. Warehousing and distribution remain critical, supporting inventory management and regional allocation of vehicles. Value-added services such as pre-delivery inspection, customization, and maintenance continue to grow as dealerships and OEMs look to differentiate offerings. Transportation’s leadership reflects its indispensable role in the entire finished vehicles logistics ecosystem.

- For instance, Ryder System, Inc. operates over 260,000 commercial vehicles and manages 55 million annual deliveries, offering OEMs advanced logistics with integrated telematics covering 100% fleet visibility for predictive routing and maintenance.

By End-User

OEMs dominate the end-user segment with 55% share, owing to their central role in manufacturing and large-scale distribution. Their reliance on integrated logistics providers ensures timely vehicle delivery to domestic and international markets. Strong OEM partnerships drive innovation in efficiency, route optimization, and sustainability. Dealerships represent the next largest share, leveraging logistics to maintain consistent vehicle availability for customers. Other end-users, including rental agencies and corporate fleets, contribute steadily but remain smaller in scale. OEM dominance stems from high production volumes and the strategic need for reliable logistics operations that support global automotive supply chains.

Key Growth Drivers

Rising Global Vehicle Production

The increase in global vehicle production acts as a core driver for the finished vehicles logistics market. OEMs are expanding capacity to meet demand in emerging economies, supported by urbanization and rising disposable incomes. Higher production volumes require advanced logistics networks to ensure timely delivery across domestic and export markets. This creates demand for integrated transport, warehousing, and value-added services. Strong collaboration between manufacturers and logistics providers ensures cost efficiency, minimizes delays, and supports expansion into new geographies, strengthening the overall market growth trajectory.

- For instance, Kuehne + Nagel expanded its processing capacity at its new Paris Charles-de-Gaulle air hub: the 12,900 m² facility enables handling of 300 airfreight pallets per week, increasing throughput by a factor of 2.5.

Growing Demand for Electric Vehicles (EVs)

The accelerating shift toward electric vehicles drives new requirements in logistics operations. EV distribution needs specialized handling due to battery safety, charging infrastructure, and compliance regulations. OEMs are investing in tailored logistics strategies to meet rising consumer and regulatory expectations. This segment’s rapid growth opens opportunities for logistics firms offering temperature-controlled warehousing and safe multimodal transport solutions. The expansion of EV sales, especially in Asia and Europe, ensures steady demand for logistics providers capable of meeting sustainability goals while ensuring secure and efficient transportation processes.

- For instance, CEVA has launched a reverse logistics solution for EV batteries designed to cover 80 % of European volumes by 2030, with battery logistics centers already tested in Ghislenghien, Belgium.

Expansion of Global Automotive Trade

The globalization of automotive trade continues to boost finished vehicles logistics demand. Automakers increasingly export vehicles to diverse regions, requiring large-scale, coordinated logistics solutions. Ports, shipping networks, and rail transport infrastructure are being expanded to handle rising export volumes. Trade agreements and reduced tariffs further encourage cross-border movement, intensifying reliance on professional logistics services. Companies offering end-to-end solutions, from port handling to last-mile delivery, are positioned to capture significant growth. This trend underlines the importance of efficient, cost-effective, and sustainable global logistics systems supporting automotive exports and imports.

Key Trends & Opportunities

Digitalization and Smart Logistics

The adoption of digital platforms, telematics, and IoT-based tracking is reshaping finished vehicles logistics. Real-time monitoring of fleet movements reduces delays and enhances transparency across the supply chain. Logistics providers are investing in predictive analytics to optimize routes, minimize fuel costs, and improve delivery reliability. The integration of blockchain also ensures data security and transaction transparency. These technologies not only reduce operational risks but also create opportunities for logistics firms to differentiate through efficiency, customer service, and cost competitiveness in a highly competitive automotive logistics environment.

- For instance, UPS has equipped its entire van fleet, numbering over 100,000 vehicles, with its AI-driven ORION system, achieving significant annual fuel and cost savings that have surpassed initial estimates through continuous upgrades.

Sustainability and Green Logistics Initiatives

Sustainability emerges as a key opportunity as automakers and logistics providers align with global carbon reduction goals. Growing regulatory pressure and consumer preference for green practices push companies to adopt electric fleets, rail-based transport, and renewable-powered warehouses. Green packaging and reduced idling times in transport also contribute to efficiency. Logistics firms that invest in sustainable operations can attract OEM partnerships and government incentives. This trend positions environmentally responsible logistics as a competitive advantage while addressing long-term environmental challenges in the automotive industry.

- For instance, GXO Logistics powers 100% of its UK warehouse network with renewable electricity as part of its sustainability strategy, serving a wide range of customers including those in the automotive and industrial sectors.

Key Challenges

High Operational Costs

The finished vehicles logistics market faces the challenge of rising operational costs, including fuel, labor, and infrastructure expenses. Logistics providers must balance cost efficiency with the need for timely and safe vehicle deliveries. Volatile fuel prices directly impact transportation expenses, while increasing wages and compliance costs add pressure. Firms are investing in automation and route optimization to offset these expenses, but smaller players often struggle to maintain margins. Managing cost escalation without compromising service quality remains a critical challenge for sustaining profitability.

Infrastructure Bottlenecks

Infrastructure limitations significantly affect the efficiency of finished vehicles logistics. Congestion at ports, inadequate rail connectivity, and limited warehousing capacity disrupt timely deliveries. Emerging markets, despite growing demand, often lack modernized transport networks, creating delays and additional costs. These bottlenecks restrict scalability and hinder expansion into new regions. Logistics firms and OEMs are forced to invest in private infrastructure or partnerships to overcome these barriers. Addressing infrastructure gaps is essential to ensure reliability, reduce lead times, and support the seamless flow of vehicles across global markets.

Regional Analysis

North America

North America holds a 35% share of the finished vehicles logistics market, supported by advanced transport infrastructure and a strong automotive manufacturing base. The U.S. leads with extensive OEM networks and high vehicle exports, while Canada contributes with growing electric vehicle distribution. Logistics providers benefit from established rail and road systems, enabling efficient cross-country and cross-border movement. Increasing investment in digital platforms and sustainable fleets enhances operational efficiency. Rising EV adoption further drives demand for specialized logistics solutions, particularly battery handling. The region’s dominance is reinforced by technological innovation and consistent growth in vehicle sales.

Europe

Europe accounts for 30% of the market, driven by its dense automotive clusters and strong export orientation. Germany, France, and the UK remain central to production and distribution, with premium and luxury brands fueling logistics demand. The region emphasizes sustainability, with logistics providers adopting electric transport fleets and intermodal solutions to cut emissions. Advanced rail networks and port facilities enhance efficiency across borders. Growing EV penetration requires specialized logistics capabilities, including safe handling of high-voltage batteries. Europe’s market share reflects its robust infrastructure, regulatory alignment, and leadership in integrating green logistics into automotive distribution chains.

Asia-Pacific

Asia-Pacific leads the global finished vehicles logistics market with a 40% share, supported by high vehicle production and exports. China, Japan, and India dominate regional output, with China emerging as the largest EV producer. Expanding middle-class demand and rapid urbanization further boost logistics needs across domestic and international markets. Investments in port expansion, road upgrades, and multimodal transport networks strengthen capacity. Regional players increasingly integrate digital technologies to manage high volumes efficiently. With EV adoption accelerating, Asia-Pacific’s scale, cost competitiveness, and export-oriented automotive sector reinforce its leadership in the global logistics landscape.

Latin America

Latin America accounts for 8% of the finished vehicles logistics market, driven primarily by Brazil and Mexico. These countries serve as regional manufacturing hubs, supplying both domestic markets and exports to North America and Europe. Logistics providers face challenges from infrastructure limitations but benefit from growing OEM investments. Rising consumer demand, particularly in urban centers, supports growth in distribution and transportation services. Trade agreements with North America encourage cross-border logistics activity, strengthening regional integration. Latin America’s share reflects its emerging role as a production and export base, with expanding opportunities in EV logistics solutions.

Middle East & Africa

The Middle East & Africa region holds a modest 7% share, but it shows steady growth potential. The UAE and South Africa lead, supported by strong vehicle imports and re-exports. Limited domestic production makes the market heavily dependent on efficient port logistics and regional distribution networks. Growing demand for luxury vehicles and rising investments in EV adoption create opportunities for specialized logistics services. Infrastructure development, particularly in port and warehousing facilities, supports regional expansion. While share remains smaller compared to major regions, strategic location and trade routes enhance its importance in global automotive logistics flows.

Market Segmentations:

By Vehicle:

By Service:

- Transportation

- Warehousing

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The finished vehicles logistics market features strong competition with leading players including DB Schenker, Nippon Express, DHL Supply Chain, Ryder System, Inc., XPO Logistics, GEFCO, Kuehne + Nagel, DSV, Ceva Logistics, and United Parcel Service (UPS). The finished vehicles logistics market is highly competitive, shaped by global demand for efficient, cost-effective, and sustainable transport solutions. Companies focus on expanding multimodal networks that integrate road, rail, sea, and air to ensure timely deliveries across regions. Digital transformation plays a central role, with investments in IoT-based tracking, predictive analytics, and blockchain improving transparency and operational efficiency. Sustainability initiatives, such as electric fleets and carbon-reduction strategies, are increasingly adopted to align with regulatory standards and customer expectations. Continuous investment in infrastructure, partnerships, and advanced technologies enables market participants to strengthen competitiveness in this dynamic environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DB Schenker

- Nippon Express

- DHL Supply Chain

- Ryder System, Inc.

- XPO Logistics

- GEFCO

- Kuehne + Nagel

- DSV

- Ceva Logistics

- United Parcel Service (UPS)

Recent Developments

- In December 2024, NIPPON EXPRESS HOLDINGS, a global logistics service provider, entered into a strategic partnership agreement with Tive, Inc. for real-time monitoring services associated with cargo information. This has enabled NIPPON to provide enhanced services for semiconductors and other industries with the availability of real-time monitoring and control technology, especially for cargo transports sensitive to temperature, humidity, and more.

- In March 2024, The Port of Dunkirk and CEVA Logistics signed a contract for a plot of land where CEVA will establish a new finished vehicle logistics operation for sea-based imports and exports.

- In February 2024, ORTEC, a global provider of leading end-to-end supply chain solutions developed specifically for the operational needs of manufacturers, retailers, and distributors, introduced a state-of-the-art solution purpose-fit for the operational needs of the manufacturing and finished goods logistics industries.

- In February 2024, SYNC Auto Logistics launched its next generation AI fueled Technology infrastructure which is going to enable the company to transform the auto logistics industry as we know it. This system provides real time optimization from quoting and booking through tracking and post-delivery of the logistics functions.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Service, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global vehicle production and exports.

- Electric vehicle growth will increase demand for specialized logistics solutions.

- Digital platforms will enhance efficiency through real-time tracking and predictive analytics.

- Sustainability initiatives will drive adoption of electric fleets and green logistics.

- Multimodal transport networks will gain importance for cost and time optimization.

- Infrastructure investments will strengthen warehousing and port handling capacity.

- Strategic OEM-logistics partnerships will enhance supply chain reliability.

- Emerging markets will contribute strongly with rising automotive demand.

- Value-added services will grow with customization and pre-delivery inspections.

- Competition will intensify as players invest in technology and global expansion.