Market Overview

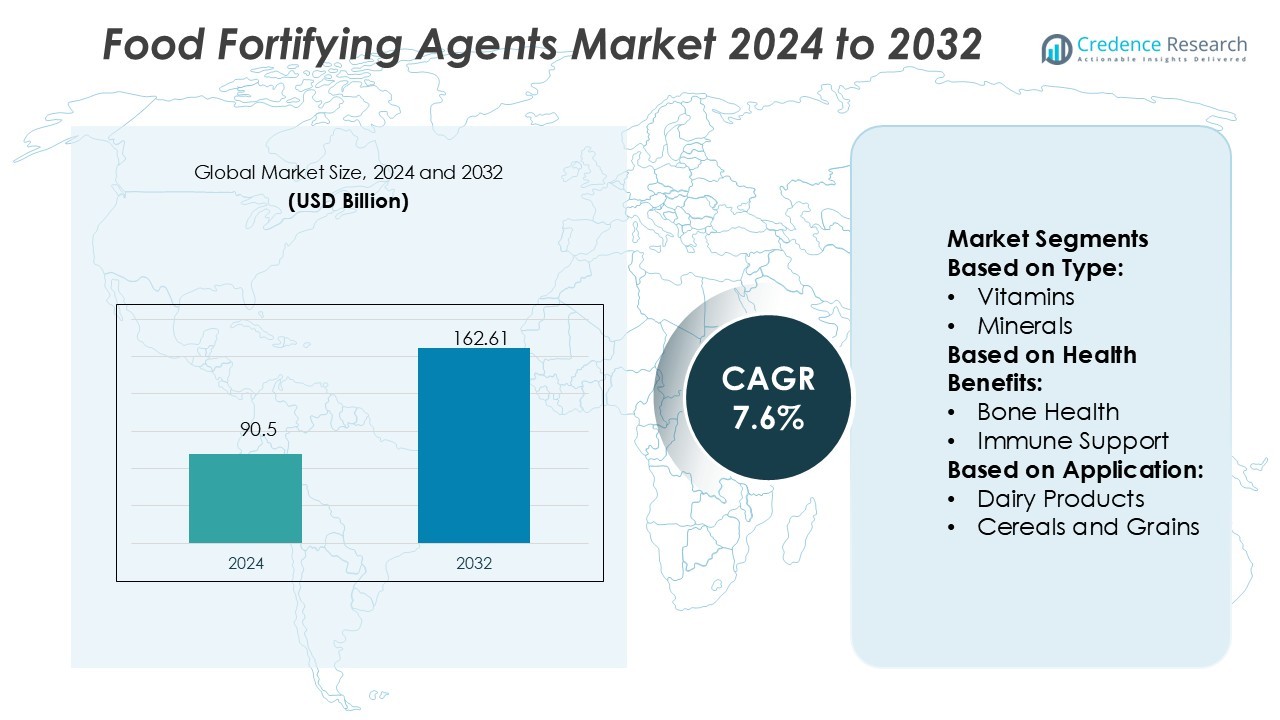

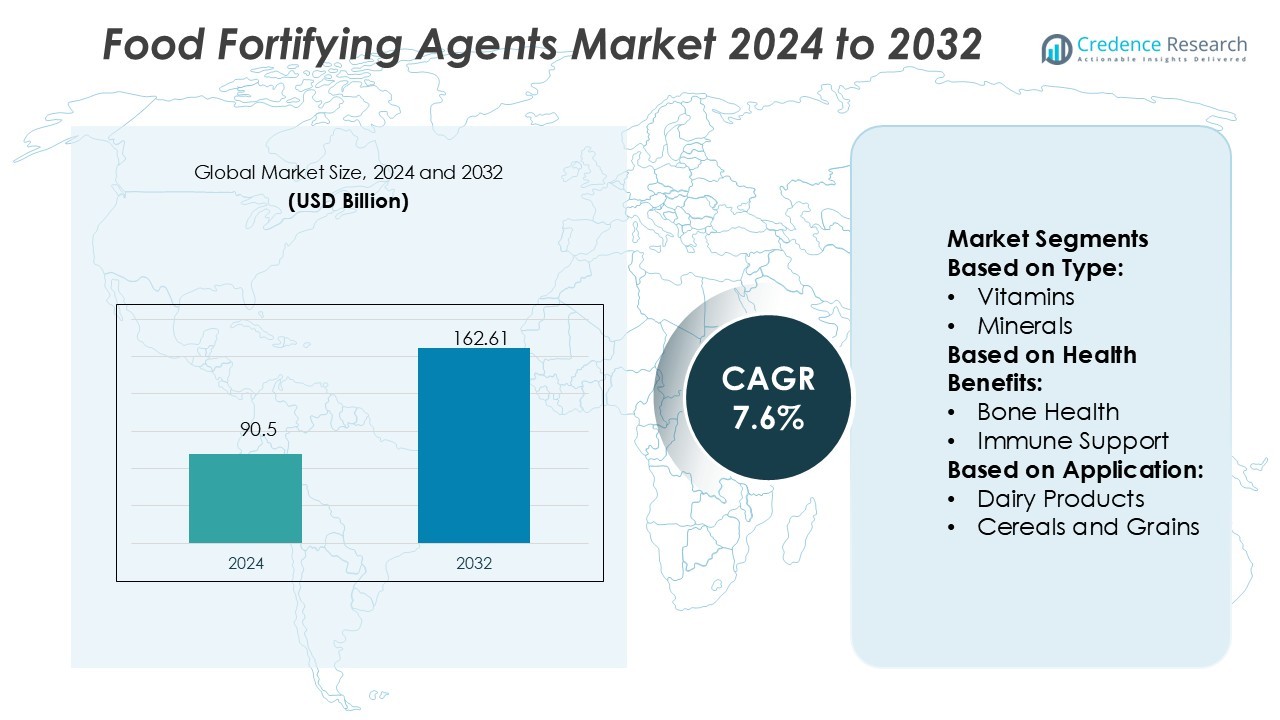

Food Fortifying Agents Market size was valued USD 90.5 billion in 2024 and is anticipated to reach USD 162.61 billion by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Fortifying Agents Market Size 2024 |

USD 90.5 Billion |

| Food Fortifying Agents Market, CAGR |

7.6% |

| Food Fortifying Agents Market Size 2032 |

USD 162.61 Billion |

The Food Fortifying Agents Market is shaped by prominent players including BASF SE, DSM Nutritional Products, Archer Daniels Midland Company (ADM), Cargill, Incorporated, Ingredion Incorporated, Kerry Group, Lonza Group, Tate & Lyle PLC, Glanbia Nutritionals, and Nutra Food Ingredients LLC. These companies drive innovation through advanced formulations of vitamins, minerals, amino acids, and proteins tailored for diverse applications such as dairy, cereals, beverages, and dietary supplements. They focus on expanding clean-label solutions, plant-based fortification, and bioavailability technologies to meet evolving consumer demands. Regionally, North America leads the market with a 34% share, supported by strong regulatory frameworks, high consumer awareness, and well-established food processing industries that prioritize functional and fortified nutrition.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Fortifying Agents Market was valued at USD 90.5 billion in 2024 and is projected to reach USD 162.61 billion by 2032, growing at a CAGR of 7.6%.

- Rising health awareness and preventive nutrition drive market growth, with fortified dairy holding the largest application share at 36%, supported by strong consumer demand for calcium- and vitamin-enriched products.

- Clean-label and plant-based fortification represent major trends, as companies innovate with natural ingredients and bioavailability technologies to meet evolving consumer preferences.

- The competitive landscape is shaped by BASF SE, DSM Nutritional Products, Archer Daniels Midland Company (ADM), Cargill, Incorporated, Ingredion Incorporated, Kerry Group, Lonza Group, Tate & Lyle PLC, Glanbia Nutritionals, and Nutra Food Ingredients LLC, focusing on R&D, partnerships, and regional expansions.

- North America leads with a 34% share, followed by Europe at 28% and Asia-Pacific at 25%, with growth fueled by regulatory frameworks, technological adoption, and expanding fortified food consumption.

Market Segmentation Analysis:

By Type

In the Food Fortifying Agents Market, vitamins hold the dominant share at 38%, driven by their widespread application across dietary supplements, beverages, and infant nutrition. Strong consumer demand for immunity-boosting and energy-enhancing products reinforces their leadership. Minerals follow closely, supported by rising use in bone and heart health applications. Amino acids and proteins are gaining ground in sports nutrition and functional foods, while fatty acids continue to grow due to cardiovascular health awareness. The diverse applicability of vitamins ensures consistent demand, making them the most preferred fortifying type.

- For instance, Mondi’s thermoformable barrier films include products with up to 18 layers of film structure, engineered for pasteurisation, sterilisation, retort, and microwave applications.

By Health Benefits

Bone health leads this segment with a 34% market share, supported by high adoption of calcium, vitamin D, and related minerals in fortified dairy products and supplements. Rising cases of osteoporosis and lifestyle-related deficiencies further propel demand. Immune support is also growing rapidly, driven by increased awareness of preventive healthcare and higher intake of fortified vitamins and antioxidants. Heart health products attract attention due to rising cardiovascular cases, while digestive health fortification benefits from probiotic and fiber-infused foods. Overall, bone health fortification remains the most significant growth contributor.

- For instance, The patterned foil helps manage microwave energy, allowing it to provide quick and even cooking. This process can reduce cooking time by up to 50% for some foods compared to standard paperboard or CPET trays, according to laboratory tests.

By Application

Dairy products dominate the application segment with a 36% share, attributed to their established role in delivering fortified calcium, vitamin D, and probiotics. Global preference for nutrient-rich milk, yogurt, and cheese drives steady adoption in both developed and developing regions. Cereals and grains follow as key carriers of fortified vitamins and minerals, ensuring balanced nutrition in daily diets. Beverages also see strong uptake with fortified juices and energy drinks gaining traction. Infant nutrition and dietary supplements contribute significantly, but dairy products remain the most widely adopted fortification platform.

Key Growth Drivers

Rising Health Awareness and Preventive Nutrition

The Food Fortifying Agents Market is driven by growing consumer awareness about preventive healthcare and nutrition. Rising lifestyle-related health issues, such as cardiovascular diseases and osteoporosis, increase demand for fortified foods. Consumers actively seek nutrient-rich options like fortified dairy, cereals, and beverages to boost immunity and maintain long-term health. Governments and health organizations also support awareness campaigns, which encourage adoption. This growing preference for functional and fortified foods strengthens the market outlook, making health awareness a critical growth driver.

- For instance, Optimal biodegradable microperforated package had shelf life extended by 4 days compared with open containers, and by 2 days compared with the best commercial plastic package.

Government Regulations and Fortification Programs

Government-led initiatives and mandatory fortification programs strongly propel the Food Fortifying Agents Market. Many countries enforce fortification of staples like rice, wheat flour, and milk with essential vitamins and minerals to combat malnutrition. These programs ensure mass adoption and create consistent demand for fortifying agents. Policies encouraging fortified foods in public health schemes further enhance accessibility, especially in developing regions. Strong regulatory frameworks also build consumer trust, supporting higher acceptance. As a result, government regulations play a vital role in expanding the fortification market.

- For instance, DuPont Teijin Films’ Mylar® Harvest Fresh rPET films incorporate up to 50% post-consumer recycled (PCR) content in the base polyester film.These films maintain comparable heat seal, mechanical and optical performance versus virgin material.

Expanding Demand for Functional Foods and Beverages

Functional foods and beverages have become mainstream, significantly driving the Food Fortifying Agents Market. Consumers increasingly choose products enriched with proteins, amino acids, and probiotics for improved energy, immunity, and digestion. Rising demand for sports nutrition and weight management products also supports fortification adoption. Beverage manufacturers integrate vitamins and minerals into juices, energy drinks, and dairy alternatives, catering to health-conscious consumers. With the global trend toward convenient yet nutritious food options, functional fortification ensures strong growth opportunities for manufacturers and ingredient suppliers.

Key Trends & Opportunities

Shift Toward Plant-Based Fortification

The shift toward plant-based and clean-label products opens new opportunities in the Food Fortifying Agents Market. Consumers demand natural sources of vitamins, proteins, and fatty acids derived from algae, seeds, and legumes. Plant-based fortification aligns with vegan and vegetarian lifestyles while addressing sustainability concerns. Companies investing in natural ingredients and plant-derived alternatives strengthen their market presence. This trend also appeals to environmentally conscious consumers who value ethical sourcing and eco-friendly production, making plant-based fortification a major growth opportunity.

- For instance, modern digital printing technology enables high-coverage color reproduction, with some presses capable of achieving over 90% of Pantone colors. Using digital printing on substrates like aluminum and PET.

Technological Advancements in Microencapsulation

Microencapsulation technologies represent a growing trend that enhances stability, bioavailability, and taste of fortifying agents. This innovation allows manufacturers to incorporate sensitive nutrients like omega-3 fatty acids and probiotics into various foods without altering flavor or shelf life. Advancements in encapsulation enable customized nutrient delivery, supporting wider application in cereals, beverages, and infant formulas. Companies adopting such technologies gain a competitive advantage by offering products that ensure high nutrient retention and consumer satisfaction, making it a key trend in market development.

- For instance, ExxonMobil and partners developed stretch hood films with 35% post-consumer recycled (PCR) content for stretch applications, and 50% PCR content for shrink hood films, without loss of strength or clarity. For instance, ExxonMobil and partners developed stretch hood films with 35% post-consumer recycled (PCR) content for stretch applications, and 50% PCR content for shrink hood films, without loss of strength or clarity.

Key Challenges

High Cost of Fortification and Production

One of the main challenges in the Food Fortifying Agents Market is the high cost of fortification. Incorporating quality vitamins, minerals, and amino acids requires advanced technologies, which increase production expenses. These costs are often passed on to consumers, limiting adoption in price-sensitive markets. Small and medium-sized food producers face difficulties in managing expenses while maintaining profitability. The challenge is especially significant in developing regions, where affordability plays a major role in consumer preferences, slowing market penetration.

Regulatory and Standardization Issues

Regulatory complexities and lack of global standardization hinder smooth market expansion. While some countries mandate fortification, others have voluntary or inconsistent guidelines, creating compliance challenges for manufacturers. Varying safety regulations and labeling requirements further complicate product development and international trade. These inconsistencies limit scalability and delay product launches in new markets. Companies must invest significantly in regulatory compliance, increasing operational costs. Thus, the absence of harmonized global standards remains a key barrier to widespread adoption of food fortifying agents.

Regional Analysis

North America

North America leads the Food Fortifying Agents Market with a 34% share, supported by strong consumer demand for functional foods and beverages. The U.S. drives adoption through widespread use of fortified dairy, cereals, and dietary supplements, reinforced by strict regulatory standards and health-focused initiatives. Rising awareness of preventive healthcare and high disposable incomes further accelerate market penetration. Canada also contributes through government-supported fortification programs addressing micronutrient deficiencies. The region’s established food processing industry, coupled with technological innovations such as microencapsulation, positions North America as a dominant market, sustaining steady demand across diverse product categories.

Europe

Europe accounts for 28% of the Food Fortifying Agents Market, driven by growing health awareness and strict nutritional regulations. Countries such as Germany, France, and the UK emphasize fortified cereals, infant nutrition, and beverages. Consumer preference for natural and clean-label fortified foods also strengthens market adoption. The EU’s strong focus on tackling vitamin D and iron deficiencies encourages manufacturers to expand fortification practices. Additionally, rising demand for plant-based fortification aligns with Europe’s sustainability goals. Regulatory frameworks ensuring product quality and safety make Europe a leading region, with robust opportunities in functional and specialized nutrition segments.

Asia-Pacific

Asia-Pacific holds a 25% share of the Food Fortifying Agents Market, driven by rapid urbanization, expanding middle-class populations, and increasing health consciousness. China and India play leading roles through large-scale government initiatives targeting malnutrition, including fortified rice and wheat programs. Rising demand for fortified dairy, infant nutrition, and beverages fuels growth, particularly among young consumers seeking preventive health solutions. Japan and South Korea also adopt advanced fortification technologies in functional foods. With growing investments in health-focused innovations and supportive policies, Asia-Pacific is positioned as the fastest-growing region, offering vast opportunities for ingredient suppliers and manufacturers.

Latin America

Latin America captures a 7% share of the Food Fortifying Agents Market, with Brazil and Mexico at the forefront due to mandatory fortification of staples like flour and milk. Rising concerns over nutritional deficiencies and obesity drive greater demand for fortified dairy and cereals. Economic improvements and expanding urban populations contribute to stronger adoption of functional beverages and dietary supplements. However, affordability challenges limit premium fortified products’ penetration. Government programs addressing public health concerns, coupled with growing consumer interest in fortified infant nutrition, support regional growth, making Latin America an emerging but steadily expanding market.

Middle East & Africa

The Middle East & Africa region represents 6% of the Food Fortifying Agents Market, primarily driven by government efforts to combat widespread micronutrient deficiencies. Countries such as South Africa, Saudi Arabia, and the UAE implement fortification programs for flour, milk, and edible oils to address anemia and vitamin deficiencies. Rising disposable incomes in urban centers fuel demand for fortified beverages and dietary supplements. However, rural affordability and limited awareness remain challenges. Growing interest in fortified infant nutrition and healthcare-focused foods indicates long-term opportunities, positioning the region as a developing but high-potential market for fortifying agents.

Market Segmentations:

By Type:

By Health Benefits:

- Bone Health

- Immune Support

By Application:

- Dairy Products

- Cereals and Grains

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Food Fortifying Agents Market is characterized by strong competition among leading players such as Nutra Food Ingredients LLC, BASF SE, Tate & Lyle PLC, Cargill, Incorporated, Kerry Group, Glanbia Nutritionals, Lonza Group, DSM Nutritional Products, Ingredion Incorporated, and Archer Daniels Midland Company (ADM). The Food Fortifying Agents Market features a highly competitive landscape shaped by continuous innovation and evolving consumer preferences. Companies focus on expanding their portfolios with advanced vitamins, minerals, amino acids, and proteins tailored for multiple applications, including dairy, cereals, beverages, and dietary supplements. Research and development efforts emphasize improving nutrient bioavailability, stability, and taste through technologies such as microencapsulation. Market participants also prioritize sustainability by developing plant-based and clean-label solutions to align with consumer demand for natural ingredients. Strategic partnerships, mergers, and regional expansions strengthen their global presence, ensuring long-term growth while addressing diverse nutritional needs worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, PLANTSTRONG, a plant-based food brand, expanded into the plant-based milk market, offering four shelf-stable varieties fortified with essential nutrients like calcium, vitamin D, and vitamin B12. The company has addressed consumer concerns about additives and lack of nutrients in many plant-based products by carefully formulating its milk.

- In March 2024, MYPROTEIN – The Hut.com Ltd. launched Jimmy’s x MYPROTEIN Iced Coffee in collaboration with Jimmy’s, the iced coffee brand. This product is designed to meet consumers’ on-the-move demand and increase the company’s ready-to-drink offerings.

- In January 2024, the WK Kellogg Co launched Eat Your Mouth Off, a new line of vegan cereal with chocolate and fruity tastes. The cereal puffs have 22 grams of plant-based protein, 0 grams of sugar, and 2 grams of carbohydrates per serving. The brand lists canola oil, lentil protein, oat fiber, soy protein isolate, and pea protein isolate as ingredients.

- In March, 2023, Dairy Farmers of America (DFA) launched a probiotics-fortified, lactose-free UHT milk in collaboration with Good Culture. This product is the first of its kind in the U.S. market, combining the nutritional benefits of dairy with microbiome-boosting probiotics, providing an affordable alternative to kefir and kombucha.

Report Coverage

The research report offers an in-depth analysis based on Type, Health Benefits, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing consumer demand for fortified foods.

- Rising preventive healthcare awareness will drive adoption of fortified products.

- Functional beverages and dairy will remain key growth categories.

- Plant-based fortification will gain momentum with increasing vegan and vegetarian diets.

- Microencapsulation technology will enhance nutrient stability and bioavailability.

- Government-led fortification programs will strengthen demand in developing regions.

- Infant nutrition and dietary supplements will continue to attract high investments.

- Clean-label and natural ingredient fortification will dominate future product launches.

- Strategic collaborations will support global expansion and product innovation.

- Emerging economies will become major markets due to rising middle-class populations.