Market Overview:

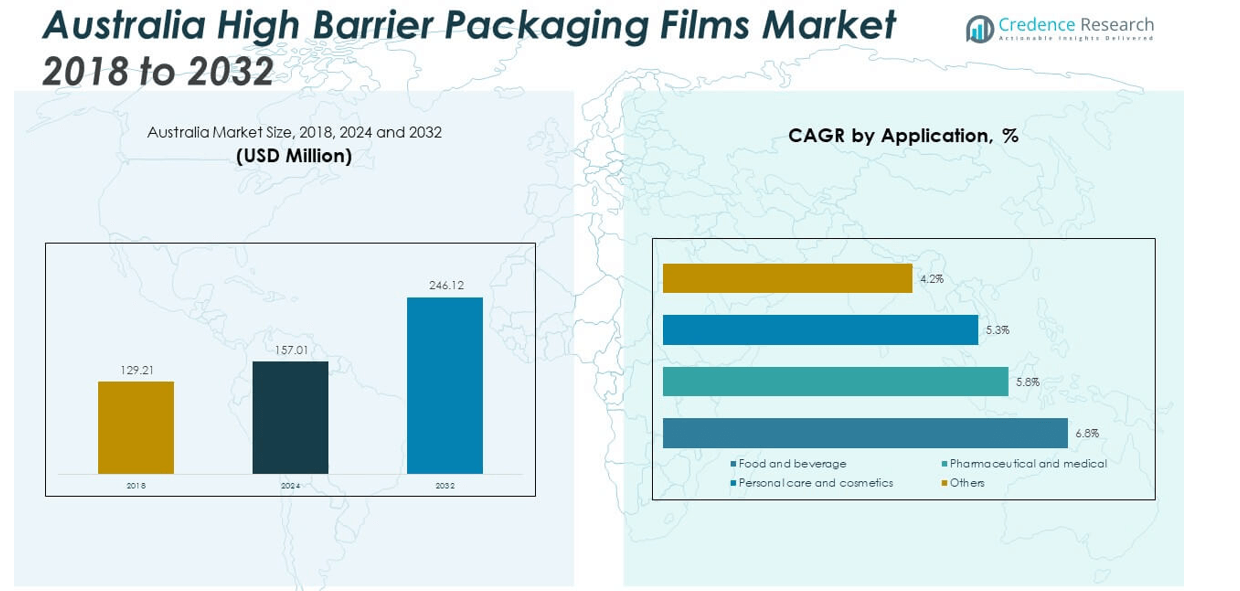

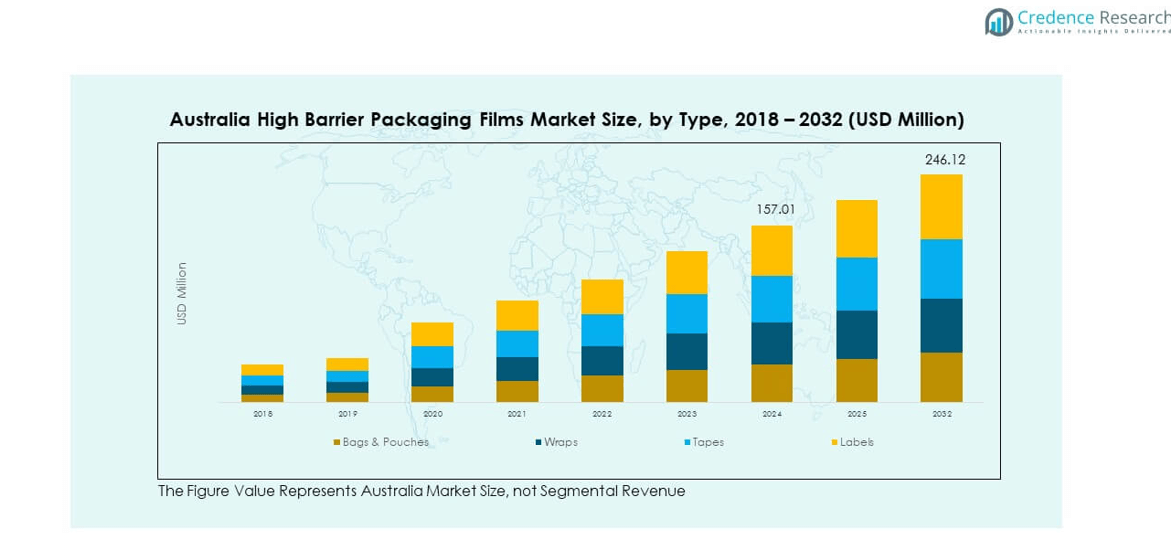

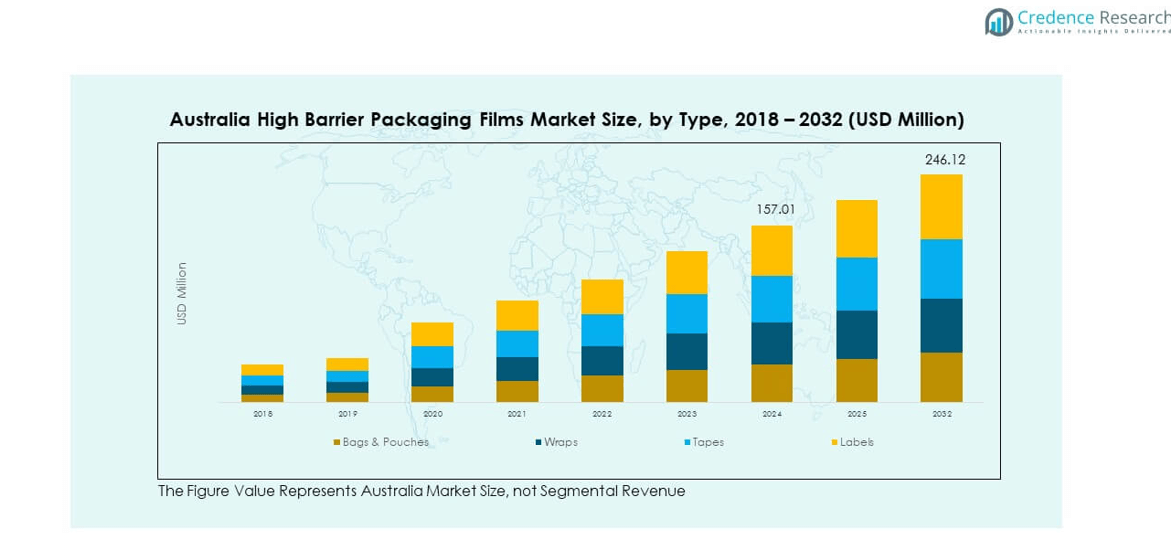

The Australia High Barrier Packaging Films Market size was valued at USD 129.21 million in 2018 to USD 157.01 million in 2024 and is anticipated to reach USD 246.12 million by 2032, at a CAGR of 5.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia High Barrier Packaging Films Market Size 2024 |

USD 157.01 million |

| Australia High Barrier Packaging Films Market, CAGR |

5.78% |

| Australia High Barrier Packaging Films Market Size 2032 |

USD 246.12 million |

Growth in the market is driven by rising demand for extended shelf life in food and beverage packaging, stricter regulations on food safety, and growing consumer preference for convenient packaging solutions. The need for sustainable films with lower environmental impact is also encouraging innovation. Manufacturers are actively adopting advanced barrier technologies to balance performance, recyclability, and cost-effectiveness, ensuring consistent adoption across industries.

Geographically, Australia plays a significant role in the regional packaging sector due to strong demand from food exports and domestic consumption. The Asia-Pacific region, including China and Japan, leads the market with higher production and consumption levels. Emerging economies in Southeast Asia are witnessing growing adoption due to urbanization and changing lifestyles. These trends position Australia within a dynamic regional ecosystem of high barrier packaging films.

Market Insights:

- The Australia High Barrier Packaging Films Market was valued at USD 129.21 million in 2018, reached USD 157.01 million in 2024, and is projected to hit USD 246.12 million by 2032, growing at a CAGR of 5.78%.

- Eastern and Southeastern Australia held 48% share in 2024, driven by strong food processing, retail, and export industries, while Queensland and Western Australia accounted for 32% due to dairy, meat, and seafood exports.

- Tasmania and the Northern Territories represented 20% share and are the fastest-growing regions, supported by premium food exports, seafood production, and niche healthcare packaging demand.

- Bags and pouches held the largest product share at 38% in 2024, reflecting dominance in food and beverage packaging due to flexibility, durability, and preservation qualities.

- Labels and wraps together accounted for 34% share, indicating strong adoption in branding-focused formats and large-scale food distribution within the Australia High Barrier Packaging Films Market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference for Convenient and Longer-Lasting Food Packaging

The Australia High Barrier Packaging Films Market is driven by increasing demand for packaging that extends shelf life. Consumers seek ready-to-eat and processed foods that remain fresh for longer. Retail chains emphasize packaging that reduces spoilage and improves logistics efficiency. It is supported by innovations that maintain product safety and integrity during transport. Food manufacturers adopt advanced barrier films to meet these needs and gain competitive advantages. The focus on packaging convenience aligns with busy urban lifestyles. This driver strengthens the link between consumer expectations and packaging innovation. Manufacturers continue to refine films to balance durability with lightweight design.

- For instance, Amcor’s AmLite Recyclable high-barrier packaging doubled the shelf life of Popcorn Shed’s premium popcorn from six to twelve months for export markets such as Australia, allowing products to retain freshness even after lengthy sea transit.

Growing Emphasis on Food Safety Regulations and Compliance Standards

Strict national and international regulations fuel the demand for high-performance packaging films. Food exporters in Australia prioritize compliance with stringent safety requirements across global markets. Companies adopt barrier films to prevent contamination and maintain hygiene. It helps manufacturers protect brand reputation while meeting industry certifications. Regulatory bodies encourage sustainable practices, pushing firms toward safer barrier materials. This increases adoption of films with stronger protective qualities. Compliance standards also create opportunities for premium packaging solutions. Businesses in the market gain global competitiveness through adherence to safety benchmarks.

- For instance, Australia’s Food Standards Code underwent major updates in August 2025, including new regulations for microbiological criteria and safe food packaging to enable exporters to meet international requirements for ready-to-eat foods and seafood.

Rising Adoption of Sustainable and Eco-Friendly Packaging Materials

Sustainability acts as a strong driver shaping investment in packaging innovation. Firms explore recyclable and biodegradable barrier films to reduce environmental footprints. It creates alignment with government sustainability targets and corporate ESG goals. Consumers increasingly demand eco-conscious products, encouraging retailers to adopt greener packaging. Manufacturers invest in R&D to produce thinner yet stronger films that conserve resources. The trend reduces landfill waste and supports circular economy principles. Partnerships with recycling initiatives further accelerate adoption. Companies focusing on green innovation establish a stronger presence in competitive markets.

Expansion of Export-Oriented Food and Beverage Production in Australia

The growth of food exports strengthens the demand for advanced barrier packaging solutions. Producers rely on films that preserve product freshness across long-distance shipping. It becomes vital in dairy, meat, and seafood exports requiring controlled packaging conditions. Australian brands aim to meet global market expectations with high-quality packaging. This encourages investment in barrier technology tailored for export logistics. The market benefits from rising international food demand. Longer transit times necessitate packaging that ensures product safety. Export growth continues to reinforce the role of barrier films in maintaining global trade value.

Market Trends:

Adoption of Digital Printing and Customization in Packaging Films

The Australia High Barrier Packaging Films Market is witnessing a strong shift toward digital printing. Brands demand flexible packaging that enhances shelf appeal with vibrant graphics. It enables customization that improves consumer engagement. Digital technologies allow faster design adjustments and small-batch production runs. It supports targeted marketing campaigns for different demographics. Packaging differentiation strengthens brand recognition in competitive retail environments. Printing innovations enhance traceability through smart codes and labeling. This trend creates synergy between aesthetics, branding, and functional packaging.

- For instance, ePac Flexible Packaging installed HP Indigo digital presses in Melbourne, which enabled high-quality digital printing for small and medium brands with variable graphics and serialized data, supporting product-level traceability for the Australian market.

Integration of Smart Packaging Features to Enhance Consumer Safety

Smart packaging solutions are becoming prominent across the regional market. Sensors and indicators embedded in barrier films monitor freshness and quality. It provides transparency to consumers regarding product safety. Food and pharmaceutical companies invest in intelligent labeling to ensure compliance. Interactive features create stronger consumer trust. Packaging films with QR codes link buyers to supply chain information. This trend helps companies combat counterfeiting and improve recall management. Smart features expand the role of barrier films beyond protection to communication.

- For instance, freshness indicator films equipped with temperature-sensing enzyme coatings are now applied to perishable packaging, visually alerting consumers and distributors in Australia to spoilage risks when exposed to heat, thus improving food safety and shelf-life transparency.

Advancement in Multi-Layer Film Structures for Performance Optimization

Film manufacturers develop complex multi-layer structures to achieve superior protection. The Australia High Barrier Packaging Films Market benefits from films that balance oxygen, moisture, and UV resistance. It supports packaging needs of industries ranging from snacks to pharmaceuticals. Multi-layer designs improve durability without adding excessive weight. They allow manufacturers to tailor films for specific products. It also helps achieve cost efficiency by optimizing raw material use. R&D in polymers and coatings enhances film strength. This trend boosts versatility and application scope across diverse sectors.

Shift Toward Premiumization and High-End Packaging Applications

Premium packaging demand is rising with growth in health-conscious and luxury food segments. High-barrier films play a central role in ensuring premium product quality. It appeals to consumers willing to pay more for freshness and safety. Packaging aesthetics combined with protective performance drive premium market adoption. Companies align packaging strategies with evolving consumer lifestyles. The trend extends to nutraceuticals, organic foods, and gourmet items. High-end packaging creates stronger brand value in competitive retail channels. Premiumization positions high barrier films as enablers of both safety and luxury.

Market Challenges Analysis:

High Production Costs and Complex Raw Material Procurement

The Australia High Barrier Packaging Films Market faces challenges in managing production costs. Advanced materials such as multi-layer polymers and specialized coatings increase manufacturing expenses. It creates pressure on companies to balance innovation with affordability. Volatile raw material prices further add to uncertainty in production planning. Manufacturers often depend on imports, exposing them to currency fluctuations and supply chain risks. These challenges make cost optimization a critical factor for survival. Businesses that fail to manage expenses risk losing competitiveness. High costs limit adoption among small-scale food processors and regional players.

Recycling Limitations and Stringent Sustainability Expectations

Sustainability targets challenge manufacturers to design recyclable barrier films without compromising performance. The Australia High Barrier Packaging Films Market faces difficulties in achieving compatibility between barrier efficiency and recyclability. It requires heavy investment in R&D to overcome technical limitations. Recycling infrastructure across the region also struggles to handle complex multi-layer materials. Companies encounter regulatory pressure to reduce plastic waste. Failure to comply risks reputational damage and legal consequences. Meeting sustainability expectations demands both innovation and collaboration across value chains. These issues create significant hurdles for manufacturers trying to balance environmental and commercial priorities.

Market Opportunities:

Expansion of E-Commerce Packaging Needs and Retail Transformation

The Australia High Barrier Packaging Films Market benefits from rapid e-commerce growth. Online retail creates rising demand for packaging that ensures product safety during delivery. It strengthens the need for durable and lightweight barrier films. Companies use this opportunity to expand product reach to new consumer segments. E-commerce packaging trends emphasize both safety and visual appeal. It creates demand for innovative film designs that support branding. Businesses adopting digital-friendly packaging strategies gain competitive advantages. This opportunity reshapes supply chain dynamics across the retail sector.

Adoption of Sustainable Technologies and Bio-Based Materials

Innovation in eco-friendly solutions opens growth avenues for packaging producers. The Australia High Barrier Packaging Films Market gains momentum from bio-based and compostable film options. It aligns with consumer demand for greener alternatives. Companies investing in sustainable R&D secure long-term industry relevance. Adoption of renewable raw materials reduces environmental impacts. It also opens opportunities in premium green product categories. Partnerships with government-backed sustainability programs enhance credibility. Businesses that innovate sustainably capture stronger market positions in evolving global markets.

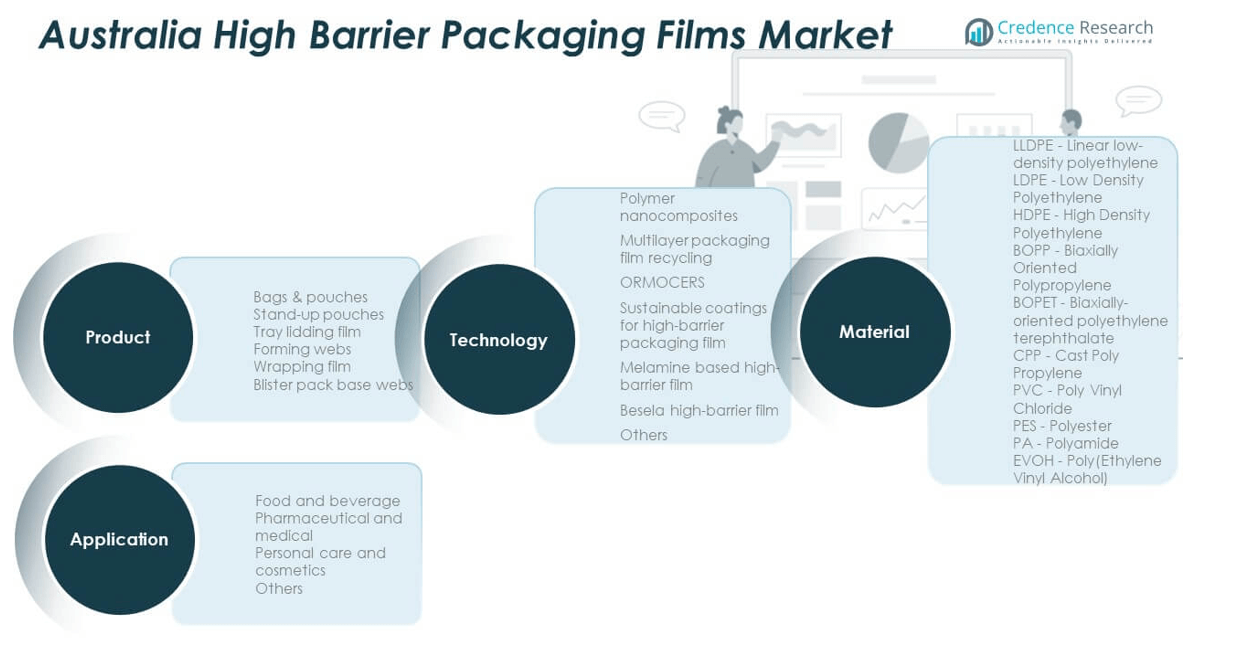

Market Segmentation Analysis:

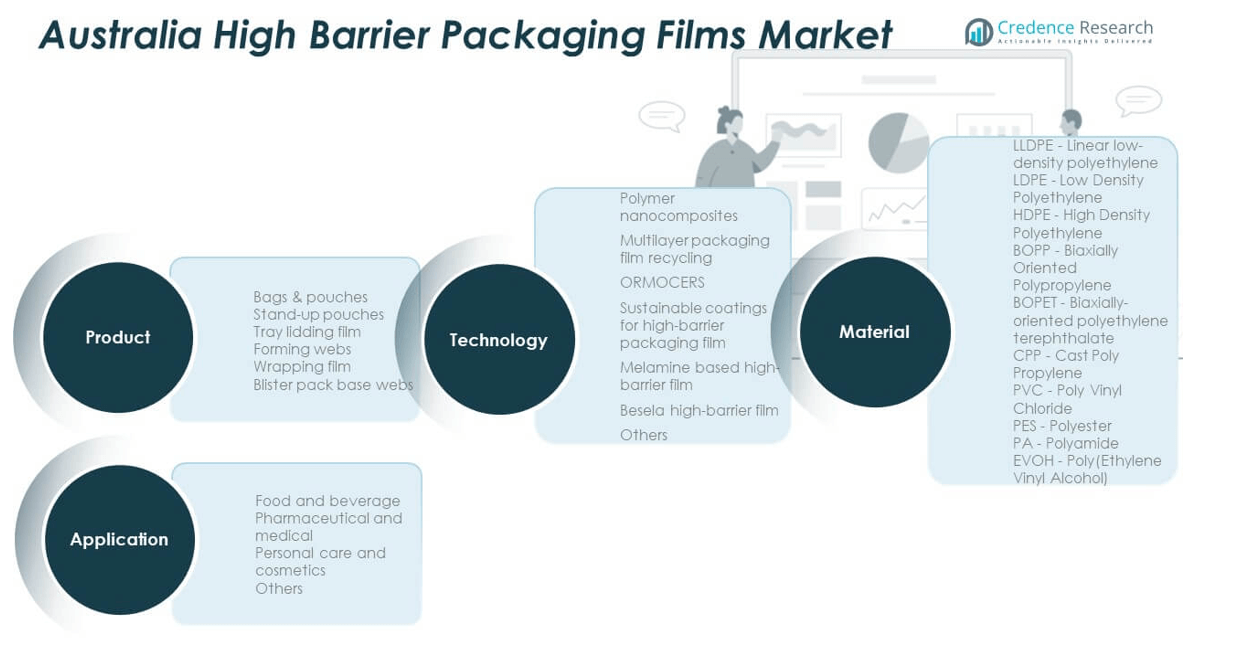

By Product Segment

The Australia High Barrier Packaging Films Market is strongly led by bags and pouches, supported by their versatility and wide adoption across food and personal care industries. Stand-up pouches gain momentum in retail environments due to strong shelf visibility and consumer convenience. Tray lidding films and forming webs remain critical in fresh produce, meat, and dairy packaging. Wrapping films continue to serve large-scale food distribution, while blister pack base webs address pharmaceutical needs with secure and tamper-resistant features.

- For instance, Huhtamaki launched its Push Tab blister lid film, made from mono-material PET and free of aluminium, allowing easier recycling and compatibility with existing blister pack lines in Australia’s pharmaceutical sector.

By Application Segment

Food and beverage dominates the market, reflecting the country’s strong packaged food industry and rising exports. Pharmaceutical and medical applications rely on barrier films to ensure product safety and regulatory compliance. Personal care and cosmetics drive demand for flexible and visually appealing formats. Other applications, including industrial goods, steadily contribute to overall adoption. It is the diverse use cases that reinforce market expansion.

- For instance, MultiFresh vacuum skin films from MULTIVAC are used for meat and seafood in Australia, offering highly transparent packaging that preserves freshness, prevents drip loss, and extends shelf life for both retailers and exporters.

By Technology Segment

Polymer nanocomposites remain at the forefront, offering superior strength and extended shelf life. Multilayer packaging film recycling gains traction under sustainability goals. ORMOCERS and sustainable coatings demonstrate potential in high-performance and eco-conscious applications. Melamine-based and Besela high-barrier films serve specialized markets that require advanced protection. It reflects a balance between innovation and practicality.

By Material Segment

LLDPE and LDPE are preferred for flexibility and cost efficiency, while HDPE provides enhanced strength. BOPP and BOPET dominate in flexible packaging due to clarity, printability, and barrier performance. CPP and PVC remain relevant in specific applications. PES and EVOH gain adoption in premium and high-barrier packaging solutions, strengthening the material landscape.

Segmentation:

By Product Segment

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

By Application Segment

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

By Technology Segment

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine Based High-Barrier Film

- Besela High-Barrier Film

- Others

By Material Segment

- LLDPE – Linear Low-Density Polyethylene

- LDPE – Low-Density Polyethylene

- HDPE – High-Density Polyethylene

- BOPP – Biaxially Oriented Polypropylene

- BOPET – Biaxially-Oriented Polyethylene Terephthalate

- CPP – Cast Polypropylene

- PVC – Polyvinyl Chloride

- PES – Polyester

- EVOH – Poly(Ethylene Vinyl Alcohol)

Regional Analysis:

Eastern and Southeastern Australia as Core Demand Centers

The Australia High Barrier Packaging Films Market sees its largest demand concentrated in Eastern and Southeastern regions, including New South Wales and Victoria. These states account for nearly 48% of the market share, supported by strong food processing, retail, and export-oriented industries. It is further fueled by urban populations with high consumption of packaged food, beverages, and pharmaceuticals. Large retail chains and distribution hubs in Sydney and Melbourne reinforce consistent adoption of advanced packaging formats. Growing sustainability programs in these regions also accelerate the transition to recyclable and eco-friendly barrier films. Their dominance highlights their role as the economic and industrial heart of the market.

Queensland and Western Australia Driving Export Growth

Queensland and Western Australia collectively hold around 32% of the market share, driven by seafood, meat, and dairy exports. Queensland benefits from its agricultural and livestock production, requiring packaging that extends shelf life during export. Western Australia strengthens demand through mining and resource-driven exports, creating secondary packaging opportunities. It is supported by export routes to Asia-Pacific markets that require strict quality compliance. These regions focus on durable packaging solutions that maintain product integrity over long shipping distances. Their contribution reflects the critical role of export logistics in shaping demand for barrier films.

Rising Opportunities in Tasmania and Northern Territories

Tasmania and the Northern Territories account for close to 20% of market share, with growth tied to niche and specialty sectors. Tasmania benefits from seafood exports and premium food production, demanding advanced barrier films for freshness preservation. The Northern Territories, though smaller in scale, show rising adoption in healthcare and specialty packaging. It is supported by government investment in local industries and trade diversification. Both regions highlight opportunities in premium, eco-conscious packaging segments catering to export and domestic markets. Their rising importance signals untapped potential that can strengthen the broader market growth in Australia.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia High Barrier Packaging Films Market features strong competition shaped by multinational players and regional manufacturers. It is driven by continuous innovation in packaging materials, technologies, and sustainability solutions. Leading companies such as Amcor, Sealed Air, Huhtamaki, and Orora dominate with established supply chains and diverse portfolios. Mid-sized firms enhance competitiveness through customized packaging formats and export-oriented solutions. Strategic investments in recycling capabilities and eco-friendly film technologies strengthen market positioning. It is also influenced by pricing pressures, regulatory compliance, and consumer demand for sustainable options. Competitive intensity is reinforced by acquisitions, partnerships, and consistent product launches across food, pharmaceutical, and personal care packaging.

Recent Developments:

- In September 2025, Sealed Air Corporation reached a major global milestone with the installation of its 4,000th rotary vacuum packaging system, reinforcing a commitment to reliability and customer partnerships through its CRYOVAC brand.

- In April 2025, Amcor plc completed a major acquisition of Berry Global, securing its role as the global leader in consumer packaging and dispensing solutions for nutrition and health. The all-stock deal achieved $650 million in identified synergies with integration already underway across its rigid and flexible packaging segments.

- In August 2025, Coveris launched MonoFlexBP, a new resealable monomaterial tray packaging solution for refrigerated goods including tortilla wraps. This recyclable innovation aligns with Coveris’ “No Waste” mission and offers extended shelf life as well as improved convenience for both manufacturers and consumers.

- In September 2025, ProAmpac expanded its capabilities with the addition of PAC Worldwide, showcasing its latest advanced flexible packaging solutions at PACK EXPO Las Vegas. Its launches included mono-material films for recyclability and fibre-based products, tailored for evolving sustainability regulations and high performance in food, e-commerce, and industrial sectors.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable barrier films will create opportunities for eco-friendly packaging solutions.

- Food and beverage exports will continue to drive adoption of durable packaging across key states.

- Pharmaceutical applications will strengthen due to regulatory focus on safety and compliance.

- Digital printing and customization in packaging will grow as brands seek stronger shelf appeal.

- Recycling technologies for multilayer films will gain traction under circular economy goals.

- Premium packaging formats will expand in health-conscious and organic product categories.

- Investments in bio-based and compostable film materials will reshape competitive strategies.

- Retail and e-commerce packaging demand will increase with the rise of online shopping.

- Regional innovation hubs will focus on lightweight yet high-strength film development.

- Strategic partnerships between global firms and local players will accelerate market expansion.