Market Overview

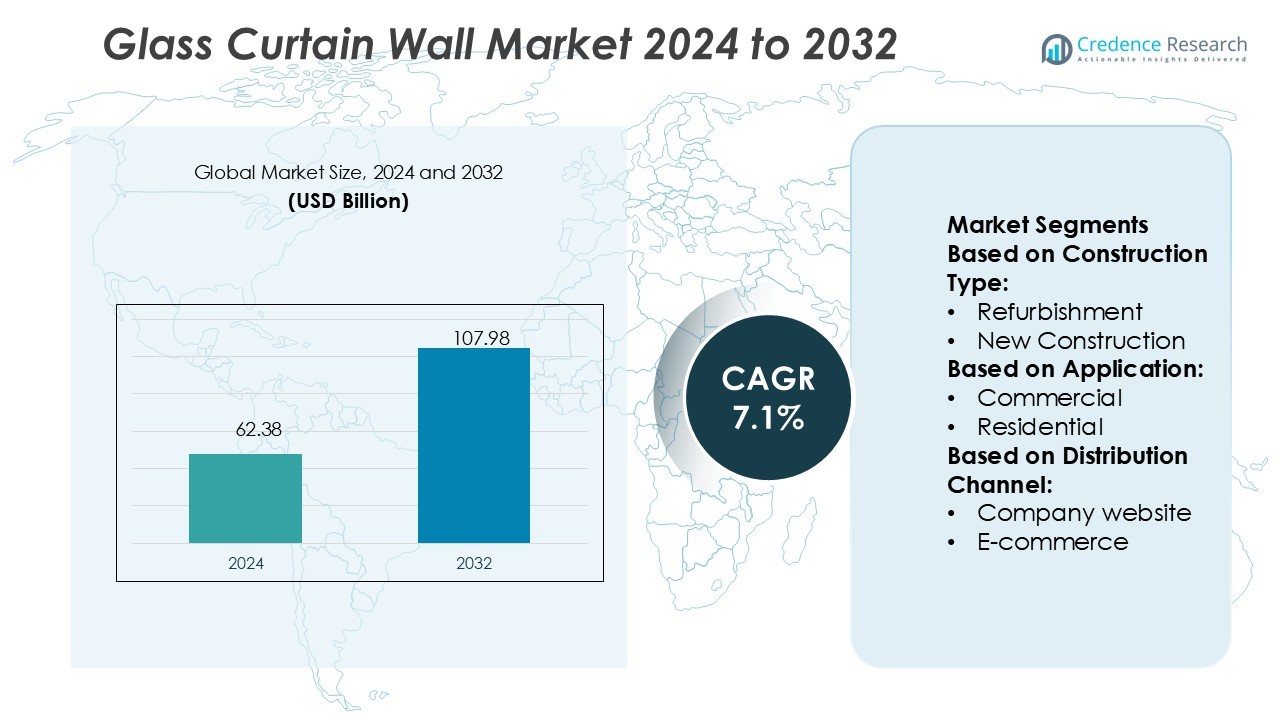

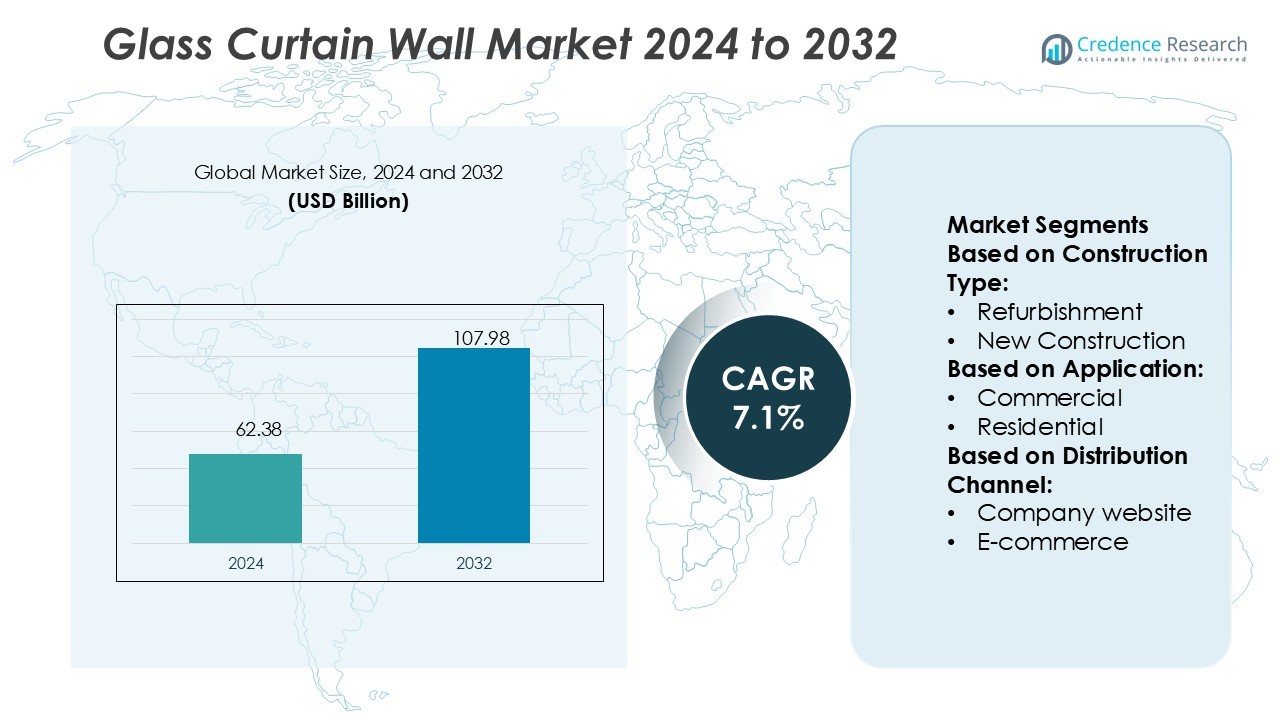

Glass Curtain Wall Market size was valued USD 62.38 billion in 2024 and is anticipated to reach USD 107.98 billion by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Curtain Wall Market Size 2024 |

USD 62.38 Billion |

| Glass Curtain Wall Market, CAGR |

7.1% |

| Glass Curtain Wall Market Size 2032 |

USD 107.98 Billion |

The glass curtain wall market is shaped by leading players such as Reynaers Group, Guardian Industries Corp., EFCO Corporation, Schott AG, Saint-Gobain Group, Nippon Sheet Glass Co., Ltd, Elicc Group, AGC Inc., Central Glass Co. LTD, and EFP International B.V. These companies focus on innovation in energy-efficient glazing, smart glass technologies, and sustainable production processes to strengthen their competitive edge. Europe leads the global market with a 32% share, supported by strict environmental regulations, advanced recycling infrastructure, and strong demand for premium commercial and residential projects, positioning the region as a frontrunner in adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The glass curtain wall market size was USD 62.38 billion in 2024 and will reach USD 107.98 billion by 2032, registering a CAGR of 7.1%.

- Rising demand for energy-efficient and sustainable buildings is a key driver, supported by innovations in smart glass, double-glazing systems, and low-emissivity coatings.

- A major trend is the growing adoption of modern architectural designs and premium facades in commercial projects, with the commercial segment holding a 68% share.

- High installation and maintenance costs, along with safety concerns related to structural performance under extreme conditions, remain key restraints.

- Europe leads with a 32% share, driven by strict environmental regulations and recycling infrastructure, while Asia-Pacific holds 30% and is the fastest-growing region due to rapid urbanization and large-scale high-rise construction.

Market Segmentation Analysis:

By Construction Type

The new construction segment dominates the glass curtain wall market, holding a 61% share in 2024. This leadership is driven by rapid urbanization, infrastructure expansion, and rising demand for modern architectural designs in commercial and residential projects. Governments and private developers favor curtain wall systems for energy efficiency and aesthetics in new builds. Increasing focus on green building standards and advanced glazing technologies further supports adoption. In contrast, refurbishment projects grow steadily, supported by retrofitting initiatives in aging buildings to enhance energy performance and extend lifespan.

- For instance, Ardagh commissioned its NextGen hybrid furnace in Obernkirchen, achieving a 64 % reduction in emissions per bottle at that line.It built a hydrogen electrolyser in Limmared (Sweden) to feed low-carbon hydrogen into its glass melting system.

By Application

The commercial segment leads with a 68% share, making it the largest application area in the market. Corporate offices, retail complexes, and institutional buildings adopt glass curtain walls for aesthetic appeal and natural lighting benefits. Multinational firms prioritize these structures to project modern brand identity and comply with sustainability regulations. Demand is reinforced by large-scale commercial construction projects in urban hubs worldwide. The residential segment, though smaller, is expanding as luxury apartments and high-rise housing projects integrate curtain walls for premium design, energy efficiency, and higher property value.

- For instance, Encirc has implemented new techniques to lightweight its glass water bottles. Separately, Encirc’s new hydrogen-powered hybrid furnace, scheduled to be operational in 2027 in partnership with Diageo, aims to produce up to 200 million net-zero bottles per year.

By Distribution Channel

Offline channels dominate the distribution landscape, capturing a 72% share in 2024. Supermarkets, hypermarkets, and specialty stores remain primary sales points, ensuring physical inspection and trusted procurement for large-scale projects. Construction firms and architects prefer direct interactions with suppliers, enabling tailored solutions and after-sales support. Specialty stores contribute significantly by offering customized glass curtain wall systems. Online channels, including company websites and e-commerce platforms, are gaining traction, driven by digital procurement trends and increased transparency in pricing and product specifications, though still secondary in terms of total market contribution.

Key Growth Drivers

Rising Demand for Energy-Efficient Buildings

The adoption of glass curtain walls is strongly driven by the rising need for energy-efficient building solutions. These systems allow better insulation, natural lighting, and reduced reliance on artificial heating and cooling. Governments are enforcing stricter energy regulations, pushing developers to incorporate sustainable glazing solutions. With increased emphasis on green certifications such as LEED, curtain wall installations have become essential in new construction. Advanced technologies in double-glazed and low-emissivity glass further enhance energy savings, strengthening their role in sustainable infrastructure growth.

- For instance, Anchor Glass’s catalog lists a 12 fl oz long-neck bottle (model 812V6A) with a weight of 198.45 g and height of 228.60 mm. The company’s New Product Development (NPD) team designs custom bottles and utilizes its in-house mold-making facility to streamline the process from design to pilot samples.

Urbanization and Large-Scale Infrastructure Development

Rapid urbanization worldwide has boosted large-scale infrastructure and commercial construction projects, directly driving demand for curtain wall systems. Expanding metropolitan cities increasingly adopt glass facades in high-rise buildings, shopping complexes, and airports. These structures serve both functional and aesthetic purposes, enhancing city skylines and delivering modern architectural appeal. Emerging economies, particularly in Asia-Pacific and the Middle East, invest heavily in smart cities and large-scale real estate projects. This consistent rise in new construction projects solidifies curtain walls as a standard choice in modern urban infrastructure development.

- For instance, Gerresheimer’s Lohr site now uses an oxy-hybrid furnace that can operate with up to 50% electricity input, reducing CO₂ emissions by up to 40% compared to conventional furnace technology.

Growing Preference for Aesthetic and Premium Designs

Architectural preferences for premium, aesthetic, and innovative designs have accelerated the adoption of glass curtain walls. Developers and corporations prefer sleek glass facades that enhance visibility, natural daylight, and brand identity. Curtain wall systems offer design flexibility and modern appeal, making them the first choice for corporate offices and luxury residential complexes. Growing disposable incomes and demand for premium housing also support this trend. Additionally, advanced customization options in glass, coatings, and finishes make curtain walls attractive for projects aiming to differentiate through visual impact.

Key Trends & Opportunities

Integration of Smart and Adaptive Glass Technologies

A major trend is the integration of smart glass technologies into curtain wall systems. Dynamic glazing and electrochromic glass allow buildings to adjust transparency levels automatically, reducing heat gain and glare. This innovation aligns with sustainable building practices while enhancing occupant comfort. Market players are investing in adaptive glazing solutions to meet evolving architectural and regulatory demands. As smart cities expand, opportunities for smart curtain wall installations rise, positioning this segment as a major growth avenue for manufacturers and construction stakeholders.

- For instance, AGI Greenpac’s Bhongir plant utilizes a colouring forehearth line, which enables the production of a variety of glass colors for specialized container segments. The company manufactures a wide range of container sizes, from 5 ml pharmaceutical vials to 4,000 ml liquor bottles.

Sustainability and Recycling Opportunities

Sustainability initiatives present opportunities for growth in the glass curtain wall market. Manufacturers are increasingly focusing on recycled glass and low-carbon production processes to align with global environmental goals. Green construction trends and consumer awareness of eco-friendly materials drive higher adoption of curtain wall systems with reduced environmental footprints. Opportunities exist in developing curtain walls that incorporate recyclable components and innovative coatings for thermal efficiency. These practices not only support environmental compliance but also improve brand positioning for companies adopting sustainable production methods.

- For instance, BPL Offset offers a variety of glass bottles, including round, clear 300 ml juice bottles and 500 ml transparent water bottles suitable for freezer use. As a manufacturer and retailer, the company offers customizable printing and sources materials that meet the needs of food and beverage applications.

Key Challenges

High Installation and Maintenance Costs

One of the primary challenges in the glass curtain wall market is the high cost of installation and maintenance. Curtain wall systems require specialized materials, advanced engineering, and skilled labor, significantly increasing project costs. Maintenance demands, including regular cleaning and inspection, further add to expenses. For developers in cost-sensitive regions, these financial constraints limit adoption, especially in residential projects. Market growth may slow in price-sensitive sectors unless technological advancements or economies of scale help reduce overall cost burdens for end-users.

Structural and Safety Concerns

Structural integrity and safety concerns pose another challenge for the widespread adoption of glass curtain walls. Exposure to extreme weather conditions, seismic activities, or thermal stresses can compromise curtain wall performance. Failure in sealing or glazing can lead to water leakage, energy inefficiency, or even structural hazards. Ensuring compliance with stringent building codes and standards requires advanced design and testing, which increases complexity. These safety-related concerns make developers cautious, pushing suppliers to continually innovate and strengthen durability to maintain market confidence.

Regional Analysis

North America

North America holds a 28% share of the glass curtain wall market in 2024, driven by strong adoption in commercial high-rise projects across the U.S. and Canada. The region benefits from stringent energy-efficiency standards, which encourage the use of advanced glazing solutions and low-emissivity coatings. Demand is supported by corporate headquarters, luxury residential towers, and institutional buildings prioritizing modern aesthetics and sustainability. Ongoing investments in urban redevelopment and infrastructure upgrades further stimulate the market. Additionally, the integration of smart glass technologies and retrofitting projects in older buildings strengthens regional demand.

Europe

Europe leads the global glass curtain wall market with a 32% share in 2024, supported by its advanced recycling infrastructure and strict environmental regulations. Countries such as Germany, France, and the UK dominate due to their high demand for energy-efficient building solutions. Green construction policies and rising adoption of premium glass facades in commercial and residential projects drive growth. The region also benefits from innovation in lightweight and recycled glass products, aligning with sustainability goals. Renovation and refurbishment projects, particularly in older European cities, further boost the adoption of modern curtain wall systems.

Asia-Pacific

Asia-Pacific accounts for a 30% share of the glass curtain wall market in 2024, making it the fastest-growing regional segment. Rapid urbanization, large-scale commercial construction, and smart city initiatives across China, India, and Southeast Asia are major drivers. High-rise buildings, airports, and retail complexes increasingly incorporate curtain walls for aesthetics and energy efficiency. Rising disposable incomes also fuel demand in luxury residential projects. Governments in the region actively promote sustainable infrastructure, enhancing market growth. Additionally, the presence of cost-effective manufacturing hubs in China and India supports competitive pricing and higher adoption rates.

Latin America

Latin America captures a 4% share of the glass curtain wall market in 2024, with Brazil and Mexico leading adoption. Growth is fueled by commercial real estate projects, modern office complexes, and high-end residential towers in major urban centers. The market benefits from gradual economic recovery, foreign investments, and rising focus on sustainable construction practices. Developers are increasingly turning to curtain walls to meet architectural demands for aesthetics and energy efficiency. However, high costs and limited local production capacity challenge growth. Still, ongoing investments in infrastructure and urban redevelopment projects provide long-term opportunities in the region.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the glass curtain wall market in 2024, supported by rapid construction growth in Gulf countries. Mega-projects in Saudi Arabia, UAE, and Qatar, including smart cities and high-rise developments, significantly boost demand. Luxury hotels, shopping malls, and office towers increasingly feature curtain wall facades to attract global investors. Harsh climatic conditions drive the use of high-performance glazing with thermal control features. While Africa remains at an early stage, urbanization and commercial expansion in South Africa and Nigeria present emerging opportunities for growth in the market.

Market Segmentations:

By Construction Type:

- Refurbishment

- New Construction

By Application:

By Distribution Channel:

- Company website

- E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The glass curtain wall market features strong competition with key players including Reynaers Group, Guardian Industries Corp., EFCO Corporation, Schott AG, Saint-Gobain Group, Nippon Sheet Glass Co., Ltd, Elicc Group, AGC Inc., Central Glass Co. LTD, and EFP International B.V. The glass curtain wall market is highly competitive, characterized by continuous innovation and strategic expansion. Companies emphasize the development of advanced glazing technologies, lightweight materials, and sustainable solutions to align with global green building standards. The market is shaped by rising demand for energy-efficient designs, driving significant investment in smart glass and double-glazing systems. Strategic collaborations with construction firms, along with investments in research and development, enhance product portfolios and broaden applications across commercial and residential projects. Regional expansion, acquisitions, and technological advancements remain central to strengthening market presence and achieving long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Reynaers Group

- Guardian Industries Corp.

- EFCO Corporation

- Schott AG

- Saint-Gobain Group

- Nippon Sheet Glass Co., Ltd

- Elicc Group

- AGC Inc.

- Central Glass Co. LTD

- EFP International B.V

Recent Developments

- In January 2025, Kawneer introduced a new addition to its curtain wall framing product family with the 1600UT SS Curtain Wall System. Specifically created to address the building and construction market’s thermal curtain wall requirements, the 1600UT SS will enter the marketplace with a complete system U-factor of 0.29, utilizing standard 1″ glass/COG 0.24. For applications with extra thermal loads, the system can attain a total system U-factor of 0.24 for 1′ glass/COG 0.20.

- In November 2024, AluK India is revolutionizing high-rise buildings with the introduction of its W75U Unitized Curtain Walling System, an elegant, innovative solution that not just makes building tall but seen. Designed to draw attention and constructed to last, it is the perfect solution for every skyscraper. The system has an array of strong advantages for high-rise buildings.

- In October 2024, Kuraray’s Advanced Interlayer Solutions Division introduced Trosifol® R3, a sustainable interlayer for laminated glass that reduces CO₂ emissions by up to 90% compared to standard PVB interlayers. Unveiled at Glasstec 2024, this innovation aligns with Kuraray’s commitment to sustainability, offering architects and engineers a high-performance, eco-friendly solution for reducing the carbon footprint in construction projects.

- In May 2024, Dow Chemical International Private Limited (Dow India) and Glass Wall Systems India signed an agreement for Dow to supply DOWSIL™ Facade Sealants from Dow’s Decarbia™ portfolio of reduced-carbon solutions.

Report Coverage

The research report offers an in-depth analysis based on ConstructionType, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for energy-efficient and sustainable buildings.

- Adoption of smart glass and adaptive glazing technologies will accelerate.

- Urbanization will continue to drive large-scale commercial and residential projects.

- Retrofitting of old buildings with curtain walls will increase steadily.

- Asia-Pacific will emerge as the fastest-growing regional market.

- Europe will maintain leadership due to strict environmental regulations.

- Integration of recyclable and eco-friendly materials will gain momentum.

- High-rise construction in developing economies will create strong growth opportunities.

- Digital design and modular construction methods will improve adoption.

- Strategic partnerships between manufacturers and builders will strengthen market presence.