Market Overview:

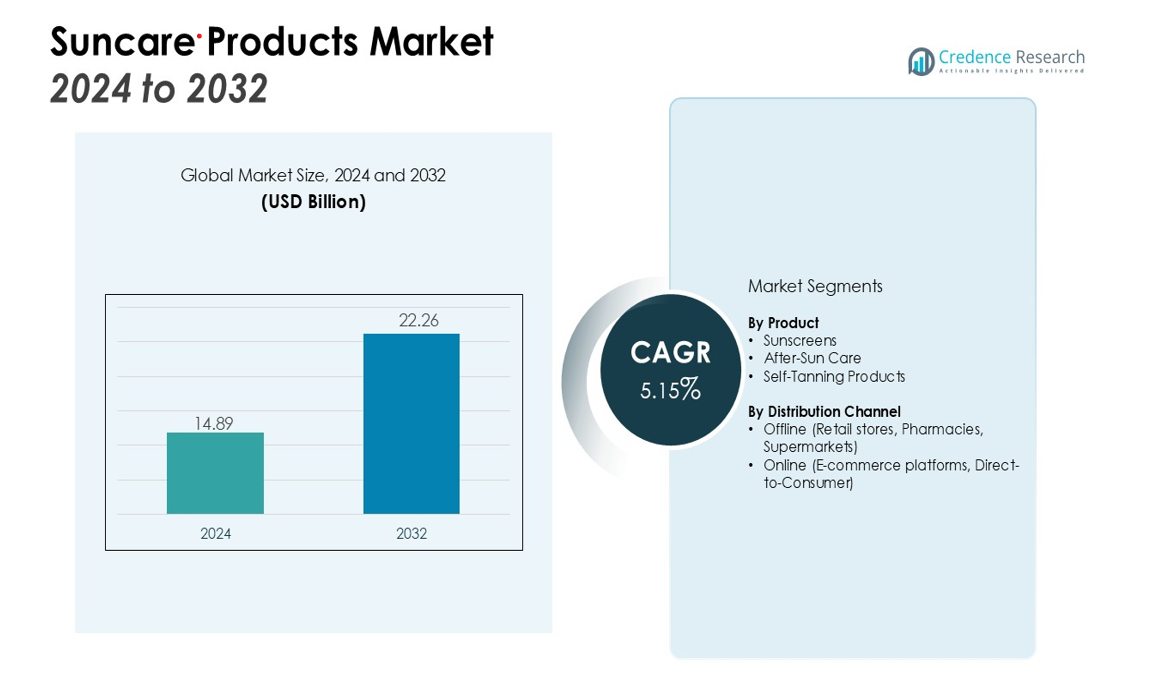

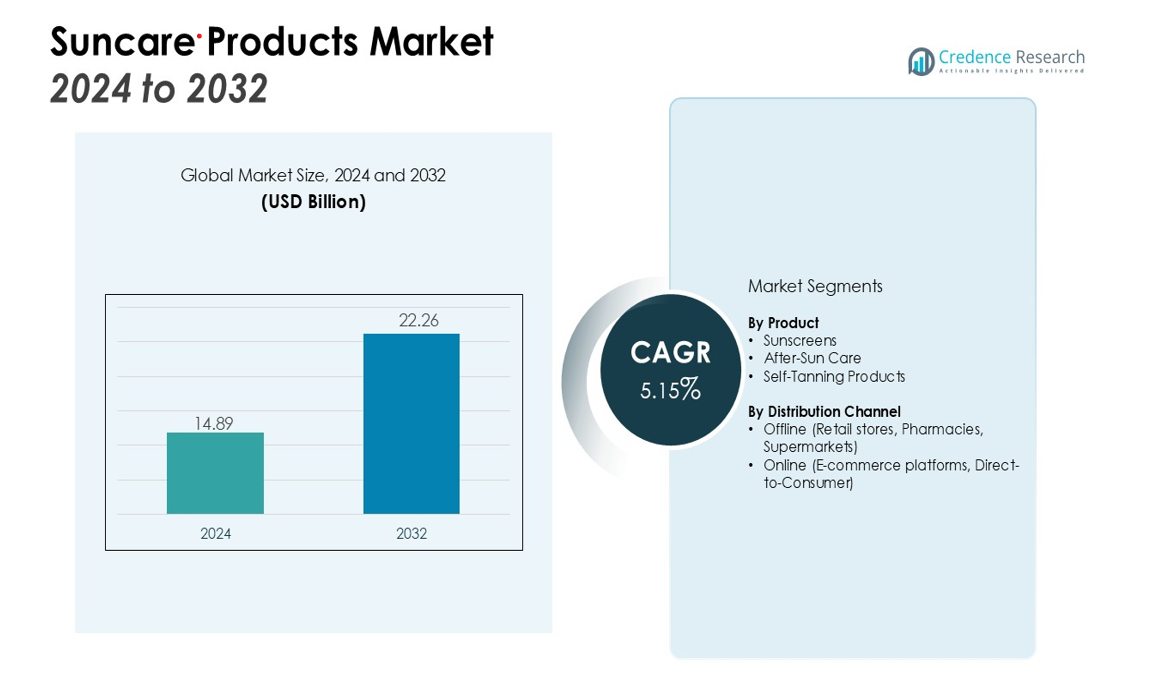

The Suncare Products Market size was valued at USD 14.89 billion in 2024 and is anticipated to reach USD 22.26 billion by 2032, at a CAGR of 5.15% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Suncare Products Market Size 2024 |

USD 14.89 billion |

| Suncare Products Market, CAGR |

5.15% |

| Suncare Products Market Size 2032 |

USD 22.26 billion |

Key drivers of the market include growing consumer awareness about the harmful effects of UV radiation, increasing disposable incomes, and the rising popularity of natural and organic skincare products. Innovations in formulations, such as the use of mineral-based sunscreens and the launch of eco-friendly packaging, are also contributing to market growth. Additionally, the growing influence of celebrity endorsements and digital marketing strategies have elevated consumer interest in premium suncare brands. The increasing demand for products catering to specific skin types and conditions further fuels market expansion.

Regionally, North America holds the largest market share, driven by high consumer awareness and advanced retail channels. Europe follows closely, supported by strong demand in countries like Germany and the UK. The Asia Pacific region is expected to witness the fastest growth, with rising consumer awareness and the growing popularity of suncare products in emerging economies like India and China. This region’s expanding middle class and increasing focus on skin health are key factors driving the demand for suncare products.

Market Insights:

- The Suncare Products Market was valued at USD 14.89 billion in 2024 and will reach USD 22.26 billion by 2032, expanding at a CAGR of 5.15% during 2024–2032.

- Rising awareness of UV-related skin damage, such as premature aging and skin cancer, continues to drive steady demand for daily-use sunscreens.

- Growing consumer preference for natural, mineral-based, and reef-safe formulations fuels innovation and aligns with stricter global safety regulations.

- Companies are expanding multi-functional offerings, with sprays, gels, and hybrid cosmetics combining sun protection with hydration and anti-aging properties.

- Regulatory hurdles and consumer perception challenges, including concerns over greasy textures or skin irritation, remain barriers to broader adoption.

- North America leads with 34% share, supported by high awareness and premium demand, while Europe holds 28% share with strong sustainability initiatives.

- Asia Pacific, holding 25% share, is the fastest-growing region, driven by urbanization, e-commerce expansion, and strong demand in India and China.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Awareness of UV Damage and Skin Health

Growing awareness of the harmful effects of UV radiation continues to drive demand for Suncare Products. Consumers recognize the link between sun exposure and risks such as premature aging and skin cancer. Health campaigns and dermatological recommendations have strengthened the adoption of daily sun protection routines. It is encouraging more frequent use of sunscreens beyond seasonal or beach-related applications.

- For instance, in March 2025, Kolmar Korea developed its UV-Duo Plus technology, a hybrid composite sunscreen that enhances protection against photoaging by effectively blocking long-wavelength UVA light in the 400 nm range.

Shift Toward Natural and Organic Formulations

A clear preference for natural and mineral-based formulations is reshaping consumer choices in Suncare Products. Shoppers are actively seeking products that avoid harmful chemicals and support skin safety. The popularity of reef-safe sunscreens, free from oxybenzone and octinoxate, is expanding in both developed and emerging markets. It is creating opportunities for companies to innovate with eco-friendly and sustainable ingredient profiles.

- For instance, in April 2025, Shiseido developed a next-generation mineral sunscreen technology that increases the UV protection effect by up to 2.2 times compared to previous formulations without the technology.

Innovation in Product Formats and Multi-Functional Benefits

Advances in formulation and design are transforming the Suncare Products portfolio. Brands are introducing sprays, gels, sticks, and hybrid cosmetics that combine sun protection with skincare benefits. Anti-aging properties, hydration support, and lightweight textures appeal to modern consumers seeking convenience. It strengthens the premiumization trend and elevates the market beyond traditional sunscreen offerings.

Influence of Lifestyle Trends and Digital Marketing

Changing lifestyles and growing engagement with beauty and wellness trends continue to support Suncare Products adoption. Celebrity endorsements and influencer campaigns highlight product visibility and shape consumer behavior. Online platforms and targeted marketing enhance awareness of premium and specialized options. It positions suncare as an essential part of personal care, not just seasonal necessity.

Market Trends:

Growing Demand for Multi-Functional and Innovative Formats

Innovation in Suncare Products is reshaping the market, with consumers favoring multifunctional offerings. Sunscreens combined with anti-aging, hydration, and brightening properties appeal to buyers seeking convenience and added value. Spray-based and stick formats are gaining traction for portability and ease of use. Hybrid products blending sun protection with cosmetics, such as tinted moisturizers or BB creams, are increasingly popular. It is driving premiumization and shifting consumer perception of sunscreen from a seasonal necessity to a year-round skincare essential. The trend reflects broader interest in products that integrate wellness, beauty, and protection into daily routines.

- For instance, Cell Fusion C developed its UV Care Formula Jelly, an edible sun care product that contains 1000mg of the patented plant extract Agatri, which helps address skin damage from UV rays.

Sustainability and Personalization Driving Product Innovation

Sustainability has emerged as a critical trend shaping Suncare Products, with brands adopting reef-safe ingredients and recyclable packaging to meet rising environmental expectations. Consumers prefer mineral-based formulations that avoid harmful chemicals while maintaining effective UV protection. Companies are introducing biodegradable packaging solutions to align with eco-conscious demand. Personalization is also influencing the market, with products tailored to specific skin types, tones, and sensitivities. It is encouraging greater inclusivity and helping brands address unmet needs in diverse consumer segments. Digital engagement, including AI-based skin analysis tools, supports personalized recommendations and strengthens brand loyalty in competitive markets.

- For instance, Perfect Corp.’s AI Skin Analysis technology provides personalized skincare recommendations by detecting up to 15 different skin concerns, including wrinkles, spots, and texture.

Market Challenges Analysis:

Regulatory and Safety Compliance Challenges

The Suncare Products market faces increasing challenges from evolving safety regulations and ingredient restrictions. Governments and health organizations are tightening rules around chemical UV filters such as oxybenzone, driving brands to reformulate product lines. It creates pressure on companies to invest in costly research and development to ensure compliance. Meeting diverse regulatory standards across global markets adds further complexity. Consumer concerns over ingredient safety amplify scrutiny, forcing transparency in labeling and product claims. This environment slows product launches and increases operational costs for industry players.

High Competition and Consumer Perception Barriers

Intense competition in the Suncare Products sector creates challenges for differentiation, especially in crowded retail spaces. Mass-market and premium brands alike face difficulty in maintaining loyalty, as consumers often shift toward new entrants or cost-effective alternatives. It also struggles with negative perceptions that sunscreens feel greasy, cause irritation, or leave a white cast, which deters consistent usage. Educating consumers about the importance of daily sun protection remains a hurdle in many markets. Seasonal demand patterns further strain profitability, as sales often peak in summer months while remaining lower in colder seasons. These factors collectively hinder consistent revenue growth and long-term brand stability.

Market Opportunities:

Expansion Through Premium and Multi-Functional Products

The Suncare Products market presents strong opportunities in premiumization and the development of multi-functional solutions. Consumers are increasingly drawn to products that combine sun protection with skincare benefits such as hydration, anti-aging, and brightening effects. It allows brands to position offerings as essential daily care products rather than seasonal purchases. Hybrid formats like tinted sunscreens and cosmetic-infused SPF products appeal to convenience-focused buyers. Demand for lightweight, non-greasy, and dermatologically tested formulas creates room for product differentiation. Expanding premium ranges with targeted features will strengthen margins and enhance brand loyalty.

Sustainability and Growth in Emerging Markets

Sustainable innovation provides a key growth avenue for Suncare Products, with eco-friendly packaging, reef-safe ingredients, and biodegradable formulations resonating strongly with environmentally aware consumers. It aligns with regulatory pressures and consumer demand for safer, greener alternatives. Emerging economies in Asia Pacific and Latin America also offer high growth potential, driven by rising disposable incomes and increasing awareness of skin health. Companies can capture these markets through affordable yet innovative product lines tailored to local skin types and climates. E-commerce channels further extend accessibility, enabling brands to scale faster in underserved regions. Together, these trends open pathways for long-term global expansion.

Market Segmentation Analysis:

By Product

The Suncare Products market is segmented by product type, including sunscreens, after-sun care, and self-tanning products. Sunscreens dominate the market, driven by increasing awareness of skin protection from harmful UV rays. Within this category, sprays, lotions, and gels are the most commonly used formats. Anti-aging sunscreens, offering added benefits like hydration and skin nourishment, are gaining popularity. After-sun care products are growing due to rising awareness of skin recovery post-exposure, while self-tanning products see increasing demand as consumers seek alternative ways to achieve a tan without sun exposure. Innovation in these product types continues to drive the market, particularly with the introduction of mineral-based and eco-friendly formulations.

- For instance, BASF developed Tinomax™ CC, a functionalized particle that enhances UV protection and sensory feel, composed of 100% natural-origin content according to the ISO 16128 standard.

By Distribution Channel

The distribution channel segment of Suncare Products includes online and offline channels. Offline sales continue to dominate, with brick-and-mortar stores, pharmacies, and supermarkets being key contributors. These channels provide consumers the ability to try products before purchase, strengthening customer loyalty. However, e-commerce has emerged as the fastest-growing distribution channel, driven by convenience and the increasing popularity of direct-to-consumer sales. Online platforms also enable greater access to niche and premium brands, expanding market reach. Digital marketing strategies and influencer collaborations play a significant role in driving online sales, especially in emerging markets where e-commerce growth is robust.

- For instance, Ulta Beauty’s Ultamate Rewards loyalty program, which strengthens customer engagement across both its offline and online channels, grew to 44.6 million active members in 2025.

Segmentations:

By Product

- Sunscreens

- After-Sun Care

- Self-Tanning Products

By Distribution Channel

- Offline (Retail stores, Pharmacies, Supermarkets)

- Online (E-commerce platforms, Direct-to-Consumer)

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America Leading with Strong Consumer Awareness and Premium Demand

North America holds 34% share of the Suncare Products market, making it the largest regional contributor. The region benefits from strong consumer awareness and high adoption of preventive skincare routines. Advanced retail networks and global brand penetration ensure accessibility across both online and offline channels. It experiences growing demand for mineral-based sunscreens and dermatologist-recommended solutions. Seasonal tourism boosts summer sales, while premium, multi-functional products maintain year-round demand. Strict regulatory oversight also drives cleaner and safer formulations across the market.

Europe Strengthened by Regulatory Compliance and Sustainability Focus

Europe accounts for 28% share of the Suncare Products market, supported by robust demand in Germany, France, and the UK. The region is influenced by strict safety standards and consumer preference for eco-friendly and reef-safe formulations. Strong recycling systems and sustainable packaging initiatives align with environmental policies, pushing innovation. Cosmetic-integrated SPF products continue to perform well in urban markets, reflecting demand for convenience. Southern European countries such as Spain and Italy show seasonal peaks due to high tourist activity. It remains a leader in sustainable suncare innovation and sets a benchmark for global standards.

Asia Pacific Emerging as the Fastest-Growing Market

Asia Pacific represents 25% share of the Suncare Products market and is the fastest-growing region. It benefits from rapid urbanization, lifestyle shifts, and expanding middle-class populations in India, China, and Indonesia. Strong cultural interest in whitening and brightening formulations supports rising product adoption. It also gains from the surge of e-commerce, making products more accessible across diverse geographies. Affordable solutions alongside premium offerings allow companies to target a wide consumer base. Year-round demand across different climates strengthens its long-term growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Beiersdorf AG

- Groupe Clarins

- Johnson & Johnson

- Coty Inc.

- Shiseido Co. Ltd.

- L’oreal

- The Estee Lauder Companies Inc.

- Burt’s Bees

- Bioderma Laboratories

- Unilever

Competitive Analysis:

The Suncare Products market is highly competitive, with several key players dominating the global landscape. Leading brands such as L’Oréal, Estée Lauder, Johnson & Johnson, and Beiersdorf AG focus on innovation and expanding their product portfolios to cater to evolving consumer preferences. These companies invest heavily in research and development, emphasizing mineral-based formulations, eco-friendly packaging, and multi-functional products like tinted sunscreens. Smaller, emerging brands are capitalizing on the growing demand for natural and organic skincare products, offering specialized products that appeal to environmentally conscious consumers. The market is also witnessing increased digital marketing efforts, with influencers and celebrities boosting brand visibility. Regional players, particularly in Asia Pacific, are responding to local preferences, offering affordable and culturally tailored solutions. Price sensitivity remains a critical factor, with premium brands focusing on differentiating themselves through product quality and unique formulations.

Recent Developments:

- In August 2025, Beiersdorf AG launched its NIVEA Epigenetics Rejuvenating Serum with Epicelline, the biggest launch in the brand’s history.

- In July 2025, Johnson & Johnson MedTech announced a strategic co-promotion agreement with Pacira BioSciences to expand its portfolio for early intervention of osteoarthritis of the knee.

- In May 2025, Shiseido Co. Ltd. announced itsits decision to merge with its wholly-owned subsidiary, ETWAS Co., Ltd., effective July 1, 2025, as part of a plan to improve operational efficiency.

Report Coverage:

The research report offers an in-depth analysis based on Product, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Suncare Products market will continue expanding with rising awareness of skin health and UV protection.

- Demand for mineral-based and reef-safe formulations will strengthen as regulations and eco-conscious preferences align.

- Multi-functional sunscreens offering anti-aging, hydration, and cosmetic benefits will drive premium product adoption.

- Growth of e-commerce and direct-to-consumer channels will enhance global product accessibility.

- Brands will focus on personalization, tailoring solutions to skin types, tones, and sensitivities.

- Innovation in packaging, including biodegradable and recyclable formats, will support sustainability goals.

- Emerging markets in Asia Pacific and Latin America will see rising demand, fueled by income growth and lifestyle changes.

- Digital marketing, influencer collaborations, and AI-driven skin analysis tools will enhance consumer engagement and loyalty.

- Companies will invest in dermatological research to address consumer concerns over product texture, irritation, and safety.

- Seasonal reliance will reduce as daily sun protection becomes integral to skincare routines worldwide.