Market Overview

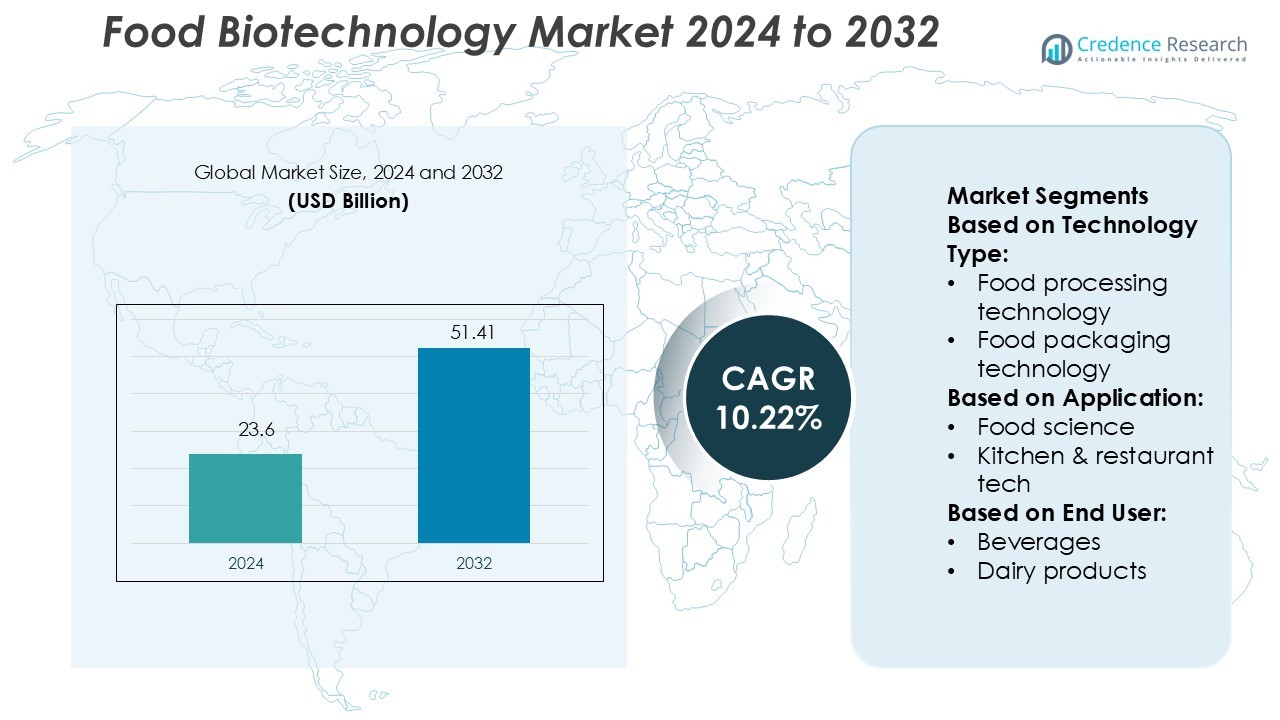

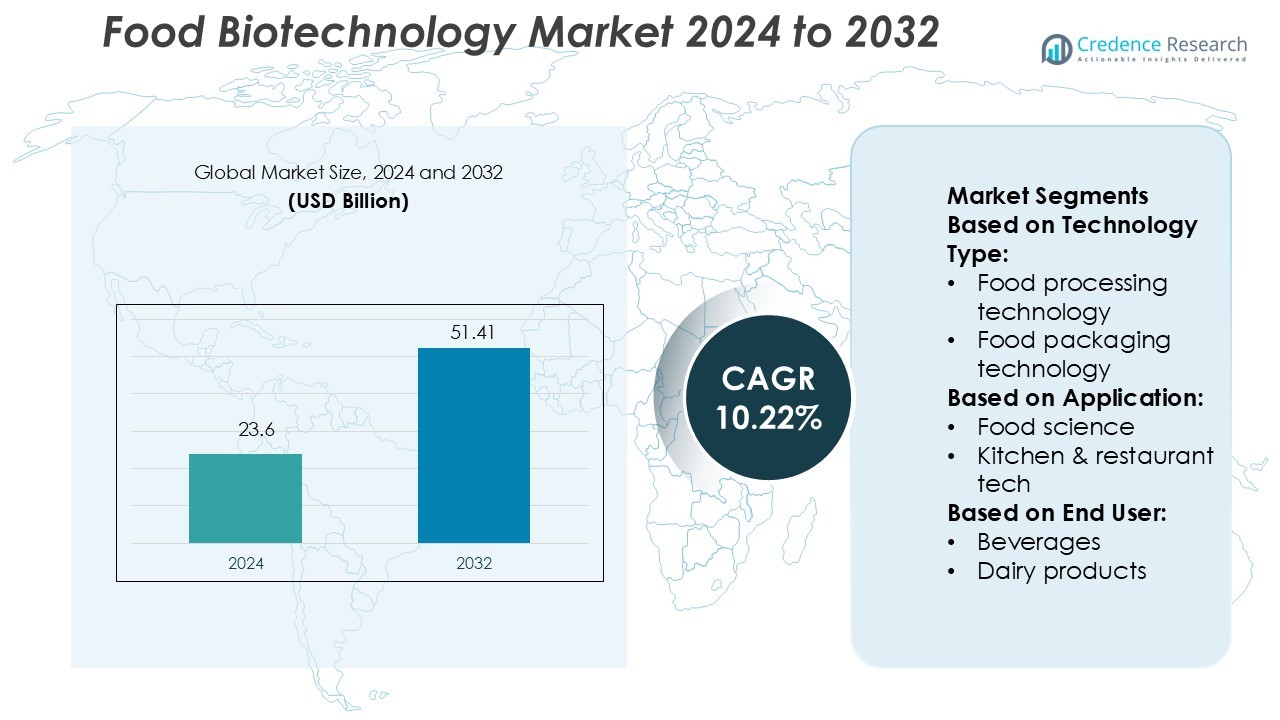

Food Biotechnology Market size was valued USD 23.6 billion in 2024 and is anticipated to reach USD 51.41 billion by 2032, at a CAGR of 10.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Biotechnology Market Size 2024 |

USD 23.6 Billion |

| Food Biotechnology Market, CAGR |

10.22% |

| Food Biotechnology Market Size 2032 |

USD 51.41 Billion |

The food biotechnology market features strong competition, with major players advancing innovation through automation, sustainable processing, and smart logistics solutions. Companies focus on enhancing product quality, shelf life, and operational efficiency through precision fermentation, biosensors, and AI integration. Strategic investments in R&D support the development of functional ingredients, lab-grown foods, and eco-friendly packaging. Partnerships between food tech platforms and biotechnology firms strengthen supply chains and food safety systems. Asia Pacific leads the market with a 34% share, driven by rapid industrialization, strong government support, and a growing consumer base for functional and fortified foods. This regional dominance shapes global strategies and market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Biotechnology Market size was valued at USD 23.6 billion in 2024 and is projected to reach USD 51.41 billion by 2032, growing at a CAGR of 10.22% during the forecast period.

- Strong market growth is driven by rising demand for functional foods, sustainable processing methods, and biotechnology-based food safety systems.

- Precision fermentation, biosensors, and AI-powered automation are key trends improving product shelf life, quality, and traceability.

- The market remains competitive with companies investing in R&D, product innovation, and strategic partnerships to strengthen supply chains and reduce operational costs.

- Asia Pacific leads the market with a 34% regional share, followed by Europe and North America, while food processing technology dominates the segment landscape, supported by rapid industrialization and growing consumer preference for fortified foods.

Market Segmentation Analysis:

By Technology Type

Food processing technology holds the dominant share in the food biotechnology market due to its widespread use across multiple production stages. Advanced bioprocessing methods improve shelf life, maintain nutritional quality, and enhance flavor. Automation and precision fermentation help manufacturers achieve consistent product standards. The demand for minimally processed and functional foods drives investment in this segment. Packaging technology also sees steady growth as companies adopt smart and biodegradable solutions. Food safety technology gains traction through stricter regulatory requirements and quality assurance measures. These developments position food processing as a key growth enabler for the market.

- For instance, Flippy 2’s high throughput of 60 baskets per hour translates to a theoretical cycle time of 60 seconds per basket. The ability to handle multiple baskets simultaneously means that an entire order can be fulfilled very quickly, potentially in a sub-60-second time frame for certain items.

By Application

Food science dominates the application segment, supported by extensive R&D activities focused on product innovation and sustainability. Biotechnology applications in food science enhance nutrient profiles, optimize fermentation, and create healthier formulations. Companies use genetic engineering and microbial solutions to meet evolving consumer preferences. Kitchen and restaurant tech also grows steadily, supported by AI-powered cooking systems and automated prep solutions. Delivery and supply chain applications expand with the rise of smart tracking and cold chain technologies. Food science remains the largest revenue generator due to its role in enabling innovation and improving production efficiency.

- For instance, House Wellness Foods Corporation developed its Lp20 probiotic formulation containing 20 billion heat-inactivated Lactobacillus plantarum cells per gram, engineered to enhance nutrient absorption and shelf stability.

By End User

Beverages represent the dominant end-user segment, driven by the large-scale use of biotechnology in fermentation and flavor enhancement. Functional beverages, probiotics, and plant-based drinks lead innovation in this space. Producers invest in biotechnological processes to improve texture, extend shelf life, and reduce production costs. Dairy products and bakery segments also register strong adoption due to demand for clean-label and fortified products. Meat and seafood applications grow with alternative protein and lab-grown solutions. Beverages remain the largest segment as brands leverage biotechnology to create differentiated, value-added products with strong market appeal.

Key Growth Drivers

Rising Adoption of Advanced Bioprocessing Techniques

The food biotechnology market grows steadily with the rising use of advanced bioprocessing methods. Modern fermentation and enzyme technologies improve shelf life, flavor, and nutritional value. These innovations allow producers to reduce processing time and costs. Demand for clean-label, minimally processed products boosts investment in efficient bioprocessing solutions. Major players focus on scaling precision fermentation to meet consumer expectations. This approach improves production efficiency and product consistency. As consumer preferences shift toward natural and healthier food, bioprocessing technology plays a key role in driving overall market expansion.

- For instance, DH implemented a serverless rider-management architecture using Amazon EventBridge Scheduler, scaling to support 3 million registered riders delivering 10 million daily orders.

Growing Demand for Sustainable and Functional Foods

Sustainability and health concerns push food companies to integrate biotechnology into product development. Techniques like microbial fermentation and bioengineering help reduce waste and energy use. Functional foods enriched with probiotics, proteins, and plant-based ingredients gain strong consumer interest. Manufacturers adopt biotechnology to meet regulatory standards and environmental goals. Demand for eco-friendly packaging and traceable production further accelerates adoption. This driver reflects how biotechnology supports both innovation and environmental responsibility. The market benefits from a clear shift toward sustainable food systems and health-conscious consumer behavior.

- For instance, Flytrex’s drone delivery service in the DoorDash + Dallas-Fort Worth area covers over 30,000 households and more than 100,000 residents.The current drone models carry up to 6.6 pounds (≈ 3 kg); next-generation units are certified for payloads up to 8.8 pounds.

Expansion of Global Food Supply Chains

Global supply chain expansion creates strong demand for biotechnology in food safety and preservation. Advanced preservation techniques ensure product quality and reduce spoilage during transport. Biotechnology enables real-time monitoring of freshness, microbial content, and safety standards. Companies use these solutions to comply with international regulations and ensure product traceability. Emerging markets also drive adoption as logistics infrastructure expands. This shift enhances cross-border trade and ensures stable supply to meet growing food demand. Biotechnology strengthens global distribution networks, improving reliability and reducing food loss across supply chains.

Key Trends & Opportunities

Integration of Automation and AI in Food Production

Automation and AI are reshaping how biotechnology supports the food industry. Smart sensors, robotic handling, and AI-driven analytics optimize production and quality control. Automation reduces human error, improves efficiency, and enables mass customization. AI models help predict spoilage rates, fermentation quality, and nutrient retention. Startups and established firms are investing in automated systems to scale production at lower costs. This trend creates opportunities for advanced food tech companies. It also accelerates the shift toward data-driven and precise manufacturing practices in the global food biotechnology market.

- For instance, J&J’s supply-chain platform, built with Databricks, reduced data-engineering workloads by 45 % to 50 % and cut data-delivery lag from ~24 hours to under 10 minutes.

Rise of Alternative Proteins and Plant-Based Solutions

The alternative protein market creates major growth opportunities for biotechnology providers. Companies use precision fermentation, cell culture, and genetic engineering to develop plant-based and lab-grown products. These products meet rising consumer demand for sustainable and ethical food options. Improved protein structure and flavor innovations boost mainstream adoption. Governments and investors support this trend through funding and partnerships. As alternative proteins become cost-competitive, biotechnology plays a critical role in scaling production. This trend positions biotech firms at the center of the future protein ecosystem.

- For instance, Abbott achieved worldwide sales of $11.1 billion. During that quarter, the Medical Devices business delivered a 12% organic increase, while Diabetes Care grew 19% organically.

Expansion of Food Traceability and Safety Systems

Food traceability gains importance as global regulations tighten. Biotechnology enables real-time tracking of food safety parameters, reducing contamination risks. DNA barcoding, biosensors, and microbial testing strengthen quality assurance. Retailers and suppliers use these systems to increase transparency and build consumer trust. Digital traceability solutions also improve supply chain resilience. Companies that adopt these technologies can reduce recalls and operational disruptions. This growing focus on transparency and safety offers strong opportunities for biotech solution providers across global markets.

Key Challenges

Despite growing demand, biotechnological food production faces high costs due to advanced equipment and R&D requirements. Scaling up lab-based processes to commercial volumes requires substantial capital investment. Small and medium producers struggle with limited funding and access to technology. The high cost of enzymes, culture media, and precision fermentation systems remains a barrier to mass-market adoption. Addressing cost-efficiency through innovation and process optimization is crucial to achieving sustainable market growth.

Regulatory Complexity and Consumer Acceptance Issues

Stringent global regulations surrounding genetically modified organisms and biotech-derived foods pose significant hurdles. Approval timelines and labeling laws vary across regions, complicating commercialization strategies. Consumer skepticism regarding genetic modification and synthetic ingredients affects market perception. Companies like HelloFresh SE and Delivery Hero SE emphasize transparency and education to improve acceptance. Harmonizing international standards and enhancing consumer awareness remain essential to ensure smooth integration of biotechnology within the food ecosystem.

Regional Analysis

North America

North America holds a 32% market share in the food biotechnology market, supported by strong R&D infrastructure and a mature food processing sector. The region benefits from advanced regulatory frameworks, encouraging the adoption of biosensors, fermentation technologies, and clean-label ingredients. Major companies like BASF SE and Miso Robotics actively invest in AI-integrated biotech solutions. Rising consumer demand for functional and fortified food products accelerates growth. The U.S. leads in biotech-enabled production for beverages, dairy, and alternative proteins. Strategic collaborations between food tech firms and research institutions further enhance innovation and market expansion.

Europe

Europe accounts for a 28% market share, driven by its emphasis on sustainable and traceable food systems. The region’s strong regulatory standards push industries to adopt advanced food safety and packaging technologies. Companies like HelloFresh SE and Delivery Hero SE leverage biotechnology to reduce waste and ensure quality. Demand for plant-based and cultured foods continues to rise, supported by consumer awareness and environmental goals. Investment in smart fermentation, bio-packaging, and waste-to-value solutions positions Europe as a leader in sustainable biotech integration within the food industry.

Asia Pacific

Asia Pacific leads the market with a 34% market share, supported by its expanding food manufacturing base and growing consumer population. Countries like China, India, and Japan invest heavily in food processing and safety technologies. Local players such as Swiggy and Zomato integrate biotechnology with delivery and cold chain systems to maintain quality. Rapid urbanization and rising disposable incomes drive demand for fortified and functional food products. Government initiatives promoting food safety and modern processing methods further enhance market penetration. This region shows strong potential for future capacity expansion and innovation.

Latin America

Latin America holds a 4% market share, showing steady growth driven by increased investment in modern food processing infrastructure. Brazil and Mexico are emerging as key markets due to rising consumer interest in healthier and safer food options. Biotechnology adoption focuses on packaging, quality control, and fermentation technologies. Regional producers invest in cost-effective solutions to improve export competitiveness. Partnerships with global biotech firms are helping accelerate the introduction of advanced production methods and enhance food security in the region.

Middle East & Africa

The Middle East & Africa capture a 2% market share, primarily driven by rising demand for processed and packaged foods. Countries like the UAE and South Africa are adopting biotech solutions to improve food safety and extend shelf life. The region faces infrastructure and regulatory gaps, but ongoing investment in food security programs supports market growth. Partnerships with global technology providers and local food producers are helping introduce cost-effective, scalable biotechnology applications. These efforts aim to reduce dependency on imports and strengthen domestic food production capabilities.

Market Segmentations:

By Technology Type:

- Food processing technology

- Food packaging technology

By Application:

- Food science

- Kitchen & restaurant tech

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food biotechnology market is shaped by key players including Zomato, Miso Robotics, LUNCHBOX, BASF SE, Carlisle Technology, Swiggy, HelloFresh SE, Delivery Hero SE, Flytrex Inc., and Nymble (Epifeast Inc.). The food biotechnology market is highly competitive, driven by rapid innovation, strategic collaborations, and expanding global demand. Companies focus on integrating biotechnology with automation, precision fermentation, and advanced packaging solutions to enhance efficiency and sustainability. Investments in R&D strengthen capabilities in functional ingredients, food safety, and smart processing technologies. Digital platforms and AI-driven systems enable real-time monitoring, ensuring higher product quality and reduced waste. Market leaders also adopt sustainable production methods, including lab-grown and plant-based solutions, to meet environmental goals. This dynamic landscape fosters constant technological advancement, encouraging both established firms and emerging players to scale globally.

Key Player Analysis

- Zomato

- Miso Robotics

- LUNCHBOX

- BASF SE

- Carlisle Technology

- Swiggy

- HelloFresh SE

- Delivery Hero SE

- Flytrex Inc.

- Nymble (Epifeast Inc.)

Recent Developments

- In May 2025, Layn Natural Ingredients has recently launched an upgraded biotechnology facility, which will greatly improve the company’s abilities in precision fermentation and enzyme manufacturing. The initial innovation to come from the facility is Galacan, an advanced beta glucan.

- In May 2025, Nestlé announced a strategic overhaul of its worldwide R&D activities, featuring improved proficiency in biotechnology and the establishment of a new deep tech center in Orbe, located in the canton of Vaud.

- In February 2025, BASF is preparing to launch Prexio Active, a novel insecticide, after submitting registration dossiers in key Asia Pacific markets such as India. This marks a significant expansion of BASF’s insecticide portfolio, providing sustainable solutions for rice farmers. Prexio Active targets all four rice hopper species and has no known cross-resistance to market standards.

- In August 2024, ADAMA Australia collaborated with Elemental Enzymes to introduce a novel bio-fungicide to the Australian market by 2026. This product, based on Elemental Enzymes’ patented peptide technology, was expected to target foliar diseases in winter crops and spring turf, offering a new mode of action against fungal diseases such as septoria in wheat.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand through increased adoption of sustainable and bio-based food technologies.

- Automation and AI integration will enhance production efficiency and quality control.

- Demand for functional and fortified foods will drive investments in advanced biotechnology.

- Alternative proteins and cultured foods will gain strong consumer acceptance.

- Smart packaging and biosensor technologies will strengthen food safety and traceability.

- Strategic collaborations between biotech firms and food delivery platforms will accelerate innovation.

- Regulatory frameworks will evolve to support wider commercialization of biotech-enabled foods.

- Cold chain and logistics will adopt biotech solutions to extend product shelf life.

- Investment in R&D will boost the development of high-value ingredients and fermentation systems.

- Emerging markets will witness rapid adoption of modern food biotechnology solutions.