Market Overview:

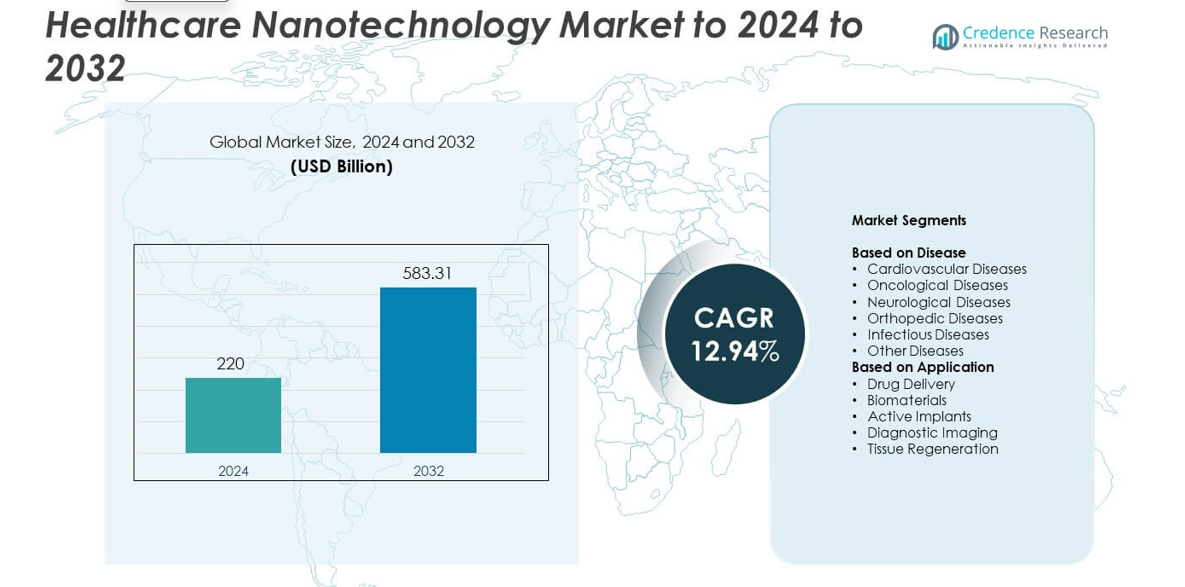

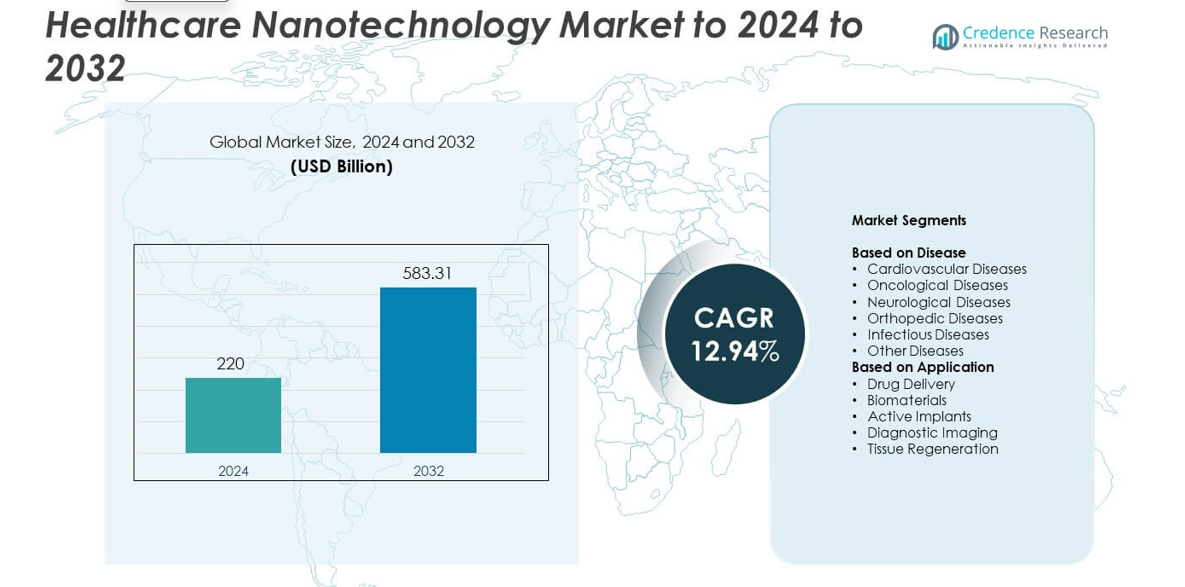

Healthcare Nanotechnology Market size was valued at USD 220 billion in 2024 and is anticipated to reach USD 583.31 billion by 2032, at a CAGR of 12.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Nanotechnology Market Size 2024 |

USD 220 billion |

| Healthcare Nanotechnology Market, CAGR |

12.94% |

| Healthcare Nanotechnology Market Size 2032 |

USD 583.31 billion |

The healthcare nanotechnology market is led by major players including Johnson and Johnson, Novartis AG, Pfizer Inc., Merck and Co. Inc., Sanofi SA, Nanobiotix, CytImmune Sciences Inc., Bristol-Myers Squibb Company (Celgene Corporation), Taiwan Liposome Company Ltd., and Starpharma Holdings Limited. These companies focus on advancing nanomedicine for targeted drug delivery, diagnostics, and regenerative therapies. North America holds the largest regional share of around 38.2% in 2024, driven by strong R&D investment and early technology adoption. Europe follows with 27.4% share, supported by innovation in clinical nanotechnology, while Asia Pacific captures 24.1% share due to expanding pharmaceutical manufacturing and government-backed research programs.

Market Insights

- The healthcare nanotechnology market was valued at USD 220 billion in 2024 and is projected to reach USD 583.31 billion by 2032, expanding at a CAGR of 12.94%.

• Growing adoption of nanomedicine in oncology, cardiovascular, and neurological treatments is driving market growth through improved drug targeting and reduced side effects.

• Emerging trends include integration of AI in nanotechnology research, rising use of nanosensors in diagnostics, and expanding applications in regenerative medicine.

• The market is competitive with key players investing in nanocarrier systems, clinical trials, and product innovations to strengthen global presence.

• North America leads with 38.2% share, followed by Europe with 27.4% and Asia Pacific with 24.1%, while oncological diseases hold 37.6% and drug delivery dominates applications with 42.8% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Disease

Oncological diseases dominate the healthcare nanotechnology market, accounting for around 37.6% share in 2024. The dominance stems from the widespread adoption of nanocarriers and nanoparticle-based drug formulations for targeted cancer therapy. Advancements in nanomedicine have improved tumor imaging, site-specific delivery, and reduced systemic toxicity. The growing prevalence of cancer and increasing investments in precision oncology are major drivers. Nanotechnology-enabled diagnostic tools and theranostic platforms are accelerating early detection and personalized treatment, further strengthening demand in this disease category.

- For instance, Alnylam’s LNP-siRNA patisiran reaches steady-state Cmax 7.15 ± 2.14 µg/mL at 0.3 mg/kg every 3 weeks, confirming effective nanoparticle delivery in humans.

By Application

Drug delivery leads the healthcare nanotechnology market, holding nearly 42.8% share in 2024. The segment benefits from the superior efficacy, bioavailability, and controlled release achieved through nanocarriers such as liposomes, dendrimers, and polymeric nanoparticles. Rising demand for targeted therapies and reduction in adverse drug reactions drive adoption across pharmaceuticals and biotechnology sectors. Continuous innovation in nanostructured drug systems and regulatory approvals for nanomedicines support market expansion. Growing research in mRNA delivery and nanoparticle-based formulations continues to enhance clinical outcomes and commercial opportunities.

- For instance, Bristol Myers Squibb’s nab-paclitaxel (Abraxane) demonstrated a significantly higher objective response rate versus solvent-based paclitaxel in the pivotal Phase III clinical trial (33% vs 19%, \(P=0.001\))

Key Growth Drivers

Advancements in Nanomedicine and Targeted Drug Delivery

Continuous innovation in nanomedicine and targeted drug delivery significantly drives the healthcare nanotechnology market. Nanoparticles enable site-specific drug transport, reducing toxicity and improving therapeutic efficiency. Pharmaceutical companies are investing in nanocarrier systems such as liposomes, micelles, and dendrimers to enhance drug solubility and control release. Growing regulatory approvals for nanoparticle-based formulations further accelerate adoption. This technological evolution supports personalized medicine and expands nanotechnology’s role in oncology, neurology, and infectious disease treatment.

- For instance, Moderna’s mRNA-1273 delivered via lipid nanoparticles achieved 94.1% efficacy in a 30,000-participant phase-3 trial, demonstrating clinical impact of nano-enabled delivery.

Rising Burden of Chronic and Lifestyle Diseases

The growing prevalence of cancer, cardiovascular disorders, and neurological diseases creates strong demand for nanotechnology-based therapies. Nanomedicine provides precise diagnostics and controlled treatment options for complex diseases. The global shift toward minimally invasive healthcare solutions enhances the use of nanoscale devices and biomaterials. Increasing investments in research to develop disease-specific nanocarriers and biosensors further support market growth. Healthcare providers are integrating nanotechnology to improve patient outcomes and reduce hospital stays.

- For instance, Jazz Pharmaceuticals’ liposomal CPX-351 (Vyxeos) improved median overall survival to 9.56 months vs 5.95 months versus 7+3 in a phase-3 AML study (HR 0.69).

Expanding Role of Diagnostic and Imaging Applications

The adoption of nanotechnology in imaging and diagnostics is accelerating, boosting early disease detection and precision care. Nanoparticles enhance contrast in MRI, CT, and PET scans, allowing accurate visualization of cellular processes. Growing demand for non-invasive diagnostic methods and integration of nanoprobes in imaging systems promote innovation. The convergence of nanotechnology with AI-based image analysis offers faster, more reliable results. These advancements are improving diagnostic accuracy and driving growth across the medical imaging segment.

Key Trends & Opportunities

Growth in Regenerative Medicine and Tissue Engineering

Nanotechnology is becoming integral to regenerative medicine, aiding in the development of advanced biomaterials and scaffolds. Nanoscale coatings and structures enhance tissue repair and compatibility in orthopedic and cardiovascular implants. Research in stem cell-based nanoscaffolds is expanding possibilities for organ regeneration and wound healing. The increasing collaboration between biotechnology firms and academic institutions fosters innovation, opening opportunities for next-generation regenerative solutions using nanomaterials.

- For instance, Evonik’s RESOMER RG 752 H (PLGA 75:25) shows inherent viscosity 0.14–0.22 dL/g and biodegrades in ≤6 months, supporting controlled-release and scaffold use.

Integration of Artificial Intelligence and Nanotechnology

The combination of AI with nanotechnology is transforming data-driven healthcare applications. AI models enable predictive analysis of nanomaterial interactions and optimize nanoparticle design for therapy and diagnostics. Integration in drug discovery shortens development cycles and enhances precision. Smart nanodevices equipped with AI algorithms allow real-time monitoring of biological responses, boosting personalized medicine. This synergy is creating opportunities for faster innovation and clinical translation in healthcare nanotechnology.

- For instance, Nanite’s SAYER platform combines AI-driven polymer design with multiplexed in-vivo screening to create tissue-targeted polymer nanoparticles for gene delivery, as reported in 2024 collaboration releases.

Key Challenges

Regulatory and Safety Concerns

Strict regulatory frameworks and safety assessment challenges hinder the widespread adoption of nanotechnology in healthcare. Understanding long-term toxicity, biocompatibility, and environmental impact of nanomaterials remains complex. Limited standardization across regions leads to delays in clinical translation and product approval. These factors increase development costs and reduce market accessibility for smaller innovators. Addressing these challenges requires harmonized guidelines and robust toxicological evaluation frameworks.

High Production Costs and Complex Manufacturing

Manufacturing nanomaterials involves advanced technology, precision control, and high capital investment. The complexity of producing uniform and stable nanoparticles affects scalability and affordability. Small and medium enterprises face difficulties in meeting stringent quality standards, limiting product commercialization. Additionally, maintaining consistent particle size and purity demands specialized infrastructure. These production challenges constrain large-scale adoption, slowing market growth despite rising demand in medical applications.

Regional Analysis

North America

North America dominates the healthcare nanotechnology market, accounting for around 38.2% share in 2024. The region’s leadership is driven by strong research infrastructure, high healthcare spending, and early adoption of nanomedicine in drug delivery and diagnostics. The United States leads with extensive investments in nanobiotechnology and cancer nanotherapeutics. Strategic collaborations between pharmaceutical companies and research institutions enhance innovation. Regulatory approvals from the FDA for nanoparticle-based formulations further boost commercialization. Growing demand for precision medicine and advanced imaging solutions continues to strengthen regional growth across both the U.S. and Canada.

Europe

Europe holds a significant 27.4% share of the healthcare nanotechnology market in 2024, supported by advanced medical research and strong governmental funding. Countries such as Germany, the United Kingdom, and France are leading contributors to nanomedicine development. The region benefits from favorable regulatory initiatives promoting nanotechnology integration in healthcare systems. Expanding clinical applications in drug delivery, diagnostics, and tissue regeneration further accelerate growth. Academic–industry partnerships and increasing use of nanoscale implants in orthopedic and cardiovascular treatments are driving innovation, reinforcing Europe’s position as a key center for nanomedicine research and commercialization.

Asia Pacific

Asia Pacific captures nearly 24.1% share in the healthcare nanotechnology market in 2024, emerging as the fastest-growing region. The expansion is fueled by rising healthcare investments, growing pharmaceutical manufacturing, and strong government support for nanotechnology research. China, Japan, South Korea, and India are rapidly adopting nanomedicine in cancer therapy, biosensors, and regenerative medicine. Increasing prevalence of chronic diseases and expanding biotechnology sectors drive innovation. Collaborative research initiatives between universities and technology firms further boost advancements, positioning Asia Pacific as a dynamic hub for cost-effective nanotechnology-based healthcare solutions and large-scale clinical applications.

Latin America

Latin America represents around 6.1% share of the healthcare nanotechnology market in 2024, showing gradual growth driven by improving healthcare infrastructure and research funding. Brazil and Mexico are key contributors, focusing on nanomaterials for diagnostic imaging and controlled drug delivery. Rising investments in public health innovation and expanding pharmaceutical manufacturing strengthen market development. Regional collaborations with international research institutions are promoting technology transfer and local expertise. Growing awareness of nanomedicine benefits and initiatives to modernize healthcare systems are fostering gradual adoption of nanoscale medical technologies across the region.

Middle East & Africa

The Middle East & Africa accounts for approximately 4.2% share in the healthcare nanotechnology market in 2024. Growth is supported by increasing healthcare modernization programs and rising interest in advanced medical technologies. The United Arab Emirates, Saudi Arabia, and South Africa are investing in nanotechnology-based healthcare research. Expanding partnerships with global biotechnology companies and establishment of nanomedicine research centers are strengthening regional development. Although adoption remains limited due to cost constraints, growing awareness and government-backed healthcare diversification initiatives are expected to enhance future investment and technology integration across the region.

Market Segmentations:

By Disease

- Cardiovascular Diseases

- Oncological Diseases

- Neurological Diseases

- Orthopedic Diseases

- Infectious Diseases

- Other Diseases

By Application

- Drug Delivery

- Biomaterials

- Active Implants

- Diagnostic Imaging

- Tissue Regeneration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The healthcare nanotechnology market is shaped by leading players such as Johnson and Johnson, Novartis AG, Pfizer Inc., Merck and Co. Inc., Sanofi SA, Nanobiotix, CytImmune Sciences Inc., Bristol-Myers Squibb Company (Celgene Corporation), Taiwan Liposome Company Ltd., and Starpharma Holdings Limited. The competitive landscape is characterized by continuous innovation in nanomedicine, focusing on drug delivery, diagnostic imaging, and regenerative therapies. Companies are investing heavily in research collaborations, clinical trials, and advanced nanocarrier systems to enhance therapeutic efficacy. Strategic mergers and partnerships between pharmaceutical and nanotechnology firms strengthen global market presence. Increasing regulatory approvals for nanomedicines and expanding production capacities are accelerating commercialization. The competition also centers around improving scalability, safety, and biocompatibility of nanomaterials. Firms are prioritizing next-generation technologies such as nanosensors, nanorobotics, and bio-nanomaterials to achieve higher clinical precision and expand application reach across oncology, cardiovascular, and neurological disease management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson and Johnson

- Novartis AG

- Pfizer Inc.

- Merck and Co. Inc.

- Sanofi SA

- Nanobiotix

- CytImmune Sciences Inc.

- Bristol-Myers Squibb Company (Celgene Corporation)

- Taiwan Liposome Company Ltd.

- Starpharma Holdings Limited

Recent Developments

- In 2025, Sanofi is embedding AI across its entire value chain to become an “AI-powered biopharma company,” with the goal of accelerating R&D and delivering treatments faster

- In 2025, Johnson & Johnson advanced their robotics with AI-driven simulation technologies for healthcare, particularly in surgical robotics with systems like the MONARCH™ platform.

- In 2022, CytImmune Sciences reported data demonstrating their nanoparticle-based platform enhancing immune system molecules for cancer treatment.

Report Coverage

The research report offers an in-depth analysis based on Disease, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing integration of nanotechnology with precision medicine will enhance personalized treatment approaches.

- Expanding use of nanoscale drug delivery systems will improve therapeutic efficiency and safety.

- Advancements in nanorobotics will enable minimally invasive surgeries and targeted cellular repair.

- Growing demand for nanotechnology-based diagnostic tools will strengthen early disease detection.

- Rising research in regenerative nanomedicine will accelerate innovations in tissue engineering and wound healing.

- Collaboration between biotechnology firms and research institutions will boost clinical translation of nanotherapies.

- Development of smart nanomaterials will support real-time monitoring and responsive drug release.

- Increased government funding and supportive regulations will expand global nanomedicine adoption.

- Integration of AI and nanotechnology will improve design, testing, and efficiency of medical nanodevices.

- Sustainable and biocompatible nanomaterials will gain traction in eco-friendly healthcare solutions.