Market Overview:

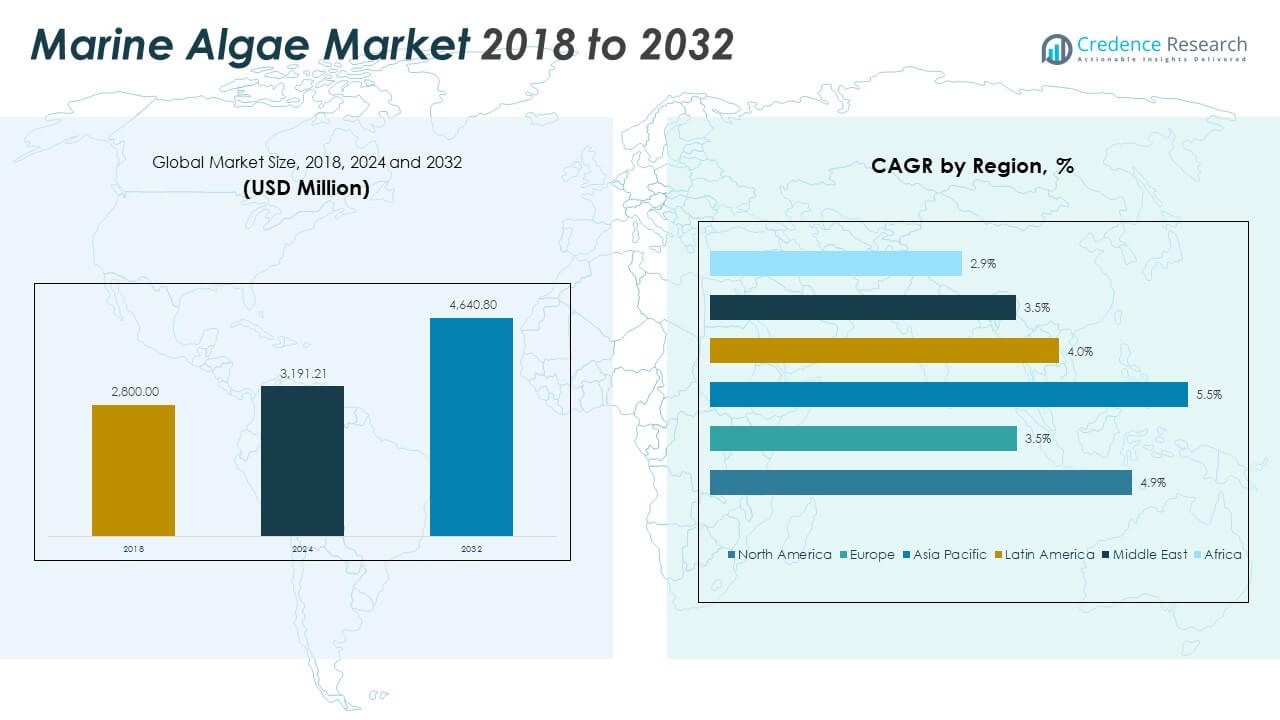

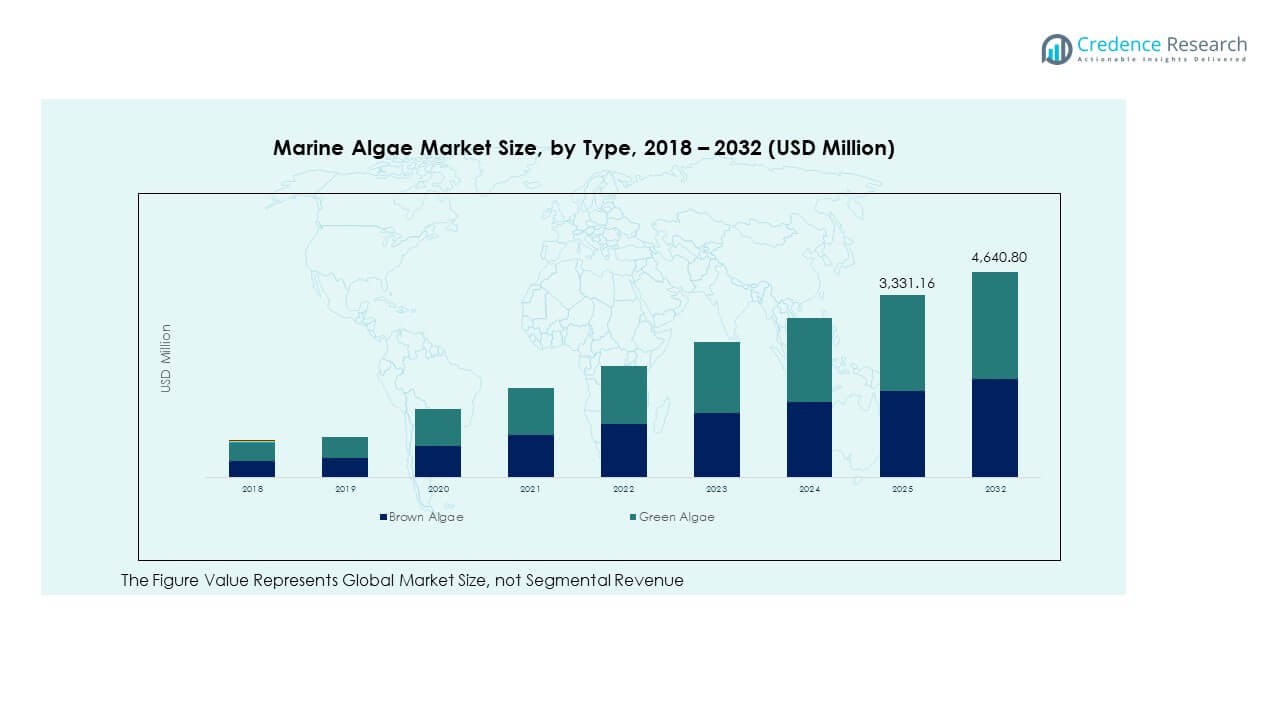

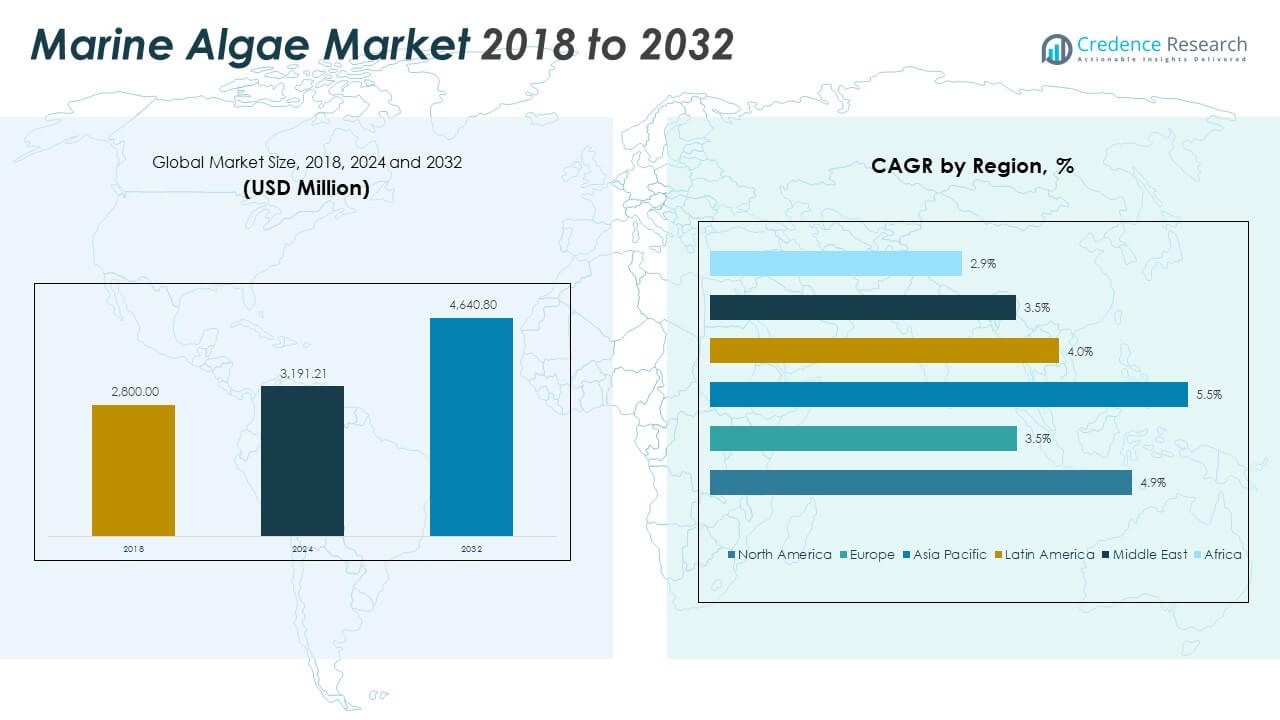

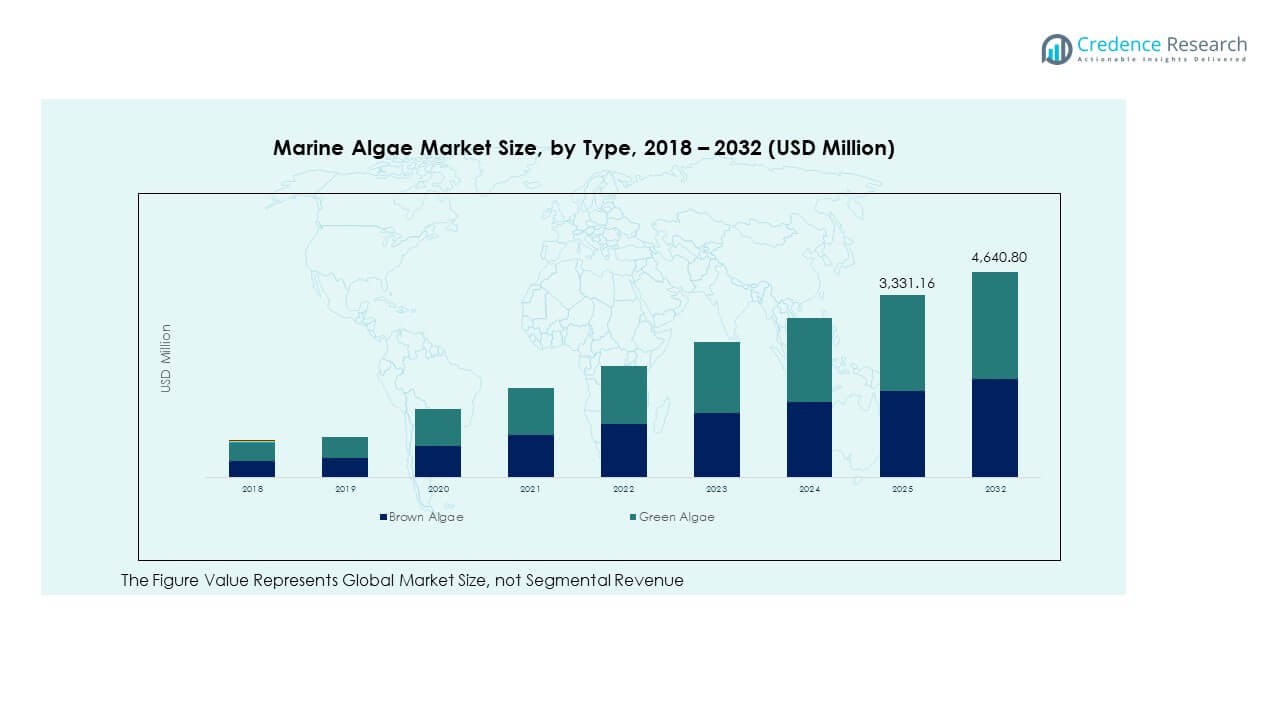

The Marine Algae Market size was valued at USD 2,800.00 million in 2018 to USD 3,191.21 million in 2024 and is anticipated to reach USD 4,640.80 million by 2032, at a CAGR of 4.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Algae Market Size 2024 |

USD 3,191.21 Million |

| Marine Algae Market, CAGR |

4.85% |

| Marine Algae Market Size 2032 |

USD 4,640.80 Million |

The market growth is driven by rising demand for algae-based ingredients across food, nutraceutical, pharmaceutical, and cosmetic industries. Marine algae offer functional benefits, including antioxidant, antimicrobial, and nutritional properties. Increasing consumer preference for clean-label and plant-based products supports wider adoption. Technological improvements in cultivation and extraction enhance efficiency and yield. Expanding investments in sustainable aquaculture strengthen the supply chain and open new commercial opportunities.

Asia Pacific leads the Marine Algae Market due to its established algae cultivation infrastructure and strong export capabilities. North America shows strong growth driven by innovation and functional product demand. Europe focuses on sustainability and regulatory frameworks, making it an emerging hub for bio-based ingredients. Latin America, the Middle East, and Africa are developing markets supported by favorable climatic conditions and growing awareness of algae’s commercial potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Marine Algae Market was valued at USD 2,800.00 million in 2018, reached USD 3,191.21 million in 2024, and is projected to hit USD 4,640.80 million by 2032, growing at a CAGR of 4.85%.

- Asia Pacific holds 53.0% of the market share, driven by strong aquaculture infrastructure, large-scale production, and high consumer demand. North America follows with 20.1%, supported by advanced research and functional product innovation, while Europe stands at 14.8% due to its strong regulatory framework and bio-based production capabilities.

- Asia Pacific is the fastest-growing region, supported by export-oriented strategies, resource availability, and rapid product diversification across industries.

- Brown algae represent the dominant type segment, contributing roughly 55% of total revenue in 2032, supported by its broad applications in food, pharmaceuticals, and cosmetics.

- Green algae account for about 45% of the segment, showing steady growth due to rising use in health supplements, nutraceuticals, and sustainable materials.

Market Drivers

Rising Demand for Nutrient-Rich and Functional Ingredients in Consumer Products

The growing consumer interest in natural and nutrient-dense ingredients drives steady expansion in the Marine Algae Market. Algae contain proteins, omega-3 fatty acids, minerals, and antioxidants that support health and wellness. Food and beverage companies use it in functional foods, supplements, and fortified drinks. Pharmaceutical firms explore bioactive compounds for therapeutic use. It strengthens its value in nutraceuticals and clean-label products. Demand for plant-based diets reinforces its role as an alternative protein source. Strong product adoption creates new market pathways. Expanding consumer segments accelerate the growth pace.

Increasing Applications in Renewable Energy and Industrial Sectors

The demand for sustainable raw materials boosts interest in algae-based biofuels. Marine algae provide a scalable source for renewable energy, helping reduce reliance on fossil fuels. Biofuel producers invest in advanced processing systems to enhance efficiency. Algae also support bioplastics production, creating biodegradable packaging alternatives. It aligns with circular economy goals and climate targets. Industrial usage broadens its commercial scope beyond food. Major companies explore its potential to lower carbon footprints. Integration with renewable energy strategies ensures long-term growth.

- For instance, in May 2025, HutanBio announced that its HBx microalgal biofuel achieved net-negative carbon emissions verified through an ISO 14040/14044 lifecycle assessment. The study, covered by S&P Global, confirmed carbon removal of up to 5.78 metric tons CO₂e per ton of fuel produced, supporting its large-scale deployment plans in arid and coastal regions such as Morocco.

Growing Awareness About Sustainable Aquaculture and Environmental Benefits

Algae farming supports responsible resource management and ecosystem balance. It captures carbon dioxide and improves water quality, aligning with climate goals. Governments and environmental agencies promote algae cultivation to enhance coastal ecosystems. Sustainable aquaculture companies use it to lower environmental impacts. It reinforces the transition toward greener production systems. Policy incentives and sustainability certifications support wide adoption. Research institutions highlight its environmental and commercial value. This focus on sustainability strengthens industry positioning and market reputation.

- For instance, in October 2025, the European Union allocated EUR 5.7 million under the European Maritime, Fisheries and Aquaculture Fund to four large-scale projects, including ATL.A.HUB and SEAGROW. This funding aims to scale sustainable algae farming across the Mediterranean and Atlantic coasts and support the creation of blue innovation hubs, as confirmed by the European Climate, Infrastructure and Environment Executive Agency (CINEA).

Expansion of Biotechnology and Advanced Cultivation Technologies

Biotechnology advancements increase algae yields and improve strain efficiency. Innovations in photobioreactors and open pond systems enable cost-effective production. Enhanced extraction techniques improve the quality of derived compounds. It strengthens industrial scalability and consistency. Producers achieve stable supply chains through improved farming methods. Automation and digital tools optimize energy use and resource management. Public-private collaborations support commercial infrastructure development. These technological gains raise productivity and competitiveness.

Market Trends

Growing Popularity of Algae-Based Functional Food and Beverage Products

Functional food consumption is rising due to increasing health awareness. Marine algae offer a natural, clean-label source of key nutrients. Beverage companies launch algae-infused juices, smoothies, and wellness drinks. Snack and supplement makers adopt algae for protein enrichment. It helps brands meet plant-based demand trends. Premium functional ingredients strengthen product positioning in health-focused categories. Expanding consumer acceptance accelerates product diversification. This trend shapes future innovation pipelines.

- For instance, in February 2025, Brevel Ltd and The Central Bottling Company (CBC Group) entered a 10-year partnership to develop algae-enriched functional beverages and dairy alternatives. Brevel’s patented technology combines light-assisted fermentation with microalgae cultivation to produce a neutral-tasting protein powder containing 60–70% microalgae protein, supporting large-scale commercial applications.

Widening Use of Algae-Derived Bioactive Compounds in Cosmetic Formulations

Cosmetic brands adopt marine algae extracts for anti-aging and skin care benefits. Bioactive compounds enhance skin hydration, elasticity, and UV protection. Natural ingredient demand grows as consumers shift toward clean beauty. It enhances the performance of creams, serums, and sunscreens. Companies focus on algae strains with unique antioxidant properties. Product launches feature sustainable sourcing credentials. This trend strengthens algae’s role in personal care innovation. Cosmetic manufacturers expand algae partnerships globally.

Integration of AI and Automation in Large-Scale Algae Cultivation

Technology integration improves efficiency in large-scale algae production. AI-driven monitoring systems ensure optimal growth conditions. Automated harvesting and processing reduce operational costs. It supports consistent quality and higher production volumes. Digital technologies enable predictive maintenance and resource optimization. Companies invest in scalable systems to meet commercial demand. Advanced data analytics improve decision-making and yields. This trend aligns with the industrialization of algae farming.

- For instance, in April 2025, Pond Technologies Holdings Inc. announced the integration of AI algorithms into its algae cultivation control systems. The technology focuses on optimizing light, nutrient, and CO₂ management to enhance operational efficiency and sustainability at its Ontario facility.

Strategic Collaborations Between Industry Players and Research Institutes

Partnerships between algae producers and R&D institutions accelerate product innovation. Joint projects explore advanced cultivation methods and novel applications. Research centers provide technical expertise and new strain discoveries. It supports faster commercialization of algae-based solutions. Government-backed programs encourage public-private cooperation. Startups collaborate with established firms to scale their technologies. These alliances expand product portfolios and market reach. This trend fosters a competitive and innovation-driven landscape.

Market Challenges Analysis

High Production Costs and Complex Processing Infrastructure

Production involves specialized cultivation and processing systems that increase operational expenses. Marine algae farming requires controlled environmental conditions to maintain yield. Equipment investment and energy use make scaling difficult for smaller producers. It limits the entry of new market players. High processing costs affect profit margins and price competitiveness. Limited access to cost-effective technology hinders mass adoption. Supply chain inefficiencies add to operational burdens. These factors challenge industry expansion and long-term profitability.

Regulatory Uncertainty and Lack of Standardized Quality Protocols

Regulatory frameworks for marine algae products remain fragmented across regions. Absence of clear labeling, safety, and quality standards creates compliance risks. It slows down approvals and product commercialization. Companies face trade barriers and limited market access. Differing regulations across countries increase legal complexity. Industry stakeholders call for harmonized safety norms. Consumer trust depends on consistent product quality assurance. This regulatory gap restrains smooth global trade and innovation flow.

Market Opportunities

Rising Potential in Pharmaceuticals and High-Value Nutraceutical Applications

Pharmaceutical and nutraceutical companies explore algae compounds for targeted health solutions. Marine algae contain unique bioactive ingredients that support cardiovascular, metabolic, and immune health. Demand for natural alternatives to synthetic additives creates growth space. It supports development of novel therapies and functional supplements. Expanding clinical research strengthens its scientific credibility. Growing healthcare spending amplifies commercial prospects. Strategic alliances can speed up global expansion. These factors make algae a key ingredient for advanced healthcare products.

Expanding Role in Circular Economy and Sustainable Product Innovation

Sustainability goals encourage industries to adopt algae for eco-friendly solutions. Marine algae can replace fossil-based inputs in fuels, chemicals, and packaging. It strengthens green manufacturing strategies. Companies use algae to reduce emissions and enhance energy efficiency. Governments support algae initiatives through funding and incentives. Industrial diversification expands demand in multiple sectors. It creates new opportunities for product innovation and investment. These drivers position algae as a strategic resource for sustainable transformation.

Market Segmentation Analysis:

By Type, brown algae hold the largest share due to their extensive use in food, cosmetics, and industrial applications. Brown varieties provide alginates, fucoidan, and other bioactive compounds that support multiple end-use industries. Green algae show strong adoption in health supplements and biofuel production because of their high protein and chlorophyll content. Blue-green algae gain traction for their antioxidant and anti-inflammatory properties, driving demand in nutraceutical and pharmaceutical applications. Red algae remain vital for hydrocolloid production, particularly carrageenan, which strengthens their position in food and personal care industries.

- For instance, Aliga Microalgae, a Danish food-tech firm, expanded its Chlorella microalgae capacity by acquiring one of Europe’s largest fermentation plants in the Netherlands. The facility increased annual Chlorella production to approximately 600 tonnes, enabling scaled supply for sustainable protein ingredients in food and dietary supplements.

By Application, food and beverages represent the dominant segment due to algae’s natural stabilizing and thickening properties. It supports product innovation in plant-based foods, functional beverages, and nutritional additives. Animal feed applications grow with the increasing focus on sustainable protein sources. Nutraceutical use expands with rising consumer preference for natural ingredients and health-promoting compounds. Pharmaceutical applications benefit from ongoing research into algae-derived bioactives with therapeutic potential. Cosmetics and personal care use algae for moisturizing, anti-aging, and skin protection functions. Other applications, including fertilizers and bioplastics, create new opportunities for product diversification and market penetration.

- For instance, Arborea, a UK-founded climate-tech company, operates a BioSolar Leaf pilot facility in Lisbon, Portugal, growing over 30,000 microalgae species under sunlight. The system produces nutrient-dense proteins, pigments, and lipids for plant-based food and beverage formulations while absorbing CO₂ and purifying surrounding air.

Segmentation:

By Type

- Brown Algae

- Green Algae

- Blue-Green Algae

- Red Algae

By Application

- Food & Beverages

- Animal Feed

- Nutraceutical

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Marine Algae Market size was valued at USD 575.68 million in 2018 to USD 642.05 million in 2024 and is anticipated to reach USD 931.42 million by 2032, at a CAGR of 4.9% during the forecast period. North America holds a market share of 20.1%. Strong adoption of algae in functional foods, nutraceuticals, and pharmaceuticals drives steady growth. The region benefits from advanced research capabilities, sustainable aquaculture practices, and a growing focus on clean-label ingredients. Major companies invest in large-scale cultivation and processing technologies. It strengthens product diversification and improves supply reliability. Regulatory support for sustainable sourcing and innovation encourages market expansion. Health-conscious consumers accelerate demand for algae-based products. Expanding investments in renewable materials add further momentum to the industry.

Europe

The Europe Marine Algae Market size was valued at USD 433.44 million in 2018 to USD 461.36 million in 2024 and is anticipated to reach USD 605.87 million by 2032, at a CAGR of 3.5% during the forecast period. Europe accounts for 14.8% of the global market. The region is a hub for sustainable algae cultivation and bio-based innovations. Strong emphasis on regulatory compliance and product safety standards enhances market credibility. Food, cosmetics, and pharmaceutical sectors remain key demand drivers. It benefits from advanced biotechnology research and structured value chains. Government-backed programs support eco-friendly production initiatives. Coastal nations like France, Spain, and Norway lead in algae harvesting. Expanding interest in algae for clean energy further diversifies growth channels.

Asia Pacific

The Asia Pacific Marine Algae Market size was valued at USD 1,406.44 million in 2018 to USD 1,637.55 million in 2024 and is anticipated to reach USD 2,504.18 million by 2032, at a CAGR of 5.5% during the forecast period. Asia Pacific leads with a market share of 53.0%. The region dominates due to abundant natural resources, established aquaculture industries, and cost-effective production systems. China, Japan, and South Korea are major producers with well-developed cultivation infrastructure. Rising consumer preference for healthy and natural products fuels demand in food, nutraceutical, and cosmetic applications. It benefits from supportive policies and technological advancements in algae farming. Export-oriented strategies strengthen regional competitiveness. Expanding industrial applications boost regional leadership. Asia Pacific continues to set the pace for global industry expansion.

Latin America

The Latin America Marine Algae Market size was valued at USD 201.60 million in 2018 to USD 227.82 million in 2024 and is anticipated to reach USD 310.33 million by 2032, at a CAGR of 4.0% during the forecast period. Latin America represents 6.6% of the market. The region shows rising potential due to growing algae cultivation in coastal countries like Chile and Brazil. Strong interest in algae for agriculture, feed, and biofertilizer applications creates growth avenues. It benefits from favorable climatic conditions and expanding investments in sustainable aquaculture. Nutraceutical producers are exploring local sourcing to meet clean-label demand. Technological improvements enhance productivity and quality. Regional governments support diversification of marine industries. Growing export capabilities strengthen its role in the global supply chain.

Middle East

The Middle East Marine Algae Market size was valued at USD 106.40 million in 2018 to USD 113.59 million in 2024 and is anticipated to reach USD 149.00 million by 2032, at a CAGR of 3.5% during the forecast period. Middle East holds a 3.2% market share. The region focuses on controlled environment algae farming to address resource constraints. Investments in biotechnology and desert aquaculture projects drive adoption. Food security strategies support algae integration into local production systems. It benefits from strategic partnerships with international technology providers. Expanding cosmetic and wellness industries create niche opportunities. Rising awareness of sustainable resources strengthens algae acceptance. Research centers in Gulf countries contribute to innovative cultivation practices. Gradual commercialization supports steady regional growth.

Africa

The Africa Marine Algae Market size was valued at USD 76.44 million in 2018 to USD 108.83 million in 2024 and is anticipated to reach USD 140.01 million by 2032, at a CAGR of 2.9% during the forecast period. Africa accounts for 2.9% of the market. The region remains in the early stage of algae commercialization but shows promising potential. Coastal regions offer favorable environmental conditions for cultivation. Limited technological capacity and funding slow development, though pilot projects are expanding. It benefits from international collaborations and capacity-building programs. Growing demand for sustainable food and feed ingredients supports market creation. Government initiatives aim to enhance blue economy strategies. Local industries explore algae for fertilizer and animal feed production. Gradual progress may position Africa as an emerging participant in the global value chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cargill, Incorporated

- Acadian Seaplants Limited

- CP Kelco

- Dow Chemical Company

- I. du Pont de Nemours and Company

- Gelymar SA

- Irish Seaweeds

- Marcel Trading Corporation

- Qingdao Gather Great Ocean Algae Industry Group (GGOG)

- Seasol International Pty Ltd

- Yan Cheng Hairui Food Co., Ltd.

- Ocean Harvest Technology Limited

- Mara Seaweed

- Algatechnologies

Competitive Analysis:

The Marine Algae Market is highly competitive, with global and regional players driving product innovation and capacity expansion. Leading companies such as Cargill, Acadian Seaplants Limited, CP Kelco, Dow Chemical Company, and Gelymar SA hold strong positions through advanced cultivation and processing technologies. It benefits from strategic mergers, partnerships, and R&D investments that strengthen global supply chains. Smaller players focus on niche applications in food, nutraceutical, and personal care products to capture market share. Technological advancements support scalability and cost efficiency, while regulatory alignment enhances market access. Competitive intensity remains strong as companies target sustainable sourcing and premium product segments. Firms invest in product diversification and geographic expansion to maintain leadership and secure future growth.

Recent Developments:

- In October 2025, Cargill, Incorporated announced the deepening of its renewable energy partnership with Mars and GoldenPeaks Capital through an innovative 224 MWac solar procurement project in Poland. This initiative, unveiled on October 7, 2025, underscores Cargill’s commitment to sustainability by advancing renewable energy sourcing within its global supply chain.

- In September 2025, Dow Chemical Company deepened its collaboration with Macquarie Asset Management through an expanded equity partnership in Diamond Infrastructure Solutions. This strategic alliance focuses on optimizing Dow’s US Gulf Coast infrastructure assets to enhance operational resilience and sustainability.

- In February 2025, the Irish Seaweed sector saw the formation of the Irish Seaweed Association, a new collaborative organization designed to unite growers, researchers, and policymakers. Initiated by Irish Seaweeds and supported by Trinity College Dublin, it aims to promote sustainable seaweed farming and innovation across Ireland’s coastline.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of high-value nutraceutical and functional food applications will strengthen market penetration.

- Integration of algae cultivation with renewable energy projects will support sustainable growth strategies.

- Growing focus on algae-based ingredients in pharmaceuticals will create new commercialization pathways.

- Increased use of algae in clean-label cosmetic products will diversify end-use industries.

- Advancements in bioreactor technology will reduce production costs and improve yield efficiency.

- Strategic collaborations between global producers and regional suppliers will enhance supply chain stability.

- Rising demand for eco-friendly materials will push algae adoption in packaging and biofuels.

- Government incentives and policy support will encourage sustainable farming investments.

- Scaling of AI-driven monitoring systems will boost operational efficiency and quality control.

- Expanding algae cultivation projects in emerging economies will reshape regional market dynamics.