Market Overview:

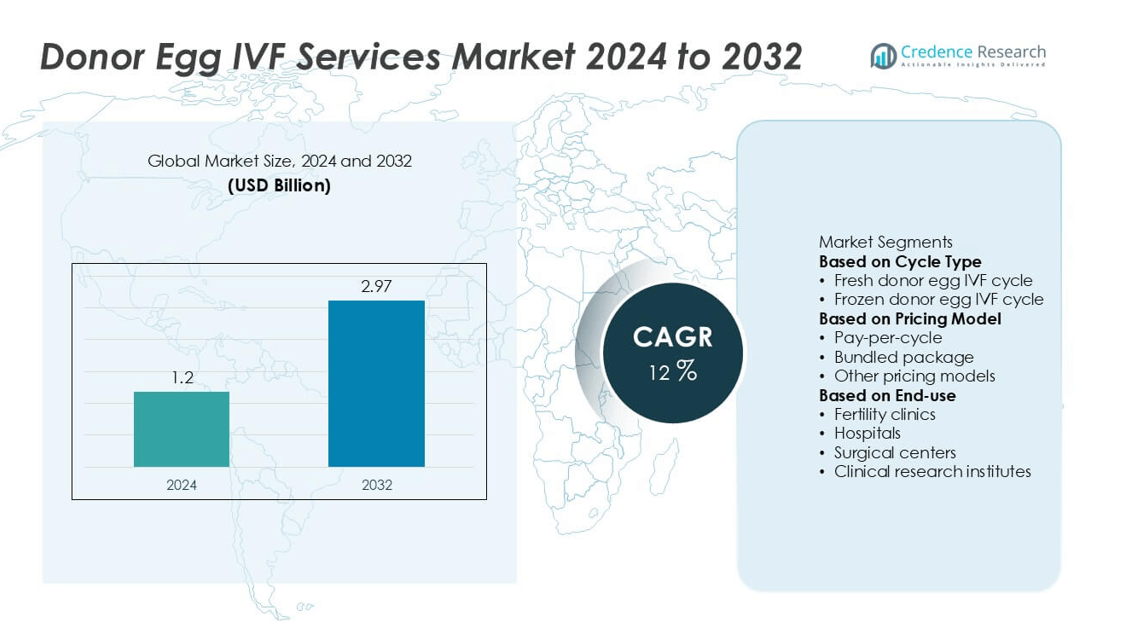

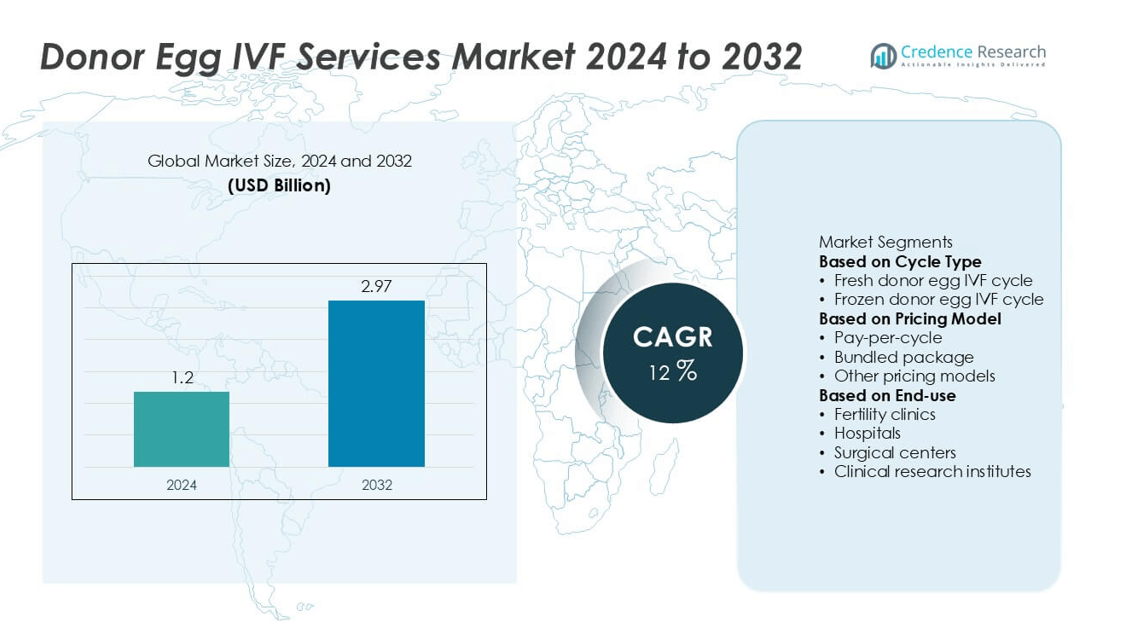

The global Donor Egg In-Vitro Fertilization (IVF) Services market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.97 billion by 2032, growing at a compound annual growth rate CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Donor Egg IVF Services Market Size 2024 |

USD 1.2 billion |

| Donor Egg IVF Services Market, CAGR |

12% |

| Donor Egg IVF Services Market Size 2032 |

USD 2.97 billion |

The Donor Egg IVF Services market is led by major players such as Beacon CARE Fertility Ltd., Boston IVF, Bourn Hall, Cape Fertility, Fertility Centers of Illinois, Fertility Centers of New England, Inc., HRC Fertility Management, KL Fertility Centre, Medfem Fertility Clinic, and Merrion Fertility Clinic. These companies maintain strong global presence through advanced reproductive technologies, extensive donor networks, and high clinical success rates. North America dominates the global market with a 38% share, driven by advanced healthcare infrastructure and rising demand for assisted reproduction. Europe follows with 29%, supported by favorable regulations and medical tourism, while Asia-Pacific, holding 22%, emerges as the fastest-growing region due to increasing infertility awareness and expanding fertility clinic networks.

Market Insights

- The global Donor Egg IVF Services market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.97 billion by 2032, growing at a CAGR of 12% during the forecast period.

- Rising infertility rates, delayed pregnancies, and increased awareness of assisted reproductive technologies are driving market growth, with the frozen donor egg IVF cycle segment holding a 65% share due to its flexibility and high success rates.

- Key market trends include growing adoption of genetic screening, AI-based embryo selection, and the expansion of digital fertility platforms for donor matching and patient management.

- The competitive landscape features leading players such as Beacon CARE Fertility Ltd., Boston IVF, Bourn Hall, and Cape Fertility, focusing on clinical excellence, technological innovation, and strategic collaborations.

- Regionally, North America leads with 38% of the market, followed by Europe with 29%, while Asia-Pacific (22%) emerges as the fastest-growing region driven by rising demand and healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Cycle Type

The frozen donor egg IVF cycle segment dominated the Donor Egg IVF Services market in 2024, accounting for approximately 65% of the total market share. The preference for frozen cycles is driven by their greater flexibility, lower cost, and reduced medical complications compared to fresh cycles. Advanced cryopreservation techniques such as vitrification have improved egg survival and fertilization rates, further enhancing adoption. Additionally, frozen cycles allow better scheduling for both donors and recipients, contributing to their wider acceptance across fertility clinics globally.

- For instance, Boston IVF implemented a vitrification system using the Cryotec method that maintained an average post-thaw egg survival rate of 98.4% across 1,800 frozen donor eggs. The clinic reported consistent fertilization rates above 80% using this protocol, reducing overall patient cycle cancellations and increasing clinical efficiency.

By Pricing Model

The pay-per-cycle segment held the largest share of the Donor Egg IVF Services market in 2024, representing around 54% of the total market. This pricing model remains dominant due to its transparency, simplicity, and suitability for patients seeking cost control per treatment attempt. Many fertility clinics favor this model as it provides predictable revenue and flexibility for patients. However, bundled packages are gaining traction, supported by rising demand for multi-cycle assurance programs offering higher success rates and cost savings for patients pursuing multiple IVF cycles.

- For instance, HRC Fertility, like many clinics, offers various financial programs, including multi-cycle packages and shared-risk or refund programs for services like donor egg IVF, which aim to help manage costs and provide multiple attempts.

By End-use

The fertility clinics segment led the market in 2024, capturing nearly 70% of the overall market share. Specialized fertility centers offer advanced reproductive technologies, personalized treatment plans, and higher success rates, making them the preferred choice for donor egg IVF procedures. Increasing awareness, accessibility to reproductive care, and global expansion of fertility networks drive segment growth. Hospitals and surgical centers follow, leveraging established medical infrastructure, while clinical research institutes contribute to innovation through trials and advancements in egg freezing and embryo implantation technologies.

Key Growth Drivers

Rising Infertility Rates and Delayed Parenthood

Increasing infertility rates among both men and women, coupled with the global trend of delayed parenthood, are major drivers of the Donor Egg IVF Services market. Lifestyle factors such as stress, obesity, and late marriages contribute to infertility, leading couples to seek assisted reproductive technologies. The growing acceptance of IVF and donor egg procedures among older women further supports market growth. As more couples opt for fertility treatments, demand for donor egg services continues to rise across both developed and emerging economies.

- For instance, Merrion Fertility Clinic is the only clinic in Ireland that reports its success rates in an official clinical publication, highlighting the growing reliance on transparent data among patients. The clinic reported an overall success rate (clinical maternity per embryo transfer for all age groups in IVF and ICSI cycles) of 41.9% in 2022, with the rate increasing to 52.6% for day 5 good or better quality embryos.

Technological Advancements in IVF Procedures

Innovations in IVF technologies-such as improved egg freezing techniques, genetic screening, and embryo selection-are significantly enhancing success rates and patient satisfaction. The adoption of vitrification for egg preservation has reduced cell damage, increasing the viability of donor eggs. Moreover, advances in laboratory automation and artificial intelligence in embryo analysis are streamlining procedures and improving outcomes. These technological improvements are making donor egg IVF more reliable and accessible, thereby driving strong market growth globally.

- For instance, Reprofit International Clinic deployed the EmbryoScope+ time-lapse monitoring system combined with AI-based embryo grading, analyzing over 25,000 embryos annually. This integration improved blastocyst selection accuracy by 32% and shortened fertilization-to-transfer time by 18 hours, optimizing pregnancy outcomes and lab throughput.

Expanding Fertility Clinic Networks and Awareness Programs

The rapid expansion of fertility clinic chains and increasing awareness about reproductive health are fueling the growth of donor egg IVF services. Governments and private healthcare providers are launching campaigns to educate the public on infertility treatment options. Growing insurance coverage and financing options for IVF further encourage patients to seek professional treatment. Additionally, cross-border reproductive care and medical tourism are expanding, particularly in regions offering affordable and advanced fertility solutions.

Key Trends & Opportunities

Growing Adoption of Frozen Donor Eggs

The shift toward frozen donor eggs is a defining trend in the market, offering greater flexibility and convenience for patients and clinics alike. The use of vitrified eggs eliminates the need for donor-recipient synchronization and reduces costs. With high survival rates and efficient storage logistics, frozen donor eggs support broader patient access and international egg banks. This trend creates new opportunities for fertility service providers to scale operations and cater to a more diverse global clientele.

- For instance, Cryos International, the world’s largest sperm and egg bank, maintains a large repository of vitrified donor eggs and uses advanced technology to ship donor products to more than 100 countries worldwide.

Rising Demand for Personalized and Ethical Fertility Treatments

Patients increasingly seek personalized fertility treatments emphasizing transparency, genetic health, and ethical donor selection. Clinics are integrating genetic testing and data-driven treatment plans to improve pregnancy outcomes. Ethical practices, such as informed donor consent and identity disclosure options, are gaining importance in regulatory frameworks. This shift toward ethical, patient-centric care is opening new opportunities for service providers to build trust, differentiate their offerings, and strengthen their market position.

- For instance, IVIRMA Global implemented a genomic screening protocol analyzing over 600 inherited conditions in donor candidates through next-generation sequencing. The initiative screened 5,700 donors in one operational cycle, enabling precise donor-recipient matching and enhancing ethical transparency in patient care across its 70 fertility centers.

Key Challenges

High Treatment Costs and Limited Insurance Coverage

Despite technological advances, the high cost of donor egg IVF remains a major barrier to accessibility. Many patients in low- and middle-income countries lack adequate financial support or insurance coverage for fertility treatments. The out-of-pocket nature of these expenses discourages widespread adoption, especially among middle-income populations. Limited reimbursement policies and varying national regulations further restrict patient affordability, slowing market penetration in developing regions.

Ethical and Legal Complexities in Donor Egg Usage

Ethical and regulatory concerns surrounding donor egg IVF procedures present significant challenges for market players. Issues related to donor anonymity, consent, and embryo ownership create complex legal landscapes across regions. Inconsistent international regulations hinder cross-border reproductive care and complicate donor matching. Moreover, ethical debates over embryo selection and commercialization of donor eggs can impact public perception and policy development, posing hurdles to market expansion and operational compliance.

Regional Analysis

North America

North America held the largest share of the Donor Egg IVF Services market in 2024, accounting for 38% of the global market. The region’s dominance is driven by advanced healthcare infrastructure, high awareness of assisted reproductive technologies, and favorable insurance policies supporting fertility treatments. The United States leads the market with a strong presence of specialized fertility clinics and egg banks. Growing social acceptance of donor-assisted reproduction and rising infertility rates due to delayed pregnancies continue to support market expansion, while technological advancements further enhance IVF success rates across the region.

Europe

Europe captured 29% of the global Donor Egg IVF Services market share in 2024, supported by a well-established network of fertility centers and favorable government regulations on assisted reproduction. Countries such as Spain, the United Kingdom, and the Czech Republic are major hubs for donor egg IVF, attracting patients through cost-effective treatments and high clinical success rates. Increasing cross-border reproductive tourism and expanding donor availability strengthen market growth. Public funding in certain nations and rising awareness of infertility treatments contribute to sustained demand across the European region.

Asia-Pacific

The Asia-Pacific region accounted for 22% of the global Donor Egg IVF Services market share in 2024, emerging as the fastest-growing regional segment. Factors such as rising infertility rates, growing disposable income, and increasing acceptance of assisted reproduction fuel growth. Countries like India, Japan, China, and Australia are witnessing rapid expansion in fertility clinics offering affordable and advanced IVF procedures. Government initiatives to improve reproductive health and greater adoption of frozen donor eggs are also driving market penetration. Expanding medical tourism further positions Asia-Pacific as a key growth region.

Latin America

Latin America represented 7% of the global Donor Egg IVF Services market share in 2024, driven by increasing demand for affordable fertility treatments and improving healthcare accessibility. Countries such as Brazil, Mexico, and Argentina are witnessing growing investments in reproductive technologies. The region benefits from rising awareness and medical tourism, as patients seek cost-effective yet high-quality IVF services. However, limited insurance coverage and varying regulatory standards across countries slightly restrain growth. Ongoing infrastructure development and international collaborations with fertility networks are expected to enhance the region’s market performance.

Middle East & Africa

The Middle East & Africa accounted for 4% of the global Donor Egg IVF Services market share in 2024, representing a developing but promising market. Rising infertility rates, cultural shifts toward acceptance of IVF, and investments in advanced healthcare facilities are driving adoption. The United Arab Emirates and South Africa lead the regional market, offering state-of-the-art fertility centers and medical tourism opportunities. Nonetheless, high treatment costs and limited awareness in rural areas continue to challenge growth. Efforts to modernize healthcare systems and promote fertility education are expected to accelerate market expansion in the coming years.Top of Form

Market Segmentations:

By Cycle Type

- Fresh donor egg IVF cycle

- Frozen donor egg IVF cycle

By Pricing Model

- Pay-per-cycle

- Bundled package

- Other pricing models

By End-use

- Fertility clinics

- Hospitals

- Surgical centers

- Clinical research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Donor Egg IVF Services market features prominent players such as Beacon CARE Fertility Ltd., Boston IVF, Bourn Hall, Cape Fertility, Fertility Centers of Illinois, Fertility Centers of New England, Inc., HRC Fertility Management, KL Fertility Centre, Medfem Fertility Clinic, and Merrion Fertility Clinic. These organizations compete through technological innovation, service diversification, and global expansion of fertility networks. Leading providers focus on improving egg preservation techniques, enhancing success rates through genetic screening and AI-driven embryo selection, and offering patient-centric treatment models. Strategic partnerships with research institutes and cross-border fertility programs enable wider accessibility and donor diversity. Digital transformation in patient engagement, data analytics, and virtual consultations further strengthen operational efficiency. Continuous investment in clinical excellence, ethical compliance, and cost optimization positions these key players competitively in an evolving market driven by rising demand for assisted reproductive technologies worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Beacon CARE Fertility Ltd. posted an overview of its advanced egg donation programme, emphasising its in-house egg bank.

- In April 2025, Boston IVF published a blog explaining its donor egg IVF programme, underscoring flexible donor egg options for patients.

- In 2024, HRC Fertility announced refreshed “Nest and Stork” all-inclusive IVF packages that include donor egg and surrogate options

Report Coverage

The research report offers an in-depth analysis based on Cycle Type, Pricing Model, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Donor Egg IVF Services market will continue to experience strong growth driven by rising infertility rates and delayed family planning.

- Technological advancements in genetic testing, egg freezing, and AI-based embryo selection will enhance success rates and patient confidence.

- Expanding global fertility clinic networks will increase accessibility to donor egg IVF services in both developed and emerging regions.

- Growing acceptance of assisted reproductive technologies will drive higher demand across diverse age groups and demographics.

- The frozen donor egg IVF segment will maintain its dominance due to improved preservation techniques and flexible treatment options.

- Increased government support, healthcare investments, and favorable regulations will promote wider market adoption.

- Ethical and transparent donor matching practices will strengthen patient trust and clinic reputation.

- Digital transformation in fertility services will improve patient engagement and streamline clinical processes.

- Medical tourism for affordable and advanced IVF treatments will rise in emerging economies.

- Market competition will intensify as global players expand partnerships, research initiatives, and cross-border fertility programs.